Professional Documents

Culture Documents

Allied Bank Ltd. Financial Statements Analysis

Uploaded by

bilal_juttttOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Allied Bank Ltd. Financial Statements Analysis

Uploaded by

bilal_juttttCopyright:

Available Formats

92

FINANCIAL STATEMENTS ANALYSIS 7

TEN YEARS PERFORMANCE

1990 1991 1992 1993 1994 1995 1996 1997 1998 1999

Capital & Reserves 418 451 566 645 733 1219 1389 1515 3002 3012

Deposits 19825 25041 33757 37121 41445 51124 55897 63430 76541 93107

Advances 11115 11871 15734 18037 19901 29552 32766 36231 42719 55264

Investments 7268 9981 14586 14948 16549 15610 15553 20193 25605 26775

Income 2044 2349 3435 4453 5010 6102 7056 8397 8974 10925

Expenditure 1983 2249 3080 4038 4665 5571 6822 8368 8814 10854

Pre-tax Profit 61 100 355 415 345 531 234 29 170 71

Total Assets 23319 28342 37973 41759 47390 58480 63439 72404 89356 106926

TREND ANALYSIS OF TEN YEARS PERFORMANCE

1990 1991 1992 1993 1994 1995 1996 1997 1998 1999

Capital & Reserves 7.89 25.50 13.96 13.64 66.30 13.95 9.07 98.15 0.33

Deposits 26.31 34.81 9.97 11.65 23.35 9.34 13.48 20.67 21.64

Advances 6.80 32.54 14.64 10.33 48.50 10.88 10.57 17.91 29.37

Investments 37.33 46.14 2.48 10.71 (5.67) (0.37) 29.83 26.80 4.57

Income 14.92 46.23 29.64 12.51 21.80 15.63 19.01 6.87 21.74

Expenditure 13.41 36.95 31.10 15.53 19.42 22.46 22.66 5.33 23.14

Pre-tax Profit 63.93 255.00 16.90 (16.87) 53.91 (55.93) (87.61) 486.21 (58.24)

Total Assets 21.54 33.98 9.97 13.48 23.40 8.48 14.13 23.41 19.66

Hailey College of Commerce, University of the Punjab

93

De posites, Advance s & Inve stme nts

100000

90000

80000

R s . in b illio n

70000

60000

50000

40000

30000

20000

10000

0

1990 1991 1992 1993 1994 1995 1996 1997 1998 1999

Ye ar s

Deposits Advances Investments

Hailey College of Commerce, University of the Punjab

94

Deposites, Advances & Investments

60

50

40

P erc en tag e

30

20

10

0

1990 1991 1992 1993 1994 1995 1996 1997 1998 1999

-10

Years

Deposits Advances Investments

The graph shows a good picture of company’s past 10 years performance regarding

deposits, advances and investments. Deposits and advances are constantly increasing but

the rate of increase is different during different periods. But when we see at the rate of

change, it has a lot of ups and downs. Particularly rate of change in Advances fluctuate in

a very wider band. In year 1992 advances increased by 6.80% in the next year it increased

by 32.54% and in year 1995 it increased by 48%. There is no stability in the rate of

change.

Hailey College of Commerce, University of the Punjab

95

Income, Expenditures & Pre-tax Profit Income, Expenditures & Pre-tax Profit

600 12000

500 10000

R s . in b illio n

400 8000

R s . in b illio n

300

6000

200

4000

100

2000

0

1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 0

-100 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999

-200 Ye ars

Ye ars

Income Expenditure Pre-tax Prof it

Income Expenditure Pre-tax Profit

The graph shows that the income of the bank is increasing gradually. This seems to be

good but at the same time if we take into consideration the facts, not only income of the

bank is increasing but expenditure is too increasing that shows the in efficiency of the

management. The pre-tax profit is least. The bank should notice that what are the reasons

behind this? Why the expenses are increasing with the passage of time. Another thing

notable in this regard is that there is a great fluctuation in the income expenditure and

profit. This fluctuation is giving a negative impression to the investor, and as well other

people who are dealing with the bank in other matters, this complex situation can be

controlled by effective organization and techniques.

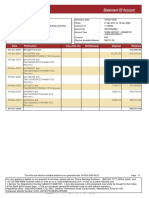

ALLIED BANK OF PAKISTAN LTD.

BALANCE SHEET

AS ON DECEMBER 31, 1999

ASSETS 1999 1998 1997

Cash 8,601,193 7,646,937 6,316,337

Balance with other Banks 1,757,510 1,878,796 1,380,840

Money at call and short notice. 300,000 100,000 450,000

Investments 26,774,766 25,605,470 20,192,699

Advances net of provisions 55,263,762 42,719,179 36,231,357

Operating Fixed Assets 3,062,045 2,488,619 872,730

Capital work in Progress 44,246 37,472 33160

Net investments in Finance Lease 34,415 53,707 43,755

Other Assets 11,088,394 8,827,987 6,882,772

106,926,331 89,358,167 72,403,650

LIABILITIES

Deposits and other accounts 93,107,291 76,541,153 63,429,709

Borrowings from other bank agents etc. 7,144,163 6,243,517 4,914,558

Bills Payable 1,073,491 1,084,150 802,367

Other Liabilities 2,588,936 2,487,440 1,741,598

103,913,881 86,356,261 70,888,232

Net Assets 3,012,450 3,001,906 1,515,418

Hailey College of Commerce, University of the Punjab

96

PRESENTED BY

Share capital 1,063,156 1,063,156 1,063,156

Reserve fund and Other Reserves 480,760 455,760 451,760

Unappropriate profit 1,638 16,094 502

Shareholders equity 1,545,554 1,535,010 1,515,418

Surplus on revaluation of Fixed Assets. 1,466,896 1,466,896 -

3,012,450 3,001,906 1,515,418

MEMORANDUM ITEMS

Bills for collection 8,142,388 10,910,897 10,062,812

Acceptances endorsements and other 18,360,244 13,354,826 13,622,536

obligations

contingent liabilities and commitments - - -

Hailey College of Commerce, University of the Punjab

97

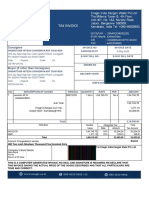

ALLIED BANK OF PAKISTAN

PROFIT AND LOSS ACCOUNT

FOR THE YEAR ENDED DECEMBER 31, 1999

PARTICULARS 1999 1998 1997

Mark up interest and discount or return earned 7,287,432 6,059,060 5,026,784

Less Cost/Return on Deposits, borrowing etc 6,953,006 5,289,971 4,639,053

334,426 769,089 387,731

Free commission and brokerage 358,997 426,229 361,322

Profit from dealing securities 1,172,042 1,033,310 1,130,242

Profit from investment securities 971,956 755,170 564,453

Dividend Income 21,791 14,401 18,398

Other operating income 995,310 607,820 1,191,176

3,520,078 2,836,930 3,265,591

3,854,504 3,606,019 3,653,322

OPERATING EXPENSES

Administrative Expenses 3,772,889 3,396,440 2,960,699

Provision written back and against non performing Advances (53,131) (254,885) 712,492

Loss from diminution value of investments -- 218,398 (9,649)

Other provisions -- 36,587 33,157

3,719,758 3,396,440 3,696,699

134,746 209,579 (43,377)

Other Income 64,356 88,017 104,144

199,102 297,596 60,767

Other charges 128,004 128,004 32,001

Profit before taxation 71,098 169,592 28,766

Taxation – Current 60,554 150,000 335,125

Deferred -- -- (320,023)

60,554 150,000 15,102

Profit after taxation 10,554 19,592 13,664

Unappropriated profit brought forward 16,091 502 338

Profit available for appropriation 26,638 20,094 14,002

Appropriations

Transfer to statutory reserve 25,000 4,000 13,500

Unappropriated profit carry forward 1,638 16,094 502

Hailey College of Commerce, University of the Punjab

98

ALLIED BANK OF PAKISTAN LTD.

COMMON SIZE BALANCE SHEET

As on december 31, 1999

ASSETS 1999 1998 1997

Cash 8.04 8.56 8.72

Balance with other Banks 1.64 2.10 1.91

Money at call and short notice. 0.28 0.11 0.62

Investments 25.04 28.65 27.89

Advances net of provisions 51.68 47.81 50.04

Operating Fixed Assets 2.86 2.78 1.21

Capital work in Progress 0.04 0.04 0.05

Net investments in Finance Lease 0.03 0.06 0.06

Other Assets 10.37 9.88 9.51

100.00 100.00 100.00

LIABILITIES

Deposits and other accounts 87.08 85.66 87.61

Borrowings from other bank agents etc. 6.68 6.99 6.79

Bills Payable 1.00 1.21 1.11

Other Liabilities 2.42 2.78 2.41

97.18 96.64 97.91

Net Assets 2.82 3.36 2.09

PRESENTED BY

Share capital 0.99 1.19 1.47

Reserve fund and Other Reserves 0.45 0.51 0.62

Unappropriate profit 0.00 0.02 0.00

Shareholders equity 1.45 1.72 2.09

Surplus on revaluation of Fixed Assets. 1.37 1.64 -

2.82 3.36 2.09

MEMORANDUM ITEMS

Bills for collection 7.61 12.21 13.90

Acceptances endorsements and other obligations 17.17 14.95 18.81

contingent liabilities and commitments - - -

Hailey College of Commerce, University of the Punjab

99

ALLIED BANK OF PAKISTAN

COMMON SIZE PROFIT AND LOSS ACCOUNT

FOR THE YEAR ENDED DECEMBER 31, 1999

PARTICULARS 1999 1998 1997

Mark up interest and discount or return earned 100.00 100.00 100.00

Less Cost/Return on Deposits, borrowing etc 95.41 87.31 92.29

4.59 12.69 7.71

Free commission and brokerage 4.93 7.03 7.19

Profit from dealing securities 16.08 17.05 22.48

Profit from investment securities 13.34 12.46 11.23

Dividend Income 0.30 0.24 0.37

Other operating income 13.66 10.03 23.70

48.30 46.82 64.96

52.89 59.51 72.68

OPERATING EXPENSES

Administrative Expenses 51.77 56.06 58.90

Provision written back and against non performing Advances (0.73) (4.21) 14.17

Loss from diminution value of investments - 3.60 (0.19)

Other provisions - 0.60 0.66

51.04 56.06 73.54

1.85 3.46 (0.86)

Other Income 0.88 1.45 2.07

2.73 4.91 1.21

Other charges 1.76 2.11 0.64

Profit before taxation 0.98 2.80 0.57

Taxation – Current 0.83 2.48 6.67

Deferred - - (6.37)

0.83 2.48 0.30

Profit after taxation 0.14 0.32 0.27

Unappropriated profit brought forward 0.22 0.01 0.01

Profit available for appropriation 0.37 0.33 0.28

Appropriations

Transfer to statutory reserve 0.34 0.07 0.27

Unappropriated profit carry forward 0.02 0.27 0.01

Hailey College of Commerce, University of the Punjab

100

RATIOS ANALYSIS

PROFITABILITY RATIOS

NET PROFIT RATIO

Net Profit after Tax

= × 100

Interest Received

1997 1998 1999

Net Profit After Tax 13,664 19,592 10,554

Interest Received 5,026,784 6,059,060 7,287,432

Net Profit Ratio 0.2718% 0.3234 % 0.1448 %

Net profit as percentage of Interest

Net Profit Ratio

received increased a little in 1998 (from

0.2718% to 0.323%), but it is very low 0.3500

and has a decreasing trend in year 1999

0.3000

it decreased to 0.1448% from year 1998

i.e. 0.3234% the decrease in the profit 0.2500

Percentage

from year 1998 to year 1999 is too much 0.2000

than an increase in profit volume from 0.1500

year 1997 to year 1998. The decreasing 0.1000

Net Profit trend shows the management’s

0.0500

inefficiencies to control the operating

costs and maximize the profit. -

1997 1998 1999

Years

Hailey College of Commerce, University of the Punjab

101

RETURN ON ASSETS

Net Profit after Tax

= × 100

Total Assets

1997 1998 1999

Net Profit After Tax 13,664 19,592 10,554

Total Assets 72,403,650 89,358,167 106,926,331

Return on Assets 0.0189 0.0219 0.0099

This ratio shows that the return is lesser

Return on Assets

in 1999 as compared to return on assets

in the year 1998. it was 0.0189% in 1997 0.0250

and increased to 0.0219% in 1998, but it

decreased very sharply in 1999 to 0.0200

0.0099%. Although interest and discount

Percentage

on loans which is the major source of 0.0150

revenue for bank has increased in 1999 0.0100

as compared to last year, but cost on

deposits and borrowing which is the 0.0050

major expenditure of bank has increased

more in the current year than the last -

1997 1998 1999

year.

Years

Another reason of decrease in return is

the reduction in lending rate and increase in financial cost, total assets in 1999 have also

increased substantially than last year so return on assets has decreased in 1999.

Hailey College of Commerce, University of the Punjab

102

RETURN ON SHAREHOLDERS FUNDS

Net Profit after Tax

= × 100

Shareholders Funds

1997 1998 1999

Net Profit After Tax 13,664 19,592 10,554

Shareholders’ Funds 1,515,418 3,001,906 3,012,450

Return on Shareholders’ Funds 0.9017 0.6527 0.3503

Return on Shareholders Fund

This ratio is a further explanation of the

above ratio that is the rate of return has 1.0000

decreased substantially in year 1998 and 0.9000

again in year 1999. The reason behind is 0.8000

that rate of increase in revenue in 1999 is 0.7000

Percentage

lesser than the rate of increase in 0.6000

0.5000

expenditure, moreover in 1999 profit after 0.4000

tax has decreased and on the other hand 0.3000

its denominator shareholders fund has 0.2000

increased due to increase in reserve fund 0.1000

and other reserves. Therefore both the -

1997 1998 1999

factors are responsible for this worrisome

ratio. Years

If this ratio decreases due to decrease in Profit, it is not a positive sign, but if the ratio

decreases due to increase in shareholders’ equity, it is not bad. In this case the net profit of

year is more 1998 then that of year 1997, but the ratio decreased due to increase in the

shareholders’ equity, which is resultant of increased reserves. The sharp decline in year

1999 is due to decrease in profits.

Hailey College of Commerce, University of the Punjab

103

RETURN ON EQUITY CAPITAL

Net Profit after Tax

= × 100

Equity Capital

1997 1998 1999

Net Profit After Tax 13,664 19,592 10,554

Equity Share Capital 1,063,156 1,063,156 1,063,156

Return on Equity Share Capital 1.2852 1.8428 0.9927

Calculation made on the base of data

Return on Equity Capital

available shows that profit earning after

taxes in 1999 has decreased due to 2.0000

increased financial cost of funds for which 1.8000

expected investment avenues did not 1.6000

open up the situation rather worsened 1.4000

Percentage

with reduced return on lending. 1.2000

1.0000

0.8000

Here in this ratio we see that ratio is 0.6000

disturbed by the single factor of reduction 0.4000

in profit as there in no further flotation of 0.2000

share in the stock exchange in current -

year. 1997 1998 1999

Years

Hailey College of Commerce, University of the Punjab

104

EARNING PER SHARE

Net Profit after Tax

= × 100

No. of Equity Shares

1997 1998 1999

Net Profit After Tax 13,664 19,592 10,554

No. of Equity Shares 106,316 106,316 106,316

Return on Equity Share Capital 0.1285 0.1843 0.0993

Earning per Share

This ratio is telling the same story as was

telling the above ratio. Because there is 0.2000

no issuance of share capitals in year 0.1800

1998 and year 1999. The profit increased 0.1600

in year 1998, but it has decreased in 0.1400

0.1200

Rupees

1999 and that is why earning per share

0.1000

has also decreased. 0.0800

0.0600

This ratio has a great importance for the 0.0400

shareholders point of view. The 0.0200

shareholders want a higher return on their -

investment. 1997 1998 1999

Years

Hailey College of Commerce, University of the Punjab

105

RATE OF RETURN AT LOANS

Interest Income

= × 100

Total Loans

1997 1998 1999

Interest Income 5,026,784 6,059,060 7,287,432

Total Loans 36,231,357 42,719,179 55,263,762

Rate of Return on Loans 13.8741 14.1835 13.1866

Rate of Return at Loans

Here we are watching very interesting

situation, as there is an increasing 14.4000

interest income in 1999 but ratio is 14.2000

decreasing reason is this that growth ratio 14.0000

(20%) in interest income not 13.8000

Percentage

accompanied by ratio of increase in total 13.6000

loans. 13.4000

As government reduced lending rate 13.2000

during 1999 and people borrowed more 13.0000

from banks for investment that is why 12.8000

return on loans has decreased in 1999. 12.6000

1997 1998 1999

Investment in any country will be Years

encouraged by fall in the interest ratio. In

improvement in the ratio leads to improvement in very aggregate profitability measures.

Hailey College of Commerce, University of the Punjab

106

OPERATING RATIO

Operating Costs

= × 100

Interest Earned

1997 1998 1999

Operating Costs 3,696,699 3,396,440 3,719,758

Interest Earned 5,026,784 6,059,060 7,287,432

Operating Ratio 73.5400 56.0556 51.0435

As the graph shows the operating costs

Operating Ratio

are decreasing year by year. In year

1997 it was 73.54 % of the interest 80.0000

earned and it decreased in year 1998 to 70.0000

56.06% in the next year it again 60.0000

decreased to 51.04% of the interest

Percentage

50.0000

earned. The decreasing trend of the

40.0000

operating costs shows the efficiency of

30.0000

the management to control the operating

costs. But the Operating costs itself as a 20.0000

percentage of the interest earned is very 10.0000

heavy although the management is trying -

to control these costs; these are still a 1997 1998 1999

very huge percentage of interest earned. Years

Hailey College of Commerce, University of the Punjab

107

LIQUIDITY RATIOS

CURRENT RATIO

Current Assets

=

Current Liabilities

1997 1998 1999

Current Assets 8,147,177 9,625,733 10,658,703

Current Liabilities 49,911,493 54,266,721 67,896,718

Current Ratio 1:0.16 1:0.18 1:0.16

Current Ratio

Current ratio of the bank is going to be

decreased as in it 0.16 in 1997, increased 1.2000

somewhat to 0.18 in 1998 and decreased

Current Asset/Current

1.0000

0.16 in 1999. The fluctuation in the ratio is

normal thing by year to year, but is 0.8000

Liabilities

alarming because, it is less than one. It is 0.6000

recommended that the current ratio

0.4000

should be at least 1 : 1, where it not so. It

means the Bank is not in a position to its 0.2000

current liabilities fully. It should be

-

increased. 1997 1998 1999

Years

Hailey College of Commerce, University of the Punjab

108

LOAN TO DEPOSITS RATIO

Total Loans

= × 100

Total Deposits

1997 1998 1999

Total Loans 36,231,357 42,719,179 55,263,762

Total Deposits 63,429,709 76,541,153 93,107,291

Loan to Deposit Ratio 57.12% 55.81% 59.35%

Loan to Deposit Ratio

This ratio shows a relationship between

loans and advances and reveals how 60.0000

much productively the deposits are used.

Analysis shows an increase in loan to 59.0000

deposit ratio, this is because of Govt. has 58.0000

Percentage

decreased lending rate that is why

57.0000

borrowing is more in 1999 as compared

to in 1998 on the other hand bank’s 56.0000

deposits are also increasing sharply if 55.0000

deposits increase by higher rate than an

increase in loan then bank has to face 54.0000

difficulty to pay its borrowing cost to the 1997 1998 1999

lender. Years

Hailey College of Commerce, University of the Punjab

109

LOAN TO ASSETS RATIO

Total Loans

= × 100

Total Assets

1997 1998 1999

Total Loans 36,231,357 42,719,179 55,263,762

Total Assets 72,403,650 89,358,167 106,926,331

Loan to Assets Ratio 50.0408 47.8067 51.6840

Total assets of the bank increased from

Loan to Assets Ratio

Rs.89 (billion) to Rs.107 (billion) in 1999

(72 billion to 89 billion in year 1998) and 52.0000

advances/loans net of provision have

51.0000

increased from Rs.43 (billion) in 1998 to

Rs.55 (billion) in 1999. We have 22% 50.0000

Percentage

increase in assets and 28% increase in 49.0000

total assets is lesser than the increase in 48.0000

total advances which has resulted in an

47.0000

increase in loan to assets ratio from

46.0000

47.80% in 1998 to 51.68% in 1999.

45.0000

1997 1998 1999

Years

Hailey College of Commerce, University of the Punjab

110

LONG TERM SOLVENCY & CAPITAL RATIOS

EQUITY CAPITAL TO ASSETS RATIO

Equity Capital

= × 100

Total Assets

1997 1998 1999

Equity Capital 1,063,156 1,063,156 1,063,156

Total Assets 72,403,650 89,358,167 106,926,331

Equity Capital to Assets Ratio 1.47% 1.19% 0.99%

In current year bank’s assets have been

Equity Capital to Assets

increased from Rs.89 billion to Rs.107

billion there by increase @ 20.22% over 1.6000

the last year (year 1998: 23.42% 1.4000

increase). On the other hand bank’s

1.2000

equity has not increased and remained

Percentage

1.0000

unchanged during the year 1999, so this

0.8000

is the reason that ratio equity to assets

0.6000

has decreased from 1.19% in 1998 to

0.994% in 1999. Denominator total assets 0.4000

have increased substantially during the 0.2000

year 1999 but no increase in equity -

capital resulting in decreasing ratio. 1997 1998 1999

Years

Hailey College of Commerce, University of the Punjab

111

PROPRIETARY RATIO

Shareholders’ Funds

= × 100

Total Assets

1997 1998 1999

Shareholders’ Funds 1,515,418 3,001,906 3,012,450

Total Assets 72,403,650 89,358,167 106,926,331

Proprietary Ratio 2.09% 3.36% 2.82%

This ratio explains that participation in the

Proprietry Ratio

assets by the shareholders funds is

limited by outsiders fund but when we 4.0000

take year under review (1999) we see 3.5000

ratio has further decreased in 1999 as

3.0000

compared to the year 1998 that was

Percentage

2.5000

increased in year 1998. Reason behind

2.0000

this is that increase in assets in financed

by outsider’s fund rather than the fund 1.5000

provided by the shareholders because 1.0000

there is lesser increase in shareholders 0.5000

fund as compared to increase in total -

assets. 1997 1998 1999

Years

Hailey College of Commerce, University of the Punjab

112

DEBT EQUITY RATIO

Long term Debt

= × 100

Shareholders’ Equity

1997 1998 1999

Long Term Debt 70,888,232 86,356,261 103,913,881

Shareholders’ Equity 1,515,418 3,001,906 3,012,450

Debt Equity Ratio 97.9:2.09 96.64:3.36 97.18:2082

This ratio depicts the relation between

Debt Equity Ratio

equity and debt financing. This current

year ratio shows an increase in ratio from 120.0000

28.76times to 34.49 times. The ultimate

increase in this ratio has decreased the 100.0000

ling term solvency of the bank. Because 80.0000

Percentage

lesser is the equity financing lesser will be

60.0000

the soundness of the bank.

40.0000

The reason behind this increase is an

20.0000

increase in external borrowings although

there is an increase in internal debt but -

rate of increase in external borrowing. 1997 1998 1999

Years

Hailey College of Commerce, University of the Punjab

113

Recommendations

Allied Bank of Pakistan Limited is a well known and successful financial institution in the

banking sector, it is said, nothing is perfect in the world, and there is always space for

deficiencies. I would like to suggest some recommendations for the deficiencies which I

have found during my internship. I am humbly committed that these recommendations

are not result of financial analysis of the bank because recent accounts were not

available to me.

In order to complete with the other banks ATM services should be expanded

throughout the country.

All branches should be linked through network that can better help to meet the

daily transactions. In this regard Internet, E-mail and Fax Services should be

provided at least in the main branches of each region.

Some of the schemes are not profit making where as the bank is an institution that

earn earns from them, so those unprofitable schemes should be finished as

Karsaaz Scheme.

Separate counters must be set up to give the facility of bills collection of all utilities

like WAPDA, SUI GAS, and TELEPHONE.

There should be separate cashiers for the Receipts & Payments in the each

branch office.

Door to door marketing in this regard especially media and electronic marketing

should be promoted in order to acquire handsome share of banking sector.

Bank branches must be beautified internally and externally by providing

appropriate interior decoration.

As we know that only 15% of the people have their bank accounts, so it is the

need of the time to open the branches in rural areas as well.

The bank should acquire the services of the highly qualified people accompanied

by lucrative incentives to promote its status as desirable in the next millennium.

In order to market its products as Allied Tahaffuz Deposit Scheme, it should

accentuate to give advertisements on both print and electronic media.

The bank should develop healthy relationships with the renowned banks of the

work in order to expand its operations globally.

The individual efficiency of worthy employees should be rewarded in the form of

proper increments and promotion in grades.

Hailey College of Commerce, University of the Punjab

You might also like

- Bank Reconciliation Statement GuideDocument3 pagesBank Reconciliation Statement GuideZuŋɘʀa AɓɗuɭɭʌhNo ratings yet

- Ap 6050003562019Document1 pageAp 6050003562019Vijayraj SriramNo ratings yet

- Tripleplay Interactive Network PVT - LTD.: CommentsDocument1 pageTripleplay Interactive Network PVT - LTD.: CommentsAjay KumarNo ratings yet

- Mkombozi Commercial Bank - Financial Statement Dec - 2019 PDFDocument1 pageMkombozi Commercial Bank - Financial Statement Dec - 2019 PDFMsuyaNo ratings yet

- JEEVES Invoice PDFDocument1 pageJEEVES Invoice PDFBijay BeheraNo ratings yet

- Complain Info - Funds Non ReceiptDocument1 pageComplain Info - Funds Non ReceiptVinod KumarNo ratings yet

- Bank of Kigali 1H 2010 Results UpdateDocument48 pagesBank of Kigali 1H 2010 Results UpdateBank of KigaliNo ratings yet

- Í Np10È Alvero Jevanniâââââââ R Ça, 02?Î Mr. Jevanni Rodriguez AlveroDocument3 pagesÍ Np10È Alvero Jevanniâââââââ R Ça, 02?Î Mr. Jevanni Rodriguez AlveroJevanni AlveroNo ratings yet

- E-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsDocument1 pageE-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsStephen NjeruNo ratings yet

- Bank Reconciliation PDFDocument2 pagesBank Reconciliation PDFFazal Rehman MandokhailNo ratings yet

- Í - (+È NAILSÂDOTÂGLOWÂPH ÂÂÂ Â Ç+&' 5+Î Nails Dot Glow Phils., IncDocument2 pagesÍ - (+È NAILSÂDOTÂGLOWÂPH ÂÂÂ Â Ç+&' 5+Î Nails Dot Glow Phils., IncRACELLE ACCOUNTINGNo ratings yet

- SBP Amends Currency Management StrategyDocument1 pageSBP Amends Currency Management StrategySharjeel HussainNo ratings yet

- AS Accounting For AQA: Second Edition Tutor Support Material: Answers To Selected QuestionsDocument37 pagesAS Accounting For AQA: Second Edition Tutor Support Material: Answers To Selected QuestionsHarvey SahotaNo ratings yet

- Account Statement: (Company Name) (Street Address, City, ST ZIP Code) (Phone) (Fax) (Email)Document1 pageAccount Statement: (Company Name) (Street Address, City, ST ZIP Code) (Phone) (Fax) (Email)mr batmanNo ratings yet

- Bank StatementDocument10 pagesBank Statementjeniferbarry0905No ratings yet

- Fastag E-Statement: Customer Details Bank DetailsDocument2 pagesFastag E-Statement: Customer Details Bank DetailsKunjemy EmyNo ratings yet

- Statement May 21 XXXXXXXX1414Document2 pagesStatement May 21 XXXXXXXX1414Adithya MalnadNo ratings yet

- Jyoti Gautam's 6-year term deposit statementDocument1 pageJyoti Gautam's 6-year term deposit statementRajendra GautamNo ratings yet

- Murad Engineering Services Statement SummaryDocument2 pagesMurad Engineering Services Statement SummarysajuNo ratings yet

- My - Statement - 12 Jan, 2022 - 18 Jan, 2022 - 9880560175Document5 pagesMy - Statement - 12 Jan, 2022 - 18 Jan, 2022 - 9880560175Sunanda BidariNo ratings yet

- Sanlam Kenya Plc. - Audited Financial Statements For The Period Ended 31st Dec 2017Document3 pagesSanlam Kenya Plc. - Audited Financial Statements For The Period Ended 31st Dec 2017Anonymous KAIoUxP7No ratings yet

- Contact City of Johannesburg for Utility BillsDocument3 pagesContact City of Johannesburg for Utility BillsKoolter PolskieNo ratings yet

- Customer StatementDocument1 pageCustomer StatementadesinaifakunleNo ratings yet

- Mohammed Salihu: Customer StatementDocument15 pagesMohammed Salihu: Customer StatementKabiru MohammedNo ratings yet

- Summary of Current Charges (RS) : Talk To Us SMSDocument7 pagesSummary of Current Charges (RS) : Talk To Us SMSpavandattaNo ratings yet

- Statement 2024 1Document1 pageStatement 2024 1xfzm99mr8rNo ratings yet

- Í Qdo - È Hayco Loveâfaithâââââ P Çrâ'54Eî Ms. Love Faith Pasetes HaycoDocument5 pagesÍ Qdo - È Hayco Loveâfaithâââââ P Çrâ'54Eî Ms. Love Faith Pasetes HaycoLove Faith HopeNo ratings yet

- E-Bill From Enagic India PDFDocument3 pagesE-Bill From Enagic India PDFHitesh ChavdaNo ratings yet

- Inbound Regular InvoiceDocument3 pagesInbound Regular InvoiceMutiara RachmawatyNo ratings yet

- Invoice # 75668Document1 pageInvoice # 75668Patrick WhiteNo ratings yet

- Internship Report On Credit Policy of Brac Bank LTDDocument54 pagesInternship Report On Credit Policy of Brac Bank LTDwpushpa23No ratings yet

- Fees IU PDFDocument1 pageFees IU PDFMOIN UDDIN AHMEDNo ratings yet

- Your Personal Loan Statement: Mev J BernhardtDocument2 pagesYour Personal Loan Statement: Mev J BernhardtJeannine BernhardtNo ratings yet

- Account StatementDocument1 pageAccount StatementReziir rmcNo ratings yet

- Nedbank Investment Statement - 28 Oct 2021Document2 pagesNedbank Investment Statement - 28 Oct 2021Janice MkhizeNo ratings yet

- Miss Nonkumbulo V Shabane Veronica Ward 30 Shoba Location Izingolweni 4260Document1 pageMiss Nonkumbulo V Shabane Veronica Ward 30 Shoba Location Izingolweni 4260nonkumbuloshabaneNo ratings yet

- Bank StatementDocument1 pageBank StatementBobbi Ryan BrayNo ratings yet

- Gerrymdayanan : Prk3Crossingsalimbalan Baungon 8707bukidnonDocument4 pagesGerrymdayanan : Prk3Crossingsalimbalan Baungon 8707bukidnonTommyjames ElfiroNo ratings yet

- Business Account StatementDocument2 pagesBusiness Account Statementmohamed elmakhzniNo ratings yet

- State Bank of IndiaDocument1 pageState Bank of IndiaAnjusha NairNo ratings yet

- User Statement 65246 5409888907720648Document27 pagesUser Statement 65246 5409888907720648Muniru QudusNo ratings yet

- 616 Units Rs. 8,609.25: Munawar MughalDocument2 pages616 Units Rs. 8,609.25: Munawar MughalStudents LinkNo ratings yet

- ICON College of Technology and Management Course: Btec HND in Business, Unit 12: TaxationDocument6 pagesICON College of Technology and Management Course: Btec HND in Business, Unit 12: TaxationmuhammadislamkhanNo ratings yet

- Replace Damaged Euro NotesDocument3 pagesReplace Damaged Euro NotesBlessing KatukaNo ratings yet

- Governing Body: International Labour OfficeDocument33 pagesGoverning Body: International Labour OfficeMu Eh HserNo ratings yet

- CHIB 2010 Annual ReportDocument159 pagesCHIB 2010 Annual ReportJerome DominguezNo ratings yet

- Carasa 0808Document17 pagesCarasa 0808thefranknessNo ratings yet

- E-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsDocument1 pageE-Return Acknowledgment Receipt: Personal Information and Return Filing Detailssimon kinuthiaNo ratings yet

- In R 1905000001925Document2 pagesIn R 1905000001925Siddhartha kumar singhNo ratings yet

- Up To 2020-02-18 - HSBC Business Direct Portfolio Summary 02 - StatementDocument3 pagesUp To 2020-02-18 - HSBC Business Direct Portfolio Summary 02 - StatementLevi dos SantosNo ratings yet

- Demand Deposit Account Transaction History: Histórico de Movimentos de Conta À OrdemDocument4 pagesDemand Deposit Account Transaction History: Histórico de Movimentos de Conta À Ordemshahid2opuNo ratings yet

- Statement of Account: Penyata AkaunDocument4 pagesStatement of Account: Penyata AkaunNaufal MalbarNo ratings yet

- The Interest Rate On Your Savings Account Is Going Down Soon - 01072020Document2 pagesThe Interest Rate On Your Savings Account Is Going Down Soon - 01072020PawełNo ratings yet

- Sep-11Document2 pagesSep-11Binay PradhanNo ratings yet

- Sivakumar Ganesan 06 - 5688060: Dear Valued CustomerDocument4 pagesSivakumar Ganesan 06 - 5688060: Dear Valued CustomerSIVAKUMAR_GNo ratings yet

- Philippines The Manila Electric Company Electricity Company 1 95851Document1 pagePhilippines The Manila Electric Company Electricity Company 1 95851البرنس اليمنيNo ratings yet

- Muhammad Alief No 7,,Kg Pendamar JLN Damar 11 41200, KLANG, SELDocument2 pagesMuhammad Alief No 7,,Kg Pendamar JLN Damar 11 41200, KLANG, SELnajwa mardianaNo ratings yet

- Lab Assignment No. 1: A B (A+B) 2 (A-B) 2Document2 pagesLab Assignment No. 1: A B (A+B) 2 (A-B) 2Qudsia ShahidNo ratings yet

- Lab Assignment No. 1: A B (A+B) 2 (A-B) 2Document2 pagesLab Assignment No. 1: A B (A+B) 2 (A-B) 2Qudsia ShahidNo ratings yet

- Nestle - ZakaDocument33 pagesNestle - ZakazakavisionNo ratings yet

- Allied Bank Account OpeningDocument33 pagesAllied Bank Account Openingbilal_jutttt100% (2)

- Mission/ Vision Statement: Business PhillosophyDocument77 pagesMission/ Vision Statement: Business Phillosophybilal_juttttNo ratings yet

- NBP Internship ReportDocument184 pagesNBP Internship Reportbilal_jutttt100% (1)

- Acknowledgement: in The Name of Allah The Most Grecious and MercifulDocument76 pagesAcknowledgement: in The Name of Allah The Most Grecious and Mercifulbilal_juttttNo ratings yet

- Bài Tập Buổi 1 FA1 (F3)Document4 pagesBài Tập Buổi 1 FA1 (F3)nhtrangclcNo ratings yet

- Michael Ho Black Scholes ModelDocument14 pagesMichael Ho Black Scholes ModelHicham NassitNo ratings yet

- International Business FinanceDocument14 pagesInternational Business FinanceKshitij ShahNo ratings yet

- P&G Case Analysis on Crest Whitestrips Advanced SealDocument4 pagesP&G Case Analysis on Crest Whitestrips Advanced SealAbdullah Ahmed67% (3)

- Auto - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel BrokingDocument6 pagesAuto - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel Brokingmoisha sharmaNo ratings yet

- FCFE ValuationDocument27 pagesFCFE ValuationTaleya FatimaNo ratings yet

- DM 1591541524857400Document17 pagesDM 1591541524857400Maro MeroNo ratings yet

- Chapter 11Document34 pagesChapter 11Kad Saad100% (3)

- Ifrs 7 Financial Instruments DisclosuresDocument70 pagesIfrs 7 Financial Instruments DisclosuresVilma RamonesNo ratings yet

- Fundamental Accounting Principles 24th Edition Ebook PDFDocument61 pagesFundamental Accounting Principles 24th Edition Ebook PDFwilliam.dailey153100% (40)

- Enge 1013 Week 1 FinalsDocument16 pagesEnge 1013 Week 1 Finalsdarwin favilaNo ratings yet

- Apple SWOTDocument12 pagesApple SWOTElly TanNo ratings yet

- Reliance Industries' financial analysisDocument111 pagesReliance Industries' financial analysisAparna KumariNo ratings yet

- Public Disclosure DocumentsDocument52 pagesPublic Disclosure DocumentsEdgar Arbey RomeroNo ratings yet

- 01 Fisher Account 5e v1 PPT ch01Document29 pages01 Fisher Account 5e v1 PPT ch01yuqi liuNo ratings yet

- Test Bank For Investments Analysis and Management 12th Edition JonesDocument10 pagesTest Bank For Investments Analysis and Management 12th Edition Jonesverityfelixl6e40No ratings yet

- Lending Risk MitigationDocument33 pagesLending Risk MitigationdhwaniNo ratings yet

- BIBLIOGRAPHY RESEARCH SOURCESDocument9 pagesBIBLIOGRAPHY RESEARCH SOURCESyezdiarwNo ratings yet

- Long and Short-Term Financial PlanningDocument50 pagesLong and Short-Term Financial PlanningMuhammad Fikri RahadianNo ratings yet

- Meaning of LeverageDocument5 pagesMeaning of LeverageAdeem AshrafiNo ratings yet

- 5.ZCMA6022 CVP AnalysisDocument71 pages5.ZCMA6022 CVP AnalysisPAVITRAN JAGANAZANNo ratings yet

- FIN 3512 Fall 2019 Quiz #1 9.18.2019 To UploadDocument3 pagesFIN 3512 Fall 2019 Quiz #1 9.18.2019 To UploadgNo ratings yet

- Duration and ConvexityDocument21 pagesDuration and ConvexityStanislav LazarovNo ratings yet

- Venu ResumeDocument4 pagesVenu ResumeVenu MadhavNo ratings yet

- MKTG1100 Chapter 1Document40 pagesMKTG1100 Chapter 1Marcus YapNo ratings yet

- The Securities and Exchange Board of India (Sebi)Document33 pagesThe Securities and Exchange Board of India (Sebi)Sakshi DamwaniNo ratings yet

- Group 13 (Candlestick)Document17 pagesGroup 13 (Candlestick)Ruchika SinghNo ratings yet

- Digital Marketing Unit 2Document6 pagesDigital Marketing Unit 2Mohammad NizamudheenpNo ratings yet

- Tugas Problem - Kel7Document3 pagesTugas Problem - Kel7AshdhNo ratings yet