Professional Documents

Culture Documents

Cash Flow

Uploaded by

manishpandey19720 ratings0% found this document useful (0 votes)

79 views1 pageTo begin with.

Original Title

cash flow

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTo begin with.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

79 views1 pageCash Flow

Uploaded by

manishpandey1972To begin with.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 1

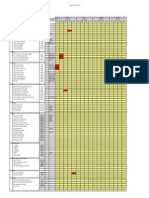

Cash Flow Sensitivity Analysis

April 26, 2016

For the year ended 12/31/2009

% change in receipts and disbursements

5.0%

Expected

$20,000

Pessimistic

$20,000

Optimistic

$20,000

30,000

20,000

10,000

28,500

19,000

9,500

31,500

21,000

10,500

Total Cash Inflows

Available Cash Balance

Cash Outflows (Expenses):

Advertising

Bank Service Charges

Contingencies

Credit Card Fees

Delivery Charges

Deposits

Dues & Subscriptions

Health Insurance

Insurance

Interest

Inventory Purchases

Lease Payments

Licenses & Permits

Miscellaneous

Office

Payroll

Payroll Taxes

Professional Fees

Rent or Lease

Repairs & Maintenance

Sales tax

Services

Signs

Supplies

Taxes & Licenses

Utilities & Telephone

Other:

$60,000

$80,000

$57,000

$77,000

$63,000

$83,000

$15,000

1,000

3,000

4,000

$14,250

950

2,850

3,800

$15,750

1,050

3,150

4,200

1,000

950

1,050

Subtotal

Other Cash Out Flows:

Capital Purchases

Building Construction

Decorating

Fixtures & Equipment

Install Fixtures & Equip.

Remodeling

Lease Payments

Loan Principal

Owner's Draw

Other:

$24,000

$22,800

$25,200

$100,000

$95,000

$105,000

$1,000

$950

$1,050

$101,000

$125,000

($45,000)

$95,950

$118,750

($41,750)

$106,050

$131,250

($48,250)

Beginning Cash Balance

Cash Inflows (Income):

Accounts Receivable Collections

Loan Proceeds

Sales & Receipts

Other:

Subtotal

Total Cash Outflows

Ending Cash Balance

You might also like

- ConsultancyDocument4 pagesConsultancyGajanan Shirke AuthorNo ratings yet

- Food & Beverage Service - TypesDocument5 pagesFood & Beverage Service - TypesGurdip SinghNo ratings yet

- Barter Calculator - Serenity v2.3Document147 pagesBarter Calculator - Serenity v2.3Muhammad RizkyNo ratings yet

- Bar Management ChartDocument1 pageBar Management CharthernanmarioNo ratings yet

- Planned Inventory Change Order A Clear and Concise ReferenceFrom EverandPlanned Inventory Change Order A Clear and Concise ReferenceNo ratings yet

- Catering Budgeting WorksheetDocument3 pagesCatering Budgeting Worksheetmohd_shaarNo ratings yet

- Legends Hospitality Catering MenuDocument29 pagesLegends Hospitality Catering Menustephanie_iovienoNo ratings yet

- Customer Preferences For Restaurant Technology InnovationsDocument22 pagesCustomer Preferences For Restaurant Technology InnovationsDeepankar SinghNo ratings yet

- .Setup Myho Tel - Co M: Banquet Booking Inquiry FormDocument1 page.Setup Myho Tel - Co M: Banquet Booking Inquiry FormSrikanth ReddyNo ratings yet

- Hospitality Operations ManagementDocument19 pagesHospitality Operations ManagementMaricel Sanchez - Costillas100% (1)

- 10 Service Tips For BartendersDocument2 pages10 Service Tips For Bartendersmd91101No ratings yet

- Bartender Tips, Tricks and Drink RecipesDocument6 pagesBartender Tips, Tricks and Drink RecipesDante TablateNo ratings yet

- MPH Restaurant Bar Events Standards. Training Manual 2022Document216 pagesMPH Restaurant Bar Events Standards. Training Manual 2022Mervin CuyuganNo ratings yet

- Dining BeoDocument13 pagesDining Beoapi-282247907No ratings yet

- A Guide To Food and Beverage Service CEN v2Document4 pagesA Guide To Food and Beverage Service CEN v2Thamil ArasanNo ratings yet

- Toast Profit Loss Statement Template 2022Document24 pagesToast Profit Loss Statement Template 2022Krishna SharmaNo ratings yet

- Chart of Accounts-Fast FoodDocument6 pagesChart of Accounts-Fast Foodgenie1970No ratings yet

- Pre Opening ChecklistDocument49 pagesPre Opening ChecklistShubham BishtNo ratings yet

- Beer Tending Mix OlogyDocument22 pagesBeer Tending Mix OlogynormaNo ratings yet

- Cost AnalysisDocument3 pagesCost AnalysisRegenia D. ChapmanNo ratings yet

- 1 07 PDFDocument1 page1 07 PDFKamrulNo ratings yet

- Kitchen Order Guide ExampleDocument15 pagesKitchen Order Guide ExampleAndre CandraNo ratings yet

- Banquets Definition of BanquetDocument17 pagesBanquets Definition of BanquetARUN JOSENo ratings yet

- Menu Costing TemplateDocument4 pagesMenu Costing TemplateAli KhanNo ratings yet

- Wyeth Analysis TemplateDocument8 pagesWyeth Analysis TemplateAli Azeem RajwaniNo ratings yet

- Working CapitalDocument27 pagesWorking CapitalSudipta ChatterjeeNo ratings yet

- 1 LecDocument2 pages1 LecMaricel Sanchez - CostillasNo ratings yet

- BSC BeverageDocument179 pagesBSC BeverageAndrew HarrisNo ratings yet

- "We Will Make Your Dream Come True": Phone 518.583.4657Document8 pages"We Will Make Your Dream Come True": Phone 518.583.4657bobbykennyNo ratings yet

- Job Description: Job Title Conference and Banqueting Supervisor Department Scope of WorkDocument4 pagesJob Description: Job Title Conference and Banqueting Supervisor Department Scope of WorktheauctionhunterNo ratings yet

- DHMCT I - Non Alcoholic Beverage BevargeDocument8 pagesDHMCT I - Non Alcoholic Beverage BevargeKailash JoshiNo ratings yet

- HOSPA Finance Community USALI PDFDocument56 pagesHOSPA Finance Community USALI PDFVanjB.Payno100% (1)

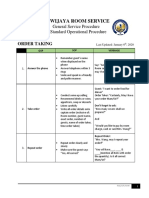

- Room Service GSP & SOPDocument6 pagesRoom Service GSP & SOPEdo HadiNo ratings yet

- Annual Sales ProjectionsDocument6 pagesAnnual Sales Projectionsmanishpandey1972No ratings yet

- Sequences of SpielsDocument5 pagesSequences of SpielsRoy AmoresNo ratings yet

- POM ProjectDocument42 pagesPOM ProjectGowtham YaramanisettiNo ratings yet

- 129 F & B Cardinal Service SinsDocument5 pages129 F & B Cardinal Service SinsmacarioamoresNo ratings yet

- Bar Protocol: The Disgruntled Bar Manager's Guide and Help for Those in the Beverage and Restaurant IndustryFrom EverandBar Protocol: The Disgruntled Bar Manager's Guide and Help for Those in the Beverage and Restaurant IndustryNo ratings yet

- Restaurant/restaurant ManagementDocument2 pagesRestaurant/restaurant Managementapi-77648654No ratings yet

- Function ContractDocument5 pagesFunction ContractShoubhik SinhaNo ratings yet

- Catering and Events Depot NEWDocument30 pagesCatering and Events Depot NEWLancemachang EugenioNo ratings yet

- FB Diagnostic ToolDocument8 pagesFB Diagnostic ToolBôuzitMèdNo ratings yet

- MOM Minutes of The MeetingDocument2 pagesMOM Minutes of The MeetingNaga ChaitanyaNo ratings yet

- Food and Beverage ManagerDocument3 pagesFood and Beverage ManagerQuy TranxuanNo ratings yet

- Bar Inventory TemplateDocument14 pagesBar Inventory Templateagdeshpande09No ratings yet

- Chinaware Glassware PotoDocument60 pagesChinaware Glassware PotodamianuskrowinNo ratings yet

- 02.hotel Initial - Revenue Projection - Revised IDocument145 pages02.hotel Initial - Revenue Projection - Revised Ianon_843580047No ratings yet

- Study Guide Bar StandardsDocument8 pagesStudy Guide Bar Standardsjohn carter100% (1)

- Director Manager Restaurant Operations in San Francisco CA Resume Paolo FazzariDocument1 pageDirector Manager Restaurant Operations in San Francisco CA Resume Paolo FazzariPaoloFazzariNo ratings yet

- Weekly Sales and Deposits Summary: Your Restaurant Name HereDocument1 pageWeekly Sales and Deposits Summary: Your Restaurant Name HereDeepson ShresthaNo ratings yet

- Manage and Operate A Coffee Shop: D1.HPA - CL4.01 Trainer GuideDocument64 pagesManage and Operate A Coffee Shop: D1.HPA - CL4.01 Trainer GuidePhttii phttiiNo ratings yet

- PFRDocument31 pagesPFRadiadzzNo ratings yet

- MOM Minutes of The MeetingDocument2 pagesMOM Minutes of The MeetingSagar KaleNo ratings yet

- Royal Club MenuDocument16 pagesRoyal Club Menubong alcantaraNo ratings yet

- Bar Opening ProceduresDocument3 pagesBar Opening ProceduresFasra ChiongNo ratings yet

- Front Desk - Early Shift - Receptionist - Check ListDocument2 pagesFront Desk - Early Shift - Receptionist - Check ListAbrahamNo ratings yet

- Reading-Finding HotelsDocument2 pagesReading-Finding Hotelssarah mansorNo ratings yet

- KRT ProposalDocument13 pagesKRT ProposalShafiq SsekittoNo ratings yet

- Manual of Food Safety Management System, Fss Act 2006Document152 pagesManual of Food Safety Management System, Fss Act 2006Sharif HossenNo ratings yet

- GMP Haccp CCPDocument66 pagesGMP Haccp CCPmanishpandey1972No ratings yet

- Cost of Good Solds: Cogs (Usd) Total Per UnitDocument1 pageCost of Good Solds: Cogs (Usd) Total Per Unitmanishpandey1972No ratings yet

- HotelDocument72 pagesHotelSakkarai ManiNo ratings yet

- Food Classification CriteriaDocument10 pagesFood Classification Criteriamanishpandey1972No ratings yet

- Hazard Identification ChecklistDocument4 pagesHazard Identification Checklistmanishpandey1972No ratings yet

- The Langkawi Tourism Blueprint 2011-2015Document96 pagesThe Langkawi Tourism Blueprint 2011-2015manishpandey19720% (1)

- Comprehensive Hotel Resort Risk Management ChecklistDocument50 pagesComprehensive Hotel Resort Risk Management ChecklistHector Eduardo ErmacoraNo ratings yet

- Excel Gantt v4Document14 pagesExcel Gantt v4PMPNo ratings yet

- Energy Efficient Pools 3Document28 pagesEnergy Efficient Pools 3manishpandey1972No ratings yet

- Training MotivationDocument15 pagesTraining Motivationmanishpandey1972No ratings yet

- Yellow Springs Hospitality Study - June 2005Document78 pagesYellow Springs Hospitality Study - June 2005megbach06No ratings yet

- ProblemDocument2 pagesProblemmanishpandey1972100% (1)

- Problem TrackingDocument2 pagesProblem Trackingmanishpandey1972No ratings yet

- 12 - Month Sales Planner: Property Name: Prepared By: MonthDocument12 pages12 - Month Sales Planner: Property Name: Prepared By: Monthmanishpandey1972No ratings yet

- CeoDocument19 pagesCeomanishpandey1972No ratings yet

- CeoDocument19 pagesCeomanishpandey1972No ratings yet

- Hotel InfoDocument41 pagesHotel InfoNetaji BhosaleNo ratings yet

- Swot by BaldrigeDocument52 pagesSwot by BaldrigeGajanan Shirke AuthorNo ratings yet

- Waste ManagementDocument45 pagesWaste Managementmanishpandey1972No ratings yet

- Training Budget PlannerDocument4 pagesTraining Budget Plannermanishpandey1972No ratings yet

- Inventorycontrolfinalppt 091029152005 Phpapp01Document26 pagesInventorycontrolfinalppt 091029152005 Phpapp01Anupam JyotiNo ratings yet

- Room and Linen PlanningDocument22 pagesRoom and Linen Planningmanishpandey1972No ratings yet

- Training Plan: Waiter: Category TaskDocument2 pagesTraining Plan: Waiter: Category Taskmanishpandey1972100% (1)

- Shift Ready / Meeting Rush: Position Chart/ Shift PlanDocument2 pagesShift Ready / Meeting Rush: Position Chart/ Shift Planmanishpandey1972No ratings yet

- Yearly Budget ProjectionsDocument1 pageYearly Budget Projectionsmanishpandey1972No ratings yet

- Hotel Monthly Task ChecklistDocument24 pagesHotel Monthly Task Checklistmanishpandey1972100% (6)

- Food and Beverage Cover AnalysisDocument17 pagesFood and Beverage Cover Analysismanishpandey1972No ratings yet

- Shift Ready / Meeting Rush: Position Chart/ Shift PlanDocument2 pagesShift Ready / Meeting Rush: Position Chart/ Shift Planmanishpandey1972No ratings yet

- Hotel Discount GridDocument85 pagesHotel Discount Gridmanishpandey1972No ratings yet