Professional Documents

Culture Documents

Cup Pa Mania

Uploaded by

deepaksikri0 ratings0% found this document useful (0 votes)

11 views2 pagesCopyright

© Attribution Non-Commercial (BY-NC)

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views2 pagesCup Pa Mania

Uploaded by

deepaksikriCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 2

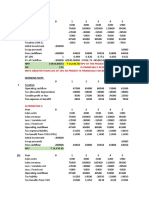

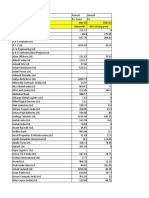

CUPPAMANIA

Year 0 1 2 3

Investment Cash flow

Pkg Eqipment -1000000

Production M/C OC -75000 -500000

Change in NWC on incremental basis -30000 -10000 -15000 10000

Investment Cash flow -1105000 -510000 -15000 10000

PV of Investment CF Rs. -1,583,164.89

Operating Cashflow

Gross Profits 500000 500000 500000

Depreciation of pkg equipment 200000 200000 200000

Depreciation of prod m/c(existing 1/3 share only yr-1) 100000 100000 100000

R& D expense (reduce for tax benefits) 100000 0 0

Allocated Overheads 2500 3000 3500

EBIT 97500 197000 196500

Taxes 40 39000 78800 78600

NOPAT 58500 118200 117900

Add Depreciation 358500 418200 417900

Add R&D Expense 458500 418200 417900

Operating Cash Flow 458500 418200 417900

PV of Operating CF Rs. 1,581,335.43

Terminal Cashflow

Salvage Value of Production M/C

Release of NWC

Terminal Cash Flows 0 0 0

PV of terminal CF Rs. 80,115.93

FCFF -1105000 -51500 403200 427900

NPV Rs. 98,716.78

Discounted pay back (4 yrs and 4 months) -1105000 -46396.4 327246.2 312876.8

-25000 -25000 -25000

PV Rs. -92,397.43

NPV of cuppamania Rs. 6,319.36

4 5 Sunk Cost Incidental Benefit

R&D 100000 Tax rebate for R&D

10000

10000 0

500000 500000

200000 200000

100000 100000 Yr2-5 depreciation expense for new production m/c bought in yr-1

0 0

3500 3500

196500 196500

78600 78600

117900 117900

417900 417900

417900 417900

417900 417900

100000

35000

0 135000

427900 552900

281871 328119.2

-25000 -25000

You might also like

- Yum YumDocument2 pagesYum YumSurbhi KambojNo ratings yet

- Cup Pa Mania ProjectDocument4 pagesCup Pa Mania ProjectDurgaprasad VelamalaNo ratings yet

- CF Assignment 1 Group 4Document41 pagesCF Assignment 1 Group 4Radha DasNo ratings yet

- Base Case Analysis Best CaseDocument6 pagesBase Case Analysis Best CaseMaphee CastellNo ratings yet

- CF Assignment 1 Group 9Document51 pagesCF Assignment 1 Group 9rishabh tyagiNo ratings yet

- CB Numericals 1Document13 pagesCB Numericals 1Vedashree MaliNo ratings yet

- Practice Problems 2Document9 pagesPractice Problems 2Divyam GargNo ratings yet

- 23 Nov 2018 Mixed Questions With Solutions PDFDocument9 pages23 Nov 2018 Mixed Questions With Solutions PDFLaston MilanziNo ratings yet

- A. CF - 500 Tine 5 Years Discount Rate 10% PV $310.46 B. PV $1,895.39 C. Time 50 Years PV $4,957.41 D. Time 100 Years PV $4,999.64Document11 pagesA. CF - 500 Tine 5 Years Discount Rate 10% PV $310.46 B. PV $1,895.39 C. Time 50 Years PV $4,957.41 D. Time 100 Years PV $4,999.64Hoàng QuânNo ratings yet

- Capital BudgetingDocument14 pagesCapital BudgetingbhaskkarNo ratings yet

- Investment 80000 Cost Reduction 22000 Life 5 Salvage 20000 Tax 21% Discounting Rate 10%Document7 pagesInvestment 80000 Cost Reduction 22000 Life 5 Salvage 20000 Tax 21% Discounting Rate 10%Sneha DasNo ratings yet

- Group4 SectionA SampavideoDocument5 pagesGroup4 SectionA Sampavideokarthikmaddula007_66No ratings yet

- Final CaseDocument25 pagesFinal CaseSakshi SharmaNo ratings yet

- Case01 02Document24 pagesCase01 02Sakshi SharmaNo ratings yet

- Initial Investment Fixed Cost Variable Cost Particulars Amount (RS.) Particulars Amount (RS.) ParticularsDocument5 pagesInitial Investment Fixed Cost Variable Cost Particulars Amount (RS.) Particulars Amount (RS.) ParticularsPrince JoshiNo ratings yet

- Summary of Operating Assumptions (For Example)Document5 pagesSummary of Operating Assumptions (For Example)Krishna SharmaNo ratings yet

- GYM Financial ModelingDocument12 pagesGYM Financial ModelingDivyanshu SharmaNo ratings yet

- Carbide Chemical Company-Replacement of Old Machines-Discounting of CashflowsDocument1 pageCarbide Chemical Company-Replacement of Old Machines-Discounting of CashflowsRajib Dahal50% (2)

- FM09 CH 10 Im PandeyDocument19 pagesFM09 CH 10 Im PandeyJack mazeNo ratings yet

- Making Capital Investment DecisionsDocument48 pagesMaking Capital Investment DecisionsJerico ClarosNo ratings yet

- Corporate Finance MidtermDocument6 pagesCorporate Finance MidtermFarid HaqverdiyevNo ratings yet

- Solution Manual - Capital Budgeting Part 2Document21 pagesSolution Manual - Capital Budgeting Part 2Lab Dema-alaNo ratings yet

- Allied Sugar Company!!: Financial SummaryDocument2 pagesAllied Sugar Company!!: Financial SummaryFawad Ejaz BhattíNo ratings yet

- Q1Document31 pagesQ1Bhaskkar SinhaNo ratings yet

- FIN341 Excel Demo - Chapter 11Document23 pagesFIN341 Excel Demo - Chapter 11mai tharatharnNo ratings yet

- (MCOF19M018) CF ProjectDocument8 pages(MCOF19M018) CF ProjectFaaiz YousafNo ratings yet

- Analysis of Project Cash FlowsDocument16 pagesAnalysis of Project Cash FlowsTanmaye KapurNo ratings yet

- Case 5Document12 pagesCase 5JIAXUAN WANGNo ratings yet

- Seminar XIIDocument67 pagesSeminar XIINeko IvanishviliNo ratings yet

- Answer Key Discussion of Sir Paul of PreweekDocument2 pagesAnswer Key Discussion of Sir Paul of PreweekElaine Joyce GarciaNo ratings yet

- ACTIVITY 1 Capital BudgetingDocument12 pagesACTIVITY 1 Capital BudgetingkmarisseeNo ratings yet

- MADocument11 pagesMANurbergen YeleshovNo ratings yet

- Chapter 1Document18 pagesChapter 1Kenny WongNo ratings yet

- Flujos de Expansi N. Simulador. 2019 Unidad 1Document6 pagesFlujos de Expansi N. Simulador. 2019 Unidad 1yoki cortezNo ratings yet

- 2.Hola-Kola - The Capital Budgeting DecisionDocument3 pages2.Hola-Kola - The Capital Budgeting DecisionGautam D50% (2)

- Capital Budgeting-Q1-SolutionDocument1 pageCapital Budgeting-Q1-SolutionShubhamSoodNo ratings yet

- FM09-CH 11Document5 pagesFM09-CH 11Mukul KadyanNo ratings yet

- Mystic SportsDocument34 pagesMystic SportshelloNo ratings yet

- Session-8 Capital BudgetingDocument11 pagesSession-8 Capital BudgetingKishan TCNo ratings yet

- Chapter 14-Ch. 14-Cash Flow Estimation 11-13.El-Bigbee Bottling CompanyDocument1 pageChapter 14-Ch. 14-Cash Flow Estimation 11-13.El-Bigbee Bottling CompanyRajib DahalNo ratings yet

- Alternative 1Document10 pagesAlternative 1Sreyas S KumarNo ratings yet

- Quiz 3032Document4 pagesQuiz 3032PG93No ratings yet

- Bethesda & GoodweekDocument8 pagesBethesda & GoodweekDian Pratiwi RusdyNo ratings yet

- Slides of Lecture#09 Corporate Finance (FIN-622)Document4 pagesSlides of Lecture#09 Corporate Finance (FIN-622)sukhiesNo ratings yet

- Acquisition Cash FlowDocument3 pagesAcquisition Cash Flowkaeya alberichNo ratings yet

- Chapter 8 Solutions Berk and DemerzoDocument9 pagesChapter 8 Solutions Berk and DemerzoKishan TCNo ratings yet

- Practice Problem Set #1 Capital Budgeting - Solution - : FIN 448, Sections 2 & 3, Fall 2020 Advanced Financial ManagementDocument5 pagesPractice Problem Set #1 Capital Budgeting - Solution - : FIN 448, Sections 2 & 3, Fall 2020 Advanced Financial ManagementAndrewNo ratings yet

- Cashflows Year 0 Year 1 Year 2 Year 3Document3 pagesCashflows Year 0 Year 1 Year 2 Year 3Keshav NarayanNo ratings yet

- Same Questions - F303 - 1st MidDocument5 pagesSame Questions - F303 - 1st MidRafid Al Abid SpondonNo ratings yet

- Bajaj Finserv Investor Presentation - Q2 FY2018-19Document19 pagesBajaj Finserv Investor Presentation - Q2 FY2018-19AmarNo ratings yet

- Aika - A3 IRR and NPV Analysis FinalDocument29 pagesAika - A3 IRR and NPV Analysis FinalSarah BunoNo ratings yet

- Statement - I Cost of Project Particulars Sl. No. Ref. Annex Total CostDocument15 pagesStatement - I Cost of Project Particulars Sl. No. Ref. Annex Total Costsohalsingh1No ratings yet

- Advanced Corporate Finance Case 2Document3 pagesAdvanced Corporate Finance Case 2Adrien PortemontNo ratings yet

- SampaSoln EXCELDocument4 pagesSampaSoln EXCELRasika Pawar-HaldankarNo ratings yet

- p11 29Document5 pagesp11 29Saeful AzizNo ratings yet

- Appendix-11B-Replacement Project Analysis-A Lathe For Trimming Molded Plastics Was Purchased.Document1 pageAppendix-11B-Replacement Project Analysis-A Lathe For Trimming Molded Plastics Was Purchased.Rajib Dahal100% (2)

- Coprate Finance (Case Study) : Ansa Abrar MCOF19M019 3 RegularDocument7 pagesCoprate Finance (Case Study) : Ansa Abrar MCOF19M019 3 RegularFaaiz YousafNo ratings yet

- CF StudyhDocument9 pagesCF StudyhMuhammad SahalNo ratings yet

- (MCOF19M028) CF AssignmentDocument5 pages(MCOF19M028) CF AssignmentFaaiz YousafNo ratings yet

- MC Donald's Nutrition FactsDocument22 pagesMC Donald's Nutrition FactsMarcus SmithNo ratings yet

- BSE500 MarketCap PBDocument72 pagesBSE500 MarketCap PBdeepaksikriNo ratings yet

- GodrejDocument4 pagesGodrejdeepaksikriNo ratings yet

- India Strategy ReportDocument23 pagesIndia Strategy ReportdeepaksikriNo ratings yet

- Competitors Bajaj MotorsDocument11 pagesCompetitors Bajaj MotorsdeepaksikriNo ratings yet

- Past Simple PDFDocument4 pagesPast Simple PDFderlinNo ratings yet

- Chapter 3-PIC IO Port ProgrammingDocument36 pagesChapter 3-PIC IO Port Programmingouterrace67% (3)

- Case Study On Toy WarDocument15 pagesCase Study On Toy Warneeraj1412No ratings yet

- Module2.Shs CGPDocument54 pagesModule2.Shs CGPRommelyn Perez Pelicano75% (4)

- Concept PaperDocument3 pagesConcept PaperDan Reynald Domingo SomeraNo ratings yet

- Week 1Document3 pagesWeek 1Markdel John EspinoNo ratings yet

- Module1 Lesson 1Document22 pagesModule1 Lesson 1ARLENE NORICONo ratings yet

- Rfid: Threats, Failures, and FixesDocument43 pagesRfid: Threats, Failures, and FixesChromatonNo ratings yet

- Jurnal Review Manajemen ResikoDocument31 pagesJurnal Review Manajemen ResikoAdityaP.NugrahaNo ratings yet

- Activateroom HLDZDocument11 pagesActivateroom HLDZPerinorte100% (2)

- Lecture05e Anharmonic Effects 2Document15 pagesLecture05e Anharmonic Effects 2Saeed AzarNo ratings yet

- Engineering Economy: Chapter 6: Comparison and Selection Among AlternativesDocument25 pagesEngineering Economy: Chapter 6: Comparison and Selection Among AlternativesBibhu R. TuladharNo ratings yet

- Reading Comprehension TextsDocument15 pagesReading Comprehension TextsCMRotaruNo ratings yet

- How Order Management Help E-Commerce Increase Performance During The Pandemic PeriodDocument4 pagesHow Order Management Help E-Commerce Increase Performance During The Pandemic PeriodInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- English Grammar Book-Final - 2-5-21Document42 pagesEnglish Grammar Book-Final - 2-5-21Manav GaurNo ratings yet

- Presumption - Person Possession A Falsified Document and Be Made Use of It, He Is The Material Author of The FalsificationDocument3 pagesPresumption - Person Possession A Falsified Document and Be Made Use of It, He Is The Material Author of The FalsificationbeabineneNo ratings yet

- 2006 Consensus Agreement On The Design and Conduct of Clinical Studies With Low-Level Laser Therapy and Light Therapy For Musculoskeletal Pain and DisordersDocument2 pages2006 Consensus Agreement On The Design and Conduct of Clinical Studies With Low-Level Laser Therapy and Light Therapy For Musculoskeletal Pain and DisordersDetian WangNo ratings yet

- Department of Education: School-Based Action Research ACTION PLAN FOR S.Y. 2021-2022Document4 pagesDepartment of Education: School-Based Action Research ACTION PLAN FOR S.Y. 2021-2022roela badiangNo ratings yet

- Hormones MTFDocument19 pagesHormones MTFKarla Dreams71% (7)

- Introductory Econometrics A Modern Approach Solutions Manual PDFDocument9 pagesIntroductory Econometrics A Modern Approach Solutions Manual PDFAnonymous bzcYj42Ain0% (2)

- 3 C FamilyIImoot2015Document3 pages3 C FamilyIImoot2015ApoorvaChandraNo ratings yet

- Sorrows of A Trophy WifeDocument786 pagesSorrows of A Trophy WifeAngel MilanNo ratings yet

- Dallas Baptist University Writing Center: Narrative EssayDocument3 pagesDallas Baptist University Writing Center: Narrative EssayumagandhiNo ratings yet

- What Is Black Box Testing?: Black Box Testing Is Done Without The Knowledge of The Internals of The System Under TestDocument127 pagesWhat Is Black Box Testing?: Black Box Testing Is Done Without The Knowledge of The Internals of The System Under TestusitggsipuNo ratings yet

- Malatras ChristosDocument13 pagesMalatras Christosdimco2007No ratings yet

- Position PaperDocument19 pagesPosition PaperShara BasilioNo ratings yet

- Resilient Modulus of Hot-Mix Asphalt Gap Graded With Waste Rubber Tire AdditivesDocument10 pagesResilient Modulus of Hot-Mix Asphalt Gap Graded With Waste Rubber Tire Additivesdanang abdilahNo ratings yet

- Assessment - Manage Quality Customer Service - BSBCUS501 PDFDocument29 pagesAssessment - Manage Quality Customer Service - BSBCUS501 PDFEricKang26% (19)

- Girls, Gangs and Crime-The Profile of The Female OffenderDocument16 pagesGirls, Gangs and Crime-The Profile of The Female OffenderLiLiThBLaCkNo ratings yet

- Num PyDocument46 pagesNum Pyytmusik4No ratings yet