Professional Documents

Culture Documents

Stock V NS

Uploaded by

Mervic Al Tuble-Niala0 ratings0% found this document useful (0 votes)

56 views2 pagesStock corporations have capital stock divided into shares and are authorized to distribute profits as dividends to shareholders. Non-stock corporations do not have shares and are formed for charitable, religious, educational, or similar purposes rather than profit. Profits of non-stock corporations are not distributed but used to further the corporation's purpose. Membership and voting rights also differ between the two types of corporations.

Original Description:

corpo

Original Title

Stock v NS

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentStock corporations have capital stock divided into shares and are authorized to distribute profits as dividends to shareholders. Non-stock corporations do not have shares and are formed for charitable, religious, educational, or similar purposes rather than profit. Profits of non-stock corporations are not distributed but used to further the corporation's purpose. Membership and voting rights also differ between the two types of corporations.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

56 views2 pagesStock V NS

Uploaded by

Mervic Al Tuble-NialaStock corporations have capital stock divided into shares and are authorized to distribute profits as dividends to shareholders. Non-stock corporations do not have shares and are formed for charitable, religious, educational, or similar purposes rather than profit. Profits of non-stock corporations are not distributed but used to further the corporation's purpose. Membership and voting rights also differ between the two types of corporations.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

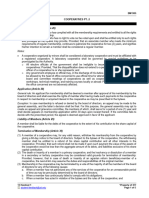

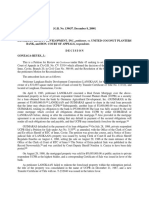

Stock v.

Non-Stock Corporations

Stock

Definition

Non-Stock

Corporations which have capital

stock divided into shares and

are authorized to distribute to the

holders of shares dividends or

allotments of the surplus profits on

the basis of the shares (3)

All other private corporations (3)

Purpose

Primarily to make profits for its

shareholders

May be formed or organized for

charitable, religious, educational,

professional, cultural, fraternal,

literary, scientific, social, civic

service, or similar purposes like

trade, industry, agricultural and like

chambers, or any combination

thereof. (88)

Distribution of Profits

Profit is distributed to shareholders

Whatever incidental profit made is

not distributed among its members

but is used for furtherance of its

purpose. AOI or by-laws may

provide for the distribution of its

assets among its members upon its

dissolution. Before then, no profit

may be made by members.

Composition

Stockholders

Members

Scope of right to vote

Each stockholder votes according to

the proportion of his shares in the

corporation. No shares may be

deprived of voting rights except

those classified and issued as

"preferred" or "redeemable" shares,

and as otherwise provided by the

Code. (Sec. 6)

Each member, regardless of class,

is entitled to one (1) vote UNLESS

such right to vote has been limited,

broadened, or denied in the AOI or

by-laws. (Sec. 89)

Voting by proxy

May be denied by the AOI or the bylaws. (Sec. 89)

Cannot be denied. (Sec. 58)

Voting by mail

May be authorized by the by-laws,

with the approval of and under the

conditions prescribed by the SEC.

(Sec. 89)

Not possible.

Who exercises Corporate

Powers 23

Board of Directors or Trustees

Members of the corporation

One where no part of its income is

distributable as dividends to its

members, trustees or officers. (87)

Governing Board

Board of Directors or Trustees,

consisting of 5-15 directors /

trustees.

Board of Trustees, which may

consist of more than 15 trustees

unless otherwise provided by the

AOI or by-laws. (Sec, 92)

Directors / trustees shall hold office

for 1 year and until their successors

are elected and qualified (Sec. 23).

Board classified in such a way that

the term of office of 1/3 of their

number shall expire every year.

Subsequent elections of trustees

comprising 1/3 of the board shall be

held annually, and trustees so

elected shall have a term of 3 years.

(Sec. 92)

Election of officers

Officers are elected by the Board of

Directors (Sec. 25), except in close

corporations where the stockholders

themselves may elect the officers.

(Sec. 97)

Officers may be elected directly by

the members UNLESS the AOI or

by-laws provide otherwise. (Sec.

92)

Place of meetings

Generally, the meetings must be

held at the principal office of the

corporation, if practicable. If not,

then anyplace in the city or

municipality where the principal

office of the corporation is located.

(Sec. 51)

Any place within the Philippines, if

provided for by the by-laws (Sec.

93)

Transferability of interest

or membership

Transferable.

Generally non-transferable since

membership and all rights arising

there from are personal. However,

the AOI or by-laws can provide

otherwise. (Sec. 90)

Term of

trustees

directors

or

Distribution of assets in

case of dissolution

See Sec. 94.

You might also like

- Non Stock CorporationsDocument18 pagesNon Stock CorporationsArvin Antonio Ortiz100% (2)

- Non-Stock CorporationsDocument34 pagesNon-Stock CorporationsJohn Cloyd DejarmeNo ratings yet

- Classification, Formation & Incorporation: 4LM1 Castillo, Angelica Elaine Montemayor, Anna Carmela Yacob, Judith ElisciaDocument29 pagesClassification, Formation & Incorporation: 4LM1 Castillo, Angelica Elaine Montemayor, Anna Carmela Yacob, Judith ElisciaMikkboy RosetNo ratings yet

- Corporation LawDocument181 pagesCorporation LawRodil FlanciaNo ratings yet

- Cir vs. Club Filipino (5 Scra 321 1962) : See Sec. 94Document40 pagesCir vs. Club Filipino (5 Scra 321 1962) : See Sec. 94XXXNo ratings yet

- DefinitionDocument15 pagesDefinitionMargaret LarinNo ratings yet

- Title X Appraisal RightDocument26 pagesTitle X Appraisal RightMaryjane De GuzmanNo ratings yet

- CorporationDocument64 pagesCorporationJanaisa BugayongNo ratings yet

- Non Stock CorporationDocument15 pagesNon Stock CorporationBudoy100% (1)

- BL2 - Corp LawDocument82 pagesBL2 - Corp LawKlang B.No ratings yet

- BL2 CORP. NOTES I APPRAISAL RIGHT Non Stock Corp.Document5 pagesBL2 CORP. NOTES I APPRAISAL RIGHT Non Stock Corp.Angel moodyNo ratings yet

- Salient Coop Code 2008Document71 pagesSalient Coop Code 2008magrocapalonga24No ratings yet

- Corporation Code Reviewer Atty LadiaDocument137 pagesCorporation Code Reviewer Atty LadiaALEXANDRIA RABANESNo ratings yet

- RFBT 2 Module 1 Corporations Lesson 7Document8 pagesRFBT 2 Module 1 Corporations Lesson 7JQ RandomNo ratings yet

- Corporations Can Impose Additional Requirements (In Being A Director or A Trustee) Unless Contrary To Public PolicyDocument10 pagesCorporations Can Impose Additional Requirements (In Being A Director or A Trustee) Unless Contrary To Public PolicyJoe MedinaNo ratings yet

- Share Holding Co. (Fixed)Document41 pagesShare Holding Co. (Fixed)Aimee EemiaNo ratings yet

- The Corporation Code of The Philippines: Title Xi Non-Stock Corporations (Sections 87-95)Document39 pagesThe Corporation Code of The Philippines: Title Xi Non-Stock Corporations (Sections 87-95)Diane Dee YaneeNo ratings yet

- Definition and Attributes of A CorporationDocument6 pagesDefinition and Attributes of A Corporationkeith105No ratings yet

- The Philippine Cooperative Code of 2008 (Republic Act No. 9520Document80 pagesThe Philippine Cooperative Code of 2008 (Republic Act No. 9520Jane Melody RatoNo ratings yet

- Board of DirectorsDocument50 pagesBoard of Directorsncq6dmzmp4No ratings yet

- Corporation Law ReviewerDocument84 pagesCorporation Law ReviewerrickyNo ratings yet

- CorpDocument202 pagesCorpKent Braña TanNo ratings yet

- 05B Non Stock CorporationsDocument16 pages05B Non Stock Corporationsgilberthufana446877No ratings yet

- Lesson 2 NON STOCK CORPORATIONSDocument9 pagesLesson 2 NON STOCK CORPORATIONSVanessa Evans CruzNo ratings yet

- 13 Handout 12Document5 pages13 Handout 12Sell JaviniarNo ratings yet

- CoopDocument28 pagesCoopJuhuanna AleNo ratings yet

- Cooperative UnionsDocument5 pagesCooperative UnionsQueen ValleNo ratings yet

- Corporation Law PDFDocument56 pagesCorporation Law PDFApril Isidro100% (2)

- CorpocompletenotesimptDocument127 pagesCorpocompletenotesimptkimaldita27No ratings yet

- Corporation Law ReviewerDocument84 pagesCorporation Law ReviewerSam100% (1)

- Rights of Stockholders PDFDocument26 pagesRights of Stockholders PDFAce LimpinNo ratings yet

- Title Iii Board of Directors and TrusteesDocument11 pagesTitle Iii Board of Directors and TrusteesMikaela Joy FloraNo ratings yet

- Corporation LawDocument96 pagesCorporation LawLhine KiwalanNo ratings yet

- Board of Directors Officer and Rights of The CorporationDocument10 pagesBoard of Directors Officer and Rights of The CorporationAce LimpinNo ratings yet

- Salient Points of Ra 9520 & Spud-Mpc byDocument25 pagesSalient Points of Ra 9520 & Spud-Mpc bygregbaccayNo ratings yet

- CHAPTDocument16 pagesCHAPTAngela AnonuevoNo ratings yet

- Bylaws of Kennett Square Food Co-OpDocument9 pagesBylaws of Kennett Square Food Co-OpKevin BoothNo ratings yet

- Corporation Law PDFDocument109 pagesCorporation Law PDFLyra AguilarNo ratings yet

- Section 86Document6 pagesSection 86renhasfallen2No ratings yet

- Law On Corporations13Document13 pagesLaw On Corporations13dynbelloNo ratings yet

- Non Stock Corp SlidesDocument65 pagesNon Stock Corp SlidesRyan A. SuaverdezNo ratings yet

- Sec.91. Termination of Membership.: Chapter Ii - Trustees and OfficersDocument2 pagesSec.91. Termination of Membership.: Chapter Ii - Trustees and OfficersJohn Leo Caballero DagcutanNo ratings yet

- Meetings: Caparros, Robert Emmanuel T-41 Atty. Bacalla Law On Partnership and CorporationDocument10 pagesMeetings: Caparros, Robert Emmanuel T-41 Atty. Bacalla Law On Partnership and CorporationJar JorquiaNo ratings yet

- NON Stock Corporations Stock CorporationsDocument7 pagesNON Stock Corporations Stock CorporationsJay Vhee OohNo ratings yet

- Incorporation and Organization of Private CorporationsDocument10 pagesIncorporation and Organization of Private CorporationsgerrymanderingNo ratings yet

- Incorporation and Organization of Private CorporationsDocument10 pagesIncorporation and Organization of Private CorporationsgerrymanderingNo ratings yet

- Corporation LawDocument107 pagesCorporation LawMyra De Guzman PalattaoNo ratings yet

- Holding Hands Holdings Corporation: By-Laws OFDocument12 pagesHolding Hands Holdings Corporation: By-Laws OFNorman Kenneth SantosNo ratings yet

- Denmark P. Cabaddu 2BDocument4 pagesDenmark P. Cabaddu 2BDenmark CabadduNo ratings yet

- The Handbook for Reading and Preparing Proxy Statements: A Guide to the SEC Disclosure Rules for Executive and Director Compensation, 6th EditionFrom EverandThe Handbook for Reading and Preparing Proxy Statements: A Guide to the SEC Disclosure Rules for Executive and Director Compensation, 6th EditionNo ratings yet

- Book 2: Futuristic Rugby League: Academy of Excellence for Coaching Rugby Skills and Fitness DrillsFrom EverandBook 2: Futuristic Rugby League: Academy of Excellence for Coaching Rugby Skills and Fitness DrillsNo ratings yet

- Textbook of Urgent Care Management: Chapter 6, Business Formation and Entity StructuringFrom EverandTextbook of Urgent Care Management: Chapter 6, Business Formation and Entity StructuringNo ratings yet

- Book 1: Futuristic Fifteen Man Rugby Union: Academy of Excellence for Coaching Rugby Skills and Fitness DrillsFrom EverandBook 1: Futuristic Fifteen Man Rugby Union: Academy of Excellence for Coaching Rugby Skills and Fitness DrillsNo ratings yet

- American Institute of Parliamentarians Standard Code of Parliamentary ProcedureFrom EverandAmerican Institute of Parliamentarians Standard Code of Parliamentary ProcedureRating: 5 out of 5 stars5/5 (1)

- Ihl and IhrlDocument2 pagesIhl and IhrlPriyanka DevershettyNo ratings yet

- REM Cases PDFDocument206 pagesREM Cases PDFMervic Al Tuble-NialaNo ratings yet

- RMC 30 2016Document5 pagesRMC 30 2016Mervic Al Tuble-NialaNo ratings yet

- Tax Rem Cases PDFDocument231 pagesTax Rem Cases PDFMervic Al Tuble-NialaNo ratings yet

- Succession Cases 1-10 Full TextDocument52 pagesSuccession Cases 1-10 Full TextMervic Al Tuble-NialaNo ratings yet

- The World Trade Organization... : ... in BriefDocument8 pagesThe World Trade Organization... : ... in BriefDiprajSinhaNo ratings yet

- Module CasesDocument153 pagesModule CasesMervic Al Tuble-NialaNo ratings yet

- Republic of The PhilippinesDocument4 pagesRepublic of The PhilippinesMervic Al Tuble-NialaNo ratings yet

- Case 14-38Document72 pagesCase 14-38Mervic Al Tuble-NialaNo ratings yet

- Prescription MTD MFR Default PleadingsDocument33 pagesPrescription MTD MFR Default PleadingsMervic Al Tuble-NialaNo ratings yet

- Right To Seek AsylumDocument3 pagesRight To Seek AsylumMervic Al Tuble-NialaNo ratings yet

- Borromeo V PugoyDocument3 pagesBorromeo V PugoyMervic Al Tuble-NialaNo ratings yet

- Foreign Currency Deposit Case Digest 1Document2 pagesForeign Currency Deposit Case Digest 1Mervic Al Tuble-Niala100% (1)

- Ihl and IhrlDocument2 pagesIhl and IhrlPriyanka DevershettyNo ratings yet

- Abscbn V CaDocument8 pagesAbscbn V CaAlthea Mae Casador-FabaleNo ratings yet

- Phil American Life and Gen Insurance V Sec of FinanceDocument8 pagesPhil American Life and Gen Insurance V Sec of FinanceMervic Al Tuble-NialaNo ratings yet

- RMO No 9-2014 Request For RulingDocument4 pagesRMO No 9-2014 Request For RulingMervic Al Tuble-NialaNo ratings yet

- British American Tobacco V Camacho 2008 PDFDocument28 pagesBritish American Tobacco V Camacho 2008 PDFMervic Al Tuble-NialaNo ratings yet

- British American Tobacco V Camacho 2008 PDFDocument28 pagesBritish American Tobacco V Camacho 2008 PDFMervic Al Tuble-NialaNo ratings yet

- Ruperto Suldao V Cimech SystemDocument7 pagesRuperto Suldao V Cimech SystemMervic Al Tuble-NialaNo ratings yet

- Galuba V LauretaDocument4 pagesGaluba V LauretaMervic Al Tuble-NialaNo ratings yet

- Manila Memorial Park V Dept of Social Welfare and Dept of FinanceDocument28 pagesManila Memorial Park V Dept of Social Welfare and Dept of FinanceMervic Al Tuble-NialaNo ratings yet

- Ang Mga Kaanib Sa Iglesia NG Dios Kay Kristo Hesus, H.S.K. Sa Bansang Pilipinas, Inc.Document4 pagesAng Mga Kaanib Sa Iglesia NG Dios Kay Kristo Hesus, H.S.K. Sa Bansang Pilipinas, Inc.Mervic Al Tuble-NialaNo ratings yet

- Rule 111 Cases Prosecution of Civil ActionDocument32 pagesRule 111 Cases Prosecution of Civil ActionMervic Al Tuble-NialaNo ratings yet

- Larranaga V CADocument5 pagesLarranaga V CAMervic Al Tuble-NialaNo ratings yet

- Prudente V DayritDocument9 pagesPrudente V DayritMervic Al Tuble-NialaNo ratings yet

- Teague V Martin GoluckeDocument6 pagesTeague V Martin GoluckeMervic Al Tuble-NialaNo ratings yet

- People V SayconDocument8 pagesPeople V SayconMervic Al Tuble-NialaNo ratings yet

- Law On Partnership and Corporation Study Guide de LeonDocument9 pagesLaw On Partnership and Corporation Study Guide de LeonLhorene Hope Dueñas0% (2)

- Corporate Acts Voting RequirementDocument6 pagesCorporate Acts Voting RequirementVilma PabinesNo ratings yet

- TT International 2011 Annual ReportDocument98 pagesTT International 2011 Annual ReportWeR1 Consultants Pte LtdNo ratings yet

- HEDGINGDocument57 pagesHEDGINGAnthony Kwo0% (2)

- ENTERPRISE, Forms of Business OwnershipDocument10 pagesENTERPRISE, Forms of Business OwnershipKristy JenacNo ratings yet

- Harden v. Benguet Consolidated PDFDocument12 pagesHarden v. Benguet Consolidated PDFMaica JingcoNo ratings yet

- Business Forms in BDDocument7 pagesBusiness Forms in BDPiana Monsur MindiaNo ratings yet

- New Companies Act 2013Document9 pagesNew Companies Act 2013ashishbajaj007100% (2)

- SMI Trading Techniques PDFDocument14 pagesSMI Trading Techniques PDFVijay VijiNo ratings yet

- Slide 3 Recommendation of Cadbury CommitteeDocument13 pagesSlide 3 Recommendation of Cadbury Committeecohen.herreraNo ratings yet

- Lifting of Corporate LawDocument42 pagesLifting of Corporate LawShashiRaiNo ratings yet

- Corporate Management JurisprudenceDocument37 pagesCorporate Management Jurisprudencegilberthufana446877No ratings yet

- Strategy 8 Protective Call or Synthetic Long Put: Name: - Anand BhushanDocument6 pagesStrategy 8 Protective Call or Synthetic Long Put: Name: - Anand BhushanAnand_Bhushan28No ratings yet

- Articles of AssociationDocument9 pagesArticles of AssociationNikki JohnsonNo ratings yet

- Company Law 1 Notes FinalDocument211 pagesCompany Law 1 Notes FinalOtiwaa ColemanNo ratings yet

- Topic 2 - Legal Aspects of Business Organisations (Student)Document25 pagesTopic 2 - Legal Aspects of Business Organisations (Student)aishahfarhahNo ratings yet

- Corporate Taxation: Formation, Reorganization, and LiquidationDocument33 pagesCorporate Taxation: Formation, Reorganization, and LiquidationMo ZhuNo ratings yet

- Materi ACFE - Perkorupsian Di Indonesia - Langkah BUMN-Pak Amien Sunaryadi - Komut PLNDocument16 pagesMateri ACFE - Perkorupsian Di Indonesia - Langkah BUMN-Pak Amien Sunaryadi - Komut PLNAchmad SuryamanNo ratings yet

- REIT LawDocument23 pagesREIT LawriasibuloNo ratings yet

- Anti-Takeover Defences in India (Rajat Kaushik)Document35 pagesAnti-Takeover Defences in India (Rajat Kaushik)Abhimanyu SinghNo ratings yet

- CREDIT Syllabus 2020 Final PDFDocument5 pagesCREDIT Syllabus 2020 Final PDFJessica LagmanNo ratings yet

- Bhavesh Work Sheet 01 - FDDocument8 pagesBhavesh Work Sheet 01 - FDBhavesh RathiNo ratings yet

- Hull OFOD10e MultipleChoice Questions and Answers Ch12Document6 pagesHull OFOD10e MultipleChoice Questions and Answers Ch12Kevin Molly KamrathNo ratings yet

- Chapter 6: Consolidated Financial Statements (Part 3) : Compilation of ReportsDocument43 pagesChapter 6: Consolidated Financial Statements (Part 3) : Compilation of ReportsKriz TanNo ratings yet

- White Collar Crime - MonishDocument11 pagesWhite Collar Crime - MonishBharat JoshiNo ratings yet

- Corporate Laws and PracticesDocument16 pagesCorporate Laws and PracticesMahmudul HasanNo ratings yet

- Commercial Law Review Cases Batch 2Document42 pagesCommercial Law Review Cases Batch 2KarmaranthNo ratings yet

- Statement of Compulsory Winding Up As On 30 SEPTEMBER, 2008Document4 pagesStatement of Compulsory Winding Up As On 30 SEPTEMBER, 2008abchavhan20No ratings yet

- Doctrine of Ultra Vires - Doc Sid 1Document14 pagesDoctrine of Ultra Vires - Doc Sid 1Angna DewanNo ratings yet

- Director's DutiesDocument19 pagesDirector's DutiesDashini VigneswaranNo ratings yet