Professional Documents

Culture Documents

Price Problems

Uploaded by

api-299736788Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Price Problems

Uploaded by

api-299736788Copyright:

Available Formats

Lets assume that there are three

restaurants/cafes located together

in a purely in a tourist area, such as

Whistler. These restaurants/cafs

are located near to each other and

all rely on NEW customers/tourists

each weekend. For the sake of

simplicity in this case study, lets

assume thatthere are only 3,000

tourists each week, across the

three restaurants/cafes.

These restaurants are similar in

size, location, presentation and

menu choice. As the tourists know

nothing about these restaurants

before they arrive, they tend to be

heavily influenced by price (which

is the only real distinguishing

factor). For two years, all three

restaurants maintained the same

pricing, which meant they shared

the customers equally, as shown in

the following table:

No. of meals sold

Average Price

Total Income

Variable Cost of Meals

Total Food cost

Rent/staf

Total Costs

Profit (per week)

Restaurant A

Restaurant B

Restaurant C

1,000

$10

$10,000

$2

$2,000

$5,000

$7,000

$3,000

1,000

$10

$10,000

$2

$2,000

$5,000

$7,000

$3,000

1,000

$10

$10,000

$2

$2,000

$5,000

$7,000

$3,000

Restaurant A

Restaurant B

Restaurant C

However, Restaurant A recently

changed ownership and the new

managers reduced their prices to

generate more customers. At the

same time, your other competitor

(Restaurant B) decided to increase

its prices in an attempt to appeal to

the more quality conscious

consumers. The impact on the

financials of these changes was:

No. of meals sold

Average Price

Total Income

Variable Cost of Meals

Total Food cost

Rent/staf

Total Costs

Profit (per week)

1,200

$9

$10,800

$2

$2,400

$5,000

$7,400

$3,400

800

$11

$8,800

$2

$1,600

$5,000

$6,600

$2,200

1,000

$10

$10,000

$2

$2,000

$5,000

$7,000

$3,000

Restaurant A

1,400

$8

$11,200

$2

$2,800

$5,000

$7,800

$3,400

Restaurant B

800

$10

$8,000

$2

$1,600

$5,000

$6,600

$1,400

Restaurant C

800

$10

$8,000

$2

$1,600

$5,000

$6,600

$1,400

The end result was that Restaurant

A picked up more customers (all

switching from Restaurant B).

Restaurant A was so happy that

they increased profits by more than

10% decided to reduce prices even

further. Restaurant B whose profits

reduced, decided to return to the

$10 level. The impact on the

financials of these changes was:

No. of meals sold

Average Price

Total Income

Variable Cost of Meals

Total Food cost

Rent/staf

Total Costs

Profit (per week)

Again Restaurant A won more

customers (this time both from the

other competitor and, this time,

from your restaurant!) The impact

on your profits was disastrous. They

have been more than halved. You

know that if youdontreact on

price, your profits will remain at this

new low level. But you also know

that if youdoreact the price-war

continues and all three restaurants

will be worst of. While you dont

think that Restaurant A will

proactively change their prices

again, youre pretty sure that

Restaurant B is looking to cut prices

and where will that leave you?

QUESTIONS

1.

2.

3.

4.

What price should you now set (for your restaurant C)?

How might your competitors react to your new price?

Look long term which restaurant will win this price war (if any)?

Considering your response in Q3, what is the best solution for all concerned?

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The-True-Cost-Of-Owning-A-Car ArtDocument21 pagesThe-True-Cost-Of-Owning-A-Car Artapi-299736788No ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Secret History of The Credit Card T and FalseDocument2 pagesSecret History of The Credit Card T and Falseapi-299736788No ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Oral Hygiene and OrthodonticsDocument17 pagesOral Hygiene and OrthodonticsDevangana DasNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Generation Like QuestionsDocument2 pagesGeneration Like Questionsapi-299736788No ratings yet

- Southern Italian Desserts by Rosetta Costantino With Jennie Schacht - RecipesDocument10 pagesSouthern Italian Desserts by Rosetta Costantino With Jennie Schacht - RecipesThe Recipe Club0% (4)

- The Organization of Modern KitchensDocument9 pagesThe Organization of Modern KitchensJohnson Macayan FernándezNo ratings yet

- Sports Nutrition - A Complete Guide: by Drew Griffiths (BSC, MSC)Document59 pagesSports Nutrition - A Complete Guide: by Drew Griffiths (BSC, MSC)Marco PagariganNo ratings yet

- Are You Right-Brained or Left-Brained CLC 15Document2 pagesAre You Right-Brained or Left-Brained CLC 15api-372310429No ratings yet

- Drone Build RubricsDocument4 pagesDrone Build Rubricsapi-299736788No ratings yet

- Student-Guide-Lesson-Five 3Document6 pagesStudent-Guide-Lesson-Five 3api-344973256No ratings yet

- Scratch RubricDocument1 pageScratch Rubricapi-299736788No ratings yet

- All About Me Project CLC 15Document1 pageAll About Me Project CLC 15api-299736788No ratings yet

- Lesson 5 CodeDocument5 pagesLesson 5 Codeapi-299736788No ratings yet

- Drone Build RubricsDocument4 pagesDrone Build Rubricsapi-299736788No ratings yet

- Travel RubicDocument2 pagesTravel Rubicapi-299736788No ratings yet

- CFPB Building Block Activities Reflecting-Whats-Worth-Saving WorksheetDocument2 pagesCFPB Building Block Activities Reflecting-Whats-Worth-Saving Worksheetapi-299736788No ratings yet

- Drone Build RubricsDocument4 pagesDrone Build Rubricsapi-299736788No ratings yet

- PaystubDocument7 pagesPaystubapi-299736788No ratings yet

- RubricDocument2 pagesRubricapi-299736788No ratings yet

- The Math of Credit Cards Discussion Questions: Are Getting?Document1 pageThe Math of Credit Cards Discussion Questions: Are Getting?api-299736788No ratings yet

- RubricDocument2 pagesRubricapi-299736788No ratings yet

- Dream VacationDocument8 pagesDream Vacationapi-299736788No ratings yet

- Buying A House Final Project 1Document5 pagesBuying A House Final Project 1api-299736788No ratings yet

- Buying A House Part 1Document5 pagesBuying A House Part 1api-299736788No ratings yet

- Fin10 Doc CredhstoryDocument2 pagesFin10 Doc Credhstoryapi-299736788No ratings yet

- Fin10 Doc CredcomponDocument1 pageFin10 Doc Credcomponapi-299736788No ratings yet

- RubricDocument2 pagesRubricapi-299736788No ratings yet

- Fin10 Doc CredofferDocument2 pagesFin10 Doc Credofferapi-299736788No ratings yet

- vb2010 ch05 Critical Thinking AnswersDocument4 pagesvb2010 ch05 Critical Thinking Answersapi-299736788100% (2)

- vb2010 ch02 Critical Thinking AnswersDocument2 pagesvb2010 ch02 Critical Thinking Answersapi-299736788No ratings yet

- RubricDocument2 pagesRubricapi-299736788No ratings yet

- Fin10 Doc CredscoreDocument2 pagesFin10 Doc Credscoreapi-299736788No ratings yet

- vb2010 ch03 Critical Thinking AnswersDocument2 pagesvb2010 ch03 Critical Thinking Answersapi-299736788No ratings yet

- Booklet Capstone Project Student Guide and Information Booklet CLC 11Document12 pagesBooklet Capstone Project Student Guide and Information Booklet CLC 11api-299736788No ratings yet

- Group 2 - Cuisine - Food Cost FormDocument10 pagesGroup 2 - Cuisine - Food Cost Formaira mikaela ruazolNo ratings yet

- Party Packages 1 April 23 PDFDocument2 pagesParty Packages 1 April 23 PDFsuru suruNo ratings yet

- Jurnal 2 Riset PemasaranDocument23 pagesJurnal 2 Riset PemasaranArif Ahmad DhaniNo ratings yet

- Cactus (Opuntia SPP.) As Forage (FAO Plant Production and Protection Papers, Volume 169) (Candelario Mondragón-Jacobo Etc.)Document158 pagesCactus (Opuntia SPP.) As Forage (FAO Plant Production and Protection Papers, Volume 169) (Candelario Mondragón-Jacobo Etc.)aldobarela3613100% (1)

- Chicken Tikka Masala - Cafe DelitesDocument9 pagesChicken Tikka Masala - Cafe Delitesliunokas davidNo ratings yet

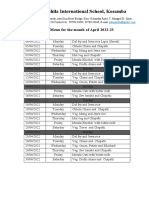

- Takshashila International School, Kosamba: Food Menu For The Month of April 2022-23Document2 pagesTakshashila International School, Kosamba: Food Menu For The Month of April 2022-23Yell YashNo ratings yet

- Unit 1 Meaningful Units: People Express - Their Personalities - in Their Clothes, - Their Cars, - and Their HomesDocument2 pagesUnit 1 Meaningful Units: People Express - Their Personalities - in Their Clothes, - Their Cars, - and Their HomesAngelica RjgNo ratings yet

- School MealsDocument21 pagesSchool MealsJFT482No ratings yet

- TurkeysDocument2 pagesTurkeysVegan FutureNo ratings yet

- Kiddush GuideDocument8 pagesKiddush GuidethebookbinderNo ratings yet

- Unit 7 - 1 ST YearDocument14 pagesUnit 7 - 1 ST YearAnonymous W98NM58GNo ratings yet

- A Widely Recognized Leading: University of Agriculture, FaisalabadDocument2 pagesA Widely Recognized Leading: University of Agriculture, FaisalabadHassan RazaNo ratings yet

- Elementary (French)Document52 pagesElementary (French)Cesar Messi100% (1)

- Reproductive Performance and Blood Constituents of Damascus Goats As Affected by YeastDocument18 pagesReproductive Performance and Blood Constituents of Damascus Goats As Affected by YeastRaj CellaNo ratings yet

- Complimentory Feeding 2Document10 pagesComplimentory Feeding 2Silji AntonyNo ratings yet

- Waste SegregationDocument10 pagesWaste SegregationFaye Y. SantiagoNo ratings yet

- PostOp Extraction InstructionDocument2 pagesPostOp Extraction InstructionHaffie HafiziNo ratings yet

- Multigrain Bread Recipe For Pastry Summit 2022Document9 pagesMultigrain Bread Recipe For Pastry Summit 2022AshNo ratings yet

- Final Tour Guide ScriptDocument3 pagesFinal Tour Guide Scriptjaemjaeem.naNo ratings yet

- Verification Trial of Botanical Pesticides As Control Agents Against Pests of EggplantDocument28 pagesVerification Trial of Botanical Pesticides As Control Agents Against Pests of EggplantKarlSteven MasubayNo ratings yet

- In Vitro Propagation of Malaysian Cassava (Manihot Esculenta Crantz) Variety Through Low Cost Tissue Culture MediaDocument4 pagesIn Vitro Propagation of Malaysian Cassava (Manihot Esculenta Crantz) Variety Through Low Cost Tissue Culture MediaIJEAB JournalNo ratings yet

- Active To Passive TransformationsDocument5 pagesActive To Passive TransformationsDavid Burgos E Irene del PozoNo ratings yet

- Hurricane Preparedness QuestionnaireDocument3 pagesHurricane Preparedness QuestionnaireJulie NelsonNo ratings yet

- Oktoberfest: Ingeniería en MinasDocument10 pagesOktoberfest: Ingeniería en MinasErik SotoNo ratings yet

- Thinking About Complementary and Alternative Med PPL With CancerDocument13 pagesThinking About Complementary and Alternative Med PPL With CancerTaranisaNo ratings yet

- ChicoryDocument9 pagesChicorySkriikkNo ratings yet