Professional Documents

Culture Documents

R 5

Uploaded by

Elwyn P. BiasonOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

R 5

Uploaded by

Elwyn P. BiasonCopyright:

Available Formats

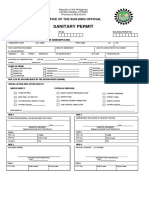

Republic of the Philippines SBR NO.

POST MARK/SBR DATE TELLER’S INITIAL

SOCIAL SECURITY SYSTEM

R-5 CONTRIBUTIONS AMOUNT

REV. 02-98 PAYMENT RETURN

DATE

(TO BE SUBMITTED IN QUADRUPLICATE)

(THIS IS YOUR OFFICIAL RECEIPT WHEN VALIDATED)

EMPLOYER’S ID NUMBER EMPLOYER’S REGISTERED NAME

ADDRESS POSTAL CODE

(NO. & STREET) (BARANGAY)

(CITY/PROVINCE) TEL. NO.

(TOWN/DISTRICT)

APPLICABLE PERIOD SOCIAL SECURITY EMPLOYEE COMPENSATION

CONTRIBUTION TOTAL

INSTRUCTIONS MONTH YEAR CONTRIBUTION

JANUARY

1. CHECK THE BOX TO INDICATE THE TYPE OF

PAYOR FEBRUARY

REGULAR EMPLOYER MARCH

HOUSEHOLD EMPLOYER APRIL

2. INDICATE THE YEAR FOR WHICH PAYMENT MAY

IS APPLICABLE.

JUNE

3. REMIT YOUR EMPLOYEES/HOUSEHOLD

HELPERS MONTHLY CONTRIBUTIONS ON

JULY

OR BEFORE THE 5TH DAY OF THE

AUGUST

FOLLOWING MONTH TO AVOID THE 3%

PENALTY PER MONTH FOR LATE PAYMENT. SEPTEMBER

4. REMIT YOUR PAYMENT EITHER: OCTOBER

a) THROUGH SSS ACCREDITED BANK; OR NOVEMBER

b) BY REGISTERED MAIL

DECEMBER

5. MAKE ALL CHECKS AND POSTAL

MONEY ORDERS PAYABLE

PENALTY PAYMENT

TO SSS

UNDER

ADD

PENALTY REFERENCE NUMBER

6. ATTACH YOUR EXTRA COPY

PAYMENT

OF THIS FORM AND SPECIAL

LESS

OVER

BANK RECEIPT WHEN

SUBMITTING THE

CORRESPONDING

CONTRIBUTION FORM R-3

(CONTRIBUTION COLLECTION

LIST) OR R-3 TAPE/ DISKETTE. TOTAL REMITTANCE P P P

7. SUBMIT YOUR FORM R-3 WITHIN FIVE (5)

FORM OF PAYMENT AMOUNT TOTAL AMOUNT IN WORDS:

DAYS AFTER THE APPLICABLE QUARTER CASH P______________________

OR YOUR R-3 TAPE/DISKETTE ON OR

BEFORE THE 10TH DAY OF THE MONTH CHECK P______________________

FOLLOWING THE APPLICABLE MONTH

TO THE NEAREST SSS OFFICE OR BANK NAME : _____________________________ CERTIFIED CORRECT:

THROUGH POSTAL SERVICES OFFICE.

CHECK NO. : ______________________________

8. INDICATE YOUR PENALTY REFERENCE

NUMBER, IF ANY, FOR PAYMENT OF DATE : ______________________________

PENALTIES.

TOTAL P______________________ SIGNATURE OVER PRINTED NAME

You might also like

- Business Permit Application FormDocument2 pagesBusiness Permit Application FormSarah DanaoNo ratings yet

- Mat 1 - Maternity NotificationDocument2 pagesMat 1 - Maternity NotificationEvelyn Isturis100% (1)

- New MSRF Pag Ibig PDFDocument2 pagesNew MSRF Pag Ibig PDFAnonymous DOdHz2N88% (33)

- Airtex Aviation Case StudyDocument4 pagesAirtex Aviation Case StudySiju Bose100% (1)

- SSS Clearance Application FormDocument2 pagesSSS Clearance Application Formnathalie velasquez86% (7)

- General Instructions: Stock Corporation: General Information Sheet (Gis)Document9 pagesGeneral Instructions: Stock Corporation: General Information Sheet (Gis)dory ganNo ratings yet

- Nandani-THE EMERGENCE OF OTT PLATFORMS DURING THE PANDEMIC AND ITS FUTURE SCOPE - Bhargav PancholiDocument47 pagesNandani-THE EMERGENCE OF OTT PLATFORMS DURING THE PANDEMIC AND ITS FUTURE SCOPE - Bhargav PancholiAbhishek Kumar100% (2)

- Intuit Case Study - Analyzing Opportunities for QuickBooks Platform ExpansionDocument6 pagesIntuit Case Study - Analyzing Opportunities for QuickBooks Platform ExpansionAndrés Pérez100% (1)

- Awareness and Internal Auditor TRG IATF 16949 August 22Document95 pagesAwareness and Internal Auditor TRG IATF 16949 August 22Atul SURVE100% (1)

- EC Medical Reimbursement Application Form 1Document2 pagesEC Medical Reimbursement Application Form 1GaryNo ratings yet

- R5 2010Document2 pagesR5 2010MyRizal150100% (1)

- Cavite Business Permit Application FormDocument2 pagesCavite Business Permit Application FormOlive Dago-oc100% (1)

- Sss r5 PDFDocument1 pageSss r5 PDFHERMAN DAGIONo ratings yet

- R-5 E Loyer Contributions MP Payment Return: Social Security SystemDocument2 pagesR-5 E Loyer Contributions MP Payment Return: Social Security SystemKathryn RellosoNo ratings yet

- SSS Employer Contributions FormDocument2 pagesSSS Employer Contributions FormUncle Cheffy - MalateNo ratings yet

- SSS Member Loan Application FormDocument2 pagesSSS Member Loan Application FormJr Sam90% (49)

- Financial Report Summary FormDocument2 pagesFinancial Report Summary Formabhishankawasthi786No ratings yet

- SSSForm Member Loan Payment ReturnDocument1 pageSSSForm Member Loan Payment ReturnDream CunananNo ratings yet

- MAT2Document2 pagesMAT2Kyle Irvin Gole CruzNo ratings yet

- Mat2 FormDocument2 pagesMat2 FormTirso Leo Adelante100% (1)

- SSSForm - Member - Loan - Payment - Return 082020Document1 pageSSSForm - Member - Loan - Payment - Return 082020CaNo ratings yet

- SMBP Payment Thru The Bank Form PDFDocument2 pagesSMBP Payment Thru The Bank Form PDFAnonymous t4Iy7YiqC0% (1)

- PAG-IBIG Loan Payment-Feb 2020Document4 pagesPAG-IBIG Loan Payment-Feb 2020Tonie Naelgas GutierrezNo ratings yet

- Social Security System Contribution Collection ListDocument4 pagesSocial Security System Contribution Collection Listjessa maeNo ratings yet

- Form BN 4: Registration of Business Names Act Statement of Additional Particulars To Be Furnished by A Firm or IndividualDocument4 pagesForm BN 4: Registration of Business Names Act Statement of Additional Particulars To Be Furnished by A Firm or IndividualJasmine JacksonNo ratings yet

- MCRF Pagibig FormDocument3 pagesMCRF Pagibig FormFrench Kamile PagcuNo ratings yet

- Membership Savings Remittance Form (MSRF, HQP-PFF-114, V01)Document2 pagesMembership Savings Remittance Form (MSRF, HQP-PFF-114, V01)Sevy D PoloyapoyNo ratings yet

- RS-5 Contributions Payment Return: Social Security SystemDocument1 pageRS-5 Contributions Payment Return: Social Security SystemMeraflor PanaresNo ratings yet

- Bank of Commerce - Customer Information SheetDocument4 pagesBank of Commerce - Customer Information SheetElaine Joyce BayaniNo ratings yet

- Annexure II Fact Sheet IndividualsDocument1 pageAnnexure II Fact Sheet IndividualsMuhammad IqbalNo ratings yet

- SLF017 ShortTermLoanRemittanceForm V02Document2 pagesSLF017 ShortTermLoanRemittanceForm V02Marites Paragua75% (4)

- ML 1Document1 pageML 1Ryan BonifacioNo ratings yet

- Sss Loan Application FormDocument4 pagesSss Loan Application FormSymphanie ChilesNo ratings yet

- Electrical Permit (Front Page)Document2 pagesElectrical Permit (Front Page)Lan BalakalNo ratings yet

- Background Information: Yes No 0 2 1 2Document3 pagesBackground Information: Yes No 0 2 1 2Vincent John RigorNo ratings yet

- Short-term loan remittanceDocument2 pagesShort-term loan remittancemaricorNo ratings yet

- If Any Infor-Mation Is Incorrect, SEE Instruc - Tions.: Business NameDocument2 pagesIf Any Infor-Mation Is Incorrect, SEE Instruc - Tions.: Business NameWomen Cup2No ratings yet

- SSS Calamity Loan Application FormDocument3 pagesSSS Calamity Loan Application FormVeronica LagoNo ratings yet

- Short-Term Loan Remittance Form (STLRF) : HQP-SLF-017Document2 pagesShort-Term Loan Remittance Form (STLRF) : HQP-SLF-017Jo Sh100% (1)

- WC-3 20220112Document5 pagesWC-3 20220112Thành CôngNo ratings yet

- Member Loan Application: This Form Is Not For SaleDocument3 pagesMember Loan Application: This Form Is Not For Salebernie romeroNo ratings yet

- SIC - 01252 Sickness NotificationDocument3 pagesSIC - 01252 Sickness NotificationJeannylyn BurgosNo ratings yet

- Direct Deposit Sign Up (BAC - NU)Document1 pageDirect Deposit Sign Up (BAC - NU)Cyber GemelasNo ratings yet

- Compensation and Final Withholding TaxesDocument7 pagesCompensation and Final Withholding TaxesbayombongumcNo ratings yet

- NBC Form A-05 Sanitary PermitDocument1 pageNBC Form A-05 Sanitary PermitDarwin CustodioNo ratings yet

- PNP Nup Loan Application Form and Promissory NoteDocument2 pagesPNP Nup Loan Application Form and Promissory NoteEnteng Teng TengitsNo ratings yet

- CREDIT INFO FORMDocument2 pagesCREDIT INFO FORMmaruthiassociates2315No ratings yet

- Business Permit Application FormDocument2 pagesBusiness Permit Application Formimbendo.cvtNo ratings yet

- SSSForm SicMat PDFDocument2 pagesSSSForm SicMat PDFHoneylyne PlazaNo ratings yet

- Employer Contributions: R-5 Social Security System Payment FormDocument1 pageEmployer Contributions: R-5 Social Security System Payment FormJamey SimpsonNo ratings yet

- Print clearly NFA license applicationDocument1 pagePrint clearly NFA license applicationLenin Rey PolonNo ratings yet

- Membership - Document Form - 100 Fillable v03 15Document2 pagesMembership - Document Form - 100 Fillable v03 15Ramon BrionesNo ratings yet

- SLF103 ApplicationRefundExcessSTLAmortization V06Document1 pageSLF103 ApplicationRefundExcessSTLAmortization V06Ina Marie BalajadiaNo ratings yet

- Employer Data Change Request: This Form Is Not For SaleDocument2 pagesEmployer Data Change Request: This Form Is Not For SaleHR ZMCNo ratings yet

- Personal Data Form: Affix Passport Size PhotographDocument3 pagesPersonal Data Form: Affix Passport Size Photographshahabuddin khanNo ratings yet

- Mat 1 FormDocument3 pagesMat 1 FormPrucel TadaNo ratings yet

- Pag-Ibig LoanDocument2 pagesPag-Ibig LoanNicasio AlonzoNo ratings yet

- General Instructions:: Is Not Applicable To The Corporation or "None" If The Information Is Non ExistentDocument4 pagesGeneral Instructions:: Is Not Applicable To The Corporation or "None" If The Information Is Non ExistentKaren Joy GoconNo ratings yet

- Apply for Moratorium on Pag-IBIG STL PaymentsDocument2 pagesApply for Moratorium on Pag-IBIG STL PaymentsJhonson MedranoNo ratings yet

- Makerere University Agricultural Production Course OutlineDocument3 pagesMakerere University Agricultural Production Course OutlineWaidembe YusufuNo ratings yet

- Tarkett Collection For Professionals 2013 1 PartDocument165 pagesTarkett Collection For Professionals 2013 1 PartDan George III100% (1)

- Mcdonalds in India and Promotion Strategy of Mcdonalds in IndiaDocument7 pagesMcdonalds in India and Promotion Strategy of Mcdonalds in IndiaKrishna JhaNo ratings yet

- Financial Management-Financial Statements-Chapter 2Document37 pagesFinancial Management-Financial Statements-Chapter 2Bir kişi100% (1)

- Lahore University of Management Sciences ACCT 100 - Principles of Financial AccountingDocument6 pagesLahore University of Management Sciences ACCT 100 - Principles of Financial AccountingAli Zain ParharNo ratings yet

- Teng2014 PDFDocument27 pagesTeng2014 PDFpramana putraNo ratings yet

- Abc and Abm Quiz PracticeDocument8 pagesAbc and Abm Quiz PracticeJyNo ratings yet

- Data Management Database Schema for Cosmetics ERPDocument12 pagesData Management Database Schema for Cosmetics ERPTejas G SrikanthNo ratings yet

- 714 - Ethiopia BriefDocument4 pages714 - Ethiopia Briefአማን በአማንNo ratings yet

- 64mx44m Multi-Span Film Greenhouse Quotation - HUIJING GREENHOUSEDocument2 pages64mx44m Multi-Span Film Greenhouse Quotation - HUIJING GREENHOUSEBiopeca EpsNo ratings yet

- Loading Status and Subject DetailsDocument12 pagesLoading Status and Subject DetailsAileen Mifranum IINo ratings yet

- Ip7 Warrnty TelestraDocument1 pageIp7 Warrnty TelestraBill DanyonNo ratings yet

- Supply chain management in Newspaper Industry: Assessing responsivenessDocument9 pagesSupply chain management in Newspaper Industry: Assessing responsivenesssplinterNo ratings yet

- Remittance and Nepalese EconomyDocument16 pagesRemittance and Nepalese EconomyBhuwanNo ratings yet

- Core Competency: Supply Chain Management Inventory Management Profit & Loss ManagementDocument3 pagesCore Competency: Supply Chain Management Inventory Management Profit & Loss ManagementsunilkumarchaudharyNo ratings yet

- BBMF 3183 Strategic Financial Management: 13 Corporate ReorganizationsDocument22 pagesBBMF 3183 Strategic Financial Management: 13 Corporate ReorganizationsKarthina RishiNo ratings yet

- 2021 Suwa - Shipyard - Machineries - Corp.20211108 12 MkhgioDocument4 pages2021 Suwa - Shipyard - Machineries - Corp.20211108 12 MkhgioLoren SanapoNo ratings yet

- 4B Plant Layout PDFDocument35 pages4B Plant Layout PDFVipin Gupta100% (3)

- Republic of Kenya: Land AgreementDocument2 pagesRepublic of Kenya: Land AgreementDiana WangamatiNo ratings yet

- Impact of GST on Small Businesses in DamanDocument33 pagesImpact of GST on Small Businesses in DamanSawan PatelNo ratings yet

- Process Control Equipment CertificateDocument3 pagesProcess Control Equipment CertificateDiego Betancourt MejiaNo ratings yet

- The Modern Building ConstructionDocument8 pagesThe Modern Building ConstructionPinky Dwi PrasetyoNo ratings yet

- Midterm Paper RESA LAWDocument3 pagesMidterm Paper RESA LAWJustine LedesmaNo ratings yet

- Manila Memorial Park Cementery IncDocument3 pagesManila Memorial Park Cementery IncAnnievin HawkNo ratings yet

- DP 304Document172 pagesDP 304Lokendra ChaudharyNo ratings yet

- FinalDocument76 pagesFinallakshay sharmaNo ratings yet