Professional Documents

Culture Documents

Wkly Tbonds

Uploaded by

Charlie del RosarioCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Wkly Tbonds

Uploaded by

Charlie del RosarioCopyright:

Available Formats

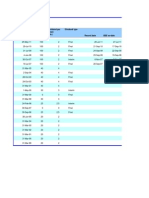

RESULTS OF TREASURY BONDS AUCTIONS

for CY 2016

(In Million Pesos)

Maturity

Period

Auction

Date

Issue

Date

Jan

10-yr.

12-Jan-16

14-Jan-16

Offering

25,000

Volume

Tendered Accepted

28,080

22,180

Rejected

5,900

Ave.

Price

95.334

Ave.

Yield

4.218

Coupon

Rate

3.625

RESULTS OF TREASURY BONDS AUCTIONS

for CY 2015

(In Million Pesos)

Maturity

Period

Auction

Date

Issue

Date

Jan

20-yr.1

20-Jan-15

22-Jan-15

25,000

73,457

25,000

48,457

97.012

3.855

3.625

Feb

10-yr.*

17-Feb-15

18-Feb-15

25,000

41,226

41,226

0.00

0.000

4.125

Mar

7-yr. 2

17-Mar-15

19-Mar-15

25,000

35,302

25,000

10,302

100.226

3.458

3.500

Apr

10-yr.

21-Apr-15

23-Apr-15

25,000

49,588

49,588

0.00

0.000

4.125

May

7-yr. 3

19-May-15

21-May-15

25,000

44,907

22,385

22,522

102.455

3.284

3.875

Jun

5-yr. 4

16-Jun-15

18-Jun-15

25,000

40,660

25,000

15,660

97.394

3.061

2.125

Jul

5-yr.5

21-Jul-15

23-Jul-15

25,000

62,897

25,000

37,897

97.40

3.089

2.125

Aug

5-yr.

18-Aug-15

20-Aug-15

25,000

51,603

25,000

26,603

100.00

3.352

3.375

5-yr.

22-Sep-15

24-Sep-15

25,000

13,371

13,371

0.00

0.000

4.750

Oct

5-yr.6

20-Oct-15

22-Oct-15

25,000

36,170

16,220

19,950

97.426

3.169

2.125

Nov

5-yr.7

10-Nov-15

12-Nov-15

25,000

21,517

9,732

11,785

98.16

3.800

3.375

Offering

Volume

Tendered Accepted

Rejected

Ave.

Price

Ave.

Yield

Coupon

Rate

Sept

no auction - December

* - Re- issuance

1 - Re- issuance of a 20-yr bond with 18-yrs remaining life

2 - Re- issuance of a 7-yr bond with 6-yrs remaining life

3 - Re- issuance of a 7-yr bond with 4-yrs & 6mos remaining life

4 - Re- issuance of a 5-yr bond with 2-yrs & 11mos remaining life

5 - Re- issuance of a 5-yr bond with 2-yrs & 10mos remaining life

6 - Re- issuance of a 5-yr bond with 5-yrs & 7mos remaining life

7 - Re- issuance of a 5-yr bond with 4-yrs & 9mos remaining life

Prepared by: SDAD

RESULTS OF TREASURY BONDS AUCTIONS

for CY 2014

(In Million Pesos)

Maturity

Period

Auction

Date

Issue

Date

Jan

3-yr*

21-Jan-14

23-Jan-14

25,000

33,222

9,620

23,602

98.31

2.399

1.625

Feb

5-yr*

18-Feb-14

20-Feb-14

25,000

39,950

25,000

14,950

94.53

3.520

2.125

Mar

7-yr

18-Mar-14

20-Mar-14

25,000

69,204

25,000

44,204

100.00

3.426

3.500

Apr

2-yr

22-Apr-14

25-Apr-14

25,000

61,285

25,000

36,285

97.87

2.727

1.625

May

3-yr

20-May-14

22-May-14

25,000

76,689

25,000

51,689

100.00

2.751

2.875

Jun

6-yr*

17-Jun-14

19-Jun-14

25,000

48,945

18,845

30,100

101.78

3.511

3.875

Jul

7-yr*

22-Jul-14

24-Jul-14

25,000

48,982

25,000

23,982

98.58

3.742

3.500

Sept

19-yr*

16-Sep-14

18-Sep-14

25,000

17,320

15,950

1,370

82.52

5.095

3.625

Oct

3-yr*

21-Oct-14

23-Oct-14

25,000

53,530

25,000

28,530

100.91

2.510

2.875

Nov

5-yr*

18-Nov-14

22-Nov-14

25,000

66,461

25,000

41,461

102.79

3.267

3.875

Dec

7-yr*

9-Dec-14

11-Dec-14

25,000

61,053

25,000

36,053

99.99

3.501

3.500

* - Re- issuance

Prepared by: SDAD

Offering

Volume

Tendered Accepted

Rejected

Ave.

Price

Ave.

Yield

Coupon

Rate

RESULTS OF TREASURY BONDS AUCTIONS

for CY 2013

(In Million Pesos)

Maturity

Period

Auction

Date

Issue

Date

Jan

7-yr*

22-Jan-13

24-Jan-13

25,000

79,780

25,000

54,780

99.99

3.876

3.875

Feb

10-yr*

19-Feb-13

21-Feb-13

25,000

97,486

25,000

72,486

104.87

3.410

4.000

Mar

20-yr

19-Mar-13

21-Mar-13

25,000

118,334

25,000

93,334

100.00

3.517

3.625

Apr

3-yr

23-Apr-13

25-Apr-13

30,000

76,454

30,000

46,454

100.00

1.453

1.625

May

5-yr

21-May-13

23-May-13

30,000

57,921

30,000

27,921

100.00

2.052

2.125

7-yr*

18-Jun-13

20-Jun-13

30,000

40,270

30,000

10,270

105.34

2.953

3.875

Jul

3-yr*

16-Jul-13

18-Jul-13

30,000

67,783

30,000

37,783

98.85

2.054

1.625

Sept

5-yr*

17-Sep-13

19-Sep-13

30,000

32,899

30,000

2,899

96.20

3.002

2.125

Oct

20-yr*

22-Oct-13

24-Oct-13

20,000

40,425

20,000

20,425

88.61

4.512

3.625

Nov

6-yr*

19-Nov-13

21-Nov-13

30,000

42,777

30,000

12,777

104.79

2.997

3.875

Dec

5-yr*

3-Dec-13

5-Dec-13

30,000

46,455

46,455

0.00

0.000

2.125

Offering

Volume

Tendered Accepted

Rejected

Ave.

Price

Ave.

Yield

Coupon

Rate

Jun

* - Re- issuance

Prepared by: SDAD

RESULTS OF TREASURY BONDS AUCTIONS

for CY 2012

(In Million Pesos)

Maturity

Period

Auction

Date

Issue

Date

3-Jan-12

17-Jan-12

5-Jan-12

19-Jan-12

9,000

9,000

31,205

29,347

9,000

9,000

22,205

20,347

101.07

104.43

4.808

5.169

5.000

5.750

31-Jan-12

14-Feb-12

2-Feb-12

16-Feb-12

9,000

9,000

41,475

32,727

9,000

9,000

32,475

23,727

100.00

102.77

5.906

4.504

5.875

5.000

13-Mar-12

27-Mar-12

15-Mar-12

29-Mar-12

9,000

9,000

16,490

12,160

9,000

0

7,490

12,160

104.46

0.00

5.159

0.000

5.750

0.000

10-Apr-12

24-Apr-12

12-Apr-12

26-Apr-12

9,000

9,000

15,440

10,980

9,000

3,700

6,440

7,280

110.50

100.00

4.610

4.999

7.000

5.000

8-May-12

22-May-12

10-May-12

24-May-12

9,000

9,000

14,710

7,560

9,000

0

5,710

7,560

102.43

0.00

5.420

0.000

5.750

8.000

5-Jun-12

19-Jun-12

7-Jun-12

21-Jun-12

9,000

9,000

5,965

14,098

0

6,650

5,965

7,448

0.00

98.29

0.000

6.024

5.000

5.875

3-Jul-12

17-Jul-12

5-Jul-12

19-Jul-12

9,000

9,000

28,049

20,951

9,000

9,000

19,049

11,951

100.00

100.00

4.466

4.695

4.625

4.750

31-Jul-12

14-Aug-12

28-Aug-12

2-Aug-12

16-Aug-12

30-Aug-12

9,000

9,000

9,000

31,414

26,256

24,693

9,000

9,000

9,000

22,414

17,256

15,693

100.00

100.00

100.00

4.830

5.731

4.662

4.875

5.750

4.750

Offering

Volume

Tendered Accepted

Rejected

Ave.

Price

Ave.

Yield

Coupon

Rate

Jan

7-yr*

10-yr*

Feb

20-yr

7-yr*

Mar

10-yr*

7-yr

Apr

5-yr*

7-yr

May

10-yr*

15-yr*

Jun

5-yr*

20-yr*

Jul

5-yr

7-yr

Aug

10-yr

25-yr

7-yr

RESULTS OF TREASURY BONDS AUCTIONS

for CY 2012

(In Million Pesos)

Maturity

Period

Auction

Date

Issue

Date

10-yr

20-yr

11-Sep-12

25-Sep-12

13-Sep-12

27-Sep-12

9,000

9,000

44,155

29,416

9,000

9,000

35,155

20,416

100.00

100.00

4.694

5.722

4.750

5.750

Nov

5-yr

7-yr

6-Nov-12

20-Nov-12

8-Nov-12

22-Nov-12

9,000

9,000

47,645

35,430

9,000

9,000

38,645

26,430

100.00

100.00

4.104

3.982

4.125

3.875

Dec

10-yr

4-Dec-12

6-Nov-12

9,000

33,086

9,000

24,086

100.00

4.046

4.000

Offering

Volume

Tendered Accepted

Rejected

Ave.

Price

Ave.

Yield

Coupon

Rate

Sept

no auction - October

* - Re- issuance

Prepared by: SDAD

RESULTS OF TREASURY BONDS AUCTIONS

for CY 2011

(In Million Pesos)

Maturity

Period

Auction

Date

Issue

Date

4-Jan-11

18-Jan-11

6-Jan-11

20-Jan-11

9,000

9,000

13,695

8,021

7,025

4,121

6,670

3,900

99.78

131.88

4.674

8.024

4.625

11.250

1-Feb-11

15-Feb-11

3-Feb-11

17-Feb-11

9,000

9,000

10,625

10,364

0

3,000

10,625

7,364

0.00

98.51

0.000

8.140

5.375

8.000

15-Mar-11

29-Mar-11

17-Mar-11

31-Mar-11

9,000

9,000

18,750

18,190

5,400

9,000

13,350

9,190

91.62

97.58

7.367

6.315

6.125

5.875

9,000

18,000

9,000

9,000

9,000

54,000

13,695

28,815

18,750

8,021

10,364

79,645

7,025

9,000

5,400

4,121

3,000

28,546

6,670

19,815

13,350

3,900

7,364

51,099

Offering

Volume

Tendered Accepted

Rejected

Ave.

Price

Ave.

Yield

Coupon

Rate

Jan

5-yr*

20-yr*

Feb

7-yr*

25-yr*

Mar

10-yr*

7-yr*

First Quarter

5-yr

7-yr

10-yr

20-yr

25-yr

Total

4.625

5.875

6.125

11.250

8.000

Apr

7-yr*

10-yr

12-Apr-11

26-Apr-11

14-Apr-11

28-Apr-11

9,000

9,000

25,970

32,349

9,000

9,000

16,970

23,349

97.49

100.00

6.334

6.445

5.875

6.500

10-May-11

24-May-11

12-May-11

26-May-11

9,000

9,000

40,687

35,675

9,000

9,000

31,687

26,675

99.94

104.11

5.885

5.213

5.875

6.375

7-Jun-11

21-Jun-11

9-Jun-11

23-Jun-11

9,000

9,000

31,652

21,246

9,000

9,000

22,652

12,246

99.82

100.45

5.907

6.436

5.875

6.500

9,000

27,000

18,000

54,000

35,675

98,309

53,595

187,579

9,000

27,000

18,000

54,000

26,675

71,309

35,595

133,579

May

7-yr*

4-yr*

Jun

7-yr*

10-yr*

Second Quarter

4-yr*

7-yr*

10-yr*

Total

* - Re- issuance

6.375

5.875

6.500

RESULTS OF TREASURY BONDS AUCTIONS

for CY 2011

(In Million Pesos)

Maturity

Period

Auction

Date

Issue

Date

19-Jul-11

21-Jul-11

9,000

22,680

9,000

13,680

100.00

4.697

4.875

2-Aug-11

16-Aug-11

4-Aug-11

18-Aug-11

9,000

9,000

41,633

44,060

9,000

9,000

32,633

35,060

104.41

100.00

5.896

5.017

6.500

5.000

31-Aug-11

13-Sep-11

28-Sep-11

1-Sep-11

15-Sep-11

29-Sep-11

9,000

9,000

9,000

24,040

41,790

30,818

9,000

9,000

9,000

15,040

32,790

21,818

100.37

107.50

100.00

4.936

5.485

7.510

5.000

6.500

7.625

9,000

18,000

18,000

9,000

54,000

22,680

68,100

83,423

30,818

205,021

9,000

18,000

18,000

9,000

54,000

13,680

50,100

65,423

21,818

151,021

Offering

Volume

Tendered Accepted

Rejected

Ave.

Price

Ave.

Yield

Coupon

Rate

Jul

4-yr

Aug

10-yr*

7-yr*

Sept

7-yr*

10-yr*

25-yr

Third Quarter

4-yr

7-yr*

10-yr*

25-yr

Total

4.875

5.000

6.500

7.625

Oct

25-yr*

25-Oct-11

27-Oct-11

9,000

26,605

9,000

17,605

105.71

7.131

7.625

8-Nov-11

22-Nov-11

10-Nov-11

24-Nov-11

9,000

9,000

17,160

23,882

7,820

9,000

9,340

14,882

99.88

100.00

5.019

5.657

5.000

5.750

6-Dec-11

8-Dec-11

9,000

32,527

9,000

23,527

111.68

6.656

7.625

9,000

9,000

18,000

36,000

17,160

23,882

59,132

100,174

7,820

9,000

18,000

34,820

9,340

14,882

41,132

65,354

Nov

7-yr*

10-yr

Dec

25-yr*

Fourth Quarter

7-yr*

10-yr*

25-yr

Total

* - Re- issuance

5.000

5.750

7.625

RESULTS OF TREASURY BONDS AUCTIONS

for CY 2010

(In Million Pesos)

Maturity

Period

Auction

Date

Issue

Date

5-Jan-10

19-Jan-10

7-Jan-10

21-Jan-10

8,500

8,500

18,325

13,241

8,500

4,371

9,825

8,870

100.00

101.06

5.274

6.233

5.250

6.500

2-Feb-10

16-Feb-10

4-Feb-10

18-Feb-10

8,500

8,500

8,425

12,835

0

2,500

8,425

10,335

0.00

100.00

0.000

7.830

0.000

7.750

16-Mar-10

30-Mar-10

18-Mar-10

31-Mar-10

8,500

8,500

27,010

14,197

8,500

8,210

18,510

5,987

101.60

100.00

6.090

6.983

6.500

7.000

8,500

17,000

17,000

8,500

51,000

18,325

40,251

22,622

12,835

94,033

8,500

12,871

8,210

2,500

32,081

9,825

27,380

14,412

10,335

61,952

Offering

Volume

Tendered Accepted

Rejected

Ave.

Price

Ave.

Yield

Coupon

Rate

Jan

3-yr

5-yr*

Feb

7-yr*

10-yr

Mar

5-yr*

7-yr

First Quarter

3-yr

5-yr

7-yr

10-yr

Total

5.250

6.500

7.000

7.750

Apr

10-yr*

13-Apr-10

15-Apr-10

8,500

9,582

3,362

6,220

99.44

7.831

7.750

11-May-10

25-May-10

13-May-10

27-May-10

8,500

8,500

17,020

26,980

8,500

8,500

8,520

18,480

100.00

100.00

6.336

8.729

6.375

8.750

8-Jun-10

22-Jun-10

10-Jun-10

24-Jun-10

8,500

8,500

17,089

21,506

8,500

8,500

8,589

13,006

99.83

100.71

7.030

7.643

7.000

7.750

8,500

8,500

17,000

8,500

42,500

17,020

17,089

31,088

26,980

92,177

8,500

8,500

11,862

8,500

37,362

8,520

8,589

19,226

18,480

54,815

May

5-yr

20-yr

Jun

7-yr*

10-yr*

Second Quarter

5-yr

7-yr

10-yr

20-yr

Total

Jul

20-yr*

7-yr*

6.375

7.000

7.750

8.750

6-Jul-10

20-Jul-10

8-Jul-10

22-Jul-10

8,500

8,500

20,919

13,629

8,500

8,500

12,419

5,129

102.16

101.00

8.521

6.809

8.750

7.000

3-Aug-10

5-Aug-10

8,500

18,420

8,500

9,920

102.58

7.368

7.750

Aug

10-yr*

* - Re- issuance

RESULTS OF TREASURY BONDS AUCTIONS

for CY 2010

(In Million Pesos)

Maturity

Period

Auction

Date

Issue

Date

31-Aug-10

14-Sep-10

28-Sep-10

2-Sep-10

16-Sep-10

30-Sep-10

Offering

Volume

Tendered Accepted

Rejected

Ave.

Price

Ave.

Yield

Coupon

Rate

Sept

7-yr*

10-yr

25-yr

8,500

8,500

8,500

23,570

15,841

22,246

8,500

7,245

8,500

15,070

8,596

13,746

17,000

17,000

8,500

8,500

51,000

37,199

34,261

20,919

22,246

114,625

17,000

15,745

8,500

8,500

49,745

20,199

18,516

12,419

13,746

64,880

106.93

100.00

100.00

5.720

6.149

7.925

7.000

6.125

8.000

Third Quarter

7-yr

10-yr

20-yr

25-yr

Total

7.000

7.002

8.750

8.000

Oct

5-yr*

7-yr

12-Oct-10

26-Oct-10

14-Oct-10

28-Oct-10

8,000

8,000

18,115

9,955

8,000

8,000

10,115

1,955

105.53

100.00

5.007

5.278

6.375

5.375

9-Nov-10

23-Nov-10

11-Nov-10

25-Nov-10

8,000

8,000

14,140

16,260

8,000

8,000

6,140

8,260

101.51

100.00

5.919

4.571

6.125

4.625

7-Dec-10

9-Dec-10

8,000

8,695

8,695

0.00

0.000

4.625

24,000

8,000

8,000

40,000

43,070

9,955

14,140

67,165

16,000

8,000

8,000

32,000

27,070

1,955

6,140

35,165

Nov

10-yr*

5-yr

Dec

5-yr*

Fourth Quarter

5-yr

7-yr

10-yr

Total

* - Re- issuance

Prepared by: SDAD

5.500

5.375

6.125

You might also like

- 2021 MDRT Mentoring PerformanceMonitoring Sheet TEMPLATEDocument6 pages2021 MDRT Mentoring PerformanceMonitoring Sheet TEMPLATEJanine KalaloNo ratings yet

- 2 1610141004 Anjar Richardo Manufandu 15,766,180 5,500,000Document5 pages2 1610141004 Anjar Richardo Manufandu 15,766,180 5,500,000Achmmad JhordanNo ratings yet

- PHR Loanrepaymentschedule - UnlockedDocument6 pagesPHR Loanrepaymentschedule - Unlockedtmahesh0No ratings yet

- Ramlal Statement 127Document11 pagesRamlal Statement 127Mohit Kumar ChowdaryNo ratings yet

- Ramlal Statement 128Document11 pagesRamlal Statement 128Mohit Kumar ChowdaryNo ratings yet

- Receipts: Month 1 Month 2 Month 3Document6 pagesReceipts: Month 1 Month 2 Month 3Tamar PkhakadzeNo ratings yet

- Dealer OutstandingDocument6 pagesDealer OutstandingMysore Jeevan KumarNo ratings yet

- Data Herr Sisba SMK Annuqayah RevisiDocument14 pagesData Herr Sisba SMK Annuqayah RevisiRiyadi SahenNo ratings yet

- Loan ComparisonDocument15 pagesLoan ComparisonijkendrickNo ratings yet

- Refno. Date Account Debit CreditDocument8 pagesRefno. Date Account Debit CreditVenice DatoNo ratings yet

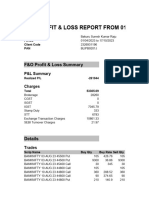

- F&O P&L Report.Document8 pagesF&O P&L Report.Suresh KumarNo ratings yet

- 2016 10 Vancouver WestDocument5 pages2016 10 Vancouver WestEthan HekimNo ratings yet

- Excel Cost EstimateDocument8 pagesExcel Cost EstimateLyn SantosNo ratings yet

- Curs 10 - InterogariDocument19 pagesCurs 10 - InterogariDPDNo ratings yet

- Ageing Debtors 2022 23Document10 pagesAgeing Debtors 2022 23Manojit GamingNo ratings yet

- DividendDocument2 pagesDividendMadhura RamamurthyNo ratings yet

- Report Sales DTD SbyDocument2 pagesReport Sales DTD Sbyilma hitriyahNo ratings yet

- HembyN Week 5 ProjectDocument4 pagesHembyN Week 5 Projectgaskinsje1No ratings yet

- Auction TreasuryBills PDFDocument1 pageAuction TreasuryBills PDFattiqueNo ratings yet

- Pakistan Investment Bonds: Auction Profile (Face Value)Document11 pagesPakistan Investment Bonds: Auction Profile (Face Value)Taimoor KhanNo ratings yet

- Proyeccion 2022Document3 pagesProyeccion 2022fuentes miguelNo ratings yet

- 1Document6 pages1Safitri HandayaniNo ratings yet

- AmiraDocument9 pagesAmirabiltu paulNo ratings yet

- Mortgage CalculatorDocument8 pagesMortgage CalculatorDaveNo ratings yet

- Accumulated-Depreciation ScheduleDocument5 pagesAccumulated-Depreciation ScheduleGolamMostafaNo ratings yet

- Discounts Allowed: Cash BookDocument1 pageDiscounts Allowed: Cash BookPierytwinkleNo ratings yet

- Bank QNB Kesawan TBK.: Company Report: July 2014 As of 25 July 2014Document3 pagesBank QNB Kesawan TBK.: Company Report: July 2014 As of 25 July 2014davidwijaya1986No ratings yet

- FIN 511 - Quiz 3 AnswersDocument32 pagesFIN 511 - Quiz 3 AnswersAsma AyedNo ratings yet

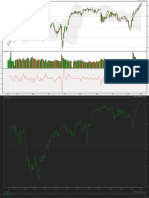

- Bollinger Bands (20,2) (Upper/Lower) : 2228.316/2080.067: Last 2213.35Document22 pagesBollinger Bands (20,2) (Upper/Lower) : 2228.316/2080.067: Last 2213.35mkpai-1No ratings yet

- Island Land Sold - 2016Document1 pageIsland Land Sold - 2016cutty54No ratings yet

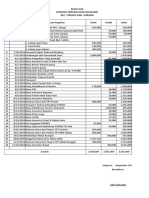

- Buku Kas Karang Taruna Desa Majasari Kec. Cibogo Kab. SubangDocument5 pagesBuku Kas Karang Taruna Desa Majasari Kec. Cibogo Kab. SubangAyatulsyifakhoerunnishaNo ratings yet

- Rehan Seerat - CLODocument2 pagesRehan Seerat - CLOhajrasuleman22No ratings yet

- Manhattan Beach Real Estate Market Conditions - September 2015Document15 pagesManhattan Beach Real Estate Market Conditions - September 2015Mother & Son South Bay Real Estate AgentsNo ratings yet

- 17T BLS071011FDocument2 pages17T BLS071011FRajashree JagadevNo ratings yet

- Batam Copier: Tanjungpinang-KepriDocument5 pagesBatam Copier: Tanjungpinang-KeprirahmawatiNo ratings yet

- Num Pago 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41Document2 pagesNum Pago 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41Maye VacaNo ratings yet

- Close Price 7,736.07 High Price Low Price A 7,776.22: All Are in Current DayDocument285 pagesClose Price 7,736.07 High Price Low Price A 7,776.22: All Are in Current DayJinn KyoNo ratings yet

- URIBEDocument1 pageURIBEliz hernandezNo ratings yet

- First Method - Banknifty BreakoutDocument5 pagesFirst Method - Banknifty BreakoutsrirubanNo ratings yet

- Treasury Bonds OutstandingDocument6 pagesTreasury Bonds OutstandingNiloy MallickNo ratings yet

- S.No Year Acquirer TargetDocument41 pagesS.No Year Acquirer Targetsrinu VasuNo ratings yet

- Nanaimo Council Expenses June30 2016Document28 pagesNanaimo Council Expenses June30 2016News NanaimoNo ratings yet

- Statement of Check Issued F.Y. 2019 (For JHS & SHS) : Mamasapano National High SchoolDocument2 pagesStatement of Check Issued F.Y. 2019 (For JHS & SHS) : Mamasapano National High SchoolBai Alleha MusaNo ratings yet

- Factory - 1: Date Description Rent Payment BalanceDocument2 pagesFactory - 1: Date Description Rent Payment BalanceMitul RahmanNo ratings yet

- Manhattan Beach Real Estate Market Conditions - October 2015Document15 pagesManhattan Beach Real Estate Market Conditions - October 2015Mother & Son South Bay Real Estate AgentsNo ratings yet

- Business Permit (Cash Deposits) Retainers (PDC'S)Document1 pageBusiness Permit (Cash Deposits) Retainers (PDC'S)Jops SpojNo ratings yet

- Canara Bank StatementDocument65 pagesCanara Bank StatementEr Md AamirNo ratings yet

- SMRUDocument3 pagesSMRUadjipramNo ratings yet

- Anggaran Dana Outing Ii TAHUN 2016: No. Keterangan Jumlah Harga SatuanDocument7 pagesAnggaran Dana Outing Ii TAHUN 2016: No. Keterangan Jumlah Harga SatuanaliffianiNo ratings yet

- SS AgingDocument59 pagesSS AgingChristian AndreNo ratings yet

- RINCIAN in Dan Out Sei Maki 2016Document10 pagesRINCIAN in Dan Out Sei Maki 2016Anonymous dr93RjfPEYNo ratings yet

- Island Land Sold - 2016Document2 pagesIsland Land Sold - 2016cutty54No ratings yet

- Marca Nume Prenume Data Nasterii FilialaDocument19 pagesMarca Nume Prenume Data Nasterii FilialaMădă BorlanNo ratings yet

- All Unclaimed PB Prizes HampshireDocument308 pagesAll Unclaimed PB Prizes HampshireSouthern Daily EchoNo ratings yet

- Life GoalsDocument11 pagesLife GoalsNieva Asor DomingoNo ratings yet

- Manhattan Beach Real Estate Market Conditions - October 2016Document15 pagesManhattan Beach Real Estate Market Conditions - October 2016Mother & Son South Bay Real Estate AgentsNo ratings yet

- Indocement Tunggal Prakarsa TBKDocument3 pagesIndocement Tunggal Prakarsa TBKRika SilvianaNo ratings yet

- Bank NiftyDocument5 pagesBank NiftyAlloySebastinNo ratings yet

- Rekap Kasir Maret 2020Document4 pagesRekap Kasir Maret 2020Hardi OtoyNo ratings yet

- Coins of England & The United Kingdom (2018): PreDecimal IssuesFrom EverandCoins of England & The United Kingdom (2018): PreDecimal IssuesEmma HowardRating: 4.5 out of 5 stars4.5/5 (2)

- Ifrs 9 GuideDocument25 pagesIfrs 9 GuideCharlie del RosarioNo ratings yet

- Investments in Debt and Equity SecuritiesDocument39 pagesInvestments in Debt and Equity SecuritiesCharlie del Rosario42% (12)

- Caatts For Data Extraction and Analysis: It Auditing & Assurance, 2E, Hall & SingletonDocument29 pagesCaatts For Data Extraction and Analysis: It Auditing & Assurance, 2E, Hall & SingletonCharlie del RosarioNo ratings yet

- Chapter Seven: Customer-Driven Marketing Strategy: Creating Value For Target CustomersDocument36 pagesChapter Seven: Customer-Driven Marketing Strategy: Creating Value For Target CustomersCharlie del RosarioNo ratings yet

- Ifrs 15Document89 pagesIfrs 15milithebillyNo ratings yet

- IFRS15 Basis For ConclusionsDocument177 pagesIFRS15 Basis For ConclusionsCharlie del RosarioNo ratings yet