Professional Documents

Culture Documents

Charles R. HOWELL, Commissioner of Banking and Insurance of The State of New Jersey, v. Citizens First National Bank of Ridgewood, Appellant

Uploaded by

Scribd Government DocsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Charles R. HOWELL, Commissioner of Banking and Insurance of The State of New Jersey, v. Citizens First National Bank of Ridgewood, Appellant

Uploaded by

Scribd Government DocsCopyright:

Available Formats

385 F.

2d 528

Charles R. HOWELL, Commissioner of Banking and

Insurance of the State of New Jersey,

v.

CITIZENS FIRST NATIONAL BANK OF RIDGEWOOD,

Appellant.

No. 16452.

United States Court of Appeals Third Circuit.

Argued October 3, 1967.

Decided November 22, 1967.

Walter W. Weber, Jr., Weber, Muth & Weber, Ramsey, N. J., for

appellant.

Marilyn Loftus Schauer, Asst. Atty. Gen., Dept. of Law and Public Safety,

Division of Law, Trenton, N. J. (Arthur J. Sills, Atty. Gen., of New Jersey,

Trenton, N. J., on the brief), for respondent.

Before STALEY, Chief Judge, and MARIS and VAN DUSEN, Circuit

Judges.

OPINION OF THE COURT

MARIS, Circuit Judge.

The plaintiff, Charles R. Howell, Commissioner of Banking and Insurance of

the State of New Jersey, brought this action in the District Court for the District

of New Jersey against the defendant, Citizens First National Bank of

Ridgewood, for injunctive and declaratory relief. The complaint alleged that

the defendant had merged with the former First National Bank and Trust

Company of Ramsey, located in Ramsey, New Jersey, after which the

defendant operated its Ridgewood, New Jersey, office as its principal office and

the Ramsey office of the merged bank as a branch office; that subsequently, the

defendant filed an application with the Comptroller of the Currency of the

United States for permission to establish a branch office in the Interstate

Shopping Center at Ramsey which the Comptroller approved and which the

defendant, shortly thereafter, commenced to operate. The complaint sought a

judgment declaring the operation of the second branch to be in violation of

federal and state laws and prayed for an injunction restraining its operation.

2

The question which the case presents is whether under the statute law of New

Jersey, to the extent that it is made applicable to national banks by the federal

law, the defendant was empowered, with the approval of the Comptroller of the

Currency to establish and operate a second branch office in Ramsey. Taking the

view that this was a question of state law as to which the decisions of the New

Jersey courts would be authoritative, but as to which they had not yet clearly

spoken, the district court entered an order staying the proceedings pending the

institution by the plaintiff of a suit in the New Jersey courts to determine the

question and directing dismissal of the present action when that suit is

commenced. It was from that order that the appeal now before us was taken.

While it is settled that it may be appropriate for a federal court to decline to

exercise its jurisdiction or to postpone such exercise and remit the parties to the

state courts in a case which involves a decisive issue of unsettled state law, 1 we

are satisfied that the case now before us is not one which is appropriate for

such abstention.

The basic statutory authority for a national bank to establish branch offices

within the state outside the municipality in which its principal office is located

is contained in clause (2) of paragraph (c) of section 5155 of the Revised

Statutes, as amended by section 23 of the Banking Act of 1933, which provides,

in pertinent part, as follows:

"(c) A national banking association may, with the approval of the Comptroller

of the Currency, establish and operate new branches: (1) Within the limits of

the city, town or village in which said association is situated, if such

establishment and operation are at the time expressly authorized to State banks

by the law of the State in question; and (2) at any point within the State in

which said association is situated, if such establishment and operation are at the

time authorized to State banks by the statute law of the State in question by

language specifically granting such authority affirmatively and not merely by

implication or recognition, and subject to the restrictions as to location imposed

by the law of the State on State banks. * * *" 12 U.S.C.A. 36(c).

The New Jersey statute involved is section 19 of the Banking Act of 1948,

which, in pertinent part, provides as follows:

"A. Any bank or savings bank may, pursuant to a resolution of its board of

directors or board of managers, establish and maintain branch offices, subject to

the conditions and limitations of this article.

"B. No bank or savings bank shall establish or maintain a branch office which

is located outside the municipality in which it maintains its principal office;

except that a bank or savings banks may establish and maintain a branch office

or offices anywhere in the same county as that in which it maintains its

principal office

(1) when such bank is a receiving bank as defined in section 132, or a receiving

savings bank as defined in section 205, and each proposed branch will be

established at a location occupied by the principal office or a branch office of a

merging bank, as defined in section 132, or a merging savings bank, as defined

in section 205; or

10

(2) when each proposed branch will be established at a location occupied by

the principal office or a branch office of a banking institution in liquidation or

in contemplation of liquidation; or

11

(3) when each proposed branch will be established in a municipality in which

no banking institution has its principal office or a branch office." N.J.S.A.

17:9A-19.

12

A close reading of the federal statute discloses that the precise question

presented to the district court for decision in the present case is not whether the

New Jersey statute, as construed and applied in that State by its Commissioner

of Banking and its courts, grants to a State bank in the defendant's position

authority to establish a second branch office in Ramsey, but rather whether, to

quote the words of the statute, it does so "affirmatively" on its face "and not

merely by implication or recognition." The legislative history of the Banking

Act of 1933 does not indicate with any clarity just why the Congress adopted

this restrictive mechanical rule for determining the applicability of State branch

banking statutes to national banks. What history there is indicates that the

Congress was concerned to permit branch banking in a state only if the state by

express statute has authorized it.2 In any event it is clear that the rule was

intended by the Congress to limit the applicability to national banks of state

branch banking laws solely to such authority as is expressly granted by a

statute. Thus the determination of the extent of the application of a state branch

banking statute to a national bank under the federal Banking Act of 1933 is

purely a question of federal law, a question to be decided by reading the state

statute through lenses prescribed by the Congress. A decision by the state

courts as to the meaning and application of a state branch banking statute would

not be conclusive on the federal courts as to this federal question and might be

wholly irrelevant. For the state courts might well consider the legislative history

of such a statute, its overall provisions, its general scheme and its administrative

interpretation, and reach the conclusion that it granted the branch banking

authority by implication or recognition even though it clearly did not do so by

affirmative language. It is such a construction as this of a state branch banking

statute which the federal statute expressly denies to the Comptroller of the

Currency and the national banks which he supervises.

13

It will thus be seen that the present case involves a purely federal question, the

meaning of the New Jersey branch banking statute for the purposes of clause

(2) of paragraph (c) of section 5155 of the Revised Statutes, as amended, and

under the interpretive criteria laid down in that clause. See Union Savings Bank

of Patchogue v. Saxon, 1964, 118 U.S.App.D.C. 296, 335 F.2d 718, 723. The

question is accordingly one which the district court should proceed to consider

and decide, and as to which its abstention in favor of the state courts is not

appropriate.

14

The order of the district court will be reversed and the cause remanded to the

district court for further proceedings not inconsistent with this opinion.

Notes:

1

Railroad Commission of Texas v. PullMan Co., 1941, 312 U.S. 496, 61 S.Ct.

643, 85 L.Ed. 971; Burford v. Sun Oil Co., 1943, 319 U.S. 315, 63 S.Ct. 1098,

87 L.Ed. 1424; Alabama Public Service Commission v. Southern R. Co., 1951,

341 U.S. 341, 71 S.Ct. 762, 95 L.Ed. 1002; Louisiana P. & L. Co. v. Thibodaux

City, 1959, 360 U.S. 25, 79 S.Ct. 1070, 3 L.Ed.2d 1058; Harrison v. N.A.

A.C.P. 1959, 360 U.S. 167, 79 S.Ct. 1025, 3 L.Ed.2d 1152; Martin v. Creasy,

1959, 360 U.S. 219, 79 S.Ct. 1034, 3 L.Ed.2d 1186. But see Allegheny County

v. Frank Mashuda Co., 1959, 360 U.S. 185, 79 S.Ct. 1060, 3 L.Ed.2d 1163

See the Senate debates upon a prior bill, S. 4412, 72d Cong., upon which the

Banking Act of 1933, as passed, was largely based. 76 Cong.Rec. 1449, 1997,

2205, 2207-8

You might also like

- Fed. Sec. L. Rep. P 94,105 Ronson Corporation v. Liquifin Aktiengesell Schaft Appeal of Franklin National Bank and Franklin New York Corporation, 483 F.2d 852, 3rd Cir. (1973)Document5 pagesFed. Sec. L. Rep. P 94,105 Ronson Corporation v. Liquifin Aktiengesell Schaft Appeal of Franklin National Bank and Franklin New York Corporation, 483 F.2d 852, 3rd Cir. (1973)Scribd Government DocsNo ratings yet

- First Nat. Bank in St. Louis v. Missouri, 263 U.S. 640 (1924)Document11 pagesFirst Nat. Bank in St. Louis v. Missouri, 263 U.S. 640 (1924)Scribd Government DocsNo ratings yet

- Mercantile Nat. Bank at Dallas v. Langdeau, 371 U.S. 555 (1963)Document17 pagesMercantile Nat. Bank at Dallas v. Langdeau, 371 U.S. 555 (1963)Scribd Government DocsNo ratings yet

- Walker Bank & Trust Company, a Corporation v. James J. Saxon, Comptroller of the Currency, and the First National Bank of Logan, of Logan, Utah, a National Banking Association, 352 F.2d 90, 1st Cir. (1965)Document7 pagesWalker Bank & Trust Company, a Corporation v. James J. Saxon, Comptroller of the Currency, and the First National Bank of Logan, of Logan, Utah, a National Banking Association, 352 F.2d 90, 1st Cir. (1965)Scribd Government DocsNo ratings yet

- Van Reed v. Peoples Nat. Bank of Lebanon, 198 U.S. 554 (1905)Document4 pagesVan Reed v. Peoples Nat. Bank of Lebanon, 198 U.S. 554 (1905)Scribd Government DocsNo ratings yet

- Roth v. Delano, 338 U.S. 226 (1949)Document4 pagesRoth v. Delano, 338 U.S. 226 (1949)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Sixth CircuitDocument10 pagesUnited States Court of Appeals, Sixth CircuitScribd Government DocsNo ratings yet

- Herrmann v. Edwards, 238 U.S. 107 (1915)Document6 pagesHerrmann v. Edwards, 238 U.S. 107 (1915)Scribd Government DocsNo ratings yet

- Farmers' and Mechanics' Nat. Bank v. Dearing, 91 U.S. 29 (1875)Document8 pagesFarmers' and Mechanics' Nat. Bank v. Dearing, 91 U.S. 29 (1875)Scribd Government DocsNo ratings yet

- W. M. Jackson, As Superintendent of Banks of The State of Georgia v. First National Bank of Valdosta, 349 F.2d 71, 1st Cir. (1965)Document7 pagesW. M. Jackson, As Superintendent of Banks of The State of Georgia v. First National Bank of Valdosta, 349 F.2d 71, 1st Cir. (1965)Scribd Government DocsNo ratings yet

- Oklahoma Ex Rel. Johnson v. Cook, 304 U.S. 387 (1938)Document7 pagesOklahoma Ex Rel. Johnson v. Cook, 304 U.S. 387 (1938)Scribd Government DocsNo ratings yet

- Agricultural Bank v. Tax Comm'n., 392 U.S. 339 (1968)Document18 pagesAgricultural Bank v. Tax Comm'n., 392 U.S. 339 (1968)Scribd Government DocsNo ratings yet

- In Re First National Bank of Boston, A National Banking Association, 70 F.3d 1184, 1st Cir. (1995)Document10 pagesIn Re First National Bank of Boston, A National Banking Association, 70 F.3d 1184, 1st Cir. (1995)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Ninth CircuitDocument5 pagesUnited States Court of Appeals, Ninth CircuitScribd Government DocsNo ratings yet

- Farmers Bank v. Fed. Reserve Bank, 262 U.S. 649 (1923)Document12 pagesFarmers Bank v. Fed. Reserve Bank, 262 U.S. 649 (1923)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Fourth CircuitDocument9 pagesUnited States Court of Appeals, Fourth CircuitScribd Government DocsNo ratings yet

- Citizens & Southern Nat. Bank v. Bougas, 434 U.S. 35 (1977)Document10 pagesCitizens & Southern Nat. Bank v. Bougas, 434 U.S. 35 (1977)Scribd Government DocsNo ratings yet

- Jenkins v. Neff, 186 U.S. 230 (1902)Document7 pagesJenkins v. Neff, 186 U.S. 230 (1902)Scribd Government DocsNo ratings yet

- Montana Nat. Bank of Billings v. Yellowstone County, 276 U.S. 499 (1928)Document4 pagesMontana Nat. Bank of Billings v. Yellowstone County, 276 U.S. 499 (1928)Scribd Government DocsNo ratings yet

- In Re Appointment of a Conservator for Burke Justice, Jr., Marguerite Justice, Successor Conservator of the Estate of Burke Justice, Jr., Adult Ward, First National Bank of Washington, 418 F.2d 1162, 1st Cir. (1969)Document5 pagesIn Re Appointment of a Conservator for Burke Justice, Jr., Marguerite Justice, Successor Conservator of the Estate of Burke Justice, Jr., Adult Ward, First National Bank of Washington, 418 F.2d 1162, 1st Cir. (1969)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Tenth CircuitDocument5 pagesUnited States Court of Appeals, Tenth CircuitScribd Government DocsNo ratings yet

- Hempstead Bank v. James E. Smith, Comptroller of The Currency of The United States and The Chase Manhattan Bank, National Association, 540 F.2d 57, 2d Cir. (1976)Document7 pagesHempstead Bank v. James E. Smith, Comptroller of The Currency of The United States and The Chase Manhattan Bank, National Association, 540 F.2d 57, 2d Cir. (1976)Scribd Government DocsNo ratings yet

- First Federal Savings and Loan Association of Boston v. Carol S. Greenwald, Etc., 591 F.2d 417, 1st Cir. (1979)Document13 pagesFirst Federal Savings and Loan Association of Boston v. Carol S. Greenwald, Etc., 591 F.2d 417, 1st Cir. (1979)Scribd Government DocsNo ratings yet

- National Bank of North America v. Associates of Obstetrics & Female Surgery, Inc., 425 U.S. 460 (1976)Document3 pagesNational Bank of North America v. Associates of Obstetrics & Female Surgery, Inc., 425 U.S. 460 (1976)Scribd Government DocsNo ratings yet

- First Nat. Bank of Canton v. Williams, 252 U.S. 504 (1920)Document5 pagesFirst Nat. Bank of Canton v. Williams, 252 U.S. 504 (1920)Scribd Government DocsNo ratings yet

- The First Bank and Trust Company v. James E. Smith, Comptroller, Etc., 509 F.2d 663, 1st Cir. (1975)Document5 pagesThe First Bank and Trust Company v. James E. Smith, Comptroller, Etc., 509 F.2d 663, 1st Cir. (1975)Scribd Government DocsNo ratings yet

- Federal Intermediate Credit Bank of Columbia v. Mitchell, 277 U.S. 213 (1928)Document4 pagesFederal Intermediate Credit Bank of Columbia v. Mitchell, 277 U.S. 213 (1928)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Third CircuitDocument13 pagesUnited States Court of Appeals, Third CircuitScribd Government DocsNo ratings yet

- Merchants' Nat. Bank of Richmond v. Richmond, 256 U.S. 635 (1921)Document5 pagesMerchants' Nat. Bank of Richmond v. Richmond, 256 U.S. 635 (1921)Scribd Government DocsNo ratings yet

- Yonkers v. Downey, 309 U.S. 590 (1940)Document5 pagesYonkers v. Downey, 309 U.S. 590 (1940)Scribd Government DocsNo ratings yet

- Willis M. Duryea, Jr. v. The Third Northwestern National Bank of Minneapolis, A National Banking Association, Bruce Winslow, John Doe and Mary Roe, 602 F.2d 809, 3rd Cir. (1979)Document3 pagesWillis M. Duryea, Jr. v. The Third Northwestern National Bank of Minneapolis, A National Banking Association, Bruce Winslow, John Doe and Mary Roe, 602 F.2d 809, 3rd Cir. (1979)Scribd Government DocsNo ratings yet

- Michigan Nat. Bank v. Robertson, 372 U.S. 591 (1963)Document4 pagesMichigan Nat. Bank v. Robertson, 372 U.S. 591 (1963)Scribd Government DocsNo ratings yet

- Clarke v. Securities Industry Assn., 479 U.S. 388 (1987)Document25 pagesClarke v. Securities Industry Assn., 479 U.S. 388 (1987)Scribd Government DocsNo ratings yet

- First National Bank in Mena, Cross-Appellee v. Jack A. Nowlin, Cross-Appellant, 509 F.2d 872, 1st Cir. (1975)Document13 pagesFirst National Bank in Mena, Cross-Appellee v. Jack A. Nowlin, Cross-Appellant, 509 F.2d 872, 1st Cir. (1975)Scribd Government DocsNo ratings yet

- Northside Iron and Metal Company, Inc. v. Dobson and Johnson, Inc., and The Third National Bank, 480 F.2d 798, 3rd Cir. (1973)Document5 pagesNorthside Iron and Metal Company, Inc. v. Dobson and Johnson, Inc., and The Third National Bank, 480 F.2d 798, 3rd Cir. (1973)Scribd Government DocsNo ratings yet

- Citizens' Bank v. Parker, 192 U.S. 73 (1904)Document16 pagesCitizens' Bank v. Parker, 192 U.S. 73 (1904)Scribd Government DocsNo ratings yet

- AMER. BANK v. Fed. Reserve Bank, 262 U.S. 643 (1923)Document5 pagesAMER. BANK v. Fed. Reserve Bank, 262 U.S. 643 (1923)Scribd Government DocsNo ratings yet

- First National Bank of Southaven v. William B. Camp, Comptroller of The Currency of The United States, and Coahoma National Bank, Intervenor-Appellee, 471 F.2d 1322, 1st Cir. (1973)Document7 pagesFirst National Bank of Southaven v. William B. Camp, Comptroller of The Currency of The United States, and Coahoma National Bank, Intervenor-Appellee, 471 F.2d 1322, 1st Cir. (1973)Scribd Government DocsNo ratings yet

- Missouri Ex Rel. Burnes Nat. Bank of St. Joseph v. Duncan, 265 U.S. 17 (1924)Document7 pagesMissouri Ex Rel. Burnes Nat. Bank of St. Joseph v. Duncan, 265 U.S. 17 (1924)Scribd Government DocsNo ratings yet

- United States Court of Appeals Fourth CircuitDocument12 pagesUnited States Court of Appeals Fourth CircuitScribd Government DocsNo ratings yet

- First Nat. City Bank v. Banco Nacional de Cuba, 406 U.S. 759 (1972)Document9 pagesFirst Nat. City Bank v. Banco Nacional de Cuba, 406 U.S. 759 (1972)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Third CircuitDocument5 pagesUnited States Court of Appeals, Third CircuitScribd Government DocsNo ratings yet

- State of Missouri Ex Rel. W. R. Kostman, Commissioner of Finance v. First National Bank in St. Louis, A National Banking Association, Defendant-Appellant, 538 F.2d 219, 1st Cir. (1976)Document3 pagesState of Missouri Ex Rel. W. R. Kostman, Commissioner of Finance v. First National Bank in St. Louis, A National Banking Association, Defendant-Appellant, 538 F.2d 219, 1st Cir. (1976)Scribd Government DocsNo ratings yet

- Jordan Brown, and All Others Similarly Situated v. First National City Bank, 503 F.2d 114, 1st Cir. (1974)Document8 pagesJordan Brown, and All Others Similarly Situated v. First National City Bank, 503 F.2d 114, 1st Cir. (1974)Scribd Government DocsNo ratings yet

- First National Bank of Bellaire v. Comptroller of The Currency, 697 F.2d 674, 1st Cir. (1983)Document25 pagesFirst National Bank of Bellaire v. Comptroller of The Currency, 697 F.2d 674, 1st Cir. (1983)Scribd Government DocsNo ratings yet

- United States Court of Appeals Fourth CircuitDocument6 pagesUnited States Court of Appeals Fourth CircuitScribd Government DocsNo ratings yet

- The First National Bank of Portland, A National Banking Association v. Frank A. Dudley, Trustee in Bankruptcy of The Estate of Northwest Variety Wholesale, Inc., 231 F.2d 396, 1st Cir. (1956)Document11 pagesThe First National Bank of Portland, A National Banking Association v. Frank A. Dudley, Trustee in Bankruptcy of The Estate of Northwest Variety Wholesale, Inc., 231 F.2d 396, 1st Cir. (1956)Scribd Government DocsNo ratings yet

- Arnold Tours, Inc. v. William B. Camp, Comptroller of The Currency of The United States, South Shore National Bank, 472 F.2d 427, 1st Cir. (1972)Document18 pagesArnold Tours, Inc. v. William B. Camp, Comptroller of The Currency of The United States, South Shore National Bank, 472 F.2d 427, 1st Cir. (1972)Scribd Government DocsNo ratings yet

- State Finance Company, A Corporation v. Roy Lee Morrow, 216 F.2d 676, 10th Cir. (1954)Document5 pagesState Finance Company, A Corporation v. Roy Lee Morrow, 216 F.2d 676, 10th Cir. (1954)Scribd Government DocsNo ratings yet

- Brief of Amicus Curiae State of UtahDocument46 pagesBrief of Amicus Curiae State of UtahmmeindlNo ratings yet

- Anderson Nat. Bank v. Luckett, 321 U.S. 233 (1944)Document14 pagesAnderson Nat. Bank v. Luckett, 321 U.S. 233 (1944)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Ninth CircuitDocument5 pagesUnited States Court of Appeals, Ninth CircuitScribd Government DocsNo ratings yet

- In Re Curtis Reed Johnson, Debtor. Home State Bank of Lewis, Lewis, Kansas, and Cross-Appellant v. Curtis Reed Johnson, and Cross-Appellee, 904 F.2d 563, 10th Cir. (1990)Document5 pagesIn Re Curtis Reed Johnson, Debtor. Home State Bank of Lewis, Lewis, Kansas, and Cross-Appellant v. Curtis Reed Johnson, and Cross-Appellee, 904 F.2d 563, 10th Cir. (1990)Scribd Government DocsNo ratings yet

- Suttle v. Reich Bros. Constr. Co., 333 U.S. 163 (1948)Document5 pagesSuttle v. Reich Bros. Constr. Co., 333 U.S. 163 (1948)Scribd Government DocsNo ratings yet

- William Gabovitch v. Maurice A. Lundy, 584 F.2d 559, 1st Cir. (1978)Document4 pagesWilliam Gabovitch v. Maurice A. Lundy, 584 F.2d 559, 1st Cir. (1978)Scribd Government DocsNo ratings yet

- First Nat. Bank in Plant City v. Dickinson, 396 U.S. 122 (1969)Document14 pagesFirst Nat. Bank in Plant City v. Dickinson, 396 U.S. 122 (1969)Scribd Government DocsNo ratings yet

- Talbott v. Board of County Commissioners of Silver Bow CountyDocument8 pagesTalbott v. Board of County Commissioners of Silver Bow CountyScribd Government DocsNo ratings yet

- State of South Dakota v. The National Bank of South Dakota, Sioux Falls, and First Bank Stock Corporation, 335 F.2d 444, 1st Cir. (1964)Document7 pagesState of South Dakota v. The National Bank of South Dakota, Sioux Falls, and First Bank Stock Corporation, 335 F.2d 444, 1st Cir. (1964)Scribd Government DocsNo ratings yet

- The Fireside Chats of Franklin Delano Roosevelt: Radio Addresses to the American People Broadcast Between 1933 and 1944From EverandThe Fireside Chats of Franklin Delano Roosevelt: Radio Addresses to the American People Broadcast Between 1933 and 1944No ratings yet

- Coyle v. Jackson, 10th Cir. (2017)Document7 pagesCoyle v. Jackson, 10th Cir. (2017)Scribd Government Docs100% (1)

- Consolidation Coal Company v. OWCP, 10th Cir. (2017)Document22 pagesConsolidation Coal Company v. OWCP, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Payn v. Kelley, 10th Cir. (2017)Document8 pagesPayn v. Kelley, 10th Cir. (2017)Scribd Government Docs50% (2)

- United States v. Garcia-Damian, 10th Cir. (2017)Document9 pagesUnited States v. Garcia-Damian, 10th Cir. (2017)Scribd Government Docs100% (1)

- United States v. Kieffer, 10th Cir. (2017)Document20 pagesUnited States v. Kieffer, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Olden, 10th Cir. (2017)Document4 pagesUnited States v. Olden, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Greene v. Tennessee Board, 10th Cir. (2017)Document2 pagesGreene v. Tennessee Board, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Brown v. Shoe, 10th Cir. (2017)Document6 pagesBrown v. Shoe, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Wilson v. Dowling, 10th Cir. (2017)Document5 pagesWilson v. Dowling, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- City of Albuquerque v. Soto Enterprises, 10th Cir. (2017)Document21 pagesCity of Albuquerque v. Soto Enterprises, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Harte v. Board Comm'rs Cnty of Johnson, 10th Cir. (2017)Document100 pagesHarte v. Board Comm'rs Cnty of Johnson, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Kearn, 10th Cir. (2017)Document25 pagesUnited States v. Kearn, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Publish United States Court of Appeals For The Tenth CircuitDocument10 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsNo ratings yet

- Publish United States Court of Appeals For The Tenth CircuitDocument24 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsNo ratings yet

- Publish United States Court of Appeals For The Tenth CircuitDocument14 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government Docs100% (1)

- Pecha v. Lake, 10th Cir. (2017)Document25 pagesPecha v. Lake, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Apodaca v. Raemisch, 10th Cir. (2017)Document15 pagesApodaca v. Raemisch, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Voog, 10th Cir. (2017)Document5 pagesUnited States v. Voog, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Roberson, 10th Cir. (2017)Document50 pagesUnited States v. Roberson, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Northglenn Gunther Toody's v. HQ8-10410-10450, 10th Cir. (2017)Document10 pagesNorthglenn Gunther Toody's v. HQ8-10410-10450, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Windom, 10th Cir. (2017)Document25 pagesUnited States v. Windom, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Webb v. Allbaugh, 10th Cir. (2017)Document18 pagesWebb v. Allbaugh, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- NM Off-Hwy Vehicle Alliance v. U.S. Forest Service, 10th Cir. (2017)Document9 pagesNM Off-Hwy Vehicle Alliance v. U.S. Forest Service, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Muhtorov, 10th Cir. (2017)Document15 pagesUnited States v. Muhtorov, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Magnan, 10th Cir. (2017)Document27 pagesUnited States v. Magnan, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Henderson, 10th Cir. (2017)Document2 pagesUnited States v. Henderson, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Pledger v. Russell, 10th Cir. (2017)Document5 pagesPledger v. Russell, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Publish United States Court of Appeals For The Tenth CircuitDocument17 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsNo ratings yet

- United States v. Magnan, 10th Cir. (2017)Document4 pagesUnited States v. Magnan, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Kundo, 10th Cir. (2017)Document7 pagesUnited States v. Kundo, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Grade Math TleDocument256 pagesGrade Math TleSunshine GarsonNo ratings yet

- J.S.mill - of NationalityDocument4 pagesJ.S.mill - of NationalityIleanaBrâncoveanuNo ratings yet

- Dr. Thein Lwin Language Article (English) 15thoct11Document17 pagesDr. Thein Lwin Language Article (English) 15thoct11Bayu Smada50% (2)

- Syllabus of Fourth Year B.A. LL.B., Fourth Year B.B.A. LL.B. and Second Year LL.BDocument12 pagesSyllabus of Fourth Year B.A. LL.B., Fourth Year B.B.A. LL.B. and Second Year LL.BAzak ShaikhNo ratings yet

- Political Provocation': China Hits Back As Biden Calls Xi Dictator' - US News - The GuardianDocument2 pagesPolitical Provocation': China Hits Back As Biden Calls Xi Dictator' - US News - The Guardianssp consultNo ratings yet

- G.R. Chawla vs. DdaDocument4 pagesG.R. Chawla vs. DdaKishore Kumar JhaNo ratings yet

- Handbook For Tactical Operations in The Information EnvironmentDocument17 pagesHandbook For Tactical Operations in The Information EnvironmentVando NunesNo ratings yet

- Legal & Judicial Ethics Cases - Pale 2017Document5 pagesLegal & Judicial Ethics Cases - Pale 2017MichelleIragAlmarioNo ratings yet

- End of Term Assessment Social Studies Fm4 BusinessDocument2 pagesEnd of Term Assessment Social Studies Fm4 BusinessShelly RamkalawanNo ratings yet

- 19th Cent PHDocument8 pages19th Cent PHKrizzi Dizon GarciaNo ratings yet

- David Lloyd - Settler Colonialism and The State of ExceptionDocument22 pagesDavid Lloyd - Settler Colonialism and The State of ExceptionAfthab EllathNo ratings yet

- Commissioners For Oaths Adv ActDocument7 pagesCommissioners For Oaths Adv ActmuhumuzaNo ratings yet

- Castle Rock Vs GonzalesDocument31 pagesCastle Rock Vs GonzalessabastialtxiNo ratings yet

- Dela Cruz vs. Andres, 522 SCRA 585, April 27, 2007Document7 pagesDela Cruz vs. Andres, 522 SCRA 585, April 27, 2007TNVTRLNo ratings yet

- The International Tribunal For The Law of The Sea (ITLOS) - InnoDocument70 pagesThe International Tribunal For The Law of The Sea (ITLOS) - InnoNada AmiraNo ratings yet

- Balochistan Public Service Commission: List of CandidatesDocument7 pagesBalochistan Public Service Commission: List of CandidatesRahimullahNo ratings yet

- Remembering The World Record Set by PAF Fighter Pilot Zafar Masud and His TeamDocument2 pagesRemembering The World Record Set by PAF Fighter Pilot Zafar Masud and His TeamNasim Yousaf (Author & Researcher)No ratings yet

- Into The QuagmireDocument285 pagesInto The Quagmirecofitabs80% (5)

- Current Heads of DepartmentsDocument30 pagesCurrent Heads of DepartmentsUsama AhmadNo ratings yet

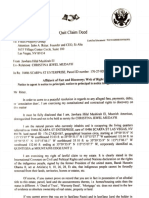

- Quit Claim Deed - FOCUS PROPERTY GROUP Et Alia 30jan2020Document4 pagesQuit Claim Deed - FOCUS PROPERTY GROUP Et Alia 30jan2020empress_jawhara_hilal_el100% (1)

- The Imaculate Deception - The Bush Crime Family ExposedDocument45 pagesThe Imaculate Deception - The Bush Crime Family ExposedKifan Radu MariusNo ratings yet

- Statutes of The Fci: Federation Cynologique Internationale (Aisbl)Document19 pagesStatutes of The Fci: Federation Cynologique Internationale (Aisbl)almaNo ratings yet

- Life and Work of RizalDocument3 pagesLife and Work of RizalGracielle DesavilleNo ratings yet

- Harshit Shukla-1 (1) - 1Document1 pageHarshit Shukla-1 (1) - 1Harish KumarNo ratings yet

- 2021 KY Legislative ScorecardDocument14 pages2021 KY Legislative ScorecardKentucky Scorecard100% (1)

- Electoral Politics in The PhilippinesDocument54 pagesElectoral Politics in The PhilippinesJulio Teehankee100% (2)

- FrontpageAfrica Interviews TRANSCO CLSG GM, Sept 28Document18 pagesFrontpageAfrica Interviews TRANSCO CLSG GM, Sept 28TRANSCO CLSG100% (1)

- Ranjit Singh Administration FeaturesDocument2 pagesRanjit Singh Administration FeaturesshumailaNo ratings yet

- Natalia Realty, Inc. vs. Department of Agrarian ReformDocument3 pagesNatalia Realty, Inc. vs. Department of Agrarian ReformaudreyracelaNo ratings yet

- By Senator Rich Alloway: For Immediate ReleaseDocument2 pagesBy Senator Rich Alloway: For Immediate ReleaseAnonymous CQc8p0WnNo ratings yet