Professional Documents

Culture Documents

Betting System and Method (US Patent 7206762)

Uploaded by

PriorSmart0 ratings0% found this document useful (0 votes)

396 views10 pagesU.S. patent 7206762: Betting system and method. Granted to Sireau on 2007-04-17 (filed 2001-01-17) and assigned to Regent Markets Group Ltd.. Currently involved in at least 1 patent litigation: Regent Markets Group, Ltd. v. IG Markets, Inc. (Illinois). See http://news.priorsmart.com for more info.

Original Title

Betting system and method (US patent 7206762)

Copyright

© Public Domain

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentU.S. patent 7206762: Betting system and method. Granted to Sireau on 2007-04-17 (filed 2001-01-17) and assigned to Regent Markets Group Ltd.. Currently involved in at least 1 patent litigation: Regent Markets Group, Ltd. v. IG Markets, Inc. (Illinois). See http://news.priorsmart.com for more info.

Copyright:

Public Domain

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

396 views10 pagesBetting System and Method (US Patent 7206762)

Uploaded by

PriorSmartU.S. patent 7206762: Betting system and method. Granted to Sireau on 2007-04-17 (filed 2001-01-17) and assigned to Regent Markets Group Ltd.. Currently involved in at least 1 patent litigation: Regent Markets Group, Ltd. v. IG Markets, Inc. (Illinois). See http://news.priorsmart.com for more info.

Copyright:

Public Domain

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 10

«2 United States Patent

Sireau

2

US 7,206,762 B2

Apr. 17, 2007

(10) Patent No.:

45) Date of Patent:

sy

AND METHOD

(73) Inventor: Jean-Yves Sirean, Hong Kong (HK)

(73) Assignee: Regent Markets Group Ltd,

Cyberjaya (MY)

(7) Notice: Subject o any disclaimer, the term ofthis

pateat is extended or adjusted uader 35

USC. 1540) by 1176 days

(21) Appl. No. 097764,778

46325

4641

46328

32000 Vig 705-400

52004 Lallemant 70093

FOREIGN PATENT DOCUMENTS

wo Wossos) ——TI997

wo Woon wip99

WO WODDTIID. KIB

OTHER PUBLICATIONS

Ext Receives Financial Being Licease, PR Newswire, Feb. 18,

(22) Fil: Jan, 17,2001 eae

Engen Pal Of, feisty of Een pt eliion

6) Prior Publication Data ‘No. 00 302 $301-1238, jun. 6, 2003, 57 pages.

US 20010032169 A1 Oa. 18,200 oe

(20) Foreign Application Priority Date Primary Exominr—logishN Patel

aoe tosorsao 74) Atornes, Agent, o Frm—Sioel Rives LLP

‘Ape 27, 2000 (GB) 102107 Gy apsTRAcT

Gh) we

06g 400 (200601) Blac be nen opener

roses oPeable to atcep parame inp bya usr ad eating 1

eu Se TWS/3T; TOSH463; 70526 edolds bet on an aspect of a financial market; and a

(58) Field of Clasifaton Seach ae a eee

a6s26 ceming a finan ns

‘See application file for complete search history. Rancher ie raped ee aed el

9) References Cited of the parameters input by the user and the dita obtained

frm te dit fos

US. PATENT DOCUMENTS

S709785 A 51998 Rowse 46 80 Claims, 1 Drawing Sheet

Un Teminis3

|

Fond te 4d ;

atte] Haat |

ae]

Farm]

coms

commie Newer |

(se |

csingantine | __[ PSone |

am es peesig mie ne

be |

‘alba

stg Fc 8

commas =

Toa cen

[

co

Sunt Naga

‘oer

U.S. Patent Apr. 17,2007 US 7,206,762 B2

FIG. 1

r..Ct™~CSY

User Terminals 3

Financial Markets, |

I

Real-Time

Historical

Data Feed $

Second Data

Communications

Network 4

\Data Feed 6

First data

Communications

Network 2

‘Payment

System 9

Central processing machine 1 Data Storage |

[—| Facility 7

I

Third Data

‘Communications

Network 10

‘Accounting

System 11

“Archival Data

Storage Facility 8

Fourth Data,

Communications

‘Network 13

Management

Terminal 12

US 7,206,762 B2

1

BETTING SYSTEM AND METHOD

RELATED APPLICATIONS

‘This application cloims priority from European Patent

Applicaton No. 003025301, filed Ma. 28, 2000, and UK

Patent Application No. 001027017, fed Ape. 27, 2000.

BACKGROUND

“The present diselosure relates to a betting system and

‘method for buying and selling of fixed-odds financial bets

‘Although betting in maay diverse forms has beea in

existence for thousands of years, the concept of a bet onthe

futuee performance of one or more financial market indiea-

torsisa relatively recent one. Such et may tke ne of two

forms, as willbe described.

‘The first form of such a bet (the “spread bet") is one

‘which, ifwon bythe making ofa correc prediction, pays out

sum proportional tothe market Muctuation. For instance, a

speculator may bet that a given stock will fll within a set

period of time, and, if this prediction is corret, may receive

‘Winnings in direet proportion to the amouat by whicl the

stock fas fallen in that period of time.

‘The oer form that such a bet may take is known asthe >

“digital option". Digital bes are of the same form as a

traditional sporting bet in that the speculator predicts a

certain event and receives either a fixed sum of winnings iE

‘that event does occur) or no winnings (ithe event doesnot

‘ceur).Forinstanee, a speculator may bet hata certain stock

index will rise to a certain level by a certain time. Ifthe

‘named index does reach this level, the speculator wins an

‘greed amount of money inrespective of any amount by

\hich the iadex has exceeded the predicted level. It is this,

type of bet that i known asa “fixed odds” bet

However, problems face the individual investor who

wishes to place bots on the financial markets, The wide

‘universe of financial instrments and derivatives products i

typically available ony to professional investors who bave

the financial resources and know-how to access these pro

vt.

Problems also face the bookmaker who wishes to offer

financial bes tothe private investor. These include the fact

that financial bookmaking is labor-intensive, with skilled

staff boing required constantly to adapt the dds offered on

‘an immense variety of possible bets to market conditions

that are changing on a ssinute-by-minute basis,

The average sizeof abet placed by an individval customer

‘will, in general, be very small compared to the average size

of atypical stock market direct iavestment. The potential

profit 1 the bookmaker from sueh small investment ill,

therefore be too small fr it to be evonomically viable to

employ skilled staff to calculate the odds to offer to indi-

vidual speculators sulfciently quickly.

A further problem facing bookmakers is that it is very

ificlt to accurately price complicated or unusual bets, nd

‘bookmakers typically offeronly’a few standard bets ona few

markets,

‘A need exists for a system and method that alleviates

some ofall of the above problems, and which enables a

bookmaker eficienly to offer a wide eange of financial bets

to speculators wishing to place relatively small bets:

SUMMARY.

According to first embodiment, a fixed-odds beting

system comprises a user terminal openble to accept para

x“

8

s

2

ters, input by a user, relating to 2 fixed bet on an

aspect of a financial marke; and a conta processing

‘machine having data feed toa source of data concerning

a financial market and means operable to calculate the ied

‘os forthe bet, base om at feast some ofthe paramcters

fnput by th user and the data obtained fromthe data feed

Aantageously, the user terminal may be operable t

receive and display the odds calcolstad by the central

processing machine

Preferaby, the data fet the source of data concerning

the fancal market comprises at leat a dita feed 10

realtime information concerning the financial markt. Con-

‘venient the data fet the source of data concering the

financial marke may comprise data fed to historical data

concerning the financial market. Advantageously, the data

food is connecied to the source of data concerning the

financial market over a fst data communications netork

Profrably, the fist deta communications networks the

lnvemat oa leased line. The cental processing machine

‘ay bave at least one other daa fed Wo a source of data

concerning one or moe eter financial markets

‘The wserteminal andthe centel processing machine are

preferably connected to one anner via second data

communieations network sucha the Interne

Convent the sytem muy fer comprise payment

system fr dedting payment forthe bet fom the we, he

‘mechanism being linked to the ental processing machine

“The payment system for deducting payment frm the user

say include an E-cash or crit cir payment system.

‘The system may fuer comprise an secountng system

linked to the cenel processing mschine anda management

teminal openble provide information reirding the

operation ofthe Beting system to an administrator thereo.

Advantageously, the parameters for calculating the ods

‘ay include one of more of the following: the relevant

financial marke: the amount tha the user wishes tobe or

the amount thatthe user wishes to win; and one oF mare

ari o target level

‘The system may furher comprise @ storage faiiy for

storing information relating to bes. The etal processing

amschine prfrably inludes means to retrieve information

stored in the storage faciiy, and provide information to a

‘scr cating fo bet proviusy placed hy the see

Preferably, the central processing machine ‘includes

‘means to calculate a price at which to ofc to purchase the

previously placed bet frm the user and to display the price

Calculate by the eental processing machine

In another eubodineat, 2 method of operating a fixed

cds bting system including a cena proessing machine

in communication with a data feed to @ source of dita

concern financial navel, and ower ternal in com-

‘munication with the central processing machine, comprises

accepting fom a user parameters relating 10 ixo-adds bot

oman aspect of fn market receiving one or more of

the parameters at the central processing machine; obsining

data conceming the financial market via the data fod: and

te central processing machine caeulating a fxe-odds

ic forthe bet based on at east one af the parameter input

by the user and the data obtained from the data fed

The metbod may father comprise the steps of displaying

the calculated eds to the user and deducting of receiving

payment from the wer for placing the bet

Preferably, the step of receiving one or more parameters

from the user inclodes the step of receiving infomation

relating to one or more of the following? the relevant

US 7,206,762 B2

3

financial market; the amount that the user wishes to win oF

the amount that the user wishes to bet; ane one or more

barrier or anget levels

“The step ofobiining data concerning he faancial market

‘may include the step of obtaining real-time data relating to

‘one or more of the following: market prices; option quotes,

interest rates and dividend yields,

“The step of obtaining daia concerning a financial market

‘may include the steps of obtaining historical data relating to

‘market prices.

Preferably, the step of calculating the fxed-ads price

‘comprises the step of calculating an estimate ofthe future

volaiity ofthe financial marke.

Conveniently, the method may further comprise the steps

of ehecking the parameters input by the user for logical

inconsistencies therebetween and checking the opening

times ofthe financial market

Preferably, the method further comprises the step of

providing at Teast one other data feed 10-2 source of data

‘concerning ane of more other financial markets.

Conveniently, the step of receiving parameters from the

ser preferably includes the step of receiving parameters

relating to an aspect of the one or more other financial

markets

vo

‘Advantageonsly, the step of calculating the fixedodds *

price for the bet preferably includes the step of calculating

concation matrix containing information concerning the

‘nancial market and the one of more ther fsancial markets

Preferably, dhe system fuser comprises the sep of pro

viding a storage facility, accessible by the central processing

‘machine, for storing information relating to bets,

Conveniently, the step of calculating odds includes the

step of calculating a hedging factor based on information

‘concern previously placed bets obtained from the storage

facility. The method may farther comprise the steps of: (1)

calculating, at the central processing machine, a price at

‘which to olfer to buy a previously placed bet fom the user,

ana proving the price tothe user via the user terminal

In yet another embodiment,» computer program com-

rises computer program code means adapted to: receive

fone or more parameters from a user relating t a fixed-odds

bet on an aspect ofa financial market; obtain data concem-

ing a financial market via a data feed, and calculate a

fixed-odds price for the bet based on at lest one of the

parameters input by the user and the data obtined from the

data feed, The computer program may be embodied on a

computer readable medium or otherwise operable on a

compute,

In sill another embodiment, central processing machine

having a data feed toa source of data concerning 2 financial

:matket is operable to calculate fixed os, based on param

ters input by a user and data obtained fom the data fed

Conveniently, the data feed to the source of data concem-

jing the fizancial market may comprise a data food to

real-time information concerning the financial market,

Advantageously, the data feed to the source of data

‘concerning the financial market may comprise data feed to

at least historical data conceming the financial market

Preferably, the data feed is connected to te souree of data

concerning the financial market over a first data communi

cations network such asthe Internet oF 2 leased line.

‘Advantageously, at least one other data feed may be

provided tea source of data concerning one oF more other

Tinancial marks,

‘The central processing machine may’ further comprise 3

storage facility for storing information relating to bets

s

4

‘The central processing machine may aso have means to

caleulate a price at which to offer to purchase a previously

placed bet from the user.

Advantageously, the central processing machine may

further comprise a management terminal operable to display

information regarding the operation of the betting sytem to

‘an administrator thereo.

Additonal characteristics and advantages will be appar-

cnt trom the following detsiled description of prefered

embodiments which proceeds with reference to the aecom-

paying drawing,

BRIEF DESCRIPTION OF THE DRAWING

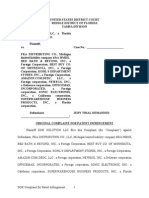

FIG. 1 shows a schematic layout ofthe components ofa

‘rating system in aecordance with 2 prefered embodiment

othe present invention.

DETAILED DESCRIPTION OF PREFERRED.

EMBODIMENTS,

With reference to FIG, 1, a central processing machine 1

cof a betting system in accordance with a preferred embodi-

‘ment comprises a server running a server operating system

A computer program embodying an aspoct of the beting

system is loaded onto the cental processing machine 1, a8

will be described in greater detail bel.

The central pressing machine 1 is linked vi a fist data

‘communications network 2 oa plurality of wer teinals 3.

Preferably, the fist network 2 is the Internet. The user

terminals comprise PC's, or other suitable machines, ran

fing an appropriate operating system to interlace” with

prospective customers, for inslance a Windows or UNIX

{ype operating system,

“The centeal processing machine 1 is further connected via

second dita communications nesvork 4 1 two data feeds,

‘one of which isa data feed § toa source of realtime market

information, and the other of whichis a data feed 6 to a

source of historical market information. Preferably, the

sacond network 4 s the Internet or a leased ine. Examples

of real-time market quotes data feeds are those provided by

financial information providers such as Reuters, Bloomberg,

‘Bridge, DBC, etc. The primary requirement for this data ink

is that it shouldbe real-time, which isto say thatthe quotes,

retrieved via the data Tink are up-o-thesecond realtime

market quotes.

‘The betting system of FIG. 1 further comprises a data

storage facility 7, comprising a file server operable to store

information conceming placed, pending and expired bets on

‘one of more disks. The data storage facility is connected to

anatchival data storage fcilty 8, which is operable to retain

information oa a plurality of apes or oer long-temn storage

medi

The betting system inchodes an E-cash or ereit card

‘payment system 9, which is inked tothe central processing

‘machine I by a third data communications aetwork 10, Aa

accounting system 11 is also included in the betting system,

this accounting system being direty linked to the een

processing machine 1

‘A management ternal 12 also comprises part of the

betting system. This management terminal 12s linked tthe

central processing machine I via a fouth data communica

tions network 13, which is preferably th Internet

Tn operation, an individual users able to log on tow user

terminal 3 for the purpose of placing a fixed-ods financial

bet. user-id and password, provided (othe individual by

the administrator ofthe betting system, may be required to

US 7,206,762 B2

5

4 so. In practice, the user terminal 3 may comprise a

edicated temninal in a public betting fecilty, or may

alternatively comprise the user's own PC.

‘When the wser attempts to log on to the betting system at

the user terminal 3, the user terminal 3 connec to the

central processing machine 1 via the first network 2. Ifa

password is raquired, the password must be accepted by the

central processing machine I before the user is allowed to

log on to the betting system,

“The user is now able to place a fixed-odds financial bet

using the betting system. The user teminal 3 presents the

user with a suitable interfoe for doing so, this interface

‘comprising & numberof menus othe lke through which the

‘user may navigate to glean information or select bet param

ers. Bet parameters thatthe user may select may include,

among other: the financial marke(s) upon which the bets

to be based (for instance a foreign exchange rate); the

‘amount thatthe user wishes to bet or the amount that the user

wishes to win; or one or more baricr or target levels

(cating to market performance) which seta threshold for

the financial market parameter being monitored, Once the

‘bet parameters are devided upon hy the user, these param

fers are submitted tothe central processing machine I via

the frst network 2

“The fist step performed by the ceatml processing ”

‘machine 1 upon receipt of the bet parameters fom the user

terminal 3 is to ascertain whether or not the bet defined by

the bet parameters is within reasonable reach of current

‘market prices. In order to decide whether or not this isthe

case, the central processing machine 1 gathers information

concerning the current markt prices fom the data fed $10

the souree of real-time market information. If the data

derived thereftom indicates that there is na realistic possi=

bility ofthe market price changing with the rapidity required

by the bet, then the central processing machine 1 will reject

the bet

[Next the bet parameters put by the user are checked by

the central processing machine 1 for logical inconsistencies,

and the bet is rejected if'such inconsistencies are found 1 be

presen. For instance, if @ user has input bet parameters

defining a bet that a certain financial index will remain

‘erwoen a high value of 110 and a low value of 120, the

central processing machine 1 will determine thatthe het is

logically inconsistent and reject te bet.

A further step performed by the central processing

machine 1 on receipt of a set of bet parameters from user

terminal 3 isto check the opening times of the relevant

financial markets. The cetral processing machine 1 has, for

‘his purpose, a link oa source of information containing the

‘opening hours and public holidays of all ofthe markets upon

which bets are offered. Ifa user is allowed to et upon the

performance of a market during @ period for which that

‘markets closed he user gains an uafir advantage and thus

such a bet would be rejected

Once it as been established by the eental processing

‘machine I thatthe bet parameters input by the user define 3

valid bet, the next step isto determine the real-time ra

‘market valves from which to calculate the price of the bet.

Inorder todo ths, the centeal processing machine | accesses

the data foed Sw the source of real-time market information,

‘The data derived thereftom may include current market

prices, option quotes, interest rate levels, dividend yields (in

the case of stocks or stock indices) or carving casts (e.,

storage, delivery or insurance costs inthe case of commod

ties) The central processing machine T may also access the

data feed 6 to the source of historical market infomnation,

s

6

and the data gathered therefrom may include historical

closing prices for the relevant markets

(Once a set of valid bet parameters have been received by

the conta processing machine 1 and the relevant infoma-

tion has been gathered from the data feeds 5,6, the central

processing machine 1 uses the information to caleulate the

‘dds that willbe offered to the user forthe bet.

‘The first step in the process isto calculate the implied

volatility ofthe or each market ypon which the bets based

‘The volatility ofa markets defined as the amount by whieh

the market fluctutes during a given period, and is often

defined as the annualized standard deviation of the natural

Tgarithm ofthe price retums ofthe dey closing values of

the market

‘The implied volatility is the market volatility thatthe

listed options market implies forthe fiture, market volatility

being a major fctor in the determination of the price of an

‘option. Ifthe price of the listed options relating to a given,

‘market for a piven time period is known, this FIGURE can

‘oe reverse-engincerd to calculate the future volatility of the

‘market implied by that option pice, Various techniques exist

for this reverse engineering operation, the most comatoaly

vwsed of which is an algorithm based on the Black and

Scholes option priciag model, however the skilled person

will ealize that any of several alternative algorithms may be

sed instead

‘A standard option priciag model such as the Black and

Scholes model assumes thatthe facial markets fallow a

{og-normal dstibution. This assumption does not, however,

accurately reflect the market panies (like the 1987 stock

‘market crash), which occur witha higher requency than

‘would be expected in a purely lognormal distribution. To

adjust forthe “fatter tls" ofthe real distribution of market

returns, the concept of “volatility smile” is introduced,

‘whereby options with diferent strike prices trae at diferent

implied volailities. Options wit different expiry dates also

trae at different implied volatilities, reflecting diferent

expectations of markot volatility over differen ime poriog

Since there wil likely not be any option with exactly the

sume expiry date and target price as the bet, interpol

‘ill bused to arrive a the best estimate ofthe voat

the bet

To calculate the volatility to be used to price the bet,

options prices are gathered from the data feed § to the

real-time source of market information. The implied vola-

lites ofthe options with strike prices closest othe bartier

for target level ofthe be, and with expiry dates closest tothe

‘expiry date othe bet, ae computed, These implied volatility

poiuls are then interpolated oareve atthe implied volatility

‘most appropiate for the expiry date and barrier or target

level ofthe bet (if the bet has several barir or target levels,

the Kevel that will lad tothe highest selling price for the bet

‘may be nsed) This interpolated implied volatility is used by

the central processing machine Ito calculate the odds forthe

bat

Tis also necessary for the cental pressing machne 1

to take into account the grow of the market oF markets in

question. In order to derive this valu, the intrest rate and

‘other components of the carrying cost for each market

(extracted from the data feed $ to the real-time source of

‘market information are required. For stocks or stock indi-

2s, the growth ofthe market is typically approximated as

‘being te interest rate minus the annualized dividend vio

Ina similar manner to that deseribed above, the interest ite

for an arbitrary time period may be estimated by interpo-

lating between the deposit rates for earlier and later matu-

‘ie o arrive at an appropriate value. For foreign exchange

US 7,206,762 B2

1

‘ates, the grow rates defined as the diference between the

{epost rats in each currency and for other markets such as

commodities, the growth rate incorporates factors such as

storage or dlivery costs, and insurance fees

A complex bet may involve predictions on the perfors s

smanees of several diferent markets, and if such a bet is

placed then correlation muti for these different markets

will need to be computed. Such a conlation matex is

computed by calculating te correlation coefiients of the

relevant markets over a period of historical data cbtained_ 10

from the data feed 6 t0 the source of historical market

information. Ideally, this time period isin proportion to the

Tength of the bet

Once all ofthe necessary information has been gathered

‘or computed by the ceatral processing machine 1, the cena

processing machine I proceeds o calculate the odds forthe

bet defined by the bet parameters, There ae various ways in

\which this may be performed for each type of bet that might.

be placed by the user. Common bets that might be placed

include:

‘an “upidown" bet that a given market will be above oF

below a given level on a given date;

‘an “expiry range” bet tata given markot will be between

two given levels ona given date

a “rainbow” bet, which is essentially a mulkimarket >

expiry range bet;

‘a bullseye” bet that a given market will have an exactly

sven value on a given date:

“one-touch” bet that a given market will touch a given

barrier level at some point before the expiry of the bet,

“noctouch” bet that given marke wll ot tonch a given

barrier level at any point before the expiry of the bet,

‘a“range” bet that a given market wil touch neither of wo

ativen barier levels at ny point before the expiry ofthe bet

“double onetoveh” bet that a given market will touch

both of two given barrier levels at some point before the

expiry ofthe bet:

a “win”, “place” or “show” bet that a market will be

respectively the best, or within the top two best, oop three

‘ost, performing markets (in percentage tems) over a given

period; and

‘a “quinella”, “tierce” or “extota” bet defined from their

rctrack equivalents.

An example of how the price of an expiry range bet might

be caleuated is as follows

‘The formula forthe underiying asset price S is given by:

aS-mssie

8

where ms the grow rate, sis dhe volatility, tis time and

isa variable that follows a Wiener process. The variable 7

‘can be understood by considering the changes in the value

thereof over small intervals of time. Consider a small

interval of time having a duration of dt and define das the

change in during dt. There ae two basi properties that dz

‘must have for2 to he following a Wiener process:

dz must be related to dt by the equation

where € isa random drawing from a standantized normal

istribution (Le, a normal distibution with a mean of 270

and a standard deviation of 10), and the values of dz, forany

to diferent shoe intervals of time dt, must be independent.

Solving this equation, we obtain

«

SiS eager d¥4e00)

8

‘where S( isthe asset price at ime tan S isthe initial asset

price

Lot p be the probability of success ofa bet in this model at

‘expiry time t, Te present value ofthis bet thn hecome:

Prescre

where Ps the present value (oF fair price) of the bel isthe

interest cate, and ti the time to maturity. We denote:

slo

and

‘whore S(t) is the asst price atime isthe time to maturity,

S is the intial asset price, r is the interest rate, g isthe

dividend rate ands is the volaiity.

‘Then, he variable x is defined as

Xow

and is normally distributed with probability density:

mde

tw eat

woe fie

where N(x) is the cumulative probability of the normal

distibution, Let S be the inital market price, and let

eee)

‘where UT and D are the up and down bartiees of the bet

respectively. The peice of the expiry ange bet, defined by U

and D, is then given by:

Gebel

Other formulae for different types of bets may realy be

derived by emplaying the same principles, The type of

forma employed is also not essential to the working ofthe

system—many different methods of caleulating odds exist,

fad any ofthese may’ be use ia the system,

US 7,206,762 B2

9

(Once the price ofthe bet defined by the bet parameters

input by the user is determined, a house mark-up is added

‘and the bet is offered to the user via the user teminal 3,

Since te systom operates on real-time values derived from

the constantly fluctuating markets, the customer is allowed

only a shoct time in which to decide whether or not to

purchase the beta the calculated price. This time period is,

preferably, no more than thisy to sixty seconds, andthe olfer

4s withdeawn after this time.

the user decides vo purchase the bet, he or she will be

prompted to input a username and password (if these were

‘ot input at an earir stag). This information is verified by

the central processing machine 1 and i itis accepted, will,

check the credit balance of the user onthe accounting system,

11, If this reveals that the user has sufficient funds 10

purchase the bet, the transaction with the usr i effected nd

the bet is recorded on the data storage facility 7.

Fach user ofthe system may, on entering his or her valid

‘username and password, view a ist of oustanding bets that

he or she has placed ona user terminal 3. In onder to provide

this list the central processing machine 1 recieves infor.

‘mation regarding the user's previously placed bets from the

ata storage facility 7. The central processing machine 1

snus, for each previously placed bet, determine whether the

bet has: already expired or flilled the conditions ofthe bet.

0 thatthe user has won the bet; sleady expired or cont

‘vened the conditions of the bet so that the user has lost the

bets or has aot yet reached the date or conditions af expiry.

‘The central processing machine 1 derives this information

‘by comparing the bet parameters with both real-time market

information and historical market information for the rel.

‘evant time period obtained via the data feeds 8, 6, The status

‘of each previously placed bet is passed tothe ser terminal

3 for display to the use. IFthe user has won any ofthe bets,

the central processing machine 1 insiicts the accounting

system IT to credit the user's acconnt accoedingly

‘The system may also be provided with a facility to offer

to buy an unexpired bet back from the user. The price that.

is offered for a bet is calelated by fist determining the

value ofthe bet using similar techniques to those desrbed 40

above, witha house mark-up being included in the price. As

eseribed above, the user is given no more than thiety to

sixty seconds to decide whether or aot to aecept the price

offered before the offer is withdrawn.

All of the wansactions between the senttal processing

‘machine 1 and the users ofthe system may be monitored by

an administrator of the system athe management terminal

12. This facility allows the administrator to ensure that the

system is running smoothly and thatthe algorithms and/or

‘models employed by the contal processing machine 1 are

producing appropriate resus

‘Asa frther consideration, the administrator of the system,

:may’be concemed about his or her financial exposure athe

system may accordingly include means to inform the admin

istrawr, in real-time, of the financial exposure via the

‘management terminal 12. This facility allows the adminis-

trator to “hedge” in the futures and options markets, There

are four types of hedging ratio commonly used, namely the

ela, theta, gamma and vega hedging ratios. These ratios,

along with the appeopriate hedging echnigues, are well

‘known in the ar.

In an altomative embodiment, the E-cash or credit card

payment system 9 is replaced by a system that operates with,

“viral” or “fantasy” money instead of real fund. In such

an embodiment, betors are allocated an initial amount of

“fantasy” money to purchase bets, Suevessfl bettors ave

the chance to win prizes or ober benefits

10

As a further consideration, whether or not the payment

system comprises real or fantasy” money, the administrator

of the system may wish 10 ack the bettors who are

consistenily successful at forecasting the direction of the

5 financial markets, The wministator knows that under the

assumption of efficent markets, no person may consistently

forecast the financial markets, and therefore succesful et-

tors are simply those that have beea suocessfl by chance

However, tracking successful bets may provide useful

10 information forthe administrator, such as useful elves for

‘wocking down problems with this embodiment. The admin

istrator may also sell or provide the information comprised

ofthe ongoing bes of the sucessful bettors, o third partes

‘who may choose to use or rely upon this information onthe

1 elif thatthe succesful bettors have a special gift rather

than being simply lucky.

‘The betting system for caleulating the fixed-price odds

that may be offered to a prospective bettor is particularly

‘well-suited to bets placed on the financial markets since the

2 calculation of fixed-price okl is suliciently dial, time

consuming and computationally intensive o make caleula-

tion thereof by humans inefficient forall but the largest of

bots. The systom described herein allows an administrator of

the system to offer reasonable and well-alculated odds in

reabtime to individual speculators beting small sums of

‘money on an almost unlimited number of eventualites,

‘without the need o employ highly-skilled staff to do so, This

servie has not been available in the past

will be obvious to those having skill inthe at that many

‘changes may be made to the deals of the above-described

cembodiments without departing fom the underlying pein-

ciples theroof, The scope of the preset invention should,

therefore, be determined only by the following claims,

“The invention claimed is:

1. A method of operating a fixed-odds betting system

including a cena processing mochine in communication

wit a data feed o a soure of data concerning a financial

‘market, and a user terminal in communication with the

central processing machine, the method comprising the steps

of

Via the user terminal, accepting from a user multiple

parameters relating toa ixed-odls hot on an aspect of

‘financial market:

at the central processing machine, receiving one of more

of the parameters from the user terminal;

atthe central processing machine, obtaining data coacem-

ing the financial market via the data feed;

at the central processing machine, calculating a fhxed-

fodds price for the bet based on at least one of the

parameters ceived from the user terminal and the dsta

obtained from the dat feed; and

communicating the fixed-odds price to the user.

2. A method according to claim 1 further comprising

displaying the calculated fixed-ods price to the user.

3. A method according to claim 1, father comprising:

receiving an authorization from the user to place the bet

‘and

receiving a payment from the user foe placing the bet.

4, A method according to claim 1, futher comprising:

placing the bet; and

crediting an account ofthe user in response to uctation

of said aspect of the fiancial market satisfying the

parameters ofthe bt.

5, A method according to claim 1, wherein the step of

obiaining data concerning the financial market includes

biasing eeul-time data

s

US 7,206,762 B2

aT

6.4 method according to claim 1, wherein the step of

obiaining data concerning a financial market includes

oblaiaing historical data representative ofa history of mar

et prices.

7. A method according to claim 1, wherein the sep of $

calculating the fixed-odds price comprises calculating an

estimate of a future volatility of the financial marke.

8. A.method according to claim 7, whercin:

the sep of obtaining data concerning the financial market

inlides obtaining real-time data concerning the finan-

cial marke; and

the step of caleulating the estimate ofthe fature volatility

‘ofthe fmancial market is at eat partially based on the

realtime data

9, A method according to claim 1, futher comprising:

befor: calculating the fixeddds price, checking the

parameters input by the user fr logical inconsistencies

therebetween,

10. A method according to claim 1, further comprising:

‘before calculating the fxed-odds pice, checking an open

ing time of the fnaneial market

11, A method according to claia 1, wherein

the central processing machine is in communication with,

‘a second dala ead to a source of data concerning a

second financial market different from the financial *

market and

the step of receiving parameters from the user terminal

includes receiving parameters relating to an aspect of

the second financial market.

12. A method secording to claim 1, wherein:

the ceatral processing machine i in communication with

1 second data food to a source of data concerning &

second fnancial market different from the financial

smarket; and

the step of caleuating the fixed-adds price for the het

includes calculating a conelation matrix containing

information concerning the financial market and the

second financial market

13. A method according to claim 1, wherein the system

further includes a data storage facility accessible By the

central processing machine, and furter comprising storing

in the daa storage facility information eating to previously

placed bes

14. A method according to claim 13, fuer comprising

reading from the data storage failty the stored information

relating to previously placed bets, and wherein the step of

caleulating the fixed-odds price for the bet includes ealeu-

lating» hedging factor based on te information concerning

previously placed bets read from the storage facility

15, A.method according to claim 13, futher comprising:

at the central processing machine, calculating a price at

which to oll to buy one or more of the previously

placed bets

16. A method according to claim 18, further comprising

providing the price to the user via the user termi

17. Amethod according 1 claim 1, wherein the financial

‘market includes a foreign cureney market.

18, A method accorting 1 claim 1, wherein the financial

market includes a commodities market

19. A method according t claim 1, wherein the financial

‘market includes a stock market

20, A method according to claim 1, wherein the aspect of

the financial market includes change ina market index.

21. A method according to claim 1, wherein the aspect of

the financial market includes a change ina stock price

x

8

s

12

22. A method acconding to claim 1, wherein the aspect of

‘he financial market includes a change in a foreign currency

exchange ete

23. A method acconling to claim 1, wherein the step of

receiving one or more parameters from the user terminal

includes receiving an identifier of a selected financial mar

et

24, A method acconling to claim 1, wherein the step of

receiving one or more parameters from the user terminal

includes receiving information regarding an amount thatthe

ser wishes to win,

25, A method acconling to claim 1, whercin the step of

receiving one o more parameters from the user terminal

includes receiving 2 target level ofthe aspect of te financial

market.

26. A computer program embodied on a computer read

able medium and operable on a central processing machine

in communication with a data fed, for:

receiving one or more parameter from a use relating 10

a fixed-odds bet on an aspect of financial market;

obtaining dota conceming the financial market vi the

data foods

calelating fixes price for the bet based on at least

‘one of the parameters received from the user aud the

data obiined via the data feed; and

communicating the fixed-odds price to the user.

27.8 computer program according to claim 26, whercia

the step of calculating the fxed-ods price comprises cal~

culating an estimate of a fiture volatility of the financial

market

28. A computer program according to claim 27, wherein:

the data feed includes a realtime data feed: nd

the step of obtaining data concerning the financial market

includes obtaining real-time data conceming the finan-

cial market via the data feed; and

the step of calulating the fixed-odds price is atleast,

partially based om the real-time dat

29. A fixed-odds betting system comprising:

‘means for accepting bet parameters from user relating 0

a fixed-ods bet on an aspect of financial market;

means for obtaining financial market data;

means for calculating a ixed-ods price forthe fined-odds

bet based on at least one ofthe bet parameters from the

user and at least some of the financial market data

obtained; and

means for communicating the fxed-oclds price to the wer.

30. A fixed-odds beting system according to claim 29,

‘wherein at least one of the bet parameters is @ predicted

performance of an aspect of the financial market and further

comprising. means for calculating. a fixed odds for the

predicted performance ofthe financial market

31. A fixed-odds beting system aecording to claim 30,

wherein the predicied performance includes a predicted

‘Muctuation of the aspect of the financial market during abet

period of the bet.

32. A fixed-odds beting system comprising:

‘user terminal operable to accept from a user multiple

parameters relating toa fixed-ods bet on an aspect of

a financial market;

1 data feed to a source of data conceming the financial

market and

‘central processing machine in communication withthe

ata fee aad the user ternal, the central processing

‘machine operable to calculate fxed-odds price forthe

fixed-odds bet based on at Least one of the parameters

‘input by the user and data obtained fom the data feed.

US 7,206,762 B2

13

33. A system according to claim 32, wherein the data feed

includes a real-time data food to a source of real-time data

‘concerning the financial market

34. Asystom according to claim 32, wherein the source of

data conceming the financial market includes a source of

historical data eonceming the finaacil market.

35. A system according to claim 32, wherein the central

processing machine isin communication with the data feed

‘over a data communications network.

36. A.ystem according to claim 32, further comprising a

sevond data feed to a source of data concering a second

Financial marke different from the fsancil market.

37. A sysiem according to claim 36, wherein the central

processing machine is operable to compute a coalation

‘matrix for the financial market and the second financial

market.

238. A system according to claim 32, wherein the central

processing. machine is in communication with the user

terminal over a data communication network.

39. A.gystem according to claim 38, wherein the central

processing machine serves an interface to the user terminal,

And the user teminal is operable to display the interface to

the user for facilitating input ofthe parameters.

40. Asystem according to ela 39, wherein the interface

includes set of menus from which the user ean select at

least some of the parameters,

41 Asystem according to elsim 32, further comprising

data storage fxility aocessible by the central processing

‘machine the data storage fality operable for string iafor-

‘mation regarding previously placed bes.

42, A ystem acconding to claim 32, futher comprising

snultiple other user terminals in communication with the

central processing machine for accepting bets from other

users, and wherein the central processing machine is oper-

able to identity one or more successful users whose bets are

consistently success

43. \ system according to claim 42, further comprising

means for proving toa third party information concerning

bets placed by one or more ofthe succesful users.

44, system according to claim 32, further comprising 8

faciity for buying hack the fixed-odds bet from the usr.

45. A system acconling to claim 32, fuer comprising a

‘payment system in communication with the central process-

ing machine and configured to reeive a payment from the

user forthe Hixed-odd pice.

46. Asystem acconting fo claim 32, futher comprising an

accounting system inked tothe central processing machine

47. Asystem according to claim 46, wherein the ac

{ng gystem maintains an account forthe user and ered the

‘account in response to fuetustion of said aspect of the

financial market satisfying the parameters of the fixedodds

bet

48. A computerimplemented method for beting on a

‘nancial market, comprising:

presenting an interface including a set of memus for

facilitating selection ofa set of parameters fora bet;

receiving the set of parameters from a user via the

imerface;

obtaining financial market data conceming the finsocil

market

caleulating a fxed-odd price forthe bet based on the se

‘of parameters received from the user and ut least some

of the financial market data

offering the bet to the user forthe fixed-odds price: and

receiving from the user an acceptance ofthe oller and a

paymeat of the fixed-adds price,

8

s

14

49. A method according to claim 8, wherein the finan

market includes a foreign cureney market

50. A method according to claim 48, wherein the financial

‘market includes a commodities market.

1. Amethod according to claim 4, wherein the financial

‘market includes stock marke

52. A method acconling to claim 48, wherein the set of

parameters includes a change in a market index.

53. method acconling to claim 48, wherein the set of

parameters includes a change in a stock price

54. A method acconling to claim 48, wherein the set of

parameters includes a change ina foreign curency exchange

rte.

58. A method acconling to claim 48, wherein the set of

parameters includes a selected financial market,

56. A method acconling to claim §8, wherein the set of

parameters includes:

‘target fr the selected financial market:

1 second selected financial market; and

‘target fr the second selected financial market

57. A method according to claim 86, wherein the step of

calculating the fixed-odds price fr the bet includes ealeu-

lating correlation matrix for the selected fiaaacal market

and the second selected financial market.

58. A method acconling to claim 48, wherein the set of

parameters includes a bot period,

59. A metho! acconting.to claim $8, wherein calculating

te fixed-odds price comprises estimating a future volatility

of the faancil market during the bet period

60. A method acconting to elim 48, wherein the set of

parameters includes a bet expiration time:

‘61. A method accondingto claim 60, wherein calculating

the fixed-odds price comprises estimating a fue volatility

of the fmuncial market for @ period preceding the bet

expiration time,

62. Amethod according to claim 48, wherein the financial

‘market data ineludes real-time market data

63. Amethod according to claim 48, wherein the financial

‘market data includes historical market data

64. method acconling to claim 48, wherein the set of

parameters includes a target for an aspect ofthe financial

market

65. A method acconting to claim 64, wherein the target

includes a range.

(6. A method acconting to claim 64, wherein the target

includes a hair

67. Amethod according to claim 64, wherein the finan

‘market includes @ foreign euerency’ market and the target

includes a predicted currency exchange rate

68 A method according to claim 64, wherein the financial

market includes a stock market and the target includes a

predicted stock price,

69, Amethod according to claim 64, wherein the aspect of

the financial market includes a market index.

70. A method according to claim 69, wherein the financial

‘market includes a commodities market.

‘TL-Amethod according to claim 69, wherein the financial

‘market includes a stock mack.

72. A method according to claim 48, futher comprising

‘monitoring the financial market; and

in response to the financial market meeting the set of

parameters, providing a et payollt the ser.

7B. A method acconling to claim 72, wherein the set of

parameters inludes abet period and the step of monitoring

ofthe financial market ineludes obtaining market data for

the bet period

US 7,206,762 B2

15

74. A method according to claim 48, whersin the step of

offering the bot to the use involves offering the bot to the

ser fora limited time.

78. A method according to claim 74, wherein the limited

time is between 30 seconds and 60 seconds.

6. A method ccordng to claim 48, whecn:

the financial market has a growth rate; and

the step of calulating the fixe-odds price is at least

partially based on the growth rate

7A method according to claim 48, wherein the bet has

‘bet expiation time, an, after rceiving the acceptance and

the payment from the user and before the het expiration

‘ime, further comprising:

calulating a cureat value ofthe bet; and

offering to buy the bet from dhe use fra price based on

the Value ofthe bet.

16

78. A method according to claim 48, futher comprising:

storing information conceming the bet and one or more

other previously-ploced bets; and

calculating a hedging factor based on the bet and the

5 previously-placed bets.

79. A method according to claim 48, further compising:

storing predictions made by multiple betors:

‘comping te predictions o outcomes of events to which

the prodictions relate; and

identifying at least one successful bettor whose predic-

tions ar consistently similar to the outcomes

80, A method according to claim 79, further comprising

offering toa third party information comprising subsequent

predictions made by the atleast one succesful bettor

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Like Kind Card Game (US Patent 6193235)Document12 pagesLike Kind Card Game (US Patent 6193235)PriorSmartNo ratings yet

- Like Kind Money Board Table Game (US Patent 6186505)Document11 pagesLike Kind Money Board Table Game (US Patent 6186505)PriorSmartNo ratings yet

- Method and Apparatus For Retrieving Data From A Network Using Linked Location Identifiers (US Patent 6226655)Document22 pagesMethod and Apparatus For Retrieving Data From A Network Using Linked Location Identifiers (US Patent 6226655)PriorSmartNo ratings yet

- Casing Spacer (US Patent 6736166)Document10 pagesCasing Spacer (US Patent 6736166)PriorSmartNo ratings yet

- Wine Cellar Alarm System (US Patent 8710985)Document11 pagesWine Cellar Alarm System (US Patent 8710985)PriorSmartNo ratings yet

- Modern Telecom Systems LLCDocument19 pagesModern Telecom Systems LLCPriorSmartNo ratings yet

- Cell Regulatory Genes, Encoded Products, and Uses Related Thereto (US Patent 7030227)Document129 pagesCell Regulatory Genes, Encoded Products, and Uses Related Thereto (US Patent 7030227)PriorSmartNo ratings yet

- Intelligent User Interface Including A Touch Sensor Device (US Patent 8288952)Document9 pagesIntelligent User Interface Including A Touch Sensor Device (US Patent 8288952)PriorSmartNo ratings yet

- User Interface With Proximity Sensing (US Patent 8035623)Document15 pagesUser Interface With Proximity Sensing (US Patent 8035623)PriorSmartNo ratings yet

- Multicasting Method and Apparatus (US Patent 6434622)Document46 pagesMulticasting Method and Apparatus (US Patent 6434622)PriorSmartNo ratings yet

- High-Speed Serial Linking Device With De-Emphasis Function and The Method Thereof (US Patent 7313187)Document10 pagesHigh-Speed Serial Linking Device With De-Emphasis Function and The Method Thereof (US Patent 7313187)PriorSmartNo ratings yet

- Casino Bonus Game Using Player Strategy (US Patent 6645071)Document3 pagesCasino Bonus Game Using Player Strategy (US Patent 6645071)PriorSmartNo ratings yet

- TracBeam v. AppleDocument8 pagesTracBeam v. ApplePriorSmartNo ratings yet

- Advance Products & Systems v. CCI Piping SystemsDocument5 pagesAdvance Products & Systems v. CCI Piping SystemsPriorSmartNo ratings yet

- VIA Technologies Et. Al. v. ASUS Computer International Et. Al.Document18 pagesVIA Technologies Et. Al. v. ASUS Computer International Et. Al.PriorSmartNo ratings yet

- Senju Pharmaceutical Et. Al. v. Metrics Et. Al.Document12 pagesSenju Pharmaceutical Et. Al. v. Metrics Et. Al.PriorSmartNo ratings yet

- Perrie v. PerrieDocument18 pagesPerrie v. PerriePriorSmartNo ratings yet

- Richmond v. Creative IndustriesDocument17 pagesRichmond v. Creative IndustriesPriorSmartNo ratings yet

- Eckart v. Silberline ManufacturingDocument5 pagesEckart v. Silberline ManufacturingPriorSmartNo ratings yet

- Senju Pharmaceutical Et. Al. v. Metrics Et. Al.Document12 pagesSenju Pharmaceutical Et. Al. v. Metrics Et. Al.PriorSmartNo ratings yet

- ATEN International v. Uniclass Technology Et. Al.Document14 pagesATEN International v. Uniclass Technology Et. Al.PriorSmartNo ratings yet

- Sun Zapper v. Devroy Et. Al.Document13 pagesSun Zapper v. Devroy Et. Al.PriorSmartNo ratings yet

- GRQ Investment Management v. Financial Engines Et. Al.Document12 pagesGRQ Investment Management v. Financial Engines Et. Al.PriorSmartNo ratings yet

- Merck Sharp & Dohme v. Fresenius KabiDocument11 pagesMerck Sharp & Dohme v. Fresenius KabiPriorSmartNo ratings yet

- Mcs Industries v. Hds TradingDocument5 pagesMcs Industries v. Hds TradingPriorSmartNo ratings yet

- Shenzhen Liown Electronics v. Luminara Worldwide Et. Al.Document10 pagesShenzhen Liown Electronics v. Luminara Worldwide Et. Al.PriorSmartNo ratings yet

- TracBeam v. T-Mobile Et. Al.Document9 pagesTracBeam v. T-Mobile Et. Al.PriorSmartNo ratings yet

- Dok Solution v. FKA Distributung Et. Al.Document99 pagesDok Solution v. FKA Distributung Et. Al.PriorSmartNo ratings yet

- Merck Sharp & Dohme v. Fresenius KabiDocument10 pagesMerck Sharp & Dohme v. Fresenius KabiPriorSmartNo ratings yet

- Multiplayer Network Innovations v. Konami Digital EntertainmentDocument6 pagesMultiplayer Network Innovations v. Konami Digital EntertainmentPriorSmartNo ratings yet