Professional Documents

Culture Documents

Financial Accounting 2 Chapter 1 Solman

Uploaded by

Elijah Lou ViloriaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Accounting 2 Chapter 1 Solman

Uploaded by

Elijah Lou ViloriaCopyright:

Available Formats

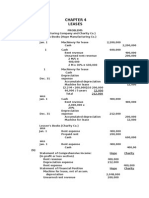

CHAPTER 1

CURRENT LIABILITIES, PROVISIONS AND

CONTINGENCIES

PROBLE

MS

1-1. (Washington

Company)

Accounts Payable,

12/31/12, before

adjustments

Unrecorded checks

in payment to

creditors

Unrecorded

purchases (150,000

x 98%) Accounts

Payable, 12/31/12,

as adjusted

1-2.

(Adams Company)

16

1,000,000

(350,000)

147,000

797,000

Accounts Payable, 12/31/12, before adjustments

Goods purchased FOB shipping point, lost in

transit

Returned to supplier

Accounts Payable, 12/31/10, as adjusted

1-3.

P1,500,000

240,000

(80,000)

P1,660,000

(Jefferson Corporation)

(a) (1) Gross Method

Dec. 16 Purchases

Freight in

Accounts Payable Intel Company

Cash

19

26

31

26

31

66,000

1,400

Purchases

Accounts Payable Celeron Corporation

72,000

Accounts Payable- Intel Company

Purchase Discount (2% x 66,000)

Cash

66,000

Accounts Payable Celeron Corporation

Purchase Discount (2% x 72,000)

Cash

72,000

(a) (2) Net Method

Dec. 16 Purchases

Freight in

Accounts Payable Intel Company

Cash

19

66,000

1,400

72,000

1,320

64,680

1,440

70,560

64,680

1,400

64,680

1,400

Purchases

Accounts Payable Celeron Corporation

69,840

Accounts Payable Intel Company

Cash

64,680

Accounts Payable Celeron Corporation

Purchase Discounts Lost

Cash

69,840

720

69,840

64,680

70,560

Chapter 1 Current Liabilities, Provisions and Contingencies

(b)

Dec. 31

1-4.

Purchase Discounts Lost

Accounts Payable Celeron

Corporation

(Madison Company)

(a)

10/01/12 Automobiles (1,747,200 112%)

Discount on Notes Payable

Notes Payable

12/31/12

10/01/13

140,400

46,800

140,400

1,747,200

1,747,200

P1,606,800

1,080,000

120,000

1,200,000

Interest Expense

Discount on Notes Payable

120,000 x 7/12

70,000

Interest Expense

Discount on Notes Payable

120,000 70,000

50,000

Notes Payable

Cash

(b) At December 31, 2013:

Current Liabilities:

Notes Payable, net of P50,000 Discount

1-6.

1,747,200

Interest Expense

Discount on Notes Payable

187,200 46,800

(Monroe Corporation)

(a)

06/01/12 Cash

Discount on Notes Payable

Notes Payable

05/31/13

1,560,000

187,200

46,800

(b) At December 31, 2012:

Current Liabilities:

Notes Payable, net of P140,400 Discount

12/31/12

720

Interest Expense

Discount on Notes Payable

1,560,000 x 12% x 3/12

Notes Payable

Cash

1-5.

720

70,000

50,000

1,200,000

1,200,000

P 1,150,000

(Unison Company)

(a) Market interest rate is 5%

Principal

Stated interest (8,000,000 x 9%)

Maturity value

PV factor at 5% for 1 period

Present value at May 1, 2012

Face value of the note

Premium on Notes Payable

P8,000,00

0

720,000

P8,720,00

0

0.9524

P8,304,92

8

8,000,000

P 304,928

Chapter 1 Current Liabilities, Provisions and Contingencies

05/01/12

Equipment

Notes Payable

Premium on Notes Payable

12/31/12

Interest Expense

Premium on Notes Payable (304,928 x 8/12)

Interest Payable(8,000,000 x 9% x

8/12)

8,304,928

8,000,000

304,928

276,715

203,285

480,000

4/30/13

Interest Expense

138,537*

Premium on Notes Payable (304,928

203,285)

101,643

Interest Payable

480,000

Notes Payable

8,000,000

Cash

8,720,000

*balancing figure (difference is due to rounding off of present value factor)

Carrying value as of December 31, 2012

Notes Payable

Premium on Notes Payable

Interest Payable

Total

(or 8,304,928 + 276,715)

P8,000,00

0

101,643

480,000

P8,581,64

3

b. market rate of interest is 12%.

Principal

Stated interest (8,000,000 x 9%)

Maturity value

PV factor at 12% for 1 period

Present value at May 1, 2012

Face value of the note

Discount on Notes Payable

05/01/12

Equipment

Discount on Notes Payable

Notes Payable

12/31/12

Interest Expense

Discount on Notes Payable (213,912 x

8/12)

Interest Payable(8,000,000 x 9% x

8/12)

P8,000,00

0

720,000

P8,720,00

0

0.8929

P7,786,08

8

8,000,000

P 213,912

7,786,088

213,912

8,000,000

622,608

142,608

480,000

4/30/13

Interest Expense

311,304*

Interest Payable

480,000

Notes Payable

8,000,000

Discount on Notes Payable

71,304

Cash

8,720,000

*balancing figure (difference is due to rounding off of present value factor)

Carrying value as of December 31, 2012

Notes Payable

P8,000,00

0

Discount on Notes Payable

Interest Payable

Total

(or 7,786,088 + 622,608)

(71,304)

480,000

P8,408,69

6

Chapter 1 Current Liabilities, Provisions and Contingencies

1-7.

(Harrison Company)

Amount to be accrued on 12/31/10 (the best estimate of the obligation)

P800,000

No obligation is recognized for the suit filed in September 2012 nor for the

suit filed in October. However, disclosure is necessary in the notes to the

financial statements for the suit filed in October 2012 by Pasig City

government since it is reasonably possible the Pasig City government will

be successful.

1-8.

( Tyler Corporation)

a.

b.

c.

1-9.

Premium Inventory

Cash / Accounts Payable

225,000

Premium Expense

Cash (1,000 x 50)

Premium Inventory (1,000 x 150)

100,000

50,000

Premium Expense

Estimated Liability for Premium Claims

Outstanding

(40% x 1,000,000)/ 100 = 4,000

4,000 1,000 = 3,000; 3,000 x (150 50) =

300,000

300,000

225,000

150,000

(Polk Company)

(a) Premium Expense (300,000 x 30%)/20 x 28

Cost of mugs already distributed (4,000 x

28)

Estimated liability for premium claims

outstanding

(b)

300,000

P126,000

112,000

P 14,000

Premium Expense for 2012 (see a)

P126,000

1-10. Taylor Company

(a)

Expected future redemption, beg

Redeemed during the year

Expected future redemption, end

Total

Net cost of premium (120 50)

Premium expense

(2)

2011

P40,000

30,000

P70,000

5

P14,000

x P70

P980,00

0

2012

P(30,000)

90,000

80,000

P140,000

5

P28,000

x P70

P1,960,000

Provision for premium claims outstanding

12/31/10 (30,000/5) x

P70

12/31/11 (80,000/5) x

P70

P 420,00

P1,120,00

Chapter 1 Current Liabilities, Provisions and Contingencies

1-11. (Van Department Store)

(a)

Allocation of original consideration

received:

Sales revenue (98% x P5,000,000)

Liability for Customer Loyalty Awards (2% x

P5,000,000)

Revenue in 2011 as a result of redemption

100,000 x 25/90

Revenue in 2012 as a result of redemption

Total accumulated revenue from redemption as of

12/31/12 (100,000 x 60/95)

Less revenue earned in

2011

Revenue in 2012 as a result of redemption

P4,900,000

P 100,000

P

(b)

Liability as of 12/31/11 (100,000 27,778)

Liability as of 12/31/12 (100,000 63,158)

27,778

63,158

27,778

35,380

P 72,222

P 36,842

1-12. (Jackson Company)

2010

Sale of product

Accts. Receivable/Cash

Sales

Accrual of repairs

Warranty Expense

Warranty Liability

6% x 1M

6% x 2.5M

6% x 3.5M

Actual repairs

Warranty Liability

Cash/ AP, etc.

2011

2012

1,000,000

2,500,000

3,500,000

1,000,000

2,500,000

3,500,000

60,000

150,000

60,000

8,000

150,000

210,000

210,000

38,000

112,500

112,500

38,000

8,000

1-13. (Filmore Company)

(a)

Warranty Liability, January 1

Warranty expense (8% x 4,200,000)/(8% x 6,960,000)

Actual repair costs

incurred

Warranty liability, December 31

2011

P

0

336,000

2012

P187,200

556,800

(148,800)

P187,200

(180,000)

P564,000

(b)

On 2011 sales (4,200,000) x 5% x

On 2012 sales [(1/2 of 3%) + 5%] x

6,960,000

Warranty Liability, December 31, 2012, as analyzed

1-14. (Pierce Corporation)

Cash

Unearned Revenue from Gift Certificates

Outstanding

Unearned Revenue from Gift Certificates Outstanding

Sales

P105,000

452,400

P557,400

2,000,000

2,000,000

1,280,000

1,280,000

Note: The gift certificates estimated to expire will be recognized as

revenues at the date of actual expiration.

Chapter 1 Current Liabilities, Provisions and Contingencies

1-15. (Buchanan Company)

Cash

Unearned Revenue from Gift Certificates

Outstanding

Unearned Revenue from Gift Certificates

Outstanding

Sales

Unearned Revenue from Gift Certificates

Outstanding

Revenue from Forfeited Gift Certificates

3,000,000

3,000,000

2,750,000

2,750,000

150,000

150,000

1-16. (Lincoln Company)

Refundable Deposits, January 1,

2012

Deposits received during 2012

Deposits refunded during 2012

Deposits forfeited during 2010 (100,000 82,000)

Refundable Deposits, December 31,

2012

1-17. (Johnson Company)

(a)

Cash

Unearned Service Contract

Revenue

P250,000

200,000

(267,000)

(18,000)

P165,000

2011

2012

720,000

Cost of Service Contract

25,000

Cash, Accounts Payable, etc.

Unearned Service Contract

Revenue

72,000

Service Contract Revenue

2011: 720,000=72,000x20% x

2012: 720,000=72,000x20% x

=108,000720,000 x 30% x

=864,000 x 30% x

86,400

72,000+108,000+86,400=266,400

(b)

Unearned Service Contract Revenue, Jan. 1

Sale of contracts during the

year

Service contracts earned during the year

Unearned Service Contract Revenue, Dec. 31

864,000

720,000

864,000

100,000

25,000

100,000

266,400

72,000

266,400

2011

2012

-----

P648,000

P720,000

(72,000)

P648,000

864,000

(266,400)

P1,245,600

Unearned Service Contract Revenue at December 31, 2012 may also be

computed as:

720,000 x 65%

468,000

864,000 x 20% x

86,400

864,000 x 80%

691,200

Total

1,245,600

(c)

2011

2012

Revenue from service

contracts

P72,000

P266,400

Cost of service contracts

25,000

100,000

Profit from service

contracts

P47,000

P166,400

Chapter 1 Current Liabilities, Provisions and Contingencies

1-18. (Grant Publication)

(a)

Subscriptions sold in 2009 and 2010

(5,000,000 + 4,500,000)

Expired subscriptions in

2009

2010 (2,800,000 + 1,200,000)

Unearned subscriptions, Jan. 1, 2011

(b)

(b)

(c)

2011

Cash

Unearned Subscription Revenue

P9,500,000

P1,000,000

4,000,000

5,500,000

5,500,000

Unearned Subscription Revenue

Subscription Revenue

1,200,000 + 2,000,000 + 1,800,000

2012

Cash

Unearned Subscription Revenue

5,000,000

Unearned Subscription Revenue

Subscription Revenue

1,300,000 + 2,400,000 + 2,000,000

5,700,000

Unearned Subscription Revenue, January

1

Subscription received during the year

Subscription revenue for the year

Unearned Subscription Revenue,

December 31

5,000,000

P4,500,000

5,000,000

7,000,000

7,000,000

5,700,000

2011

2012

P4,500,000 P5,000,000

5,500,000 7,000,000

(5,000,000) (5,700,000)

P5,000,000 P6,300,000

1-19. (Hayes Co.)

Property Taxes Payable

Property tax expense July 1 to Dec. 31

(72,000 x 6/12)

P

36,000

Payment in 2012 (Nov. payment = 72,000/3)

(24,000)

Income Tax Payable

Pretax income before accrued property taxes

P1,629,000

Less accrued property tax

12,000

Income subject to tax

P1,617,000

Income tax rate

30%

Income tax expense

P 485,100

2012 payments for 2012 income tax(480,000

190,000)

(290,000)

VAT Payable

Output VAT (12% x 9,000,000)

P 1,080,000

2012 payments of VAT

(725,000)

Total current liabilities for taxes

P 12,000

195,100

355,000

P562,100

1-20. (Garfield Company)

1.

B = 8,000,000 x 8% = 640,000

2.

B = 8% (8000,000 B

) B = 640,000 - .08B

Chapter 1 Current Liabilities, Provisions and Contingencies

B = 640,000/1.08 = 592,593

c.

B = .08 (8,000,000 T )

T = .30 (8,000,000 B )

B = .08 {8,000,000 - .30 (8,000,000 B ) }

B = .08 {8,000,000 2,400,000 + .30B}

B = 448,000 + .024B

B = 448,000/0.976 = 459,016

d.

B = .08 {8,000,000 B T }

T = .30 (8,000,000 B)

B = .08{8,000,000 B - .30 (8,000,000

B)}

B = .08 {8,000,000 B 2,400,000 + .

30B}

B = 448,000 - .056B

B = 448,000/1.056 = 424,242

1-21. (Arthur Corporation)

a.

Bonus to sales manager = .08 x 3,000,000

Bonus to each sales agent = .06 x

3,000,000

2.

240,000

180,000

Total Bonus = .36 {3,000,000 B

T ) T = .30 {3,000,000 B }

{3,000,00

B = .36

0

B - .30 (3,000,000 B)}

B = .36

{3,000,000 B 900,000 + .30B}

B = 756,000 - .252B

B = 756,000/1.252

B (Each): 603,834 / 3

3.

=

=

603,834

(total)

201,278

B = .32 {3,000,000

B } B = 960,000 - .

32B

B = 960,000/1.32

B (Sales Manager): 727,273 x 12/32

B (Each Sales Agent): 727,273 x 10/32

=

=

=

727,273

(total)

272,727

227,273

1-22. (Cleveland, Inc.)

B=.

06

{9,000,000 B T }

T = .30 (9,000,000 B)

B=.

06

(9,000,000 B - .30 (9,000,000 B ) }

B=.

06

{ 9,000,000 B 2,700,000 + .30B }

B = 378,000 - .042B

B = 378,000 / 1.042 = 362,764

T = .30 (9,000,000 362,764)

T = 2,591,171

1-23. (McKinley Company)

a.

Vacation earned by employees in 2012

P

200,000

Adjustment in rate for unused vacation pay in previous

periods

(250,000 150,000) x 10%

Vacation pay expense in 2012

2.

Unused vacation pay in previous periods, adjusted to

current rate (250,000 150,000) x 110%

Vacation pay earned by employees in 2012 unused

10,000

P

210,000

P110,000

200,000

Chapter 1 Current Liabilities, Provisions and Contingencies

P310,00

0

Liability for vacation pay, 12/31/12

1-24. (Roosevelt Corporation)

The full amount of P2,000,000 is classified as current liability because on December

31, 2012 (the reporting date), the enterprise has no unconditional right to defer the

settlement of the obligation for a period of at least 12 months.

1-25.

Current

Case 1 . Taft, Inc.

3,600,000 x 80%

3,000,000 2,880,000

Case

2.

Taft, Inc.

Case

3.

Wilson Corporation

Situation A

Situation B

Situation C

Situation D

P2,880,000

P 120,000

2,000,000

Current

Non-current

6,000,000

0

6,000,000

-0-

0

6,000,000

0

6,000,000

1-26. (Harding Company)

Current Liabilities

14% Notes Payable, refinanced on March 10,

2013

Current portion of 16% notes payable

Total current liabilities

1-27. (Coolidge Company)

Current Liabilities:

Accounts Payable

Mortgage Notes Payable

Bank Notes Payable due currently

Interest Payable

Value Added Tax Payable

Income Tax Payable

Withholding Tax Payable

Total Current Liabilities

Noncurrent

P2,500,000

800,000

P3,300,00

0

P 270,000

1,300,000

100,000

7,500

288,000

315,000

120,000

P2,400,500

VAT: 2,688,000 / 1.12 = 2,400,000; 2,400,000 x 12% = 288,000

The damages claimed by employees cannot be recognized since the amount

is not reasonably estimable.

Chapter 1 Current Liabilities, Provisions and Contingencies

MULTIPLE CHOICE QUESTIONS

Theory

MC1

MC2

MC3

MC4

MC5

MC6

MC7

MC8

MC9

MC10

D

B

C

B

B

A

B

C

C

C

Problems

MC23

D

MC24

C

MC25

MC26

MC27

MC28

A

D

C

A

MC29

MC30

MC31

MC32

MC33

MC34

D

D

D

C

A

A

MC35

MC36

D

B

MC37

MC38

MC39

MC40

A

A

B

MC41

MC42

D

C

MC43

MC44

MC45

C

C

MC46

MC47

MC48

MC49

MC50

B

C

A

D

A

MC11

MC12

MC13

MC14

MC15

MC16

MC17

MC18

MC19

MC20

MC21

MC22

D

B

D

B

B

A

B

A

B

C

D

D

540,000 + 30,000 + 15,000 = 585,000

100,000 + (100,000 x 0.3 x 9/12) = 102,250 x .944 = 96,524

Proceeds = 100% - 10% = 90% ; Effective interest = 10%/90% =

11.11%

P500,000, which is the reasonable estimate

Given

65,000 + 815,000 780,000 = 100,000

6% ( 4,500,000-2,500,000)+=2,5012,000= +

(8,500 x

126,750

540,000 + 960,000 780,000 = 720,000

[(1/2 x 35%) + 50% x 2,100,000] + 92.5%(2,730,000) = 3,942,750

[(15% + 35%) x P2,100,000] + (1/2 x 15% x 2,730,000) = 729,750

(15% + 35%) x P2,730,000 = 682,500

(x 50% x 2,100,000) + (67.5% x 2,730,000) + (92.5% x 2,475,000) =

4,657,125

1,000 x 750 = 750,000

42,000 + (750,000 x 3/10) = 267,000

{(500,000 x 80%) 300,000} = 100,000; 100,000 x (50+5-40) =

1,500,000

{ (3,000,000 x 60%) / 10 } 42,000 =

138,000;

138,000 x P0.50 = 69,000

(400,000 x 70%) 100,000 = 180,000 ; ( 180,000 /5) x 20 = 720,000

(180,000 x 50%) 75,000 = 15,000

24,000 x 300 =

7,200,000

7,200,000 1,700,000 = 5,500,000

1,500,000 x 4% =

60,000

B = 0.45 {2,000,000 B - .30 (2,000,000

B}) ;

B = 479,087

Total B = 0.35 {2,000,000 B} ; total B = 518,519

B to Sales Manager = 518,519 x 15/35 =

222,222

B to Each Sales Agent = 518,519 x 10/35 = 148,148

B = 0.10 {2,500,000 - .30 (2,500,000 B)} = 180,412

600,000 + 900,000 + 400,000 = 1,900,000

2,400,000 1,900,000 = 500,000

3,800,000 + 2,000,000 5,000,000 = 800,000 decrease in profit

472,000+200,000+9,600+64,000+380,000+26,000+100,000+50,000+

24,000+48,000+57,500= 1,431,100

1

0

You might also like

- Answers - V2Chapter 1 2012Document10 pagesAnswers - V2Chapter 1 2012Christopher Diaz0% (1)

- CPA Review Notes 2019 - BEC (Business Environment Concepts)From EverandCPA Review Notes 2019 - BEC (Business Environment Concepts)Rating: 4 out of 5 stars4/5 (9)

- Vol 2 CH 1Document20 pagesVol 2 CH 1lee jong sukNo ratings yet

- 2014 Volume 2 CH 1 Solution ManualDocument10 pages2014 Volume 2 CH 1 Solution ManualGabriel Dave AlamoNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Answers - Chapter 1 Vol 2 2009Document10 pagesAnswers - Chapter 1 Vol 2 2009Shiela PilarNo ratings yet

- AP 5902 Liability Supporting NotesDocument6 pagesAP 5902 Liability Supporting NotesMeojh Imissu100% (1)

- Financial Accounting Baysa and Lupisan 2008 Volume 2 EditionDocument21 pagesFinancial Accounting Baysa and Lupisan 2008 Volume 2 EditionAsfjaslkf Dsgsdhsd0% (2)

- Wiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- AP 5902Q Liabs Supporting NotesDocument2 pagesAP 5902Q Liabs Supporting NotesEmms Adelaine TulaganNo ratings yet

- Commercial Bank Revenues World Summary: Market Values & Financials by CountryFrom EverandCommercial Bank Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Accounting Principles 10th Edition Weygandt Kimmel Chapter 3 PDFDocument139 pagesAccounting Principles 10th Edition Weygandt Kimmel Chapter 3 PDFbeenie manNo ratings yet

- Credit Union Revenues World Summary: Market Values & Financials by CountryFrom EverandCredit Union Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Cheat SheetDocument9 pagesCheat SheetKhushi RaiNo ratings yet

- Consumer Lending Revenues World Summary: Market Values & Financials by CountryFrom EverandConsumer Lending Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Batch 17 1st Preboard (P1)Document13 pagesBatch 17 1st Preboard (P1)mjc24100% (7)

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- CMA April - 14 Exam Question SolutionDocument55 pagesCMA April - 14 Exam Question Solutionkhandakeralihossain50% (2)

- CH 18 ADocument9 pagesCH 18 AAlex YaoNo ratings yet

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionFrom EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNo ratings yet

- Unit 1 - Essay QuestionsDocument7 pagesUnit 1 - Essay QuestionsJaijuNo ratings yet

- Wiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)From EverandWiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)No ratings yet

- Non-Financial Liabilities HomeworDocument6 pagesNon-Financial Liabilities HomeworIsabelle Guillena60% (5)

- CH 01 Review and Discussion Problems SolutionsDocument11 pagesCH 01 Review and Discussion Problems SolutionsArman BeiramiNo ratings yet

- Workshop Solutions T1 2014Document78 pagesWorkshop Solutions T1 2014sarah1379No ratings yet

- Chapter 2 - Correction of Errors PDFDocument12 pagesChapter 2 - Correction of Errors PDFRonald90% (10)

- CH 3 Vol 1 AnswersDocument17 pagesCH 3 Vol 1 Answersjayjay112275% (4)

- AC550 Week Four AssigmentDocument8 pagesAC550 Week Four Assigmentsweetpr22No ratings yet

- CH 3 Vol 1 AnswersDocument17 pagesCH 3 Vol 1 AnswersGeomari D. Bigalbal100% (2)

- Problem 2-26 (IAA)Document19 pagesProblem 2-26 (IAA)gghyo88No ratings yet

- ACCADocument12 pagesACCAAbdulHameedAdamNo ratings yet

- Financial Accounting 2 Chapter 4Document27 pagesFinancial Accounting 2 Chapter 4Elijah Lou ViloriaNo ratings yet

- CH1&2 Homework AnswersDocument5 pagesCH1&2 Homework AnswersGabriel Aaron DionneNo ratings yet

- Dec-12 Solution PDFDocument58 pagesDec-12 Solution PDFOsan JewelNo ratings yet

- Chaper 1 - FS AuditDocument12 pagesChaper 1 - FS AuditLouie De La Torre60% (5)

- Answers - V2Chapter 3 2012 PDFDocument17 pagesAnswers - V2Chapter 3 2012 PDFkea paduaNo ratings yet

- BONEO Pup Receivables3 SRC 2 1Document13 pagesBONEO Pup Receivables3 SRC 2 1hellokittysaranghaeNo ratings yet

- FM Paper Solution (2012)Document6 pagesFM Paper Solution (2012)Prreeti ShroffNo ratings yet

- Week 6 - Solutions (Some Revision Questions)Document13 pagesWeek 6 - Solutions (Some Revision Questions)Jason0% (1)

- G-1 Template NewDocument5 pagesG-1 Template NewShucheng NieNo ratings yet

- AnswersDocument8 pagesAnswersTareq ChowdhuryNo ratings yet

- Merger & Acquisition Accounting & Auditing Impact - Liquidation and Reorganisation - Jawaban Tugas Week 10Document10 pagesMerger & Acquisition Accounting & Auditing Impact - Liquidation and Reorganisation - Jawaban Tugas Week 10Ragil Kuning ManikNo ratings yet

- Chapter 9 - Shareholder's EquityDocument12 pagesChapter 9 - Shareholder's EquityLouie De La Torre50% (4)

- Mpu3123 Titas c2Document36 pagesMpu3123 Titas c2Beatrice Tan100% (2)

- Acc For Busi AssignmentDocument12 pagesAcc For Busi Assignmentpramodh kumarNo ratings yet

- Chapter 11 Advacc 1 DayagDocument17 pagesChapter 11 Advacc 1 Dayagchangevela67% (6)

- Suggested Solutions Receivable Financing 1. A: "Weighted Average Time To Maturity"Document2 pagesSuggested Solutions Receivable Financing 1. A: "Weighted Average Time To Maturity"cutieaikoNo ratings yet

- Accounting Part 2: Problem SolvingDocument10 pagesAccounting Part 2: Problem Solvingnd555No ratings yet

- ACAE 15 Activity Receivable FinancingDocument3 pagesACAE 15 Activity Receivable FinancingNick ivan AlvaresNo ratings yet

- FA2 Spring 2011 Suggested SolutionDocument6 pagesFA2 Spring 2011 Suggested Solutionaqsa_22inNo ratings yet

- Financial Accounting 2 Chapter 3 SolmanDocument28 pagesFinancial Accounting 2 Chapter 3 SolmanElijah Lou ViloriaNo ratings yet

- Not Collectible Within The Normal Operating Cycle Hence Amount To Be Collected Beyond 12 Months Shall Be Classified As A Noncurrent ReceivableDocument1 pageNot Collectible Within The Normal Operating Cycle Hence Amount To Be Collected Beyond 12 Months Shall Be Classified As A Noncurrent ReceivablecutieaikoNo ratings yet

- FfsDocument9 pagesFfsDivya PoornamNo ratings yet

- 1P91+F2012+Midterm Final+Draft+SolutionsDocument10 pages1P91+F2012+Midterm Final+Draft+SolutionsJameasourous LyNo ratings yet

- Financial Accounting 2 Chapter 4Document27 pagesFinancial Accounting 2 Chapter 4Elijah Lou ViloriaNo ratings yet

- Financial Accounting 2 Chapter 3 SolmanDocument28 pagesFinancial Accounting 2 Chapter 3 SolmanElijah Lou ViloriaNo ratings yet

- 2Document15 pages2Charo Santos LeyvaNo ratings yet

- Financial Accounting 2 Chapter 1 SolmanDocument17 pagesFinancial Accounting 2 Chapter 1 SolmanElijah Lou ViloriaNo ratings yet

- SPOCDocument1 pageSPOCvikasNo ratings yet

- CH 4 - Brief Exercises - 16thDocument18 pagesCH 4 - Brief Exercises - 16thkesey100% (2)

- Salary Tax CalculationDocument8 pagesSalary Tax CalculationAlisha GanejuNo ratings yet

- Business Taxation Notes Income Tax NotesDocument303 pagesBusiness Taxation Notes Income Tax NotesIkra MalikNo ratings yet

- Fruitas IsDocument6 pagesFruitas IscrookshanksNo ratings yet

- Inter QuestionnareDocument23 pagesInter QuestionnareAnsh NayyarNo ratings yet

- HMRC PDFDocument17 pagesHMRC PDFjohnnybck1125No ratings yet

- Journalizing Basic Accounting Tolentino John Carlo BSMA 2ADocument7 pagesJournalizing Basic Accounting Tolentino John Carlo BSMA 2Ajohn carlo tolentinoNo ratings yet

- FTP - Corporation 2021Document2 pagesFTP - Corporation 2021Claude PeñaNo ratings yet

- Payslip 2018 2019 9 IV3563 IVANGELDocument1 pagePayslip 2018 2019 9 IV3563 IVANGELbhakti Mehta67% (3)

- Evaluate and Authorize Payment RequestsDocument15 pagesEvaluate and Authorize Payment RequestsMagarsaa Hirphaa100% (3)

- Activity in Deductions From Gross EstateDocument3 pagesActivity in Deductions From Gross EstateLucy HeartfiliaNo ratings yet

- Vendor Registration FormDocument3 pagesVendor Registration FormSourabh ShrivastavaNo ratings yet

- Taxguru - In-Taxation of CharitableReligious TrustDocument5 pagesTaxguru - In-Taxation of CharitableReligious TrustfcNo ratings yet

- Engagement Letter For Business Bookkeeping and Tax PrepartionDocument2 pagesEngagement Letter For Business Bookkeeping and Tax PrepartionPinky Daisies100% (1)

- Tax Evasion VS Tax AvoidanceDocument5 pagesTax Evasion VS Tax AvoidanceJeth KebengNo ratings yet

- Form IR2 4Document3 pagesForm IR2 4khaingshwe wutyiNo ratings yet

- ABS CBN V CB G.R. No. L-52306Document5 pagesABS CBN V CB G.R. No. L-52306Evan TriolNo ratings yet

- Chapter 5 Income Tax On CorporationsDocument96 pagesChapter 5 Income Tax On Corporationschavezcelvia18No ratings yet

- Estimated Port DisbursementDocument7 pagesEstimated Port DisbursementKhurram RahmanNo ratings yet

- Brothers Maharjan Itta & Tile Udhayog Pvt. LTD.: Balance SheetDocument36 pagesBrothers Maharjan Itta & Tile Udhayog Pvt. LTD.: Balance SheetMenuka SiwaNo ratings yet

- Green Clean SpreadsheetDocument3 pagesGreen Clean SpreadsheetRalph MorganNo ratings yet

- 7110 s19 Ms 21 PDFDocument15 pages7110 s19 Ms 21 PDFkazamNo ratings yet

- ACT Invoice BillDocument2 pagesACT Invoice BillRahul Christopher EvansNo ratings yet

- Sunbeam TransactionsDocument3 pagesSunbeam TransactionsmegafieldNo ratings yet

- Real-Estate 101 - The Cost of Transferring A Land Title in The Philippines - PHILREP Realty CorpDocument8 pagesReal-Estate 101 - The Cost of Transferring A Land Title in The Philippines - PHILREP Realty CorpcarmanvernonNo ratings yet

- Percentage Tax Return: BIR Form NoDocument2 pagesPercentage Tax Return: BIR Form NoRichard Rhamil Carganillo Garcia Jr.No ratings yet

- Activity / Assignment: Solve The Following. Show Your Solutions: 5 Points EachDocument2 pagesActivity / Assignment: Solve The Following. Show Your Solutions: 5 Points EachMa. Alexandria PalmaNo ratings yet

- Area Code AO Type Range Code AO No.: Signature of The DeclarantDocument2 pagesArea Code AO Type Range Code AO No.: Signature of The Declarantyraju88No ratings yet

- Solved Assuming A 25 Percent Tax Rate Compute The After Tax Cost PDFDocument1 pageSolved Assuming A 25 Percent Tax Rate Compute The After Tax Cost PDFAnbu jaromiaNo ratings yet

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProFrom EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProRating: 4.5 out of 5 stars4.5/5 (43)

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyFrom EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNo ratings yet

- How to get US Bank Account for Non US ResidentFrom EverandHow to get US Bank Account for Non US ResidentRating: 5 out of 5 stars5/5 (1)

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCFrom EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCRating: 4 out of 5 stars4/5 (5)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsFrom EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNo ratings yet

- Taxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipFrom EverandTaxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipNo ratings yet

- U.S. Taxes for Worldly Americans: The Traveling Expat's Guide to Living, Working, and Staying Tax Compliant AbroadFrom EverandU.S. Taxes for Worldly Americans: The Traveling Expat's Guide to Living, Working, and Staying Tax Compliant AbroadNo ratings yet

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyFrom EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyRating: 4 out of 5 stars4/5 (52)

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessFrom EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessRating: 5 out of 5 stars5/5 (5)

- Lower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderFrom EverandLower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderNo ratings yet

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionFrom EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionRating: 5 out of 5 stars5/5 (27)

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesFrom EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesRating: 4 out of 5 stars4/5 (9)

- Founding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationFrom EverandFounding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationNo ratings yet

- The Hidden Wealth of Nations: The Scourge of Tax HavensFrom EverandThe Hidden Wealth of Nations: The Scourge of Tax HavensRating: 4 out of 5 stars4/5 (11)

- Decrypting Crypto Taxes: The Complete Guide to Cryptocurrency and NFT TaxationFrom EverandDecrypting Crypto Taxes: The Complete Guide to Cryptocurrency and NFT TaxationNo ratings yet

- Tax-Free Wealth For Life: How to Permanently Lower Your Taxes And Build More WealthFrom EverandTax-Free Wealth For Life: How to Permanently Lower Your Taxes And Build More WealthNo ratings yet

- Deduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesFrom EverandDeduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesRating: 3 out of 5 stars3/5 (3)

- Beat Estate Tax Forever: The Unprecedented $5 Million Opportunity in 2012From EverandBeat Estate Tax Forever: The Unprecedented $5 Million Opportunity in 2012No ratings yet

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingFrom EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingRating: 5 out of 5 stars5/5 (3)

- Taxes Have Consequences: An Income Tax History of the United StatesFrom EverandTaxes Have Consequences: An Income Tax History of the United StatesNo ratings yet