Professional Documents

Culture Documents

Fifo

Uploaded by

frankoppongOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fifo

Uploaded by

frankoppongCopyright:

Available Formats

Inventory Valuation Example 1

Date Transactions Units Purchased Units Sold Unit Cost Inventory Units

May 1 Inventory 700 $10 700

May 3 Purchase 100 $12 800

May 8 Sale (*1) 500 ?? 300

May 15 Purchase 600 $14 900

May 19 Purchase 200 $15 1,100

May 25 Sale (*2) 400 ?? 700

May 27 Sale (*3) 100 ?? 600

May 31 Ending Inventory ?? 600

Total 1,600 1,000

FIFO, Perpetual Purchases Sale (*1) Sale (*2) Sale (*3) Ending Inventory

700 x $10 500 x $10

200 x $10

100 x $12 100 x $12

100 x $14

100 x $14

600 x $14

400 x $14

200 x $15 200 x $15

$ 19,600 $ 5,000 $ 4,600 $ 1,400 $ 8,600

Total Purchases Cost of goods sold Ending Inventory

$ 19,600 $ 11,000 $ 8,600

`

FIFO, Periodic Purchases Sale (*1) Sale (*2) Sale (*3) Ending Inventory

700 x $10 500 x $10

200 x $10

100 x $12 100 x $12

100 x $14

100 x $14

600 x $14

400 x $14

200 x $15 200 x $15

$ 19,600 $ 5,000 $ 4,600 $ 1,400 $ 8,600

Total Purchases Cost of goods sold Ending Inventory

$ 19,600 $ 11,000 $ 8,600

Copyright © 1999-2009 by AccountingStudy.com.TM Page 1 of 1

You might also like

- Date Content REF DR CRDocument3 pagesDate Content REF DR CRThành PhạmNo ratings yet

- Inventory CalculationDocument8 pagesInventory CalculationsarasatiwanamiNo ratings yet

- Tugas 5 Akuntansi Keuangan MenengahDocument5 pagesTugas 5 Akuntansi Keuangan MenengahLiussetiawan AndyNo ratings yet

- Item Description Quantity Unit Price TotalDocument4 pagesItem Description Quantity Unit Price TotalXian AspergaNo ratings yet

- Finasyifa Nurohmah (C1C021067)Document1 pageFinasyifa Nurohmah (C1C021067)FINASYIFA NUROHMAH 1No ratings yet

- FIRST IN FIRST OUT (FIFO) - Perpetual Inventory SystemDocument3 pagesFIRST IN FIRST OUT (FIFO) - Perpetual Inventory SystemFlorence Tresvalles AlticheNo ratings yet

- Final Test Acc 1 SolutionDocument4 pagesFinal Test Acc 1 SolutionNicolas ErnestoNo ratings yet

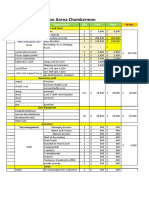

- Badminton Arena Chamkarmon: No Item Description Qty Unit AmtDocument2 pagesBadminton Arena Chamkarmon: No Item Description Qty Unit AmtKruseng LengseiNo ratings yet

- p4 2Document5 pagesp4 2Ernike SariNo ratings yet

- Tutorial Intermediate Accounting 1 - Meeting 1 (Answers)Document4 pagesTutorial Intermediate Accounting 1 - Meeting 1 (Answers)WILLIAM CHANDRANo ratings yet

- AKL P6-2 Achmad Faizal AzmiDocument5 pagesAKL P6-2 Achmad Faizal AzmiTiara Eva TresnaNo ratings yet

- YeDocument5 pagesYeTiara Eva TresnaNo ratings yet

- Who Wants To Be A Millionaire (I)Document34 pagesWho Wants To Be A Millionaire (I)King YiyoNo ratings yet

- Laurensius Adrian Wahyu Setiaji - 1402204311 - Latihan Soal P4.2Document6 pagesLaurensius Adrian Wahyu Setiaji - 1402204311 - Latihan Soal P4.2Laurensius Adrian Wahyu SetiajiNo ratings yet

- UntitledDocument4 pagesUntitledRima WahyuNo ratings yet

- Who Wants To Be A Millionaire Games Worksheet Templates Layouts 34711Document34 pagesWho Wants To Be A Millionaire Games Worksheet Templates Layouts 34711Ever Armando Vargas AdamesNo ratings yet

- Camida RapidasDocument1 pageCamida RapidasJoséJaramilloNo ratings yet

- Welcome To Who Wants To: Be A MillionaireDocument36 pagesWelcome To Who Wants To: Be A MillionaireAthena PhysicsNo ratings yet

- Sport Who Wants To Be A MillionaireDocument34 pagesSport Who Wants To Be A Millionairejose luis gonzalezNo ratings yet

- Testing IndicatorDocument1 pageTesting IndicatorAhmad KimpulNo ratings yet

- Welcome To Who Wants To: Be A MillionaireDocument36 pagesWelcome To Who Wants To: Be A MillionaireNathania LynchNo ratings yet

- Polygons Convex and ConcaveDocument12 pagesPolygons Convex and ConcaveBA RTNo ratings yet

- Hu Wants 2 B A Milliomaire On AssessmentDocument36 pagesHu Wants 2 B A Milliomaire On AssessmentMimi AcapulcoNo ratings yet

- Backtest Results and Broker Spread Comparison for Forex and Gold TradingDocument7 pagesBacktest Results and Broker Spread Comparison for Forex and Gold TradingZen oh SamaNo ratings yet

- Welcome To: Who Wants To Be A MillionaireDocument36 pagesWelcome To: Who Wants To Be A Millionaireanon_291634294No ratings yet

- Who Wants To Be A Millinaire Sport and HobbiesDocument49 pagesWho Wants To Be A Millinaire Sport and HobbiesNestor DuránNo ratings yet

- Método Del Costo Mínimo Origen Destino 1 2 3 A B CDocument5 pagesMétodo Del Costo Mínimo Origen Destino 1 2 3 A B Celvia de la hozNo ratings yet

- DEMODocument52 pagesDEMOĐoàn Minh NhậtNo ratings yet

- Testing Indicator Fibo TP 2Document1 pageTesting Indicator Fibo TP 2Face StressorNo ratings yet

- BSAIS 3B MODULE 2 Unit 1 To 4 LUMAPAY ROSALIE Q. Cost Accounting and ControlDocument26 pagesBSAIS 3B MODULE 2 Unit 1 To 4 LUMAPAY ROSALIE Q. Cost Accounting and ControlNaruse JunNo ratings yet

- Quesnay Tableau-March 2017Document7 pagesQuesnay Tableau-March 2017Ben SmithNo ratings yet

- Millionaire BuenoDocument36 pagesMillionaire BuenoPatricio MansillaNo ratings yet

- Welcome To: Who Wants To Bea MillionaireDocument34 pagesWelcome To: Who Wants To Bea MillionaireDavid DuezNo ratings yet

- хто хоче стати міліонером10Document35 pagesхто хоче стати міліонером10Ірина ГреськоNo ratings yet

- P4-5 Consolidation Entries and Financial StatementsDocument3 pagesP4-5 Consolidation Entries and Financial StatementsErnike SariNo ratings yet

- Documentacion SR MillionaireDocument34 pagesDocumentacion SR MillionaireLuis Manrique PerdomoNo ratings yet

- Documentacion SR MillionaireDocument34 pagesDocumentacion SR MillionaireLuis Manrique PerdomoNo ratings yet

- 6.01 6.02 6.04 - Promotion 1 Who Wants To Be A Millionaire RAINWATERDocument34 pages6.01 6.02 6.04 - Promotion 1 Who Wants To Be A Millionaire RAINWATERDezyne EcoleNo ratings yet

- Welcome To Who Wants To: Be A MillionaireDocument47 pagesWelcome To Who Wants To: Be A MillionaireGiao HuynhNo ratings yet

- Day 1 Assignment (Case CHP 1) - M Farhan I (29120616) YP64CDocument2 pagesDay 1 Assignment (Case CHP 1) - M Farhan I (29120616) YP64Cfarhan izharuddinNo ratings yet

- Welcome To Who Wants To: Be A MillionaireDocument36 pagesWelcome To Who Wants To: Be A MillionaireJhon CarreñoNo ratings yet

- Pricelist Balsa Sheet OctDocument1 pagePricelist Balsa Sheet OctFebby ArsyiNo ratings yet

- Academic Club BudgetDocument2 pagesAcademic Club BudgetVidara RodriguesNo ratings yet

- UntitledDocument10 pagesUntitledRima WahyuNo ratings yet

- Solution P6-2Document2 pagesSolution P6-2Frantino M Hutagaol100% (1)

- Tutorial Test 8 Solution Requirement 1Document3 pagesTutorial Test 8 Solution Requirement 1Minh HiềnNo ratings yet

- Marketing Expense BudgetDocument3 pagesMarketing Expense Budgetstubborn527No ratings yet

- Balance Sheet for Beginners - ExerciseDocument6 pagesBalance Sheet for Beginners - Exercise7n6jgvvsnqNo ratings yet

- Event Planning Budget Template (Excel)Document3 pagesEvent Planning Budget Template (Excel)MicrosoftTemplates100% (7)

- Welcome To Who Wants To: Be A MillionaireDocument36 pagesWelcome To Who Wants To: Be A MillionaireAyşenur UysalNo ratings yet

- who-wants-to-become-a-millionaire-activities-promoting-classroom-dynamics-group-form_53751Document47 pageswho-wants-to-become-a-millionaire-activities-promoting-classroom-dynamics-group-form_53751Pearl NgọcNo ratings yet

- ACT B861F - Tutorial 2 - Questions and Solution: RequiredDocument7 pagesACT B861F - Tutorial 2 - Questions and Solution: RequiredCalvin MaNo ratings yet

- Welcome To: Who Wants To Be A MillionaireDocument36 pagesWelcome To: Who Wants To Be A MillionaireNguyen YenNo ratings yet

- Dinamic Graphics 3 PDFDocument97 pagesDinamic Graphics 3 PDFFlorinNo ratings yet

- Personal Monthly Budget: Housing EntertainmentDocument1 pagePersonal Monthly Budget: Housing EntertainmentasgarNo ratings yet

- BookDocument4 pagesBookapi-425662833No ratings yet

- Business Startup Costs Template: Budget Actual DifferenceDocument7 pagesBusiness Startup Costs Template: Budget Actual DifferenceFachrurrozi Ayah NajwaNo ratings yet

- Ghana Investment Act: ScheduleDocument17 pagesGhana Investment Act: SchedulefrankoppongNo ratings yet

- Changing Teaching Practices Using Curriculum Differentiation To Respond To Students' DiversityDocument109 pagesChanging Teaching Practices Using Curriculum Differentiation To Respond To Students' Diversityfrankoppong100% (1)

- UNDERSTANDING INVESTMENT MANAGEMENT: The Problem of Content and DefinitionDocument10 pagesUNDERSTANDING INVESTMENT MANAGEMENT: The Problem of Content and DefinitionfrankoppongNo ratings yet

- Relationship BTW MotivationDocument16 pagesRelationship BTW MotivationfrankoppongNo ratings yet

- ProveDocument1 pageProvefrankoppongNo ratings yet

- QbasicDocument57 pagesQbasicgodsyearsNo ratings yet

- What Is Faith?Document26 pagesWhat Is Faith?joeNo ratings yet

- FinancialDocument12 pagesFinancialfrankoppongNo ratings yet

- Age Character CalculationDocument1 pageAge Character CalculationManoj RautNo ratings yet

- Management Accounting Final ExamDocument4 pagesManagement Accounting Final Examacctg2012No ratings yet

- Chap005 (Modified)Document63 pagesChap005 (Modified)Kate LiNo ratings yet

- 2nd Quarter Financial Report 2019Document94 pages2nd Quarter Financial Report 2019Vika OktarinaNo ratings yet

- Royal Dutch Shell Valuation As of December 3, 2018Document35 pagesRoyal Dutch Shell Valuation As of December 3, 2018KevinNo ratings yet

- IAS 12 Income Tax AccountingDocument6 pagesIAS 12 Income Tax AccountingAnn Christine C. Chua100% (2)

- ACC314 Revision Ratio Questions - SolutionsDocument8 pagesACC314 Revision Ratio Questions - SolutionsRukshani RefaiNo ratings yet

- SEO-Optimized Multiple Choice Exam QuestionsDocument3 pagesSEO-Optimized Multiple Choice Exam QuestionsChristian Joy ReyesNo ratings yet

- Auditing (1) Master MindsDocument18 pagesAuditing (1) Master Mindstsg_ramaraoNo ratings yet

- South-Western Workbook, TeacherDocument288 pagesSouth-Western Workbook, TeacherJack Jack100% (3)

- Adv Fincnce MCQDocument8 pagesAdv Fincnce MCQGLEN GOMESNo ratings yet

- Secor Chrystal Jean E. Shareholders EquityDocument53 pagesSecor Chrystal Jean E. Shareholders EquityAbriel BumatayNo ratings yet

- Auditing Problem For Shareholder's EquityDocument14 pagesAuditing Problem For Shareholder's Equityblack hudieNo ratings yet

- Accounting Exercises 1Document2 pagesAccounting Exercises 1api-448952030No ratings yet

- Appendix BDocument5 pagesAppendix Bowenish9903No ratings yet

- Asian Paints Equity ValuationDocument24 pagesAsian Paints Equity ValuationYash DangraNo ratings yet

- 04102012-Press Publication-2011 Annual Report-UkDocument272 pages04102012-Press Publication-2011 Annual Report-UkGbrnr Ia AndrntNo ratings yet

- Audit of Receivables and Adjusting EntriesDocument6 pagesAudit of Receivables and Adjusting EntriesEliyah Jhonson100% (1)

- BOOOOMDocument221 pagesBOOOOMScrappy WellNo ratings yet

- General Accounting Cheat SheetDocument35 pagesGeneral Accounting Cheat SheetZee Drake100% (5)

- IA 3 MidtermDocument9 pagesIA 3 MidtermMelanie Samsona100% (1)

- ACCA Dec 2011 F7 Mock PaperDocument10 pagesACCA Dec 2011 F7 Mock PaperCharles AdontengNo ratings yet

- Bharti Airtel DCFDocument27 pagesBharti Airtel DCFHemant bhanawatNo ratings yet

- MMPC 04 PDF EBOOK Merged SECUREDocument74 pagesMMPC 04 PDF EBOOK Merged SECURERakesh dahiyaNo ratings yet

- NFM Annual Report and Financial AnalysisDocument44 pagesNFM Annual Report and Financial AnalysisRyanRuceMelvilleNo ratings yet

- Automatic Car Wash Project Report FinalDocument20 pagesAutomatic Car Wash Project Report FinalTahina Randrianirina100% (1)

- Solved Pitt Reported The Following Information For 2018 and 2019 Required Compute Pitt SDocument1 pageSolved Pitt Reported The Following Information For 2018 and 2019 Required Compute Pitt SAnbu jaromiaNo ratings yet

- Analysis of Financial Statements RatiosDocument9 pagesAnalysis of Financial Statements RatiosViren DeshpandeNo ratings yet

- 3-2 Ex 1 Sheila's Interior DecoratingDocument3 pages3-2 Ex 1 Sheila's Interior Decoratingjugraj grewalNo ratings yet

- Consolidated financial statements of Zena GroupDocument27 pagesConsolidated financial statements of Zena Groupbcnxv100% (1)