Professional Documents

Culture Documents

Case Questions

Uploaded by

jaj0 ratings0% found this document useful (0 votes)

284 views1 pagepeople to find your content by providing more information about it.

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentpeople to find your content by providing more information about it.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

284 views1 pageCase Questions

Uploaded by

jajpeople to find your content by providing more information about it.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

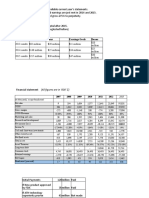

Valuation of AirThread Connections Case Questions

1. Methodological Approach to the Valuation

Note: For this question only, no calculations are required. You are, however,

required to describe in writing and with formulas the approach to the valuation.

a. Please describe the methodological approach that should be used to value

AirThread WACC, APV, or some combination thereof.

b. How should the cash flows be valued for 2008 through 2012?

c. How should the terminal value or going concern be estimated?

d. How should nonoperating investments in equity affiliates be accounted for in the

valuation?

[Hint: it may be possible to use more than one technique simultaneously]

2. Finding the Appropriate Discount Rate

a. What discount rate should Ms. Zhang use for the unlevered free cash flows for

2008 through 2012?

b. Is this the same discount rate that should be used to value the terminal rate? Why

or why not?

3. Long-Term Growth Rate

a. Develop an estimate of the long term growth rate that should be used to estimate

AirThreats terminal value.

b. Using your estimate of the long-term growth rate, what is the present value of

AirThreads going concern value?

4. Valuation of AirThread

a. What is the total value of AirThread before considering any synergies?

b. What is the total value of AirThread, assuming Ms. Zhangs estimates for

synergies are accurate?

c. Should the value of the tax shields reflect the personal tax disadvantage of interest

income to ordinary debt holders? If so, what is the personal income tax

disadvantage of the debt?

You might also like

- Concept Based Practice Questions for Tableau Desktop Specialist Certification Latest Edition 2023From EverandConcept Based Practice Questions for Tableau Desktop Specialist Certification Latest Edition 2023No ratings yet

- Air Thread Case QuestionDocument1 pageAir Thread Case QuestionSimran MalhotraNo ratings yet

- Valuation of Airthread Connections Questions TraductionDocument2 pagesValuation of Airthread Connections Questions TraductionNatalia HernandezNo ratings yet

- ATC Case SolutionDocument3 pagesATC Case SolutionAbiNo ratings yet

- Kotler Mm16e Inppt 02Document40 pagesKotler Mm16e Inppt 02Zahirrudin MahmudNo ratings yet

- Tata Motors ValuationDocument38 pagesTata Motors ValuationAkshat JainNo ratings yet

- Balakrishnan MGRL Solutions Ch09Document53 pagesBalakrishnan MGRL Solutions Ch09Rachna Menon100% (1)

- Corporate Finance Case 1 (Contract Services Division)Document2 pagesCorporate Finance Case 1 (Contract Services Division)needdocs7No ratings yet

- Final AssignmentDocument15 pagesFinal AssignmentUttam DwaNo ratings yet

- HP Case Competition PresentationDocument17 pagesHP Case Competition PresentationNatalia HernandezNo ratings yet

- Does IT Payoff Strategies of Two Banking GiantsDocument10 pagesDoes IT Payoff Strategies of Two Banking GiantsScyfer_16031991No ratings yet

- Wikler Case Competition PowerpointDocument16 pagesWikler Case Competition Powerpointbtlala0% (1)

- APV ExampleDocument3 pagesAPV Exampleveda20No ratings yet

- Advanced Principles Corporate FinanceDocument6 pagesAdvanced Principles Corporate Financeveda20No ratings yet

- Real Options ExcercisesDocument3 pagesReal Options ExcercisesSudhakar Joshi0% (1)

- Tata MotorsDocument2 pagesTata MotorsTanvi SharmaNo ratings yet

- IPL - A Group 9 - FinalDocument8 pagesIPL - A Group 9 - Finalvibhor1990No ratings yet

- CV Midterm Exam 1 - Solution GuideDocument11 pagesCV Midterm Exam 1 - Solution GuideKala Paul100% (1)

- 04 WestvacoDocument4 pages04 Westvacoelvarg09No ratings yet

- Evaluate The Business Model of A CompanyDocument13 pagesEvaluate The Business Model of A CompanySundaresan SabanayagamNo ratings yet

- Simulado 5 (PREP) - BC 1Document7 pagesSimulado 5 (PREP) - BC 1Maria Clara OliveiraNo ratings yet

- DC 51: Busi 640 Case 3: Valuation of Airthread ConnectionsDocument4 pagesDC 51: Busi 640 Case 3: Valuation of Airthread ConnectionsTunzala ImanovaNo ratings yet

- Valuation of Airthread ConnectionsDocument11 pagesValuation of Airthread ConnectionsPerumalla Pradeep KumarNo ratings yet

- As S Ignment 2: Mccaw Cellular Communications: The at & T/Mccaw Merger NegotiationDocument9 pagesAs S Ignment 2: Mccaw Cellular Communications: The at & T/Mccaw Merger NegotiationSong LiNo ratings yet

- Ross CorpFin Casemap1Document44 pagesRoss CorpFin Casemap1alokkuma05No ratings yet

- Chapter 8 Long Lived Assets - SolutionsDocument102 pagesChapter 8 Long Lived Assets - SolutionsKate SandersNo ratings yet

- CarlsbergDocument14 pagesCarlsbergRohit PantNo ratings yet

- Analyse The Structure of The Personal Computer Industry Over The Last 15 YearsDocument7 pagesAnalyse The Structure of The Personal Computer Industry Over The Last 15 Yearsdbleyzer100% (1)

- 1800flowers Com Company AnalysisDocument21 pages1800flowers Com Company AnalysissyedsubzposhNo ratings yet

- SP 2021 Q Paper Submitted - Milind AkarteDocument5 pagesSP 2021 Q Paper Submitted - Milind AkarteRamkumarArumugapandiNo ratings yet

- Mariott Corp AnalysisDocument14 pagesMariott Corp AnalysisvarjinNo ratings yet

- Earn Pay-Outs: Sales Goals Bonus Earnings Goals BonusDocument5 pagesEarn Pay-Outs: Sales Goals Bonus Earnings Goals BonusUjjwal BhardwajNo ratings yet

- Cloudstrat Case StudyDocument10 pagesCloudstrat Case StudyAbhirami PromodNo ratings yet

- Super Project FinalDocument29 pagesSuper Project FinalSamuel ChuquistaNo ratings yet

- Barb William and Steven LauDocument6 pagesBarb William and Steven Lauzaidirock68No ratings yet

- Fin 600 - Radio One-Team 3 - Final SlidesDocument20 pagesFin 600 - Radio One-Team 3 - Final SlidesCarlosNo ratings yet

- Assignment 2Document3 pagesAssignment 2rupinisinnanNo ratings yet

- Ch14. Target CostingDocument16 pagesCh14. Target CostingVivek AnandanNo ratings yet

- PGP MAJVCG 2019-20 S3 Unrelated Diversification PDFDocument22 pagesPGP MAJVCG 2019-20 S3 Unrelated Diversification PDFBschool caseNo ratings yet

- The GainersDocument10 pagesThe Gainersborn2growNo ratings yet

- Bellaire Clinical Labs, Inc. (A)Document6 pagesBellaire Clinical Labs, Inc. (A)VijayKhareNo ratings yet

- Grameen PhoneDocument37 pagesGrameen PhoneSK Nasif HasanNo ratings yet

- Video Conferencing Industry: 5 Forces Worksheet: Key Barriers To EntryDocument1 pageVideo Conferencing Industry: 5 Forces Worksheet: Key Barriers To EntryHasnain Ali BhuttoNo ratings yet

- Corporate Valuation Yeats and Tse CostingDocument27 pagesCorporate Valuation Yeats and Tse CostingSagar IndranNo ratings yet

- Gyaan Kosh Term 4: Management of OrganizationsDocument25 pagesGyaan Kosh Term 4: Management of OrganizationsYash NyatiNo ratings yet

- Decision+Analysis+for+UG 2C+Fall+2014 2C+Course+Outline+2014-08-14Document9 pagesDecision+Analysis+for+UG 2C+Fall+2014 2C+Course+Outline+2014-08-14tuahasiddiqui0% (1)

- Discussion 1 PmoDocument1 pageDiscussion 1 PmoKashyap ChintuNo ratings yet

- TM ACC ABCandABM1Document7 pagesTM ACC ABCandABM1anamikarblNo ratings yet

- Nptel Course Financial Management Assignment Ii: Liabilities Rs. (Million) Asset Rs. (Million)Document3 pagesNptel Course Financial Management Assignment Ii: Liabilities Rs. (Million) Asset Rs. (Million)yogeshgharpureNo ratings yet

- AkilAfzal ZR2001040 FinalDocument4 pagesAkilAfzal ZR2001040 FinalAkil AfzalNo ratings yet

- Asynchronous Content - Managing Segments and CustomersDocument2 pagesAsynchronous Content - Managing Segments and CustomersbadtranzNo ratings yet

- Southwest Airlines AssignmentDocument8 pagesSouthwest Airlines AssignmentFaezahFae MuhammadNo ratings yet

- Case Study 2: Sustainability of Ikea GroupDocument3 pagesCase Study 2: Sustainability of Ikea Groupneha reddyNo ratings yet

- Case Questions WilkinsDocument1 pageCase Questions Wilkinsvimal_prajapatiNo ratings yet

- Financial Management E BookDocument4 pagesFinancial Management E BookAnshul MishraNo ratings yet

- Case 3 - Ocean Carriers Case PreparationDocument1 pageCase 3 - Ocean Carriers Case PreparationinsanomonkeyNo ratings yet

- Swati Anand - FRMcaseDocument5 pagesSwati Anand - FRMcaseBhavin MohiteNo ratings yet

- Managerial Finance Case Write UpDocument3 pagesManagerial Finance Case Write Upvalsworld100% (1)