Professional Documents

Culture Documents

Imp Stat Banking Rbi

Uploaded by

Raven FormourneCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Imp Stat Banking Rbi

Uploaded by

Raven FormourneCopyright:

Available Formats

1/21/2016

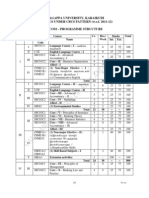

DBIERBI:DATABASEOFINDIANECONOMY

IndianBankingSectorataGlance

Amountin`Billion

Year

201415

Items

Amount

Outstanding

Percentage

Variation

1BalanceSheetOperations

1.1TotalLiabilities/assets

120342

9.6

1.2Deposits

94351

10.6

1.3Borrowings

11498

4.4

1.4Loansandadvances

73882

9.7

1.5Investments

31695

9.9

1.6Offbalancesheetexposure(aspercentageofonbalancesheetliabilities)

124.8

1.7Totalconsolidatedinternationalclaims

4053

7.3

891

10.1

2.2ReturnonAsset(RoA)(Percent)

0.8

2.3ReturnonEquity(RoE)(Percent)

10.4

2.6

2Profitability

2.1Netprofit

2.4NetInterestMargin(NIM)(Percent)

3CapitalAdequacy

3.1Capitaltoriskweightedassetsratio(CRAR)@

12.9

3.2TierIcapital(aspercentageoftotalcapital)@

79.7

3.3CRAR(tierI)(Percent)@

10.3

4.1GrossNPAs

3243

22.7

4.2NetNPAs

4AssetQuality

1761

23.5

4.3GrossNPAratio(GrossNPAsaspercentageofgrossadvances)

4.3

4.4NetNPAratio(NetNPAsaspercentageofnetadvances)

2.4

44.2

3.2

61023

8.6

4.5ProvisionCoverageRatio(Percent)**

4.6Slippageratio(Percent)

5SectoralDeploymentofBankCredit#

5.1Grossbankcredit

5.2Agriculture

7659

15.0

5.3Industry

26576

5.6

5.4Services

14131

5.7

5.5Personalloans

11664

15.5

21

9.9

6TechnologicalDevelopment

6.1Totalnumberofcreditcards(inmillion)

6.2Totalnumberofdebitcards(inmillion)

553

40.3

189279

17.0

7.1Totalnumberofcomplaintsreceivedduringtheyear

85131

11.2

7.2Totalnumberofcomplaintsaddressed

84660

7.5

96

6.3NumberofATMs

7CustomerServices*

7.3Percentageofcomplaintsaddressed

8FinancialInclusion

8.1Creditdepositratio(Percent)

8975

20.7

553713

44.3

109759

14.5

1.2Deposits

85332

14.9

1.3Borrowings

11013

9.0

1.4Loansandadvances

67352

14.5

1.5Investments

28833

10.3

8.2Numberofnewbankbranchesopened

8.3Numberofbankingoutletsinvillages(Total)

201314

78.3

1BalanceSheetOperations

1.1TotalLiabilities/assets

1.6Offbalancesheetexposure(aspercentageofonbalancesheetliabilities)

1.7Totalconsolidatedinternationalclaims

122

3777

14.0

809

11.2

0.8

2Profitability

2.1Netprofit

2.2ReturnonAsset(RoA)(Percent)

http://dbie.rbi.org.in/DBIE/dbie.rbi?site=publications#!4

1/2

1/21/2016

DBIERBI:DATABASEOFINDIANECONOMY

2.3ReturnonEquity(RoE)(Percent)

2.4NetInterestMargin(NIM)(Percent)

10.7

2.7

3CapitalAdequacy

3.1Capitaltoriskweightedassetsratio(CRAR)@

13

3.2TierIcapital(aspercentageoftotalcapital)@

77.5

3.3CRAR(tierI)(Percent)@

10.1

4.1GrossNPAs

2644

36.2

4.2NetNPAs

4AssetQuality

1426

44.5

4.3GrossNPAratio(GrossNPAsaspercentageofgrossadvances)

3.8

4.4NetNPAratio(NetNPAsaspercentageofnetadvances)

2.1

44.7

3.3

56208

14.0

4.5ProvisionCoverageRatio(Percent)**

4.6Slippageratio(Percent)

5SectoralDeploymentofBankCredit#

5.1Grossbankcredit

5.2Agriculture

6660

13.5

5.3Industry

25165

13.6

5.4Services

13375

17.1

5.5Personalloans

10097

13.1

19

1.9

6TechnologicalDevelopment

6.1Totalnumberofcreditcards(inmillion)

6.2Totalnumberofdebitcards(inmillion)

394

19.2

161750

40.4

7.1Totalnumberofcomplaintsreceivedduringtheyear

76573

8.6

7.2Totalnumberofcomplaintsaddressed

78745

12.9

96

6.3NumberofATMs

7CustomerServices*

7.3Percentageofcomplaintsaddressed

8FinancialInclusion

8.1Creditdepositratio(Percent)

11315

43.0

383804

43.0

1.1TotalLiabilities/assets

95900

15.2

1.2Deposits

74297

15.1

1.3Borrowings

10104

19.7

1.4Loansandadvances

58798

15.9

1.5Investments

26131

17.0

8.2Numberofnewbankbranchesopened

8.3Numberofbankingoutletsinvillages(Total)

201213

78.9

1BalanceSheetOperations

1.6Offbalancesheetexposure(aspercentageofonbalancesheetliabilities)

138.3

1.7Totalconsolidatedinternationalclaims

3312

17.9

912

11.5

2Profitability

2.1Netprofit

2.2ReturnonAsset(RoA)(Percent)

2.3ReturnonEquity(RoE)(Percent)

2.4NetInterestMargin(NIM)(Percent)

13.8

2.6

3CapitalAdequacy

3.1Capitaltoriskweightedassetsratio(CRAR)@

13.9

3.2TierIcapital(aspercentageoftotalcapital)@

74.1

http://dbie.rbi.org.in/DBIE/dbie.rbi?site=publications#!4

2/2

You might also like

- Imp Ratios For FMCG SectorDocument1 pageImp Ratios For FMCG SectorRaven FormourneNo ratings yet

- Emami Valuation AnalysisDocument14 pagesEmami Valuation AnalysisRaven FormourneNo ratings yet

- 0FLTPDocument40 pages0FLTPRiteshHPatelNo ratings yet

- Banking Finance and Insurance: A Report On Financial Analysis of IDBI BankDocument8 pagesBanking Finance and Insurance: A Report On Financial Analysis of IDBI BankRaven FormourneNo ratings yet

- Amul Macho Final Ad 1222197348763059 9Document27 pagesAmul Macho Final Ad 1222197348763059 9Raven FormourneNo ratings yet

- Marketing & Law: Advertising - Ethics, Law & CasesDocument21 pagesMarketing & Law: Advertising - Ethics, Law & CasesRaven FormourneNo ratings yet

- CEAT Annual Report 2014 15Document196 pagesCEAT Annual Report 2014 15Raven FormourneNo ratings yet

- Threats OppsDocument14 pagesThreats OppsRaven FormourneNo ratings yet

- Franchising in MarketsDocument165 pagesFranchising in MarketsRaven FormourneNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Impact of Working Capital Management On Profiabilty: NMB Bank LimitedDocument9 pagesImpact of Working Capital Management On Profiabilty: NMB Bank LimitedSocialist GopalNo ratings yet

- Mixed Business Grammar WorksheetDocument8 pagesMixed Business Grammar Worksheet04 CASEY LIM 林恺希No ratings yet

- CAPITAL MARKET-WPS OfficeDocument31 pagesCAPITAL MARKET-WPS OfficeDele AremoNo ratings yet

- International Financial ManagementDocument46 pagesInternational Financial ManagementmaazNo ratings yet

- Local Treasury Manual 3Document4 pagesLocal Treasury Manual 3Raies JumawanNo ratings yet

- JSSI Hydraulics Credit RatingDocument2 pagesJSSI Hydraulics Credit RatingVibhu SinghNo ratings yet

- Alagappa University, Karaikudi SYLLABUS UNDER CBCS PATTERN (W.e.f. 2011-12)Document26 pagesAlagappa University, Karaikudi SYLLABUS UNDER CBCS PATTERN (W.e.f. 2011-12)Mathan NaganNo ratings yet

- Chamwaza Business PlanDocument18 pagesChamwaza Business PlanJohn LukwesaNo ratings yet

- Money Vocabulary BankDocument1 pageMoney Vocabulary BankLuis ENo ratings yet

- Module-Intermediate Accounting 1-LM01-CP1 PDFDocument25 pagesModule-Intermediate Accounting 1-LM01-CP1 PDFNikka Rebaya100% (1)

- Banking & Finance Banking: Central Bank of India Case StudyDocument1 pageBanking & Finance Banking: Central Bank of India Case StudyPriya RajNo ratings yet

- The Next 20 Billion Digital MarketDocument4 pagesThe Next 20 Billion Digital MarketakuabataNo ratings yet

- FloraBank User ManualDocument113 pagesFloraBank User Manualkash50% (2)

- Standard Charter-Ad PlanDocument25 pagesStandard Charter-Ad Plansyed usman wazirNo ratings yet

- KPMG-CBDC-Report FINAL - V 1 02 PDFDocument92 pagesKPMG-CBDC-Report FINAL - V 1 02 PDFBaatar SukhbaatarNo ratings yet

- E7 - TreasuryRCM TemplateDocument30 pagesE7 - TreasuryRCM Templatenazriya nasarNo ratings yet

- Function of CBDocument5 pagesFunction of CBingle_rupaliNo ratings yet

- Internship Humayun IuDocument65 pagesInternship Humayun IuYouth ViralNo ratings yet

- Foreign Companies Regulations 2018Document20 pagesForeign Companies Regulations 2018Muneeb Ahmed ShiekhNo ratings yet

- Roland Berger Studie Global Logistics Markets Fin 20140820 PDFDocument49 pagesRoland Berger Studie Global Logistics Markets Fin 20140820 PDFmutton moonswamiNo ratings yet

- Business of Investment BankingDocument35 pagesBusiness of Investment BankingHarsh SudNo ratings yet

- Chap 3 QuizDocument2 pagesChap 3 QuizLeonard CañamoNo ratings yet

- University of The West Indies, Mona Department of Management Studies ACCT 3043 - Auditing I Tutorial Questions 7Document1 pageUniversity of The West Indies, Mona Department of Management Studies ACCT 3043 - Auditing I Tutorial Questions 7Priscella LlewellynNo ratings yet

- Samplepractice Exam 15 October 2020 Questions and AnswersDocument6 pagesSamplepractice Exam 15 October 2020 Questions and AnswersMartha Nicole MaristelaNo ratings yet

- Enhanced WeAccess Enrollment Forms - v2.27.18Document38 pagesEnhanced WeAccess Enrollment Forms - v2.27.18CharmaineDabuNo ratings yet

- Notice Inviting TenderDocument52 pagesNotice Inviting Tenderruchita vishnoiNo ratings yet

- NBP Internship UOGDocument39 pagesNBP Internship UOGAhsanNo ratings yet

- CAPE U1 Partnership Revaluation QuestionsDocument6 pagesCAPE U1 Partnership Revaluation QuestionsNadine DavidsonNo ratings yet

- PM Lecture 7Document12 pagesPM Lecture 7Atharva BanarseNo ratings yet

- AnubhavbaseratepptDocument12 pagesAnubhavbaseratepptChandan SinghNo ratings yet