Professional Documents

Culture Documents

Advance Tax Interest Calculator

Uploaded by

saurabh26100 ratings0% found this document useful (0 votes)

67 views2 pagesCopyright

© Attribution Non-Commercial (BY-NC)

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

67 views2 pagesAdvance Tax Interest Calculator

Uploaded by

saurabh2610Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You are on page 1of 2

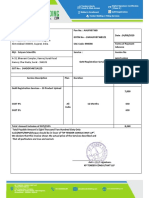

Advance Tax Interest Calculator

Individual Assessee Individual Total Interest U/s 234 C 229

Corporate Month Of Filling of Return 6 Total Interest U/S 234 B 0

Total Tax Liability 18,960 Total Interest 229

TDS 1,258

Total Advance Tax Payable 17,702

Advance Tax Paid Amount in Rs.

Up to 15th June 0

Up to 15th September 0

Up to 15th December 10,000

Up to 15th March 6,000

Total 16,000

Self Assessment Paid in Month of Amount in Rs.

3 March 0

4 April 0

5 May 0

6 June 0

7 July 0

8 August 1702

9 September 0

10 October 0

11 November 0

12 December 0

Interest U/S 234 C First Quarter 0

Interest U/S 234 C Second Quarter 159 3 3

Interest U/S 234 C Third Quarter 19

Interest U/S 234 C Fourth Quarter 51

Total 229

Interest U/S 234 B April Actual Paid

Interest U/S 234 B May 0 0 0 0 0

Interest U/S 234 B June 0 5310.6 5,311 159.318 159.318

Interest U/S 234 B July 10000 10621.2 621 18.636 18.636

Interest U/S 234 B August 16000 17702 1,702 51.06 51.06

Interest U/S 234 B September 90.39% 1,702 Excess than Liability

Interest U/S 234 B October

Interest U/S 234 B November 16,000 1702

Interest U/S 234 B December 16,000 1702

Total 0 16,000 1702

16,000 1702

16,000 1702

17,702 0

17,702 0

17,702 0

17,702 0

17,702 0

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Export Items in FOODDocument3 pagesExport Items in FOODsaurabh2610No ratings yet

- Comtax - Up.nic - in - cSTAct - CST UP Form-1 With AnnexureDocument4 pagesComtax - Up.nic - in - cSTAct - CST UP Form-1 With Annexuresaurabh261050% (2)

- 5 51 460 6883203Document21 pages5 51 460 6883203Chandan SinghNo ratings yet

- Exchange Control Declaration (GR) Form No.Document5 pagesExchange Control Declaration (GR) Form No.iqbal sNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- CT600 2021 Version 3 04 22Document11 pagesCT600 2021 Version 3 04 22Antoon Lorents0% (1)

- IHRM CH 2Document29 pagesIHRM CH 2Irfan ur Rehman100% (1)

- LVB K7 MH 1 HOMYf AfDocument14 pagesLVB K7 MH 1 HOMYf AfArunabh senNo ratings yet

- FAR139 FAR 139 Cash and Accrual BasisDocument4 pagesFAR139 FAR 139 Cash and Accrual BasisJuniah MyreNo ratings yet

- Chapter 3 Homework Solutions: Problems: 1, 2, 6, 16, 17Document21 pagesChapter 3 Homework Solutions: Problems: 1, 2, 6, 16, 17Abigail VillalvaNo ratings yet

- HDocument4 pagesHPrashant Sagar GautamNo ratings yet

- Acc. No.: Boulton's Toy EmporiumDocument5 pagesAcc. No.: Boulton's Toy EmporiumMisty TranquilNo ratings yet

- Impact of World Cup On India 4oct2023Document4 pagesImpact of World Cup On India 4oct2023Keval RajparaNo ratings yet

- Tribal1 Zalia 12 Ak 1Document4 pagesTribal1 Zalia 12 Ak 1Alif Maulana IbrahimNo ratings yet

- 1 Mankiew Chapter 1Document35 pages1 Mankiew Chapter 1Thành Đạt Lại (Steve)No ratings yet

- Satyam ScientificDocument1 pageSatyam ScientificHussain ShaikhNo ratings yet

- Internship Project Report" OnDocument60 pagesInternship Project Report" OnDiksha Sawhney80% (5)

- Services Marketing: Jashandeep Singh, PHDDocument103 pagesServices Marketing: Jashandeep Singh, PHDmannatNo ratings yet

- Capital Budgeting 2Document4 pagesCapital Budgeting 2Nicole Daphne FigueroaNo ratings yet

- 4 PDFDocument2 pages4 PDFRÁvi DadheechNo ratings yet

- Weekly Sales Call Report Excel TemplateDocument7 pagesWeekly Sales Call Report Excel Templatekoyangi jagiyaNo ratings yet

- T2sch100-Fill-20e - Balance Sheet InformationDocument2 pagesT2sch100-Fill-20e - Balance Sheet Informationnh nNo ratings yet

- ElonMuskBook NEWDocument5 pagesElonMuskBook NEWRJ GutierrezNo ratings yet

- FDAdvice 10153571792 134129209Document2 pagesFDAdvice 10153571792 134129209Manjeet SharmaNo ratings yet

- Accounting StandardsDocument6 pagesAccounting StandardsJohnsonNo ratings yet

- Messari Crypto Theses 2024Document193 pagesMessari Crypto Theses 2024Geoff K. ChengNo ratings yet

- Iso 50005 - 2021Document51 pagesIso 50005 - 2021Lilia LiliaNo ratings yet

- Operations Management: William J. StevensonDocument32 pagesOperations Management: William J. StevensonMichelle Manalo CanceranNo ratings yet

- HP-Compaq Group 10 Assignment 04 SlidesDocument13 pagesHP-Compaq Group 10 Assignment 04 SlidesAhmad RaufNo ratings yet

- KLE Tech - Research Policy DocumentDocument30 pagesKLE Tech - Research Policy DocumentNEERAJ GUPTANo ratings yet

- Tle10q2m2 Activity SheetDocument4 pagesTle10q2m2 Activity SheetLavinia RamosNo ratings yet

- Service Definition, Concept, Characteristics, Importance and ClassificationDocument1 pageService Definition, Concept, Characteristics, Importance and ClassificationReet KalsiNo ratings yet

- Summer Internship Report (Nitin)Document28 pagesSummer Internship Report (Nitin)Viswajit100% (1)

- Chapter 2 - FADocument23 pagesChapter 2 - FANouh Al-SayyedNo ratings yet

- L2.2 - Market EquilibriumDocument2 pagesL2.2 - Market Equilibrium12A1-41- Nguyễn Cẩm VyNo ratings yet