Professional Documents

Culture Documents

TVM Formulas (I, N)

Uploaded by

Vikas SonkarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TVM Formulas (I, N)

Uploaded by

Vikas SonkarCopyright:

Available Formats

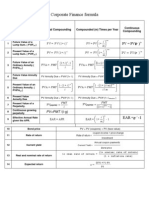

N

u

Time Value of

m Continuous

Money Formula Annual Compounding Compounded (m) Times per Year

b Compounding

For:

e

r

nm

Future Value of a i

1 F V = P V ( 1 + i )n FV = PV 1 + FV = PV(e )in

Lump Sum. ( FVIFi,n ) m

- nm

Present Value of a i

2 PV = FV ( 1 + i )-n PV = FV 1 + PV = FV( e )-in

Lump Sum. ( PVIFi,n ) m

Future Value of an ( 1 + i )n - 1 1 (i / m) nm 1

3 FVA = PMT FVA PMT

Annuity. ( FVIFAi,n ) i i/m

Present Value of an 1 - ( 1 + i )- n 1 - 1 + (i / m) - nm

4 PVA = PMT PVA = PMT

Annuity. ( PVIFAi,n ) i i/m

Present Value of a PMT PMT

5 PVperpetuity PVperpetuity

Perpetuity. i [(1 i )1/ m 1]

m

Effective Annual Rate i

6 EAR = APR EAR = 1 + - 1 EAR = e i - 1

given the APR. m

The length of time ln ( FV/PV)

ln (FV/PV) n= 1

7 required for a PV to n= i

grow to a FV. ln (1 + i ) m * ln 1 n=

i

* ln ( FV/PV)

m

The APR required for FV

1/ n FV 1 /( nm )

1

8 i= -1 i = m * - 1 i = * ln (FV/PV)

a PV to grow to a FV. PV PV

n

i FVA m

The length of time (FVA)( i ) ln +

required for a series ln + 1 m PMT i

9 PMT n=

of PMT’s to grow to a n= i

future amount (FVA). ln (1 + i ) m * ln 1 +

m

( PVA )(i / m)

( PVA )(i ) ln 1

ln 1 PMT

n

The length of time

PMT , ,

required for a series n i

10 of PMT’s to exhaust a ln (1 i ) m * ln1

specific present m

amount (PVA).

for PVA(i) < PMT

for PVA(i/m) < PMT

Legend

i = the nominal or Annual Percentage Rate n = the number of periods

m = the number of compounding periods per year EAR = the Effective Annual Rate

ln = the natural logarithm, the logarithm to the base e e = the base of the natural logarithm ≈ 2.71828

PMT = the periodic payment or cash flow Perpetuity = an infinite annuity

Prepared by Jim Keys

You might also like

- Corporate Finance Formulas: A Simple IntroductionFrom EverandCorporate Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- PMT I N: 1 +) (FVA) (LNDocument2 pagesPMT I N: 1 +) (FVA) (LNSave All Hindu TemplesNo ratings yet

- Time Value of Money FormulasDocument2 pagesTime Value of Money FormulasZubayer HussainNo ratings yet

- Formula Time Value of MoneyDocument2 pagesFormula Time Value of MoneySaifur R. SabbirNo ratings yet

- FN3105 Formula Spreadsheet Mid TermDocument1 pageFN3105 Formula Spreadsheet Mid TermGD GamingNo ratings yet

- Business Finance FORMULA SHEETDocument1 pageBusiness Finance FORMULA SHEETAli JibranNo ratings yet

- Time Value of Money FormulasDocument1 pageTime Value of Money FormulasAmit Shankar Choudhary100% (1)

- Chapter 4: Time Value of MoneyDocument41 pagesChapter 4: Time Value of MoneyAnkush SharmaNo ratings yet

- Time Value of Money Formulas SheetDocument1 pageTime Value of Money Formulas SheetBilal HussainNo ratings yet

- Corporate Finance FormulasDocument3 pagesCorporate Finance FormulasMustafa Yavuzcan83% (12)

- FBL2Document14 pagesFBL2FaleeNo ratings yet

- Maximizing Shareholder Value Through Discounted Cash Flow AnalysisDocument18 pagesMaximizing Shareholder Value Through Discounted Cash Flow AnalysisPhuntru PhiNo ratings yet

- Distance Test PDFDocument10 pagesDistance Test PDFSoneni HandaNo ratings yet

- Quick Reference: TVOM Formulas: Compound InterestDocument8 pagesQuick Reference: TVOM Formulas: Compound Interestbasco23No ratings yet

- TMV Practice ProblemsDocument3 pagesTMV Practice ProblemsPrometheus SmithNo ratings yet

- Liquidity Maturity Risk Return Current Account/demand Deposit Saving Account/profit and Loss Sharing Fixed Account/term DepositDocument10 pagesLiquidity Maturity Risk Return Current Account/demand Deposit Saving Account/profit and Loss Sharing Fixed Account/term DepositRuman MahmoodNo ratings yet

- FM (Actuary Exam) FormulasDocument15 pagesFM (Actuary Exam) Formulasmuffinslayers100% (1)

- Formula Sheet-Coporate FinanceDocument3 pagesFormula Sheet-Coporate FinanceWH JeepNo ratings yet

- TVM formulae cheat sheetDocument4 pagesTVM formulae cheat sheetShawron weevNo ratings yet

- Investment Tools - Time Value of MoneyDocument29 pagesInvestment Tools - Time Value of MoneyPankaj KumarNo ratings yet

- Formula Sheet (Time Value of Money)Document3 pagesFormula Sheet (Time Value of Money)Allan CabreraNo ratings yet

- Exam FM Formula Summary: A Few NotesDocument9 pagesExam FM Formula Summary: A Few NotesFemibarinNo ratings yet

- Corporate Finance Lesson 1Document13 pagesCorporate Finance Lesson 1Vivian WongNo ratings yet

- (4.4) (4.5) Future Value Interest Factor: F - C 4 5 - B FDocument2 pages(4.4) (4.5) Future Value Interest Factor: F - C 4 5 - B FtheatresonicNo ratings yet

- Calculate fair share price using dividend discount modelDocument9 pagesCalculate fair share price using dividend discount modelTannao100% (1)

- Summary of Formulas For Time Value of MoneyDocument3 pagesSummary of Formulas For Time Value of MoneyMarilyn Varquez100% (1)

- Calculating WACC and Valuing Projects with Different Costs of CapitalDocument7 pagesCalculating WACC and Valuing Projects with Different Costs of CapitalkasimgenelNo ratings yet

- Finance Midterm Formula SheetDocument1 pageFinance Midterm Formula SheetDonMuslimanoNo ratings yet

- Final Formula SheetDocument2 pagesFinal Formula SheetShahzia MudbhatkalNo ratings yet

- Cong ThucDocument12 pagesCong ThucGiang Thái HươngNo ratings yet

- Formula Sheet For Mid-Term ExamDocument4 pagesFormula Sheet For Mid-Term ExamPrashant Pratap SinghNo ratings yet

- Pvif 1 - (1+i) - N (1 - (1+i) - N) /i I FVIF (1+i) N - 1 (1+i) (N) - 1) /i IDocument12 pagesPvif 1 - (1+i) - N (1 - (1+i) - N) /i I FVIF (1+i) N - 1 (1+i) (N) - 1) /i ISyed Abdul Mussaver ShahNo ratings yet

- Time Value Money Formulas ExplainedDocument3 pagesTime Value Money Formulas ExplainedRahat IslamNo ratings yet

- Time Value of Money Formula Sheet: Financial ManagementDocument3 pagesTime Value of Money Formula Sheet: Financial ManagementTechbotix AppsNo ratings yet

- Time Value of Money: Formulas & ExamplesDocument12 pagesTime Value of Money: Formulas & ExamplesKarthik HegdeNo ratings yet

- Calculating Present and Future Values of Cash FlowsDocument3 pagesCalculating Present and Future Values of Cash FlowsjainswapnilNo ratings yet

- Determinants of Interest RatesDocument51 pagesDeterminants of Interest RatesBrithney ButalidNo ratings yet

- TVM Concepts ExplainedDocument32 pagesTVM Concepts ExplainedVivek SharmaNo ratings yet

- Time Value of Money: Suggested Readings: Chapter 3, Van Horne / DhamijaDocument18 pagesTime Value of Money: Suggested Readings: Chapter 3, Van Horne / DhamijaSaurabh ChawlaNo ratings yet

- Time Value of MoneyDocument4 pagesTime Value of MoneyChitrakshi KumarNo ratings yet

- Time Value of Money 2Document11 pagesTime Value of Money 2techukjobsNo ratings yet

- Investment Tools - Time Value of MoneyDocument34 pagesInvestment Tools - Time Value of MoneyChanchal PurohitNo ratings yet

- Finance 3000 Midterm2 Formula Sheet: October 28, 2015Document2 pagesFinance 3000 Midterm2 Formula Sheet: October 28, 2015Jack JacintoNo ratings yet

- ) K + 1 PV ( FV: PVGP PMT/ (K-G) (C+ (M-P) /N) / (M+P) /2 + + 2Document1 page) K + 1 PV ( FV: PVGP PMT/ (K-G) (C+ (M-P) /N) / (M+P) /2 + + 2Shubham AggarwalNo ratings yet

- Fin All Formula - Docx 1Document9 pagesFin All Formula - Docx 1Marcus HollowayNo ratings yet

- FRL 300 Formula Sheet Common FinalDocument3 pagesFRL 300 Formula Sheet Common FinalAnonymous WimU99ilUNo ratings yet