Professional Documents

Culture Documents

Leave Encashment Rule0001

Uploaded by

Pankaj Kamble0 ratings0% found this document useful (0 votes)

486 views12 pagesCOAL India Limited LEA VE ENCASHMENT RULES CONTENTS Scope Aim Eligibility Extent of Leave Encashable Encashment Benefit Procedure 7. Encashmcnt of leave on 'Termination' of service / Retirement on death of an Employee Deduction Competent Authority Tenure Clarification Regarding the Calendar Year against which the encashment shall be accounted for.

Original Description:

Original Title

leave encashment rule0001

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCOAL India Limited LEA VE ENCASHMENT RULES CONTENTS Scope Aim Eligibility Extent of Leave Encashable Encashment Benefit Procedure 7. Encashmcnt of leave on 'Termination' of service / Retirement on death of an Employee Deduction Competent Authority Tenure Clarification Regarding the Calendar Year against which the encashment shall be accounted for.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

486 views12 pagesLeave Encashment Rule0001

Uploaded by

Pankaj KambleCOAL India Limited LEA VE ENCASHMENT RULES CONTENTS Scope Aim Eligibility Extent of Leave Encashable Encashment Benefit Procedure 7. Encashmcnt of leave on 'Termination' of service / Retirement on death of an Employee Deduction Competent Authority Tenure Clarification Regarding the Calendar Year against which the encashment shall be accounted for.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 12

LEAVE ENCASHMENT RULES.

CONTENTS

Subjects Tem No. Page

1. Scope 1 3

2 Aim 2 3

3. Eligibility 3 3

4, Extent of Leave Encashable 4 3

5. Eneashiment Benefit 3 4

6 Procedure 6 4

7. Eneashment of Leave on ‘Termination’ of

Service/Retirement 7 3

‘On death of an Employee 8 6

9. Deduction 9 6

10. Competent Authority 10 6

1... Tenure im 6

12, Clarification Regarding the Calendar Year ‘Annexure-1 7

‘against which the encashment shall be

accounted for

13, Encashability of Earned Leave ‘Annexure-IL se

during study Leave

14. Amendment of Leave Encashment Scheme Memorandum No.203. 9

15. Encashment of Half Pay Leave Office Order No.192_ 10

16. Clarification of Half Pay Leave ‘Memorandum No.9 I

17. Pay of Cash equivalent of Leave Memorandum No.W1S 12

‘Salary in cash of death while in service

18 Full D.A. on half basic pay Memorandum No.60 13

COAL INDIA LIMITED

LEAVE ENCASHMENT SCHEME

(For Executive Cadre Employees)

(Corrected upto 29th May, 1989)

1.0 Scope

1.1 This scheme shall apply to all Executive Carde Employees of Coal India Limited

‘and its Subsidiary companies but shall not apply to :

Executive cadre Employees on deputation from a Government Department or from

Government Undertakings who are not permanently absorbed in the Company.

20 Aim

2.1 Encashment of leave may be allowed to encourage employees fo take leave on a

planned and systematic basis.

3.0 Eligibility

3.1. Eneashment of eared leave will be allowed atthe option ofthe employees, subject

to the approval ofthe Sanctioning Authority competent to Sanction earned leave.

3.2 Encashment of earned leave will be allowed at the time when the employee is

actually proceeding on at least seven days’ regular leave as defined in para 4.3 ofthis

Scheme.

3.3. Encashiment will not be allowed where leave cannot be granted inthe interest of

the Company.

4.0 Extent of Leave Encashable

4.1 Only earned leave on fll pay atthe credit is encashable and not any other kind of

leave, such as, half;pay leave, commuted leave, study leave, et.

Sanction of earned leave, half:pay leave and commuted leave which will be

regarded as regular leave for the purpose of para 4.3 of the scheme will be restricted to

the limits as prescribed in Leave Rules ofthe Company.

42. Eneashment will be allowed to an employce only ones in @ calender year

Note: For this purpose the year in which the eave actually commences, should be

taken as the year of encashment irrespective of the period to which the encashment

constructively may relate, in accordance with the provision of Clause 6.3 of the

Encashment Scheme.

(Authority = CIL OM NO. C-S(AY/S2056/283 dt. 6-9-77)

4.3 Minimum 7 day's regular leave will have to be taken and the eared Teave can be

encashed upto 50% of the eamed leave at eredit or 30 days, whichever is less.

(Authority : CIL 90 No. C-SA(vi)/52056/528 dated 28-4-1983) — Regarding para 3.2,

41, 54,43, 5.5, & 63.

4.4 Eamed leave at credit will be determined as on the date of proceeding on leave

5.0 Encashment Benefit

5.1 For computing the rate of encashment, basic pay including special pay, non-

practicing allowance, personal pay and deamess allowance only will be included. Al

‘ther allowance, viz, HRA, CCA, Coalfield Allowance, Charge Allowance,

Underground Allowance etc. will be excluded.

(Authority : CIL OM. No. C-5(AY52056 dated 6-1-1977)

5.2. The rate of encashment per day will be calculated on the basis of emoluments

specified in para 5.1 drawn by the employee in the month preceding the month in which

the proceeds on leave (after deducting inadmissible allowances) divided by 30.

5.3. Eneashment benefits will not be reckoned as salary for the purposes of provident

Fund, Gratuity, Bonus etc,

5.4 Where an employee, having received encashment cutails his leave at his option

‘and this results in leave being availed of for less than 7 (Seven days.) the entire amount

paid as encashment will be recovered fom the salary, next payable to the employee.

5.5. If'an employee, who has been allowed the benefit of encashment of leave as per

this scheme, is recalled to duty while he is on leave, sanctioned to him, the encashiment

‘of his eared leave already allowed will not be affected in any way and will not need

any revision.

5.6 The full portion of the camed leave encashed and the leave availed of will be

deducted from the leave at his edit

6.0 Procedure

6.1 The application for leave wherever necessary, should specifically indicate the

{quantum of eared leave that the employee desires to encash which shall not be more

than the limits specified in para 4.3.

6.2 In order thatthe availability of officers for duty is properly regulated applications

for leave should be made atleast 30 days in advance.

6.3 The sanctioning authority, while sanctioning leave applied for, should specifically

indicate the period and the kind/inds of leave that the employee will actually avail of

and the number of days of eared {eave allowed for encashment.

(Authority : CIL OM No. C-SA(w)/S2056/528 dated 284.83)

64 Separate orders shall be issued in respect of thie leave sanetioned for actually

availing by the employee and the portion of earned leave that is granted for encashment.

6.5 No encashment of leave during the period under suspension will be permissible.

7.0 Encashment of Leave on Termination of ServicelRetirement

7.1 Leave at credit shall not be @fanted for encashment if an employee resigns from

the service. ‘

Note : According to para 7.1 of the Leave Encashment Scheme for Executive Cadre

Emplayees, leave at credit shall not be granted for encashment if an employee resigns

from the service,

‘A question in this connection has been raised as to whether “resigns from the

service” would mean the date on which the resignation has been submitted or the date

‘on which the resignation is effective ie. the date of final quitting service.

‘The matter was examined in consultation with Finance and itis clarified that since

__ there is no restriction on granting of leave to an employee during the period prior to the

date of his actual quitting offtelease from service on submission of resignation, the

‘words "resigns from service would mean the actual date of quitting of service and hence

the facility of encashment of leave may, if allowed be available before and upto’ that

date and not beyond the date of actual quitting of the service,

(Authority : CIL OM No: C-5(B)52056/182 dated 12/15-6-1978)

72 An executive governed under Coal India Service Rules, whose services are

torminated, otherwise than on disciplinary grounds, or who retires on superannuation,

‘may be allowed to encash the earned leave at his credit, subject to a maximum of 240

days, in terms of this Scheme. However, this will not be applicable in the ease of

executives who are employed in the coal companies on contract, on tenure, on

deputation, on re-employment and on temporary basis,

(Authority : CIL OM No. C-5(B)52056/592 dated 18-9-78)

Note+I:A reference is invited to this Office Circular letter NO. C-5(BY'52056/592 dated

8th September, 1978 introducing an amendment to para 7.2 of the Leave Encashment,

‘Scheme for Executive Cadre Employees, Inthe said amendment, it was provided that an

executive governed under Coal India Service Rules whose services. are terminated

‘otherwise on disciplinary grounds or who retires on superannuation, may be allowed to

cencash the earned leave at his credit subject fo a maximum of 180 days in terms of the

Scheme. However, the benefit of eneashment was not applicable in the case of

executives who are ‘employed inthe coal companies on contract, on tenure, on

deputation, on re-employment and on temporary basis.

‘The Leave Encashment Rules for Executive Cadre employees provide for

encashment of leave at credit on "superannuation", and the requirement of

applying for leave preparatory to retirement and its being refused in the company’s

interest for availability of the leave after superannution is no longer necessary.

{The matter has been further examined and for the sake of equity it has been

4ecided, with competent approval, and in partial modification of the earlier orders,

dated 18-9-78, that the benefit of encashment of earned leave ateredit, on the date

of attaining the age off superannuation, shall also be allowed 10 such of the re-

employed executives as are appointed on contract, on tenure, on deputation or on

re-employciment whose re-employment comes to an end, on attaining the age oF

superannuation ic. 58 years subject fo @ maximum of 180 days.

(Authority : CIL OM No. C-5(B)/52056/532 dated 26.9-79)

Note IN: Further to this Office Circular No C-5(BY52056/532 dated 26th September,

1979, wherein it was clarified that the benefit of encashment of earned leave at

credit on the date of ataining the age of superannuation, shall also be allowed to

such of the re-employed executives, whose reemployment comes to an end on

attaining the age of superannuation, i. 58 Years, subject to @ maximum of 180

ays. it has been decided, that the employees retiring on superannuation and ro-

‘employed thereafter will also be entitled to encashment of earned Ieave earned by

them during the period of re-employemt.

(Authority : CIL OM No. C-5(AV/52056/15 dated 13-4-81)

8.0 On Death of an Employee

8.1. The specified limit will not apply in case of death of an employee in service, in

‘hich ease the family of the deceased employce shall be paid cash equivalent of leave

salary (i.e. pay plus DA only) that the deceased employee would have got had he gone

‘on earned leave that would have been due and admissible to him but for the death on the

date immediately following the death and in any case not execeding leave salary for 180

days.

9.0 Deduction

9.1 No deduction other than Income Tax will be made from the amount payable to &

serving employee iff the encashment is for a period of fess than 30 days!'1P the

encashment is 30 days ot more monthly instalments or re-payment of advances and other

dues shall be reeovered at the rate of onc instalment for each period of 30 days. In case

of retitemenv/etrenchment or death, company’s dues shall be recovered from the amount

of encashment.

10.0 Competent Authority

10.1 The Sanctioning Authorities for eneashment of leave will be those competent to

snction carned leave.

110 Tenure

11.1 This seheme shall come into force with effect from Ist September, 1976.

11.2 The Company reserves the right to alter, amend or withdraw this scheme at its

discretion without assingning any reasons therefor.

6

You might also like

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Annual Leave and Other Paid Time Off GuidanceDocument5 pagesAnnual Leave and Other Paid Time Off GuidanceFedSmith Inc.No ratings yet

- Leave Rule WorkerDocument8 pagesLeave Rule WorkerparthivglsNo ratings yet

- Leave RulesDocument10 pagesLeave Rulesdinesh005No ratings yet

- VRS 2012 Oo ReintDocument8 pagesVRS 2012 Oo ReintShrinath GonganiNo ratings yet

- Leave Rules: 1. Short Title and CommencementDocument13 pagesLeave Rules: 1. Short Title and Commencementpriyanka joshiNo ratings yet

- Chapter 5 LEAVEDocument49 pagesChapter 5 LEAVEjanyaaan100% (2)

- Leave Rules 1982Document104 pagesLeave Rules 1982NOOR AHMEDNo ratings yet

- MemoDocument5 pagesMemoRhoda Mhaye Balaoro AndalloNo ratings yet

- Half Pay Leave Chap-6Document26 pagesHalf Pay Leave Chap-6VinodxxxNo ratings yet

- Changes To The Employment CodeDocument4 pagesChanges To The Employment CodeTAYLOR ZULUNo ratings yet

- 340 Lev 001211119Document37 pages340 Lev 001211119bhanuNo ratings yet

- WAPDA Leave Rules 1982Document99 pagesWAPDA Leave Rules 1982Abdullah zeeshan50% (2)

- HandBook - LeaveRulesDocument23 pagesHandBook - LeaveRulesB.R SinghNo ratings yet

- Labor 2 Final Exam Q An ADocument4 pagesLabor 2 Final Exam Q An ARonal JimNo ratings yet

- 1385465617HandBook For POs (2013) - 181-190Document10 pages1385465617HandBook For POs (2013) - 181-190Mata BharatNo ratings yet

- Ministry of Personnel, Public Grievances and Pensions (Deptt. of Personnel and Training) OM No. 49014/2/93 Estt. (C) Dated 12 July, 1994. (Xxiii)Document2 pagesMinistry of Personnel, Public Grievances and Pensions (Deptt. of Personnel and Training) OM No. 49014/2/93 Estt. (C) Dated 12 July, 1994. (Xxiii)rahul106No ratings yet

- VOLUNTARY RETIREMENT SCHEME (VRS) - Chapter-8Document13 pagesVOLUNTARY RETIREMENT SCHEME (VRS) - Chapter-8Rajashekhar PujariNo ratings yet

- Case Law: Right To Refuse Annual Leave Under Australian LawDocument3 pagesCase Law: Right To Refuse Annual Leave Under Australian LawUmar AzizNo ratings yet

- Layoff and RetrenchmentDocument6 pagesLayoff and RetrenchmentMohd SuhailNo ratings yet

- Voluntary Retirement Scheme: VRS-Aug'07Document5 pagesVoluntary Retirement Scheme: VRS-Aug'07psychicnutNo ratings yet

- Dasuceco-National Federation of Labor v. Davao Sugar Central Co., Inc.) Absent Any IndicationDocument2 pagesDasuceco-National Federation of Labor v. Davao Sugar Central Co., Inc.) Absent Any IndicationAdi CruzNo ratings yet

- BHEL Perks ManualDocument135 pagesBHEL Perks Manualpawann1997No ratings yet

- 7 LM 63 Authorized CausesDocument7 pages7 LM 63 Authorized CausesDave Mariano BataraNo ratings yet

- Sub: - Topic: - Sub Topic:-Prepared By: - Roll No: - Subject ToDocument6 pagesSub: - Topic: - Sub Topic:-Prepared By: - Roll No: - Subject ToShah SamkitNo ratings yet

- Assignment 1 - LLDocument18 pagesAssignment 1 - LLsiddhiNo ratings yet

- Personnnel ManualDocument134 pagesPersonnnel Manualsanjay1435No ratings yet

- NLC Personnel Manual Vol-IIDocument210 pagesNLC Personnel Manual Vol-IIraghavan1984100% (2)

- Final Exam SamplexDocument9 pagesFinal Exam SamplexDuds GutierrezNo ratings yet

- Surrender Leave - Government of Tamil NaduDocument3 pagesSurrender Leave - Government of Tamil NaduDr.Sagindar83% (12)

- Ag Au JH Office Manual Chapter 9 20200706121919Document6 pagesAg Au JH Office Manual Chapter 9 20200706121919StartNo ratings yet

- Leave RulesDocument10 pagesLeave RulesjijinaNo ratings yet

- LEAVE RULES 2024 - DraftDocument13 pagesLEAVE RULES 2024 - Draftheisenbergrai420No ratings yet

- Detail LEAVE 1986Document8 pagesDetail LEAVE 1986fareeha ameenNo ratings yet

- Leave Policy As Per LawDocument4 pagesLeave Policy As Per LawNADEEM SHEHZADNo ratings yet

- 1385465617HandBook For POs (2013) - 346-350Document5 pages1385465617HandBook For POs (2013) - 346-350Mata BharatNo ratings yet

- Omnibus Rules On Leave ActivityDocument20 pagesOmnibus Rules On Leave ActivityMichaella Angelique FloresNo ratings yet

- Prakasam VRO-1Document14 pagesPrakasam VRO-1crda rayuduNo ratings yet

- Layoff and RetrenchmentDocument31 pagesLayoff and RetrenchmentAbs rssNo ratings yet

- Leave RegulationsDocument182 pagesLeave RegulationsanilpalacherlaNo ratings yet

- By Shashwat Singh A0102309189 MBA-HR Class of 2011Document9 pagesBy Shashwat Singh A0102309189 MBA-HR Class of 2011Salman KhanNo ratings yet

- Leave PolicyDocument8 pagesLeave Policyuma maheshNo ratings yet

- Leave Regulation TNEBDocument94 pagesLeave Regulation TNEBRinjumon RinjuNo ratings yet

- DocsDocument90 pagesDocsSanjay RoutNo ratings yet

- Redundancy, Termination, Layoff and RetrenchmentDocument15 pagesRedundancy, Termination, Layoff and Retrenchmentnorsiah_shukeriNo ratings yet

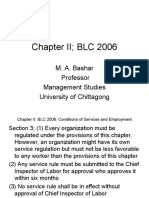

- Chapter II BLC 2006: M. A. Bashar Professor Management Studies University of ChittagongDocument30 pagesChapter II BLC 2006: M. A. Bashar Professor Management Studies University of ChittagongFàrhàt HossainNo ratings yet

- KD Sacco Human Resource PolicyDocument37 pagesKD Sacco Human Resource PolicyMwikirize Alban100% (1)

- BEPZA Instruction 1 2Document26 pagesBEPZA Instruction 1 2rahib203No ratings yet

- 2 Policies and Guidelines On Overtime Services 2-22-19Document4 pages2 Policies and Guidelines On Overtime Services 2-22-19Tin EstrellaNo ratings yet

- Sabbatical Leave Scheme For Women EmployeesDocument11 pagesSabbatical Leave Scheme For Women Employeeshimadri_bhattacharje0% (1)

- Chapter 7 - FTE - 2Document21 pagesChapter 7 - FTE - 2Rayhan TanvirNo ratings yet

- Lay Off and RetrenchmentDocument13 pagesLay Off and RetrenchmentIllogicalFlix100% (1)

- Labour Law ProjectDocument5 pagesLabour Law ProjectMayuri RaneNo ratings yet

- Leave To Government EmployeesDocument58 pagesLeave To Government Employeesvishal4644No ratings yet

- 97 Frequently Asked Questions About Compensation: With Answers from SHRM's Knowledge AdvisorsFrom Everand97 Frequently Asked Questions About Compensation: With Answers from SHRM's Knowledge AdvisorsNo ratings yet

- The Handbook for Reading and Preparing Proxy Statements: A Guide to the SEC Disclosure Rules for Executive and Director Compensation, 6th EditionFrom EverandThe Handbook for Reading and Preparing Proxy Statements: A Guide to the SEC Disclosure Rules for Executive and Director Compensation, 6th EditionNo ratings yet