Professional Documents

Culture Documents

Addressing The Crisis

Uploaded by

sarva8420030 ratings0% found this document useful (0 votes)

35 views5 pagesOriginal Title

Addressing the Crisis

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

35 views5 pagesAddressing The Crisis

Uploaded by

sarva842003Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 5

Addressing the Crisis..

• Series of wide-ranging fiscal austerity

measures were applied

• the combination of spending cuts and tax

increases did not appeal to the investors

• On April 23, 2010, Papandreou announced

that Greece would draw on $60 billion

financial assistance from Eurozone members

and the IMF

Greek Domestic Policy Responses

• The Papandreou government has unveiled three

separate packages of fiscal austerity measures

• Greece’s government deficit is down from an

estimated 13.6% of GDP in 2009 to below 3% by 2012

• In total, the measures are worth an estimated $21.6

billion or 6.4% of GDP

• On March 3, 2010, Prime Minister Papandreou won

parliamentary approval for the third and most far-

reaching of his government’s proposed austerity

measures

• Measures aim to increase revenue through a

rise in the average value-added tax rate from

19% to 21%; tax increases on fuel, tobacco,

liquor, and luxury products; and a one-off

1% tax increase on personal incomes of over

$133,000

Structural Reforms

• Measures will include raising the average

retirement age from 61 to 63

• Government also hopes to restructure Greece’s

public administration

• By reducing the levels of local administrative

authorities from five to three, reducing the

number of Greek municipalities from 1,034 to

370, and reducing the legal public entities

formed by local authorities from 6,000 to 2,000.

Financial Assistance from the Eurozone Member States & from the IMF

• On April 23, 2010, the Greek government

requested the Eurozone leaders for a financial

assistance of approx $40 billion

• Germany would reportedly provide the largest

bilateral loan, expected to be about $11.2

billion followed by France, which is expected to

loan about $8.4 billion

• Greece has requested financial assistance from

the IMF, expected to be worth $20 billion

You might also like

- Greek Fiscal Crisis ExplainedDocument8 pagesGreek Fiscal Crisis ExplainedAkriti GuptaNo ratings yet

- Govt Debt and DeficitDocument4 pagesGovt Debt and DeficitSiddharth TiwariNo ratings yet

- IMF Honduras Letter of Intent 091010Document22 pagesIMF Honduras Letter of Intent 091010La GringaNo ratings yet

- Greece Debt Crisis DDocument8 pagesGreece Debt Crisis DMehr ShahNo ratings yet

- Greek Debt CrisisDocument12 pagesGreek Debt Crisisjimmy_bhavanaNo ratings yet

- Greece Debt Crisis: Presented byDocument9 pagesGreece Debt Crisis: Presented byAnonymousNo ratings yet

- Financial Crisis in Usa & EuropeDocument23 pagesFinancial Crisis in Usa & EuropeArti ThadurNo ratings yet

- Greece's Economy Slows as Financial Crisis Takes HoldDocument5 pagesGreece's Economy Slows as Financial Crisis Takes HoldÖzhan ÜnalNo ratings yet

- Fiscal Policy in UkDocument27 pagesFiscal Policy in UkFazil Abbas BanatwalaNo ratings yet

- European Debt Crisis 2009 - 2011: The PIIGS and The Rest From Maastricht To PapandreouDocument39 pagesEuropean Debt Crisis 2009 - 2011: The PIIGS and The Rest From Maastricht To PapandreouAnuj KantNo ratings yet

- Budget 2014 Key Measures to Support GrowthDocument5 pagesBudget 2014 Key Measures to Support GrowthalbasudNo ratings yet

- Greece Crisis and Its Impact FinalDocument20 pagesGreece Crisis and Its Impact FinalJigar ModyNo ratings yet

- Budget 2014Document4 pagesBudget 2014Martin ForsytheNo ratings yet

- Eurozone Debt Crisis ExplainedDocument64 pagesEurozone Debt Crisis ExplainedShanil ShazabNo ratings yet

- The True Cost of Austerity and Inequality: Greece Case StudyDocument9 pagesThe True Cost of Austerity and Inequality: Greece Case Studykarasa1No ratings yet

- Greece Debt Crisis: Biif Vikas Mittal S. JoshiDocument20 pagesGreece Debt Crisis: Biif Vikas Mittal S. JoshiShivgan JoshiNo ratings yet

- Portugal & The Eurozone Crises Project By: Akash Saxena Gaurav Mohan Aditya ChaudharyDocument15 pagesPortugal & The Eurozone Crises Project By: Akash Saxena Gaurav Mohan Aditya ChaudharyAkash SaxenaNo ratings yet

- UK Facing Debt Crisis as Economy Remains Mired in Low GrowthDocument34 pagesUK Facing Debt Crisis as Economy Remains Mired in Low Growthalastair82sNo ratings yet

- How To Budget For Covid 19 EnglishDocument5 pagesHow To Budget For Covid 19 EnglishRegienald P. FabroNo ratings yet

- Tullett Prebon Project Armagedon Aug 2011Document34 pagesTullett Prebon Project Armagedon Aug 2011SwamiNo ratings yet

- NIESR Election Briefing - The Macroeconomics of Parties' Tax and Spending PlansDocument8 pagesNIESR Election Briefing - The Macroeconomics of Parties' Tax and Spending PlansAshutoshAparajNo ratings yet

- Social Security & Medicare Shortfalls Exceed $100 Trillion Over 30 YearsDocument20 pagesSocial Security & Medicare Shortfalls Exceed $100 Trillion Over 30 YearsOWNEditorNo ratings yet

- International Financial ManagementDocument47 pagesInternational Financial ManagementAshish PriyadarshiNo ratings yet

- Investing in Public Services to Rebuild the EconomyDocument13 pagesInvesting in Public Services to Rebuild the EconomykkarajanevaNo ratings yet

- Greece Debt Crisis: Dareen Atef Dina Wahba Safiya Galal Sarah Hani Dr. Amir NasryDocument16 pagesGreece Debt Crisis: Dareen Atef Dina Wahba Safiya Galal Sarah Hani Dr. Amir Nasrypriyaagarwal26No ratings yet

- Greece - ESM MoU, Draft 11/8/2015 (English)Document29 pagesGreece - ESM MoU, Draft 11/8/2015 (English)Yannis Koutsomitis100% (1)

- Chancellor For A DayDocument5 pagesChancellor For A DayNigel WatsonNo ratings yet

- Autumn Budget 2018Document106 pagesAutumn Budget 2018edienewsNo ratings yet

- Greek RestructuringDocument8 pagesGreek RestructuringSeven LoveNo ratings yet

- Greek Finance Min Presentations at Eurogroup, 11 15 Feb 2015Document30 pagesGreek Finance Min Presentations at Eurogroup, 11 15 Feb 2015Yannis KoutsomitisNo ratings yet

- Η έκθεση-απάντηση της Ελληνικής κυβέρνησης στο Διεθνές Νομισματικό Ταμείο σχετικά με την παροχή οικονομικής αρωγής - Μάιος 2010Document81 pagesΗ έκθεση-απάντηση της Ελληνικής κυβέρνησης στο Διεθνές Νομισματικό Ταμείο σχετικά με την παροχή οικονομικής αρωγής - Μάιος 2010Peter NousiosNo ratings yet

- Euro Zone Crisis ExplainedDocument73 pagesEuro Zone Crisis ExplainedYogesh Rana100% (1)

- Deficit Committee PaperDocument5 pagesDeficit Committee PaperRyan DeCaroNo ratings yet

- 15 Budget DeficitDocument5 pages15 Budget Deficitthreestars41220027340No ratings yet

- Greece: Extend and Pretend Will Probably Not Be The End: Where We Stand: A Tight Calendar What To Expect?Document5 pagesGreece: Extend and Pretend Will Probably Not Be The End: Where We Stand: A Tight Calendar What To Expect?Maevious Ø AtlasNo ratings yet

- National Law Institute University: Greek Sovereign Debt CrisisDocument15 pagesNational Law Institute University: Greek Sovereign Debt Crisisalok mishraNo ratings yet

- Chapter Thee TaxDocument18 pagesChapter Thee TaxEmebet TesemaNo ratings yet

- Spending Review Framework 080610Document26 pagesSpending Review Framework 080610jasonweymanNo ratings yet

- Fiscal Developments 2013 and Medium Term ProspectsDocument31 pagesFiscal Developments 2013 and Medium Term ProspectsVassos KoutsioundasNo ratings yet

- Italy Delivers Early Budget Balance in 2013Document2 pagesItaly Delivers Early Budget Balance in 2013Heidi LiNo ratings yet

- RecommendationDocument11 pagesRecommendationArsalan NadeemNo ratings yet

- Truth About Obama's BudgetDocument4 pagesTruth About Obama's BudgetCOAST100% (1)

- Greece Crisis and Impact: Dr. P.A.JohnsonDocument14 pagesGreece Crisis and Impact: Dr. P.A.JohnsonPrajwal KumarNo ratings yet

- Overcoming financial crises through austerity and stimulus remediesDocument16 pagesOvercoming financial crises through austerity and stimulus remediesRoxanaT22No ratings yet

- Greek Debt CrisisDocument11 pagesGreek Debt CrisisISHITA GROVERNo ratings yet

- TreasuryDocument4 pagesTreasurylosangelesNo ratings yet

- Greek Government Debt CrisisDocument8 pagesGreek Government Debt CrisisShuja UppalNo ratings yet

- Why Dose Govt. Impose Taxes-Fiscal Deficit: Pratima Tripathi (Imb2010012) Manupriya (Imb2010044)Document29 pagesWhy Dose Govt. Impose Taxes-Fiscal Deficit: Pratima Tripathi (Imb2010012) Manupriya (Imb2010044)Nikki ShresthaNo ratings yet

- Brexit Party ManifestoDocument24 pagesBrexit Party ManifestoChristianNo ratings yet

- The Main Objectives of The EU Are: To Promote Economic and Social Progress, To Introduce EuropeanDocument3 pagesThe Main Objectives of The EU Are: To Promote Economic and Social Progress, To Introduce EuropeanBence CsillagNo ratings yet

- Op-Ed On Greece What Is Currently Going OnDocument2 pagesOp-Ed On Greece What Is Currently Going OnPavel StorojaNo ratings yet

- A Plan For JobsDocument36 pagesA Plan For JobsChristianNo ratings yet

- Funding the Greek Crisis: The European Union, Cohesion Policies, and the Great RecessionFrom EverandFunding the Greek Crisis: The European Union, Cohesion Policies, and the Great RecessionNo ratings yet

- EIB Investment Report 2021/2022 - Key findings: Recovery as a springboard for changeFrom EverandEIB Investment Report 2021/2022 - Key findings: Recovery as a springboard for changeNo ratings yet

- Debt Time Bomb! Debt Mountains: The Financial Crisis and its Toxic Legacy for the Next Generation: A Christian PerspectiveFrom EverandDebt Time Bomb! Debt Mountains: The Financial Crisis and its Toxic Legacy for the Next Generation: A Christian PerspectiveRating: 5 out of 5 stars5/5 (1)

- Global Tax Revolution: The Rise of Tax Competition and the Battle to Defend ItFrom EverandGlobal Tax Revolution: The Rise of Tax Competition and the Battle to Defend ItNo ratings yet

- World on the Move: Consumption Patterns in a More Equal Global EconomyFrom EverandWorld on the Move: Consumption Patterns in a More Equal Global EconomyNo ratings yet

- Hotel Details 4 Star 166Document5 pagesHotel Details 4 Star 166sarva842003No ratings yet

- CloudDocument1 pageCloudsarva842003No ratings yet

- Pride of TamilianDocument9 pagesPride of Tamiliansarva842003No ratings yet

- Pride of TamilianDocument9 pagesPride of Tamiliansarva842003No ratings yet

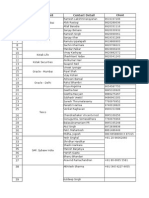

- List of SchoolsDocument8 pagesList of Schoolssarva842003No ratings yet

- Mid Size CompaniesDocument42 pagesMid Size Companiessarva842003No ratings yet

- PampletsDocument2 pagesPampletssarva842003No ratings yet

- Coimbatore BiometricsDocument16 pagesCoimbatore Biometricssarva842003No ratings yet

- UP Election HeatDocument3 pagesUP Election Heatsarva842003No ratings yet

- EclipseDocument5 pagesEclipsejeevanpbNo ratings yet

- Mid Size CompaniesDocument42 pagesMid Size Companiessarva842003No ratings yet

- Mumbai IT Companies DatabaseDocument4 pagesMumbai IT Companies Databasesarva842003No ratings yet

- Orion StaffingDocument12 pagesOrion Staffingsarva842003No ratings yet

- Direct Clients Bangalore BasedDocument15 pagesDirect Clients Bangalore Basedsarva8420030% (1)

- BFSI BangaloreDocument3 pagesBFSI Bangaloresarva842003No ratings yet

- SAP Bangalore BasedDocument12 pagesSAP Bangalore Basedsarva842003No ratings yet

- Top 40 IT Contacts of Major Companies in BangaloreDocument15 pagesTop 40 IT Contacts of Major Companies in Bangaloresarva842003100% (2)

- Linkedin Connections Export Microsoft OutlookDocument30 pagesLinkedin Connections Export Microsoft Outlooksarva842003No ratings yet

- SAP Bangalore BasedDocument12 pagesSAP Bangalore Basedsarva842003No ratings yet

- Client List - Principal BusinessDocument9 pagesClient List - Principal Businesssarva842003No ratings yet

- DTH Services in IndiaDocument28 pagesDTH Services in Indiasarva842003No ratings yet

- Contact Id Contact Owner First Name Last Name: Sheet1Document2 pagesContact Id Contact Owner First Name Last Name: Sheet1sarva842003No ratings yet

- DTH Services in IndiaDocument28 pagesDTH Services in Indiasarva842003No ratings yet

- Application For Cement Corporation of IndiaDocument8 pagesApplication For Cement Corporation of IndiavardhiniayyappangodNo ratings yet