Professional Documents

Culture Documents

Daywork Rates

Uploaded by

ebed_meleckCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Daywork Rates

Uploaded by

ebed_meleckCopyright:

Available Formats

Daywork and Prime Cost

Building Industry

Example of calculation of standard hourly base rate, as defined in Section 3 of RICS/Construction

Confederation Definition of Prime Cost of Daywork carried out under a Building Contract, for typical building

craft operative and general operative from 6 April 2012.

Craft Operative

Rate

Rate

pw

pa

Guaranteed minimum weekly earnings

Standard Basic Rate 46 weeks

Employers National Insurance Contribution at 13.8%

(above secondary threshold of 144 per week - see notes 6 & 7)

Employers contribution to:

CITB annual levy (see note 7)

Holiday with pay: 234 hours @

Welfare benefit: 52 credits @

Annual Labour cost

Hourly rate of labour

407.94

General Operative

Rate

Rate

pw

pa

18,765.24

306.93

1,675.49

10.46

11.39

14,118.78

1,034.28

106.06

2,447.64

592.28

7.87

11.39

79.80

1,841.58

592.28

23,586.71

17,666.72

Craft Operative

23,586.71

1794

= 13.15

General Operative

17,666.72

1794

= 9.85

NOTES

1. Standard working hours per annum calculated as: 52 weeks @ 39 hours, less holiday of 234 hours = 1794

2. It should be noted that all labour costs incurred by the contractor in his capacity as an employer, other than those contained in the

hourly rate, are to be taken into account under Section 6.

3. The above example does not include all likely costs. It is for the convenience of users only and does not form part of the

Definitions. All basic costs are subject to re-examination according to the time when and the area where the daywork is executed.

4. The calculation of your costs should take into consideration any additional and/or statutory holiday pay.

5. The number of hours worked in the year shown in the calculation are those applicable to England and Wales.

6. The calculation shows the rate of the Employers National Insurance contribution to be 13.8% for both a craft operative and for a

general operative on earnings above the secondary threshold of 144.00 per week

7. The CITB-ConstructionSkills levy payable by employers is 0.5% of payroll in respect of all employees employed by them (1.5% for

labour only subcontractors) in the industry in the preceding financial year.

You might also like

- Investments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsFrom EverandInvestments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- Business Reporting July 2010 Marks PlanDocument24 pagesBusiness Reporting July 2010 Marks PlanMohammed HammadNo ratings yet

- Sa5 Pu 14 PDFDocument102 pagesSa5 Pu 14 PDFPolelarNo ratings yet

- VanDerbeck14e SM Ch03Document32 pagesVanDerbeck14e SM Ch03Mahnoor MaalikNo ratings yet

- Chapter 3 Accounting For Labor: Review SummaryDocument12 pagesChapter 3 Accounting For Labor: Review SummaryRoann Noguerraza BorjaNo ratings yet

- Cost Accounting2Document12 pagesCost Accounting2stephborinaga0% (2)

- Tips - Estimating Day Work Rates 2nd EditionDocument52 pagesTips - Estimating Day Work Rates 2nd EditionNisay QSNo ratings yet

- Assignment C: Malta College of Arts & Science & TechnologyDocument13 pagesAssignment C: Malta College of Arts & Science & TechnologyKarl AttardNo ratings yet

- Paper P4 Advanced Financial Management: Tuition Mock Examination June 2012 Answer GuideDocument21 pagesPaper P4 Advanced Financial Management: Tuition Mock Examination June 2012 Answer Guideseemi_ariesNo ratings yet

- Guideline For Calculating Hourly RateDocument4 pagesGuideline For Calculating Hourly RatemallinathpnNo ratings yet

- Nes 124 - Quiz #6Document2 pagesNes 124 - Quiz #6PatrickNo ratings yet

- Taxation (United Kingdom) : Tuesday 4 June 2013Document22 pagesTaxation (United Kingdom) : Tuesday 4 June 2013Eric MugaNo ratings yet

- Yaniza, Regine Mae L. - ULO 3A Let's Check: Situation 01Document7 pagesYaniza, Regine Mae L. - ULO 3A Let's Check: Situation 01Regine Mae Lustica Yaniza100% (1)

- 4Ch11 Financial AnalysiskDocument14 pages4Ch11 Financial AnalysiskJoshua EllisNo ratings yet

- ST2 Pu 13Document44 pagesST2 Pu 13Shabbeer ZafarNo ratings yet

- FA Answer KeyDocument9 pagesFA Answer Keyimsana minatozakiNo ratings yet

- Project Financial Evaluation: Introduction To Financial Figures of MeritDocument5 pagesProject Financial Evaluation: Introduction To Financial Figures of MeritjupadhyayNo ratings yet

- Food Engineering Design and EconomicsDocument53 pagesFood Engineering Design and EconomicsMohammad Reza AnghaeiNo ratings yet

- POA 2008 ZA + ZB CommentariesDocument28 pagesPOA 2008 ZA + ZB CommentariesEmily TanNo ratings yet

- Chapter 12Document58 pagesChapter 12Léo Audibert0% (1)

- Investment AppraisalDocument24 pagesInvestment AppraisalDeepankumar AthiyannanNo ratings yet

- 4.11 Financial Analysis1 G2Document15 pages4.11 Financial Analysis1 G2aravindan_muthuNo ratings yet

- 2-4 2005 Dec ADocument14 pages2-4 2005 Dec AnsarahnNo ratings yet

- Construction Contracts-IAS 11 & Rev Rec & Journals-EY-PG22Document22 pagesConstruction Contracts-IAS 11 & Rev Rec & Journals-EY-PG22varadu1963No ratings yet

- Chapter 6 2021 RevisionDocument20 pagesChapter 6 2021 RevisionAri LosNo ratings yet

- Other Supporting Docs NeededDocument33 pagesOther Supporting Docs NeededMark Ivan JagodillaNo ratings yet

- AirThread G015Document6 pagesAirThread G015Kunal MaheshwariNo ratings yet

- Capital BudgetingDocument3 pagesCapital BudgetingAnonymous LC5kFdtcNo ratings yet

- Management Accounting/Series-3-2007 (Code3023)Document15 pagesManagement Accounting/Series-3-2007 (Code3023)Hein Linn Kyaw100% (1)

- IAS 19, Employee Benefits - Publications - Members - ACCADocument3 pagesIAS 19, Employee Benefits - Publications - Members - ACCAWaqas Ahmad KhanNo ratings yet

- Cap BudDocument29 pagesCap BudJorelyn Joy Balbaloza CandoyNo ratings yet

- Cost Benefit Analysis ToolkitDocument8 pagesCost Benefit Analysis ToolkitAmila Kulathunga100% (1)

- CH13MANDocument50 pagesCH13MANEmranul Islam ShovonNo ratings yet

- Economic ReportDocument9 pagesEconomic ReportYeeXuan TenNo ratings yet

- Sa Mar13 p6 Unincorp2Document9 pagesSa Mar13 p6 Unincorp2Hasan Ali BokhariNo ratings yet

- ContinueDocument3 pagesContinueHannah Denise BatallangNo ratings yet

- Sample Document Preliminary Energy Audit TemplateDocument22 pagesSample Document Preliminary Energy Audit TemplateYogesh ChaudhariNo ratings yet

- M10 Employee BenefitsDocument51 pagesM10 Employee BenefitsbelijobNo ratings yet

- Prime Cost of Daywork Rates 2014-15Document1 pagePrime Cost of Daywork Rates 2014-15Peter Jean-jacquesNo ratings yet

- Chapter 14 - Economic Analysis of Agricultural MachinesDocument25 pagesChapter 14 - Economic Analysis of Agricultural MachinesVonne Bryan IhalasNo ratings yet

- Mid Term 2ndDocument16 pagesMid Term 2ndMinh Thư Nguyễn ThịNo ratings yet

- FM202 - Exam Q - 2011-2 - Financial Accounting 202 V3 - AM NV DRdocDocument6 pagesFM202 - Exam Q - 2011-2 - Financial Accounting 202 V3 - AM NV DRdocMaxine IgnatiukNo ratings yet

- Financial Decision Making - Sample Suggested AnswersDocument14 pagesFinancial Decision Making - Sample Suggested AnswersRaymond RayNo ratings yet

- Lsbf.p4 Mock QuesDocument21 pagesLsbf.p4 Mock Quesjunaid-chandio-458No ratings yet

- Idoc - Pub 169018566 Engineering Economy 7th Edition Solution Manual Blank Tarquin 160312152003Document6 pagesIdoc - Pub 169018566 Engineering Economy 7th Edition Solution Manual Blank Tarquin 160312152003Tural RamazanovNo ratings yet

- Taxation of An Unincorporated Business Part 2 - The Existing BusinessDocument9 pagesTaxation of An Unincorporated Business Part 2 - The Existing BusinessIkram KhokharNo ratings yet

- Sa4 Pu 15 PDFDocument9 pagesSa4 Pu 15 PDFPolelarNo ratings yet

- 2009-Management Accounting Main EQP and CommentariesDocument53 pages2009-Management Accounting Main EQP and CommentariesBryan Sing100% (1)

- 2-4 2005 Jun QDocument10 pages2-4 2005 Jun QAjay TakiarNo ratings yet

- MBA 7131 - Managerial Economic - Case Study 1Document3 pagesMBA 7131 - Managerial Economic - Case Study 1Malar VeelyNo ratings yet

- Investment AppraisalDocument23 pagesInvestment AppraisalHuzaifa Abdullah100% (2)

- 6.2 Shadow Bid Model AssumptionsDocument8 pages6.2 Shadow Bid Model Assumptionsshammuji9581No ratings yet

- Smart Meter Analisis Biaya Manfaat UKDocument93 pagesSmart Meter Analisis Biaya Manfaat UKastri06No ratings yet

- AC2097 AC2097 Management Accounting Summer 2020 Online Assessment GuidanceDocument13 pagesAC2097 AC2097 Management Accounting Summer 2020 Online Assessment Guidanceduong duongNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Shoreline and Slipway BillDocument8 pagesShoreline and Slipway Billebed_meleckNo ratings yet

- 4U Business PlanDocument13 pages4U Business Planebed_meleckNo ratings yet

- Inception Report RailDocument7 pagesInception Report Railebed_meleckNo ratings yet

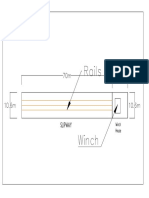

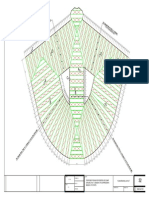

- Slipway Arrangement PDFDocument1 pageSlipway Arrangement PDFebed_meleckNo ratings yet

- Slipway Arrangement PDFDocument1 pageSlipway Arrangement PDFebed_meleckNo ratings yet

- COST of Concrete ProductionDocument14 pagesCOST of Concrete Productionebed_meleckNo ratings yet

- Slipway Arrangement PDFDocument1 pageSlipway Arrangement PDFebed_meleckNo ratings yet

- Truss Type 1 (04-13) 2Document1 pageTruss Type 1 (04-13) 2ebed_meleckNo ratings yet

- Code of Procedure v1.0 DraftFinalDocument64 pagesCode of Procedure v1.0 DraftFinalebed_meleckNo ratings yet

- Slipway BEMEDocument4 pagesSlipway BEMEebed_meleckNo ratings yet

- Design Calculation CPDocument34 pagesDesign Calculation CPebed_meleckNo ratings yet

- Distance From Reeference Bollard (M) Depth From SurfaceDocument4 pagesDistance From Reeference Bollard (M) Depth From Surfaceebed_meleckNo ratings yet

- Cathodic Protection DesignDocument23 pagesCathodic Protection Designebed_meleckNo ratings yet

- Truss Type 1 (04-13) 1Document1 pageTruss Type 1 (04-13) 1ebed_meleckNo ratings yet

- Jetty Layout DrawingDocument1 pageJetty Layout Drawingebed_meleck50% (2)

- Plan Bracing Details (32-33)Document1 pagePlan Bracing Details (32-33)ebed_meleckNo ratings yet

- Truss Type 1 (04-13)Document1 pageTruss Type 1 (04-13)ebed_meleckNo ratings yet

- Vol - VI Road Signs and Markings - v1.0 - DraftFinalDocument107 pagesVol - VI Road Signs and Markings - v1.0 - DraftFinalebed_meleckNo ratings yet

- Bridges 6 ComputationsDocument221 pagesBridges 6 Computationsebed_meleck100% (2)

- Week 6 DQDocument3 pagesWeek 6 DQebed_meleckNo ratings yet

- Organisational Behaviour DQ1Document2 pagesOrganisational Behaviour DQ1ebed_meleckNo ratings yet

- Floor PlanDocument1 pageFloor Planebed_meleckNo ratings yet

- Sheet Pile System DrawingDocument1 pageSheet Pile System Drawingebed_meleckNo ratings yet

- Samaila Consultant Limited: Culvert No. Location DateDocument8 pagesSamaila Consultant Limited: Culvert No. Location Dateebed_meleck100% (2)

- Checklist For Inspection For PipelineDocument2 pagesChecklist For Inspection For Pipelineebed_meleckNo ratings yet