Professional Documents

Culture Documents

Revised Syllabus T y y Business Economics - III

Uploaded by

api-292680897Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Revised Syllabus T y y Business Economics - III

Uploaded by

api-292680897Copyright:

Available Formats

Revised Syllabus and Paper Pattern of T.Y.B.

Com: Business Economics Paper V

and VIw.e.f. Academic Year 2014-15

T.Y.B.Com.: Business Economics Paper V

SEMESTERV

Module IIntroduction to

Public Finance

Module II Public Revenue

Module III Public

Expenditure and Public

Debt

Module IV Financial

Markets

Concept of Public Finance: Meaning, Scope and

Functions, Distinction between Public and Private

Finance- Principles of Maximum Social Advantage:

Dalton & Musgrave versions-Modern Trends in Public

Finance: Sound Finance v/s Functional Finance,

Redistributive Taxation, Anti-Inflationary Taxation.

Public Revenue : Sources of Revenue (Tax & Non Tax

Revenue) Merits and Demerits of Direct & Indirect

Tax- Impact and Incidence of Taxation

Public Expenditure: Classification and Causes of

increase in Public Expenditure Budget and Types of

Budget - Public Debt :Types, Burden and Management Concepts of deficit- FRBM Act 2003 Fiscal

Federalism: Concept& Key Issues

Money Markets Components - Features of Indian

Money Market Money Market Reforms in India since

1991.

Capital Markets Meaning, Role, Structure and Reforms

in India since 1991.

T.Y.B.Com.: Business Economics Paper VI

SEMESTER VI

Module I International

Theories of International Trade: Comparative Cost

Theory,

Trade

Heckscher Ohlin Theory, Terms of Trade: Meaning &

Types Gains from Trade (with Offer Curves)

Module II Balance of

Concept & Structure of BOP, Causes of Disequilibrium,

Measures to Correct Disequilibrium in BOP- Indias

Payments and WTO

BOP Position since 1991- WTO Agreements with

reference to TRIPS, TRIMS and GATS

Module III Foreign

Concept of Foreign Exchange Market: Functions and

Dealers - Exchange Rate Systems - Spot and Forward

Exchange Market

Exchange Rate - Hedging, Arbitrage and Speculation.

Module IV Exchange Rate

Exchange Rate Determination -Purchasing Power Parity

Theory - Role of Central Banks in Foreign Exchange

Management

Market -RBIs Intervention in Foreign Exchange Rate

Management Since 1991 (stages)

(15 Lectures)

(10 Lectures)

(10 Lectures)

(10 Lectures)

(15 Lectures)

(10 Lectures)

(10 Lectures)

(10 Lectures)

References:

Hajela T. N. Money, Banking & Public Finance, 8th Edition, 2009, ANE Books

Publications

Benson KunjuKunju Financial Market and Financial Services in India, First Edition, July,

2012, New Century Publication

Mishra S. K. &Puri V. K. Indian Economy, 31st Edition, 2013, Himalaya Publication

House

Dominic Salvatore International Economics, 8th Edition, 2009, John Wiley & Sons

Mithani D. M. Money, Banking, International Trade and Public Finance, 16th Edition,

2010, Himalaya Publication House

Jhingan M. L. International Economics 6th Edition, 2007, Vrinda Publication

Bo Sodersten International Economics, 3rd Edition, 2004, MacMilan Publication.

Hajela T. N. Money, Banking and International Trade, 8th Edition, 2009, ANE Books

Publication

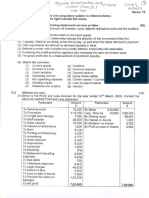

PAPER PATTERN

T.Y.B.COM.: Business Economics - Paper V & VI

Internal and External Examination for Semesters V and VI

Internal Examination

The Internal Examination will be of 25 marks and is split into

i.

Test Paper of 20 marks consisting of questions of objective types.

ii.

5 marks for responsible behavior and active class participation

External Examination

Question Paper Pattern for Semester End Examination.

There will be Five questions in all. All the questions are COMPULSORY and will have

internal choice. (Total 75 marks)

Q1. Module I (Total marks 15)

Three questions: A BC.

Attempt any Two

Q2. Module II (Total marks 15)

Three questions: A BC.

Attempt any Two

Q3. Module III (Total marks 15)

Three questions: A BC.

Attempt any Two

Q4. Module IV (Total marks 15)

Three questions: A BC.

Attempt any Two

Q5. ModulesI to IV (Total marks 15)

a. True or False with reasons. Attempt any Four out of Eight: Two from each module. (2

marks each)

b. Choose the correct option. Attempt any Seven out of Twelve: Three from each module. (1

mark each)

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Downloadable Template - Freelance Proposal by Ryan RobinsonDocument6 pagesDownloadable Template - Freelance Proposal by Ryan Robinsonapi-292680897No ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- 4.133 MSC It Sem I and IIDocument14 pages4.133 MSC It Sem I and IIniyati25No ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- LibraryDocument1 pageLibraryapi-292680897No ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- LibraryDocument1 pageLibraryapi-292680897No ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- 4 183-s y B Com-Commerce-Sem-Iii-IvDocument8 pages4 183-s y B Com-Commerce-Sem-Iii-Ivapi-292680897No ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Sybaf Sem - IV March - 2017Document19 pagesSybaf Sem - IV March - 2017api-292680897No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- 4 77-b Com-Accounting-And-Finance-Semester-I-And-Ii-Syllabus-With-Course-Structure 1Document71 pages4 77-b Com-Accounting-And-Finance-Semester-I-And-Ii-Syllabus-With-Course-Structure 1api-292680897No ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Tybaf Sem V VIDocument42 pagesTybaf Sem V VIapi-292680897No ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Baf-Economics-Ii-Semester-Iii-And-Iv-Syllabus-To-Be-Implememnted-2017 2018 - 2Document71 pagesBaf-Economics-Ii-Semester-Iii-And-Iv-Syllabus-To-Be-Implememnted-2017 2018 - 2api-292680897No ratings yet

- 4 184-m Com-Semester-Iii-And-IvDocument98 pages4 184-m Com-Semester-Iii-And-Ivapi-292680897No ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- BcomDocument368 pagesBcomapi-292680897No ratings yet

- 4 32-B-Tybsc-Applied-Comp 2016-17Document12 pages4 32-B-Tybsc-Applied-Comp 2016-17api-292680897No ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- BscitDocument351 pagesBscitapi-292680897No ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- BafDocument48 pagesBafapi-292680897No ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- 4 81-m Com-Semester-I-And-Ii-Syllabus-With-Course-StructureDocument33 pages4 81-m Com-Semester-I-And-Ii-Syllabus-With-Course-Structureapi-292680897No ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- BMM BooksDocument5 pagesBMM Booksapi-292680897No ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- 4 76-f - y - B - Sc-Information-Technology 2016-17Document48 pages4 76-f - y - B - Sc-Information-Technology 2016-17api-292680897No ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- 4 130 MSC It Sem III and IVDocument29 pages4 130 MSC It Sem III and IVapi-292680897No ratings yet

- 4 76 B Com Semester I and II Syllabus With Course Structure-1 2Document80 pages4 76 B Com Semester I and II Syllabus With Course Structure-1 2api-292680897No ratings yet

- 4 80 Bms Semester I and II Syllabus With Course Structure 1Document88 pages4 80 Bms Semester I and II Syllabus With Course Structure 1api-292680897No ratings yet

- 4.211 T.Y.B.sc. Computer Science Sem V & VIDocument24 pages4.211 T.Y.B.sc. Computer Science Sem V & VIAjay PashankarNo ratings yet

- 4 233-s y B SC - Information-TechnologyDocument44 pages4 233-s y B SC - Information-Technologyapi-292680897No ratings yet

- 4 81 M Com Semester I and II Syllabus With Course StructureDocument41 pages4 81 M Com Semester I and II Syllabus With Course Structureapi-292680897No ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 4.82 F.Y.B.sc - Computer Science1Document33 pages4.82 F.Y.B.sc - Computer Science1Mandar BhaveNo ratings yet

- Rules To UploadDocument17 pagesRules To Uploadapi-292680897No ratings yet

- 4 7-t - y - Bms 1 Revised Syllabus 2016-17Document98 pages4 7-t - y - Bms 1 Revised Syllabus 2016-17api-292680897No ratings yet

- Schedule For Inter College 1Document1 pageSchedule For Inter College 1api-292680897No ratings yet

- 4 133 MSC It Sem I and IIDocument14 pages4 133 MSC It Sem I and IIapi-292680897No ratings yet

- Schedule For College 1 1Document1 pageSchedule For College 1 1api-292680897No ratings yet

- 4.129 Tybsc ItDocument24 pages4.129 Tybsc ItNitesh INo ratings yet

- Solved Englesbe Company S Futa Tax Liability Was 289 50 Futa Tax ForDocument1 pageSolved Englesbe Company S Futa Tax Liability Was 289 50 Futa Tax ForAnbu jaromiaNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Acc 201 Taxation PDFDocument166 pagesAcc 201 Taxation PDFadekunle tosinNo ratings yet

- Islamabad Electric Supply Company: Say No To CorruptionDocument1 pageIslamabad Electric Supply Company: Say No To CorruptionxaviNo ratings yet

- 1194 Sneha Babu-Teleperformance (CSE) 2019-2020Document3 pages1194 Sneha Babu-Teleperformance (CSE) 2019-2020Popi BhowmikNo ratings yet

- Determination of Income Tax Due and Payable If There Is A Given Creditable Withholding TaxDocument12 pagesDetermination of Income Tax Due and Payable If There Is A Given Creditable Withholding Taxgellie mare flores100% (1)

- Schedules of Alphanumeric Tax CodesDocument5 pagesSchedules of Alphanumeric Tax CodesKatherine YuNo ratings yet

- Profit and Loss AccountDocument1 pageProfit and Loss AccountmuazzampkNo ratings yet

- InvoiceDocument2 pagesInvoicenithinamirthNo ratings yet

- Emp Code Emp Name Department Cost Center PF No. Location Designation Esi No. Date of Birth Bank A/c No Pan No. Date of Joining Gender Eps No. UANDocument1 pageEmp Code Emp Name Department Cost Center PF No. Location Designation Esi No. Date of Birth Bank A/c No Pan No. Date of Joining Gender Eps No. UANAmit ThakurNo ratings yet

- Sami Direct Business PlanDocument22 pagesSami Direct Business Planindicmedia100% (1)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Tax Quiz BeeDocument10 pagesTax Quiz BeeMitchelle DumlaoNo ratings yet

- Lesson 2 Nature, Classifications and Collection of TaxesDocument25 pagesLesson 2 Nature, Classifications and Collection of TaxesMegumi ParkNo ratings yet

- 2022 ItrDocument9 pages2022 Itrjoel.henderson3No ratings yet

- Barharwa Nagar PanchayatDocument1 pageBarharwa Nagar PanchayatJhilmil MandholiaNo ratings yet

- Pay Advice DetailsDocument1 pagePay Advice DetailsMarie LizaNo ratings yet

- 1 Property Rating and Property TaxationDocument10 pages1 Property Rating and Property TaxationAyodele Kehinde RotimiNo ratings yet

- B.a.H SEC VI Contemporary Economic IssuesDocument4 pagesB.a.H SEC VI Contemporary Economic IssuessifarNo ratings yet

- Maintenance of Books - FCRADocument15 pagesMaintenance of Books - FCRAJatinKalraNo ratings yet

- REPORT1 - Ashish Kumar BasuDocument19 pagesREPORT1 - Ashish Kumar BasuArabinda GhoshNo ratings yet

- Ias 1 QuestionsDocument7 pagesIas 1 QuestionsIssa AdiemaNo ratings yet

- Indicative Profit Rates: Savings Accounts Term DepositsDocument1 pageIndicative Profit Rates: Savings Accounts Term DepositsHammad HaseebNo ratings yet

- CHP 4 EconDocument10 pagesCHP 4 Econld123456No ratings yet

- Determining Taxable Value of SupplyDocument23 pagesDetermining Taxable Value of SupplyBba ANo ratings yet

- 2.1bsa-Cy1 - Angela R. Reveral - Business - Taxation - Final - TaskDocument3 pages2.1bsa-Cy1 - Angela R. Reveral - Business - Taxation - Final - TaskAngela Ricaplaza Reveral0% (1)

- Word Problems Fractions Proportionality PercentageDocument1 pageWord Problems Fractions Proportionality PercentageRODRÍGUEZ BARRENO JUAN CARLOSNo ratings yet

- Tax1 SummaryDocument8 pagesTax1 SummarychimchimcoliNo ratings yet

- GST's Impact on Indian EconomyDocument10 pagesGST's Impact on Indian EconomyKetan YadavNo ratings yet

- Income TaxDocument30 pagesIncome TaxMohd Hossain Natiqi100% (1)

- Tax Invoice DetailsDocument1 pageTax Invoice DetailsDipin JainNo ratings yet

- BOC - Form 1Document1 pageBOC - Form 1sandhwani3893No ratings yet

- The War Below: Lithium, Copper, and the Global Battle to Power Our LivesFrom EverandThe War Below: Lithium, Copper, and the Global Battle to Power Our LivesRating: 4.5 out of 5 stars4.5/5 (8)

- Kaizen: The Ultimate Guide to Mastering Continuous Improvement And Transforming Your Life With Self DisciplineFrom EverandKaizen: The Ultimate Guide to Mastering Continuous Improvement And Transforming Your Life With Self DisciplineRating: 4.5 out of 5 stars4.5/5 (36)

- The Myth of the Rational Market: A History of Risk, Reward, and Delusion on Wall StreetFrom EverandThe Myth of the Rational Market: A History of Risk, Reward, and Delusion on Wall StreetNo ratings yet

- The Genius of Israel: The Surprising Resilience of a Divided Nation in a Turbulent WorldFrom EverandThe Genius of Israel: The Surprising Resilience of a Divided Nation in a Turbulent WorldRating: 4 out of 5 stars4/5 (16)

- The Trillion-Dollar Conspiracy: How the New World Order, Man-Made Diseases, and Zombie Banks Are Destroying AmericaFrom EverandThe Trillion-Dollar Conspiracy: How the New World Order, Man-Made Diseases, and Zombie Banks Are Destroying AmericaNo ratings yet