Professional Documents

Culture Documents

12415-12417 Wisconsin - Performance Report

Uploaded by

Bay Area Equity Group, LLC0 ratings0% found this document useful (0 votes)

20 views1 page12415-12417 Wisconsin - Performance Report

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document12415-12417 Wisconsin - Performance Report

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

20 views1 page12415-12417 Wisconsin - Performance Report

Uploaded by

Bay Area Equity Group, LLC12415-12417 Wisconsin - Performance Report

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

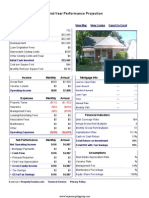

First-Year Performance Projection

12415-12417 Wisconsin Street

View Map View Comps Export to Excel

Detroit, MI 48204

4-bedroom, 2-bath Duplex

Square Feet 1,500

Initial Market Value $58,995

Purchase Price $58,995

Downpayment $58,995

Loan Origination Fees $0

Depreciable Closing Costs $500

Other Closing Costs and Fixup $0

Initial Cash Invested $59,495

Cost per Square Foot $39

Monthly Rent per Square Foot $0.70

Income Monthly Annual Mortgage Info First Second

Gross Rent $1,050 $12,600 Loan-to-Value Ratio 0% 0%

Vacancy Losses $0 $0 Loan Amount --- ---

Operating Income $1,050 $12,600 Monthly Payment --- ---

Loan Type --- ---

Expenses Monthly Annual Term --- ---

Property Taxes ($119) ($1,428) Interest Rate --- ---

Insurance ($83) ($1,000) Monthly PMI ---

Management Fees ($105) ($1,260)

Leasing/Advertising Fees $0 $0 Financial Indicators

Association Fees $0 $0 Debt Coverage Ratio N/A

Maintenance $0 $0 Annual Gross Rent Multiplier 5

Other $0 $0 Monthly Gross Rent Multiplier 56

Operating Expenses ($307) ($3,688) Capitalization Rate 15.1%

Cash on Cash Return 15%

Net Performance Monthly Annual Total Return on Investment 15%

Net Operating Income $743 $8,912 Total ROI with Tax Savings 15%

- Mortgage Payments $0 $0

= Cash Flow $743 $8,912 Assumptions

+ Principal Reduction $0 $0 Real Estate Appreciation Rate %

+ First-Year Appreciation $0 $0 Vacancy Rate %

= Gross Equity Income $743 $8,912 Management Fee 10%

+ Tax Savings $0 $0 Maintenance Percentage %

= GEI w/Tax Savings $743 $8,912 Equity Share Percentage 100%

© 2004-2011 PropertyTracker.com Terms of Service Privacy Policy

www.bayareaequitygroup.com

You might also like

- Reservation AgreementDocument1 pageReservation AgreementBay Area Equity Group, LLCNo ratings yet

- 6517 Rosemont - Performance ReportDocument1 page6517 Rosemont - Performance ReportBay Area Equity Group, LLCNo ratings yet

- 7422 Evergreen - Performance ReportDocument1 page7422 Evergreen - Performance ReportBay Area Equity Group, LLCNo ratings yet

- 7411 Forrer - Performance ReportDocument1 page7411 Forrer - Performance ReportBay Area Equity Group, LLCNo ratings yet

- 7242 Montrose - Performance ReportDocument1 page7242 Montrose - Performance ReportBay Area Equity Group, LLCNo ratings yet

- Speed NetworkingDocument2 pagesSpeed NetworkingBay Area Equity Group, LLCNo ratings yet

- 9941 Mansfield - Performance ReportDocument1 page9941 Mansfield - Performance ReportBay Area Equity Group, LLCNo ratings yet

- 7333 Brace - Performance ReportDocument1 page7333 Brace - Performance ReportBay Area Equity Group, LLCNo ratings yet

- 4406-4408 Lakewood - Performance ReportDocument1 page4406-4408 Lakewood - Performance ReportBay Area Equity Group, LLCNo ratings yet

- San Juan - Desk AppraisalDocument8 pagesSan Juan - Desk AppraisalBay Area Equity Group, LLCNo ratings yet

- 5630 Romeyn - Performance ProjectionDocument1 page5630 Romeyn - Performance ProjectionBay Area Equity Group, LLCNo ratings yet

- Mark Twain - Performance ProjectionDocument1 pageMark Twain - Performance ProjectionBay Area Equity Group, LLCNo ratings yet

- 12415-12417 Wisconsin - Performance ReportDocument1 page12415-12417 Wisconsin - Performance ReportBay Area Equity Group, LLCNo ratings yet

- Tuller Avenue - Performance ReportDocument1 pageTuller Avenue - Performance ReportBay Area Equity Group, LLCNo ratings yet

- 7803 Stahelin - Performance ReportDocument1 page7803 Stahelin - Performance ReportBay Area Equity Group, LLCNo ratings yet

- San Juan - Performance ReportDocument1 pageSan Juan - Performance ReportBay Area Equity Group, LLCNo ratings yet

- McKinney - Performance ReportDocument1 pageMcKinney - Performance ReportBay Area Equity Group, LLCNo ratings yet

- 9926 Archdale ST - Performance ReportDocument1 page9926 Archdale ST - Performance ReportBay Area Equity Group, LLCNo ratings yet

- Joann - Performance ReportDocument1 pageJoann - Performance ReportBay Area Equity Group, LLCNo ratings yet

- 4406-4408 Lakewood - Performance ReportDocument1 page4406-4408 Lakewood - Performance ReportBay Area Equity Group, LLCNo ratings yet

- Rossiter - Performance ReportDocument1 pageRossiter - Performance ReportBay Area Equity Group, LLCNo ratings yet

- 9926 Archdale - Performance ReportDocument1 page9926 Archdale - Performance ReportBay Area Equity Group, LLCNo ratings yet

- Blackstone - Performance ReportDocument1 pageBlackstone - Performance ReportBay Area Equity Group, LLCNo ratings yet

- 4406-4408 Lakewood - Performance ReportDocument1 page4406-4408 Lakewood - Performance ReportBay Area Equity Group, LLCNo ratings yet

- McKinney - Performance ReportDocument1 pageMcKinney - Performance ReportBay Area Equity Group, LLCNo ratings yet

- Ellsworth - Performance ReportDocument1 pageEllsworth - Performance ReportBay Area Equity Group, LLCNo ratings yet

- 6693 Baldwin - Performance ReportDocument1 page6693 Baldwin - Performance ReportBay Area Equity Group, LLCNo ratings yet

- East State Fair - Performance ReportDocument1 pageEast State Fair - Performance ReportBay Area Equity Group, LLCNo ratings yet

- Rossiter - Performance ReportDocument1 pageRossiter - Performance ReportBay Area Equity Group, LLCNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)