Professional Documents

Culture Documents

Bamacro15-2 Carryisdead

Uploaded by

api-276766667Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bamacro15-2 Carryisdead

Uploaded by

api-276766667Copyright:

Available Formats

BijaAdvisors

Macro Radar

Cognitive Science Meets Economic Analysis

Better Decisions, Better Results

Issue 15-2

Jan 20, 2015

CARRY IS DEAD, LONG LIVE CARRY

I had a busy week fielding phone calls from clients trying to make sense of it all. Its been a long time

since Ive sensed such unease and frustration from these seasoned veterans, including those doing quite

well. It can be chilling to hear people I hold in very high regard, say things like, Things are different

now, The markets dont care about fundamentals anymore, or You have to ignore the facts and just

go with the flow, especially since I disagree.

Markets do reflect fundamentals, perhaps more so today than they have for some time. What is at issue, I

believe, is that the cause and effect relationships between so many global macroeconomic factors, have

changed. Some of them have reverted back to earlier times, as in centuries earlier. Thats important,

because it means we havent seen the interactions behave like this since before the advent of modern

monetary policy. The implications are big, huge even, and they are compounded by the unwillingness or

inability of policymakers and many investors to recognize the paradigm shift.

What Was I Thinking?

Cognitive dissonance, that discomfort we feel when we are confronted with information that is

inconsistent with our beliefs, is a powerful thought driver. We dont like it when things dont make

sense, and when we are forced to make important decisions quickly, whether we have resolved that

dissonance or not, we tend to tighten up our frames. Framing, a phenomenon whereby we use an overly

narrow approach to analyze an issue, such as correlating short-term price action to data and actions

observed over a very limited, typically recent, period, has become a key factor. Confined to that

framework, cognitive bias drives us to search for and interpret information in a way that confirms our

preconceptions, while ignoring or even actively discrediting that which does not conform to our views.

So thats the science that helps explain why so many very smart people have concluded that markets

dont care about fundamentals. I know from experience that the periods in which I have achieved my

best performance are those in which I have had a firm grasp on what is driving fundamentals and I am

able to accurately anticipate the markets response to them playing out as expected. This edition of

Macro Radar focuses on the key factors that provided clarity for the conversations I had with clients last

week. I hope you find it helpful too.

Testing the Hypothesis

US Dollar strength would appear to be all but inevitable. While it may well be the case, its important to

understand why. I put that question to each caller, and the answers all gravitated to one simple point. The

US economy is doing well. Conversely, most others are struggling. Its a valid hypothesis, and one that

should be easy to prove.

!

Copyright 2015 by Bija Advisors LLC.; BijaAdvisorsLLC.com

Reproduction or retransmission in any form, without written permission, is a violation of Federal Statute

Important disclosures appear at the back of this document

Bija Advisors Macro Radar January 20, 2015

2

!

CURRENCIES

1 Year Performance vs USD

Euro

-14.26%

British Pound

-7.96%

Swiss Franc

+3.47%

Japanese Yen

-11.34%

With all this money flowing into the US Dollar on the back of a positive prognosis for the US relative to

the other countries, we would expect equity markets to have diverged, and P/E ratios to reflect radically

different expectations. However, neither of those are in evidence.

EQUITIES

1 Year Performance

P/E Ratio

S&P 500

+6.4%

17.91

Dax

+5.13%

17.99

Nikkei

+8.78%

20.56

Considering the hypothesis of growth in the US and slowing in the other countries, along with the

ensuing talk and action regarding the ramping up of central bank balance sheets in the other countries,

and the opposite in the US, we would expect rates in the US to be on the rise, while those in the other

countries should be coming off. However, using the 10 year government rate as our benchmark, the

hypothesis would once again appear to be in trouble.

GOVERNMENT BONDS

1 Year Change in Yield

Current 10 Year Rate

US 10 Year

-125 bps

1.8368%

German 10 Year

-139 bps

0.4394%

UK 10 Year

-147 bps

1.5270%

Japanese 10 Year

-54 bps

0.2010%

Ive been arguing for years that carry is king when it comes to tracking the currencies of the worlds

wealthiest nations. To some it may sound obvious, but Ive had a lot of pushback from those who find it

hard to believe that a few basis points could make much of a difference. Im not unsympathetic to the

opposition. It does sound crazy that a 5 or 10 bp shift in the interest rate differential could trigger a 5 or

10%+ move in the exchange rate, but weve been seeing it for years.

When yields collapsed in emerging markets more than a decade ago, I began looking at the ratio of

interest rate differentials to predict exchange rate shifts, rather than the nominal differential. While

others saw historically tight spreads and argued that they were unsustainable, the ratios showed that they

had plenty of room to run.

You see, when the risk-free rate is 7%, it will take a lot more than an extra 50bps to convince an investor

to shift his money over to something more risky. However, when the risk-free rate is 50 bps, another 50

is a doubling of the return. So, the lower rates went, the less additional return those riskier investments

needed to offer in order to attract capital. Factor in the new technology which has enabled the near

!

Copyright 2015 by Bija Advisors LLC.; BijaAdvisorsLLC.com

Reproduction or retransmission in any form, without written permission, is a violation of Federal Statute

Bija Advisors Macro Radar January 20, 2015

3

!

instantaneous transfer of capital between assets and currencies at a fraction of the cost, and impact is

super-sized.

Lets take a look at a chart comparing the EUR/USD exchange rate with the ratio of 2 year swaps in

Europe vs the US, beginning from mid 2010 until the end of 2012. Very compelling, right?

However, when you extend the chart to today, the relationship would appear to have broken down. Lets

not jump to conclusions, though.

Looking at the daily correlation between the 2, over rolling 6 month periods, it turns out that they have

actually become more correlated. In other words, the EUR/USD exchange rate has become hyper!

Copyright 2015 by Bija Advisors LLC.; BijaAdvisorsLLC.com

Reproduction or retransmission in any form, without written permission, is a violation of Federal Statute

Bija Advisors Macro Radar January 20, 2015

4

!

sensitive to changes in the 2 year swap rates. However, there was a a drastic pullback in the relationship

before the correlation snapped back again, and the upward trend resumed.

So the answer to the question as to what is driving the USD strength, is fairly straightforward. It is the

change in the ratio of interest rate differentials. The reason it snapped so dramatically, is that it had to

make up for the initially delayed reaction. Therefore, we probably shouldnt expect to see such violent

moves in the same direction, now that it has caught up.

You may be thinking to yourself, Duneier is splitting hairs. I mean, when you say the USD is

strengthening versus the other currencies because the US economy is stronger and its prospects are

better, obviously it assumes rates would be higher in the US. I could not disagree more. That argument

assumes a causal relationship, one that is not in evidence, and in fact, US rates are not higher, they are

lower. They simply havent fallen as quickly.

When we understand what is really happening, when relationships and outcomes make sense along the

way, we gain confidence and conviction. That allows us to stay with positions longer and increase the

size. If investors and money managers truly believe that they understand what is happening in the world,

then portfolio returns should be just as massive as the moves weve been witnessing, but they arent.

Again, it goes back to cognitive dissonance. When analyzed independently, price action in specific

assets can be explained with nice, neat, widely accepted arguments. The problem comes when trying to

use those same explanations to shed light on several of them, simultaneously. They dont jibe, at least

not in a way that we have come to expect.

So, yes, a strong US economy would explain why the USD is so strong, but not why rates and inflation

are lower, nor why stocks and other risky assets are struggling. You could attribute the strong Dollar to a

world where carry is king, and every additional basis point of relative yield attracts more and more

capital, but why then are emerging market debt and currencies not rallying? Even within the US, the

destination for all this capital from around the world, we arent seeing it flow beyond government debt.

!

Copyright 2015 by Bija Advisors LLC.; BijaAdvisorsLLC.com

Reproduction or retransmission in any form, without written permission, is a violation of Federal Statute

Bija Advisors Macro Radar January 20, 2015

5

!

Global Macroeconomic Cheat Sheet

There is a coherent, consistent explanation for why markets are moving, policymakers are deciding and

fundamentals are playing out as they are. Below is my global macro cheat sheet, which I reference any

time I read a CB statement, witness a major move in markets, listen to an analyst speak, take on a

position and await the release of new data. The implications of each and every item on the list are far

reaching and likely to remain with us for years to come.

I have written about these items repeatedly and will continue to do so until they are no longer valid. If

youre not thinking about these things regularly and understanding their direct impact on the

ramifications of policy decisions, the economy, feedback loops and market psychology, I would wager

youre either underperforming your views or getting lucky.

1. The financial crisis did not destroy private wealth.

2. Wealth disparity is nearing historic highs and economic analysis needs to adjust for the impact of the

shift in marginal utility. Government intervention is the only thing that can change its course.

3. Monetary policy is impotent with regard to the real economy. It merely affects shifts between

financial instruments.

4. The impact of Chinas monumental urbanization project, which began in 1996, ended, by pure

coincidence, in the midst of the financial crisis.

5. Technology is moving ever more rapidly up the cognitive value chain.

6. Fiscal policy is the only thing that can affect the real economy, and the only thing that can drive

yields and inflation higher.

7. Economies and markets are now global.

8. Policymakers are people.

In this list you will find the answers to all of your questions. Why have commodities collapsed and how

long will they stay down here? Why is it that unemployment is likely to continue to fall without

triggering wage inflation? How is it that some assets have become hyper sensitive to interest rate

adjustments, yet carry isnt a factor further out on the risk curve? How can prices be so tight, yet

untradable? Can the US economy find its legs if the rest of the world is teetering on the brink of failure?

Why has the cost of a college education been increasing at several multiples of the overall inflation rate?

Why is deflation more likely than inflation, and why doesnt it matter? What will trigger the US Dollar

free-fall? Why is competitive devaluation a fools game, and why will protectionism escalate? Why are

tech companies sitting on so much cash?

Thats a lot to digest, so Ill leave it here for now.

About the Author

For nearly three decades, Stephen Duneier has applied cognitive science to investment management, and

life itself. The result has been top tier returns with near zero correlation to any major index, the

development of a billion dollar hedge fund, a burgeoning career as an artist and a rapidly shrinking

bucket list.

Mr. Duneier teaches Decision Analysis in the College of Engineering at the University of California

Santa Barbara. Through Bija Advisors' publications and consulting practice, he helps portfolio managers

!

Copyright 2015 by Bija Advisors LLC.; BijaAdvisorsLLC.com

Reproduction or retransmission in any form, without written permission, is a violation of Federal Statute

Bija Advisors Macro Radar January 20, 2015

6

!

and business leaders improve performance by applying proven decision-making skills to their own

processes.

As a speaker, Stephen has delivered informative and inspirational talks on global macro economic

themes, how cognitive science can improve performance, and the keys to living a more deliberate life, to

audiences around the world for more than 20 years. Each is delivered via highly entertaining stories that

inevitably lead to further conversation, and ultimately, better results.

Stephen Duneier was formerly Global Head of Currency Option Trading at Bank of America and

Managing Director of Emerging Markets at AIG International. His artwork is represented by the world

renowned gallery, Sullivan Goss. He received his master's degree in finance and economics from New

York University's Stern School of Business.

Bija Advisors LLC

Web: BijaAdvisorsLLC.com

Email: info@bijaadvisorsllc.com

Twitter: @BijaSeeds

Phone: 805 452 9429

In publishing research, Bija Advisors LLC is not soliciting any action based upon it. Bija Advisors LLCs publications contain material

based upon publicly available information, obtained from sources that we consider reliable. However, Bija Advisors LLC does not

represent that it is accurate and it should not be relied on as such. Opinions expressed are current opinions as of the date appearing on Bija

Advisors LLCs publications only. All forecasts and statements about the future, even if presented as fact, should be treated as judgments,

and neither Bija Advisors LLC nor its partners can be held responsible for any failure of those judgments to prove accurate. It should be

assumed that, from time to time,Bija Advisors LLC and its partners will hold investments in securities and other positions, in equity, bond,

currency and commodities markets, from which they will benefit if the forecasts and judgments about the future presented in this document

do prove to be accurate. Bija Advisors LLC is not liable for any loss or damage resulting from the use of its product.

!

Copyright 2015 by Bija Advisors LLC.; BijaAdvisorsLLC.com

Reproduction or retransmission in any form, without written permission, is a violation of Federal Statute

You might also like

- Baseeds 14-8 LivinglifedeliberatelyDocument6 pagesBaseeds 14-8 Livinglifedeliberatelyapi-276766667100% (1)

- Baseeds 15-32Document5 pagesBaseeds 15-32api-276766667No ratings yet

- Baseeds 15-29Document3 pagesBaseeds 15-29api-276766667No ratings yet

- Basar 1Document5 pagesBasar 1api-276766667No ratings yet

- Baseeds 15-33Document2 pagesBaseeds 15-33api-276766667No ratings yet

- Baseeds 14-1 PacmanDocument3 pagesBaseeds 14-1 Pacmanapi-276766667No ratings yet

- Baseeds 15-30Document4 pagesBaseeds 15-30api-276766667No ratings yet

- Baseeds 15-25Document4 pagesBaseeds 15-25api-276766667No ratings yet

- Baseeds 15-24 ProsecutorfallacyDocument5 pagesBaseeds 15-24 Prosecutorfallacyapi-276766667No ratings yet

- Portfolio Post-MortemDocument9 pagesPortfolio Post-Mortemapi-276766667No ratings yet

- Baseeds 15-7 WakeupcallDocument5 pagesBaseeds 15-7 Wakeupcallapi-276766667No ratings yet

- Baseeds 15-26Document3 pagesBaseeds 15-26api-276766667No ratings yet

- Baseeds 14-7 DeathofvoltradingDocument3 pagesBaseeds 14-7 Deathofvoltradingapi-276766667No ratings yet

- Bamacro15-3 MoralhazardDocument3 pagesBamacro15-3 Moralhazardapi-276766667No ratings yet

- Baseeds 14-6 WhenmacrolostitswayDocument3 pagesBaseeds 14-6 Whenmacrolostitswayapi-276766667No ratings yet

- Baseeds 15-11Document3 pagesBaseeds 15-11api-276766667No ratings yet

- Baseeds 15-15 EursurpriseDocument2 pagesBaseeds 15-15 Eursurpriseapi-276766667No ratings yet

- Baseeds 14-2 WoodsshockDocument4 pagesBaseeds 14-2 Woodsshockapi-276766667No ratings yet

- Baseeds 15-22Document4 pagesBaseeds 15-22api-276766667No ratings yet

- Baseeds 15-21 BlindedbymyopiaDocument4 pagesBaseeds 15-21 Blindedbymyopiaapi-276766667No ratings yet

- Bamacro15 5Document3 pagesBamacro15 5api-276766667No ratings yet

- Bamacro15-1 FiduciaryfollyDocument5 pagesBamacro15-1 Fiduciaryfollyapi-276766667No ratings yet

- Baseeds 15-20Document2 pagesBaseeds 15-20api-276766667No ratings yet

- Baseeds 13-7Document3 pagesBaseeds 13-7api-276766667No ratings yet

- Baseeds 13-10Document4 pagesBaseeds 13-10api-276766667No ratings yet

- Baseeds 13-17Document3 pagesBaseeds 13-17api-276766667No ratings yet

- Baseeds 15-19Document5 pagesBaseeds 15-19api-276766667No ratings yet

- Baseeds 15-17Document3 pagesBaseeds 15-17api-276766667No ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Plan Contable EmpresarialDocument432 pagesPlan Contable EmpresarialJhamil Nirek PascasioNo ratings yet

- CV Siti Nur Najihah BT Nasir 1Document1 pageCV Siti Nur Najihah BT Nasir 1sitinurnajihah458No ratings yet

- Complete History of The Soviet Union, Arranged To The Melody of TetrisDocument2 pagesComplete History of The Soviet Union, Arranged To The Melody of TetrisMikael HolmströmNo ratings yet

- Notes On Fundamentals of Property OwnershipDocument17 pagesNotes On Fundamentals of Property OwnershipNeil MayorNo ratings yet

- Evaluation Sheet For Extension ServicesDocument1 pageEvaluation Sheet For Extension Servicesailine donaireNo ratings yet

- The Impact of Motivation On Organizational PerformanceDocument96 pagesThe Impact of Motivation On Organizational PerformanceRandolph Ogbodu100% (2)

- SWOT-ToWS Analysis of LenovoDocument2 pagesSWOT-ToWS Analysis of Lenovoada9ablao100% (4)

- Mixed Use Traffic Impact StudyDocument77 pagesMixed Use Traffic Impact StudyusamaNo ratings yet

- Manila City - Ordinance No. 8330 s.2013Document5 pagesManila City - Ordinance No. 8330 s.2013Franco SenaNo ratings yet

- MyNotesOnCNBCSoFar 2016Document38 pagesMyNotesOnCNBCSoFar 2016Tony C.No ratings yet

- Caso Estudio Baker SKF - 2Document1 pageCaso Estudio Baker SKF - 2jhonatanNo ratings yet

- CV - Contract Manager Muhammad NadeemDocument5 pagesCV - Contract Manager Muhammad NadeemMuhammad Nadeem BashiriNo ratings yet

- Unit 1 Econ VocabDocument5 pagesUnit 1 Econ VocabNatalia HowardNo ratings yet

- Performance Management System at BHELDocument24 pagesPerformance Management System at BHELshweta_46664100% (3)

- To Sell or Scale Up: Canada's Patent Strategy in A Knowledge EconomyDocument22 pagesTo Sell or Scale Up: Canada's Patent Strategy in A Knowledge EconomyInstitute for Research on Public Policy (IRPP)No ratings yet

- JBS Usa Lux S.A. and JBS S.A. Announce Expiration Of, and Receipt of Requisite Consents in Connection With, The Consent SolicitationsDocument2 pagesJBS Usa Lux S.A. and JBS S.A. Announce Expiration Of, and Receipt of Requisite Consents in Connection With, The Consent SolicitationsJBS RINo ratings yet

- PDF Rencana Pengembangan Madrasah Contoh RPMDocument19 pagesPDF Rencana Pengembangan Madrasah Contoh RPMTeguh KaryaNo ratings yet

- Brochure (Eng) - 2021 Oda KoreaDocument9 pagesBrochure (Eng) - 2021 Oda Koreasunjung kimNo ratings yet

- Guc 57 56 21578 2022-06-21T23 25 51Document3 pagesGuc 57 56 21578 2022-06-21T23 25 51Mariam MhamoudNo ratings yet

- What Is Public Choice Theory PDFDocument8 pagesWhat Is Public Choice Theory PDFSita SivalingamNo ratings yet

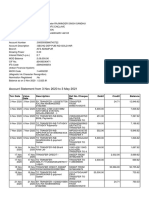

- Account Statement From 3 Nov 2020 To 3 May 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument8 pagesAccount Statement From 3 Nov 2020 To 3 May 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceRajwinder SandhuNo ratings yet

- 1 Plastics Give A Helpful HandDocument10 pages1 Plastics Give A Helpful HandNIranjanaNo ratings yet

- The Currency Correlation Secret - TwoDocument10 pagesThe Currency Correlation Secret - Twofebrichow100% (1)

- 184 History of AgricultureDocument25 pages184 History of AgricultureBhupendra PunvarNo ratings yet

- Cost AccountingDocument2 pagesCost AccountingLouina YnciertoNo ratings yet

- ABPS3103 Topic 7Document20 pagesABPS3103 Topic 7Damon CopelandNo ratings yet

- Challan Form SargodhaDocument1 pageChallan Form SargodhaUsama NazirNo ratings yet

- Borjas 2013 Power Point Chapter 8Document36 pagesBorjas 2013 Power Point Chapter 8Shahirah Hafit0% (1)

- Study On The Thermal Pyrolysis of Medical Waste (Plastic Syringe) For The Production of Useful Liquid Fuels PDFDocument53 pagesStudy On The Thermal Pyrolysis of Medical Waste (Plastic Syringe) For The Production of Useful Liquid Fuels PDFaysarNo ratings yet

- 19, Cabaltica, Ednalyn A. What Is The Basel Committee?Document3 pages19, Cabaltica, Ednalyn A. What Is The Basel Committee?chenlyNo ratings yet