Professional Documents

Culture Documents

Particulars

Uploaded by

Anupam MohantyOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Particulars

Uploaded by

Anupam MohantyCopyright:

Available Formats

Particulars XYZ Ltd ABC Ltd

No. Of Outstanding Shares 200,000 100,000

Earning After Tax 400,000 100,000

Market Price Per Share 25 12

i. Pre Merger Earning Per Share (EPS): Earning after tax/Number of

Shares outstanding

For XYZ Ltd= 400,000/200,000

=2

For ABC Ltd (EPS)=100,000/100,000

= 1.

P/E Ratio= Market Price per Share/ Pre Merger Earning Per Shar4e

EPS

For XYZ Ltd (P/E Ratio) =25/2=12.5

For ABC Ltd (P/E Ratio) =12.5/1=12.5.

ii. Current Market Price of ABC Ltd if P/E ratio is 8 = Rs 1*8=Rs8.

Exchange Ratio=25/8=3.125

Post-Merger EPS of XYZ Ltd=

(400,000+100,000)/(200,000+(100,000/3.125))

500,000/2, 32,000=Rs 2.16

III. Desired Exchange Ratio: Total Number of Share post merger =

Post Merger earnings/Pre-Merger EPS of XYZ Ltd=

500,000/2=2, 50,000

Number of Shares Required=2, 50,000-200,000=50,000

Therefore Exchange Rate = 50,000/100,000

=0.5

2.)

Particulars India Cement Small Cement

Profit After Tax` 56 21

No. of Shares(Lakhs) 10 8.4

E.P.S (Rs) 5.6 2.5

P/E Ratio 12.5 7.5

a. Market Price per Share =EPS*P/E Ratio.

Hence for Indian Cement Market Price per Share is =5.6*12.5= Rs 70

For Small Cement Market Price per Share is =2.5*75 =Rs18.75.

Maximum Exchange Ratio= Total No of shares of Post Merger/Pre Merger Earning Per

Share (EPS)

= (5600, 000+2100,000)/2.5

= 30,80,000

No. of share required=3080000-8,40,000

=22,40,000

Exchange rate=22,40,000/1000000

=2.24

Market price per share=70/18.75

=3.73

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Individually Managed Accounts An Investor's GuideDocument272 pagesIndividually Managed Accounts An Investor's Guidebrew1cool12381No ratings yet

- Description of Research InterestsDocument6 pagesDescription of Research InterestsManas DimriNo ratings yet

- Crg660 Debt Financing PDFDocument3 pagesCrg660 Debt Financing PDFazianNo ratings yet

- Cost Management AccountingDocument200 pagesCost Management Accountingsombitsg23.pumbaNo ratings yet

- Geojit Report by Antique 170927Document27 pagesGeojit Report by Antique 170927Ganesh CvNo ratings yet

- Assignment On Interest Rates and Bond Valuation Course Title: Corporate Finance Course Code: BUS 573Document8 pagesAssignment On Interest Rates and Bond Valuation Course Title: Corporate Finance Course Code: BUS 573বিবেক রায়No ratings yet

- Financial System Scope and FunctionDocument2 pagesFinancial System Scope and FunctionvivekNo ratings yet

- 5 6188064231535936141Document95 pages5 6188064231535936141SRISAI SURYANo ratings yet

- Interest Rate Derivatives: The Standard Market ModelsDocument31 pagesInterest Rate Derivatives: The Standard Market ModelsFlávio CostaNo ratings yet

- Aa2 - Chapter 8 Suggested Answers: Exercise 8 - 1Document5 pagesAa2 - Chapter 8 Suggested Answers: Exercise 8 - 1Izzy BNo ratings yet

- EGX 30 Methodology - en 11 02 2013Document10 pagesEGX 30 Methodology - en 11 02 2013Darkmatter DarkmatterrNo ratings yet

- International Parity Relationships and Forecasting FX Rates: Chapter FiveDocument30 pagesInternational Parity Relationships and Forecasting FX Rates: Chapter FiveNamrata PrajapatiNo ratings yet

- Behavioural Corporate Finance Power PointDocument12 pagesBehavioural Corporate Finance Power PointLawrence NgariNo ratings yet

- AXIS BANK + EnaamDocument8 pagesAXIS BANK + Enaammaharshi_mehta2089No ratings yet

- Original ProjectDocument61 pagesOriginal Projectlawrence amoasiNo ratings yet

- Internal Audit Report Re The CMH Asset Weaknesses PDFDocument8 pagesInternal Audit Report Re The CMH Asset Weaknesses PDFmikekvolpeNo ratings yet

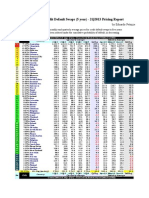

- Sovereign Credit Default Swaps (5 Year) - 2Q2013 Pricing ReportDocument1 pageSovereign Credit Default Swaps (5 Year) - 2Q2013 Pricing ReportEduardo PetazzeNo ratings yet

- Cfas Finals ReviewerDocument5 pagesCfas Finals ReviewerKim Nicole BantolaNo ratings yet

- Mba 1 Sem Managerial Economics Cbcs Summer 2017Document2 pagesMba 1 Sem Managerial Economics Cbcs Summer 2017Sandeep SahadeokarNo ratings yet

- Recognition of Revenue From Exchange TransactionsDocument12 pagesRecognition of Revenue From Exchange TransactionsCrazy SoloNo ratings yet

- Parcor TheoriesDocument2 pagesParcor TheoriesKristine Claire PangandoyonNo ratings yet

- Three Largest Stock Market Indexes in The US-A4Document3 pagesThree Largest Stock Market Indexes in The US-A4鄭茗秋No ratings yet

- Business Plan Rubric New 1Document3 pagesBusiness Plan Rubric New 1Aron Joel CaoleNo ratings yet

- Chapter 1 - Introduction To Corporate FinanceDocument16 pagesChapter 1 - Introduction To Corporate FinanceBenjaminNo ratings yet

- Study DK Goel Accountancy Class 12 - Volume 1 Chapter 3Document6 pagesStudy DK Goel Accountancy Class 12 - Volume 1 Chapter 3kamalpanjwani07No ratings yet

- A Summer Training Report ON Recruitment and Selection in Sharekhan LimitedDocument79 pagesA Summer Training Report ON Recruitment and Selection in Sharekhan LimitedAkash SharmaNo ratings yet

- Af6004 FinalDocument30 pagesAf6004 FinalKamal PereraNo ratings yet

- Financial Derivatives: The Role in The Global Financial Crisis and Ensuing Financial ReformsDocument26 pagesFinancial Derivatives: The Role in The Global Financial Crisis and Ensuing Financial Reformsqazwsx4321No ratings yet

- RM - Cia 3Document14 pagesRM - Cia 3KULDEEP SINGH 2228327No ratings yet

- Q4FY23 Financial ResultsDocument21 pagesQ4FY23 Financial ResultsRiya ThakurNo ratings yet