Professional Documents

Culture Documents

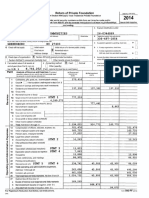

2008 990 PF

Uploaded by

Fund for Democratic Communities0 ratings0% found this document useful (0 votes)

14 views26 pagesThis is our 2008 990-PF forms filed each year with the IRS. What is Form 990? Guidestar explains it this way:

Form 990 is an annual reporting return that certain federally tax-exempt organizations must file with the IRS. It provides information on the filing organization’s mission, programs, and finances.

As a private foundation F4DC files the 990-PF version. If you are unfamiliar with these forms, reading them may be confusing. There is a link to the Foundation Center’s “Demystifying the 990-PF” tutorial. The Nonprofit Coordinating Committee of NYC also has a lengthy multi-chapter guide to the form posted as individual pdfs.

Original Title

2008-990-PF

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis is our 2008 990-PF forms filed each year with the IRS. What is Form 990? Guidestar explains it this way:

Form 990 is an annual reporting return that certain federally tax-exempt organizations must file with the IRS. It provides information on the filing organization’s mission, programs, and finances.

As a private foundation F4DC files the 990-PF version. If you are unfamiliar with these forms, reading them may be confusing. There is a link to the Foundation Center’s “Demystifying the 990-PF” tutorial. The Nonprofit Coordinating Committee of NYC also has a lengthy multi-chapter guide to the form posted as individual pdfs.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views26 pages2008 990 PF

Uploaded by

Fund for Democratic CommunitiesThis is our 2008 990-PF forms filed each year with the IRS. What is Form 990? Guidestar explains it this way:

Form 990 is an annual reporting return that certain federally tax-exempt organizations must file with the IRS. It provides information on the filing organization’s mission, programs, and finances.

As a private foundation F4DC files the 990-PF version. If you are unfamiliar with these forms, reading them may be confusing. There is a link to the Foundation Center’s “Demystifying the 990-PF” tutorial. The Nonprofit Coordinating Committee of NYC also has a lengthy multi-chapter guide to the form posted as individual pdfs.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 26

11442 10/02/2008 1

rom 990-PF

AN

Return of Private Foundation

or Section 4947(a)(1) Nonexempt Charitable Trust

Treated as a Private Foundation

tiga Reverun Ser” Note. The foundation maybe sl to ue copy thre to say tate reporting requremens

For calendar year 2008, or tax year Beginning and engin

& Check al hat apo Initial return Falta ‘Amended tum ‘Address change Name change’

Use the IRS | Nae oftomeon 7 Employer identiiaton number

label 344869

otterwise, | THE FUND FOR DEMOCRATIC COMMUNITIES rember ee pap

print | Tamberard sree (orP.O boxrumber fas rot deveresto set acdees) | Roomvaute 17-5329

ortype. | 1214 GROVE STREET © exemption app nara >

See Specitic [oxy orton, at ard 2P cove Forsgnorgnaatene, check rere >

Instructions. |_ GREENSBORO Nc_27403

H Check type of organization

TR) Secton SOTO) sem rte onsen

tone eek an etaencorpion > []

‘Section 4947()(1) nonexempt charitabe trust |_| Other taxable private foundation Morte oursten slat wes erminted

1’ Fair market value ofall assets at end | J Accounting metnod: IX] cash [_] Accrual Lundersecton 507(b(1}), checkers >

of yar (rom Patt, co (), (ote tepeciy Fhe fandeten ena Bomerthernaon

line 16) S$ 265 , 964] (Part column (4) must be on cash basis) Lunde ston 8716), chek eee >

Part! Analysis of Revenue and Expenses Tie | (a) Revene one (@) Biers

taoancuts columns C3 (may nl ecesoay | PESEEPe |) Netinestnert | (6) Aes ret sree

cual to ams in ot (90651 of to estuctrs)) ie,

Contos, as, recived lac chee 402,000

2 check B [the foundation snot eauredta stack Se

3 lnlereston savings and temporary cash investments 5,056 5,056 5,056]

4 Divers and interest rom securties

52 Gross rents

@ |b Netrental income or (oss)

| 6a netancr fos) tom se ota tonne 12

S| b crosses pic tral assets ono so

| 7 captal gain net income (tom Part IV, ine 2) °

8 Net shor-tem captal gain Q

Income medieatons

a Gross sles ess rus & allwances

Less: Cost of goods sold

Gross profit or (oss) tach schedule)

‘1 Other income (attach sched)

42_Total Ad ines t through 11 407, 056 5,056 5,056]

« | 12 Compensation of offices, directors, ustes, ee 15,000 11,250

3 | 14. omer empoyessalanes and wages 77,260 57,945

§ | 15 Penson plans employes eet 7,342 5,506

S| 16a Legal ees attach schedue) See Stmt 1 2,313]

a PD Accounting feos (atch schedule) Stmt 2 875

Z| © ctor protesnal es atch eect)

B [a7 terest

B [18 tansomernioas) orp ttesinwcon) Stmt 3 062 336] 336) 5,750

| 19 spre atch sch) andcepsten Ste 4 6,514

B |20 occupancy 7,056 3,813

= |24 Tevet corterences, end mesings 5,028 31833

E | 22 Printing and pubications 2,971 2,971

2| 23 onwesemn itn) Stmt 5 stmt 6 24,311) 75| 75) 2,370

& |24 Total operating and administrative expenses

S| Adsines 13 trough 23, 156,732 471| 471 103, 438

B | 25 contnbutons, gis, grans paid 43,128 43,128

26 Total expenses and disbursements, As ins 24 snd 25 799,660 471| a7 146,566

‘27 Subtract ine 25 trom tne 12

2 Excess of revenue over expenses & disbursements 207,196

Net investment income negative, enter-0-) 4,585)

€ Adjusted net income (f nagatve entero. 4,585]

For Privacy Act and Paperwork Reduction Act Notice, see page 80 of the instructions,

For 990-PF (208

Form 990-PF (2008) THE FUND FOR DEMOCRATIC COMMUNITIES 26-0344869 Page 2

Parti” Balance Sheets fzeiehifcirarana cay CSCMOSSATY [Psa ee

* v {a)_B00k Valve {o) Book Value c) Fair Marist Vaio

1 Cosh—oninret ag 6 405} 19,238 19,235

2_Saings na tenprry cosh vests 38,137| 213,194] 213,194

2 Acai cele

Les: stovnce fr sunt accounts

4 Pleo cele >

Les slovonce er sountl accounts

5 Gate recavaie

6 Recvaties ue fom fer, ret, stn, nd ther

)

25_Toa abies od nes 7 rough a o

Foundations that follow SFAS 117, check here [X)

Bl oe Unearets 30,768, 265,964

S| 25. Termporaniy restricted

B| 25 Pemanenty artes

Zz Foundations that do not follow SFAS 117, check here > [_]

| _—_srdcomplt ins 27 trough 31

S| 27 capital sok it neat or caer nds

| 29 Retained earnings, accumulated income, endowment, oF other funds

B) 20 Total net assets or fund balances (see page 17 ofthe

3) nsreion) 58,768, 268,964

| 21 Total liabilities and net assets/fund balances (see page 17

efeitos 50,760] 268,964

Part ill Analysis of Changes in Net Assets or Fund Balances

1 Teale aoe ound blest begining yes—Pa I column (ne 3 (mis ogre wh

encore reported on po year rtur) 1 58,768

2 Ener unt tom Pa ne 278 2 207,196

9 Ober meenses rot nelusean ine 2 erize) 3

4 adines 1.2 ands 4 365,964

5 Decreases otneesin ne? lie) 5

6 Tone ser ud tlre ed ofa in ins ne )—Port I coun) ne 30 365,964

Form 990-PF (a)

11442 10/02/2009 11:58 AM

Form 990-PF (2008) THE FUND FOR DEMOCRATIC COMMUNITIES 26-0344869 Page 3

PartIV_ Capital Gains and Losses for Tax on Investment Income

(a), List and cescroe te kas) f prope sok eg. rel estate, (8) Mavacqares | (0) Daieacaured | (a) Dasa

sary rex wtereune or comer secx, 200.8% LOCO) Eputaae (mean) | to, day)

4a N/A.

»

Fl

(0 Depeiaion alowed (a) Codtarcrerboae TH) Gan er fon)

(6) ross sake pree for alewabs) Pus expense of sae (©) pes minus (@)

»

d

‘Complete ony for assets showing gain in column (hand onmed by the foundation on 12/31/68 (9, cans(Col gan minus

) Austad bane () Boose cioa batt ee than oF

:

5

PartV Qualification Under Section 4940(e) for Reduced Tax on Net Investment Income,

(For optional use by domestic private foundations subject tothe section 4940(a) taxon ne Investment income.)

If section 4940(4)(2) apples, leave this part blank

‘Was the foundation lable forthe section 4942 tax onthe distributable amount of any year in the base period? —-[_] Yes [X] No

Ye," the foundation does nat quay under section 4940(e). De nat complete this prt

4 Enier the appropriate amount in eech column for each year, see page 18 ofthe instructions before making ny entries,

@, (b) ©, @

Base ped yrs cst aula ditions Netvote of rondSntobleuse eesets stun ato

calender nx yearSegining in shed oy elo

2007 2,262 22,377 0.101086

2006:

2005;

20041

2005)

2 Total of tne 1, column (d) 2 0.101086

3 Average distribution ratio forthe 5-year base period divide the total online 2 by 5, or by the

‘umber of yeers the foundation has been in existence fess than S years 3 0.101086

4 Enter the net vale of oncharitable-use assets for 2008 from Part X, ine S 4 215,076

‘5 Multiply tine 4by line 3 5 21,741

6 Enter 195 of net investment income (19h of Part tine 276) 6 46

7 Ratings S and 6 1 21,787

8 Enter qualifying cistibutions rom Part Xl tne 4 146,566

Iie & is equa oor greater than ne 7, check the born Part VI, ine 1b, and complete that part using a 1% tax rate. See

the Part VI instructions on page 18,

Form 990-PF (208

11442 10/02/2009 11.5 AM

Form 990-PF (2008) THE FUND FOR DEMOCRATIC COMMUNITIES 26-0344869 Page 4

Part Vi Excise Tax Based on Investment Income (Section 4940(a), 4940(b), 4940(e), or 4948—see page 18 of the instructions)

Te Bren operaing unalone descrbed nsecton S402, chechee [| ardent NA” on ine

Dae of ing eter: etach copy ot ling ltr nacessiy—te nettle)

b Domestic foundations that meet the section 4940(e} requirements in Part V, check 4 46

rere) and ere 9 of Pat ne 27

ater domes undone enter 2 of ne 27 Exempt foregn exoanzatons eter 4%

Pat ine 2c

2 Tecunder eacton 61 domes ecto 42479) truss an ible foundten ony. Oters er) a °

3 Add tines 1 and 2 3 46

4 Subtitie A (income) tax (domestic section 4947(a}(1) trusts and taxable foundations only. Others enter -0-) 4 0

5 Tax based on investment income. Subtract line 4 from line 3. If zero or less, enter -O- 5 46

© CrestcPaymens

‘22008 estintd tx payers and 2007 overpeynent reste io 2008 6a

Exempt torn eganzaone tx weld a source se

¢Tarpeidvin applean fr exenaon of tne ie (Fe 886) fe

Backup whaling enone vated a

1 Tel reds and peymets Ad ine 6 trough 6d 1

8 Enerany penalty fr underpayment ot estinated tx Checker] i Fonm 2220 ataced a

9 Tax due. If the total of lines 5 and 6 is more than line 7, enter amount owed rls 46

40. Overpayment Ine smere thn tela fies Sad 8 er he amount overpaid > [ae

11_Enterinegmount one 0's be, Cede to 2009 estimated tx retuniea_p [11

Part VIl-A. Statements Regarding Act ies

‘Dig etre, luton atonpt to hunce ny Tolan Halse ain Ba ars

pata cr leven ran ola eampagn? el TX

Did teped mare than 100 aun the ya (te ret ore pocalpupone (ee fae 183

eftbenstucors er dfn)? w| |x

Me arewer Yeon, ach eid despa tects ere eal of any ll

publaed or tad by te oundatan in cannectan vith he aches.

Did eudton le For 120.90. i er? se] [x

Emer te amount an) oft pot expendties (eaten 495) posed ding he year,

(1 Onthetunioton > 3 (2) Onfounaton managers. $

‘© Enter the remmbursement (any) pad bythe foundation during the year for politcal expenditure tax impesed on

foundation managers. BS

2. Has the foundation engaged in any aetites that have nat previously been reported to the IRS? 2 x

tes. attach a detailed description ofthe activites.

‘3 Has the foundation made any changes, not previously reported to the IRS, ints governing instrument, ates of

incorporation, or bylaws, or eter similar instruments? If"Yes,” attach a conformed copy ofthe changes 3 x

442. Did the foundation have unrelated business gross income of $1,000 or more dung the year? 4a x

b If "Yes," has it fled a tax return on Form 990-T for this year? N/A [4b

15) Was therealiquiaten termination, dssoiin, or substantial contacto cute the year? 5 x

Yea, attach the statement equredby Gere Instruction T

8 Are the requirements of section $08(¢) (eating o sections 4841 through 4945) satisfied ether:

« By language inthe governing instrument, of

1 By state legislation that effectively amends the governing instrument so that no mandatory rections that

confict withthe stat law remain inthe governing instrument? o|x

7. Did the foundation have at least $5,000 in assets at any time during the year? If "Yes." complete Parl, cal. (c), and Part XV 7|x

‘8a Enter the states to vnich the foundation reports or wth which itis registered (see page 19 ofthe

instructions). NC.

1b Ifthe answer is "Yes" to line 7, has the foundation furnished a copy of Form 880-PF tothe Attomey General

(ce designate) of each state as required by General Instruction G7 If"No," attach explanation a» | x

8 _Isthe foundation claiming status asa private operating foundation within the meaning of secon 49424)(3)

‘or 49421)(5) for calendar year 2008 or he taxable year beginning in 2008 (see Instructions for Pat XIV on

page 27)? "Yes," complete Part XIV o|x

410. Did any persone become substantial contributors during the tax year? I "Yes. attach a schedule isting ther

names and addresses Stmt_8 ol Xx

9/23 FTP 1 TOT FT rorm 980-PF 208)

11442 10/02/2008 1

Form 990-PF (2008)

AN

Part VILA Statements Regarding Activities (continued)

THE FUND FOR DEMOCRATIC COMMUNITIES 26-0344869

Page 5

"

2

®

1“

1

At anytime during the yes. i te foundation, deco ine ow a cooled entiy wi he

meaning of secon 512 "Yes" alach echecl (a page 20 el he tts)

Dic the foundation acquire a cect or incirect interest n any applicable insurance contract before

‘August 17, 20087

Dic the foundation comply withthe pubic inepection requirements fr is annual returns and exemption application?”

Website addess WwW. £4dc.org

‘The books are incareot_& MARNIE THOMPSON Tetephoneno, & 336-275-1781

1214 GROVE STREET

Locatedst » GREENSBORO, NC

Section 4947(a)(1) nonexempt charitable trusts fling Form 990-PF in leu of Form 1041—Check here

and enter the amount of tax-exempt interest received or accrued during the year

Part VIB Statements Regarding Activities for Which Form 4720 May Be Required

zpss & 27403

> | ss |

rn x

2 x

lx

-O

te

3a

le Form 4720 any item is checked in the "Yes" column, unless an exception applies

During the year cid the foundation (either directly o nec)

(1) Engage inthe sale or exchange o leasing of property wth a d'squalifed person?

(2) Borrow money from, lend money to, or atherwise extend credit to (or accept from) a

squalid person?

(3) Furnish goods, services, or facilis to (or accept them from) a disqualified person?

(4) Pay compensation to, or pay o reimburse the expenses of, a disqualified person?

(6) Transfer any income of assets toa clequalified person (or make any of ether avalable for

the benefit or use ofa disqualified person)?

[Agree to pay money or property toa government oficial? (Exception. Check “Not

the foundation agreed to make a grant o orto ernpoy theofficial fo @ period after

termination of government service, if terminating vithin 90 days.)

I any answer is "Yes" to 14(1}(6), did any ofthe acts fal to qualify under the exceptions described in Regulations

section 53 4941(¢)-3 on a current notice regarding disaster assistance (see page 20 ofthe instructions)?

Organizations relying on a current notice regarding disaster assistance check here

Dic the foundation engage ina prior year in any ofthe acts described in a, other than excepted acs, that

were not corrected before the first day ofthe tax year beginning in 20087

“Taxes on failure to cistribute income (section 4942) (does not apply for years the foundation was a private

‘operating foundation defined in eecton 4942()(3) or 4042()5))

[At the end of ax year 2008, did the foundation have any uncstributed income (ines 6d and

66, Par Xil} for tax year(s) beginning before 2008?

1108," fitthe years 20 2 20 2

‘Ace there ary years iste in 2a for which the foundation fs not appying the provisions of section 4942(a)(2)

(relating to incorec valuation of assets) to the years uncstributed income? if applying section 4942(a)(2),

tall years lsted, answer "No" and attach statement—see page 20 ofthe inetructons,)

Ifthe provisions of section 4842(a)(2) are being applied to any ofthe years Iisted in 25, st the years here

> 20 20 20 20

Dic the foundation hold more than a 2% cirect or indirect interest in any business

enterprise al any tie during the year?

Ife," did it have excess business holdings in 2008 as a result of (1) any purchase bythe foundation or

lisqualified persons after May 26, 1969; (2) the lapse ofthe 5-year period or longer period approved by the

‘Commissioner under section 484(¢\7) to dispose of holdings acquired by gi or bequest; or (8) the apse

‘ofthe 10, 15 oF 20-year frst phase holding period” (Use Schedule C, Form 4720, to determine the

foundation nad excess business holdings in 2008.)

Dic the foundation invest during the year any amount in a manner that would jeopardize ts charitable purposes?

Di the foundation make any investment ina pri year (out after December 31, 1989) that coud jeopardize its

N/A | 46

no

N/A | 2b

Bi no

N/A | 3b

4a x

40 x

Form 990-PF (2008

11442 10/02/2009 11:58 AM

Form 900-PF 2008) THE FUND FOR DEMOCRATIC COMMUNITIES 26-0344869 Page 6

Part VII-B Statements Regarding Activities for Which Form 4720 May Be Required (continued)

‘5a During the year cid the foundation pay or incur any amount to

(1) Carry on propaganda, or otherwise attempt to influence legislation (section 4945(€))? Lyes [Ki no

(2) Influence the outcome of any specific public election (see section 4955); of to cary on,

rectly or indcectly, any voler registration deve? H Yes & No.

(9) Provide @ grant to an individual for rave, study, oF other similar purposes” Yes [X No

(4) Provide 2 grant to an exganization other than a charitable, et. organization described in

section 609(a)(1), (2), or), or section 4940(d)(2)? (ae page 22 of the instructions) Ll ves Xi no.

(6) Provide for any purpose other than religious, chartabl, scientific, Iterary, of

‘educational purposes, or forthe prevention of crusty to children or animals? Dyes BX No.

Hany answer is "Yes" to 5a(1}{8), did any ofthe transactions fal to qualify under the exceptions described in

Regulations section 53.4945 or in @ current notice regarding disaster assistance (see page 22 of the instructions)? N/A | sv

Crprttons ren on a cure nto epardng acer alana check ete ro

the aneweri"Yes" to questo S(), oes the foundation clam exerptn tom he ax

because I mained expenditure repanebly forthe rant? N/A (ves [1 no

ives tach the tater rete by Regltonssecton 534945.)

aid the funded, cringe year, rece an unde, recor net, ope prembne

cn personal benefit contact? Ll ves i no

> Dethe foundation, curing the year. pa rei, Alc onc, che peraanal bene Snot? w»| [x

I youanewered "Yes" oo fhe Frm 8570.

7a Aany ime ding th tx year. vaste foundation apart oa prohbted tx sheer tansacon? (yes ff) no

'b__Ifyes, did the foundation receive any proceeds or have any net income attributable to the transaction? N/A | 7.

Pat Vil Information About Officers, Directors, Trustees, Foundation Managers, Highly Paid Employ

and Contractors

7 Listall fier, directors, rstee, foundation managers and thelr compensation (ao page 22 ofthe insrutions)

See e) copesne | LSREBGE |e pape

(0) Nae andes (oy ue ete | (Ohcetironee | hsgese? |e) Epes,

2 Compensation of five highest-paid employees (other than those included on line 1see page 23 ofthe instructions).

Inne, enter "NONE,

(a) Nore and odcres of eas employes psd ere han 850,000 i mespewat™ |) conan Sos thee

srteoepmion aaa siowerces

Total numberof other employees paid over $50,000, >

Form 990-PF (a5)

11442 10/02/2009 11.5 AM

Form 990-PF 2008) THE FUND FOR DEMOCRATIC COMMUNITIES 26-0344869

Part Vill Information About Officers, Directors, Trustees, Foundation Managers, Highly Paid Employees,

and Contractors (continued)

3 Five highest-paid independent contractors for professional services (see page 23 of the instructions), none, enter "NONE

(a)_ Nar an ads of ach person gid me than $5,000 b) Type ot sevice

(e)_Conpensston|

NONE

Total numberof ethers receiving ver 850,000 for professional services >

PartIX-A Summary of Direct Charitable Activities

Listne foundations ur largest dred cartableacbitesdureg te tm year Include lever latscalivomaton euch ab he nab

‘ferganaatene ard ter benetoare ered cararnces artered aaron papers prio te Expenses

7 PROMOTION OF GRASSROOTS DEMOCRACY -- GRANT MAKING,

COMMUNITY DISCUSSIONS, YOUTH GROUPS, ETC.

146,566

2

2

4

PartX-B_ Summary of Program-Related Investments (see page 23 of the instructions)

Desobe the to bigest ogra sled investments made by he fundation dug he tye cn Ings 1 and 2 ‘Around

1 N/A

2

‘Alohar pograrnreaiad restnants, Sa page 24 che nsructons

3

Total, Add lines 1 tough 3

Form 980-PF (2005)

11442 10/02/2009 11.5 AM

Form 990.P 2008) THE FUND FOR DEMOCRATIC COMMUNITIES 26-0344869 Page 8

PartX Minimum Investment Return (All domestic foundations must complete this part. Foreign foundations,

‘see page 24 of the instructions.)

1 Fair market vale of assets not used (or held or use) crecly in crying out chatable, ete

purposes:

‘a Average monthiy fer market value of securities ta o

1b Average of monthly cash balances tb 218,351

© Fair market value of ll other assets (see page 24 ofthe instructions) 1c 0

4 Total (anes ta, b, and c) ‘a 216,351

© Reduction claimed for blockage or other factors reported on ines 1a and

‘1c (attach detaiec explanation) o

2 Aequston indebtedness applicable to line 1 assets 2 o

3. Subtractline 2 rom line 14 218,351

Cash deemed held for chartabe activities, Enter 1% % of line 3 (fr greater amount, see page 25

ofthe instructions) 4 3,275

'5 Net value of nonchartable-use assets, Subtect ne 4 from ine 3. Enter here and on Patt, ine 4 3 215,076

Minimum investment return. Enter 5% oftine 5 é 10,754

Part XI Distributable Amount (see page 25 of the instructions) (Secten 4642()) and (NS) private operating

foundations and certain foreign organizations check here [X] and do not complet this part)

Minimum investment return fram Part X, tne 6 4

2a Taxon investment income for 2006 ftom Pat VI, ne 5 za

'b-_tncome tax for 2008, (This does not nce the tax trom Part VI) 2

& Adines 28 end 2 2e

3 Dictribuable amount before adjustments. Subtract ine 2e from tne 1 3

4 Recoveries of amounts treted es qualiyng distributions 4

5 Addines 3 ana 4 5

{8 Deduction trom estrbutable amount (see page 2 of the instructions) 6

7 Distributable amount as adjusted, Subrat ine 6 ftom line 5. Enter here and on Pat Xi

tne 4 1

Part Xi Qualifying Distributions (see page 25 of the instructions)

71 Amounts pa (ncuding administrate expenses) fo accomplish charable, tc, purposes

‘a Expenses, contrioutons, gts, ete—Iotal rom Part |, column (ne 26 1a 146,566

_Program-elated ivestments—ttal rom Part X-B 4b

2 Amounts paid to acquire asets used (or hed or use) rectly in carrying out chartabl, ete

purposes 2

3 Amounts set aside for speci chartable projec tha satis the:

Suitably test (pir IRS approval required) 3a

'b Cash distributon test (attach the required schedule) ab

4 Qualtying distributions. Add ines ta through 3. Enter here and on Part V, ine 8, and Pat Xl ine 4 4 146, 566

‘5 Foundations that qualify under section 4940(e) or the reduced rae of taxon net investment income.

Enier 1% of Pat | line 270 (see page 26 of te instructions) 5 46

6 Adjusted qualifying distributions. Subtract ine 5 from line 4 146,520

Note. The amount on ine 6 wil be used in Prt V, column (b), in subsequent years when calculating whether the foundation

qualifies for the section 4840(e) reduction of ax in those years

Fam 990-PF (209)

11442 10021

Form 990-PF (2008)

Part Xill

AN

THE FUND FOR DEMOCRATIC COMMUNITIES 26-0344869

Undistributed Income (see page 26 of the instructions)

Pages

1

Distributable amount for 2008 from Part Xl

line7

Undistibuted income, if any, as of the end of 2007.

Enter mount for 2007 only

bb Total or prior years: 20 2 20

«

coxpus

©

@

Excess distributions caryover, if any to 2008:

From 2003

From 2004

From 2005

From 2008

From 2007

Total of ines 3a through &

Qualying estributions for 2008 from Part XI,

lines: mS

‘Applied to 2007, but nat more than line 2a

Appled to undistributed incame of prior years (Election

required—see page 26 ofthe instructions)

Treated as distributions out of compus (Election

required—see page 26 ofthe inetructions)

Applied to 2008 dstibutable amount

Remaining amount dstibuted out of corpus

Excess distributions caryover applied to 2008

(ifan amount appears in column (), the same

‘amount must be shawn in column (2).)

Enter the net total of each column as

Indicated below:

Corpus. Add ines 3, 4, and de, Subtract ne S

Poe years! undistributed income. Subtract

line from tne 25

Enter the amount of prior years’ undistributed

income for which a noice of defciency has been

Issued, oF on Which the section 49424a) tax has

been previously assessed

Subtract ine 6e from tine 6, Taxable

‘amount—see page 27 ofthe instructions

Undistibuted income for 2007. Subtract ine

4a from line 2a. Taxable amount—see page

27 ofthe intructions

Undistributed income for 2008. Subtract ines

“4d and 5 from ine 1. This amount must be

distributed in 2008

‘Amounts treated as distributions out of corpus

to satisfy requirements imposed by section

170(0)1}\F) or 494216)(3) (see page 27 of the

instructions)

Excess cistibuttons carryover fom 2003 nat

applied online 5 or ine 7 (see page 27 ofthe

instructions)

Excess distributions carryover 102008.

Subtract ines 7 and 8 from line 6a

Analy of line 8:

Excess from 2004

Excess from 2005

Excess from 2008

Excess from 2007

Excess from 2008

For 990-PF (208

11442 1002/2008 1

‘AN

Form 990-PF (2008) THE FUND FOR DEMOCRATIC COMMUNITIES 26-0344869 Page 10

Part XIV. Private Operating Foundations (see page 27 of the instructions and Part VII-A, question 9)

18

2a

If the foundation has recelved a ring or determination letter that it sa private operating

oundation, an! the ruling i effective for 2008, enter the date ofthe ring > N/A

Check box to indicate whether the foundation isa private operating foundation described in section [| aaa) or | | aap

Enter the lesser ofthe acjusted net Taxyest Pri 3 yes (e) Total

income fem Part othe minimum (a) 2008 (o) 2007 (e) 2008 (a) 2005

investment return from Part X for

‘each yea sted 4,585| 644) 5,229

5% ofline 23 3,897 547) 4,444

Qualifying distributions from Part Xi,

line 4 for each year sted 146,566 2,262 148,828

Amounsincuded in ine enol sad recy

for ctve conduct of exempt aces

Qualifying distributions made directly

{or active conduct of exempt actus,

Subtract ine 2d from line 26 146 566 2,262 148,828

Complete 3a, b, oF ¢ forthe

‘atterative test relied upon

“Assets” alternative test—enter:

(1) Value of all assets

(2) Value of assets qualying under

section 4942((3)(8))

“Endowment erative teste 26 of

simu syesimant tun shown Pat

line fr each yar ated 7,169| 429 7,598

“Support” alternative tester

(1) Total support other than gross,

Investment income (interest,

dvidends, rents. payments on

‘secures loans (section

'512(a)(5), or royalties)

‘Suppor from genera pubic

‘and 5 of more exempt

‘organizations 2s proved in

section 4942(9(3)(8)

Largest amount of suppor from

{en exempt organization

(4)_Gcoss investment income

@)

®

Part XV Supplementary Information (Complete this part only if the foundation had $5,000 or more in assets

at any time during the year—see page 27 of the instructions.)

Information Regarding Foundation Managers:

List any managers of the foundation who have cantbted more than 2% of the ttal cantibutions received bythe foundation

before the close of any tax year (bt only they have contributed more than $5,000). (See section 507(4)(2).)

See Statement 10

List any managers of the foundation who ovm 1036 or more ofthe stock ofa corporation (or an equally large portion ofthe

‘ownership ofa partnership or other entity) of which the foundation has a 10% or greater interest,

N/A

Information Regarding Gontibuon, Gran, it Loan, Scholerhip, te, Programs

Check hae [| ithe tundaten ony males conttons to preset chatable egenzatons and dest accep

nated equa fr ins Ite oundten maka its graf, (8 page 28 he matte) oni oF

erganzaons under ober onions, compet ta 2b and

“The name, adéress, and telephone number ofthe person to whom applications should be addressed

GRANT PROPOSALS 336-617-5329

FUND _FOR DEMOCRATIC COMMUNITIES GREENSBORO NC 27403

“The form in which applications should be submited and infomation and materials they should nolude

See Statement 11

“Any submission deadlines:

See Statement 12

‘Any restrictions or imitations on awards, suchas by geographical areas, chartable fields, Kinds of institutions, or ther factors:

See Statement 13

Form 990-PF (208

11442 10/02/2009 11.5 AM

Form 990.PF 008) THE FUND FOR DEMOCRATIC COMMUNITIES 26-0344869 Page tt

Part XV Supplementary Information (continued)

3_ Grants and Contributions Paid During the Year or Approved for Future Payment

Recipient "Sow any me "fate Purpose grat or rout

pe ) reece! tention

Name and address (home or business) or sunt

‘Paid during the year

See Statement 14

43,128

Total > 32 43,128

'b_ Approved for future payment

N/A

Total >

Daa Form 990-PF (208)

11442 10/02/2009 11.5 AM

Form 990-PF (2008) THE FUND FOR DEMOCRATIC COMMUNITIES 26-0344869 Page 12

Part XVI-A_ Analysis of Income-Producing Activities

Enter gross amounts unless oherse iccate. Unisedbuerees income | Ssdeiy woos a4 my

Retted ot ext

° » © ° tecionneame

Brsinssonce] —atent [tga | Aunt (Seerage att

1 Program sence revenue . hemenstere

>

4

'

19 Fees and contracts from government agencies

“Membership ues and assessments

Interest on savings and temporary cash investments 14 5, 056|

Dividends and interest from securties

Net rental income or (oss) from realestate:

‘2 Dettfnanced property

b Not debictinanced property

6 Net renal income or (loss) from personal property

7 Other investment income

8 Gain or (ess) from sale of assets oter than inventory

3

0

1

Net income or (oss) from special events

40 Gross proft or (oss) from sales of inventory

11 Other revenue: a

b

d

42 Subjoial Add columns (6), (@, and (@) 0 5,056] 0

49 Total. Add line 12, columns (), (2), and (e) 8 5,056

(See worksheet in tine 13 instructions on page 26 to verify calculation.

PartXVF-B Relationship of Activities to the Accomplishment of Exempt Purposes

Line No, | Plain below how each acy for which income is reported in column (e) of Part XV-A contributed importantly to

’ the accomplishment of the foundations exempt purposes (other than by providing funds for such purposes). (See

age 28 ofthe instructons,

N/A

Daa Form 990-PF (208)

11442 10/02/2009 11:58 AM

Form 990.PF (2008) THE FUND FOR DEMOCRATIC COMMUNITIES 26-0344869 Page 13

Part XVI Information Regarding Transfers To and Transactions and Relationships With Noncharitable

Exempt Organizations

“1 Did the oxganizaton crectly or indirect engage in any ofthe folowing wth any other organization described Yes | No

in section 501(c ofthe Code (other than section 501(c)3) organizations) orn section 527, relating to pottcal

‘organizations?

‘Transfers from the reporting foundiaton to noncharitable exempt organization of

(1) cash fran x

(2) Other assets fara) x

bb Other transactions:

(1) Sales of assets toa noncharitable exempt organization Io«1) x

(2) Purchases of assets from a nonchaitable exempt organization cy x

(@) Rental of facies, equipment, or ether assets foo) x

(4) Reimbursement arrangements fecay x

(6) Loans or oan guarantees ious x

(6) Pesformance of services of membership or fundraising solictations Cy x

© Sharing o facies, equipment, mang Ist, other assets, or paid empoyees te x

4 Ifthe anewer to any ofthe above i “Yes,” complete the follaing schedule. Column (b) should alvays chow the fair market

value ofthe goods, other assets, or services given by the reporting organization. Ifthe foundation received less than fair market

value in any traneaction of sharing arrangement, ehod in column (d) the value of the ood. ther assets, of eenioes received

(a) uneno | (b) Amourtinvovec | (c) Name ctnorcartane enpt sganzaten | (d)Oescigion ot vans, asastons, ad staring arangenerts

N/A

2a_ Is the foundation direct or indrecty afisted with, or related to, one or more tax-exempt organizations

described in secon 801(c) ofthe Code (ther than section 601(¢}3)) or in section 5277

bb_I1 "Yes." complete the follwing schedule

(2) Name atewganzaten (0) Type cteganzaien (e) Descipton of atonani

N/A

bel, fs tre, cores, and corgsete. Declaration of preparer fther than taxpayer oF Husa) based on aliformation of which preparer has ary Knowedge

» » PRESIDENT

Sigasare doce arta = Tae

Date eg

Checkit Signature on

y Chuck Averre, CPA gi2gjog _|reter#ort +1] expression,

Sign Here

Preparers

Use Only

sate

Fiménone(nyoust Hollingsworth Avent Averre & Purvis, PA

saltenpiyed) adtess, 200 W. Millbrook Road EN» 56-2119415

and 71 cose Raleigh, NC 27609 shores 919-848-4100

Form 990-PF (2008

11442 10/02/2008 1

AN

Depreciation and Amortization

rom 4562

see eesten (Including Information on Listed Property)

Intemal Reverse Sect” so see separate instructions. Attach to your tax return.

Nereis) own on retarn Ieentiying number

THE FUND FOR DEMOCRATIC COMMUNITIES 26-0344869

Business er ety fo wich is form votes

Indirect Depreciation

Part! Election To Expense Certain Property Under Section 179

Note: If you have any listed property, complete Part V before you complete Part I

1 Maximum smount. See the instructions fora higher it for certain businesses. i 250, 000

2. Total cost of section 179 property placed in service (see instructions) 2

3 Threshold cost of section 178 property before reduction in imtation (see instructions) 3 ‘B00, 000

4 Reduction in imation, Subtract line 3 from line 2, If zero ot less, enter-0- ‘

{5 Dolar imation fr tx year, Subic om i 1260 cross, ener 0. I mare fing separate, se istetons 5

(2) Descroton ot prover (8) Cont (business use ont) |e) Eien

é

7 Usted propery. Enter the amount rom ine 29 7

8 Total elected cost of section 179 property. Add amounts in column (c), nes 6 and 7 a

9 Tentative deduction. Enter the smaller of ine Sor line 8 °

40 Carryover of cieallowied deduction from line 13 of your 2007 Ferm 4862 40

114 Business income limitation. Enter the smaller of business income (nt less than zea) or line 5 (see instructions) m7

12._Section 179 expense deduction. Ad lines 9 and 10, but do net eter more than line 11 12

13 _ Carryover of eisallowed deduction to 2008. Add ines 9 and 10, less ine 12 > lis

‘Note: Do nat use Par I or Part il below fr isted property. Instead, use Par V.

Partil Special Depreciation Allowance and Other Depreciation (Do not include listed property.) (See instructions.

{4 Special deprecation allowance for qualified property (ther than listed property) placed in service

during the tax year (see instructions) 14 500

45 Property subject to section 168(9) election 15

16 _Oither depreciation (nciuding ACRS) 16 1,030

Part ill MACRS Depreciation (Do not include listed property.) (See instructions.)

‘Section &

{7 _ MACRS deductons for assets placed in service in ox years beginning before 2008, [a 1,847

18_tyou se elesng to group ay osets laced nsenoe cng te tenes” to one of mote genet! ott socourtschecknete

‘Section B—Assets Placed in Service During 2008 Tax Year Using the General Depreciation System

(©) North and] (e)_ Basix cepreision [ay meoory

(2) Cisieaton of popety Searpocrs | (laneeciatenuee [R= | a) cameron | (0 athoe | tg) cepreitin decton

iga_ Sear proper

bS.year property 14,572| 5.0 | BY 200DB 2,915

¢ 7-year proper 1,557| 7.0 | HY 200DB, 222

'd_ 10-year property

ce 15:year property

1 20-year property

9 25.yea proper 25 ys. Si

Ih Residential rental 215ys wnt SA.

property 275 ys MM SM

Nonresident eal 39 ys. MM Si.

property MM Sit

‘Section Assets Placed in Service During 2008 Tax Year Using the Alternative Depreciation System

2a_Ciess ie Si.

bb 12.80" iy Sit

© 40year 40 ys. ma SA.

PartlV_ Summary (See instructions.)

21 Usted property. Enter amount from ine 28 a

22. Total. Add amounts from line 12, hn 14 through 17 lines 19 and 20 in column (@), and ne 2.

Enier here and on the appropiate nes of your return, Partnerships and S corporations —e ict. 2 6,514

23 For esses shown above and placed in sence during the current year,

center the portion ofthe bass atibutabe to section 263A costs 2

For Paperwork Reduction Act Notice, see separate instructions. Form 4562 2005)

11442 10021

AN

4

THE FUND FOR DEMOCRATIC COMMUNITIES 26-0344869

PartV. sted Property (Include automobiles, certain other vehicles, cellular telephones, certain computers, and

property used for entertainment, recreation, or amusement.)

24a _Do you nave evience to suppor the businessinvestmert vee claimed? [Ives [ [no | 24) i Yes," is the evidence witen? ‘ves | [No

“spadthnen © cukfeses ry o | @ @ o @

vegcleers] Oweecean | eke | comerarer | Gena comecme [Feceey | Memo | oxpoaiton | eet

28 Aad amounts in column (fy, nes 25 trough Z7_ Enter here and on ne 21, page 7 Lae

moma

se ant soe sot pea

Anois usin a eee esa enocreaeo eny eee ee ee a ene

santana clon chaulyway teases

se boymovet anc sonccebyenln sspectet

aoe awa a eran an stators eee

Part Vi Amortization

aaa a Es

rian doa tna z Te

Seon ee cnn une tomga 4 Ties

Form 4562 (2008)

11442 THE FUND FOR DEMOCRATIC COMMUNITIES 10/2/2009 11:58 AM

26-0344869 Federal Statements

FYE: 12/31/2008

Statement 1 - Form 990-PF, Part |, Line 16a - Legal Fees

Description

Net Adjusted Charitable

Total Investment Net Purpose

‘Statement 2 - Form 990-PF, Part |, Line 16b - Accounting Fees

Description

Net Adjusted Charitable

Total Investment Net Purpose

ACCOUNTING

$ §

Total

‘Statement 3 - Form 990-PF, Part |, Line 18 - Taxes

Description

Net Adjusted Charitable

Total Investment Net Purpose

LOYER TAXES

$ 7,666 $ $ $ 5,750

396

396

Total

13

11442 THE FUND FOR DEMOCRATIC COMMUNITIES, 10/2/2009 11:58 AM

26-0344869 Federal Statements

FYE: 12/31/2008

Statement 4 - Form 990-PF, Part |, Line 19 - Depreciation

Description

Date Cost Prior Year Current Year Net Investment Adjusted Net

Acquired Basis Depreciation Method Life. _Depreciation Income Income

APPLE MACBOOK PRO 17"

10/19/07 § 4,664 § 208 200DB 5s 1,782 $ $

WESTERN DIGITAL 250 GB MYBOOK PRO

10/19/07 171 8 200DB 5 65

DESK, HUTCH, CHAIR, CABINET, BKCASE,

1/10/08 1,185 7 71

SMALL DESK, TABLE

5/01/08 200DB 7 13

2 DRAWER FILING CAB

9/08/08 20008 7 16

LEATHER OFFICE CHATR

10/02/08 28 7 18

HP LASERJET PRINTER

1/14/08 419 200DB 5 84

2 COMPAC PRESARIO LAPTOPS

2/01/08 1 200DB 5 426

500 GB EXTERNAL DRIVE

2/01/08 20008 5 29

LINKSYS NAS200 NETWRK SYSTEM

2/23/08 200DB 5 8

WD 500 GB HARD DRIVE

2/23/08 200DB 5 30

BH 500 COPIER

6/02/08 9,599 5 1,920

VOSTRO 200 DESKTOP

6/20/08 5 16

2 VOSTRO 1400 LAPT

6/24/08 5 235

‘TELEPHONE

4/26/08 5 cn

NETWORK & ROUTER EQUIPMENT

9/23/08 65 5 99

2 DRAWER FILE CABINET

9/10/08 60 7 34

QUICKBOOKS PREMIER

30/07 438 28 3 146

11442 THE FUND FOR DEMOCRATIC COMMUNITIES, 10/2/2009 11:58 AM

26-0344869 Federal Statements

FYE: 12/31/2008

ss ‘orm 990-PF, Part I, Line 19 - Depre:

Description

Date Cost Prior Year Current Year Net Investment Adjusted Net

Acquired Basis Depreciation Method Life. _Depreciation Income Income

DESKTOP 3.0 FOR MAC

10/20/07 $ 00 $ 2 3 § 33 $ $

ADOBE CS3 DESIGN PREM

10/13/0' 1,896 114 3 632

Ms WINDOWS XP

10/19/07 8 18 3 99

GOTHAM ROUNDED MAC LI (2)

1/05/08 576 3 384

QUICKBOOKS PRO 2007, OFFICE 2008

4/08/08 9 3

8

Statement 5 - Form 990-PF, Part |, Line 23 - Amortization

Description

Date Cost Prior Year Current Year Net Investment Adjusted Net

Acquired Basis Amortization Life _ Amortization Income Income _ COGS.

START UP COSTS

6/05/07 $ 17,726 § 68915 $ 1,182 § $

$ 17,726 § 689 8 1,182 $ o $s 0

45

11442 THE FUND FOR DEMOCRATIC COMMUNITIES 10/2/2009 11:58 AM

26-0344869 Federal Statements

FYE: 12/31/2008

Statement 6 - Form 990-PF, Part |, Line 23 - Other Expenses

Description

Net Adjusted Charitable

Total Investment. Net. Purpose

3s $ 8 3

Expenses

OUTSIDE CONTRACTOR SERVICES

9,900 960

BOOKS, SUBSCRIPTIONS

60 160

POSTAGE, MAILING SERVICE

115

SUPPLIES

530

TELEPHONE

924 499

OFFICE SUPPLIES

2,145

BOARD MEETING FOOD

2,130 672

FOOD FOR INTERNAL MEETINGS

953 646

BUSINESS MEALS

225 8

ADVERTISING

312 522

INSURANCE

1,718

DUES

585 125

VOLUNTEER APPRECIATION

118 SL

ORGANIZATIONAL DEVEL!

690

PAYROLL PRO

1,312 984

BANKING FEES

Total

11442 THE FUND FOR DEMOCRATIC COMMUNITIES, 10/2/2009 11:58 AM

26-0344869 Federal Statements

FYE: 12/31/2008

Statement 7 - Form 990-PF, Part Il, Line 14 - Land, Building, and Equipment

Beginning End End Accumulated Net

Description Net Book Cost / Basis Depreciation FMV.

com $ 71 $ 9,838 § $ 6,708

SOFTWARE 43 3,505 1,925

FURNISHINGS 1587 1335

OFFICE EQUIPMENT 9,653 7,722

START UP COSTS 17,726 15, 855

5,313

$ 25,293 8 42,309 8 8,764 $ 33,545

11442 THE FUND FOR DEMOCRATIC COMMUNITIES,

26-0344869 Federal Statements

FYE: 12/31/2008

10/2/2009 11:58 AM

Statement 8 - Form 990-PF, Part VILA,

1e 10 - Substantial Contributors

Address City, State, Zip

W. HAYDEN THOME

ROAD BEDFORD HEIGHTS OH 44146

11442 THE FUND FOR DEMOCRATIC COMMUNITIES, 10/2/2009 11:58 AM

26-0344869 Federal Statements

FYE: 12/31/2008

Statement 9 - Form 990-PF, Part VIll, Line 4 - List of Offi

ers, Directors, Trustees, Ete.

Name and Average

Address Title Hours Compensation Benefits Expenses

MARNIE THOMPSON PRESIDENT 20 0 0 0

1214 GROVE STREET

SREENSBORO NC 2

ED WHIT EXE DIREC’ 20, 15,000 0 °

1214 GROVE

GREENSBORO

SABRINA ABNEY DIRECTOR 2 0 0 o

214 GROVE STREET

INSBORO NC 27403

DIRECTOR 2 0 °

DIRECTOR 2 ° ° °

1214 GROVE STREET

GREENSBORO NC 27403

JONATHAN HENDERSON DIRECTOR 2 0 °

1214

GREENSBORO

NN JOHNSON DIRECTOR 2 0 0 °

ROVE STREET

GREENSBORO NC 27403

MUKTHA JOST DIRECTOR 2 0 ° °

1214 GROVE STREET

GREENSBORO NC 27403

KYLE LAMBELET DIRECTOR 2 0 0 °

214 GROVE STREET

NICLOLE LAMBELET DIRECTOR 2 0 0 0

11442 THE FUND FOR DEMOCRATIC COMMUNITIES

26-0344869

FYE; 12/31/2008

Federal Statements

10/2/2009 11:58 AM

Statement 9 - Form 990-PF, Part Vill, Line 1 - List of Officers, Directors, Trustees,

Etc. (continued)

Name and Average

Address Title Hours Compensation Benefits Expenses

214 GROVE STREET

GREENSBORO NC 27403

ENZO MEACHUM DIRECTOR 2 o 0 °

ROVE STREET

27403

DIRECTOR 2 ° ° °

214 GROVE STREET

GREENSBORO NC 27403

STEVE SUMMERFORD DIRECTOR 2 0 0 °

4 GROVE STREET

GREENSBORO NC 27403

JOYA WESLEY DIRECTOR 2 ° ° °

1214 GROVE

GREENSBORO NC

11442 THE FUND FOR DEMOCRATIC COMMUNITIES 10/2/2009 11:58 AM

26-0344869 Federal Statements

FYE: 12/31/2008

Statement 10 - Form 990-PF, Part XV, Line 1a - Managers Who Contributed Over 2% or $5,000

Name of Manager Amount

STEPHEN JOHNSON $ 32,311

MARNIE THOMPSON 32,310

Total $ 64, 621

Statement 11 - Form 990-PF, Part XV, Line 2b - Application Format and Required Contents

Description

T COMPLETE

F4DC.ORG.

GRANT APPLICANTS

AVAILABLE ONLINE AT

GRANT

Statement 12 - Form 990-PF, Part XV, Line 2c - Submission Deadlines

Description

IN 2008 THERE WERE TWO GRANT CYCL

POSTED AT WHW.F4DC.ORG

“THE FUND FOR DEMOCRAT

GUIDELINES." PROPOSALS

OFFICE #Y 11:50 PM ON THE POST

GRANT CYCLES W

DOCUMENT BN

: 2008 GRANT

EIVED AT TH

D DEADLINE DATE.

apc

Statement 13 - Form 990-PF, Part XV, Line 2d - Award Restrictions or Limitations

Description

MUST SIGN GRANT AGREEMENT FORM STATING THAT GRANT WILL BE

USED FOR THE PURPOSE INTENDED. OTHER GUIDELINES ARE LATD

OUT IN A DOWNLOADABLE DOCUMENT ENTITLED "AFTER THE GRANT

IS AWARDED" AT '4DC ORG

10-13

11442 THE FUND FOR DEMOCRATIC COMMUNITIES, 10/2/2009 11:58 AM

26-0344869 Federal Statements

FYE: 12/31/2008

Statement 14 - Form 990-PF, Part XV, Line 3a - Grants and Contributions Paid During the

Year

Name Address

Address Relationship Status Purpose Amount

HOMEKEEPING MORTGAGE DEFA 2808 FOUR SEASONS BLVD

GREENSBORO NC 27406 STAFF/BOARD DEVELOPMENT /OUTREACH 3,000

HEIRS TO A FIGHTING TRADI 104 SOUTHAMPTON DRIVE

KNIGHTDALE NC 27545 SPEAK YOUR TRUTH INSTITUTES 1,500

LATINO COALITION OF RANDO P 0 BOK 352

HEVILLE NC 27204 RANDOLPH READS

JUST ECONOMICS OF WESTERN

ASHEVILLE NC 28802 VOICES FOR ECONOMIC JUSTICE 2,000

PAIGN FOR Y 117 sourH

DUDLEY Wi FARM LABOR ORGANIZING COMMIT!

COMMUNITY IN 4515 BROMLEY DRIVE

GREENSBORO NC 2 WEBSITE PUBLICITY - COMMUNITY ASS'N

FRESHLIFE, INC P © BOX 1310

DURKAM NC 27709 DISCOVERY CA 2,000

STONE CIRCLES 6602 NICKS ROAD

MEBANE NC 27302 SOUL SANCTUARY 2,000

BURNSVI |AND COMMUNITY P © BOX 1059

BURNSVILLE NC 28714 FUND BILINGUAL COMMUNITY ORGANI 2,000

GREATER GLENWOOD NEIGHBOR C/O KATES, 1118 LEXINGTON

MURAL 500

2808 FOUR SEASONS BLVD

COUNSELOR TRAINING/CERTIFICATION 3,000

122 NORTH ELM STREET M

FUTURE LEADERS PROGRAM

01 SOUTH MARSHALL ST

CRACK INTERVENTION RESEARCH PROJECT

BELOVED CoMMl 269-114 SOUTH MAIN ST

HIGH POINT N GIL BARBER HEALING THE KURT PROGRAM

CENTER FOR CREATIVE ARTS 200 NORTH DAVIE ST BOX 13

LOS ARTISTAS

PO BOX 61865

620 SOUTH ELM ST, STE 381

PARITIES COLLA!

AFSC 6306 WEST MARKET STREE

GREENSBORO NC 27410 TRUTH IN RECRUITING

11442 THE FUND FOR DEMOCRATIC COMMUNITIES, 10/2/2009 11:58 AM

26-0344869 Federal Statements

FYE: 12/31/2008

‘Statement 14 - Form 990-PF, Part XV, Line 3a - Grants and Contributions Paid During the

Year (continued)

Name Address

Address Relationship Status Purpose ‘Amount

MILLENIUM MINDS 1103 WEST LEE STREET

GREENSBORO NC 27403 KEY RING INHERITANCE/100 LEADERS 1,500

NS HE 1713 MHRA BUILDING

CAREGIVER VILLAGE

GREENSBORO HIVE 1 W FLORIDA

SBORO NC 27

c/o BRATZ,

ANNIVERSARY CELEBRATION 203

417 ARLINGTON STREET

PIN DINNER, REMEAU MTGS, UNITY CONF 825

14

You might also like

- 2011 990 PFDocument26 pages2011 990 PFFund for Democratic CommunitiesNo ratings yet

- More Than A Grocery StoreDocument24 pagesMore Than A Grocery StoreFund for Democratic CommunitiesNo ratings yet

- 2014 990 PF AmendedDocument27 pages2014 990 PF AmendedFund for Democratic CommunitiesNo ratings yet

- Form 990-P F: Return of Private FoundationDocument26 pagesForm 990-P F: Return of Private FoundationFund for Democratic CommunitiesNo ratings yet

- 2015 990 PFDocument30 pages2015 990 PFFund for Democratic CommunitiesNo ratings yet

- Reparations, How Are We Doing It?Document20 pagesReparations, How Are We Doing It?Fund for Democratic Communities100% (1)

- RCC Film Screening Resentation 3.2.15Document5 pagesRCC Film Screening Resentation 3.2.15Fund for Democratic CommunitiesNo ratings yet

- The Fund For Democratic Communities 712 South Elam Ave. Greensboro NC 27403 26-0344869 336-617-5329Document26 pagesThe Fund For Democratic Communities 712 South Elam Ave. Greensboro NC 27403 26-0344869 336-617-5329Fund for Democratic CommunitiesNo ratings yet

- 2010 990 PFDocument23 pages2010 990 PFFund for Democratic CommunitiesNo ratings yet

- 2007 990 PFDocument29 pages2007 990 PFFund for Democratic CommunitiesNo ratings yet

- 2013 990 PFDocument33 pages2013 990 PFFund for Democratic CommunitiesNo ratings yet

- A Pathway To Responsible Community Ownership of The Renaissance Center - August 7, 2013 RevisionDocument16 pagesA Pathway To Responsible Community Ownership of The Renaissance Center - August 7, 2013 RevisionFund for Democratic CommunitiesNo ratings yet

- 2009 990 PFDocument23 pages2009 990 PFFund for Democratic CommunitiesNo ratings yet

- White House Press Release Including Participatory BudgetingDocument7 pagesWhite House Press Release Including Participatory BudgetingFund for Democratic CommunitiesNo ratings yet

- RCC Proposal To The City of Greensboro, January 22, 2014Document11 pagesRCC Proposal To The City of Greensboro, January 22, 2014Fund for Democratic CommunitiesNo ratings yet

- ROOTSTOCK - July 2014Document2 pagesROOTSTOCK - July 2014Fund for Democratic CommunitiesNo ratings yet

- Renaissance Community Coop Bylaws (Unapproved)Document6 pagesRenaissance Community Coop Bylaws (Unapproved)Fund for Democratic CommunitiesNo ratings yet

- Process For Approving Bylaws and Electing Our First Board of DirectorsDocument8 pagesProcess For Approving Bylaws and Electing Our First Board of DirectorsFund for Democratic CommunitiesNo ratings yet

- RCC Presentation To The City, January 22, 2014Document52 pagesRCC Presentation To The City, January 22, 2014Fund for Democratic CommunitiesNo ratings yet

- ROOTSTOCK - Volume 1, Issue 1Document2 pagesROOTSTOCK - Volume 1, Issue 1Fund for Democratic CommunitiesNo ratings yet

- Black Coop Pioneers in The Struggle For Economic JusticeDocument87 pagesBlack Coop Pioneers in The Struggle For Economic JusticeFund for Democratic Communities100% (1)

- Nomination Form For The RCC Board of DirectorsDocument2 pagesNomination Form For The RCC Board of DirectorsFund for Democratic CommunitiesNo ratings yet

- RCC Pro Forma - January 23, 2014 RevisionDocument16 pagesRCC Pro Forma - January 23, 2014 RevisionFund for Democratic CommunitiesNo ratings yet

- A Pathway To Responsible Community Ownership of The Renaissance Center - Spreadsheets - Aug 7, 2013 RevisionDocument2 pagesA Pathway To Responsible Community Ownership of The Renaissance Center - Spreadsheets - Aug 7, 2013 RevisionFund for Democratic CommunitiesNo ratings yet

- Notes From Small Group Discussion - June 17Document11 pagesNotes From Small Group Discussion - June 17Fund for Democratic CommunitiesNo ratings yet

- A Pathway To Responsible Community Ownership of The Renaissance Center - SpreadsheetsDocument2 pagesA Pathway To Responsible Community Ownership of The Renaissance Center - SpreadsheetsFund for Democratic CommunitiesNo ratings yet

- RCC Pro Forma - May 23, 2013 RevisionDocument9 pagesRCC Pro Forma - May 23, 2013 RevisionFund for Democratic CommunitiesNo ratings yet

- A Pathway To Responsible Community Ownership of The Renaissance CenterDocument14 pagesA Pathway To Responsible Community Ownership of The Renaissance CenterFund for Democratic CommunitiesNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)