Professional Documents

Culture Documents

Decision Trees (HL)

Uploaded by

Gooroochurn KentishOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Decision Trees (HL)

Uploaded by

Gooroochurn KentishCopyright:

Available Formats

Le Bocage International School IB Business & Management (F7) Decision Trees HL Only

DECISION TREES (HL ONLY)

Decision trees are used as a quantitative tool for making decisions and they provide a logical

process. The technique makes use of diagrams where decisions are represented by Squares and

Outcomes or chances represented by Circles. Chances are estimated by assigning probability

values. The expected values of each decision are calculated to reach the best decision.

RULES TO CONSTRUCT THE DIAGRAM

The diagram is constructed from left to right and calculations are performed from right to

left.

The roots should be on the left while the branches on the right.

The branches consist of: (1) Decision nodes (2) Chance events or Outcomes.

Decision Nodes

These are used when a decision has to be taken. Normally, the decision should be

between at least two alternatives.

Chance Nodes

These are used to show the possible outcomes of a decision. The chances are beyond the

decision maker’s control.

A chance event should have a probability. The summation of all the probabilities for

each chance event should add up to one.

Actual values should be placed at the end of each branch (these are forecasts of the net

cash flow resulting from a sequence of decision and chance events through a decision

tree).

Expected values (these are the forecast actual values adjusted by the probability of their

occurrence) are calculated by taking the Actual Value x Probability.

To calculate the expected profit, the cost should be deducted.

The decision maker should choose the branch producing the best value.

The rejected decision should be cut out with the following symbol ||

© GOOROOCHURN Kentish kentishgooroochurn@yahoo.com

Le Bocage International School IB Business & Management (F7) Decision Trees HL Only

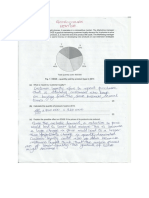

QUESTION WORKED IN CLASS

Denham Potteries has a capital spending budget of £100, 000. The production manager has put a

bid for £100, 000 for a new tunnel kiln. The marketing manager has countered with a proposal to

spend £80, 000 on the launching of a new product. This new product is in line with the firm’s

objective of diversifying, but may be rather risky given the firm’s past records of only one success

for every five new products.

Ken Cotton, the marketing manager has provided a handy table of figures to summarise the

information.

OUTCOME PROBABILITY ACTUAL VALUE (Surplus

over next 5 years)

NEW PRODUCT

Big Success 0.1 £ 900, 000

Modest Success 0.1 £ 500,000

Failure 0.8 £ 30, 000

TUNNEL KILN

Success 0.8 £ 200, 000

Failure 0.2 £ 60, 000

Business Studies 2nd Edition (Marcouse et al., 2003, pp. 588 Qun B2)

© GOOROOCHURN Kentish kentishgooroochurn@yahoo.com

Le Bocage International School IB Business & Management (F7) Decision Trees HL Only

CALCULATION OF EXPECTED VALUES

Now that the probability values and actual values have been filled in,

The first option would give:

(900 000*0.1)+(500 000*0.1)+(30 000*0.8)=£164 000

Since the case study gives costs of £ 80 000 for new product launching, it should be deducted.

164 000-80 000= £84 000

The second option would give:

(200 000*0.8)+(60 000*0.2)=£172 000

© GOOROOCHURN Kentish kentishgooroochurn@yahoo.com

Le Bocage International School IB Business & Management (F7) Decision Trees HL Only

Since the case study gives costs of £ 100 000 for tunnel kiln, it should be deducted. 172 000-100

000=£ 72 000.

MAKING THE QUANTITATIVE DECISION

Now that the net expected incomes for both options have been calculated, it is found out

that the option of launching a new product should be selected because it gives a net expected

income of £ 84 000.

QUALITATIVE REASONING FOR DENHAM POTTERIES

Whenever a decision has to be taken, both quantitative and qualitative factors have to be taken

into account. The management must first of all investigate the quality of the data collected by

the marketing manager. They may be less reliable and biased in favour of his department. The

production manager must also verify the validity of the figures collected by the marketing

manager.

The company has as objective to diversify which plays in favour of the marketing manager

especially in addition to the numerate considerations. However the management must not forget

that the probability of failure for the new product is 80 %. This implies that the firm has 80 %

risk of losing £ 50 000 (calculated as 80 000 – 30 000). This represents a high risk. Is the

company ready to take such a high risk?

The state of the existing kiln must also be checked. Is there any problem with the kiln? Is the

quality and efficiency negatively affected? All these areas must be verified before investing in

the new kiln. The new efficiency and productivity level must be known to check whether the

product is really a priority.

The other departments must also be considered and involved in the decision making process. In

the case study, it seems that the other departments have not given their proposals. It must be

well coordinated else the board will be seen as favouring one department and this may result in

low morale and misunderstanding.

© GOOROOCHURN Kentish kentishgooroochurn@yahoo.com

Le Bocage International School IB Business & Management (F7) Decision Trees HL Only

ADVANTAGES OF DECISION TREES

Help to set out problems in a clear and logical manner and encourages a logical approach

as well.

By considering all outcomes, the decision maker gets all the options in front of him,

thereby speeding up the decision making process.

Risks are not ignored because decision trees consider negative outcomes as well.

The probability of each outcome occurring is an advantage and makes calculations easier.

Decision trees take into consideration the costs of the decision as well.

This method is scientific and does not rely on imagination or intuition. It allows for

informed decision.

DISADVANTAGES OF DECISION TREES

The estimated probabilities might not always be meaningful since forecasting errors may

occur.

Decision trees are numerical/quantitative in nature and ignore qualitative data.

Data can easily be manipulated deliberately in order to justify a particular department’s

preference.

The external business environment is not taken into consideration when drawing decision

trees.

The diagram only helps in calculation but not reduction of risks in decision making.

© GOOROOCHURN Kentish kentishgooroochurn@yahoo.com

You might also like

- June 2012 Paper 12 Sample Answer by Kentish GooroochurnDocument10 pagesJune 2012 Paper 12 Sample Answer by Kentish GooroochurnGooroochurn KentishNo ratings yet

- IGCSE Communication GuideDocument37 pagesIGCSE Communication GuideGooroochurn KentishNo ratings yet

- June 2016 Paper 11 (Paper 1) Sample Answers by Kentish GooroochurnDocument8 pagesJune 2016 Paper 11 (Paper 1) Sample Answers by Kentish GooroochurnGooroochurn KentishNo ratings yet

- Paper 1 Sample (Gooroochurn Kentish)Document6 pagesPaper 1 Sample (Gooroochurn Kentish)Gooroochurn KentishNo ratings yet

- Stock Control F5Document4 pagesStock Control F5Gooroochurn KentishNo ratings yet

- Cambridge Past Paper June 2015 Paper 3 EssayDocument2 pagesCambridge Past Paper June 2015 Paper 3 EssayGooroochurn KentishNo ratings yet

- Guidance BM Exams GRNDocument8 pagesGuidance BM Exams GRNGooroochurn KentishNo ratings yet

- Guidance BM Exams GRNDocument8 pagesGuidance BM Exams GRNGooroochurn KentishNo ratings yet

- Motivation in PracticeDocument1 pageMotivation in PracticeGooroochurn KentishNo ratings yet

- Secondary Education in MauritiusDocument2 pagesSecondary Education in MauritiusGooroochurn KentishNo ratings yet

- Economies & Diseconomies of ScaleDocument4 pagesEconomies & Diseconomies of ScaleGooroochurn Kentish100% (1)

- CAMBRIDGE PAST EXAM PAPER JUNE 2003 QUESTION 1 FURNITUREDocument1 pageCAMBRIDGE PAST EXAM PAPER JUNE 2003 QUESTION 1 FURNITUREGooroochurn KentishNo ratings yet

- Extension 1 Updated)Document1 pageExtension 1 Updated)Gooroochurn KentishNo ratings yet

- TFM June 2003 P2 Q1Document3 pagesTFM June 2003 P2 Q1Gooroochurn KentishNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Shared Decision-Making Between Healthcare ProvidersDocument7 pagesShared Decision-Making Between Healthcare ProvidersDiandra DhitaNo ratings yet

- Carrots, Sticks, and Sermon Part 2Document38 pagesCarrots, Sticks, and Sermon Part 2Clara C. EkarishantiNo ratings yet

- 2 0 MCQ 1-5Document5 pages2 0 MCQ 1-5Winnie NgNo ratings yet

- 1 - Objectives, Role and Scope of Management AccountingDocument11 pages1 - Objectives, Role and Scope of Management Accountingmymy100% (2)

- DTPS GuidelinesDocument115 pagesDTPS GuidelinesRustini FloranitaNo ratings yet

- Research Online Research OnlineDocument21 pagesResearch Online Research OnlineBLEZENG RAMIREZNo ratings yet

- Continuous AssessmentDocument47 pagesContinuous AssessmentTamakloe EmmanuelNo ratings yet

- BTM Trading PsychologyDocument52 pagesBTM Trading PsychologyJalal Badshah100% (2)

- Spreadsheet Modeling and Decision Analysis Course OverviewDocument42 pagesSpreadsheet Modeling and Decision Analysis Course OverviewZhaohong WangNo ratings yet

- Manoj Bhalani WORLD INBOX (Final)Document82 pagesManoj Bhalani WORLD INBOX (Final)Manoj BhalaniNo ratings yet

- Como Llevar Un Buen Registro de Datos en Laboratorio Mediante Bitacoras para Prácticas, Tesis Ó InvestigaciónDocument6 pagesComo Llevar Un Buen Registro de Datos en Laboratorio Mediante Bitacoras para Prácticas, Tesis Ó InvestigaciónAlejandra NuñezNo ratings yet

- Hudson - Why We Should Not Reject The Value-Free Ideal of ScienceDocument26 pagesHudson - Why We Should Not Reject The Value-Free Ideal of ScienceNicole DíazNo ratings yet

- Influence of Culture on Organizational Design and Planning Systems in Australia, US, Singapore and Hong KongDocument20 pagesInfluence of Culture on Organizational Design and Planning Systems in Australia, US, Singapore and Hong KongjolliebraNo ratings yet

- CW Article Claverie Du Cluzel Final - 0Document11 pagesCW Article Claverie Du Cluzel Final - 0Esteban godoyNo ratings yet

- Community Mobilisation and ParticipationDocument21 pagesCommunity Mobilisation and ParticipationMayom Mabuong100% (1)

- NSTP 1Document28 pagesNSTP 1Mabel R. PascuaNo ratings yet

- Bio Banding EssayDocument8 pagesBio Banding Essayapi-436368658No ratings yet

- Findling&Wyart - 2021 - Computation Noise in Human Learning Anddecision-Making Origin, Impact, FunctionDocument9 pagesFindling&Wyart - 2021 - Computation Noise in Human Learning Anddecision-Making Origin, Impact, FunctionBeth LloydNo ratings yet

- Critical Decision Making Guide for FirefightersDocument50 pagesCritical Decision Making Guide for FirefightersMohamad Khair Shaiful AlamNo ratings yet

- Awayiga 2010 - Q1 - Knowledge and Skills Development of Accounting Graduates The Perceptions of Graduates and Employers in GhanaDocument22 pagesAwayiga 2010 - Q1 - Knowledge and Skills Development of Accounting Graduates The Perceptions of Graduates and Employers in GhanaGeta GetaNo ratings yet

- Sustaining Urban Land InformationDocument27 pagesSustaining Urban Land InformationUnited Nations Human Settlements Programme (UN-HABITAT)No ratings yet

- Cognition in The Attention EconomyDocument45 pagesCognition in The Attention EconomyAnonymous xcl5TSpaNo ratings yet

- Leardership Challeges Encountered by NurseDocument96 pagesLeardership Challeges Encountered by NurseyowiskieNo ratings yet

- Tabassum Fatima ThesisDocument141 pagesTabassum Fatima ThesisAnonymous hprsT3WlPNo ratings yet

- MathDocument71 pagesMathDayondon, AprilNo ratings yet

- Critical Path Method Training for Project SchedulingDocument5 pagesCritical Path Method Training for Project SchedulingNwe Ni Ni AyeNo ratings yet

- Accounting Ethics 1st Edition PDFDocument314 pagesAccounting Ethics 1st Edition PDFrefikaNo ratings yet

- Chattanooga Ice Cream Division SolutionDocument8 pagesChattanooga Ice Cream Division Solutionsamar00975% (4)

- A Neuroscientist Reveals How To Think DifferentlyDocument2 pagesA Neuroscientist Reveals How To Think DifferentlychandraNo ratings yet