Professional Documents

Culture Documents

David Wright's Executive Summary

Uploaded by

api-20697951Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

David Wright's Executive Summary

Uploaded by

api-20697951Copyright:

Available Formats

Monday March 1, 2010

David Wright's Executive LA HABRA, CA 90631

Summary Single Family Homes

This Week

Real-Time Market Profile Trend

Median List Price $ 449,900 ±+

Asking Price Per Square Foot $ 272 ±+

The median list price in LA HABRA, CA 90631 this week is $449,900. Average Days on Market (DOM) 166 ±+

Percent of Properties with Price Decrease 24 %

Percent Relisted (reset DOM) 9%

With inventory trending up but days-on-market and the Market

Action Index essentially flat recently, conditions do not seem to Percent Flip (price increased) 12 %

have strong up or down pull. Median House Size (sq ft) 1765

Median Lot Size 6,501 - 8,000 sqft

Median Number of Bedrooms 3.0

Median Number of Bathrooms 2.0

Supply and Demand Market Action Index Strong Buyer's 21.2 ±+

The market has shown some evidence of slowing recently. Both ±+ No change == Strong upward trend ≠≠ Strong downward trend

prices and inventory levels are relatively unchanged in recent weeks.

Watch the Market Action Index for changes as it can be a leading = Slight upward trend ≠ Slight downward trend

indicator for price changes.

Price

Market Action Index We continue to see prices in this zip code bouncing around this

plateau. Look for a persistent up-shift in the Market Action Index

before we see prices move from these levels.

Price Trends

7-Day Rolling Average 90-Day Rolling Average Buyer/Seller Cutoff

The Market Action Index answers the question "How's the

Market?" By measuring the current rate of sale versus the

amount of the inventory. Index above 30 implies Seller's

Market conditions. Below 30, conditions favor the buyer.

Quartiles

7-Day Rolling Average 90-Day Rolling Average

Characteristics per Quartile Investigate the market in quartiles -

where each quartile is 25% of homes

ordered by price.

Quartile Median Price Sq. Ft. Lot Size Beds Baths Age Inventory New Absorbed DOM

1.0 - 2.5

Top/First $ 899,900 3000 acres 4.0 3.5 37 45 4 1 192 Most expensive 25% of properties

8,001 -

Upper/Second $ 542,000 2046 10,000 sqft 4.0 2.8 47 46 5 4 174 Upper-middle 25% of properties

6,501 -

Lower/Third $ 392,450 1491 8,000 sqft 3.0 2.0 54 46 5 5 164 Lower-middle 25% of properties

4,501 -

Bottom/Fourth $ 299,975 1158 6,500 sqft 3.0 2.0 54 46 4 6 132 Least expensive 25% of properties

David Wright | Wright Realty | 7144429692

Powered by Altos Research LLC | www.altosresearch.com | Copyright ©2009 Altos Research LLC

You might also like

- NullDocument26 pagesNullapi-20697951No ratings yet

- Market Update: David Wright'sDocument6 pagesMarket Update: David Wright'sapi-20697951No ratings yet

- Market Update: David Wright'sDocument16 pagesMarket Update: David Wright'sapi-20697951No ratings yet

- Market Update: David Wright'sDocument6 pagesMarket Update: David Wright'sapi-20697951No ratings yet

- David Wright's Executive SummaryDocument1 pageDavid Wright's Executive Summaryapi-20697951No ratings yet

- David Wright's Executive SummaryDocument1 pageDavid Wright's Executive Summaryapi-20697951No ratings yet

- David Wright's Executive SummaryDocument1 pageDavid Wright's Executive Summaryapi-20697951No ratings yet

- David Wright's Executive SummaryDocument1 pageDavid Wright's Executive Summaryapi-20697951No ratings yet

- David Wright's Executive SummaryDocument1 pageDavid Wright's Executive Summaryapi-20697951No ratings yet

- David Wright's Executive SummaryDocument1 pageDavid Wright's Executive Summaryapi-20697951No ratings yet

- David Wright's Market UpdateDocument16 pagesDavid Wright's Market Updateapi-20697951No ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Shoshana Bulka PragmaticaDocument17 pagesShoshana Bulka PragmaticaJessica JonesNo ratings yet

- Student Research Project Science ReportDocument8 pagesStudent Research Project Science Reportapi-617553177No ratings yet

- Level I 2018 2019 Program Changes PDFDocument2 pagesLevel I 2018 2019 Program Changes PDFMuhammad BurairNo ratings yet

- Passage Planning: Dr. Arwa HusseinDocument15 pagesPassage Planning: Dr. Arwa HusseinArwa Hussein100% (3)

- Volcanoes Sub-topic:Volcanic EruptionDocument16 pagesVolcanoes Sub-topic:Volcanic EruptionVhenz MapiliNo ratings yet

- Nascsa - Sponsor Solicitation List: January 06, 2021Document35 pagesNascsa - Sponsor Solicitation List: January 06, 2021Prasoon SimsonNo ratings yet

- Data Mining in IoTDocument29 pagesData Mining in IoTRohit Mukherjee100% (1)

- Literature Review - Part Time Job Among StudentDocument3 pagesLiterature Review - Part Time Job Among StudentMarria65% (20)

- SANDWICH Elisa (Procedure) - Immunology Virtual Lab I - Biotechnology and Biomedical Engineering - Amrita Vishwa Vidyapeetham Virtual LabDocument2 pagesSANDWICH Elisa (Procedure) - Immunology Virtual Lab I - Biotechnology and Biomedical Engineering - Amrita Vishwa Vidyapeetham Virtual LabsantonuNo ratings yet

- Training Design SprintDocument11 pagesTraining Design Sprintardi wiantoNo ratings yet

- Pipe Freezing StudyDocument8 pagesPipe Freezing StudymirekwaznyNo ratings yet

- A Vocabulary of Latin Nouns and AdnounsDocument129 pagesA Vocabulary of Latin Nouns and Adnounsthersitesslaughter-1No ratings yet

- Unilever PakistanDocument26 pagesUnilever PakistanElie Mints100% (3)

- Construction Drawing: Legend Notes For Sanitary Piping Installation General Notes NotesDocument1 pageConstruction Drawing: Legend Notes For Sanitary Piping Installation General Notes NotesrajavelNo ratings yet

- Batron: 29 5 MM Character Height LCD Modules 29Document1 pageBatron: 29 5 MM Character Height LCD Modules 29Diego OliveiraNo ratings yet

- Grua Grove 530e 2 Manual de PartesDocument713 pagesGrua Grove 530e 2 Manual de PartesGustavo100% (7)

- P6 - TT2 - Revision Test 2021-2022 Page 1 of 11Document11 pagesP6 - TT2 - Revision Test 2021-2022 Page 1 of 11Nilkanth DesaiNo ratings yet

- Project Report For Tunnel ExcavationDocument19 pagesProject Report For Tunnel ExcavationAbhishek Sarkar50% (2)

- The Fastest Easiest Way To Secure Your NetworkDocument9 pagesThe Fastest Easiest Way To Secure Your NetworkMark ShenkNo ratings yet

- Introduction To Microelectronic Fabrication PDFDocument332 pagesIntroduction To Microelectronic Fabrication PDFChristy Moore92% (13)

- Machine Design 2021 Guidelines and MechanicsDocument2 pagesMachine Design 2021 Guidelines and Mechanicsreneil llegueNo ratings yet

- Unit 3: Theories and Principles in The Use and Design of Technology Driven Learning LessonsDocument5 pagesUnit 3: Theories and Principles in The Use and Design of Technology Driven Learning Lessons서재배No ratings yet

- Bullying Report - Ending The Torment: Tackling Bullying From The Schoolyard To CyberspaceDocument174 pagesBullying Report - Ending The Torment: Tackling Bullying From The Schoolyard To CyberspaceAlexandre AndréNo ratings yet

- S3 U4 MiniTestDocument3 pagesS3 U4 MiniTestĐinh Thị Thu HàNo ratings yet

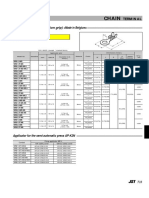

- Chain: SRB Series (With Insulation Grip)Document1 pageChain: SRB Series (With Insulation Grip)shankarNo ratings yet

- Science9 Q4 Week2Document16 pagesScience9 Q4 Week2Maria Josie Lopez TumlosNo ratings yet

- FIGMADocument22 pagesFIGMACessNo ratings yet

- VERGARA - RPH Reflection PaperDocument2 pagesVERGARA - RPH Reflection PaperNezer Byl P. VergaraNo ratings yet

- Sips 1328Document64 pagesSips 1328Jean Claude De AldánNo ratings yet

- Present Perfect Simp ContDocument14 pagesPresent Perfect Simp ContLauGalindo100% (1)