Professional Documents

Culture Documents

C. If Selling Price in Year 1 Remains at $10 Per Unit, How Many Units Must Be Sold in Year 1 For The Operating Profit To Be $200,000?

Uploaded by

Nitesh AgrawalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

C. If Selling Price in Year 1 Remains at $10 Per Unit, How Many Units Must Be Sold in Year 1 For The Operating Profit To Be $200,000?

Uploaded by

Nitesh AgrawalCopyright:

Available Formats

SOLVING FOR UNKNOWN

Cost-Volume-Profit and Budget Analysis

A partial income statement of IBN Corporation for Year 0 follows. The company uses just-in-time inventory, so production

each year equals sales. Each dollar of finished product produced in Year 0 contained $0.50 of direct materials, $0.33333 of

direct labor, and $0.16667 of overhead costs. During Year 0, fixed overhead costs were $40,000. No changes in production

methods or credit policies are anticipated for Year 1.

IBN Corporation

Partial Income Statement for Year 0

Sales (100,000 units @ $10)

Cost of Goods Sold

Gross Margin

Selling Costs

Administrative Costs

Operating Profits

$

$

150,000

100,000

$

$

$

1,000,000

600,000

400,000

$

$

250,000

150,000

Management has estimated the following changes for Year 1:

30%

increase in number of units sold

20%

increase in unit cost of materials

15%

increase in direct labor cost per unit

10%

increase in variable overhead cost per unit

5%

increase in fixed overhead costs

8%

increase in selling costs due to increased volume

6%

increase in administrative costs due to increased wages

a. what must the unit sales price be in Year 1 for IBN Corporation to earn a $200,000 operating profit?

b. What will be the Year 1 operating profit if selling prices are increased as before, but unit sales increase by 10% rather than

30%? (Selling costs would go up by only 1/3 of the amount projected previously.)

c. If selling price in Year 1 remains at $10 per unit, how many units must be sold in Year 1 for the operating profit to be $200,000?

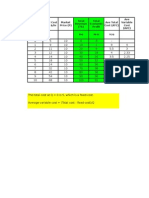

WORKINGS

Sales

COGS

Material

Labour

VO

FO

$1,000,000

$280,000

$186,665

$93,335

$40,000

Gross Margin

SC

AC

$600,000

$400,000

$150,000

$100,000

Operating Profit

$250,000

$150,000

SOLUTION 1

Sales

COGS

Material

Labour

VO

FO

SOLUTION 2

30%

20% $336,000

15% $214,665

10% $102,669

5% $42,000

Gross Margin

SC

AC

8% $162,000

6% $106,000

Operating Profit

$1,300,000

$695,333

Sales

COGS

Material

Labour

VO

FO

$604,667

Gross Margin

$268,000

SC

AC

$336,667

Operating Profit

$8.9487

SOLUTION 3

SP=$10

Sales

COGS

Material

Labour

VO

FO

$1,000,000

$1,155,330

10% unit

20% $336,000

15% $214,665

10% $102,669

5% $42,000

Proof

$695,333

$695,333

Gross Margin

$304,667

$459,997

SC

AC

$260,000

$260,000

$44,667

$199,997

2.6667% $154,000

6% $106,000

Operating Profit

If sales price is $ 10 and 100,000 units, then profit is $44,667

The difference in profit is $200,000-44,667 = $155,333

Then extra sale required is 155,333/10 = 15,533 units (rounded off)

20% $336,000

15% $214,665

10% $102,669

5% $42,000

$984,359

$695,333

$289,026

2.6667% $154,000

6% $106,000

If Sale price is same as $10 than OP is $ 336,667.

To have OP of $200,000 reduce price by following calculation

(336,667-200,000)/130,000

1.051283

The sale price should be

SP =$ 8.9487

10% unit

$260,000

$29,026

You might also like

- Guide to Management Accounting CCC (Cash Conversion Cycle) for managersFrom EverandGuide to Management Accounting CCC (Cash Conversion Cycle) for managersNo ratings yet

- Chap 014Document67 pagesChap 014Nitesh Agrawal100% (2)

- Economic and Business Forecasting: Analyzing and Interpreting Econometric ResultsFrom EverandEconomic and Business Forecasting: Analyzing and Interpreting Econometric ResultsNo ratings yet

- Managerial Accounting - WS4 Connect Homework GradedDocument9 pagesManagerial Accounting - WS4 Connect Homework GradedJason HamiltonNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Variable Costs:: Exercise 5-13: B/E Analysis and CVP GraphingDocument21 pagesVariable Costs:: Exercise 5-13: B/E Analysis and CVP GraphingAshish BhallaNo ratings yet

- Variable Costing Statements for Production & Sales ChangesDocument13 pagesVariable Costing Statements for Production & Sales ChangesimjiyaNo ratings yet

- FINAN204-21A - Tutorial 3 Week 3Document14 pagesFINAN204-21A - Tutorial 3 Week 3Danae YangNo ratings yet

- MEMO FAX CVP Analysis SampleDocument26 pagesMEMO FAX CVP Analysis SampleLita LinvilleNo ratings yet

- Guide to Japan-born Inventory and Accounts Receivable Freshness Control for Managers 2017From EverandGuide to Japan-born Inventory and Accounts Receivable Freshness Control for Managers 2017No ratings yet

- Cost Volume Profit Analysis (Decision Making) - TaskDocument9 pagesCost Volume Profit Analysis (Decision Making) - TaskAshwin KarthikNo ratings yet

- 202E06Document21 pages202E06foxstupidfoxNo ratings yet

- Metrillo - Comprehensive ProbDocument12 pagesMetrillo - Comprehensive ProbLordCelene C MagyayaNo ratings yet

- Slo 02 Acc230 08 TestDocument5 pagesSlo 02 Acc230 08 TestSammy Ben MenahemNo ratings yet

- Kuis UTS Genap 21-22 ACCDocument3 pagesKuis UTS Genap 21-22 ACCNatasya FlorenciaNo ratings yet

- ExercisesDocument19 pagesExercisesbajujuNo ratings yet

- Addtional Exercises - 6Document18 pagesAddtional Exercises - 6Gega XachidENo ratings yet

- Practice FinalDocument13 pagesPractice FinalngStephanie26No ratings yet

- Measurement ConceptsDocument46 pagesMeasurement ConceptsPrabal Pratap Singh TomarNo ratings yet

- MA 13.2 (No Solutions)Document2 pagesMA 13.2 (No Solutions)Michael ComunelloNo ratings yet

- Managerial AccountingDocument24 pagesManagerial AccountingLuân Châu100% (4)

- VANDERBECKCh7 - Multiple Choice (Theory and Problem)Document8 pagesVANDERBECKCh7 - Multiple Choice (Theory and Problem)Saeym SegoviaNo ratings yet

- MANACC - NotesW - Answers - BEP - The Master BudgetDocument6 pagesMANACC - NotesW - Answers - BEP - The Master Budgetldeguzman210000000953No ratings yet

- CVP Analysis and Absorption vs Variable CostingDocument3 pagesCVP Analysis and Absorption vs Variable CostingBenjamin0% (1)

- Review Problem: CVP Relationships: RequiredDocument6 pagesReview Problem: CVP Relationships: RequiredMaika J. PudaderaNo ratings yet

- FileDocument5 pagesFileRonnel RosalesNo ratings yet

- B. Revising The Estimated Life of Equipment From 10 Years To 8 YearsDocument4 pagesB. Revising The Estimated Life of Equipment From 10 Years To 8 YearssilviabelemNo ratings yet

- ACCT 7004 Exam F2022 TemplateDocument17 pagesACCT 7004 Exam F2022 TemplateJesse DanielsNo ratings yet

- 3. If the critical path is longer than 60 days, what is the least amount that Dr. Watage can spend and still achieve the schedule objective? How can he prove to the Pathminder Fund that this is the minimum cost alternative?Document2 pages3. If the critical path is longer than 60 days, what is the least amount that Dr. Watage can spend and still achieve the schedule objective? How can he prove to the Pathminder Fund that this is the minimum cost alternative?Jonathan Altamirano Burgos0% (1)

- Hampton FreezeDocument19 pagesHampton FreezePurbo KusumoNo ratings yet

- Question 3 - CVP AnalysisDocument13 pagesQuestion 3 - CVP AnalysisMsKhan0078100% (1)

- Cost Accounting Assignment #2Document5 pagesCost Accounting Assignment #2BRIANNIE ASRI VIVASNo ratings yet

- Managerial Accounting AssignmentsDocument3 pagesManagerial Accounting Assignmentslovely reyesNo ratings yet

- Operating Budget DiscussionDocument3 pagesOperating Budget DiscussionDavin DavinNo ratings yet

- ExploreDocument4 pagesExploreNorlyn RunesNo ratings yet

- Lagura - Ass04 Statement of Comprehensive IncomeDocument7 pagesLagura - Ass04 Statement of Comprehensive IncomeShane LaguraNo ratings yet

- CVP Analysis of Billings CompanyDocument3 pagesCVP Analysis of Billings CompanyAhmed El Khateeb100% (1)

- 1244 - Roshan Kumar Sahoo - Assignment 2Document3 pages1244 - Roshan Kumar Sahoo - Assignment 2ROSHAN KUMAR SAHOONo ratings yet

- ch10 2Document5 pagesch10 2ghsoub777No ratings yet

- Cogs Absorption Vs Marignal ExamplesDocument4 pagesCogs Absorption Vs Marignal ExampleskhalidmahmoodqumarNo ratings yet

- Question Bank - Practical QuestionsDocument10 pagesQuestion Bank - Practical QuestionsNeel KapoorNo ratings yet

- Practice Problems For The Final - 2 - UpdatedDocument8 pagesPractice Problems For The Final - 2 - Updatedmaroo566100% (1)

- Alpha University College Project Cost Accounting Group Assignment 1 (10marks) Submission Date: 23 April 2016 1Document3 pagesAlpha University College Project Cost Accounting Group Assignment 1 (10marks) Submission Date: 23 April 2016 1AndinetNo ratings yet

- HW Assignment #2 F22Document16 pagesHW Assignment #2 F22Jesse DanielsNo ratings yet

- Session 6 Q1 SolnDocument2 pagesSession 6 Q1 SolnAkshay UtkarshNo ratings yet

- Seminar 11answer Group 10Document75 pagesSeminar 11answer Group 10Shweta Sridhar40% (5)

- Marginal CostingDocument9 pagesMarginal CostingSharika EpNo ratings yet

- Chap7vanderbeck ReviewerDocument8 pagesChap7vanderbeck ReviewerSaeym SegoviaNo ratings yet

- CVPDocument8 pagesCVPJessica EntacNo ratings yet

- FinanceDocument14 pagesFinanceJarvis Gych'No ratings yet

- Trend AnlysisDocument7 pagesTrend AnlysisPradnya HingeNo ratings yet

- A.) Change in Fixed Cost and Sales Volume Acoustic Concepts Is Currently Selling 400Document5 pagesA.) Change in Fixed Cost and Sales Volume Acoustic Concepts Is Currently Selling 400Kez MaxNo ratings yet

- Midterm Test Performance Measurement: Regular ClassDocument6 pagesMidterm Test Performance Measurement: Regular ClassIvonie NursalimNo ratings yet

- AF2110 Mid Term Questoin OnlyDocument2 pagesAF2110 Mid Term Questoin OnlyannaNo ratings yet

- ACCT-312: Calculate Budgeted Gross Margin for January (Chapter 6Document3 pagesACCT-312: Calculate Budgeted Gross Margin for January (Chapter 6Amir ContrerasNo ratings yet

- SMCH 13Document47 pagesSMCH 13Lara Lewis AchillesNo ratings yet

- A. $800,000 B. $600,000 C. $440,000 D. $200,000Document15 pagesA. $800,000 B. $600,000 C. $440,000 D. $200,000sino akoNo ratings yet

- Quiz 4 CADocument8 pagesQuiz 4 CAbasilnaeem7No ratings yet

- Cost BehaviourDocument7 pagesCost BehaviourAstu GraitoNo ratings yet

- Homework Week5Document5 pagesHomework Week5Nitesh AgrawalNo ratings yet

- Case6 AnswersDocument7 pagesCase6 AnswersNitesh Agrawal100% (1)

- 13 MBS Direct - International Accounting, 7 - eDocument1 page13 MBS Direct - International Accounting, 7 - eNitesh AgrawalNo ratings yet

- 1 2Document3 pages1 2Nitesh AgrawalNo ratings yet

- In$ In$ 2011 DTA DTL DTA DTLDocument3 pagesIn$ In$ 2011 DTA DTL DTA DTLNitesh AgrawalNo ratings yet

- Tax Return ProjectDocument2 pagesTax Return ProjectNitesh AgrawalNo ratings yet

- FIN 534 Week 2 Chapter 3 SolutionDocument3 pagesFIN 534 Week 2 Chapter 3 SolutionNitesh AgrawalNo ratings yet

- (Ch12) (ECON203) (ReviewQuestions) With AnswersDocument3 pages(Ch12) (ECON203) (ReviewQuestions) With AnswersNitesh AgrawalNo ratings yet

- CH13 (5 Questions)Document4 pagesCH13 (5 Questions)Nitesh Agrawal50% (2)

- SolutionsDocument30 pagesSolutionsNitesh AgrawalNo ratings yet

- Total Hourly Output & Sales of Pizzas: This Is Where I'm at With It Please Help! Thank YouDocument2 pagesTotal Hourly Output & Sales of Pizzas: This Is Where I'm at With It Please Help! Thank YouNitesh AgrawalNo ratings yet

- Total Output & Sales Per Hour (Q) Total Cost (TC) $/HR Market Price (P) Total Revenue (TR) Total Economic Profit Ave Total Cost (ATC) Ave Variable Cost (AVC)Document2 pagesTotal Output & Sales Per Hour (Q) Total Cost (TC) $/HR Market Price (P) Total Revenue (TR) Total Economic Profit Ave Total Cost (ATC) Ave Variable Cost (AVC)Nitesh AgrawalNo ratings yet

- Toyota Camry Honda Accord Salvage Value: Since Ford Fusion Has Better Benefit Cost Ratio. Hence It Should Be BoughtDocument2 pagesToyota Camry Honda Accord Salvage Value: Since Ford Fusion Has Better Benefit Cost Ratio. Hence It Should Be BoughtNitesh AgrawalNo ratings yet

- Innovative HR PracticesDocument6 pagesInnovative HR PracticesRukmini GottumukkalaNo ratings yet

- FirstlyDocument1 pageFirstlyNitesh AgrawalNo ratings yet

- Solution 5Document10 pagesSolution 5Nitesh AgrawalNo ratings yet

- 4,5,6Document6 pages4,5,6Nitesh AgrawalNo ratings yet

- 1Document2 pages1Nitesh AgrawalNo ratings yet

- AnswerDocument1 pageAnswerNitesh AgrawalNo ratings yet

- AssignmentDocument8 pagesAssignmentNitesh AgrawalNo ratings yet

- 1Document2 pages1Nitesh AgrawalNo ratings yet

- AnswerDocument1 pageAnswerNitesh AgrawalNo ratings yet

- Assignment Sem 2 2015Document3 pagesAssignment Sem 2 2015Nitesh AgrawalNo ratings yet

- QuestionDocument1 pageQuestionNitesh AgrawalNo ratings yet

- WK4 Acc WKDocument57 pagesWK4 Acc WKNitesh AgrawalNo ratings yet

- Che 330 Fall 2015 Hw5 Due: Oct 4: WWW - Hse.Gov - Uk/Research/Rrpdf/Rr615 PDFDocument1 pageChe 330 Fall 2015 Hw5 Due: Oct 4: WWW - Hse.Gov - Uk/Research/Rrpdf/Rr615 PDFNitesh AgrawalNo ratings yet

- 1 Practice-QDocument1 page1 Practice-QNitesh AgrawalNo ratings yet

- Che 330 Fall 2015 Hw5 Due: Oct 4: WWW - Hse.Gov - Uk/Research/Rrpdf/Rr615 PDFDocument1 pageChe 330 Fall 2015 Hw5 Due: Oct 4: WWW - Hse.Gov - Uk/Research/Rrpdf/Rr615 PDFNitesh AgrawalNo ratings yet