Professional Documents

Culture Documents

Cfa 2016 Level I Errata

Uploaded by

Kazi HasanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cfa 2016 Level I Errata

Uploaded by

Kazi HasanCopyright:

Available Formats

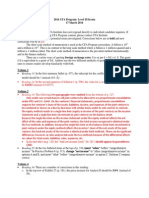

2016 CFA Program: Level I Errata

31 August 2015

To be fair to all candidates, CFA Institute does not respond directly to individual candidate inquiries. If

you have a question concerning CFA Program content, please contact CFA Institute

(info@cfainstitute.org) to have potential errata investigated. The eBook for the 2016 curriculum is

formatted for continuous flow, so the text will fit all screen sizes. Therefore, eBook page numbering

which is linked to section headsdoes not match page numbering in the print curriculum. Corrections

below are in bold and new corrections will be shown in red; page numbers shown are for the print

volumes.

The short scale method of numeration is used in the CFA Program curriculum. A billion is 109

and a trillion is 1012. This is in contrast to the long scale method where a billion is 1 million squared and a

trillion is 1 million cubed. The short scale method of numeration is the prevalent method internationally

and in the finance industry.

Volume 1

Reading 2: In Exhibit 3 (p. 172 of print), delete Level III CFA Candidate from the Improper

References column.

Reading 9: In the last sentence of Example 3 (p. 522 of print), the estimate for broker BB001 should

be 0.25 (instead of 25). In Equation 7 (p. 544 of print), the right-hand expression should be T, where

the T is not subscript.

Volume 2

Reading 17: In Example 4 (p. 228 of print), change the federalprovincial government deficit to

84,249 (instead of 82,249) in the question and in the next-to-last paragraph of the solution. This

changes the domestic private saving to 69.5 percent (instead of 71 percent) and the excess imports

to C$25,661 (instead of 23,661).

Reading 18: During production, an error was introduced in format. Seven (7) instances of M2 should

be changed to M2 (no superscript).

Volume 3

Reading 23: In Exhibit 8 (p. 64 of print), the bolded sub-total of 150,000 should appear under

Contributed Capital instead of Retained Earnings.

Reading 34: Candidates should delete Practice Problem 8 (p. 728) and its solution (p. 730). This

question is no longer assigned.

Volume 4

Volume 5

Reading 49: The formula in Solution 12 (p. 184 of print) should show Pt-1 as the denominator,

instead of Pt. The solution was correctly calculated; only the subscript is changed.

Reading 56: In the solution to Practice Problem #6 (top of p. 577 of print), reinvested cash flows are

at 8% instead of 6%.

Volume 6

You might also like

- CFA Formula Cheat SheetDocument9 pagesCFA Formula Cheat SheetChingWa ChanNo ratings yet

- CFA Level I Planner Dec 2015Document12 pagesCFA Level I Planner Dec 2015Kazi HasanNo ratings yet

- Cpa Review QuestionsDocument54 pagesCpa Review QuestionsCodeSeeker0% (1)

- How To Pass The Cfa Exam EbookDocument15 pagesHow To Pass The Cfa Exam EbookCharles Heng100% (12)

- Paper-3 Exercises-With Solutions - Bryce McBrideDocument55 pagesPaper-3 Exercises-With Solutions - Bryce McBridesamira2702100% (1)

- 2016 CFA Level III ErrataDocument1 page2016 CFA Level III ErrataimvavNo ratings yet

- CFA 2018 Level I ErrataDocument2 pagesCFA 2018 Level I ErrataSSamoNo ratings yet

- 2014 CFA Program Level I ErrataDocument2 pages2014 CFA Program Level I ErrataK Arun NarayanaNo ratings yet

- CFA 2018 Level I ErrataDocument2 pagesCFA 2018 Level I Erratakajol7awasthiNo ratings yet

- 2014 Level I ErrataDocument2 pages2014 Level I Erratacavitron1No ratings yet

- Cfa Level I Errata JuneDocument16 pagesCfa Level I Errata JuneMarket WalaNo ratings yet

- Cfa Level I Errata JuneDocument16 pagesCfa Level I Errata JuneasadsNo ratings yet

- 2014 Level II ErrataDocument2 pages2014 Level II ErrataMahe PaliNo ratings yet

- Cfa Level I Errata JuneDocument12 pagesCfa Level I Errata JuneShirish BaisaneNo ratings yet

- 2011 Level I Errata As of 15 SeptemberDocument3 pages2011 Level I Errata As of 15 SeptemberMayank TanejaNo ratings yet

- 2016 Level II ErrataDocument2 pages2016 Level II ErrataHasnain AbbasNo ratings yet

- L1 ErrataDocument3 pagesL1 Errataandrewsss1979No ratings yet

- 2024 Cfa Preread ErrataDocument3 pages2024 Cfa Preread Erratapriya11devNo ratings yet

- 2024 Cfa Level II ErrataDocument7 pages2024 Cfa Level II ErrataDEVIL RDXNo ratings yet

- 2022 CFA ErrataDocument7 pages2022 CFA ErrataĐan ThiNo ratings yet

- Cfa Level I Errata June PDFDocument4 pagesCfa Level I Errata June PDFPONo ratings yet

- Cfa Level I Errata June PDFDocument4 pagesCfa Level I Errata June PDFPONo ratings yet

- 2019 CFA Program Level I Errata SummaryDocument4 pages2019 CFA Program Level I Errata SummaryNico TuscaniNo ratings yet

- Microeconomics Principles of Consumer ChoiceDocument18 pagesMicroeconomics Principles of Consumer ChoiceHashimRaza100% (2)

- Macroeconomics Fourteenth Canadian Edition Canadian 14th Edition Ragan Solutions ManualDocument11 pagesMacroeconomics Fourteenth Canadian Edition Canadian 14th Edition Ragan Solutions Manualadelaideoanhnqr1v100% (20)

- IMA CMA Exam Prep V 3.0™ Updates and Errata Notification: For Self-Study UsersDocument7 pagesIMA CMA Exam Prep V 3.0™ Updates and Errata Notification: For Self-Study UsersM Fayez Khan LodhiNo ratings yet

- Replacement Project AnalysisDocument6 pagesReplacement Project Analysisdineshpasa76074No ratings yet

- MP1 - Engineering EconomyDocument7 pagesMP1 - Engineering EconomyNeill TeodoroNo ratings yet

- DeVry BUSN 278 Final Exam 100% Correct AnswerDocument8 pagesDeVry BUSN 278 Final Exam 100% Correct AnswerDeVryHelpNo ratings yet

- Examiner's Report: MA2 Managing Costs & Finance December 2012Document4 pagesExaminer's Report: MA2 Managing Costs & Finance December 2012Ahmad Hafid Hanifah100% (1)

- Cfa Level II ErrataDocument11 pagesCfa Level II ErrataWasita PiamwareeNo ratings yet

- Examiner's Report: F2/FMA Management Accounting For CBE and Paper Exams Covering July To December 2014Document4 pagesExaminer's Report: F2/FMA Management Accounting For CBE and Paper Exams Covering July To December 2014Kamisiro RizeNo ratings yet

- F2.fma Examreport Jul Dec14Document4 pagesF2.fma Examreport Jul Dec14Syeda ToobaNo ratings yet

- Fin701 Module3Document22 pagesFin701 Module3Krista CataldoNo ratings yet

- ME ObjectiveDocument8 pagesME ObjectiveAkshat ShuklaNo ratings yet

- MANAGERIAL FINANCE AssignmentDocument2 pagesMANAGERIAL FINANCE Assignmentfahim zamanNo ratings yet

- Chapter 14Document31 pagesChapter 14carlo knowsNo ratings yet

- Practice Problems Eng EconomyDocument4 pagesPractice Problems Eng Economymahmoud koriemNo ratings yet

- Cfa Level III Errata PDFDocument7 pagesCfa Level III Errata PDFTran HongNo ratings yet

- P2 Nov 2013 Question PaperDocument20 pagesP2 Nov 2013 Question PaperjoelvalentinorNo ratings yet

- Examiner's report on MA2 exam questionsDocument3 pagesExaminer's report on MA2 exam questionsAhmad Hafid Hanifah100% (1)

- CPA REVIEW Questions - LAMBERSDocument51 pagesCPA REVIEW Questions - LAMBERSAlellie Khay JordanNo ratings yet

- MFE 10 - Project Planning and AppraisalDocument4 pagesMFE 10 - Project Planning and AppraisalKushan Chanaka AmarasingheNo ratings yet

- IMT 24 Quantitative Techniques M1Document5 pagesIMT 24 Quantitative Techniques M1solvedcareNo ratings yet

- Chung (Macroeconomics - K59VJCC) - Microsoft TeamsDocument8 pagesChung (Macroeconomics - K59VJCC) - Microsoft TeamsDương MinhNo ratings yet

- Replacement Decision Theory BrighamDocument6 pagesReplacement Decision Theory BrighamRimpy SondhNo ratings yet

- Studiu de Caz Metoda Arborelui DecizionalDocument4 pagesStudiu de Caz Metoda Arborelui DecizionalAna RabacuNo ratings yet

- 2004 2 Question PaperDocument9 pages2004 2 Question Papermwaseem2011No ratings yet

- f7 Examreport s17Document6 pagesf7 Examreport s17huu nguyenNo ratings yet

- Fall 2008 Exam 3 BDocument5 pagesFall 2008 Exam 3 BNO NameNo ratings yet

- Making Capital Investment DecisionsDocument26 pagesMaking Capital Investment DecisionsYutriNo ratings yet

- ECO 100Y Introduction To Economics Midterm Test # 3: Last NameDocument12 pagesECO 100Y Introduction To Economics Midterm Test # 3: Last NameexamkillerNo ratings yet

- Excel Assignment #D: Software IntegrationDocument3 pagesExcel Assignment #D: Software IntegrationdivyeshNo ratings yet

- FMG 22-IntroductionDocument22 pagesFMG 22-IntroductionPrateek GargNo ratings yet

- Whirlpool Europe ExDocument9 pagesWhirlpool Europe ExJosé Ma Orozco A.0% (1)

- Post - AF3313 - Sem 1 Midterm 2015-16Document9 pagesPost - AF3313 - Sem 1 Midterm 2015-16siuyinxddNo ratings yet

- Mid Term 2ndDocument16 pagesMid Term 2ndMinh Thư Nguyễn ThịNo ratings yet

- QP March2012 p1Document20 pagesQP March2012 p1Dhanushka Rajapaksha100% (1)

- Chapter 2 - Introduction To Spreadsheet Modeling: Answer: TrueDocument5 pagesChapter 2 - Introduction To Spreadsheet Modeling: Answer: TrueRashaNo ratings yet

- Sample - Business-Economics-V-ST-jqxi8aDocument8 pagesSample - Business-Economics-V-ST-jqxi8asushainkapoor photoNo ratings yet

- Ma2 Examreport July Dec18Document4 pagesMa2 Examreport July Dec18tashiNo ratings yet

- E-Portfolio - Signature Assignment: Professor: Heather A SchumackerDocument8 pagesE-Portfolio - Signature Assignment: Professor: Heather A Schumackerapi-317520509No ratings yet

- Approaches to Geo-mathematical Modelling: New Tools for Complexity ScienceFrom EverandApproaches to Geo-mathematical Modelling: New Tools for Complexity ScienceAlan G. WilsonNo ratings yet

- IRR Answers The Question: What's The Interest Rate? Money in 20.0 Time (Years) 5 Money Out 60.0 A) Using Alegbra IRR 24.6%Document1 pageIRR Answers The Question: What's The Interest Rate? Money in 20.0 Time (Years) 5 Money Out 60.0 A) Using Alegbra IRR 24.6%Kazi HasanNo ratings yet

- FinQuiz - UsgaapvsifrsDocument12 pagesFinQuiz - UsgaapvsifrsĐạt BùiNo ratings yet

- Cfa Exam TicketDocument1 pageCfa Exam TicketKazi HasanNo ratings yet

- EMERALD Author GuideDocument15 pagesEMERALD Author GuidePavan KhetrapalNo ratings yet

- FM Outline Spring 2012 Arif IrfanullahDocument2 pagesFM Outline Spring 2012 Arif IrfanullahMunir AslamNo ratings yet

- Sample 179018Document14 pagesSample 179018Kazi HasanNo ratings yet

- L1 DemoDocument8 pagesL1 DemoKazi HasanNo ratings yet

- NPV FormulaDocument2 pagesNPV FormulaKazi HasanNo ratings yet

- Smart Summary Income Taxes CFADocument3 pagesSmart Summary Income Taxes CFAKazi HasanNo ratings yet

- Cfa Level 1 LOS Command WordsDocument0 pagesCfa Level 1 LOS Command WordsHummingbird11688No ratings yet

- Free Cash Flow To Firm/EquityDocument1 pageFree Cash Flow To Firm/EquityKazi HasanNo ratings yet

- Real Options: Answers To End-Of-Chapter QuestionsDocument19 pagesReal Options: Answers To End-Of-Chapter QuestionsCOLONEL ZIKRIA100% (1)

- L2 Ethics by JenDocument4 pagesL2 Ethics by JenKazi HasanNo ratings yet

- Key Financial Ratios For The Cfa Exam: Valuation Ratios Profitability Ratios Liquidity RatiosDocument1 pageKey Financial Ratios For The Cfa Exam: Valuation Ratios Profitability Ratios Liquidity RatiosKazi HasanNo ratings yet

- Cfa L1 R1 OutlineDocument9 pagesCfa L1 R1 OutlineKazi HasanNo ratings yet

- Sample CFA Level 1Document6 pagesSample CFA Level 1Kazi HasanNo ratings yet

- Fixed Income PDFDocument3 pagesFixed Income PDFAkash DeepNo ratings yet

- Cfa Level 1 LOS Command WordsDocument0 pagesCfa Level 1 LOS Command WordsHummingbird11688No ratings yet

- 2016 Level II ErrataDocument2 pages2016 Level II ErrataKazi HasanNo ratings yet

- Cfa L1 EthicsDocument23 pagesCfa L1 EthicsKazi HasanNo ratings yet

- Si March BrochureDocument8 pagesSi March BrochureKazi HasanNo ratings yet

- American International University - Bangladesh Faculty of Business Administration Teacher's Schedule FormDocument1 pageAmerican International University - Bangladesh Faculty of Business Administration Teacher's Schedule FormKazi HasanNo ratings yet

- Grade Summary: Financial Management: (MBA) (C)Document3 pagesGrade Summary: Financial Management: (MBA) (C)Kazi HasanNo ratings yet

- RAJUK DIT Purbachal Rajuk Application For PurbachalDocument5 pagesRAJUK DIT Purbachal Rajuk Application For Purbachalapi-3709098100% (1)

- RAJUK DIT Purbachal Rajuk Application For PurbachalDocument5 pagesRAJUK DIT Purbachal Rajuk Application For Purbachalapi-3709098100% (1)