Professional Documents

Culture Documents

Chapt-1 Gen. Prin

Uploaded by

giopar08Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapt-1 Gen. Prin

Uploaded by

giopar08Copyright:

Available Formats

INCOME TAXATION 5th Edition (BY: VALENCIA & ROXAS) 1

SUGGESTED ANSWERS

Chapter 1: General Principles

and Concepts of Taxation

CHAPTER 1

GENERAL PRINCIPLES AND CONCEPTS OF TAXATION

Problem 1 – 1 TRUE OR FALSE

1. False – Without money provided by tax power, the other inherent powers cannot

function well.

2. True

3. True

4. True

5. True

6. True

7. False – Taxation power is subject to inherent and Constitutional limitations.

8. False – Taxation power is not absolute because it is subject to limitations.

9. True

10. False – penalty is an example of imposition of amount for police power.

11. True

12. False – governmental function unless stated otherwise.

13. False – government agencies engaged in proprietory functions are subject tax unless

stated otherwise.

14. True

Problem 1 – 2 TRUE OR FALSE

1. False – Concurrence of the majority of congress.

2. False – Churches are required to pay income taxes in cases of sale of real property

and business engagement.

3. False – No public funds shall be appropriated for religious purpose.

4. False - All bills even if approved by the 2/3 of the congress should still be signed by

the President to become law.

5. False – No person shall be imprisoned for nonpayment of poll tax.

6. False – Taxation power is essentially legislative function; hence not every government

unit exercises this power.

7. True

8. False - Benefits from taxation may be or may not be experienced.

9. True

10. False – Judicial review

11. False – “Ex post facto” law is not applicable for tax purposes.

12. True

13. False – A tax evader breaks the law while the tax avoider sidesteps it.

14. False – Neither transferable/assignable

15. True

Problem 1 – 3 TRUE OR FALSE

1. True

2. True

3. True

4. True

5. False – prospective effect

6. True

7. True

8. False – national taxes

9. True

10. True

INCOME TAXATION 5th Edition (BY: VALENCIA & ROXAS) 2

SUGGESTED ANSWERS

Chapter 1: General Principles

and Concepts of Taxation

11. True

12. False – Doubts must be resolved liberally in favor of the taxpayer.

13. True

14. True

15. False – null and void

Prob. 1 – 4 Prob. 1 – 5 Prob. 1 – 6 Prob. 1 – 7 Prob. 1 – 8 Prob. 1 – 9

1. A 1. C 1. D 1. B 1. A 1. A

2. C 2. A 2. D 2. C 2. D 2. B

3. C 3. D 3. D 3. D 3. D 3. C

4. A 4. B 4. D 4. D 4. A 4. D

5. B 5. B 5. D 5. D 5. A 5. C

6. B 6. A 6. D 6. B 6. C 6. C

7. A 7. C 7. D 7. B 7. B 7. D

8. C 8. B 8. C 8. C 8. C 8. C

9. C 9. B 9. A 9. C 9. B 9. C

10. C 10. C 10. C 10. B 10. A 10. C

11. C 11. D 11. B 11. B 11. C

12. C 12. D 12. B 12. C 12. B

13. A 13. A 13. A 13. D

14. A 14. D 14. D

15. D 15. C

16. C

17. C

You might also like

- Strategic Analysis of Operating Income and Final VarianceDocument2 pagesStrategic Analysis of Operating Income and Final VarianceZen OrtegaNo ratings yet

- FARAP 4404 Property Plant EquipmentDocument11 pagesFARAP 4404 Property Plant EquipmentJohn Ray RonaNo ratings yet

- Tax Term Quiz TheoriesDocument6 pagesTax Term Quiz TheoriesRena Jocelle NalzaroNo ratings yet

- Module 5&6Document29 pagesModule 5&6Lee DokyeomNo ratings yet

- Mas QuestionsDocument2 pagesMas QuestionsEll VNo ratings yet

- De Leon Solman 2014 2 CostDocument95 pagesDe Leon Solman 2014 2 CostJohn Laurence LoplopNo ratings yet

- Accounting For Income Tax: Technical KnowledgeDocument42 pagesAccounting For Income Tax: Technical KnowledgeAngela Miles DizonNo ratings yet

- Quiz 1 Afar 1Document13 pagesQuiz 1 Afar 1Rujean Salar AltejarNo ratings yet

- Presumptive Input Tax-4% of Gross Value: He Will Be Allowed An Input Tax On His Inventory On The Transition DateDocument5 pagesPresumptive Input Tax-4% of Gross Value: He Will Be Allowed An Input Tax On His Inventory On The Transition DateLala AlalNo ratings yet

- 6&7 Chapter 7-Cost Volume-Profit Relationship and Break-Even AnalysisDocument2 pages6&7 Chapter 7-Cost Volume-Profit Relationship and Break-Even AnalysisShenedy Lauresta QuizanaNo ratings yet

- Mock Deparmentals MASQDocument6 pagesMock Deparmentals MASQHannah Joyce MirandaNo ratings yet

- True FalseDocument2 pagesTrue FalseCarlo ParasNo ratings yet

- Chapter 12 Reviewer IncotaxDocument2 pagesChapter 12 Reviewer IncotaxJere Mae MarananNo ratings yet

- COSTDocument6 pagesCOSTJO SH UANo ratings yet

- KEY Level 2 QuestionsDocument5 pagesKEY Level 2 QuestionsDarelle Hannah MarquezNo ratings yet

- Introduction To Business Taxes: September 4, 2020Document20 pagesIntroduction To Business Taxes: September 4, 2020Bancas YvonNo ratings yet

- AE 22 M TEST 3 With AnswersDocument6 pagesAE 22 M TEST 3 With AnswersJerome MonserratNo ratings yet

- Operational and Financial Budgeting: Multiple ChoiceDocument16 pagesOperational and Financial Budgeting: Multiple ChoiceNaddieNo ratings yet

- TAX-1101: Capital Assets, Capital Gains & Losses: - T R S ADocument3 pagesTAX-1101: Capital Assets, Capital Gains & Losses: - T R S AVaughn TheoNo ratings yet

- (Tax1) - Income Tax On Individuals - Discussion and ActivitiesDocument12 pages(Tax1) - Income Tax On Individuals - Discussion and ActivitiesKim EllaNo ratings yet

- Value Added TaxDocument8 pagesValue Added TaxErica VillaruelNo ratings yet

- Ar&Inventory ManagementDocument10 pagesAr&Inventory ManagementKarlo D. ReclaNo ratings yet

- Toaz - Info Quiz 3 PRDocument25 pagesToaz - Info Quiz 3 PRAprille Xay TupasNo ratings yet

- Relevant Costing Simulated Exam Ans KeyDocument5 pagesRelevant Costing Simulated Exam Ans KeySarah BalisacanNo ratings yet

- Activity No. 1 - Cost, Concepts and ClassificationsDocument4 pagesActivity No. 1 - Cost, Concepts and ClassificationsDan RyanNo ratings yet

- Income Taxation Ind PracticeDocument3 pagesIncome Taxation Ind PracticeJanine Tividad100% (1)

- AGENCYDocument20 pagesAGENCYJoshua CabinasNo ratings yet

- Management Accounting Ii-Budgeting Solve Each Problem Carefully. No Solution, No Credit. Time Limit: Strictly 30 MinutesDocument2 pagesManagement Accounting Ii-Budgeting Solve Each Problem Carefully. No Solution, No Credit. Time Limit: Strictly 30 MinutesJade TanNo ratings yet

- COSTDocument6 pagesCOSTJO SH UANo ratings yet

- INSTRUCTIONS: Select The Best Answer For Each of The Following Attempted. Mark Only One Answer For Each Item On The Answer SheetDocument13 pagesINSTRUCTIONS: Select The Best Answer For Each of The Following Attempted. Mark Only One Answer For Each Item On The Answer SheetMac Ferds100% (2)

- Reviewer in Intermediate Accounting (Midterm)Document9 pagesReviewer in Intermediate Accounting (Midterm)Czarhiena SantiagoNo ratings yet

- Ch13 Current Liabilities and Contingencies 2Document37 pagesCh13 Current Liabilities and Contingencies 2Babi Dimaano NavarezNo ratings yet

- Cost Accounting & Control Final ExaminationDocument6 pagesCost Accounting & Control Final ExaminationAlexandra Nicole IsaacNo ratings yet

- Regulatory Framework and Legal Issues in Business Activity 1Document4 pagesRegulatory Framework and Legal Issues in Business Activity 1x xNo ratings yet

- 2.3 Taxation Coverage For Performance Task 1Document33 pages2.3 Taxation Coverage For Performance Task 1?????No ratings yet

- Module 5Document6 pagesModule 5Mon Ram0% (1)

- As 12 - Full Notes For Accounting For Government GrantDocument6 pagesAs 12 - Full Notes For Accounting For Government GrantShrey KunjNo ratings yet

- Income Taxation IndividualDocument6 pagesIncome Taxation IndividualJessa BeloyNo ratings yet

- M4 - Gross Estate - Special Rules For Married Decedents - Students'Document14 pagesM4 - Gross Estate - Special Rules For Married Decedents - Students'micaella pasionNo ratings yet

- Exercise Estate TaxDocument9 pagesExercise Estate TaxNics VenturaNo ratings yet

- Bsma 2103 - Acc 204 - Midterm Examination (Part 1 - Theories)Document18 pagesBsma 2103 - Acc 204 - Midterm Examination (Part 1 - Theories)Chryshelle LontokNo ratings yet

- Chapter 4 - Job Order and Process CostingDocument12 pagesChapter 4 - Job Order and Process Costingchelsea kayle licomes fuentesNo ratings yet

- Lifted From BAR Exam Questions & QuizzersDocument17 pagesLifted From BAR Exam Questions & QuizzersabcdefgNo ratings yet

- MODULE 2 CVP AnalysisDocument8 pagesMODULE 2 CVP Analysissharielles /No ratings yet

- Acc213 Reviewer Final QuizDocument9 pagesAcc213 Reviewer Final QuizNelson BernoloNo ratings yet

- Title Ii - Incorporation and Organization of Private CorporationsDocument9 pagesTitle Ii - Incorporation and Organization of Private CorporationsTin Tin100% (1)

- Objectives of Financial Statements Analysis: Happened During A Particular Period of Time, Most Users Are Concerned AboutDocument20 pagesObjectives of Financial Statements Analysis: Happened During A Particular Period of Time, Most Users Are Concerned AboutKarla OñasNo ratings yet

- Subsequent Measurement Accounting Property Plant and EquipmentDocument60 pagesSubsequent Measurement Accounting Property Plant and EquipmentNatalie SerranoNo ratings yet

- Naqdown - Final QuestionsDocument41 pagesNaqdown - Final QuestionssarahbeeNo ratings yet

- Property, Plant and Equipment Problems 5-1 (Uy Company)Document14 pagesProperty, Plant and Equipment Problems 5-1 (Uy Company)NaSheeng100% (1)

- Fringe Benefit Part 3Document24 pagesFringe Benefit Part 3kitkathyNo ratings yet

- Financial Accounting and Reporting - QUIZ 8Document5 pagesFinancial Accounting and Reporting - QUIZ 8JINGLE FULGENCIONo ratings yet

- Use The Following Information For The Next Two Questions.: Act1108 Financial Management Inventory Management - ExercisesDocument1 pageUse The Following Information For The Next Two Questions.: Act1108 Financial Management Inventory Management - ExercisesMaryrose SumulongNo ratings yet

- Cost AccountingDocument4 pagesCost AccountingRoselyn LumbaoNo ratings yet

- PINTO - Razmen R. (MASECO MT EXAM)Document4 pagesPINTO - Razmen R. (MASECO MT EXAM)Razmen Ramirez PintoNo ratings yet

- Ch1 - General Principles and Concepts of TaxationDocument3 pagesCh1 - General Principles and Concepts of TaxationJuan FrivaldoNo ratings yet

- Problem 8 - 1 Deductible or Nondeductible From Gross IncomeDocument2 pagesProblem 8 - 1 Deductible or Nondeductible From Gross Incomeriza147No ratings yet

- Audit Theory Chapter 1, Answer KeyDocument3 pagesAudit Theory Chapter 1, Answer KeyABAGAEL CACHONo ratings yet

- Financial Accounting 1 ValixDocument70 pagesFinancial Accounting 1 ValixChraze GBNo ratings yet

- Rolando E. Caser Jr. Tax 2acc BSA-2A MWF 7:30AM - 8:30AM: Chapter 16 - Introduction To Donor's TaxDocument3 pagesRolando E. Caser Jr. Tax 2acc BSA-2A MWF 7:30AM - 8:30AM: Chapter 16 - Introduction To Donor's TaxRolando E. CaserNo ratings yet

- Tax Final (Taxation 1) As at 5th October 2004Document275 pagesTax Final (Taxation 1) As at 5th October 2004Victor J Odongo50% (4)

- Azure InvoiceDocument2 pagesAzure InvoiceAnkit SambhareNo ratings yet

- Chapter 6 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document71 pagesChapter 6 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Bhagya Viva ProjectDocument13 pagesBhagya Viva ProjectBhagya sNo ratings yet

- Reimbursement Expenses ReceiptDocument2 pagesReimbursement Expenses ReceiptIan DalisayNo ratings yet

- Tax Income, Sunk Cost and Opportunity Cost: Week 13Document46 pagesTax Income, Sunk Cost and Opportunity Cost: Week 13satryoyu811No ratings yet

- 3874105301112018Document2 pages3874105301112018Aryan SharmaNo ratings yet

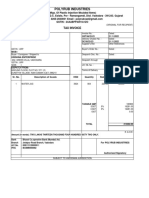

- Polyrub Industries Invoice 56Document1 pagePolyrub Industries Invoice 56jemish limbaniNo ratings yet

- Refer To The Data For Rocky Mountain Resort Inc inDocument2 pagesRefer To The Data For Rocky Mountain Resort Inc inMiroslav GegoskiNo ratings yet

- India OSP GST Challan ReportDocument26 pagesIndia OSP GST Challan ReportLaxmidhara NayakNo ratings yet

- LESCO - Web BillDocument1 pageLESCO - Web BillMalik IrfanNo ratings yet

- Damodaram Sanjivayya National Law University Visakhapatnam, Ap, IndiaDocument18 pagesDamodaram Sanjivayya National Law University Visakhapatnam, Ap, IndiaSamuel NissyNo ratings yet

- Travel Claim - Appendix A, B Etc - DotolloDocument6 pagesTravel Claim - Appendix A, B Etc - DotolloHanzelkris CubianNo ratings yet

- 200115169Document4 pages200115169Mohd Haniff KamaruddinNo ratings yet

- 596 Idbi StatementDocument11 pages596 Idbi Statementsri harshaNo ratings yet

- S.N O. Services Normal Vehicle: Phone: 011-45004321 Email: - WebsiteDocument6 pagesS.N O. Services Normal Vehicle: Phone: 011-45004321 Email: - Websitesridevibalaji0% (2)

- Swiggy Order 58514422563Document2 pagesSwiggy Order 58514422563SakshamNo ratings yet

- Reinforced Earth India PVT LTD E-11, B1 EXTN, Mcie Mathura Road, New Delhi NEW DELHI - 110044 Delhi Payslip For April - 2019Document1 pageReinforced Earth India PVT LTD E-11, B1 EXTN, Mcie Mathura Road, New Delhi NEW DELHI - 110044 Delhi Payslip For April - 2019Kaushik BiswasNo ratings yet

- Payroll Deductions Group 2Document15 pagesPayroll Deductions Group 2Ronel A GaviolaNo ratings yet

- Pin 10594Document1 pagePin 10594r_targettNo ratings yet

- Sector Class FEE PER YEAR (Direct Debit) : Fees For The School Year 2020/2021 Uition EESDocument2 pagesSector Class FEE PER YEAR (Direct Debit) : Fees For The School Year 2020/2021 Uition EESTYDK MediaNo ratings yet

- December StatementDocument3 pagesDecember StatementNoriely Altagracia Paulino Rivas100% (1)

- Chapter 8: Tax Management: Planning, Avoidance and EvasionDocument16 pagesChapter 8: Tax Management: Planning, Avoidance and EvasionCharlesNo ratings yet

- Oct Evolve and TrustDocument2 pagesOct Evolve and TrustSafeBit ProsNo ratings yet

- Sap Fico TutorialDocument29 pagesSap Fico Tutorialkmurali321No ratings yet

- Sol. Man. - Chapter 13 - Acctg For Bot - 2020 EditionDocument4 pagesSol. Man. - Chapter 13 - Acctg For Bot - 2020 EditionKathleen Rose BambicoNo ratings yet

- Certificate of Final Tax Withheld at Source: Faye and Sam General MerchandiseDocument4 pagesCertificate of Final Tax Withheld at Source: Faye and Sam General MerchandiseMay MayNo ratings yet

- 3333Document3 pages3333ßhăñĕ ßîñğhNo ratings yet

- Income Tax Refund ChartDocument2 pagesIncome Tax Refund ChartKelly Phillips ErbNo ratings yet

- AOSRSDocument3 pagesAOSRSvinushasai100% (1)