Professional Documents

Culture Documents

PaySlip - Advanced Format

Uploaded by

Yogendra RautOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PaySlip - Advanced Format

Uploaded by

Yogendra RautCopyright:

Available Formats

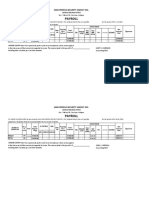

COMPANY NAME

Name Location Pay Area

PSNo Department Pay Period

Cost Center Pay Arrear Days Prev Day Recov.

Days Payable Prev.day Paid Grade

ONSITE CURRENT ONSITE PREV ONSITE PREV

FLEXI AMOUNT DRIVER WAGES CAR MILAGE CELLPHONE TOLL CHARGES HRA ADDITIONAL

MONTH MONTH PAY MONTH RECOV

PAN

Earnings - Deductions = Net Pay Bank Name Account No. Payment Mode PF No. Currency

No.

00000.00 - 00000.00 = 00000.00

Earnings Deductions

Annual Salary

Arrear/Adj Arrear/Adj

BASIC SALARY PF GROSS EARNINGS

HRA INCOME TAX EXEMPTIONS U/S 10

CONVEYANCE ALLOWANCE PROFESSIONAL TAX BALANCE

EDUCATION ALLOWANCE SPORTS CLUB STANDARD DEDUCTION

ADHOC ALLOWANCE PROF TAX

INDIA PERSONAL PAY TAXABLE SALARY

MEDICAL ALLOWANCE LOSS FROM HOUSE

PROPERTY

GROSS TAXABLE INCOME

TOTAL 80C

TOTAL DED UNDER CHAP VI-

A

NET TAXABLE INCOME

TAX AMOUNT

INCOME TAX PAYABLE

ITAX INCL SURCHARGE

TAX DEDUCTED TILL DATE

TAX TO PAY

TOTAL 27,428.00 0.00 TOTAL 1,149.00 0.00

Perks /Any Other

Investment Details Sec 10 Exemption Loan Balance

Income

TOTAL DED U/C VI-A

REBATE US 80C

Check the below link for more formats

http://www.aletterformat.com

You might also like

- PayrollDocument1 pagePayrollWingel CascayanNo ratings yet

- Erneng Rice MillDocument55 pagesErneng Rice MillRobert Mequila IINo ratings yet

- Maintenance and Other Operating Expenses (Mooe) : Documentary Requirements For The Liquidation OFDocument19 pagesMaintenance and Other Operating Expenses (Mooe) : Documentary Requirements For The Liquidation OFYoregeff DaiunNo ratings yet

- Lembaga Hasil Dalam Negeri Malaysia Amended Return Form of An Individual Amended Return FormDocument4 pagesLembaga Hasil Dalam Negeri Malaysia Amended Return Form of An Individual Amended Return Formdin aliNo ratings yet

- Manage Taxes - 8Document1 pageManage Taxes - 8I'm RangaNo ratings yet

- Erlinda ArcadeDocument36 pagesErlinda ArcadeRobert Mequila IINo ratings yet

- Payroll: High Profile Security Agency IncDocument15 pagesPayroll: High Profile Security Agency IncRobert Mequila IINo ratings yet

- Payroll: High Profile Security Agency IncDocument20 pagesPayroll: High Profile Security Agency IncRobert Mequila IINo ratings yet

- Narayan PradhanDocument1 pageNarayan PradhanANISH SHAIKHNo ratings yet

- Jadav ChennaiDocument1 pageJadav ChennaiANISH SHAIKHNo ratings yet

- Prabhu VishwakarmaDocument1 pagePrabhu VishwakarmaANISH SHAIKHNo ratings yet

- Tax Prin Tables 2019Document7 pagesTax Prin Tables 2019jessicaNo ratings yet

- Rakucha ChanneiDocument1 pageRakucha ChanneiANISH SHAIKHNo ratings yet

- Les DJMS 31 PDFDocument1 pageLes DJMS 31 PDFBennie ReidNo ratings yet

- BIR Form No. 1600Document2 pagesBIR Form No. 1600Lorraine Steffany BanguisNo ratings yet

- Income Tax Challan - 280Document1 pageIncome Tax Challan - 280Subrata SarkarNo ratings yet

- Woolworth Pay SlipDocument1 pageWoolworth Pay Slipsunny singh100% (1)

- PayslipDocument1 pagePayslipIra Angelo CorderoNo ratings yet

- SingleWindow Annex C1 C2 C3Document3 pagesSingleWindow Annex C1 C2 C3LeannecharisNo ratings yet

- Payslip OctDocument7 pagesPayslip Octthiwankaashi531No ratings yet

- Nov StatementDocument1 pageNov Statementndoorh25No ratings yet

- Payslip NovDocument7 pagesPayslip Novthiwankaashi531No ratings yet

- Payslip SepDocument7 pagesPayslip Septhiwankaashi531No ratings yet

- Vavdiya Mahesh ChanneiDocument1 pageVavdiya Mahesh ChanneiANISH SHAIKHNo ratings yet

- City Treasury Office: Togan, Juliet PDocument1 pageCity Treasury Office: Togan, Juliet PJerik ElesioNo ratings yet

- TSM orDocument2 pagesTSM orjojo cabaobasNo ratings yet

- Challanitns 280Document1 pageChallanitns 280saritabh05No ratings yet

- Xiao Enterprise Payslip Mar15Document5 pagesXiao Enterprise Payslip Mar15D Jay ApostelloNo ratings yet

- Invoice Template 4 ExcelDocument2 pagesInvoice Template 4 ExcelYi Tong LiewNo ratings yet

- Revar Maheshbhai Channei PDFDocument1 pageRevar Maheshbhai Channei PDFANISH SHAIKHNo ratings yet

- Pas 12: Accounting For Income TaxDocument2 pagesPas 12: Accounting For Income TaxKiana FernandezNo ratings yet

- Chouhan Karan ChanneiDocument1 pageChouhan Karan ChanneiANISH SHAIKHNo ratings yet

- 1 0 2 0 1 0 8 0 0 National Agency Deped - Division of Las Piñas City Gabaldon BLDG Diego Cera Avenue E. Aldana, Las Piñas CityDocument3 pages1 0 2 0 1 0 8 0 0 National Agency Deped - Division of Las Piñas City Gabaldon BLDG Diego Cera Avenue E. Aldana, Las Piñas CityReese QuinesNo ratings yet

- Single (Copy To Be Sent The ZAO)Document1 pageSingle (Copy To Be Sent The ZAO)James GonzalezNo ratings yet

- BIR MapDocument17 pagesBIR MapCeasar Ryan AsuncionNo ratings yet

- Payslip For 26 MAY 2021 TO 10 JUN 2021Document1 pagePayslip For 26 MAY 2021 TO 10 JUN 2021Jb DoriaNo ratings yet

- 2020 11 30 19 02 08 649 - 1606743128649 - XXXPM4571X - ItrvDocument1 page2020 11 30 19 02 08 649 - 1606743128649 - XXXPM4571X - ItrvSahana SkNo ratings yet

- Peepper StoryDocument1 pagePeepper StoryAnonymous ce49esgnveNo ratings yet

- Statement of Earnings and Deductions: Payment Date: Pay End DateDocument1 pageStatement of Earnings and Deductions: Payment Date: Pay End Datewebmaroc 2020No ratings yet

- LatestDocument3 pagesLatestAman SinghNo ratings yet

- Enter Income Details in This Sheet To Know Your Tax Liability in The Next SheetDocument3 pagesEnter Income Details in This Sheet To Know Your Tax Liability in The Next SheetSuryaprakashNo ratings yet

- RSM Itrv 2019-20Document1 pageRSM Itrv 2019-20Rajesh KumarNo ratings yet

- ToranDocument2 pagesToranNRJ StudiosNo ratings yet

- 2021 GeneralDocument8 pages2021 GeneralWajiha HaroonNo ratings yet

- ER300184 AttachmentsDocument1 pageER300184 AttachmentsTaleb Boubacar RimNo ratings yet

- Application Form Fao EmptyDocument3 pagesApplication Form Fao EmptyHARLEY DAVE AQUINONo ratings yet

- SIEMENSDocument83 pagesSIEMENSharkeshNo ratings yet

- TNEB Online PaymentDocument1 pageTNEB Online PaymentveerNo ratings yet

- Statement of Earnings and Deductions: Payment Date: Pay End DateDocument1 pageStatement of Earnings and Deductions: Payment Date: Pay End Datewebmaroc 2020No ratings yet

- Income Tax CalculatorDocument4 pagesIncome Tax CalculatorAchin AgarwalNo ratings yet

- FR - Ias 12Document1 pageFR - Ias 12Zubair JallohNo ratings yet

- DT 0108a Employer Annual Tax Deduction Schedule v1 2Document1 pageDT 0108a Employer Annual Tax Deduction Schedule v1 2joseph borketeyNo ratings yet

- Sepco Online BillDocument2 pagesSepco Online Billmuneer.paydiamond786No ratings yet

- Ack. 2010-11Document1 pageAck. 2010-11Kiran GajjarNo ratings yet

- Arrears TR-22Document2 pagesArrears TR-22Ana LisaNo ratings yet

- SodapdfDocument1 pageSodapdfJemmuel MedinaNo ratings yet

- RR No. 02-2006 - Annex ADocument1 pageRR No. 02-2006 - Annex AMichelle Go100% (1)

- Manage Taxes - 7Document1 pageManage Taxes - 7I'm RangaNo ratings yet

- Kajal Devi Itr 19-20 PDFDocument1 pageKajal Devi Itr 19-20 PDFShakeeb HashmiNo ratings yet

- Declaration 80D 80DDBDocument1 pageDeclaration 80D 80DDBShobit0% (1)

- Public Finance PQ1 Prelim ExamDocument24 pagesPublic Finance PQ1 Prelim ExamKayezel KrissNo ratings yet

- Articleship Vacancy List 8.2.21Document83 pagesArticleship Vacancy List 8.2.21manish rajNo ratings yet

- Adis Ababa UniversityDocument88 pagesAdis Ababa UniversityMohamed BioNo ratings yet

- (Original For Recipient) : Billing Address Shipping AddressDocument1 page(Original For Recipient) : Billing Address Shipping AddressVaru NayanNo ratings yet

- CB23352 - SalarySlipwithTaxDetails (3) - Unlocked-MergedDocument3 pagesCB23352 - SalarySlipwithTaxDetails (3) - Unlocked-MergedsathyaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengaluruসোমতীর্থ দাসNo ratings yet

- Glopack Industries Pvt. LTD.: Party DetailsDocument2 pagesGlopack Industries Pvt. LTD.: Party DetailsVIR MALIKNo ratings yet

- Tax On Presumptive Basis in Case of Certain Eligible BusinessesDocument15 pagesTax On Presumptive Basis in Case of Certain Eligible BusinessesSeemant GuptaNo ratings yet

- Tutorial 1Document36 pagesTutorial 1yyyNo ratings yet

- P00059591 InvoiceDocument2 pagesP00059591 InvoiceVijay SinghNo ratings yet

- John Williams Age 42 Is A Single Taxpayer and He PDFDocument1 pageJohn Williams Age 42 Is A Single Taxpayer and He PDFhassan taimourNo ratings yet

- Markazu UloomDocument1 pageMarkazu UloomYoonus VallatNo ratings yet

- Guidelines For Expatriates Under Employment in MalaysiaDocument3 pagesGuidelines For Expatriates Under Employment in MalaysiaDocAxi Maximo Jr AxibalNo ratings yet

- Tolentino v. Secretary of FinanceDocument2 pagesTolentino v. Secretary of FinanceAries De LunaNo ratings yet

- Aspp-08 1 Fenomena Flypaper Effect Pada Kinerja Keuangan Pemerintah Daerah Kota Dan Kabupaten Di IndonesiaDocument30 pagesAspp-08 1 Fenomena Flypaper Effect Pada Kinerja Keuangan Pemerintah Daerah Kota Dan Kabupaten Di IndonesiaRafi Irwan PrasetiyoNo ratings yet

- Universitas Diponegoro: Fakultas Ilmu Sosial Dan Ilmu PolitikDocument3 pagesUniversitas Diponegoro: Fakultas Ilmu Sosial Dan Ilmu PolitikNadya SafitriNo ratings yet

- Income Tax Calculation ChartDocument29 pagesIncome Tax Calculation Chartnaveed ansariNo ratings yet

- RCM On Residential DwellingDocument5 pagesRCM On Residential Dwellingashok babuNo ratings yet

- Chapter 2: National Income Accounting Items RM (Million) : DPB2023 MacroeconomicsDocument5 pagesChapter 2: National Income Accounting Items RM (Million) : DPB2023 MacroeconomicsSuzanaMaryRasiahNo ratings yet

- City of Union City: Detailed Tax SummaryDocument2 pagesCity of Union City: Detailed Tax SummaryAlicia RuckerNo ratings yet

- Salary Slip FormatDocument8 pagesSalary Slip Formatshrija nairNo ratings yet

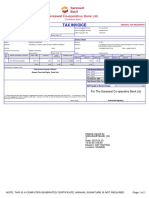

- Tax Invoice: For The Saraswat Co-Operative Bank LTDDocument1 pageTax Invoice: For The Saraswat Co-Operative Bank LTDrajas narkarNo ratings yet

- Islamabad Electric Supply Company: Say No To CorruptionDocument1 pageIslamabad Electric Supply Company: Say No To Corruptionhash guru100% (1)

- Pay Slip July-22Document1 pagePay Slip July-22KFS BANKINGNo ratings yet

- Commissioner vs. Malayan Insurance, 21 SCRA 544Document1 pageCommissioner vs. Malayan Insurance, 21 SCRA 544SURITA, FLOR DE MAE PNo ratings yet

- 2833 8369 1 SPDocument7 pages2833 8369 1 SPSenni JuniartiNo ratings yet

- Post Test Skill 1-11Document2 pagesPost Test Skill 1-11Evanya Rachma Octavya50% (2)

- Computation Gross EstateDocument6 pagesComputation Gross Estatemusic lyricsNo ratings yet

- E1 TaxDocument1 pageE1 Taxira concepcionNo ratings yet