Professional Documents

Culture Documents

Elliott Wave Theory Basics

Uploaded by

Sarat KumarCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Elliott Wave Theory Basics

Uploaded by

Sarat KumarCopyright:

Available Formats

Elliott Wave Theory Basics

1 of 7

http://www.tradersedgeindia.com/elliott_wave_theory.htm

Enriching Investors Since 1998

Profitable Trading Solutions for the Intelligent Investor

Home Contact Us Free Newsletter Services SUBSCRIBE Sitemap

About Us

Why Us

Testimonials

Elliott Waves Theory Basics

Newsletter Services

Long Term Investing

Position / Trend Trading

Swing Trading

Day Trading

Futures Trading

Futures Day Trading

Trading Methods

Day Trading

Swing Trading

Trend Trading

Long Term Investing

About Elliott Waves Theory Basics

The Elliott Wave Theory is named after Ralph Nelson Elliott. Inspired by the

Dow Theory and by observations found throughout nature, Elliott concluded

that the movement of the stock market could be predicted by observing and

identifying a repetitive pattern of waves. In fact, Elliott believed that all of

man's activities, not just the stock market, were influenced by these

identifiable series of waves.

Elliott based part his work on the Dow Theory, which also defines price

movement in terms of waves, but Elliott discovered the fractal nature of

market action. Thus Elliott was able to analyze markets in greater depth,

identifying the specific characteristics of wave patterns and making detailed

market predictions based on the patterns he had identified.

Definition of Elliott Waves

Trading Strategies

Basic Technical Analysis

Dow Theory

Elliott Wave Theory

Japanese Candlestick

Multiple Time Frame

Futures & Options

Beginners Guide - Futures

Beginners Guide - Options

FAQs: F & O

Edutorials

External Relative Strength

Exchange Traded Funds

Mastering Risk/Reward

Short Selling

What is Stop Loss

Support & Resistance

Trend is Your Friend

Market Research

In the 1930s, Ralph Nelson Elliott found that the markets exhibited certain

repeated patterns. His primary research was with stock market data for the

Dow Jones Industrial Average. This research identified patterns or waves that

recur in the markets. Very simply, in the direction of the trend, expect five

waves. Any corrections against the trend are in three waves. Three wave

corrections are lettered as "a, b, c." These patterns can be seen in long-term

as well as in short-term charts. Ideally, smaller patterns can be identified

within bigger patterns. In this sense, Elliott Waves are like a piece of broccoli,

where the smaller piece, if broken off from the bigger piece, does, in fact, look

like the big piece. This information (about smaller patterns fitting into bigger

patterns), coupled with the Fibonacci relationships between the waves, offers

the trader a level of anticipation and/or prediction when searching for and

identifying trading opportunities with solid reward/risk ratios.

There have been many theories about the origin and the meaning of the

patterns that Elliott discovered, including human behavior and harmony in

nature. These rules, though, as applied to technical analysis of the markets

(stocks, commodities, futures, etc.), can be very useful regardless of their

meaning and origin.

Simplifying Elliott Wave Analysis

Elliott Wave analysis is a collection of complex techniques. Approximately 60

percent of these techniques are clear and easy to use. The other 40 are

difficult to identify, especially for the beginner. The practical and conservative

approach is to use the 60 percent that are clear.

When the analysis is not clear, why not find another market conforming to an

Elliott Wave pattern that is easier to identify?

Market Gems

Stock Picks

Market Indices

BSE Sensex

NSE Nifty

CNX Nifty Junior

CNX 100

NSE CNX MidCap

NSE IT Sector Index

Trading Resources

Freebies

Mind over Markets

From years of fighting this battle, we have come up with the following practical

approach to using Elliott Wave principles in trading.

Multiply your capital by

investing

in the

long term trends

of

Multi Bagger Stocks

with our

TREND TRADING PICKS

WEEKLY NEWSLETTER

Check Performance

Subscribe Now

Trend Trading

Create wealth for

yourself

by

quickly identifying

changes in trends,

riding the trend

and

booking profits at the

end of the trend

with our

TREND TRADING PICKS

NEWSLETTER

Check Performance

Subscribe Now

Swing Trading

Capture brief price

swings

in

fast moving trending

stocks

for a quick

3-15% profit

in

2-7 days

with our

SWING TRADING PICKS

NEWSLETTER

Check Performance

Subscribe Now

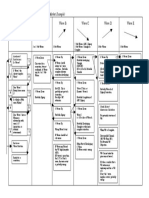

The whole theory of Elliott Wave can be classified into two parts:

Impulse patterns

Corrective patterns

Elliott Wave Basics Impulse Patterns

The impulse pattern consists of five waves. The five waves can be in either

direction, up or down. Some examples are shown to the right and below.The

first wave is usually a weak

rally with only a small

percentage of the traders

participating. Once Wave 1

is over, they sell the market

Day Trading

Capitalize

on

intra-day price

volatility of the most

active stocks in both

BULLISH & BEARISH

Markets

to

generate a steady

stream of daily income

04-05-2014 23:15

Elliott Wave Theory Basics

2 of 7

Stock Charts

Trading Lesson

http://www.tradersedgeindia.com/elliott_wave_theory.htm

with our

DAY TRADING PICKS

NEWSLETTER

Check Performance

Subscribe Now

on Wave 2. The sell-off in

Wave 2 is very vicious.

Wave 2 will finally end

without making new lows

and the market will start to

turn around for another

rally.

Futures Trading

The initial stages of the

Wave 3 rally are slow, and it

finally makes it to the top of

the previous rally (the top of

Wave 1).

At this time, there are a lot

of stops above the top of

Wave 1.

Profit from

uptrends

&

downtrends

in

BULL & BEAR

markets trading

Stock & Index

futures

with our

FUTURES TRADING

NEWSLETTER

Check Performance

Subscribe Now

Futures Day Trading

Extract

maximum profits

everyday

by

taking advantage

of

intra-day volatility

in

highly liquid futures

contract

with our

FUTURES DAY TRADING

NEWSLETTER

Subscribe Now

Traders are not convinced of the upward trend and are using this rally to add

more shorts. For their analysis to be correct, the market should not take the

top of the previous rally.

Therefore, many stops are placed above the top of Wave 1.

The Wave 3 rally

picks up steam

and takes the top

of Wave 1. As

soon as the Wave

1 high is

exceeded, the

stops are taken

out. Depending

04-05-2014 23:15

Elliott Wave Theory Basics

3 of 7

http://www.tradersedgeindia.com/elliott_wave_theory.htm

on the number of

stops, gaps are

left open. Gaps

are a good

indication of a

Wave 3 in

progress. After

taking the stops

out, the Wave 3 rally has caught the attention of traders.

The next sequence of events are as follows: Traders who were initially long

from the bottom finally have something to cheer about. They might even

decide to add positions.

The traders who were stopped

out (after being upset for a while)

decide the trend is up, and they

decide to buy into the rally. All

this sudden interest fuels the

Wave 3 rally.

This is the time when the

majority of the traders have

decided that the trend is up.

Finally, all the buying frenzy dies

down; Wave 3 comes to a halt.

Profit taking now begins to set in. Traders who were long from the lows decide

to take profits. They have a good trade and start to protect profits.This causes

a pullback in the prices that is called Wave 4.

Wave 2 was a vicious sell-off; Wave 4 is an orderly profit-taking decline.

While profit-taking is in progress, the majority of traders are still convinced the

trend is up. They were either late in getting in on this rally, or they have been

on the sideline.

They consider this profit-taking decline an excellent place to buy in and get

even.

On the end of Wave 4, more buying sets in and the prices start to rally again.

04-05-2014 23:15

Elliott Wave Theory Basics

4 of 7

http://www.tradersedgeindia.com/elliott_wave_theory.htm

The Wave 5 rally lacks the huge enthusiasm and strength found in the Wave 3

rally. The Wave 5 advance is caused by a small group of traders.

Although the prices make a new high above the top of Wave 3, the rate of

power, or strength, inside the Wave 5 advance is very small when compared to

the Wave 3 advance.

Finally, when this lackluster buying interest dies out, the market tops out and

enters a new phase.

Elliott Wave Basics Corrective Patterns

Corrections are very hard to master. Most Elliott traders make money during

an impulse pattern and then lose it back during the corrective phase.

An impulse pattern consists of five waves. With the exception of the triangle,

corrective patterns consist of 3 waves. An impulse pattern is always followed

by a corrective pattern. Corrective patterns can be grouped into two different

categories:

Simple Correction (Zig-Zag)

Complex Corrections (Flat, Irregular, Triangle)

Simple Correction (Zig-Zag)

There is only one pattern in a simple

correction. This pattern is called a

Zig-Zag correction. A Zig-Zag

correction is a three-wave pattern

where the Wave B does not retrace

more than 75 percent of Wave A.

Wave C will make new lows below the

end of Wave A. The Wave A of a

Zig-Zag correction always has a

five-wave pattern. In the other two

types of corrections (Flat and

Irregular), Wave A has a three-wave

pattern. Thus, if you can identify a

five-wave pattern inside Wave A of any correction, you can then expect the

correction to turn out as a Zig-Zag formation.

Fibonacci Ratios inside a Zig-Zag Correction

Wave B

Usually 50% of Wave A

Should not exceed 75% of Wave A

Wave C

either 1 x Wave A

or 1.62 x Wave A

or 2.62 x Wave A

A simple correction is commonly called a Zig-Zag correction.

04-05-2014 23:15

Elliott Wave Theory Basics

5 of 7

http://www.tradersedgeindia.com/elliott_wave_theory.htm

Complex Corrections (Flat, Irregular, Triangle)

The complex correction group consists of 3 patterns:

Flat

Irregular

Triangle

Flat Correction

In a Flat correction, the length of each wave is identical. After a five-wave

impulse pattern, the market drops in Wave A. It then rallies in a Wave B to the

previous high. Finally, the market drops one last time in Wave C to the

previous Wave A low.

04-05-2014 23:15

Elliott Wave Theory Basics

6 of 7

http://www.tradersedgeindia.com/elliott_wave_theory.htm

Irregular Correction

In this type of correction, Wave B makes a new high. The final Wave C may

drop to the beginning of Wave A, or below it.

Fibonacci Ratios in

an Irregular Wave

Wave B = either 1.15 x

Wave A or 1.25 x Wave A

Wave C = either 1.62 x

Wave A or 2.62 x Wave A

Triangle Correction

In addition to the three-wave correction patterns, there is another pattern that

appears time and time again. It is called the Triangle pattern. Unlike other

triangle studies, the Elliott Wave Triangle approach designates five sub-waves

of a triangle as A, B, C, D and E in sequence.

04-05-2014 23:15

Elliott Wave Theory Basics

7 of 7

http://www.tradersedgeindia.com/elliott_wave_theory.htm

Triangles, by far, most commonly

occur as fourth waves. One can

sometimes see a triangle as the Wave

B of a three-wave correction.

Triangles are very tricky and

confusing. One must study the

pattern very carefully prior to taking

action. Prices tend to shoot out of the

triangle formation in a swift thrust.

When triangles occur in

the fourth wave, the

market thrusts out of the

triangle in the same

direction as Wave 3. When

triangles occur in Wave

Bs, the market thrusts out

of the triangle in the same

direction as the Wave A.

Alteration Rule

If Wave Two is a simple correction, expect

Wave Four to be a complex correction.

If Wave Two is a complex correction,

expect Wave Four to be a simple correction.

Click HERE to email this page/website to your friend

Use of this website and/or products & services offered by us indicates your acceptance of our disclaimer.

Disclaimer: Futures, option & stock trading is a high risk activity. Any action you choose to take in the markets is totally your own responsibility.

TradersEdgeIndia.com will not be liable for any, direct or indirect, consequential or incidental damages or loss arising out of the use of this information. This

information is neither an offer to sell nor solicitation to buy any of the securities mentioned herein. The writers may or may not be trading in the securities

mentioned.

All names or products mentioned are trademarks or registered trademarks of their respective owners.

Copyright TradersEdgeIndia.com All rights reserved.

04-05-2014 23:15

You might also like

- Elliott Wave Timing Beyond Ordinary Fibonacci MethodsFrom EverandElliott Wave Timing Beyond Ordinary Fibonacci MethodsRating: 4 out of 5 stars4/5 (21)

- Mastering Elliott Wave Principle: Elementary Concepts, Wave Patterns, and Practice ExercisesFrom EverandMastering Elliott Wave Principle: Elementary Concepts, Wave Patterns, and Practice ExercisesRating: 3.5 out of 5 stars3.5/5 (2)

- Elliott Wave Cheat SheetsDocument56 pagesElliott Wave Cheat SheetsXuân Bắc100% (5)

- Harmonic Elliott Wave: The Case for Modification of R. N. Elliott's Impulsive Wave StructureFrom EverandHarmonic Elliott Wave: The Case for Modification of R. N. Elliott's Impulsive Wave StructureRating: 3 out of 5 stars3/5 (1)

- 28 Elliot Wave PDFDocument14 pages28 Elliot Wave PDFRavikumar GandlaNo ratings yet

- Elliott Wave Final ProjectDocument81 pagesElliott Wave Final Projectrinekshj100% (2)

- New Elliottwave Execution and Correlation Final Aug 13 14552100Document95 pagesNew Elliottwave Execution and Correlation Final Aug 13 14552100Peter Nguyen100% (3)

- The Encyclopedia Of Technical Market Indicators, Second EditionFrom EverandThe Encyclopedia Of Technical Market Indicators, Second EditionRating: 3.5 out of 5 stars3.5/5 (9)

- Walker, Myles Wilson - How To Indentify High-Profit Elliott Wave Trades in Real Time PDFDocument203 pagesWalker, Myles Wilson - How To Indentify High-Profit Elliott Wave Trades in Real Time PDFPaul Celen100% (11)

- Elliott Wave Rules and GuidelinesDocument4 pagesElliott Wave Rules and Guidelineskacraj100% (1)

- Elliot Wave: by Noname Intermediate Elliot Wave Advanced Elliot WaveDocument30 pagesElliot Wave: by Noname Intermediate Elliot Wave Advanced Elliot WaveGlobal Evangelical Church Sogakope BuyingLeads100% (1)

- Elliot WavesDocument6 pagesElliot WavesJorge IvanNo ratings yet

- Putting It All Together: The Elliott Wave Trading MapDocument52 pagesPutting It All Together: The Elliott Wave Trading MapRaul Domingues Porto Junior100% (3)

- Advanced Level Elliott Wave Analysis GuideDocument64 pagesAdvanced Level Elliott Wave Analysis GuideMohd Harraz Abbasy100% (2)

- The Magic and Logic ofDocument72 pagesThe Magic and Logic ofKane Oo100% (2)

- Elliott & FibboDocument17 pagesElliott & FibboSATISH100% (1)

- Elliot Wave Cheat Sheet FinalDocument16 pagesElliot Wave Cheat Sheet Finalbjm778No ratings yet

- Corrective WaveDocument1 pageCorrective WaveMoses ArgNo ratings yet

- Fox ManualDocument41 pagesFox ManualShahamijNo ratings yet

- A Report On Capital Structure of BHELDocument17 pagesA Report On Capital Structure of BHELRAVI RAUSHAN JHANo ratings yet

- Elliott Wave TheoryDocument13 pagesElliott Wave Theorymark adamNo ratings yet

- Elliott WAVe SimpleDocument22 pagesElliott WAVe Simplel3ohit100% (1)

- GuideToElliottWaveAnalysisAug2012 PDFDocument5 pagesGuideToElliottWaveAnalysisAug2012 PDFvhugeat50% (2)

- Elliott Wave Rules, Guidelines and Basic StructuresDocument22 pagesElliott Wave Rules, Guidelines and Basic Structuresalok100% (1)

- Practical Ew StrategiesDocument48 pagesPractical Ew Strategiesanudora100% (2)

- Awesome Traders Guide To Elliott Wave + A Simple Trading Strategy!Document24 pagesAwesome Traders Guide To Elliott Wave + A Simple Trading Strategy!lasersmart100% (2)

- The Mystery of Elliott Wave AnalysisDocument6 pagesThe Mystery of Elliott Wave AnalysismgrreddyNo ratings yet

- Elliott Wave Crash CourseDocument23 pagesElliott Wave Crash CourseRoshni Mahapatra100% (4)

- Elliot WaveDocument8 pagesElliot WaveGateshNdegwahNo ratings yet

- Guideline 1: How To Draw Elliott Wave On ChartDocument6 pagesGuideline 1: How To Draw Elliott Wave On ChartAtul Mestry100% (2)

- 05 - Class 05 - Elliot Wave and FibonacciDocument11 pages05 - Class 05 - Elliot Wave and FibonacciChandler BingNo ratings yet

- 10.1 Elliot Wave Corrective Rules and CharacteristicsDocument23 pages10.1 Elliot Wave Corrective Rules and CharacteristicsJustin Lim100% (1)

- AWESOME GUIDE To Elliott Wave Correction Patterns and Rules!!Document20 pagesAWESOME GUIDE To Elliott Wave Correction Patterns and Rules!!SATISH100% (1)

- How to Trade Elliott Waves Like a ProDocument131 pagesHow to Trade Elliott Waves Like a ProShah Aia Takaful Planner100% (1)

- Elliott Wave BasicsDocument16 pagesElliott Wave BasicsdeepakraoaNo ratings yet

- Wave 4 Should Not Overlap Wave 1Document4 pagesWave 4 Should Not Overlap Wave 1James Roni100% (1)

- Elliott Wave Structures Guide - Page 1Document2 pagesElliott Wave Structures Guide - Page 1Access LimitedNo ratings yet

- 1001 Discovering EWPDocument11 pages1001 Discovering EWPJustin Yeo0% (1)

- 1 5089578216180416934Document145 pages1 5089578216180416934Bruce wayne100% (3)

- Wave WorkbookDocument58 pagesWave Workbookbeattiedr100% (2)

- Elliott Wave Lesson 2: Cardinal Rules and GuidelinesDocument29 pagesElliott Wave Lesson 2: Cardinal Rules and Guidelinesfrancisblesson100% (1)

- Edition 24 - Chartered 16 February 2011Document11 pagesEdition 24 - Chartered 16 February 2011Joel HewishNo ratings yet

- Elliott IndicatorDocument160 pagesElliott IndicatorEmmanuelUhuru100% (1)

- Transcript Glenn Neely InterviewDocument15 pagesTranscript Glenn Neely Interviewasdfghjkjgfdxz100% (1)

- Elliott Wave Trade SetupsDocument6 pagesElliott Wave Trade SetupsJack XuanNo ratings yet

- Market Mirrors Trend ChangesDocument14 pagesMarket Mirrors Trend ChangesmrsingkingNo ratings yet

- How To Trade When The Market ZIGZAGS: The E-Learning Series For TradersDocument148 pagesHow To Trade When The Market ZIGZAGS: The E-Learning Series For TradersDavid ChalkerNo ratings yet

- Eliot Waves E Book Part1 PDFDocument13 pagesEliot Waves E Book Part1 PDFByron Arroba0% (1)

- 3 Seminario Elliott WaveDocument9 pages3 Seminario Elliott Wavebatraz79100% (2)

- Elliott Wave Lesson 4Document6 pagesElliott Wave Lesson 4Haryanto Haryanto HaryantoNo ratings yet

- Easy Way To Spot Elliott Waves With Just One Secret Tip PDFDocument4 pagesEasy Way To Spot Elliott Waves With Just One Secret Tip PDFJack XuanNo ratings yet

- The Amazing Elliott's Wave3 PDFDocument99 pagesThe Amazing Elliott's Wave3 PDFFlukii Polo100% (1)

- Elliott Wave TheroistDocument5 pagesElliott Wave TheroistANIL1964100% (1)

- Elliott Wave and Fibonacci - Learn About Patterns and Core ReferencesDocument33 pagesElliott Wave and Fibonacci - Learn About Patterns and Core ReferencesDuca George100% (1)

- Elliott Wave Handbook: Financial Freedom TradingDocument20 pagesElliott Wave Handbook: Financial Freedom TradingRazak Mwapachu67% (3)

- Overview of Fibonacci and Elliott Wave RelationshipsDocument11 pagesOverview of Fibonacci and Elliott Wave RelationshipsNishuNish100% (1)

- Elliott Wave CourseDocument24 pagesElliott Wave CourseShare Knowledge Nepal100% (1)

- Pattern Analysis: A Capsule Summary of The Wave PrincipleDocument118 pagesPattern Analysis: A Capsule Summary of The Wave PrincipleHarmanpreet DhimanNo ratings yet

- Elliott Wave Principle RaghuDocument42 pagesElliott Wave Principle RaghuKirtiMishra100% (1)

- Equipment Operation and MaintenanceDocument2 pagesEquipment Operation and MaintenanceSarat KumarNo ratings yet

- Vasudeva PunyahavachanaDocument15 pagesVasudeva PunyahavachanaSridhar VenkatakrishnaNo ratings yet

- INTERNET STANDARDSDocument18 pagesINTERNET STANDARDSDawn HaneyNo ratings yet

- Disclosure To Promote The Right To InformationDocument6 pagesDisclosure To Promote The Right To InformationSarat KumarNo ratings yet

- Disclosure To Promote The Right To InformationDocument5 pagesDisclosure To Promote The Right To InformationSarat KumarNo ratings yet

- Disclosure To Promote The Right To InformationDocument16 pagesDisclosure To Promote The Right To InformationSarat KumarNo ratings yet

- Disclosure To Promote The Right To InformationDocument8 pagesDisclosure To Promote The Right To InformationSarat KumarNo ratings yet

- Sri Satyanarayana Puja - Powerful Family PujaDocument6 pagesSri Satyanarayana Puja - Powerful Family PujaSarat KumarNo ratings yet

- FDA Sterile Product Manufacturing GuidelinesDocument63 pagesFDA Sterile Product Manufacturing GuidelinesSmartishag Bediako100% (2)

- INTERNET STANDARDSDocument18 pagesINTERNET STANDARDSDawn HaneyNo ratings yet

- INTERNET STANDARDSDocument18 pagesINTERNET STANDARDSDawn HaneyNo ratings yet

- INTERNET STANDARDSDocument18 pagesINTERNET STANDARDSDawn HaneyNo ratings yet

- Disclosure To Promote The Right To InformationDocument9 pagesDisclosure To Promote The Right To InformationSarat KumarNo ratings yet

- Disclosure To Promote The Right To InformationDocument11 pagesDisclosure To Promote The Right To InformationSarat KumarNo ratings yet

- Disclosure To Promote The Right To InformationDocument16 pagesDisclosure To Promote The Right To InformationSarat KumarNo ratings yet

- Disclosure To Promote The Right To InformationDocument18 pagesDisclosure To Promote The Right To InformationSarat KumarNo ratings yet

- SOP For Quality Risk Management - Pharmaceutical GuidelinesDocument14 pagesSOP For Quality Risk Management - Pharmaceutical GuidelinesSarat KumarNo ratings yet

- INTERNET STANDARDSDocument18 pagesINTERNET STANDARDSDawn HaneyNo ratings yet

- Is 10151 1982 PDFDocument32 pagesIs 10151 1982 PDFSarat KumarNo ratings yet

- Barry O Donovan Novartis (Compatibility Mode)Document3 pagesBarry O Donovan Novartis (Compatibility Mode)Sarat KumarNo ratings yet

- Disclosure To Promote The Right To InformationDocument15 pagesDisclosure To Promote The Right To InformationSarat KumarNo ratings yet

- Quality Risk Management GuidelineDocument29 pagesQuality Risk Management GuidelineSarat KumarNo ratings yet

- Barry O Donovan Novartis (Compatibility Mode)Document3 pagesBarry O Donovan Novartis (Compatibility Mode)Sarat KumarNo ratings yet

- Disclosure To Promote The Right To InformationDocument18 pagesDisclosure To Promote The Right To InformationSarat KumarNo ratings yet

- Diploma in PackagingDocument5 pagesDiploma in PackagingSarat KumarNo ratings yet

- CQA 2013 InsertDocument16 pagesCQA 2013 InsertcsteeeeNo ratings yet

- Disclosure To Promote The Right To InformationDocument16 pagesDisclosure To Promote The Right To InformationSarat KumarNo ratings yet

- ZHAO 1993compressedDocument146 pagesZHAO 1993compressedsandi123inNo ratings yet

- Process Quality Risk Assessment at NovartisDocument13 pagesProcess Quality Risk Assessment at Novartiskumar_chemicalNo ratings yet

- Certification Vs CertificateDocument2 pagesCertification Vs CertificateSubramaniyam VaithilingamNo ratings yet

- Sub-Prime CrisisDocument18 pagesSub-Prime Crisissurajvsakpal100% (2)

- Chapter 10 The Cost of CapitalDocument32 pagesChapter 10 The Cost of CapitalSaurabh PandeyNo ratings yet

- Analysis of Key Financial RatiosDocument37 pagesAnalysis of Key Financial RatiosTom HerreraNo ratings yet

- Realtime Data LLC CNS - Press Release - Final - 8 24 11Document2 pagesRealtime Data LLC CNS - Press Release - Final - 8 24 11pandersonpllcNo ratings yet

- OTM Debit Mandate Form NACH/ ECS/ Direct Debit: Unit Holder InformationDocument6 pagesOTM Debit Mandate Form NACH/ ECS/ Direct Debit: Unit Holder InformationTirthGanatraNo ratings yet

- Summer Internship ReportDocument43 pagesSummer Internship Reportnikhil yadavNo ratings yet

- 07 A Cost of CapitalDocument3 pages07 A Cost of CapitalShekhar SinghNo ratings yet

- 12basic Financial Statement 1231407912838821 1Document20 pages12basic Financial Statement 1231407912838821 1Dymphna Ann CalumpianoNo ratings yet

- Finding and Trading Rejection ZonesDocument3 pagesFinding and Trading Rejection ZonesalpepezNo ratings yet

- Microsoft Word - FINA5340 Practice Question 1 Spring 2019Document10 pagesMicrosoft Word - FINA5340 Practice Question 1 Spring 2019Mai PhamNo ratings yet

- ch01 ProblemsDocument7 pagesch01 Problemsapi-274120622No ratings yet

- Vithal Kamat Is An Engaging SpeakerDocument3 pagesVithal Kamat Is An Engaging SpeakerRishabh BajpaiNo ratings yet

- Precise Exits Entries ManualDocument44 pagesPrecise Exits Entries ManualAdil Bensellam100% (10)

- Case Studies in Finance AnalysisDocument4 pagesCase Studies in Finance AnalysisSaad HassanNo ratings yet

- Constructing A Liability Hedging Portfolio PDFDocument24 pagesConstructing A Liability Hedging Portfolio PDFtachyon007_mechNo ratings yet

- Sturman ResumeDocument1 pageSturman ResumejedsturmanNo ratings yet

- Annual Report 2003Document63 pagesAnnual Report 2003Mujahid Abbas JaffriNo ratings yet

- CH23 - Transactional Approach and CFExercises and SolutionsDocument6 pagesCH23 - Transactional Approach and CFExercises and SolutionsHossein ParvardehNo ratings yet

- Regulation of Stock ExchangesDocument12 pagesRegulation of Stock ExchangesShibashish GiriNo ratings yet

- Synopsis On A Comparative Study of Equity Linked Savings Schemes Floated by Domestic Mutual Fund PlayersDocument8 pagesSynopsis On A Comparative Study of Equity Linked Savings Schemes Floated by Domestic Mutual Fund PlayersPraveen Sehgal100% (1)

- Boeing Case:: 1. Why Is Boeing Contemplating The Launch of The 7E7 Project? Is This A Good Time To Do So?Document4 pagesBoeing Case:: 1. Why Is Boeing Contemplating The Launch of The 7E7 Project? Is This A Good Time To Do So?HouDaAakNo ratings yet

- Case Prep 2Document69 pagesCase Prep 2Blake Toll100% (1)

- PT Cardig Aero Services Tbk Consolidated Financial Statements 2015-2014Document108 pagesPT Cardig Aero Services Tbk Consolidated Financial Statements 2015-2014Bagas KNo ratings yet

- New Prudential Guidelines July 1 2010 (Final)Document66 pagesNew Prudential Guidelines July 1 2010 (Final)tozzy12345No ratings yet

- Reminiscences of A Stock OperatorDocument5 pagesReminiscences of A Stock OperatorI.Kiran KumarNo ratings yet

- Deal Money SIP PDFDocument71 pagesDeal Money SIP PDFSaurav KumarNo ratings yet

- Multiple Choice Question 61Document8 pagesMultiple Choice Question 61sweatangeNo ratings yet

- Inspection of UCB-BR Act 1949Document46 pagesInspection of UCB-BR Act 1949sandeepprinceNo ratings yet