Professional Documents

Culture Documents

MBF13e Chap20 Pbms - Final

Uploaded by

Anonymous 8ooQmMoNs1Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MBF13e Chap20 Pbms - Final

Uploaded by

Anonymous 8ooQmMoNs1Copyright:

Available Formats

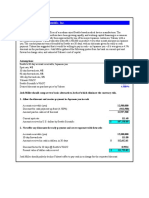

Problem 20.

1 Nikken Microsystems (A)

Assume Nikken Microsystems has sold Internet servers to Telecom Espaa for 700,000. Payment

is due in 3 months and will be made with a trade acceptance from Telecom Espaa Acceptance. The

acceptance fee is 1.0% per annum of the face amount of the note. This acceptance will be sold at a

4% per annum discount. What is the annualized percentage all-in-cost in euros of this method of

trade financing?

Assumptions

Face amount of sale

Maturity, days

Trade acceptance fee, per annum

Discount rate on sale of acceptance, per annum

All-in-Cost of Trade Acceptance

Face amount of the receivable

Less trade acceptance fee

(amount financed x acceptance fee x (days/360) )

Less discount on the sale of acceptance

(amount financed x discount rate x (days/360))

Net proceeds

Annualized percentage all-in-cost (AIC)

(acceptance fee + discount) / (amount received) x (360/180)

Values

700,000

90

1.000%

4.000%

700,000

(1,750)

(7,000)

691,250

5.063%

Problem 20.2 Nikken Microsystems (B)

Assume that Nikken Microsystems prefers to receive U.S. dollars rather than euros for the trade

transaction described in problem 2. It is considering two alternatives: 1) It can sell the acceptance for

euros at once and convert the euros immediately to U.S. dollars at the spot rate of exchange of $1.00/;

or 2) It can hold the euro acceptance until maturity but at the start sell the expected euro proceeds

forward for dollars at the 3-month forward rate of $1.02/.

a. What are the U.S. dollar net proceeds received at once from the discounted trade acceptance in option

1?

b. What are the U.S. dollar net proceeds received in 3 months in option 2?

c. What is the breakeven investment rate that would equalize the net U.S. dollar proceeds from both

options?

d. Which option should Nikken Microsystems choose?

Assumptions

Face amount of sale

Maturity, days

Spot exchange rate, $/

Forward exchange rate, 3-months, $/

Trade acceptance fee, per annum

Discount rate on sale of acceptance, per annum

a. What are the US dollar proceeds received at once?

Face amount of the receivable

Less trade acceptance fee

(face amount x acceptance fee x (days/360) )

Euro proceeds

Spot exchange rate, $/

US dollar proceeds, now

b. What are the dollar proceeds received in 3 months under option 2?

Face amount of the receivable

Less trade acceptance fee

(face amount x acceptance fee x (days/360) )

Euro net proceeds

3-month forward exchange rate, $/

US dollar net proceeds received in 3-months

c. Breakeven reinvestment rate

US dollars received now, part a)

US dollars received at end of 90 days, part b)

Breakeven reinvestment rate of $ now to equal $ in 3 months (per annum)

Values

700,000

90

1.00

1.02

1.000%

4.000%

700,000

(1,750)

698,250

1.00

698,250

700,000

(1,750)

698,250

1.02

712,215

$

$

d. Which option should Nikken Microsystems choose?

If Nikken Microsystems' opportunity cost of capital is 8%, it should be indifferent financially

between the two options However, selling the acceptance at once, option 1, improves

Nikken's liquidity and removes the debt that otherwise would be financing the acceptance from

Nikken Microsystem's balance sheet.

698,250

712,215

8.000%

Problem 20.3 Motoguzzie (A)

Motoguzzie exports large-engine motorcycles (greater than 700cc) to Australia and invoices its

customers in U.S. dollars. Sydney Wholesale Imports has purchased $3,000,000 of merchandise

from Motoguzzie, with payment due in six months. The payment will be made with a bankers

acceptance issued by Charter Bank of Sydney at a fee of 1.75% per annum. Motoguzzie has a

weighted average cost of capital of 10%. If Motoguzzie holds this acceptance to maturity, what is

its annualized percentage all-in-cost?

Assumptions

Value of shipment

Credit terms, days

Bankers' acceptance fee

Motoguzzie's WACC, per annum

All-in-cost of Bankers' Acceptance

Face amount of bankers' acceptance

Less acceptance fee for 6-month maturity

( face amount x acceptance fee x (term/360))

Amount received by Indian

Opportunity cost of capital @ Motoguzzie's WACC

(amount received x WACC x 180/360)

Annualized percentage all-in-cost (AIC)

(acceptance fee +opportunity cost) / (amount received) x (360/180)

Values

3,000,000

180

1.750%

10.000%

3,000,000.00

(26,250.00)

2,973,750.00

148,687.50

11.765%

Problem 20.4 Motoguzzie (B)

Assuming the facts in problem 1, Bank of America is now willing to buy Motoguzzies bankers

acceptance for a discount of 6% per annum. What would be Motoguzzies annualized percentage

all-in-cost of financing its $3,000,000 Australian receivable?

Assumptions

Value of shipment

Credit terms, days

Bankers' acceptance fee

Motoguzzie's WACC, per annum

Discount rate on sale of acceptance, per annum

All-in-Cost of Bankers' Acceptance

Face amount of bankers' acceptance

Less acceptance fee for 6-month maturity

Less discount on sale of acceptance

Amount received by Motoguzzie

Annualized percentage all-in-cost (AIC)

(acceptance fee + discount) / (amount received) x (360/180)

Values

3,000,000

180

1.750%

10.000%

6.000%

3,000,000.00

(26,250.00)

(90,000.00)

2,883,750.00

8.062%

Problem 20.5 Nakatomi Toyota

Nakatomi Toyota buys its cars from Toyota Motors-USA, and sells them to U.S. customers. One of

its customers is EcoHire, a car rental firm which buys cars from Nakatomi Toyota at a wholesale

price. Final payment is due to Nakatomi Toyota in 6 months. EcoHire has bought $200,000 worth

of cars from Nakatomi, with a cash down payment of $40,000 and the balance due in 6 months

without any interest charged as a sales incentive. Nakatomi Toyota will have the EcoHire receivable

accepted by Alliance Acceptance for a 2% fee, and then sell it at a 3% per annum discount to Wells

Fargo Bank.

a. What is the annualized percentage all-in-cost to Nakatomi Toyota?

b. What are Nakatomis net cash proceeds, including the cash down payment?

Assumptions

Face amount of sale (first payment of 5)

Down payment, 20% of payment

Period for financing, days

Trade acceptance fee

Discount rate on sale of acceptance, per annum

$

$

All-in-Cost of Trade Acceptance

Face amount of sale

Less cash down-payment

Amount for financing

Less trade acceptance fee

(amount financed x acceptance fee x (days/360) )

Less discount for the period

(amount financed x discount rate x (days/360))

Proceeds to Nakatomi Toyota

$

$

Values

200,000

40,000

180

2.000%

3.000%

200,000.00

(40,000.00)

160,000.00

(1,600.00)

a. Annualized percentage all-in-cost (AIC)

(acceptance fee + discount) / (amount received) x (360/180)

(2,400.00)

156,000.00

5.128%

b. Net cash proceeds to Nakatomi Toyota

Down payment

Proceeds of acceptance

Total cash proceeds

$

$

40,000

156,000.00

196,000.00

Problem 20.6 Forfaiting at Umaru Oil (Nigeria)

Umaru Oil of Nigeria has purchased $1,000,000 of oil drilling equipment from Gunslinger Drilling

of Houston, Texas. Umaru Oil must pay for this purchase over the next five years at a rate of

$200,000 per year due on March 1 of each year.

Bank of Zurich, a Swiss forfaiter, has agreed to buy the 5 notes of $200,000 each at a discount.

The discount rate would be approximately 8% per annum based on the expected 3-year LIBOR rate

plus 200 basis points, paid by Umaru Oil. Bank of Zurich also would charge Umaru Oil an

additional commitment fee of 2% per annum from the date of its commitment to finance until

receipt of the actual discounted notes issued in accordance with the financing contract. The

$200,000 promissory notes will come due on March 1 in successive years.

The promissory notes issued by Umaru Oil will be endorsed by their bank, Lagos City Bank, for

a 1% fee and delivered to Gunslinger Drilling. At this point Gunslinger Drilling will endorse the

notes without recourse and discount them with the forfaiter, Bank of Zurich, receiving the full

$200,000 principal amount. Bank of Zurich will sell the notes by re-discounting them to investors

in the international money market without recourse. At maturity the investors holding the notes will

present them for collection at Lagos City Bank. If Lagos City Bank defaults on payment, the

investors will collect on the notes from Bank of Zurich.

a. What is the annualized percentage all-in-cost to Umaru Oil of financing the first $200,000 note

due March 1, 2011?

b. What might motivate Umaru Oil to use this relatively expensive alternative for financing?

Assumptions

Face amount of the note due March 1, 2011 issued by Umaru

3-year LIBOR rate, per annum

Basis point spread, per annum

Total discount rate, per annum

Bank of Zurich commitment fee, per annum

Lagos City Bank endorsement fee, per annum

What is the all-in-cost of forfaiting?

Face amount of note

Less Lagos City bank endorsement fee

Less Bank of Zurich commitment fee for one year

Less discount on note at LIBOR plus spread

Net proceeds

Annualized all-in-cost of factoring

( total interest and fee costs / face amount of note )

Umaru Oil would probably be motivated to use a forfaiter because its credit worth is too

low to qualify for more normal financing. Note that the 11% annual costs are paid by

Umaru Oil itself -- the importer, rather than by Gunslinger Drilling, the exporter.

Values

200,000

6.000%

2.000%

8.000%

2.000%

1.000%

200,000

(2,000)

(4,000)

(16,000)

178,000

11.000%

Problem 20.7 Sunny Coast Enterprises (A)

Sunny Coast Enterprises has sold a combination of films and DVDs to Hong Kong Media

Incorporated for US$100,000, with payment due in six months. Sunny Coast Enterprises has the

following alternatives for financing this receivable: 1) Use its bank credit line. Interest would be at

the prime rate of 5% plus 150 basis points per annum. Sunny Coast Enterprises would need to

maintain a compensating balance of 20% of the loans face amount. No interest will be paid on the

compensating balance by the bank; or 2) Use its bank credit line but purchase export credit

insurance for a 1% fee. Because of the reduced risk, the bank interest rate would be reduced to 5%

per annum without any points.

a. What are the annualized percentage all-in-costs of each option?

b. What are the advantages and disadvantages of each option?

c. Which option would you recommend?

Assumptions

Face amount of receivable

Maturity, days

Bank prime rate

Spread over prime rate on credit line

Bank interest (prime + spread), per annum

Compensating balance requirement for bank credit line

Export credit insurance fee

Option 1: Bank Credit Line

Face amount of receivable

Less bank interest expense on receivable

Less compensating balance requirement

Net proceeds

Annualized all-in-cost of alternative 1

Option 2: Bank Credit Line + Export Credit Insurance

Face amount of receivable

Less credit insurance fee

Less bank interest expense on receivable

Less compensating balance requirement

Net proceeds

Values

100,000

180

5.000%

1.500%

6.500%

20.000%

1.000%

100,000

(3,250)

(20,000)

76,750

8.469%

Annualized all-in-cost of option 2

Note: The reason the compensating balance is deducted from net proceeds is that

Sunny Coast Enterprises does not get that cash and does not earn interest on it.

100,000

(1,000)

(2,500)

(20,000)

76,500

9.150%

Problem 20.8 Sunny Coast Enterprises (B)

Sunny Coast Enterprises has been approached by a factor that offers to purchase the Hong Kong

Media Imports receivable at a 16% per annum discount plus a 2% charge for a non-recourse clause.

a. What is the annualized percentage all-in-cost of this factoring option?

b. What are the advantages and disadvantages of the factoring option compared to the options in

Sunny Coast Enterprises (A)?

Assumptions

Face amount of receivable

Maturity, days

Factor discount rate, percent per annum

Charge for non-recourse clause: "factor fee"

a. What is the annualized all-in-cost of factoring?

Face amount of receivable

Less cost of factoring, discount rate

Less non-recourse clause

Net proceeds from factoring

Annualized all-in-cost of factoring

Although the costs of factoring are clearly higher than using bank credit lines, factoring

removes the receivable from the balance sheet, both as an asset and the associated debt

to finance it using the bank credit line. Factoring also provides the cash at the start of

the time period compared to waiting 6 months later under the bank credit line.

Values

100,000

180

16.000%

2.000%

100,000

(8,000)

(2,000)

90,000

22.222%

Problem 20.9 Whatchamacallit Sports (A)

Whatchamacallit Sports (Whatchamacallit) is considering bidding to sell $100,000 of ski

equipment to Phang Family Enterprises of Seoul, Korea. Payment would be due in six months.

Since Whatchamacallit cannot find good credit information on Phang, Whatchamacallit wants to

protect its credit risk. It is considering the following financing solution.

Phangs bank issues a letter of credit on behalf of Phang, and agrees to accept Whatchamacallits

draft for $100,000 due in six months. The acceptance fee would cost Whatchamacallit $500, plus

reduce Phangs available credit line by $100,000. The banker's acceptance note of $100,000 would

be sold at a 2% per annum discount in the money market. What is the annualized percentage all-in

cost to Whatchamacallit of this banker's acceptance financing?

Assumptions

Principal of note

Maturity of note, days

Acceptance fee to be paid by Whatchamacallit

Discount on sale of note, per annum

Letter of credit fee paid by Phang

Reduction in Phang's available credit line

All-in cost to Whatchamacallit:

Face amount of note

Less acceptance fee

Less interest

Net proceeds

Annualized all-in cost of financing

( total interest and fee costs / net proceeds ) x (360/maturity)

$

$

$

$

Values

100,000

180

500

2.000%

500

100,000

100,000

(500)

(1,000)

98,500

3.046%

Problem 20.10 Whatchamacallit Sports (B)

Whatchamacallit could also buy export credit insurance from FCIA for a 1.5% premium. It finances the

$100,000 receivable from Phang from its credit line at 6% per annum interest. No compensating bank

balance would be required.

a. What is Whatchamacallits annualized percentage all-in cost of financing?

b. What are Phangs costs?

c. What are the advantages and disadvantages of this option compared to the banker's acceptance

financing in Whatchamacallit (A)? Which option would you recommend?

Assumptions

Principal of note

Maturity of note, days

FCIA export credit insurance fee

Interest on credit line, per annum

a. All-in-cost to Whatchamacallit:

Face amount

Less credit insurance fee

Less interest on credit line

Net proceeds

Annualized all-in cost of financing

( total interest and fee costs / net proceeds ) x (360/term of note)

Values

100,000

180

1.500%

6.000%

Values

100,000

(1,500)

(3,000)

95,500

9.424%

b. What is the cost to Phang?

Phang has no costs under this option, and it preserves its credit line.

c. What are the advantages and disadvantages of this option?

The cost of using its credit line would cost Whatchamacallit 9.42% compared to only 3.05% with the

banker's acceptance. However, Phang would avoid the $500 cost of getting a letter of credit, and would

avoid reducing its available credit line. It could be that the sale of ski equipment itself could be

jeopardized if Phang really needs the lost availabilty of its credit line. It might be possible for

Whatchamacallit to increase its bid to reflect some or all of the financing cost difference.

Mini-Case: Crosswell International and Brazil

Price / case

Cases per container

Export to Brazil Costs & Pricing

FAS price per case, Miami (US$)

Freight, loading, & documentation

CFR price per case, Brazilian port (Santos)

Calculation

4180

$4180 per container

% of CFR

34.00

4.32

38.32

0.86

39.18

2.250%

2.50

R$97.95

2.50

1.96

2.70

1.27

0.01

0.26

1.96

0.05

1.47

R$107.63

2.000%

25.00%

1.300%

14.00

20.000%

2.000%

50.00

1.500%

% of CIF

% of freight

% of CIF

R$12 per container

% of storage & handling

% of CIF

R$50 per container

% of CIF

Distributor's Costs & Pricing

Storage cost

Cost of financing diaper inventory

Distributor's margin

Price to retailer (R$)

1.47

6.86

23.19

139.15

1.500%

7.000%

20.000%

% of CIF * months

% of CIF * months

% of Price + storage + cc

Brazilian Retailer Costs & Pricing

Industrial product tax (IPT-2)

Tax on merc circulation services (ICMS-2)

Retailer costs and markup

Price per case to consumer (R$)

20.87

28.80

56.65

245.48

15.000%

18.000%

30.000%

% of price to retailer

% of price + IPT2

% of price + IPT2 + ICMS2

Bags of 8

per case

Diapers per

case

Price to Consumer

(R$/diaper)

44

32

24

22

352

256

192

176

R$0.70

R$0.96

R$1.28

R$1.39

Export insurance

CIF to Brazilian port

Exchange rate (R$/US$)

CIF to Brazilian port (R$)

Brazilian Importation Costs

Import duties (ID)

Merchant marine renovation fee (MMRF)

Port storage fees

Port handling fees

Additional handling tax

Customs brokerage fees

Import license

Local transportation charges

Total cost to distributor (R$)

DIAPER PRICES

Small

Medium

Large

Extra Large

Rate

968

You might also like

- Nursery Rhymes Flip ChartDocument23 pagesNursery Rhymes Flip ChartSilvana del Val90% (10)

- International FinanceDocument10 pagesInternational FinancelabelllavistaaNo ratings yet

- MBF13e Chap08 Pbms - FinalDocument25 pagesMBF13e Chap08 Pbms - FinalBrandon Steven Miranda100% (4)

- Exam 1 - VI SolutionsDocument9 pagesExam 1 - VI Solutionssyeda hifzaNo ratings yet

- Instant Download Ebook PDF Entrepreneurship The Practice and Mindset by Heidi M Neck PDF ScribdDocument41 pagesInstant Download Ebook PDF Entrepreneurship The Practice and Mindset by Heidi M Neck PDF Scribdjohn.brandt885100% (47)

- MBF13e Chap10 Pbms - FinalDocument17 pagesMBF13e Chap10 Pbms - FinalYee Cheng80% (5)

- Fund 4e Chap07 PbmsDocument14 pagesFund 4e Chap07 Pbmsjordi92500100% (1)

- Essential Real AnalysisDocument459 pagesEssential Real AnalysisPranay Goswami100% (2)

- 2006 Stanford Consulting Case Interview PreparationDocument62 pages2006 Stanford Consulting Case Interview Preparationr_oko100% (3)

- MBF14e Chap04 Governance PbmsDocument16 pagesMBF14e Chap04 Governance PbmsKarl60% (5)

- Danelia Testbanks Quiz 2345Document46 pagesDanelia Testbanks Quiz 2345Tinatini BakashviliNo ratings yet

- MBF14e Chap05 FX MarketsDocument20 pagesMBF14e Chap05 FX Marketskk50% (2)

- MBF13e Chap07 Pbms - FinalDocument21 pagesMBF13e Chap07 Pbms - FinalMatthew Stojkov100% (6)

- Guide To Tanzania Taxation SystemDocument3 pagesGuide To Tanzania Taxation Systemhima100% (1)

- International Financial Management - Geert Bekaert Robert Hodrick - Chap 02 - SolutionDocument4 pagesInternational Financial Management - Geert Bekaert Robert Hodrick - Chap 02 - SolutionFagbola Oluwatobi OmolajaNo ratings yet

- MBF14e Chap05 FX MarketsDocument20 pagesMBF14e Chap05 FX MarketsHaniyah Nadhira100% (1)

- Math Grade 7 Q2 PDFDocument158 pagesMath Grade 7 Q2 PDFIloise Lou Valdez Barbado100% (2)

- Chapter 01 Solutions PalepuDocument3 pagesChapter 01 Solutions Palepuilhamuh67% (6)

- Chap07 Pbms MBF12eDocument22 pagesChap07 Pbms MBF12eBeatrice Ballabio100% (1)

- EPM Key Design Decisions - Design PhaseDocument7 pagesEPM Key Design Decisions - Design PhaseVishwanath GNo ratings yet

- MBF14e Chap02 Monetary System PbmsDocument13 pagesMBF14e Chap02 Monetary System PbmsKarlNo ratings yet

- Assessment Guidelines For Processing Operations Hydrocarbons VQDocument47 pagesAssessment Guidelines For Processing Operations Hydrocarbons VQMatthewNo ratings yet

- Ch8 Practice ProblemsDocument5 pagesCh8 Practice Problemsvandung19No ratings yet

- BRD 1834 Aug 16 BookDocument450 pagesBRD 1834 Aug 16 BookAnonymous ktIKDRGCzNo ratings yet

- BUS322Tutorial8 SolutionDocument10 pagesBUS322Tutorial8 Solutionjacklee1918100% (1)

- Chapter Fourteen Foreign Exchange RiskDocument14 pagesChapter Fourteen Foreign Exchange Risknmurar01No ratings yet

- Chapter 11Document2 pagesChapter 11atuanaini0% (1)

- Chap11 Translation PbmsDocument10 pagesChap11 Translation Pbmskk100% (2)

- Chap13 Pbms MBF12eDocument10 pagesChap13 Pbms MBF12enahorrNo ratings yet

- Ch12 HW SolutionsDocument16 pagesCh12 HW Solutionsgilli1tr100% (1)

- MBF13e Chap06 Pbms - FinalDocument20 pagesMBF13e Chap06 Pbms - Finalaveenobeatnik100% (2)

- Summer 2021 FIN 6055 New Test 2Document2 pagesSummer 2021 FIN 6055 New Test 2Michael Pirone0% (1)

- Multinational Business Finance 10th Edition Solution ManualDocument8 pagesMultinational Business Finance 10th Edition Solution ManualrspkamalgmailcomNo ratings yet

- Mid-Term I Review QuestionsDocument7 pagesMid-Term I Review Questionsbigbadbear3100% (1)

- Spot Exchange Markets. Quiz QuestionsDocument14 pagesSpot Exchange Markets. Quiz Questionsym5c2324100% (1)

- Chap 6 ProblemsDocument5 pagesChap 6 ProblemsCecilia Ooi Shu QingNo ratings yet

- Chapter 13 - Class Notes PDFDocument33 pagesChapter 13 - Class Notes PDFJilynn SeahNo ratings yet

- FX II PracticeDocument10 pagesFX II PracticeFinanceman4No ratings yet

- Week 3 Tutorial ProblemsDocument6 pagesWeek 3 Tutorial ProblemsWOP INVESTNo ratings yet

- Ch07 SSolDocument7 pagesCh07 SSolvenkeeeee100% (1)

- Finance - Module 7Document3 pagesFinance - Module 7luckybella100% (1)

- International Finance Tutorial 3 Answer-HafeezDocument5 pagesInternational Finance Tutorial 3 Answer-HafeezMohd Hafeez NizamNo ratings yet

- Solnik Chapter 3 Solutions To Questions & Problems (6th Edition)Document6 pagesSolnik Chapter 3 Solutions To Questions & Problems (6th Edition)gilli1trNo ratings yet

- TB Chapter 20Document14 pagesTB Chapter 20Mon LuffyNo ratings yet

- Case Study ch6Document3 pagesCase Study ch6shouqNo ratings yet

- International FinanceDocument181 pagesInternational FinanceadhishsirNo ratings yet

- MBFinance Chap06-Pbms-finalDocument20 pagesMBFinance Chap06-Pbms-finalLinda YuNo ratings yet

- Swaps: Problem 7.1Document4 pagesSwaps: Problem 7.1Hana LeeNo ratings yet

- Week 2 Tutorial QuestionsDocument4 pagesWeek 2 Tutorial QuestionsWOP INVESTNo ratings yet

- Chapter 5: The Market For Foreign ExchangeDocument19 pagesChapter 5: The Market For Foreign ExchangeDang ThanhNo ratings yet

- Bus 322 Tutorial 5-SolutionDocument20 pagesBus 322 Tutorial 5-Solutionbvni50% (2)

- Growth of Corporation Occurs Through 1. Internal Expansion That Is Growth 2. MergersDocument8 pagesGrowth of Corporation Occurs Through 1. Internal Expansion That Is Growth 2. MergersFazul Rehman100% (1)

- UntitledDocument5 pagesUntitledsuperorbitalNo ratings yet

- Chapter 2 - Part 2 - Problems - AnswersDocument3 pagesChapter 2 - Part 2 - Problems - Answersyenlth940% (2)

- BÀI TẬP TÀI CHÍNH QUỐC TẾDocument2 pagesBÀI TẬP TÀI CHÍNH QUỐC TẾXuan KimNo ratings yet

- Problem 19.1 Trefica de Honduras: Assumptions ValuesDocument2 pagesProblem 19.1 Trefica de Honduras: Assumptions ValueskamlNo ratings yet

- Pbm7 2Document1 pagePbm7 2jordi92500No ratings yet

- Foreign Currency Derivatives and Swaps: QuestionsDocument6 pagesForeign Currency Derivatives and Swaps: QuestionsCarl AzizNo ratings yet

- Ch1-Multinational Financial Management-An OverviewDocument17 pagesCh1-Multinational Financial Management-An Overviewbenu50% (2)

- SM Multinational Financial Management ch09Document5 pagesSM Multinational Financial Management ch09ariftanur100% (1)

- MBF12 CH3 Question BankDocument15 pagesMBF12 CH3 Question BankwertyuoiuNo ratings yet

- Solution Chapter 6 International FinanceDocument6 pagesSolution Chapter 6 International FinanceHương Lan TrịnhNo ratings yet

- Chapter 3Document22 pagesChapter 3Feriel El IlmiNo ratings yet

- Chap08 Pbms SolutionsDocument25 pagesChap08 Pbms SolutionsDouglas Estrada100% (1)

- Problem 20.1 Nikken Microsystems (A) : Assumptions ValuesDocument11 pagesProblem 20.1 Nikken Microsystems (A) : Assumptions ValuesKesarapu Venkata ApparaoNo ratings yet

- Particulars Amount Amount Rs. (DR.) Rs. (DR.)Document14 pagesParticulars Amount Amount Rs. (DR.) Rs. (DR.)Alka DwivediNo ratings yet

- 22049896 - Presentation Submission for session 11 - Nguyễn Hữu Minh TuấnDocument11 pages22049896 - Presentation Submission for session 11 - Nguyễn Hữu Minh TuấnTuấn NguyễnNo ratings yet

- Week 7 Home Work ProblemDocument3 pagesWeek 7 Home Work ProblemSandip AgarwalNo ratings yet

- Adv ch-3Document20 pagesAdv ch-3Prof. Dr. Anbalagan ChinniahNo ratings yet

- L8 - Human Resource ManagementDocument6 pagesL8 - Human Resource ManagementAnonymous 8ooQmMoNs1No ratings yet

- L3 - Planning and GoalsDocument9 pagesL3 - Planning and GoalsAnonymous 8ooQmMoNs1No ratings yet

- L9 - Dynamics of Behaviour in OrganisationsDocument5 pagesL9 - Dynamics of Behaviour in OrganisationsAnonymous 8ooQmMoNs1No ratings yet

- L6 - LeadershipDocument11 pagesL6 - LeadershipAnonymous 8ooQmMoNs1No ratings yet

- L5 - OrganisingDocument13 pagesL5 - OrganisingAnonymous 8ooQmMoNs1No ratings yet

- L1 - The Changing Paradigm of ManagementDocument8 pagesL1 - The Changing Paradigm of ManagementAnonymous 8ooQmMoNs1No ratings yet

- L7 - Managing DiversityDocument5 pagesL7 - Managing DiversityAnonymous 8ooQmMoNs1No ratings yet

- L4 - Managerial Decision MakingDocument9 pagesL4 - Managerial Decision MakingAnonymous 8ooQmMoNs1No ratings yet

- Richard Osborne - MythDocument3 pagesRichard Osborne - MythAnonymous 8ooQmMoNs1No ratings yet

- Bill Niven War MemorialsDocument7 pagesBill Niven War MemorialsAnonymous 8ooQmMoNs1No ratings yet

- Portelli Massacre at Fosse ArdeatineDocument9 pagesPortelli Massacre at Fosse ArdeatineAnonymous 8ooQmMoNs1No ratings yet

- Bill Niven War MemorialsDocument7 pagesBill Niven War MemorialsAnonymous 8ooQmMoNs1No ratings yet

- Philip Taylor PropagandaDocument3 pagesPhilip Taylor PropagandaAnonymous 8ooQmMoNs1No ratings yet

- Sontag Collective MemoryDocument7 pagesSontag Collective MemoryAnonymous 8ooQmMoNs1No ratings yet

- Fit Interview 071712 PDFDocument14 pagesFit Interview 071712 PDFAnonymous 9W8HM1nqXBNo ratings yet

- Weak & Strong FormsDocument77 pagesWeak & Strong FormsAnonymous 8ooQmMoNs1No ratings yet

- Ginsborg History of ItalyDocument8 pagesGinsborg History of ItalyAnonymous 8ooQmMoNs10% (1)

- Harry HearderDocument15 pagesHarry HearderAnonymous 8ooQmMoNs1No ratings yet

- Jock Reynolds J LT RookiesDocument14 pagesJock Reynolds J LT RookiesAnonymous 8ooQmMoNs1No ratings yet

- 08 AnsDocument13 pages08 AnsAnonymous 8ooQmMoNs1No ratings yet

- Lectures 1-3 COLOURDocument45 pagesLectures 1-3 COLOURAnonymous 8ooQmMoNs1No ratings yet

- Arithmetic Test Example PDFDocument1 pageArithmetic Test Example PDFAnonymous 8ooQmMoNs1No ratings yet

- 07 AnsDocument5 pages07 AnsAnonymous 8ooQmMoNs10% (1)

- 04 AnsDocument20 pages04 AnsAnonymous 8ooQmMoNs1No ratings yet

- Grammar Guide 2018Document56 pagesGrammar Guide 2018Tony NguerezaNo ratings yet

- 05 AnsDocument8 pages05 AnsAnonymous 8ooQmMoNs1No ratings yet

- 06 AnsDocument4 pages06 AnsAnonymous 8ooQmMoNs1No ratings yet

- 02 AnsDocument10 pages02 AnsAnonymous 8ooQmMoNs1No ratings yet

- F4-Geography Pre-Mock Exam 18.08.2021Document6 pagesF4-Geography Pre-Mock Exam 18.08.2021JOHNNo ratings yet

- NLP - Neuro-Linguistic Programming Free Theory Training Guide, NLP Definitions and PrinciplesDocument11 pagesNLP - Neuro-Linguistic Programming Free Theory Training Guide, NLP Definitions and PrinciplesyacapinburgosNo ratings yet

- (Medicine and Biomedical Sciences in Modern History) Ornella Moscucci (Auth.) - Gender and Cancer in England, 1860-1948-Palgrave Macmillan UK (2016)Document347 pages(Medicine and Biomedical Sciences in Modern History) Ornella Moscucci (Auth.) - Gender and Cancer in England, 1860-1948-Palgrave Macmillan UK (2016)Federico AnticapitalistaNo ratings yet

- Gravity & MagneticDocument13 pagesGravity & MagneticBunny Leal100% (1)

- Span of ControlDocument8 pagesSpan of Controlnaveen_gwl100% (4)

- 05 CEE2219 TM2 MidExam - 2018-19 - SolnDocument8 pages05 CEE2219 TM2 MidExam - 2018-19 - SolnCyrus ChartehNo ratings yet

- List of Holidays 2019Document1 pageList of Holidays 2019abhishek ranaNo ratings yet

- Digital Culture and The Practices of ArtDocument31 pagesDigital Culture and The Practices of ArtLívia NonatoNo ratings yet

- Lynker Technologies LLC U.S. Caribbean Watershed Restoration and Monitoring Coordinator - SE US Job in Remote - GlassdoorDocument4 pagesLynker Technologies LLC U.S. Caribbean Watershed Restoration and Monitoring Coordinator - SE US Job in Remote - GlassdoorCORALationsNo ratings yet

- First Floor Plan SCALE:1:50: Master BedroomDocument1 pageFirst Floor Plan SCALE:1:50: Master BedroomRiya MehtaNo ratings yet

- Lesson10 Sacraments of InitiationDocument76 pagesLesson10 Sacraments of InitiationInsatiable CleeNo ratings yet

- RPMDocument35 pagesRPMnisfyNo ratings yet

- Fallacy of Subjectivity:: ExamplesDocument2 pagesFallacy of Subjectivity:: ExamplesKaustav MannaNo ratings yet

- The Cornerstones of TestingDocument7 pagesThe Cornerstones of TestingOmar Khalid Shohag100% (3)

- Case Note Butler Machine 201718Document4 pagesCase Note Butler Machine 201718Maggie SalisburyNo ratings yet

- Schneider - Ch16 - Inv To CS 8eDocument33 pagesSchneider - Ch16 - Inv To CS 8ePaulo SantosNo ratings yet

- Do 18-A and 18 SGV V de RaedtDocument15 pagesDo 18-A and 18 SGV V de RaedtThomas EdisonNo ratings yet

- Highway MidtermsDocument108 pagesHighway MidtermsAnghelo AlyenaNo ratings yet

- Presentation2 Norman FosterDocument10 pagesPresentation2 Norman FosterAl JhanNo ratings yet

- Measures of Variability For Ungrouped DataDocument16 pagesMeasures of Variability For Ungrouped DataSharonNo ratings yet

- Intel Corporation Analysis: Strategical Management - Tengiz TaktakishviliDocument12 pagesIntel Corporation Analysis: Strategical Management - Tengiz TaktakishviliSandro ChanturidzeNo ratings yet

- The Periodontal Ligament: A Unique, Multifunctional Connective TissueDocument21 pagesThe Periodontal Ligament: A Unique, Multifunctional Connective TissueSamuel Flores CalderonNo ratings yet