Professional Documents

Culture Documents

US Internal Revenue Service: f8810 - 1991

Uploaded by

IRSOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

US Internal Revenue Service: f8810 - 1991

Uploaded by

IRSCopyright:

Available Formats

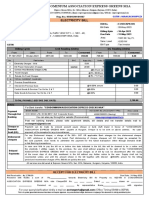

8810

OMB No. 1545-1091

Corporate Passive Activity Loss and Credit Limitations

Form

© See separate instructions.

© Attach to your tax return (personal service corporations and

Department of the Treasury

Internal Revenue Service closely held corporations only).

Name Employer identification number

1991 Passive Activity Loss

Part I

Caution: See the instructions and Worksheets 1 and 2 on page 7 before completing Part I.

1a Income (from Worksheet 2, column (a)) 1a

b Deductions and losses (from Worksheet 2, column (b)) 1b ( )

c Prior year unallowed losses (from Worksheet 2, column (c)) 1c ( )

d Combine lines 1a, 1b, and 1c. If the result is net income or -0-, see instructions 1d

2 Closely-held corporations enter net active income and see instructions. Personal

service corporations enter -0- on this line 2

3 Unallowed passive activity deductions and losses. Combine lines 1d and 2. If the

result is net income or zero, see the instructions for lines 1d and 3. Otherwise, go to

line 4 3

4 Total deductions and losses allowed. Add the income, if any, on lines 1a and 2 and

enter the result. See instructions 4

1991 Passive Activity Credits

Part II

Caution: See the instructions and complete Worksheet 5 on page 10 before completing Part II.

5a Current year passive activity credits (from Worksheet 5,

column (a)) 5a

b Prior year unallowed credits (from Worksheet 5, column (b)) 5b

6 Add lines 5a and 5b 6

7 Enter the tax attributable to net active income and net passive income. See

instructions 7

8 Unallowed passive activity credit. Subtract line 7 from line 6. If zero or less,

enter -0- 8

9 Allowed passive activity credit. Subtract line 8 from line 6. See instructions 9

For Paperwork Reduction Act Notice, see separate instructions. Cat. No. 10356T Form 8810 (1991)

You might also like

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- US Internal Revenue Service: 2290rulesty2007v4 0Document6 pagesUS Internal Revenue Service: 2290rulesty2007v4 0IRSNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- 2008 Objectives Report To Congress v2Document153 pages2008 Objectives Report To Congress v2IRSNo ratings yet

- 2008 Data DictionaryDocument260 pages2008 Data DictionaryIRSNo ratings yet

- 2008 Credit Card Bulk Provider RequirementsDocument112 pages2008 Credit Card Bulk Provider RequirementsIRSNo ratings yet

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Electricity Bill-35Document1 pageElectricity Bill-35geswanthuppalNo ratings yet

- Oka Precast Reinforced Concrete ManholesDocument2 pagesOka Precast Reinforced Concrete ManholesDukiyo SuperNo ratings yet

- ARRIETA LHIE IAN Research Project RevisedDocument27 pagesARRIETA LHIE IAN Research Project RevisedIan OcheaNo ratings yet

- NorCo Small Business GrantsDocument3 pagesNorCo Small Business GrantsBernieOHare100% (1)

- ASSIGNMENT 4 ReportsDocument10 pagesASSIGNMENT 4 ReportsNursiti DzulayhaNo ratings yet

- Sapfi ClassDocument224 pagesSapfi ClassGUDALANo ratings yet

- Xero Tax All in One GuideDocument19 pagesXero Tax All in One Guidehelencwan0142No ratings yet

- Pega AcademyDocument4 pagesPega AcademySudheer ChowdaryNo ratings yet

- NCR Companies 2023Document4 pagesNCR Companies 2023Bryan ObcianaNo ratings yet

- Quality 101Document98 pagesQuality 101Fadille NabbouhNo ratings yet

- Quiz-on-Related-Party-Disclosures AnsweDocument3 pagesQuiz-on-Related-Party-Disclosures AnsweLynssej Barbon0% (1)

- Richards, K - TrinidadDocument13 pagesRichards, K - TrinidadManuela MarínNo ratings yet

- Maruti Company During Lockdown: R. C. Bhargava (Chairman)Document3 pagesMaruti Company During Lockdown: R. C. Bhargava (Chairman)Ehtesam AlamNo ratings yet

- Ijebmr 1074 PDFDocument16 pagesIjebmr 1074 PDFI.G.N. Andhika MahendraNo ratings yet

- Emergency Plan For Construction SitesDocument4 pagesEmergency Plan For Construction SitesK S KumaraNo ratings yet

- Pay Slip-2Document1 pagePay Slip-2najarooddin1992No ratings yet

- Hbo Case Study FinalDocument2 pagesHbo Case Study FinalLysss EpssssNo ratings yet

- Digital TransformationDocument348 pagesDigital Transformationertawa waterNo ratings yet

- Implementation Guide 1111: Standard 1111 - Direct Interaction With The BoardDocument3 pagesImplementation Guide 1111: Standard 1111 - Direct Interaction With The BoardGemanta Furi BangunNo ratings yet

- EPC4A HUC Estimating Methodology Rev 0Document21 pagesEPC4A HUC Estimating Methodology Rev 0Amine DabbabiNo ratings yet

- Lea - Notes On Industrial Security ConceptsDocument45 pagesLea - Notes On Industrial Security ConceptsRODOLFO JR. CASTILLO100% (1)

- Introduction To Success by DesignDocument12 pagesIntroduction To Success by DesignWalter Carlin JrNo ratings yet

- S4 Sop Effect of Emotional IntelligenceDocument13 pagesS4 Sop Effect of Emotional IntelligenceEDUARDO RODOLFO RAMIREZ LOPEZNo ratings yet

- 2014 Pfizer Financial Report PDFDocument123 pages2014 Pfizer Financial Report PDFJoeNo ratings yet

- Parta SystemDocument3 pagesParta Systemspace_ajayNo ratings yet

- CFI Advanced Excel Formulas & Functions - BlankDocument6 pagesCFI Advanced Excel Formulas & Functions - BlankNew Era Games80% (5)

- Pom 1 Mod 3Document13 pagesPom 1 Mod 3Bhumika TewaryNo ratings yet

- MBI7211 - Sserumaga James and Hamdi Omar OsmanDocument4 pagesMBI7211 - Sserumaga James and Hamdi Omar Osmanjonas sserumagaNo ratings yet

- HRDocument8 pagesHROreo FestNo ratings yet

- Everest Group Life Annuity Insurance AssessmentDocument14 pagesEverest Group Life Annuity Insurance AssessmentKoyel RoyNo ratings yet