Professional Documents

Culture Documents

Session 30 Test

Uploaded by

Anshik Bansal0 ratings0% found this document useful (0 votes)

31 views2 pagesThe document contains the solutions to a post-class test on valuation. It answers multiple choice questions related to using the dividend discount model to value stocks, differences between the dividend discount model and free cash flow to equity models, calculating free cash flow to the firm, what is being valued in the FCFF model, and determining the appropriate debt ratio to use when calculating the cost of capital for a firm transitioning its debt ratio.

Original Description:

ffff

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document contains the solutions to a post-class test on valuation. It answers multiple choice questions related to using the dividend discount model to value stocks, differences between the dividend discount model and free cash flow to equity models, calculating free cash flow to the firm, what is being valued in the FCFF model, and determining the appropriate debt ratio to use when calculating the cost of capital for a firm transitioning its debt ratio.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

31 views2 pagesSession 30 Test

Uploaded by

Anshik BansalThe document contains the solutions to a post-class test on valuation. It answers multiple choice questions related to using the dividend discount model to value stocks, differences between the dividend discount model and free cash flow to equity models, calculating free cash flow to the firm, what is being valued in the FCFF model, and determining the appropriate debt ratio to use when calculating the cost of capital for a firm transitioning its debt ratio.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

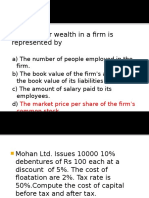

Session

30: Post Class tests

1. In the dividend discount model, you value the equity in a firm by discounting the

expected dividends at the cost of equity. The model therefor cannot be used to

value non-dividend paying stocks.

a. True

b. False

2. With FCFE models, you estimate potential dividends, by computing cash flows

after debt payments and then discounting at the cost of equity. Assume that you

value the same company using both the dividend discount and FCFE models, will

you get the same value for equity?

a. Yes

b. No

3. Maxor Inc. is a manufacturing firm that generated $120 million in EBITDA in the

most recent year. The tax rate was 30%, depreciation charges were $30 million

and capital expenditures were $45 million for the year. If the non-cash working

capital increased by $10 million during the year, estimate the free cash flow to

the firm for the year.

a. $ 8 million

b. $38 million

c. $58 million

d. $66 million

e. None of the above

4. In the FCFF model, what are you valuing when you take the present value of

FCFF at the cost of capital?

a. A value for the equity in the firm

b. A value for assets in the firm

c. A value for all assets whose earnings are shown as a part of operating

income.

d. A value for the assets in place for the firm

e. None of the above.

5. When valuing a firm, you discount the FCFF at the cost of capital. Assume that

the firm that you are valuing has an actual debt ratio of 10% and a target debt

ratio of 40%, which it is planning to move to gradually over the next 10 years.

What debt ratio should you use to compute the cost of capital for this firm?

a. The actual debt ratio (10%)

b. The target debt ratio (40%)

c. An average of the actual and target debt ratios (25%)

d. The expected debt ratio each year to get a cost of capital each year

Session 30: Post class test solutions

1. b. False. Even if a firm is not paying dividends right now, you may expect it

to start paying dividends in the future and you can value the stock based on

expected future dividends.

2. b. No. When dividends are different from FCFE, there can be value effects

from either under paying dividends or over paying dividends. For instance, if

a firm pays less in dividends than FCFE and proceeds to waste the cash, the

value of equity can be lower from the dividend discount model.

3. b. $38 million.

EBIT = 120 30 = $90 million

EBIT (1-t) + Depreciation Cap Ex Change in non-cash WC = 90 (1-.3) + 30-

45 -10 = $38 million

4. c. A value for all assets whose earnings are shown as a part of operating

income. Since the FCFF builds off operating income, you value only those

assets that are part of operating income.

5. d. The expected debt ratio each year to get a year-specific cost of capital.

The cost of capital can and often should be different each year in a valuation.

You might also like

- FINC3015 Final Exam Sample QuestionsDocument5 pagesFINC3015 Final Exam Sample QuestionsTecwyn LimNo ratings yet

- BUS 306 Exam 1 - Spring 2011 (B) - Solution by MateevDocument10 pagesBUS 306 Exam 1 - Spring 2011 (B) - Solution by Mateevabhilash5384No ratings yet

- Exam III Practice ProblemsDocument10 pagesExam III Practice ProblemsAbdul SattarNo ratings yet

- CV Midterm Exam 1 - Solution GuideDocument11 pagesCV Midterm Exam 1 - Solution GuideKala Paul100% (1)

- International Financial Management V1Document13 pagesInternational Financial Management V1solvedcareNo ratings yet

- FIN370 Final ExamDocument9 pagesFIN370 Final ExamWellThisIsDifferentNo ratings yet

- IBA Second Term Exam (A) Spring 2016 Financial ManagementDocument6 pagesIBA Second Term Exam (A) Spring 2016 Financial ManagementHaneefa Soomro0% (1)

- Chapter 1 - CompleteDocument27 pagesChapter 1 - Completemohsin razaNo ratings yet

- FINA 410 - Exercises (NOV)Document7 pagesFINA 410 - Exercises (NOV)said100% (1)

- FNCE 203 Practice Final Exam #1 - Answer Key: InstructionsDocument14 pagesFNCE 203 Practice Final Exam #1 - Answer Key: InstructionsJoel Christian MascariñaNo ratings yet

- BBA07Final09 Marking SchemeDocument4 pagesBBA07Final09 Marking SchemeKamal AkzNo ratings yet

- Business FinanceDocument6 pagesBusiness FinanceChhabilal KandelNo ratings yet

- Financial Management QualiDocument6 pagesFinancial Management QualiJaime II LustadoNo ratings yet

- BUS 635 Quiz3 Sum15 AnswersDocument5 pagesBUS 635 Quiz3 Sum15 AnswershnoamanNo ratings yet

- Corporate Finance - Mock ExamDocument5 pagesCorporate Finance - Mock ExamMinh Hạnh NguyễnNo ratings yet

- Assignments: Program: Mba Ib Semester-IiDocument13 pagesAssignments: Program: Mba Ib Semester-IiSekla ShaqdieselNo ratings yet

- Solutions Class Examples AFM2015Document36 pagesSolutions Class Examples AFM2015SherelleJiaxinLiNo ratings yet

- Solution Final Advanced Acc. First09 10Document6 pagesSolution Final Advanced Acc. First09 10RodNo ratings yet

- Chapter 1 - Updated-1 PDFDocument29 pagesChapter 1 - Updated-1 PDFj000diNo ratings yet

- Exam AnswersDocument5 pagesExam AnswersKelly Smith100% (2)

- Ch9Cost of CapProbset 13ed - MastersDFDocument4 pagesCh9Cost of CapProbset 13ed - MastersDFJaneNo ratings yet

- Sample of The Fin320 Department Final Exam With SolutionDocument10 pagesSample of The Fin320 Department Final Exam With Solutionnorbi113100% (1)

- (Lecture 8 & 9) - Cost of CapitalDocument22 pages(Lecture 8 & 9) - Cost of CapitalAjay Kumar TakiarNo ratings yet

- FIN3701 Tutorial 2 QuestionsDocument4 pagesFIN3701 Tutorial 2 QuestionsYeonjae SoNo ratings yet

- Financial Management. Instructor; Lê Vinh TriểnDocument22 pagesFinancial Management. Instructor; Lê Vinh TriểndoannamphuocNo ratings yet

- AUBG Midterm Exam 2 Solutions GuideDocument15 pagesAUBG Midterm Exam 2 Solutions GuideCyn SyjucoNo ratings yet

- Paper 12Document2,606 pagesPaper 12123shru50% (4)

- Problem Set RecapsDocument3 pagesProblem Set Recapslahlou1242No ratings yet

- Modjo Comprehensive FM AssignmentDocument4 pagesModjo Comprehensive FM Assignmentnatnaelbtamu haNo ratings yet

- Cfa L 1 Mock Test Paper - Solution - 2024Document8 pagesCfa L 1 Mock Test Paper - Solution - 2024guayrestudioNo ratings yet

- Time-Bound Home Exam-2020: Purbanchal UniversityDocument2 pagesTime-Bound Home Exam-2020: Purbanchal UniversityEnysa DlNo ratings yet

- Cost of CapitalDocument67 pagesCost of Capitalkhushi mishaNo ratings yet

- TT-2 MCQDocument7 pagesTT-2 MCQKapilBudhiraja100% (1)

- fm2 mq1Document4 pagesfm2 mq1Ramon Jonathan SapalaranNo ratings yet

- Leverage: Let's DiscussDocument9 pagesLeverage: Let's DiscussClaudette ManaloNo ratings yet

- True or False: Cost of Capital Components and WACC CalculationDocument3 pagesTrue or False: Cost of Capital Components and WACC CalculationASUS 14 A416No ratings yet

- Coroporate Finance ExamDocument4 pagesCoroporate Finance ExammustafaNo ratings yet

- Iefinmt Reviewer For Quiz (#2) : I. IdentificationDocument9 pagesIefinmt Reviewer For Quiz (#2) : I. IdentificationpppppNo ratings yet

- Ratios Test PaperDocument7 pagesRatios Test Papermeesam2100% (1)

- Cost of CapitalDocument39 pagesCost of CapitalEkta JaiswalNo ratings yet

- MCQ 501Document90 pagesMCQ 501haqmalNo ratings yet

- Valuing Common Stocks with Discounted Cash FlowDocument8 pagesValuing Common Stocks with Discounted Cash FlowMadhuram SharmaNo ratings yet

- Fin 455 Fall 2017 FinalDocument10 pagesFin 455 Fall 2017 FinaldasfNo ratings yet

- BUS 497a - Homework 1 - Solution GuideDocument5 pagesBUS 497a - Homework 1 - Solution GuidesaltyaxelNo ratings yet

- Chapters 9 and 10 EditedDocument18 pagesChapters 9 and 10 Editedomar_geryesNo ratings yet

- Allied Food Capital BudgetingDocument4 pagesAllied Food Capital BudgetingHaznetta HowellNo ratings yet

- Eco (Hons.) - BCH 2.4 (B) - GE-FINANCE - RuchikaChoudharyDocument27 pagesEco (Hons.) - BCH 2.4 (B) - GE-FINANCE - RuchikaChoudharyPrashant KumarNo ratings yet

- MAS PrefinalsDocument10 pagesMAS PrefinalsBeverly IgnacioNo ratings yet

- Compre BAV QP 2019-20 1Document3 pagesCompre BAV QP 2019-20 1f20211062No ratings yet

- Problem Set 1Document5 pagesProblem Set 1PaulNo ratings yet

- Exam 2 PracticeDocument4 pagesExam 2 PracticeRaunak KoiralaNo ratings yet

- Topic 3 FM Presentation1 Lidia'sDocument19 pagesTopic 3 FM Presentation1 Lidia'sLidia SamuelNo ratings yet

- MainExam 2018 PDFDocument12 pagesMainExam 2018 PDFAnonymous hGNXxMNo ratings yet

- PART-A (Closed Book) (75 Mins)Document4 pagesPART-A (Closed Book) (75 Mins)DEVANSH CHANDRAWATNo ratings yet

- Underline The Final Answers: ONLY If Any Question Lacks Information, State Your Reasonable Assumption and ProceedDocument4 pagesUnderline The Final Answers: ONLY If Any Question Lacks Information, State Your Reasonable Assumption and ProceedAbhishek GhoshNo ratings yet

- Cost of CapitalDocument39 pagesCost of CapitalAnonymous ibmeej9No ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- Beyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkFrom EverandBeyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkNo ratings yet

- SQL Sqlite Commands Cheat Sheet PDFDocument5 pagesSQL Sqlite Commands Cheat Sheet PDFAnshik BansalNo ratings yet

- Spark Python Install PDFDocument3 pagesSpark Python Install PDFAnshik BansalNo ratings yet

- Dell CampusambasadorDocument4 pagesDell CampusambasadorAnshik BansalNo ratings yet

- Valuation: Cash Flows & Discount RatesDocument12 pagesValuation: Cash Flows & Discount RatesAnshik BansalNo ratings yet

- Session 24Document16 pagesSession 24Anshik BansalNo ratings yet

- Session 29Document11 pagesSession 29Anshik BansalNo ratings yet

- Session 29 TestDocument2 pagesSession 29 TestAnshik BansalNo ratings yet

- The Best of Charlie Munger 1994 2011Document349 pagesThe Best of Charlie Munger 1994 2011VALUEWALK LLC100% (6)

- Valuation: Future Growth and Cash FlowsDocument12 pagesValuation: Future Growth and Cash FlowsAnshik BansalNo ratings yet

- Session 32Document16 pagesSession 32Anshik BansalNo ratings yet

- Session 27Document18 pagesSession 27Anshik BansalNo ratings yet

- Dividends: Peer Group Analysis: Me Too, Me Too.Document10 pagesDividends: Peer Group Analysis: Me Too, Me Too.Anshik BansalNo ratings yet

- Session 31 TestDocument3 pagesSession 31 TestAnshik BansalNo ratings yet

- Session 28 TestDocument2 pagesSession 28 TestAnshik BansalNo ratings yet

- Session 27 TestDocument2 pagesSession 27 TestAnshik BansalNo ratings yet

- Dividends: The Trade Off Between Cash Returns and InvestmentDocument19 pagesDividends: The Trade Off Between Cash Returns and InvestmentAnshik BansalNo ratings yet

- Post Class Tests Solutions and Dividend Policies to Increase LeverageDocument3 pagesPost Class Tests Solutions and Dividend Policies to Increase LeverageAnshik BansalNo ratings yet

- The Cash-Trust Nexus AssessmentDocument13 pagesThe Cash-Trust Nexus AssessmentAnshik BansalNo ratings yet

- Optimal Financing Mix Iv: Wrapping Up The Cost of Capital ApproachDocument16 pagesOptimal Financing Mix Iv: Wrapping Up The Cost of Capital ApproachAnshik BansalNo ratings yet

- Session 18Document19 pagesSession 18Anshik BansalNo ratings yet

- Session 25 TestDocument3 pagesSession 25 TestAnshik BansalNo ratings yet

- The Right Financing: The Perfect Financing For You. Yes, It Exists!Document17 pagesThe Right Financing: The Perfect Financing For You. Yes, It Exists!Anshik BansalNo ratings yet

- Session 24 TestDocument2 pagesSession 24 TestAnshik BansalNo ratings yet

- Getting To The Optimal Financing MixDocument7 pagesGetting To The Optimal Financing MixAnshik BansalNo ratings yet

- Investment Returns Iii: Loose Ends: No Garnishing Allowed in Investment AnalysisDocument16 pagesInvestment Returns Iii: Loose Ends: No Garnishing Allowed in Investment AnalysisAnshik BansalNo ratings yet

- Session 20 TestDocument2 pagesSession 20 TestAnshik BansalNo ratings yet

- Session 23 TestDocument2 pagesSession 23 TestAnshik BansalNo ratings yet

- Session 22 TestDocument3 pagesSession 22 TestAnshik BansalNo ratings yet

- Optimal Financing Mix Approach Adjusted Present ValueDocument16 pagesOptimal Financing Mix Approach Adjusted Present ValueAnshik BansalNo ratings yet

- 01 Modeling Core Concepts GuideDocument35 pages01 Modeling Core Concepts GuideanitalauymNo ratings yet

- Ilham AdzakyDocument9 pagesIlham AdzakyMoe ChannelNo ratings yet

- Risk Latte - RAROC of A Corporate Loan - "Back of The Envelope" CalculationsDocument3 pagesRisk Latte - RAROC of A Corporate Loan - "Back of The Envelope" CalculationsAshley JomyNo ratings yet

- Candle StrategyDocument6 pagesCandle StrategyBichitrananda MishraNo ratings yet

- q4 Marketing Plan Principles of MarketingDocument3 pagesq4 Marketing Plan Principles of MarketingCharlene EbordaNo ratings yet

- Problem Set 3 SolutionDocument12 pagesProblem Set 3 SolutionMaxNo ratings yet

- Quantitative Problems Chapter 13: Exchange Rates and Interest RatesDocument4 pagesQuantitative Problems Chapter 13: Exchange Rates and Interest RatesUmer Hayat TajikNo ratings yet

- Chapter SevenDocument8 pagesChapter SevenAsif HossainNo ratings yet

- Accounting Chapter 3 PDFDocument7 pagesAccounting Chapter 3 PDFJanna GunioNo ratings yet

- Calculate NUC from local currency faresDocument5 pagesCalculate NUC from local currency faresHassan FouadNo ratings yet

- Essentials of Entrepreneurship and Small Business Management 7th Edition Scarborough Test BankDocument28 pagesEssentials of Entrepreneurship and Small Business Management 7th Edition Scarborough Test Bankdipolarramenta7uyxw100% (19)

- Mishkin Fmi07 Ppt03Document43 pagesMishkin Fmi07 Ppt03Wahbeeah MohtiNo ratings yet

- NCFM Model Test PaperDocument8 pagesNCFM Model Test PapersplfriendsNo ratings yet

- Iron Condor Vs Steady Condor - How We Trade OptionsDocument12 pagesIron Condor Vs Steady Condor - How We Trade Optionsbarkha raniNo ratings yet

- 02 - Price Action StrategiesDocument82 pages02 - Price Action Strategiesvvpvarun94% (63)

- Nomura Warns S&P 500 Options Driven Vol Killer Looms Into Year EndDocument8 pagesNomura Warns S&P 500 Options Driven Vol Killer Looms Into Year EndKien NguyenNo ratings yet

- Chapter 8Document4 pagesChapter 8rcraw87No ratings yet

- Basics of Candlesticks PDFDocument9 pagesBasics of Candlesticks PDFNguyen hoangNo ratings yet

- Instruction: Write Your Answer in A One Whole Sheet of Paper and Upload It inDocument2 pagesInstruction: Write Your Answer in A One Whole Sheet of Paper and Upload It inJeane Mae BooNo ratings yet

- NPO MidtermDocument4 pagesNPO MidtermPatrick Ferdinand AlvarezNo ratings yet

- Finance Essay Shadow BankingDocument3 pagesFinance Essay Shadow BankingSarah AzlinaNo ratings yet

- Technical Analysis of Stocks Commodities 2015 No 05 May PDFDocument64 pagesTechnical Analysis of Stocks Commodities 2015 No 05 May PDFs9298No ratings yet

- Geogit BNP Paribas ProjectDocument54 pagesGeogit BNP Paribas ProjectAbdul Kadir ArsiwalaNo ratings yet

- A Beginner's Guide To The Stock Market - Everything You Need To Start Making Money Today by Matthew KratterDocument82 pagesA Beginner's Guide To The Stock Market - Everything You Need To Start Making Money Today by Matthew KratterSuhel Faraz100% (2)

- Equity Derivatives Exam Series QuestionsDocument6 pagesEquity Derivatives Exam Series QuestionsManish TandaleNo ratings yet

- Tutorial on security market indicesDocument2 pagesTutorial on security market indicesOne AshleyNo ratings yet

- Meaning of Variables:: Derivatives ProblemsDocument7 pagesMeaning of Variables:: Derivatives Problemsbhavani sankar areNo ratings yet

- Yield IncomeDocument22 pagesYield IncomejNo ratings yet

- Dividend Policy and Retained EarningDocument28 pagesDividend Policy and Retained EarningMd Abusaied AsikNo ratings yet

- Launchpool - Report 2021Document15 pagesLaunchpool - Report 2021Sam HarveyNo ratings yet