Professional Documents

Culture Documents

How Businesses Are Organized

Uploaded by

khase0 ratings0% found this document useful (0 votes)

20 views2 pagesSole proprietorship - One person owns / operates business advantages Unlimited liability, debts / lawsuits targeted on single person Lack of continuity limited capitol Personal collateral for a loan limited liability partnership Hybrid form of partnership Designed for professionals who do business as a partnership (doctors, accountants) Advantages Partner liability is limited to: Their own wrongful act the supervision of someone's wrongful act Taxation, individuals are taxed (no double taxation) disadvantages Small, limited capital limited number of

Original Description:

Original Title

• • • • • •

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSole proprietorship - One person owns / operates business advantages Unlimited liability, debts / lawsuits targeted on single person Lack of continuity limited capitol Personal collateral for a loan limited liability partnership Hybrid form of partnership Designed for professionals who do business as a partnership (doctors, accountants) Advantages Partner liability is limited to: Their own wrongful act the supervision of someone's wrongful act Taxation, individuals are taxed (no double taxation) disadvantages Small, limited capital limited number of

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

20 views2 pagesHow Businesses Are Organized

Uploaded by

khaseSole proprietorship - One person owns / operates business advantages Unlimited liability, debts / lawsuits targeted on single person Lack of continuity limited capitol Personal collateral for a loan limited liability partnership Hybrid form of partnership Designed for professionals who do business as a partnership (doctors, accountants) Advantages Partner liability is limited to: Their own wrongful act the supervision of someone's wrongful act Taxation, individuals are taxed (no double taxation) disadvantages Small, limited capital limited number of

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

Functional areas:

• HR

• Sales

• Marketing

• Distribution

• Legal

• Customer Service

How businesses are organized:

Sole proprietorship

• One person owns/operates business

• Advantages

• Easy to set up

• Independence, control over business

• Disadvantages

• Unlimited liability, debts/lawsuits targeted on single person

• Lack of continuity

• Limited capitol, very hard to borrow money from banks due to

concentrated risk

• Personal collateral for a loan

General partnership

• Two or more partners

• Advantages

• Easier to get loans than sole proprietorship, more people to assume

responsibility

• Disadvantages

• Unlimited liability

• Lack of continuity

• Limited capitol

• Personal collateral for a loan

Limited liability partnership

• Hybrid form of partnership

• Designed for professionals who do business as a partnership (doctors,

accountants)

• Advantages

• Partner liability is limited to the extent of:

Their own wrongful act

The supervision of someone's wrongful act

• Taxation, individuals are taxed (no double taxation)

• Disadvantages

• Varies state to state

Limited liability corporation

• Hybrid, limited liability of a corporation and tax advantages of a partnership

• Advantages

• Liability is limited to amount of investment

• Choice to be taxed as partnership or corporation

• Disadvantages

• State laws are not uniform

• Relatively new form of organization, not many precedent cases (increase

risk)

S-Corporation

• Corporation rules in organization and operation, taxed as partnership

• Advantages

Limited liability

Taxation as partnership, no double taxation

• Disadvantages

Small, limited capital

Limited number of owners

Less flexible to form and operate, more hoops to jump through

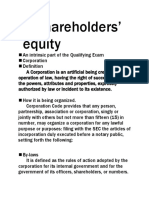

Publicly held corporation

• Business is owned by shareholders

• Advantages

Limited liability

Ease of continuity

• Disadvantages

Double taxation, company gets taxed on income and then pay

dividends which get taxed to shareholders

High startup cost, legal work and registration process

Complex regulations and legal requirements

Can be taken over against will of managers

Owners don't have control

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Diplomatic ProtectionDocument5 pagesDiplomatic ProtectionCosmin PetrescuNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- 617 NP BookletDocument77 pages617 NP BookletDexie Cabañelez ManahanNo ratings yet

- Ayog vs. Cusi - DigestDocument2 pagesAyog vs. Cusi - DigestElton John S. BonsucanNo ratings yet

- Investments and ForeignIncentives ReviewerDocument20 pagesInvestments and ForeignIncentives ReviewerCarlo AgdamagNo ratings yet

- 236 Mcleod v. NLRC (Adre)Document3 pages236 Mcleod v. NLRC (Adre)ASGarcia24No ratings yet

- (CORPO) - Stockholders and MembersDocument19 pages(CORPO) - Stockholders and MembersKrissy PepsNo ratings yet

- Fabm1 PPTDocument65 pagesFabm1 PPTBenjie Galicia AngelesNo ratings yet

- 09 Aurbach vs. Sanitary Wares Manufacturing CorporationDocument22 pages09 Aurbach vs. Sanitary Wares Manufacturing CorporationYaz CarlomanNo ratings yet

- Yutivo DigestDocument1 pageYutivo DigestSosthenes Arnold MierNo ratings yet

- Philippines Land Ownership and AcquisitionDocument15 pagesPhilippines Land Ownership and AcquisitionJohnRichieLTanNo ratings yet

- NullDocument3 pagesNullkhaseNo ratings yet

- NullDocument9 pagesNullkhaseNo ratings yet

- NullDocument1 pageNullkhaseNo ratings yet

- Wont Be Implementing This Feature.: PendingDocument8 pagesWont Be Implementing This Feature.: PendingkhaseNo ratings yet

- NullDocument1 pageNullkhaseNo ratings yet

- NullDocument2 pagesNullkhaseNo ratings yet

- Yash VaziraniDocument5 pagesYash VaziranikhaseNo ratings yet

- NullDocument1 pageNullkhaseNo ratings yet

- NullDocument3 pagesNullkhaseNo ratings yet

- Power - Refers To The Capacity of A To Effect B's Actions in Accordance With A's WishesDocument3 pagesPower - Refers To The Capacity of A To Effect B's Actions in Accordance With A's WisheskhaseNo ratings yet

- NullDocument2 pagesNullkhaseNo ratings yet

- P P P P P P P P P P P PDocument3 pagesP P P P P P P P P P P PkhaseNo ratings yet

- Equity: Investors GainDocument3 pagesEquity: Investors GainkhaseNo ratings yet

- 20's - Very Prosperous Economies WarlordsDocument2 pages20's - Very Prosperous Economies WarlordskhaseNo ratings yet

- Mau Zedong China Was Cut Off inDocument2 pagesMau Zedong China Was Cut Off inkhaseNo ratings yet

- Chapter 8 - Jovian Planets - GasDocument2 pagesChapter 8 - Jovian Planets - GaskhaseNo ratings yet

- French Revolution - 1789 - Storming ofDocument2 pagesFrench Revolution - 1789 - Storming ofkhaseNo ratings yet

- NullDocument9 pagesNullkhaseNo ratings yet

- Acid Rain: Rain Caused by Air PollutionDocument13 pagesAcid Rain: Rain Caused by Air PollutionkhaseNo ratings yet

- Chapter 9Document1 pageChapter 9khaseNo ratings yet

- Chapter 1: Accounting - Financial (GB201)Document14 pagesChapter 1: Accounting - Financial (GB201)khaseNo ratings yet

- Interest Rates Based On Riskiness of Firm'sDocument3 pagesInterest Rates Based On Riskiness of Firm'skhaseNo ratings yet

- Chapter 1: Introducing Health PsychologyDocument2 pagesChapter 1: Introducing Health PsychologykhaseNo ratings yet

- Chapter 7 - Geologically Active - ContinuallyDocument3 pagesChapter 7 - Geologically Active - ContinuallykhaseNo ratings yet

- Chapter 1: Business and Its Legal EnvironmentDocument4 pagesChapter 1: Business and Its Legal EnvironmentkhaseNo ratings yet

- • • • • •Document4 pages• • • • •khaseNo ratings yet

- Cell SignalingDocument4 pagesCell SignalingkhaseNo ratings yet

- Bryan BecherDocument3 pagesBryan BecherkhaseNo ratings yet

- Chapter 5: Elasticity of Demand and SupplyDocument3 pagesChapter 5: Elasticity of Demand and SupplykhaseNo ratings yet

- MaRS Sample Shareholders Agreement 20101028Document30 pagesMaRS Sample Shareholders Agreement 20101028HigginsAINo ratings yet

- Project Proposal: Pangiran Budi Service SDN BHD SC Pangiran Budi Service SRLDocument32 pagesProject Proposal: Pangiran Budi Service SDN BHD SC Pangiran Budi Service SRLSamurawi HailemariamNo ratings yet

- Basic Requirements and Procedure in Registering A CorporationDocument3 pagesBasic Requirements and Procedure in Registering A CorporationAnnie Lara BarzagaNo ratings yet

- J.R.S. Business Corp. v. Imperial InsuranceDocument5 pagesJ.R.S. Business Corp. v. Imperial Insurancesensya na pogi langNo ratings yet

- China National Machinery and Equipment Corp. (Group) v. Judge SantamariaDocument25 pagesChina National Machinery and Equipment Corp. (Group) v. Judge SantamariaSheena Reyes-BellenNo ratings yet

- Past Years QuestionsDocument9 pagesPast Years QuestionsAra RidzuanNo ratings yet

- Shareholders' EquityDocument18 pagesShareholders' EquityKristia AnagapNo ratings yet

- Mercantile Law Syllabus 2018 PDFDocument16 pagesMercantile Law Syllabus 2018 PDFjanezahrenNo ratings yet

- Syllabus For BL 3 FRIADocument7 pagesSyllabus For BL 3 FRIAIra BenitoNo ratings yet

- Assignment 3Document5 pagesAssignment 3Winging FlyNo ratings yet

- Corporation Law 2022 Group 2 Under Atty. Bonna SorianoDocument21 pagesCorporation Law 2022 Group 2 Under Atty. Bonna SorianoCathy GabroninoNo ratings yet

- ContentsDocument32 pagesContentsLouie PedroNo ratings yet

- Assignment On Powers of Corporation Pt. 3 Name: Section: Date: ScoreDocument2 pagesAssignment On Powers of Corporation Pt. 3 Name: Section: Date: ScoreKris Tine100% (1)

- Ucsp 11 Mod. 7 Answer KeyDocument5 pagesUcsp 11 Mod. 7 Answer KeyJOHN GLENLY PILLAZO MAHUSAYNo ratings yet

- SEC rules on SMC director eligibilityDocument7 pagesSEC rules on SMC director eligibilityalnaharNo ratings yet

- Alan Brinkley US History Chapter 17 SummaryDocument3 pagesAlan Brinkley US History Chapter 17 SummaryUmmi CiptasariNo ratings yet

- First Division (G.R. No. 225409, March 11, 2020)Document15 pagesFirst Division (G.R. No. 225409, March 11, 2020)Auxl Reign Nava0% (1)

- CfasDocument42 pagesCfasCleofe Mae Piñero AseñasNo ratings yet

- Law 3 Corporation CodeDocument22 pagesLaw 3 Corporation CodeMaria Fe MarasiganNo ratings yet