Professional Documents

Culture Documents

Nism 3 A - Compliance - Last Day Revision Test 1

Uploaded by

Rohit SharmaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Nism 3 A - Compliance - Last Day Revision Test 1

Uploaded by

Rohit SharmaCopyright:

Available Formats

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 1

About PASS4SURE.in

PASS4SURE is a professional online practice test bank for various NSE NCFM, NISM and BSE exams. The team behind

PASS4SURE has decades of experience in the financial and stock markets and have succeeded in preparing practice

question bank which will help not only to pass the exams easily but also get good knowledge of the subject.

Our online mock exams contain questions which are carefully analysed by the experts and have a high probability of being

asked in the exams. Thus all PASS4SURE questions are highly valued and contribute to an almost 100% success rate.

We do not believe in offering you thousands of questions but most important 400 500 practice questions and answers.

PASS4SURE understands that time and money is valuable for our students, so we regularly update all our exams. The old

questions are deleted and new important questions are added. Our LAST DAY REVISION test are on the spot. This is done

to ensure that the students learns what is most important and pass the exams. You do not have to try again and again

wasting time and money.

Our simple aim is to simplify the NCFM, NISM and BSE exams. ALL THE BEST.

IMPORTANT The viewing rights for this downloaded Question Bank will automatically

expire after 60 days from the date of purchase.

TEST DETAILS The SECURITIES INTERMEDIARIES COMPLIANCE ( NON FUND ) CERTIFICATION EXAM is a 100 mark

exam with 60% as passing marks. In all 100 questions will be asked with 0.25% negative marking for Wrong

Answers. The time duration is 2 hours.

All Rights Reserved. No Part of this documents may be reproduced, stored in a retrieval system, or transmitted, in any

form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior written permission

from PASS4SURE.in. For any clarification regarding this document or if you feel there are errors in the question bank,

please write us at info@pass4sure.in

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 1

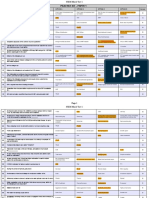

LAST DAY REVISION EXAM 1

Question 1

(a)

(b)

(c)

(d)

Question 2

(a)

(b)

(c)

(d)

The Securities Appellate Tribunal - SAT shall not be bound by the

procedure laid down by the Code of Civil Procedure, 1908, but shall be

guided by the principles of natural justice - this provision is as per

_____________.

Contract Act

SEBI Act

Companies Act

PMLA

Which bank of India has the responsibility of administering the

monetary policy?

State Bank of India

Central Bank of India

Reserve Bank of India

Bank of India

Correct Answer 1

SEBI Act

Correct Answer 2

Reserve Bank of India

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 1

Question 3

(a)

(b)

(c)

(d)

__________ allows the borrowers to lock into interest rates.

Forward Rate agreements

Interest Rate swaps

Global Depository Receipts

Both 1 and 2

Question 4

As per SEBI (Delisting of Equity Shares) Regulations, the public

shareholders can participate in the offer and such offer shall remain open

for a minimum period of _____ working days and a maximum period of

_____ working days.

(a)

(b)

(c)

(d)

2, 7

3, 5

7, 9

4,7

Correct Answer 3

Both 1 and 2

Correct Answer 4

3, 5

Answer

Explanation

The offer shall remain open for a minimum period of 3 working days and a

maximum period of 5 working days, during which the public shareholders

have to tender their bids.

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 1

Question 5

(a)

(b)

Question 6

(a)

(b)

(c)

(d)

SEBI Act states that no person shall sponsor or cause to be sponsored or

carry on or caused to be carried on any venture capital funds or

collective investment schemes including mutual funds if the same does

not obtain a certificate of registration from the SEBI - True or False ?

TRUE

FALSE

Under the Code of Conduct, SEBI prescribes Bankers to an Issue against

their participation in ____________.

Price rigging or manipulation

Creation of false market

Passing of unpublished price sensitive information

All of the above

Correct Answer 5

TRUE

Correct Answer 6

All of the above

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 1

Question 7

(a)

(b)

(c)

(d)

Question 8

(a)

(b)

(c)

(d)

The Securities and Exchange Board of India (Prohibition of Fraudulent

and Unfair Trade Practices relating to Securities Market) Regulations,

2003 prohibits _________ trade practices in securities.

manipulative

unfair

fraudulent

all of the above

The Debenture Trustees shall communicate to the debenture holders on

____________ basis regarding the compliance of the terms of the issue by

the body corporate, defaults etc and action taken thereof.

monthly

quarterly

half yearly

annual

Correct Answer 7

all of the above

Correct Answer 8

half yearly

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 1

Question 9

(a)

(b)

(c)

(d)

Question 10

(a)

(b)

(c)

(d)

Correct Answer 9

Answer

Explanation

Correct Answer 10

Answer

Explanation

As per SEBI (Intermediaries) Regulations, if any rules are violated, the

concerned authority, after considering the representations, can

recommend which of the following action(s) Cancellation of certificate of registration

Suspension of certificate of registration for a specified period

Debarring a branch or an office of the noticee from carrying out activities for

the specified period

All of the above

A Depository Participant should redress the grievances of the investors

within _______ days of the receipt of complaint.

15

20

30

45

All of the above

Any of the following actions can be recommended (i) Suspension of certificate of registration for a specified period;

(ii) Cancellation of certificate of registration;

(iii) Prohibiting the noticee to take up any new assignment or contract or

launch a new scheme for the period specified in the order;

(iv) Debarring a principal officer of the noticee from being employed or

associated with any registered intermediary or other registered person for the

period specified in the order;

(v) Debarring a branch or an office of the noticee from carrying out activities

for the specified period;

(vi) Warning the noticee

30

Depository Participant should redress the grievances of the investors within

30 days of the re-ceipt of complaint and keep the depository informed about

the number and nature of grievances redressed by it and number of grievances

pending before it.

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 1

Question 11

(a)

(b)

(c)

(d)

Question 12

(a)

(b)

Correct Answer 11

Answer

Explanation

Correct Answer 12

Answer

Explanation

As per the Code of Conduct for Prevention of Insider Trading, a

Compliance office is responsible for ______________ under the overall

supervision of the partners / proprietors.

monitoring of trades and the implementation of the code of conduct

pre-clearing of all designated employees and their dependants trades

both 1 and 2

none of the above

The restrictions on communication under insider trading do not include

communications under ordinary course of law. State whether True or

False?

FALSE

TRUE

both 1 and 2

As per the SEBI Act, an organisation / firm needs to appoint a compliance

officer who is respon-sible for setting forth policies and procedures and

monitoring adherence to the rules for the preservation of Price Sensitive

Information, pre-clearing of all designated employees and their dependants

trades, monitoring of trades and the implementation of the code of conduct

under the overall supervision of the partners / proprietors.

TRUE

The restrictions do not apply to any communication required in the ordinary

course of business or under any law.

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 1

Question 13

(a)

(b)

(c)

(d)

Question 14

(a)

(b)

(c)

(d)

____________ is defined as any person who is, or was, connected with a

company or is deemed to have been connected with the company and

who is reasonably expected to have access to unpublished price sensitive

information in respect of securities of the company

Stock Broker

Custodian

Insider

Depository Participant

As per the Prevention of Money Laundering Act, whoever commits the

offence of money-laundering shall be liable to fine which may extend to

Rs. _____ in addition to imprisonment.

Rs 10 lakhs

Rs 25 Lakhs

Rs 5 lakhs

Rs 1 lakhs

Correct Answer 13

Insider

Correct Answer 14

Rs 5 lakhs

Answer

Explanation

Whoever commits the offence of money-laundering shall be punishable with

rigorous imprisonment for a term which shall not be less than 3 years but

which may extend to 7 years and shall also be liable to fine which may extend

to Rs. 5 lakhs.

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 1

Question 15

(a)

(b)

(c)

(d)

As per SEBI (Stock Brokers and Sub Brokers) Regulations, what type of

penalty can be imposed on a stock broker if he fails to pay the penalties

imposed by an adjudicating officer ?

Monetary penalties

prosecution and imprinsonment

both monetary penalties and imprinsonment

None of the above

Question 16

(a)

(b)

(c)

(d)

Currency Derivative excludes __________.

Interest Swaps

Futures

Swaps

Options

Correct Answer 15

both monetary penalties and imprinsonment

Correct Answer 16

Interest Swaps

Answer

Explanation

Currency Derivatives are contracts between buyers and sellers, whose values

are to be derived from the underlying assets, i.e. the currency amounts.

These are risk management tools in the forex and money markets. These may

be options or futures or swaps

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 1

Question 17

(a)

(b)

(c)

(d)

Question 18

(a)

(b)

(c)

(d)

Correct Answer 17

Answer

Explanation

Correct Answer 18

As per the SEBI (Underwriters) Regulations, the capital adequacy

requirement to become an underwriter should be _______.

total networth of Rs 20 lakhs

total networth of Rs 50 lakhs

total assets of Rs 20 lakhs

total assets of Rs 50 lakhs

As per the SEBI ((Issue of Capital and Disclosure Requirements - ICDR)

regulations, a Merchant Banker has to monitor which of the foll

procedures post the issue.

the flow of application from collecting bank branches

processing of the applications including the application form for ASBA

dispatch of security certificates and re-fund orders are completed and

securities are listed.

All of the above

total networth of Rs 20 lakhs\

The capital adequacy requirement to become an underwriter should not be

less than the networth of Rs. 20 lakh.

All of the above

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 1

Question 19

(a)

(b)

Question 20

(a)

(b)

(c)

(d)

The debenture trustee shall comply with the award of Ombudsman

passed under the Securities and Exchange Board of India (Ombudsman)

Regulations, 2003. State whether True or False?

TRUE

FALSE

As per the SEBI (Buyback of Securities) Regulations, the Merchant

Banker has to send the final report to SEBI within _____ days from the

date of closure of the buy-back offer.

10

15

25

30

Correct Answer 19

TRUE

Correct Answer 20

15

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 1

Question 21

(a)

(b)

(c)

(d)

A merchant banker provide service(s) related to ______.

Underwriting

Mergers and Aquisitions

Issue of securities of a company

All of the above

Question 22

A Debenture Trustee has forgotten to inform SEBI of an action taken by

some other regulator for non-compliance on him. Is it an offence as per

the code of conduct of SEBI (Debenture Trustees) Regulations ?

(a)

(b)

Yes

No

Correct Answer 21

All of the above

Correct Answer 22

Yes

Answer

Explanation

As per the Code of Conduct for the Debenture Trustees, the Debenture

Trustee has to ensure that SEBI is promptly informed about any action, legal

proceeding, etc., initiated against it in respect of any material breach or noncompliance by it, of any law, rules, regulations, directions of SEBI or of any

other regulatory body.

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 1

Question 23

(a)

(b)

Question 24

(a)

(b)

(c)

(d)

Correct Answer 23

Answer

Explanation

Correct Answer 24

Answer

Explanation

The SEBI (Prohibition of Insider Trading) Regulations, 1992 seek to

govern the conduct of the person(s), defined as 'Investor', in respect of

securities of a company listed on a stock exchange - State True or False ?

TRUE

FALSE

The Lead Merchant Banker carries out which of the following activities :

1 - Capital structuring and formalities such as compo-sition of debt and

equity, type of instruments, etc 2 - Drafting and design of the offer

document 3 - Processing Refunds 4 - Obtaining Shareholders resolutions

for the issue

1 and 3

3 and 4

1 and 2

2 and 4

FALSE

The SEBI (Prohibition of Insider Trading) Regulations, 1992 seek to govern

the conduct of the person(s), defined as INSIDER, in respect of securities of

a company listed on a stock exchange.

1 and 2

The Lead Manager is not involved in obtaining shareholders resolution and

the Bankers manage the refunds etc.

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 1

Question 25

(a)

(b)

(c)

(d)

When any loss is caused to the beneficial owner due to negligence of the

depository or depository participant, the depository shall indemnify

the____________.

Stock Broker

Beneficial Owner

Depository Participant

None of the above

Question 26

As per SEBI Code of Conduct for Sub-Brokers, a sub broker can give a

recommendation to his clients when _______________.

(a)

(b)

he has got it verified from his broker

he has reasonable grounds for believing that the recommendations is suitable

for such a client

he has entered into an legal agreement with his client which absolves him of

any legal problems in case the client suffers losses

all of the above

(c)

(d)

Correct Answer 25

Beneficial Owner

Correct Answer 26

he has reasonable grounds for believing that the recommendations is suitable

for such a client

Answer

Explanation

A sub-broker shall not make a recommendation to any client who might be

expected to rely thereon to acquire, dispose of, retain any securities unless he

has rea-sonable grounds for believing that the recommendations is suitable for

such a client upon the basis of the facts.

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 1

Question 27

(a)

(b)

(c)

(d)

Question 28

(a)

(b)

(c)

(d)

Correct Answer 27

Answer

Explanation

Correct Answer 28

Answer

Explanation

A sub-broker shall enter into a tripartite agreement with __________

before he commences dealing in securities.

stock broker and SEBI

client and Stock Exchange

client and the main stock broker

SEBI and Stock Exchange

The responsibility of administering the Partnership Act, 1932, the

Companies Act, 1951 and the Societies Registration Act , 1980 is vested

with _________.

FMC

SEBI

DEA

MCA

client and the main stock broker

As per the Code of Conduct for Sub-Brokers - A sub-broker shall enter into a

tripartite agreement with his client and the main stock broker indicating the

rights and obligations of the stock broker, sub-broker and such client of the

stock broker.

MCA

The Ministry of Corporate Affairs (MCA) is mainly concerned with the

administration of the Companies Act, 1956 and other allied acts, rules and

regulations pertaining to the corporate sector.

Itis also vested with the responsibility of administering the Partnership Act,

1932, the Companies (Donations to National Funds) Act, 1951 and Societies

Registration Act, 1980.

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 1

Question 29

(a)

(b)

(c)

(d)

Question 30

(a)

(b)

(c)

(d)

Where any intermediary fails to comply with the conditions of

registration or contravenes any of the provisions of the securities laws,

the designated member can pass a order against the intermediary. Who

can become a designated member ?

Chairman of SEBI

Whole time member - SEBI

both 1 and 2

None of the above

As per the Depositories Act, the penalty for failure to maintain books of

account or records is Rs.1 lakh for each day of default or Rs ______,

which ever is less.

50 lakhs

1 crore

2 crores

5 crores

Correct Answer 29

both 1 and 2

Correct Answer 30

1 crore

Answer

Explanation

Section 19A of the Depositories Act lays down the penalties to be imposed

for failure to maintain books of account or records Rs.1 crore or Rs.1 lakh

for each day of default, whichever is less.

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 1

Question 31

(a)

(b)

(c)

(d)

Question 32

(a)

(b)

(c)

(d)

All of the following are functions of SEBI, under SEBI Act of 1992,

except _________ .

Prohibiting insider trading of securities

Promoting and regulating self regulatory organizations

Regulating the business in other securities markets but not in stock exchange

Regulating substantial acquisition of shares and take over of companies

Under the Prevention of Money Laundering Act 2002 (PMLA), Banks

and Financial Institution should ___________.

maintain a record of all transactions

verify and maintain the records of the identity of all its clients

Both 1 and 2

None of the above

Correct Answer 31

Regulating the business in other securities markets but not in stock exchange

Correct Answer 32

Both 1 and 2

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 1

Question 33

(a)

(b)

(c)

(d)

Question 34

(a)

(b)

(c)

(d)

As per the SEBI (Credit Rating Agencies) Regulations, the certificate of

registration as credit rating agency is valid for a period of _____ years.

2

3

5

7

Securities which are held for less than 12 months before sale are

considered ___________ investment as per Income Tax Act.

Long Term

Medium Term

Short Term

Day Trading

Correct Answer 33

Correct Answer 34

Short Term

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 1

Question 35

(a)

(b)

(c)

(d)

Question 36

(a)

(b)

(c)

(d)

Every Depository Participant should put in place an adequate

mechanism for _____the internal accounting controls.

Reviewing

Monitoring

Evaluating

All of the above

As per the SEBI (Prohibition of Insider Trading) Regulations, all

__________of the firm who intend to deal in the securities of the client

company shall pre-clear the transactions as per the pre-dealing

procedure as prescribed in the regulations.

Directors

Officers

Designated Employees

All of the above

Correct Answer 35

All of the above

Correct Answer 36

All of the above

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 1

Question 37

(a)

(b)

(c)

(d)

Question 38

(a)

(b)

(c)

(d)

Correct Answer 37

Answer

Explanation

Correct Answer 38

Which of the following is NOT an activity performed by the bankers to

an issue?

Payment of dividend or interest warrant

Collection of securities transaction tax

Acceptance of application monies

Acceptance of call monies

As per the SEBI (KYC Registration Agency-KRA) Regulations, SEBI

shall grant an initial registration to the KRA which shall be valid for a

period of _____ years from the initial date of its issue to the applicant.

3

4

5

6

Collection of securities transaction tax

Securities Transaction Tax (STT) is collected by the Stock Brokers.

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 1

Question 39

(a)

(b)

Question 40

(a)

(b)

Correct Answer 39

Answer

Explanation

Correct Answer 40

The employees of Custodian cannot be engaged in any other activity

carried on by the Custodian - State True or False ?

TRUE

FALSE

Is the Stock broker required to pre-intimate SEBI about shifting the

location where it keeps its books of accounts. State Yes or No?

Yes

No

TRUE

In cases where the custodian of securities is carrying on any activity besides

that of acting as custodian of securities, then, he should ensure that the

activities relating to his business as custodian of securities is separate and

segregated from all other activities.

Also the officers and employees engaged in providing custodial services shall

not be engaged in any other activity carried on by him.

No

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 1

Question 41

(a)

(b)

(c)

(d)

Question 42

(a)

(b)

If an Stock Broker is giving an investment advice in a publicly accessible

media, it should necessarily be accompanied by ___________.

disclosure from all the employees of the stock broking firm about their

interest in the recommended stock

disclosure from the person giving the advice about his interest in the

recommended stock

disclosure from the compliance officer of the stock broking firm about their

interest in the recommended stock

All of the above

A sub broker is recommending some shares to his clients irrespective of

the technical and financial aspects of these shares. His commission is

based on the volume these clients do in stock trading. Is this a fraud as

per the rules of SEBI (Prohibition of Fraudulent and Unfair Trade

Practices relating to securities Market) Regulations ?

Yes

No

Correct Answer 41

disclosure from the person giving the advice about his interest in the

recommended stock

Correct Answer 42

Yes

Answer

Explanation

As per SEBI (Prohibition of Fraudulent and Unfair Trade Practices relating to

securities Market) Regulations - encouraging the clients by an intermediary to

deal in securities solely with the object of enhancing his brokerage or

commission is a fraud.

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 1

Question 43

(a)

(b)

(c)

(d)

Question 44

(a)

(b)

(c)

(d)

Correct Answer 43

Answer

Explanation

Correct Answer 44

Under the Securities Contracts (Regulation) Rules, 1957 - every member

of a recognized stock exchange is required to maintain and preserve the

journals for ______ years.

1

2

3

5

Financial Markets includes _________ .

Stock / Equity Markets

Currency Markets

Bond / Debt Markets

All of the Above

5

Under Rule 15(1) every member of a recognized stock exchange is required to

maintain and preserve the following books of account and documents for a

period of 5 years:

Register of transactions (Sauda book).

Clients ledger.

General ledger.

Journals.

Cash book.

Bank pass-book.

Documents register showing full particulars of shares and securities received

and delivered.

All of the Above

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 1

Question 45

(a)

(b)

(c)

(d)

Question 46

(a)

(b)

(c)

(d)

Correct Answer 45

Answer

Explanation

Correct Answer 46

As per the SEBI (Credit Rating Agencies) Regulations, the certificate

renewal fee of a credit rating agency is _______.

Rs 5 lakhs

Rs 10 lakhs

Rs 25 lakhs

Rs 50 lakhs

According to the SEBI (Issue of Capital and Disclosure Requirements)

Regulations, the minimum subscription to be received in an issue shall

not be less than ________ of the offer through offer document.

75%

80%

90%

95%

Rs 10 lakhs

The Credit Rating Agency on being granted the registration certificate shall

pay to SEBI the registration fee of Rs. 20 lakh.

Application for renewal can be made to SEBI three months prior to the expiry

of the certificate accompanied with the renewal fees which is Rs. 10 lakh. The

period of validity of the certificate granted to the Credit Rating Agency is

three years

90%

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 1

Question 47

(a)

(b)

(c)

(d)

Question 48

(a)

(b)

(c)

(d)

As per the Depositories Act, the penalty for failure to redress

investors grievances after having been called upon to do so by SEBI

within the specified time period is Rs ________ or Rs.1 lakh for each day

of default, whichever is less.

One Crore

Two Crores

Five Crores

Ten Crores

__________ includes all offences under Part A and Part B (without the

threshold) that has cross border implications.

Part A of the Prevention of Money-Laundering Act

Part B of the Prevention of Money-Laundering Act

Part C of the Prevention of Money-Laundering Act

None of the above

Correct Answer 47

One Crore

Correct Answer 48

Part C of the Prevention of Money-Laundering Act

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 1

Question 49

(a)

(b)

Question 50

All the stock exchanges in India have same bye laws and these have to be

approved by SEBI - True or False ?

TRUE

FALSE

Every debenture trustee shall pay a renewal fee of Rs. 5 lakh every three

years within ______ days of being intimated by SEBI.

(a)

(b)

(c)

(d)

5 days

15 days

30 days

45 days

Correct Answer 49

FALSE

Answer

Explanation

Correct Answer 50

Answer

Explanation

The Stock Exchange bye laws lay down rules regarding the admission of

trading members, listing requirements, fees, suspension of admission etc etc

and differ from exchange to exchange but these have to be in conformity with

the provisions of the SC(R)A, 1956, SC(R)R, 1957 and the SEBI Act, 1992.

Such bye laws framed by the stock exchanges need to be approved by the

SEBI.

15 days

Every debenture trustee shall pay a sum of Rs. 10 lakhs as registration fees at

the time of the grant of certificate by SEBI and shall pay renewal fee of Rs. 5

lakh every three years from the fourth year from the date of initial

registration.

The renewal fee shall be paid within 15 days of being intimated by SEBI.

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 1

Question 51

(a)

(b)

Question 52

As per the Securities Contract (Regulation) Act, the Central Government

/ SEBI has the powers to prescribe admission criteria and qualifications

for members of a Stock Exchange - True or False ?

TRUE

FALSE

The Stock Brokers are required to adhere to a code of conduct apart

from the rules and regulations - True and False ?

(a)

(b)

TRUE

FALSE

Correct Answer 51

TRUE

Answer

Explanation

Correct Answer 52

Answer

Explanation

SC(R)A covers around 31 Sections. Sections 3 to 12 are specifically related to

various aspects of stock exchange recognition. The Central Government

(Powers are exercisable by SEBI also) has the powers to prescribe admission

criteria and qualifications for members.

TRUE

A stock broker or its sub broker needs to adhere to a particular code of

conduct as prescribed in the schedule II of the regulations.

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 1

Question 53

(a)

(b)

(c)

(d)

Question 54

(a)

(b)

(c)

(d)

Correct Answer 53

Answer

Explanation

Correct Answer 54

Answer

Explanation

Which Act currently deals with matters relating to foreign exchange,

external trade and payments for promoting the orderly development and

maintenance of foreign exchange market in India.

FERA

FEMA

RBI Act

MCX

The renewal fee to keep the registration in force as credit rating agency is

____.

Rs 5 lakh

Rs 10 lakh

Rs 20 lakh

Rs 25 lakh

FEMA

The Foreign Exchange Management Act (FEMA), 1999 deals with matters

relating to foreign exchange etc. This act replaced the old Foreign Exchange

Regulation Act (FERA).

Rs 10 lakh

The Credit Rating Agency on being granted the registration certificate shall

pay to SEBI the registration fee of Rs. 20 lakh.

Application for renewal can be made to SEBI three months prior to the expiry

of the certificate accompanied with the renewal fees and the renewal fee is Rs.

10 lakh.

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 1

Question 55

(a)

(b)

(c)

(d)

Question 56

(a)

(b)

As per the SEBI (Certification of Associated Persons in Securities Markets)

Regulations, 2007, a certificate is valid for a period of ______ year(s) from

the date of grant of certificate or revalidation as the case may be.

1

2

3

5

A relationship manager of a stockbroking firm has advised his clients to

buy some stocks without doing proper research as his commission is

based on the brokerage he generates. Is this a fraud as per SEBI rules ?

Yes

No

Correct Answer 55

Correct Answer 56

Yes

Answer

Explanation

Dealing in securities shall be deemed to be a fraudulent or an unfair trade

practice if it involves encouraging the clients by an intermediary to deal in

securities solely with the object of enhancing his brokerage or commission.

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 1

Question 57

(a)

(b)

(c)

(d)

Question 58

Any person connected with the proceeds of crime and projecting it as

____________ shall be guilty of the offence of money-laundering as per

the Prevention of Money-Laundering Act, 2002.

untainted property

stolen property

illegal property

embezzled property

Failure to exercise due skill, care and diligence by a Stock Broker will

lead to __________ as per the provisions of SEBI (Stock Brokers and Sub

Brokers) Regulations.

(a)

(b)

(c)

(d)

Prosecution

Monetary Penalty

Both 1 and 2

None of the Above

Correct Answer 57

untainted property

Answer

Explanation

Correct Answer 58

Answer

Explanation

As per the Prevention of Money-Laundering Act, 2002 (PMLA) - Who-ever

directly or indirectly attempts to indulge, or knowingly assists or knowingly is

a party or is actually involved, in any process or activity connected with the

proceeds of crime and projecting it as untainted property shall be guilty of the

offence of money-laundering.

Monetary Penalty

Failure to exercise due skill, care and diligence by a Stock Broker will lead

only to Monetary Penalty.

For violations like Manipulations and Insider Trading etc, the penalty can be

both Monetary and Prosecution.

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 1

Question 59

(a)

(b)

(c)

(d)

Question 60

(a)

(b)

(c)

(d)

Correct Answer 59

Answer

Explanation

Correct Answer 60

Answer

Explanation

________________ supervises three professional bodies - the Institute of

Chartered Accountants of India (ICAI), the Institute of Company

Secretaries of India (ICSI) and the Institute of Cost and Works

Accountants of India (ICWAI)

MCA

SEBI

FM

RBI

Under ___________, offences are considered as money laundering if the

total value of such offences is Rs 30 lakh or more.

Part A of PMLA

Part B of PMLA

Part C of PMLA

None of the above

MCA

MCA - Ministry of Corporate Affairs

Part B of PMLA

The offences under Prevention of Money-Laundering Act are classified under

Part A, Part B and Part C of the Schedule.

Under Part A, offences include counterfeiting currency notes.

Under Part B, offences are considered as money laundering if the total value

of such offences is Rs 30 lakh or more.

Part C includes all offences under Part A and Part B (without the threshold)

that has cross-border implications.

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 1

Question 61

(a)

(b)

(c)

(d)

Question 62

(a)

(b)

(c)

(d)

Correct Answer 61

Answer

Explanation

Correct Answer 62

The 'Public Areas' in an organisation deal with advice on _________.

Sales

Marketing

Investments

All of the above

As per the SEBI (Stock Brokers and Sub Brokers) Regulations, a subbroker should submit to the SEBI or to _________ such books, special

returns, correspondence, documents and papers as may be required.

Trading Member

Company Law Board

Income Tax

stock exchange with which it is registered

All of the above

As per SEBI (Prohibition of Insider Trading) Regulations, to prevent the

misuse of confidential information the organisation shall adopt a Chinese

Wall policy which separates those areas of the organisation which routinely

have access to confidential information, considered insider areas from those

areas which deal with sale/ marketing/investment advice considered as

Public Areas.

stock exchange with which it is registered

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 1

Question 63

(a)

(b)

(c)

(d)

Question 64

(a)

(b)

(c)

(d)

Who amongst the following collates data on subscriptions regarding

primary issuances?

Registrars

Banks

Venture Capital Funds

Custodians

As per the Code of Conduct for Bankers to an Issue, the banker to an

issue shall _________.

ensure that where a complaint is not remedied promptly, the investor is

advised of any further steps which may be available to the investor under the

regulatory system.

ensure that inquiries from investors are adequately dealt with.

ensure that grievances of investors are redressed in a timely and appropriate

manner

all of the above

Correct Answer 63

Registrars

Correct Answer 64

all of the above

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 1

Question 65

(a)

(b)

(c)

(d)

Question 66

(a)

(b)

Assistance in underwriting tie up in primary issues is done by _______.

Depositories

Transfer Agents

Registrars

Merchant Bankers

Where any intermediary fails to comply with any of the conditions of

registration a show cause notice is issued to him as per the SEBI

(Intermediaries) Regulations. Can the designated authority, after giving

an hearing to the noticee, just warn him to be more careful in future ?

Yes or No ?

Yes

No

Correct Answer 65

Merchant Bankers

Correct Answer 66

Yes

Answer

Explanation

The designated authority can recommend any of the following actions:

(i) Suspension of certificate of registration for a specified period;

(ii) Cancellation of certificate of registration;

(iii) Prohibiting the noticee to take up any new assignment or contract

(iv) Debarring a principal officer

(v) Debarring a branch or an office of the noticee from carrying out activities

for the specified period;

(vi) Warning the noticee.

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 1

Question 67

(a)

(b)

(c)

(d)

Question 68

(a)

(b)

(c)

(d)

Correct Answer 67

Answer

Explanation

Correct Answer 68

The post issue activities of a lead merchant banker includes holding conferences of stockbrokers and investors to market the issue

processing the rematerialistion requests

finalisation of the basis of allotment

all of the above

In case of Stock Brokers, the In-Person Verification (IPV) can be carried

out by __________

Authorised Person

Sub Brokers

Both 1 and 2

None of the above

finalisation of the basis of allotment

Holding of conferences is a pre issue function and processing of

rematerialisation is a function of the Depository / Registrar.

Both 1 and 2

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 1

Question 69

If an Intermediary is debarred or suspended, the intermediary shall -

(a)

allow its clients to withdraw or transfer their securities or funds held in its

custody, charging the clients for such transactions

(b)

allow its clients to withdraw or transfer their securities or funds held in its

custody, without any additional cost to such client

(c)

undertake any new assignment during the period of such debarment or

suspension.

None of the above

(d)

Question 70

(a)

(b)

(c)

(d)

The RBI's main banking functions are : 1. Issue good quality currency

notes and coins 2. Act as a banker to the Government and manages

issuances of Central and State Government Securities. 3. Act as a banker

to the banks by maintaining the banking accounts of all scheduled banks.

4. Formulate fiscal policies

1&2

2&3

3&4

1&4

Correct Answer 69

allow its clients to withdraw or transfer their securities or funds held in its

custody, without any additional cost to such client

Correct Answer 70

2&3

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 1

Practice Question Banks also available for :

NISM

NISM Series I: Currency Derivatives Certification Exam

NISM Series V A: Mutual Fund Distributors Certification Exam

NISM Series VI: NISM Series VI - Depository Operations Certification Exam

NISM Series VII: Securities Operations and Risk Management

NISM Series VII: Equity Derivatives Certification Exam

NISM Series III A: Securities Intermediaries Compliance certification Exam

NISM Series X A : Investment Adviser (Level 1) Certification Exam

NISM Series X B: Investment Adviser (Level 2) Certification Exam

NCFM

NCFM Financial Markets: A Beginners Module

NCFM Capital Market (Dealers) Module

NCFM Derivative Market (Dealers) Module

BSE

Certificate on Security Market (BCSM)

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 1

You might also like

- Financial PlanningDocument119 pagesFinancial PlanningUmang Jain100% (1)

- 5.20.2016 Board Deck v5Document60 pages5.20.2016 Board Deck v5Zerohedge100% (2)

- Nism ViiDocument33 pagesNism ViiRavi BhartiNo ratings yet

- NISM VII - SORM Short NotesDocument25 pagesNISM VII - SORM Short Notescomplaints.tradeNo ratings yet

- FN3092 SG PDF PDFDocument156 pagesFN3092 SG PDF PDFКарен ХачатрянNo ratings yet

- NISM VI - LAST DAY REVISION TEST 1 - UnlockedDocument42 pagesNISM VI - LAST DAY REVISION TEST 1 - UnlockedPriya Moorthy100% (1)

- NISM XV Research Analyst Short NotesDocument40 pagesNISM XV Research Analyst Short Notesjack75% (4)

- Nism - 6Document29 pagesNism - 6vjeshnani100% (1)

- Nism 9Document19 pagesNism 9newbie1947No ratings yet

- Mutual Funds Distributor Exam NotesDocument40 pagesMutual Funds Distributor Exam Notesprakash nagaNo ratings yet

- Nism Series III A Securities Intermediaries Compliance Non Fund Exam WorkbookDocument214 pagesNism Series III A Securities Intermediaries Compliance Non Fund Exam Workbookpiyush_rathod_13No ratings yet

- Nism Series XV - Research Analyst Certification ExamDocument17 pagesNism Series XV - Research Analyst Certification ExamRohit ShetNo ratings yet

- NISM Securities Operations and Risk Management Practice Test - NISM SORMDocument22 pagesNISM Securities Operations and Risk Management Practice Test - NISM SORMSRINIVASAN100% (4)

- Mock 12Document28 pagesMock 12Manan Sharma100% (1)

- NISM QuestionsDocument6 pagesNISM QuestionsAvibhav KumarNo ratings yet

- Nism 8 - Equity Derivatives - Last Day Revision Test 1Document54 pagesNism 8 - Equity Derivatives - Last Day Revision Test 1vgvpplNo ratings yet

- Business Analyst ResumeDocument5 pagesBusiness Analyst Resumecnu29No ratings yet

- NISM Currency Derivatives Mock Test at WWW - MODELEXAM.INDocument2 pagesNISM Currency Derivatives Mock Test at WWW - MODELEXAM.INSRINIVASAN0% (3)

- NISM Paper 1 To 5 MOCK Test - Vry ImpDocument26 pagesNISM Paper 1 To 5 MOCK Test - Vry ImpKumarGaurav50% (2)

- Nism Xiii - Common Derivatives - Last Day Revision Test 1Document54 pagesNism Xiii - Common Derivatives - Last Day Revision Test 1Vinoth Kumar50% (2)

- Nism X A - Investment Adviser Level 1 - Last Day Revision Test 3Document19 pagesNism X A - Investment Adviser Level 1 - Last Day Revision Test 3Nupur SharmaNo ratings yet

- (Hoff) Novel Ways of Implementing Carry Alpha in CommoditiesDocument13 pages(Hoff) Novel Ways of Implementing Carry Alpha in CommoditiesrlindseyNo ratings yet

- Chapter 2: Introduction To Securities MarketDocument7 pagesChapter 2: Introduction To Securities Marketravi100% (1)

- Nism & Market News: NISM - 500 Question Bank - VA SeriesDocument41 pagesNism & Market News: NISM - 500 Question Bank - VA Seriesrohit jainNo ratings yet

- NISM Mock 4 PDFDocument41 pagesNISM Mock 4 PDFnewbie194767% (3)

- Nism Series V B - Mutual Fund Foundation ExamDocument29 pagesNism Series V B - Mutual Fund Foundation ExamRanganNo ratings yet

- Nism Series XV - Research Analyst Certification ExamDocument17 pagesNism Series XV - Research Analyst Certification ExamRohit ShetNo ratings yet

- Mutual Fund Test For SistributorDocument54 pagesMutual Fund Test For Sistributorkishore JoshiNo ratings yet

- World Bank General Conditions For LoansDocument32 pagesWorld Bank General Conditions For LoansMax AzulNo ratings yet

- Derivative Market Dealer Module Practice Book SampleDocument35 pagesDerivative Market Dealer Module Practice Book SampleMeenakshi0% (1)

- Nism 5 A - Mutual Fund Exam - Practice Test 1Document24 pagesNism 5 A - Mutual Fund Exam - Practice Test 1Aditi Sawant100% (5)

- Nism Currency Derivatives Study NotesDocument23 pagesNism Currency Derivatives Study NotesNavjyot Singh Cheema100% (1)

- Nism Mutual Fund Study Notes PDFDocument28 pagesNism Mutual Fund Study Notes PDFArijitGhoshNo ratings yet

- Nism Series 15 Model PaperDocument54 pagesNism Series 15 Model PaperRohit Shet50% (4)

- Financial Services NotesDocument16 pagesFinancial Services NotesNupur ChaturvediNo ratings yet

- Nism 8 - Test-2 - Equity Derivatives - PracticeDocument31 pagesNism 8 - Test-2 - Equity Derivatives - PracticeAbhijeet KumarNo ratings yet

- NISM SERIES 1 CURRENCY - LAST DAY EXAM 1 - Unlocked PDFDocument40 pagesNISM SERIES 1 CURRENCY - LAST DAY EXAM 1 - Unlocked PDFNeeraj Kumar100% (6)

- Paper 1-NISM X A - INVESTMENT ADVISER LEVEL 1 - PRACTICE TEST 1 - UnlockedDocument19 pagesPaper 1-NISM X A - INVESTMENT ADVISER LEVEL 1 - PRACTICE TEST 1 - UnlockedHirak Jyoti Das100% (2)

- Ugb 322.viet Ha NguyenDocument53 pagesUgb 322.viet Ha NguyenPhạm Huyền100% (1)

- Answer The Following QuestionsDocument23 pagesAnswer The Following QuestionsnirajdjainNo ratings yet

- Nism 3 A - Compliance - Last Day Revision Test 2Document39 pagesNism 3 A - Compliance - Last Day Revision Test 2Rohit Sharma100% (1)

- Nism 3Document17 pagesNism 3newbie1947No ratings yet

- Nism Vi - Depository Exam - Last Day Revision Test 3Document42 pagesNism Vi - Depository Exam - Last Day Revision Test 3sandip kumar100% (2)

- PDF Nism 8 Equity Derivatives Last Day Revision Test 1 DDDocument54 pagesPDF Nism 8 Equity Derivatives Last Day Revision Test 1 DDShamayal Ahmad0% (1)

- NISM Series III-A: Securities Intermediaries Compliance (Non Fund) Certification ExaminationDocument9 pagesNISM Series III-A: Securities Intermediaries Compliance (Non Fund) Certification ExaminationGarimendra VermaNo ratings yet

- Nism Series 1 Currency - Real Feel Mock Test 2Document54 pagesNism Series 1 Currency - Real Feel Mock Test 2Neeraj Kumar100% (1)

- Nism Series 1 Currency - Practice Exam 1Document19 pagesNism Series 1 Currency - Practice Exam 1Neeraj KumarNo ratings yet

- Investment Adviser XB Level 2 Exam Study Material NotesDocument20 pagesInvestment Adviser XB Level 2 Exam Study Material NotesSRINIVASAN100% (2)

- NISM Investment Adviser Study MaterialDocument28 pagesNISM Investment Adviser Study MaterialSRINIVASAN100% (1)

- NISM Equity Derivatives Mock Test WWW - MODELEXAM.INDocument1 pageNISM Equity Derivatives Mock Test WWW - MODELEXAM.INSRINIVASAN50% (2)

- NISM Series-VIII Equity Derivatives Certification ExaminationDocument2 pagesNISM Series-VIII Equity Derivatives Certification ExaminationIntelivisto Consulting India Private Limited50% (2)

- Nism Book Summary: Nismtop500 - Series Iiia-Securities Intr ComplianceDocument44 pagesNism Book Summary: Nismtop500 - Series Iiia-Securities Intr Compliancebhavani sankar areNo ratings yet

- NISM Series III A Securities Intermediaries Compliance NF Certication ExamDocument222 pagesNISM Series III A Securities Intermediaries Compliance NF Certication ExamNIFM PGDMFNo ratings yet

- Mock 1Document10 pagesMock 1Manan SharmaNo ratings yet

- Nism 6Document30 pagesNism 6Hema lathaNo ratings yet

- Nism Equity Derivatives Study NotesDocument26 pagesNism Equity Derivatives Study NotesRam LalaNo ratings yet

- NISM Currency Derivatives Study Material by WWW - MODELEXAM.INDocument18 pagesNISM Currency Derivatives Study Material by WWW - MODELEXAM.INSRINIVASANNo ratings yet

- Equity DerivativesDocument5 pagesEquity Derivativessimplypaisa50% (2)

- STUDY MATERIAL FOR NISM Depository Operations Exam (DOCE) - NISM MOCK TEST AT WWW - MODELEXAM.INDocument28 pagesSTUDY MATERIAL FOR NISM Depository Operations Exam (DOCE) - NISM MOCK TEST AT WWW - MODELEXAM.INThiagarajan Srinivasan74% (19)

- NCFM Derivatives Market (Dealers) Module Mock Test QuestionsDocument19 pagesNCFM Derivatives Market (Dealers) Module Mock Test QuestionsPooja Khandelwal100% (1)

- Dokumen - Tips - Demo Nism 8 Equity Derivatives ModuleDocument7 pagesDokumen - Tips - Demo Nism 8 Equity Derivatives ModuleArif QureshiNo ratings yet

- Correct Answers Are Shown in GreenDocument20 pagesCorrect Answers Are Shown in Greenvineetsukhija67% (6)

- NISM SERIES X-A Site Model PaperDocument4 pagesNISM SERIES X-A Site Model Paperssk1972100% (2)

- WWW - Modelexam.in Offers Online Model Exams For NISM, NCFM & BCFM Exams. Register Now!Document24 pagesWWW - Modelexam.in Offers Online Model Exams For NISM, NCFM & BCFM Exams. Register Now!SATISH BHARADWAJNo ratings yet

- NISM Series VIII Equity DerivativesDocument1 pageNISM Series VIII Equity DerivativesKishore Steve AustinNo ratings yet

- Currency (1) 222 PDFDocument81 pagesCurrency (1) 222 PDFSoumitra NaiyaNo ratings yet

- Practice Test No. 5Document30 pagesPractice Test No. 5sanjar khokharNo ratings yet

- 4Document29 pages4zakalNo ratings yet

- Finance IVDocument9 pagesFinance IVkrish bhatiaNo ratings yet

- PROJECT - Financial Industry Sector - ARUNIMA VISWANATH - 21HR30B12Document15 pagesPROJECT - Financial Industry Sector - ARUNIMA VISWANATH - 21HR30B12ARUNIMA VISWANATHNo ratings yet

- Topic 1 - Intro To Financial Markets: Create Base On The Revision Slide On Black BoardDocument15 pagesTopic 1 - Intro To Financial Markets: Create Base On The Revision Slide On Black BoardChip choiNo ratings yet

- Trading Is A Combination of Art and ScienceDocument2 pagesTrading Is A Combination of Art and SciencedpksobsNo ratings yet

- NISM Series III A Securities Intermediaries Compliance NF Certication ExamDocument222 pagesNISM Series III A Securities Intermediaries Compliance NF Certication ExamNIFM PGDMFNo ratings yet

- Question 1) Briefly Explain Capital Allocation Process With The Help of Diagram?Document7 pagesQuestion 1) Briefly Explain Capital Allocation Process With The Help of Diagram?Usama KhanNo ratings yet

- 3rd Annual PWC Elwood Aima Crypto Hedge Fund Report (May 2021)Document52 pages3rd Annual PWC Elwood Aima Crypto Hedge Fund Report (May 2021)ForkLog100% (1)

- Money, Power Wall StreetDocument2 pagesMoney, Power Wall StreetAdyotNo ratings yet

- Finnair Financial Report 2010Document104 pagesFinnair Financial Report 2010Shi ZhanNo ratings yet

- Bloomberg Letter To CFTCDocument12 pagesBloomberg Letter To CFTCtabbforumNo ratings yet

- Fixed Income Sexurities PDFDocument424 pagesFixed Income Sexurities PDFHannah Group-IncNo ratings yet

- Cifa Reading List PDFDocument6 pagesCifa Reading List PDFDaneilNo ratings yet

- Currency Exchange Rates: 1 Usd 7 Yen 1USD 6 Yen Price/Base BDT/USD 85/1. 87/1, 83/1Document31 pagesCurrency Exchange Rates: 1 Usd 7 Yen 1USD 6 Yen Price/Base BDT/USD 85/1. 87/1, 83/1mostakNo ratings yet

- FX and Rates EM HandbookDocument206 pagesFX and Rates EM HandbookJoyce YeungNo ratings yet

- The Modern Financial System: Sargon NissanDocument40 pagesThe Modern Financial System: Sargon Nissanjagdishmisra2011No ratings yet

- Acctg 201A Course GuideDocument13 pagesAcctg 201A Course GuideDomingo Bay-anNo ratings yet

- Ver-He - Ounter: Markets: What Are They?Document2 pagesVer-He - Ounter: Markets: What Are They?softy1980No ratings yet

- SM-FOI-Unit 1,4,5Document168 pagesSM-FOI-Unit 1,4,5Priyanshu BhattNo ratings yet

- J Applied Corp Finance - 2022 - Myers - Real Options and Hidden LeverageDocument16 pagesJ Applied Corp Finance - 2022 - Myers - Real Options and Hidden LeverageVaconselos ChacuivaNo ratings yet

- The Clearing Corporation of India, PatilDocument24 pagesThe Clearing Corporation of India, PatilShrishailamalikarjunNo ratings yet

- Circular - Operational, Prudential and Reporting Norms For AIFsDocument13 pagesCircular - Operational, Prudential and Reporting Norms For AIFsRajesh AroraNo ratings yet