Professional Documents

Culture Documents

Delaying Tax Vote Could Crash Stock Market.

Uploaded by

newswithviewsOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Delaying Tax Vote Could Crash Stock Market.

Uploaded by

newswithviewsCopyright:

Available Formats

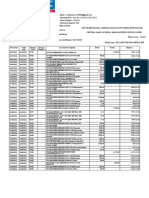

Delaying Tax Vote Could Crash Stock Market - Washington Whispers (u... http://politics.usnews.com/news/blogs/washington-whispers/2010/12/2/d...

HOME OPINION WASHINGTON WHISPERS CONGRESS TRACKER WHITE HOUSE TRACKER

WASHINGTON WHISPERS

Delaying Tax Vote Could Crash Stock Market

By PAUL BEDARD

Posted: December 2, 2010

Failure by Congress to extend the Bush tax cuts, especially locking in the 15 percent capital gains tax rate, will spark a stock market

sell off starting December 15 as investors move to lock in gains at a lower rate than the 20 percent it would jump to next year, warn

analysts.

While it is unclear how bad the sell off could be, it could wipe out the year's gains, they warn.

"Capital gains tax rate will increase from 15 to 20 percent if the tax cuts are not extended. The last time the capital gains tax rate

increased--on Jan. 1, 1987 from 20 to 28 percent--investors realized their gains at the lower tax rate," said Daniel Clifton at a

Washington partner at Strategas Research Partners. "We would expect a similar effect this time around as investors see the tax rate

going up and choose to realize their gains and incur the 15 percent tax."

In a memo to clients, Clifton says that the date most clients are focused on is December 15th for a deal in Congress before beginning to

sell. One reason: Many stock options expire that day and investors have to act.

The later Congress acts, he tells Whispers, "the more pressure that will build on the stock market."

Worse, talk that Congress will simply pass retroactive fixes to the tax system won't help, since investors will take the sure thing and

sell rather than rely on Capitol Hill. "Fixing the issue next year will not negate these negative impacts," said Clifton.

Ditto for a retroactive fix to the alternative minimum tax, he writes in the client memo. "The talk of retroactively fixing the tax cuts

ignores the fact that the AMT patch cannot be retroactively fixed and is the largest component of the tax increase. Hence, in March and

April, 27 million taxpayers will be facing an additional $70 billion in tax payments. The hit to consumer spending would be particularly

significant," he writes.

See his full memo here.

See a list of the finance and credit industry's favorite lawmakers.

Check out a roundup of editorial cartoons on the economy.

More Washington Whispers posts

Copyright © 2010 U.S.News & World Report LP All rights reserved.

Use of this Web site constitutes acceptance of our Terms and Conditions of Use and Privacy Policy.

1 of 1 12/2/2010 6:30 PM

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- 2023 WSO IB Working Conditions SurveyDocument46 pages2023 WSO IB Working Conditions SurveyHaiyun ChenNo ratings yet

- 07 Chapter Seven - Buy Side M&A (By Masood Aijazi)Document51 pages07 Chapter Seven - Buy Side M&A (By Masood Aijazi)Ahmed El KhateebNo ratings yet

- Options Futures and Other DerivativesDocument9 pagesOptions Futures and Other Derivativessmita prajapatiNo ratings yet

- FAQ - Maxicare SME Online Payment FacilityDocument7 pagesFAQ - Maxicare SME Online Payment FacilityJohn Dexter SunegaNo ratings yet

- EurobondsDocument217 pagesEurobondslovergal1992No ratings yet

- Chhattisgarh State Electricity Regulatory Commission Raipur: CSERC Tariff Order FY 2023-24Document284 pagesChhattisgarh State Electricity Regulatory Commission Raipur: CSERC Tariff Order FY 2023-24eepocapsldcNo ratings yet

- Agency Theory AssignmentDocument6 pagesAgency Theory AssignmentProcurement PractitionersNo ratings yet

- ShivamDocument6 pagesShivamAJOONEE AUTO PARTSNo ratings yet

- TCS Result Analysis 2023Document4 pagesTCS Result Analysis 2023vinay_814585077No ratings yet

- AccountStatement 3286686240 Aug04 185310 PDFDocument2 pagesAccountStatement 3286686240 Aug04 185310 PDFDarren Joseph VivekNo ratings yet

- Taxation CPALE by WMGDocument19 pagesTaxation CPALE by WMGJona Celle Castillo100% (1)

- Pune Uni M.B.A. (2016 Pattern)Document118 pagesPune Uni M.B.A. (2016 Pattern)yogeshNo ratings yet

- Mastering Financial Modelling File ListDocument1 pageMastering Financial Modelling File ListNamo Nishant M PatilNo ratings yet

- Finance Car Leasing Final ProjectDocument21 pagesFinance Car Leasing Final ProjectShehrozAyazNo ratings yet

- UCC Trust Contract EstablishingDocument4 pagesUCC Trust Contract EstablishingRoberto Monterrosa94% (16)

- BUS670 O GradyDocument5 pagesBUS670 O GradyIndra ZulhijayantoNo ratings yet

- Estate Tax-Handout 2Document4 pagesEstate Tax-Handout 2Xerez SingsonNo ratings yet

- Fund Fact Sheets NAVPU Captains FundDocument1 pageFund Fact Sheets NAVPU Captains FundJohh-RevNo ratings yet

- qX2B PJQN QnBQVKjXZ5LTt1SESnizoMtGkLWWKiEGBSA1QGVCClQblbcx6R8IDXAG3Vjerx0BmmgM9BYqjbD5y5t2A0VunOxcUzgVAa uxWA JEONWcoEwDocument6 pagesqX2B PJQN QnBQVKjXZ5LTt1SESnizoMtGkLWWKiEGBSA1QGVCClQblbcx6R8IDXAG3Vjerx0BmmgM9BYqjbD5y5t2A0VunOxcUzgVAa uxWA JEONWcoEwNurul Hafiza ZazaNo ratings yet

- Daftar Pustaka: GOKMARIA SIMARMATA, Supriyadi, M.SC., PH.D., CMA., CA., AkDocument3 pagesDaftar Pustaka: GOKMARIA SIMARMATA, Supriyadi, M.SC., PH.D., CMA., CA., AkMuhammad WildanNo ratings yet

- Unit 1 Challenge 1: D.) Unethical Behavior by Major Companies Prompted The Government To Create The Sarbanes-Oxley ActDocument16 pagesUnit 1 Challenge 1: D.) Unethical Behavior by Major Companies Prompted The Government To Create The Sarbanes-Oxley ActMeredith Eckard100% (1)

- CVP For Real Estate ProjectDocument2 pagesCVP For Real Estate Projectvivi lewarNo ratings yet

- Assignment 12Document4 pagesAssignment 12Joey BuddyBossNo ratings yet

- IFRS 16 LeasesDocument20 pagesIFRS 16 Leasesrupesh.srivastava100% (3)

- Fin Past Years July 2021Document7 pagesFin Past Years July 2021Khairi HuzaifiNo ratings yet

- Gilbert Company-WPS OfficeDocument17 pagesGilbert Company-WPS OfficeTrina Mae Garcia100% (1)

- RH Perennial - Nov 21Document46 pagesRH Perennial - Nov 21sambitNo ratings yet

- Executive SummaryDocument2 pagesExecutive Summarycsaswin2010No ratings yet

- Detailed Course Outlines of Term VI - 2018-19Document78 pagesDetailed Course Outlines of Term VI - 2018-19vimanyu vermaNo ratings yet

- IFC Sustainability +frameworkDocument84 pagesIFC Sustainability +frameworkALBERTO GUAJARDO MENESESNo ratings yet