Professional Documents

Culture Documents

Outlook

Uploaded by

Anonymous Ht0MIJCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Outlook

Uploaded by

Anonymous Ht0MIJCopyright:

Available Formats

Baird Market & Investment Strategy

Investment Strategy Outlook

April 11, 2016

Please refer to Appendix Important Disclosures.

Breadth Improves But Evidence Still Neutral

Highlights:

Fed Pursuing Slow Cycle For Rate Hikes

Rising Inflation Could Put Upward Pressure On Bond Yields

Earnings Headwind Subsiding, But Stock Valuations High

Presidential Election Cycle Warns Of More Volatility

Outlook Summary

Weight of the Evidence Neutral

Valuation Excesses Have Not Been

Relieved

U.S. Large-Caps Showing Leadership

Versus Small-Cap & The World

Cyclical Sectors Joining Relative

The persistent weakness that marked the first six weeks of the first quarter

Strength Leadership Group

was followed by persistent strength in the second six weeks, with the S&P

Bullish Breadth Divergences Could

500 rallying into positive territory for the year by the end of March. Over the

Signal That Sustainable Low Is In Place

past month investor sentiment has shifted from bullish to neutral as

widespread investor pessimism has waned. Offsetting the downgrade in

sentiment has been an upgrade in Breadth (which moved from bearish to neutral). This keeps the overall weight of the evidence at

neutral. Improving breadth does not preclude periods of consolidation or weakness, but it does set up the chance to see

bullish divergences on the next pullback. In other words, we are in a better position now to look for evidence that a cyclical low

is indeed in place.

Excessive valuations remain a significant headwind for stocks. We would add to this concern evidence that households remain fully

exposed to stocks and cash does not

appear to be building on the

Indicator Review

sidelines. The good news from a

valuation perspective is that the

headwind to earnings growth from

strength in the dollar is fading, and as

we move through 2016 this could

actually become a tailwind. To gain

confidence that any rebound we see

in earnings is more than just

currency-related volatility, we would

like to see better top-line growth.

For now, the neutral message from

the weight evidence argues for

continued caution and suggests we

could see a resurgence in volatility as

we move towards summer.

Bruce Bittles

William Delwiche, CMT, CFA

Chief Investment Strategist

bbittles@rwbaird.com

941-906-2830

Investment Strategist

wdelwiche@rwbaird.com

414-298-7802

10R.17

Federal Reserve Policy is neutral.

Global central bank actions and

commentary have fueled financial

market volatility. While overseas the

discussion is mostly focused on the

degree of additional easing that might

take place, the conversation in the U.S.

is on the pace of policy tightening

(euphemistically

referred

to

as

normalization). The latest dot-plot from

the FOMC shows that the onceexpected four rate hikes in 2016 have

been cut in half. If the consensus view at

the FOMC is correct and the Fed raises

rates twice in 2016 (on top of the 25

basis point hike in December), this

would fit with previous Slow Cycles.

While the overall pattern for such cycles

is for stocks to do relatively well, both

slow and fast tightening cycles are

marked

by

heightened

volatility,

especially over the first six months.

Source: Ned Davis Research

While the Fed has focused on

preparing the market for interest rate

hikes, the 10-year Treasury Note yield

has continued to move lower. After

beginning the year near 2.25%, the

yield on the 10-year T-Note is currently

more than 50 basis points lower than

that. While the Fed is alternately

credited and blamed for low longerterm bond yields, the yield has stayed

roughly within the bounds of what

might be considered normal based on

historical determinants of fair value.

Importantly, the largest single driver of

bond yields over time has been core

inflation. We are now seeing inflation

rates start to drift higher and this

could mean upward pressure on

bond yields as we move through

2016.

Source: Ned Davis Research

Investment Strategy Outlook

Economic

Fundamentals

remain

While economic growth

Bullish.

remains shy of robust, early-year

concerns about recession appear to

have been misplaced. Labor market

trends remain strong, with initial jobless

claims near their lows and labor force

participation seeing an upswing. The

ranks

of

the

unemployed

are

increasingly composed of those who

willingly left their previous job, a sign of

economic strength and opportunity.

Even within the manufacturing sector

there is evidence of improvement. While

the headline ISM number has seen a

modest bounce in recent months,

beneath the surface the rebound has

been

impressively

broad.

The

percentage of industries reporting

growth has expanded from less than

30% in late 2015 to 67% in March.

Source: Ned Davis Research

Valuations are still Bearish. Stocks

remain expensive by most measures,

especially those based on actual,

reported earnings. On a median P/E

basis, stocks are more expensive

now than at any point in the past

decade. While not necessarily arguing

for near-term weakness, elevated

valuations do argue for tempering

forward-return expectations. The good

news from a valuation perspective is

that stocks could soon enjoy a

currency tailwind, and expectations for

earnings growth continue to be

ratcheted lower. It is important to

remember that valuation relief need not

only come from price correction, it can

also come from earnings improvement.

An upside surprise from earnings could

start to relieve valuation excesses.

Source: Ned Davis Research

Robert W. Baird & Co.

Page 3 of 8

Investment Strategy Outlook

Sentiment is now Neutral. We have

begun to see some pockets of optimism

replace the excessive and widespread

pessimism that emerged over the first

six weeks of 2016. Optimism has yet

to be intensive enough to show up in

a sustained fashion in the sentiment

composites. While the bulk of the rally

off of the February low has been met

with skepticism and caution, recent

weeks have seen inflows into equity

funds and active investment managers

taking on more equity exposure (the

NAAIM exposure index is at its highest

level in nearly a year). While these

shorter-term sentiment indicators are no

longer a tailwind for stocks, they are

also not (yet) a headwind.

Source: Ned Davis Research

One area of concern from a sentiment

perspective is the lack of available

cash on the sidelines. While weekly

mutual fund flow data gives the

impression that cash is being amassed

in great quantities, a signficant amount

of the outflows from equity mutual

funds is actually staying in equities,

just moving to ETFs. As as result,

cash levels remain near their lows

and household exposure to equities

remains near its highs. Just as

elevated valuations tend to be followed

by muted forward returns, elevated

exposure by households to equities

tends to be followed by sub-par stock

market returns. This could add

volatility to what is already a noisy

investing environment.

Source: Ned Davis Research

Robert W. Baird & Co.

Page 4 of 8

Investment Strategy Outlook

Seasonal Patterns and Price Trends

remain neutral. An array of breadth

thrusts seen over the past month

suggests stocks could continue to build

on the rally off of the February lows. But

price momentum has started to cool

and

the

second

quarter

in

presidential election years is one of

the weakest of the entire four-year

cycle. The star in the chart to the right

shows where we are currently in the

cycle. Given the fractured nature of the

current Presidential election (with both

parties still dealing with contentious

primary campaigns), it would not at all

be surprising to see continued noise and

volatility in stocks. The good news is that

once some clarity to the election

outcome emerges, stocks could benefit

from a protracted seasonal tailwind.

Source: Ned Davis Research

The Tape (Breadth) is now neutral.

The expansion in industry group

breadth has been encouraging. The

percentage of industry groups in

up-trends has surpassed the peak

seen in late 2015. Given that the

early-2016 low was underneath the

2015 low, however, an all-clear signal

is lacking. The degree of breadth

improvement may best be seen on any

weakness that emerges this summer.

A higher low on the industry group

trend indicator would be strong

evidence that a cyclical low is indeed in

place. We have also been encouraged

by the expansion in the number of

issues on the NYSE and NASDAQ that

are making new 52-week highs.

Robert W. Baird & Co.

Page 5 of 8

Investment Strategy Outlook

While the overall weight of the

evidence is still neutral, there are still

areas of relative leadership for

investors to focus on. U.S. large-cap

stocks remain in relative up-trends

versus the rest of the world (as shown in

the chart to the right) and versus

domestic small-caps. In the current

environment the potential benefits of

diversification

gained

by

adding

overseas exposure does not seem to

offset risks from relative weakness,

poorer growth prospects and currencyrelated volatility.

For investors who are maintaining

international equity exposure we would

tilt away from developed markets and

toward emerging markets.

Domestically, small-caps are lagging

large-caps both in terms of relative

price trends but also industry group

leadership.

Source: Stock Charts

The volatility that was seen in the first

quarter does not appear to have fully

run its course, so maintaining

elevated

cash

levels

seems

appropriate.

Gold has had a big rally to begin 2016

(up nearly 20%). This seems mostly to

have stopped or stalled the down-trend

that was in place. It is premature to

conclude that a sustained up-trend is

emerging.

In terms of sectors: Utilities and

Telecom have been resilient (aided by

low interest rates) even as more

cyclical leadership has emerged.

Industrials have strengthened and are

part of the leadership group, as is the

Information Technology sector. Both

Energy and Materials have bounced

Source: Baird. Ranking of 1 indicates best relative strength; ranking of 10 indicates worst relative

strength.

off of their lows, but only Materials has

seen a significant increase in relative

strength.

Relative

weakness

in

Financials remains a concern for the

broader market.

Robert W. Baird & Co.

Page 6 of 8

Investment Strategy Outlook

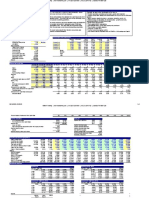

BAIRD STRATEGIC ASSET ALLOCATION MODEL PORTFOLIOS

Baird offers six strategic asset allocation model portfolios for consideration (see table below), four of which have a mix of equity and

fixed income. An individuals personal situation, preferences and objectives may suggest an allocation more suitable than those shown

below. Please consult a Baird Financial Advisor in determining an asset allocation that will meet your needs.

Model Portfolio

Mix: Stocks /

(Bonds + Cash)

All Growth

100 / 0

Capital Growth

80 / 20

Growth with

Income

60 / 40

Income with

Growth

40 / 60

Conservative

Income

20 / 80

Capital

Preservation

0 / 100

Risk Tolerance

Strategic Asset Allocation Model Summary

Emphasis on providing aggressive growth of capital with high

Well above average fluctuations in the annual returns and overall market value of the

portfolio.

Emphasis on providing growth of capital with moderately high

Above average

fluctuations in the annual returns and overall market value of the

portfolio.

Emphasis on providing moderate growth of capital and some

Average

current income with moderate fluctuations in annual returns and

overall market value of the portfolio.

Emphasis on providing high current income and some growth of

Below average

capital with moderate fluctuations in the annual returns and

overall market value of the portfolio.

Emphasis on providing high current income with relatively small

Well below average fluctuations in the annual returns and overall market value of the

portfolio.

Emphasis on preserving capital while generating current income

Well below average with relatively small fluctuations in the annual returns and

overall market value of the portfolio.

Bairds Investment Policy Committee offers a view of potential tactical allocations among equity, fixed income and cash, based upon a

consideration of U.S. Federal Reserve policy, underlying U.S. economic fundamentals, investor sentiment, valuations, seasonal trends,

and broad market trends. As conditions change, the Investment Policy Committee adjusts the weightings. The table below shows both

the normal range and current recommended allocation to stocks, bonds and cash. Please consult a Baird Financial Advisor in

determining if an adjustment to your strategic asset allocation is appropriate in your situation.

Asset Class /

Model Portfolio

Equities:

Suggested allocation

Normal range

Fixed Income:

Suggested allocation

Normal range

Cash:

Suggested allocation

Normal range

Robert W. Baird & Co.

All Growth

Capital Growth

Growth with

Income

Income with

Growth

Conservative

Income

Capital

Preservation

95%

90 100%

75%

70 - 90%

55%

50 - 70%

35%

30 - 50%

15%

10 - 30%

0%

0%

0%

0 - 0%

15%

10 - 30%

35%

30 - 50%

45%

40 - 60%

50%

45 - 65%

60%

55 85%

5%

0 - 10%

10%

0 - 20%

10%

0 - 20%

20%

10 - 30%

35%

25 - 45%

40%

15 - 45%

Page 7 of 8

Investment Strategy Outlook

ROBERT W. BAIRDS INVESTMENT POLICY COMMITTEE

Bruce A. Bittles

Managing Director

Chief Investment Strategist

B. Craig Elder

Director

PWM Fixed Income Analyst

Jay E. Schwister, CFA

Managing Director

Baird Advisors, Sr. PM

Kathy Blake Carey, CFA

Director

Associate Director of Asset Mgr Research

Jon A. Langenfeld, CFA

Managing Director

Head of Global Equities

Timothy M. Steffen, CPA, CFP

Director

Director of Financial Planning

Patrick J. Cronin, CFA, CAIA

Director

Institutional Consulting

Warren D. Pierson, CFA

Managing Director

Baird Advisors, Sr. PM

Laura K. Thurow, CFA

Managing Director

Co-Director of PWM Research, Prod & Svcs

William A. Delwiche, CMT, CFA

Director

Investment Strategist

Appendix Important Disclosures and Analyst Certification

This is not a complete analysis of every material fact regarding any company, industry or security. The opinions expressed here reflect our

judgment at this date and are subject to change. The information has been obtained from sources we consider to be reliable, but we cannot

guarantee the accuracy.

ADDITIONAL INFORMATION ON COMPANIES MENTIONED HEREIN IS AVAILABLE UPON REQUEST

The indices used in this report to measure and report performance of various sectors of the market are unmanaged and direct investment in

indices is not available.

Baird is exempt from the requirement to hold an Australian financial services license. Baird is regulated by the United States Securities and

Exchange Commission, FINRA, and various other self-regulatory organizations and those laws and regulations may differ from Australian

laws. This report has been prepared in accordance with the laws and regulations governing United States broker-dealers and not Australian

laws.

Copyright 2016 Robert W. Baird & Co. Incorporated

Other Disclosures

United Kingdom (UK) disclosure requirements for the purpose of distributing this research into the UK and other countries for

which Robert W. Baird Limited (RWBL) holds a MiFID passport.

This material is distributed in the UK and the European Economic Area (EEA) by RWBL, which has an office at Finsbury Circus House, 15

Finsbury Circus, London EC2M 7EB and is authorized and regulated by the Financial Conduct Authority (FCA).

For the purposes of the FCA requirements, this investment research report is classified as investment research and is objective.

This material is only directed at and is only made available to persons in the EEA who would satisfy the criteria of being "Professional"

investors under MiFID and to persons in the UK falling within articles 19, 38, 47, and 49 of the Financial Services and Markets Act of 2000

(Financial Promotion) Order 2005 (all such persons being referred to as relevant persons). Accordingly, this document is intended only for

persons regarded as investment professionals (or equivalent) and is not to be distributed to or passed onto any other person (such as

persons who would be classified as Retail clients under MiFID).

Robert W. Baird & Co. Incorporated and RWBL have in place organizational and administrative arrangements for the disclosure and

avoidance of conflicts of interest with respect to research recommendations.

This material is not intended for persons in jurisdictions where the distribution or publication of this research report is not permitted under the

applicable laws or regulations of such jurisdiction.

Investment involves risk. The price of securities may fluctuate and past performance is not indicative of future results. Any recommendation

contained in the research report does not have regard to the specific investment objectives, financial situation and the particular needs of

any individuals. You are advised to exercise caution in relation to the research report. If you are in any doubt about any of the contents of

this document, you should obtain independent professional advice.

RWBL is exempt from the requirement to hold an Australian financial services license. RWBL is regulated by the FCA under UK laws, which

may differ from Australian laws. This document has been prepared in accordance with FCA requirements and not Australian laws.

Robert W. Baird & Co.

Page 8 of 8

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Inogen CitronDocument8 pagesInogen CitronAnonymous Ht0MIJNo ratings yet

- The Evolution of Vanguard Advisor's Alpha: From Portfolios To PeopleDocument18 pagesThe Evolution of Vanguard Advisor's Alpha: From Portfolios To PeopleAnonymous Ht0MIJNo ratings yet

- Fitbit From Fad To FutureDocument11 pagesFitbit From Fad To FutureAnonymous Ht0MIJNo ratings yet

- As 061818Document4 pagesAs 061818Anonymous Ht0MIJNo ratings yet

- NetflixDocument4 pagesNetflixAnonymous Ht0MIJNo ratings yet

- Citron SnapDocument7 pagesCitron SnapAnonymous Ht0MIJNo ratings yet

- ISGZSGDocument16 pagesISGZSGAnonymous Ht0MIJNo ratings yet

- The Evolution of Vanguard Advisor's Alpha: From Portfolios To PeopleDocument18 pagesThe Evolution of Vanguard Advisor's Alpha: From Portfolios To PeopleAnonymous Ht0MIJNo ratings yet

- 2018 02 24berkshireletterDocument148 pages2018 02 24berkshireletterZerohedgeNo ratings yet

- Factsheet Global Allocation EnglishDocument5 pagesFactsheet Global Allocation EnglishAnonymous Ht0MIJNo ratings yet

- l0284 NB Solving For 2018Document28 pagesl0284 NB Solving For 2018Anonymous Ht0MIJNo ratings yet

- Q4 Letter Dec. 17 Final 1Document4 pagesQ4 Letter Dec. 17 Final 1Anonymous Ht0MIJNo ratings yet

- SlidesDocument70 pagesSlidesAnonymous Ht0MIJNo ratings yet

- SlidesDocument70 pagesSlidesAnonymous Ht0MIJNo ratings yet

- As 010818Document5 pagesAs 010818Anonymous Ht0MIJNo ratings yet

- Fpa Capital Fund Commentary 2017 q4Document12 pagesFpa Capital Fund Commentary 2017 q4Anonymous Ht0MIJNo ratings yet

- IP Capital Partners CommentaryDocument15 pagesIP Capital Partners CommentaryAnonymous Ht0MIJNo ratings yet

- Broadleaf Partners Fourth Quarter 2017 CommentaryDocument4 pagesBroadleaf Partners Fourth Quarter 2017 CommentaryAnonymous Ht0MIJNo ratings yet

- Where Are We in The Credit Cycle?: Gene Tannuzzo, Senior Portfolio ManagerDocument1 pageWhere Are We in The Credit Cycle?: Gene Tannuzzo, Senior Portfolio ManagerAnonymous Ht0MIJNo ratings yet

- Technical Review and OutlookDocument7 pagesTechnical Review and OutlookAnonymous Ht0MIJNo ratings yet

- Municipal Bond Market CommentaryDocument8 pagesMunicipal Bond Market CommentaryAnonymous Ht0MIJNo ratings yet

- Vltava Fund Dopis Letter To Shareholders 2017Document7 pagesVltava Fund Dopis Letter To Shareholders 2017Anonymous Ht0MIJNo ratings yet

- Gmo Quarterly LetterDocument22 pagesGmo Quarterly LetterAnonymous Ht0MIJNo ratings yet

- Master Investor Magazine Issue 33 High Res Microsoft and Coca ColaDocument6 pagesMaster Investor Magazine Issue 33 High Res Microsoft and Coca ColaKishok Paul100% (2)

- Ffir Us B M 20171130 TRDocument12 pagesFfir Us B M 20171130 TRAnonymous Ht0MIJNo ratings yet

- Bittles Market NotesDocument4 pagesBittles Market NotesAnonymous Ht0MIJNo ratings yet

- As 121117Document4 pagesAs 121117Anonymous Ht0MIJNo ratings yet

- Bittles Market Notes PDFDocument3 pagesBittles Market Notes PDFAnonymous Ht0MIJNo ratings yet

- Tami Q3 2017Document7 pagesTami Q3 2017Anonymous Ht0MIJ100% (1)

- Fixed Income Weekly CommentaryDocument3 pagesFixed Income Weekly CommentaryAnonymous Ht0MIJNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- JPM BanksDocument220 pagesJPM BanksÀlex_bové_1No ratings yet

- Interactive Brokers - Global Client Services AssociateDocument2 pagesInteractive Brokers - Global Client Services AssociateZuhaib ShaikhNo ratings yet

- Cc-6 (High Powered Money) - 2Document10 pagesCc-6 (High Powered Money) - 2sommelierNo ratings yet

- Cost of Capital ExerciseDocument2 pagesCost of Capital ExerciseLiana Monica LopezNo ratings yet

- Fundamental Equity Analysis - QMS Gold Miners FlexIndex - The QMS Advisors' Gold Miners Flexible Index Tracks Companies Involved in The Gold Mining IndustryDocument205 pagesFundamental Equity Analysis - QMS Gold Miners FlexIndex - The QMS Advisors' Gold Miners Flexible Index Tracks Companies Involved in The Gold Mining IndustryQ.M.S Advisors LLCNo ratings yet

- Module 36.1 Quizzer 2 - Subsequent To Date of Acquisition: PendonDocument3 pagesModule 36.1 Quizzer 2 - Subsequent To Date of Acquisition: PendonJoshua Daarol0% (1)

- A Global Market Rotation Strategy With An Annual Performance of 41.4 PercentDocument6 pagesA Global Market Rotation Strategy With An Annual Performance of 41.4 PercentLogical Invest100% (1)

- Treasury Bills: Getting The Price From The Interest RateDocument2 pagesTreasury Bills: Getting The Price From The Interest RateAnav AggarwalNo ratings yet

- SebiDocument13 pagesSebiNishat ShaikhNo ratings yet

- Current Valuation AS139437103Document6 pagesCurrent Valuation AS139437103Kiran KumarNo ratings yet

- Advanced Accounting Test Bank Chapter 07 Susan HamlenDocument60 pagesAdvanced Accounting Test Bank Chapter 07 Susan HamlenWilmar AbriolNo ratings yet

- 24 EegDocument27 pages24 EegAashna ChaturvediNo ratings yet

- Mutual FundsDocument30 pagesMutual FundsDeepakNo ratings yet

- Session 1Document14 pagesSession 1Deepika GulatiNo ratings yet

- Factors Affecting Stock MarketDocument80 pagesFactors Affecting Stock MarketAjay SanthNo ratings yet

- Free Cash Flow To Firm DCF Valuation Model Base DataDocument3 pagesFree Cash Flow To Firm DCF Valuation Model Base DataTran Anh VanNo ratings yet

- Financial MarketsDocument38 pagesFinancial MarketsGabbyNo ratings yet

- Utimco ActiveDocument20 pagesUtimco ActiveFortune100% (4)

- Solved Conseco Oil Company Has An Account Titled Oil and GasDocument1 pageSolved Conseco Oil Company Has An Account Titled Oil and GasAnbu jaromiaNo ratings yet

- P4 ACCA Summary + Revision Notes 2021Document139 pagesP4 ACCA Summary + Revision Notes 2021Farman ShaikhNo ratings yet

- The First Rule of Trading With Oliver Velez PDFDocument63 pagesThe First Rule of Trading With Oliver Velez PDFhansondrew95% (22)

- FMS MI CH 1 IFSDocument26 pagesFMS MI CH 1 IFSAlpa ShahNo ratings yet

- 08dps9u 1204720010545138 680917Document1 page08dps9u 1204720010545138 680917dharnaNo ratings yet

- LCS FactsheetDocument4 pagesLCS FactsheetPratik BhagatNo ratings yet

- Cap StructureDocument3 pagesCap StructureRiya GargNo ratings yet

- Chapter 4 Liquidation of Companies TYBAFDocument4 pagesChapter 4 Liquidation of Companies TYBAFvikax90927No ratings yet

- Microeconomics II - NoteDocument59 pagesMicroeconomics II - NoteZeNo ratings yet

- MBA7427 Sample Questions CH1-4 2019Document8 pagesMBA7427 Sample Questions CH1-4 2019Alaye OgbeniNo ratings yet

- INTRODUCTIONDocument79 pagesINTRODUCTIONdrkotianrajeshNo ratings yet

- Letter of Transmittal: Term PaperDocument20 pagesLetter of Transmittal: Term PaperMd SaifNo ratings yet