Professional Documents

Culture Documents

Joann - Performance Report

Uploaded by

Bay Area Equity Group, LLC0 ratings0% found this document useful (0 votes)

32 views1 page20090 Joann - Performance Report

Original Title

20090 Joann - Performance Report

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document20090 Joann - Performance Report

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

32 views1 pageJoann - Performance Report

Uploaded by

Bay Area Equity Group, LLC20090 Joann - Performance Report

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

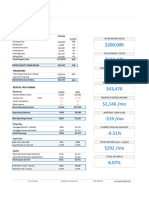

First-Year Performance Projection

20090 Joann Street

View Map View Comps Export to Excel

Detroit, MI 48205

3-bedroom, 1-bath

Square Feet 900

Initial Market Value $35,995

Purchase Price $35,995

Downpayment $35,995

Loan Origination Fees $0

Depreciable Closing Costs $500

Other Closing Costs and Fixup $0

Initial Cash Invested $36,495

Cost per Square Foot $40

Monthly Rent per Square Foot $0.78

Income Monthly Annual Mortgage Info First Second

Gross Rent $700 $8,400 Loan-to-Value Ratio 0% 0%

Vacancy Losses $0 $0 Loan Amount --- ---

Operating Income $700 $8,400 Monthly Payment --- ---

Loan Type --- ---

Expenses Monthly Annual Term --- ---

Property Taxes ($126) ($1,508) Interest Rate --- ---

Insurance ($54) ($650) Monthly PMI ---

Management Fees ($70) ($840)

Leasing/Advertising Fees $0 $0 Financial Indicators

Association Fees $0 $0 Debt Coverage Ratio N/A

Maintenance $0 $0 Annual Gross Rent Multiplier 4

Other $0 $0 Monthly Gross Rent Multiplier 51

Operating Expenses ($250) ($2,998) Capitalization Rate 15.0%

Cash on Cash Return 15%

Net Performance Monthly Annual Total Return on Investment 15%

Net Operating Income $450 $5,402 Total ROI with Tax Savings 15%

- Mortgage Payments $0 $0

= Cash Flow $450 $5,402 Assumptions

+ Principal Reduction $0 $0 Real Estate Appreciation Rate %

+ First-Year Appreciation $0 $0 Vacancy Rate %

= Gross Equity Income $450 $5,402 Management Fee 10%

+ Tax Savings $0 $0 Maintenance Percentage %

= GEI w/Tax Savings $450 $5,402 Equity Share Percentage 100%

© 2004-2011 PropertyTracker.com Terms of Service Privacy Policy

www.bayareaequitygroup.com

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- 6693 Baldwin - Performance ReportDocument1 page6693 Baldwin - Performance ReportBay Area Equity Group, LLCNo ratings yet

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- 7803 Stahelin - Performance ReportDocument1 page7803 Stahelin - Performance ReportBay Area Equity Group, LLCNo ratings yet

- 5790 Guilford - Performance ReportDocument1 page5790 Guilford - Performance ReportBay Area Equity Group, LLCNo ratings yet

- 7242 Montrose - Performance ReportDocument1 page7242 Montrose - Performance ReportBay Area Equity Group, LLCNo ratings yet

- Your Income Should Increase Every Year 2: Financial Freedom, #151From EverandYour Income Should Increase Every Year 2: Financial Freedom, #151No ratings yet

- 9941 Mansfield - Performance ReportDocument1 page9941 Mansfield - Performance ReportBay Area Equity Group, LLCNo ratings yet

- Rutland - Performance ReportDocument1 pageRutland - Performance ReportBay Area Equity Group, LLCNo ratings yet

- 6100 Greenview - Performance ReportDocument1 page6100 Greenview - Performance ReportBay Area Equity Group, LLCNo ratings yet

- Ellsworth - Performance ReportDocument1 pageEllsworth - Performance ReportBay Area Equity Group, LLCNo ratings yet

- Maddelein - Performance ReportDocument1 pageMaddelein - Performance ReportBay Area Equity Group, LLCNo ratings yet

- 9926 Archdale ST - Performance ReportDocument1 page9926 Archdale ST - Performance ReportBay Area Equity Group, LLCNo ratings yet

- 9926 Archdale - Performance ReportDocument1 page9926 Archdale - Performance ReportBay Area Equity Group, LLCNo ratings yet

- Pro Forma TemplateDocument1 pagePro Forma Templateapi-521530600No ratings yet

- Cash Flow Duplexes - Real Estate Investment - Kansas CityDocument21 pagesCash Flow Duplexes - Real Estate Investment - Kansas CityNorada Real Estate Investments100% (5)

- Apartment Analyse FormDocument5 pagesApartment Analyse FormWillie Adams III100% (1)

- Debt Service Coverage Ratio (DSCR) Worksheet: 5 Year Term Loan 10 Year SBA LoanDocument1 pageDebt Service Coverage Ratio (DSCR) Worksheet: 5 Year Term Loan 10 Year SBA LoanArun Shakthi GaneshNo ratings yet

- Example of Real Estate Investment ProformaDocument2 pagesExample of Real Estate Investment ProformaJohnNo ratings yet

- Introduction To Debt PolicyDocument8 pagesIntroduction To Debt PolicyRatnesh DubeyNo ratings yet

- Sample Financial PlanDocument12 pagesSample Financial PlanSneha KhuranaNo ratings yet

- 3402 N Shadeland Ave Flex Proforma 10-23 Blacked OutDocument1 page3402 N Shadeland Ave Flex Proforma 10-23 Blacked OutJuan bastoNo ratings yet

- Caso 2 Modelo RentabilidadDocument8 pagesCaso 2 Modelo RentabilidadCamilaNo ratings yet

- Rental Investment ReportDocument5 pagesRental Investment ReportTuba TunaNo ratings yet

- Debt Service Coverage Ratio FormulaDocument4 pagesDebt Service Coverage Ratio FormulaJacobNo ratings yet

- Debt and Policy Value CaseDocument6 pagesDebt and Policy Value CaseUche Mba100% (2)

- 5115 Cascade Palmetto Hwy Fairburn Buyer's Info Packet - Deal Analyzer For FlipsDocument1 page5115 Cascade Palmetto Hwy Fairburn Buyer's Info Packet - Deal Analyzer For FlipsSonal KaliaNo ratings yet

- Income Property Cash Flow3Document1 pageIncome Property Cash Flow3CraigFrazerNo ratings yet

- Managerial Finance AssignmentDocument5 pagesManagerial Finance AssignmentvinneNo ratings yet

- Credit Analysis Worksheet FAC COMPLETEDocument4 pagesCredit Analysis Worksheet FAC COMPLETEpaozinNo ratings yet

- Multifamily Apartment ProformaDocument4 pagesMultifamily Apartment Proformaartsan3No ratings yet

- 6.01 Develop An Income StatementDocument2 pages6.01 Develop An Income StatementAditya NigamNo ratings yet

- Cash ROI SimplifiedDocument1 pageCash ROI SimplifiedCraigFrazerNo ratings yet

- SFM FinancieroDocument17 pagesSFM FinancierojoseNo ratings yet

- Coffee Shop Business Plan - Financial PL PDFDocument18 pagesCoffee Shop Business Plan - Financial PL PDFSamenNo ratings yet

- Financial Projections SampleDocument21 pagesFinancial Projections SampleAbubakarNo ratings yet

- Five Year Plan (Service Industry) Model Inputs and Investor ScenarioDocument4 pagesFive Year Plan (Service Industry) Model Inputs and Investor Scenariomary34d100% (1)

- Re CalcuDocument4 pagesRe CalcuDarren WaynNo ratings yet

- Case Study 2Document5 pagesCase Study 2Tabish Iftikhar SyedNo ratings yet

- 2nd QuoteDocument2 pages2nd Quotealsaxon7378100% (1)

- Retirement Plan 8 Year CycleDocument4 pagesRetirement Plan 8 Year CyclesultanNo ratings yet

- Case 26 An Introduction To Debt Policy ADocument5 pagesCase 26 An Introduction To Debt Policy Amy VinayNo ratings yet

- Cash Breakeven Analysis: Awus $10,000 100%Document13 pagesCash Breakeven Analysis: Awus $10,000 100%iPakistanNo ratings yet

- Vacasa ROI CalculatorDocument1 pageVacasa ROI CalculatorSujitKGoudarNo ratings yet

- 3-Statement Model PracticeDocument6 pages3-Statement Model PracticeWill SkaloskyNo ratings yet

- Rental Property Cash Flow Analysis: Monthly Operating IncomeDocument3 pagesRental Property Cash Flow Analysis: Monthly Operating IncomeFelix BedardNo ratings yet

- AN To Debt Policy and ValueDocument7 pagesAN To Debt Policy and ValueMochamad Arief RahmanNo ratings yet

- Buford StarbucksDocument7 pagesBuford StarbucksRESHMANo ratings yet

- Ch4 Spreadsheets Update 2 13Document19 pagesCh4 Spreadsheets Update 2 13Toàn ĐìnhNo ratings yet

- Financial Plan:: The Following Sections Will Outline Important Financial InformationDocument17 pagesFinancial Plan:: The Following Sections Will Outline Important Financial InformationAyesha KanwalNo ratings yet

- 2011 Cash Flow EvaluatorDocument42 pages2011 Cash Flow EvaluatorEddie AyalaNo ratings yet

- Debt Policy and ValueDocument7 pagesDebt Policy and ValueMuhammad Nabil EzraNo ratings yet

- UntitledDocument6 pagesUntitledLarry SoongNo ratings yet

- OM 650 SW 1 10pagesDocument10 pagesOM 650 SW 1 10pagesjuan ospinaNo ratings yet

- Ust Spread Sheet v004 ConstDocument12 pagesUst Spread Sheet v004 ConstConstantin WedekindNo ratings yet

- Real Estate Investment: The Preserve at Rising Fawn (Research Report)Document16 pagesReal Estate Investment: The Preserve at Rising Fawn (Research Report)Norada Real Estate Investments100% (4)

- Case Study - Discounted Cash FlowDocument14 pagesCase Study - Discounted Cash FlowSalman AhmadNo ratings yet

- Property Analysis Spreadsheet (Roofstock)Document2 pagesProperty Analysis Spreadsheet (Roofstock)Thameem Ansari NooraniNo ratings yet

- Speed NetworkingDocument2 pagesSpeed NetworkingBay Area Equity Group, LLCNo ratings yet

- 7411 Forrer - Performance ReportDocument1 page7411 Forrer - Performance ReportBay Area Equity Group, LLCNo ratings yet

- 6517 Rosemont - Performance ReportDocument1 page6517 Rosemont - Performance ReportBay Area Equity Group, LLCNo ratings yet

- Reservation AgreementDocument1 pageReservation AgreementBay Area Equity Group, LLCNo ratings yet

- 7422 Evergreen - Performance ReportDocument1 page7422 Evergreen - Performance ReportBay Area Equity Group, LLCNo ratings yet

- Mark Twain - Performance ProjectionDocument1 pageMark Twain - Performance ProjectionBay Area Equity Group, LLCNo ratings yet

- 7333 Brace - Performance ReportDocument1 page7333 Brace - Performance ReportBay Area Equity Group, LLCNo ratings yet

- 5630 Romeyn - Performance ProjectionDocument1 page5630 Romeyn - Performance ProjectionBay Area Equity Group, LLCNo ratings yet

- 4406-4408 Lakewood - Performance ReportDocument1 page4406-4408 Lakewood - Performance ReportBay Area Equity Group, LLCNo ratings yet

- San Juan - Desk AppraisalDocument8 pagesSan Juan - Desk AppraisalBay Area Equity Group, LLCNo ratings yet

- 12415-12417 Wisconsin - Performance ReportDocument1 page12415-12417 Wisconsin - Performance ReportBay Area Equity Group, LLCNo ratings yet

- San Juan - Performance ReportDocument1 pageSan Juan - Performance ReportBay Area Equity Group, LLCNo ratings yet

- Tuller Avenue - Performance ReportDocument1 pageTuller Avenue - Performance ReportBay Area Equity Group, LLCNo ratings yet

- 9926 Archdale - Performance ReportDocument1 page9926 Archdale - Performance ReportBay Area Equity Group, LLCNo ratings yet

- McKinney - Performance ReportDocument1 pageMcKinney - Performance ReportBay Area Equity Group, LLCNo ratings yet

- Blackstone - Performance ReportDocument1 pageBlackstone - Performance ReportBay Area Equity Group, LLCNo ratings yet

- 4406-4408 Lakewood - Performance ReportDocument1 page4406-4408 Lakewood - Performance ReportBay Area Equity Group, LLCNo ratings yet

- Rossiter - Performance ReportDocument1 pageRossiter - Performance ReportBay Area Equity Group, LLCNo ratings yet

- 9926 Archdale ST - Performance ReportDocument1 page9926 Archdale ST - Performance ReportBay Area Equity Group, LLCNo ratings yet

- McKinney - Performance ReportDocument1 pageMcKinney - Performance ReportBay Area Equity Group, LLCNo ratings yet

- 4406-4408 Lakewood - Performance ReportDocument1 page4406-4408 Lakewood - Performance ReportBay Area Equity Group, LLCNo ratings yet

- East State Fair - Performance ReportDocument1 pageEast State Fair - Performance ReportBay Area Equity Group, LLCNo ratings yet

- Ellsworth - Performance ReportDocument1 pageEllsworth - Performance ReportBay Area Equity Group, LLCNo ratings yet

- 12415-12417 Wisconsin - Performance ReportDocument1 page12415-12417 Wisconsin - Performance ReportBay Area Equity Group, LLCNo ratings yet

- Rossiter - Performance ReportDocument1 pageRossiter - Performance ReportBay Area Equity Group, LLCNo ratings yet

- UntothislastDocument35 pagesUntothislastDjim MDNo ratings yet

- Aftab Automobiles Limited and Its SubsidiariesDocument4 pagesAftab Automobiles Limited and Its SubsidiariesNur Md Al HossainNo ratings yet

- ExtAud 3 Midterm Exam W AnswersDocument12 pagesExtAud 3 Midterm Exam W AnswersJANET ILLESESNo ratings yet

- Nepal Budget Highlights - 79-80 - APM & AssociatesDocument89 pagesNepal Budget Highlights - 79-80 - APM & Associatesaasthapoddar155No ratings yet

- Revision MAT Number Securing A C Sheet BDocument1 pageRevision MAT Number Securing A C Sheet Bmanobilli30No ratings yet

- FI Def Elements QBDocument13 pagesFI Def Elements QBheisenbergNo ratings yet

- IFRS 4 - Insurance ContractsDocument3 pagesIFRS 4 - Insurance ContractsSky WalkerNo ratings yet

- Complete Buyers PacketDocument9 pagesComplete Buyers Packetapi-125614979100% (1)

- Summary-Analysis of Financial Statements - The Importance of Financial Indicators in EnterpriseDocument2 pagesSummary-Analysis of Financial Statements - The Importance of Financial Indicators in EnterprisevikkgcNo ratings yet

- Annual Report 2073-74-2074-2075Document116 pagesAnnual Report 2073-74-2074-2075Aayush ChauhanNo ratings yet

- Bài Kiểm Tra Giữa Kỳ 2Document2 pagesBài Kiểm Tra Giữa Kỳ 2Thu Trang NguyễnNo ratings yet

- Sma CertificateDocument2 pagesSma CertificateAnil MishraNo ratings yet

- Akd 73680719195Document1 pageAkd 73680719195Hayat Ali Shaw100% (1)

- Bba 312 FM Home Test Jan19 FTDocument3 pagesBba 312 FM Home Test Jan19 FTDivine DanielNo ratings yet

- Capital MarketsDocument12 pagesCapital MarketsSanoj Kumar YadavNo ratings yet

- C 10: T T Q: Hapter HE Money Market Extbook UestionsDocument6 pagesC 10: T T Q: Hapter HE Money Market Extbook UestionsMalinga LungaNo ratings yet

- FIN 202, AssignmentDocument11 pagesFIN 202, AssignmentRajesh MongerNo ratings yet

- What Is Personal FinanceDocument2 pagesWhat Is Personal FinanceSyai GenjNo ratings yet

- 1430020817057Document40 pages1430020817057kazukiNo ratings yet

- Vito York Practices Medicine Under The Business Title Vito York PDFDocument1 pageVito York Practices Medicine Under The Business Title Vito York PDFhassan taimourNo ratings yet

- Lecture 3 - InterestRatesForwardsDocument10 pagesLecture 3 - InterestRatesForwardsscribdnewidNo ratings yet

- Financial Accounts Questoin Paper UNOM 2020Document4 pagesFinancial Accounts Questoin Paper UNOM 2020lucy artemisNo ratings yet

- Chapter 16: Equity Portfolio Management StrategiesDocument29 pagesChapter 16: Equity Portfolio Management StrategiesMohamed HammadNo ratings yet

- Complete The Notes Below. Write No More Than Three Words And/Or A Number For Each AnswerDocument5 pagesComplete The Notes Below. Write No More Than Three Words And/Or A Number For Each AnswerCooperative LearningNo ratings yet

- Question Bank SFM (Old and New)Document232 pagesQuestion Bank SFM (Old and New)MBaralNo ratings yet

- Ratio Analysis of Singer Bangladesh LTDDocument22 pagesRatio Analysis of Singer Bangladesh LTDSandip Kar100% (1)

- La Moneta Di Sibari: Struttura e Metrologia / Emanuela SpagnoliDocument34 pagesLa Moneta Di Sibari: Struttura e Metrologia / Emanuela SpagnoliDigital Library Numis (DLN)No ratings yet

- 3Document26 pages3JDNo ratings yet

- I. Convertible Currencies With Bangko Sentral:: Run Date/timeDocument1 pageI. Convertible Currencies With Bangko Sentral:: Run Date/timeLucito FalloriaNo ratings yet

- Bergerac Case AnalysisDocument12 pagesBergerac Case Analysissiddhartha tulsyan100% (1)