Professional Documents

Culture Documents

Together We Develop The Nation: Your Responsibility Register If You Are. - .

Uploaded by

nramuduOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Together We Develop The Nation: Your Responsibility Register If You Are. - .

Uploaded by

nramuduCopyright:

Available Formats

INDIVIDUAL

RESPONSIBILITY Your Responsibility * Register If You Are. . . .

Year of Assessment 2009 LHDNM-R/001/10 Register as a taxpayer* Individual receiving annual income more than

Update personal particulars RM25,500 (after EPF deduction)

Marital status

Married individual with non-working spouse

Together We Develop The Nation Address

receiving annual income of RM35,643 and above

Spouse particulars for married cases

(after EPF deduction)

(name, identification card and tax reference no.)

Registration

Submit completed Income Tax Return Form

Don‛t forget your

via e-Filing Method Supporting Document

responsibility..!!

1 e-Daftar Upload the scanned

Declare actual income

(www.hasil.gov.my) Indentification Card No.

Calculate own tax (New/Armed Forces/Police

/Passport)

Comply with tax installment payment instruction

(Employment : Monthly Tax Deduction (MTD)/ 2 Visit the Submit the copy

nearest LHDNM of Indentification Card No.

Other than employment : Notice of Installment Branch (New/Armed Forces /Police

/Passport)

Payment CP500)

Check balance of tax payable

Update personal particulars with employer Your Rights

Pay the tax Appeal

Keep the documents/records for 7 years Receive tax information and advice

Co-operate with LHDNM Comment and suggest

Nik Nasruddin

Teluk Intan

www.hasil.gov.my

1-300-88-3010 Disclaimer

Disclaimer

Thisleaflet

This leafletisisissued

issuedforfor general

general information

information only.only. It does

It does not contain

not contain final or

final advice advice or complete

complete information

information pertaining

pertaining to a particulartotopic

a particular topic

and should andused

not be should not reference

as legal

be used as legal reference.

You might also like

- Control Centre: Ye S N oDocument15 pagesControl Centre: Ye S N osheerazaliNo ratings yet

- 2307 BlankDocument2 pages2307 BlankJames Brooke PalomaNo ratings yet

- E-Filing Home Page, Income Tax Department, Government of IndiaDocument2 pagesE-Filing Home Page, Income Tax Department, Government of IndiassNo ratings yet

- Interest Charge On DISC-Related Deferred Tax Liability: Sign HereDocument2 pagesInterest Charge On DISC-Related Deferred Tax Liability: Sign HereIRSNo ratings yet

- RC ColaDocument2 pagesRC ColaMi MiNo ratings yet

- BIR Form No. 0605Document1 pageBIR Form No. 0605Troa BartonNo ratings yet

- BIR Form 2307Document2 pagesBIR Form 2307Angelique MasupilNo ratings yet

- BIR Form 1601-EDocument2 pagesBIR Form 1601-ELovella Phi Go100% (1)

- Date Entry: Fsic: Assessor: Batch No.: Checker: Return No.:: (Tick One Box Only)Document7 pagesDate Entry: Fsic: Assessor: Batch No.: Checker: Return No.:: (Tick One Box Only)Alvin KumarNo ratings yet

- Certificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasDocument4 pagesCertificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas Internasmar corNo ratings yet

- BIR Payment FormDocument2 pagesBIR Payment FormFratz LaraNo ratings yet

- Annex A - Application Form BIR Form 2119Document2 pagesAnnex A - Application Form BIR Form 2119Antonio Reyes IVNo ratings yet

- Dimensional Service Corporation 2307Document3 pagesDimensional Service Corporation 2307Randy RosasNo ratings yet

- 0605 Version 1999Document2 pages0605 Version 1999radzNo ratings yet

- BIR Form 0605 - Annual Registration FeeDocument2 pagesBIR Form 0605 - Annual Registration FeeRonn Robby Rosales100% (3)

- Certificate of Creditable Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)Document32 pagesCertificate of Creditable Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)Sakura AvhrynNo ratings yet

- BIR Form 0605Document3 pagesBIR Form 0605rafael soriao0% (1)

- Payment Form: Kawanihan NG Rentas InternasDocument4 pagesPayment Form: Kawanihan NG Rentas InternasMarinella Catahan MagalingNo ratings yet

- Republic of the Philippines CertificateDocument2 pagesRepublic of the Philippines CertificateLe Lhiin CariñoNo ratings yet

- Payment Form: Kawanihan NG Rentas InternasDocument3 pagesPayment Form: Kawanihan NG Rentas InternasehrgsdNo ratings yet

- PH TAX FILER RELATED PARTY TRANSACTIONSDocument3 pagesPH TAX FILER RELATED PARTY TRANSACTIONSErica Caliuag0% (1)

- Certificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasDocument4 pagesCertificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas Internaszairah jean baquilarNo ratings yet

- 2307 Jan 2018 ENCS v3Document2 pages2307 Jan 2018 ENCS v3SK GACAO PALO, LEYTENo ratings yet

- 1604E Jan 2018 ENCS Final Annex BDocument2 pages1604E Jan 2018 ENCS Final Annex BFeds100% (1)

- Monthly Remittance ReturnDocument1 pageMonthly Remittance ReturnAnalyn DomingoNo ratings yet

- One and Done 2307Document2 pagesOne and Done 2307Maricris LegaspiNo ratings yet

- EFPS Home - EFiling and Payment SystemDocument2 pagesEFPS Home - EFiling and Payment SystemJinkieNo ratings yet

- 2021 GeneralDocument8 pages2021 GeneralWajiha HaroonNo ratings yet

- Bir05 PDFDocument3 pagesBir05 PDFBarangay LumbangNo ratings yet

- BIR Form No. 2119 - Rev - Guidelines2Document3 pagesBIR Form No. 2119 - Rev - Guidelines2rhea CabillanNo ratings yet

- RMC No. 160-2022 AttachmentOriginalDocument2 pagesRMC No. 160-2022 AttachmentOriginalJoseph SaloNo ratings yet

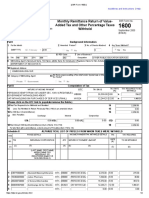

- BIR Form 1600 Monthly Remittance ReturnDocument1 pageBIR Form 1600 Monthly Remittance ReturnAnalyn DomingoNo ratings yet

- Bir Form 0605Document2 pagesBir Form 0605crypto RN100% (1)

- Payment Form: Kawanihan NG Rentas InternasDocument2 pagesPayment Form: Kawanihan NG Rentas InternasLimarOrravanNo ratings yet

- PC Square2307Document3 pagesPC Square2307SirManny ReyesNo ratings yet

- 2307 LessorDocument3 pages2307 LessorPaul EspinosaNo ratings yet

- BPLD - AF - 001 - REV.003 - NOV 2021 Business Application FormDocument1 pageBPLD - AF - 001 - REV.003 - NOV 2021 Business Application FormWORKBUDDY BOOKKEEPING SERVICESNo ratings yet

- December, 2021Document2 pagesDecember, 2021armand resquir jrNo ratings yet

- Anned B & c-0605Document2 pagesAnned B & c-0605da6795582No ratings yet

- Anned B & c-0605Document2 pagesAnned B & c-0605Rosmae BerrasNo ratings yet

- 2307 For EBS Private Individual Percenateg TaxDocument4 pages2307 For EBS Private Individual Percenateg TaxAGrace MercadoNo ratings yet

- 2307 Jan 2018 ENCS v3 Annex BDocument2 pages2307 Jan 2018 ENCS v3 Annex BAnonymous Z37BIV88% (24)

- 1604C Alphalist Format Jan 2018 Final2Document2 pages1604C Alphalist Format Jan 2018 Final2Mikho RaquelNo ratings yet

- BIR FORM 1604-F New FormDocument2 pagesBIR FORM 1604-F New FormJhen S. DomingoNo ratings yet

- Certificate of Creditable Tax Withheld at Source: Reyes, AnelynDocument9 pagesCertificate of Creditable Tax Withheld at Source: Reyes, AnelynJacqueline PamalinNo ratings yet

- Pas 12: Accounting For Income TaxDocument2 pagesPas 12: Accounting For Income TaxKiana FernandezNo ratings yet

- 0605version1999 09.02.2022Document2 pages0605version1999 09.02.2022justgracelifeNo ratings yet

- 80C CalculationDocument2 pages80C CalculationanandpurushothamanNo ratings yet

- RMC No. 73-2019 - 1604C Alphalist Format Jan 2018 Final2Document2 pagesRMC No. 73-2019 - 1604C Alphalist Format Jan 2018 Final2Leo R.No ratings yet

- Roydz - Gls Optimum PrimeDocument2 pagesRoydz - Gls Optimum PrimeJig-Etten SaxorNo ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCFrom EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCRating: 4 out of 5 stars4/5 (5)

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- Doing Your Own Taxes is as Easy as 1, 2, 3.From EverandDoing Your Own Taxes is as Easy as 1, 2, 3.Rating: 1 out of 5 stars1/5 (1)

- Indonesian Taxation: for Academics and Foreign Business Practitioners Doing Business in IndonesiaFrom EverandIndonesian Taxation: for Academics and Foreign Business Practitioners Doing Business in IndonesiaNo ratings yet

- Unabridged Articles of the Ike Jackson Report :the Future of Hip Hop Business 2020-2050: Unabridged articles of the Ike Jackson Report :The Future of Hip Hop Business 2020-2050, #2From EverandUnabridged Articles of the Ike Jackson Report :the Future of Hip Hop Business 2020-2050: Unabridged articles of the Ike Jackson Report :The Future of Hip Hop Business 2020-2050, #2No ratings yet

- MTS WF Ag 40 PDFDocument1 pageMTS WF Ag 40 PDFnramuduNo ratings yet

- PS1 PDFDocument2 pagesPS1 PDFnramuduNo ratings yet

- India's Contribution To The Rest of The WorldDocument62 pagesIndia's Contribution To The Rest of The Worldraj06740No ratings yet

- Ether Smart WiFi WC GuideDocument138 pagesEther Smart WiFi WC GuidenramuduNo ratings yet

- 07 Struts ExceptionsDocument19 pages07 Struts Exceptionsluislaar33No ratings yet

- Eclipse TutorialDocument32 pagesEclipse TutorialnramuduNo ratings yet

- Web Services & WCF: AnkitDocument18 pagesWeb Services & WCF: AnkitnramuduNo ratings yet

- Pure and Conditional ObligationDocument47 pagesPure and Conditional ObligationLmark VerdadNo ratings yet

- A.M. No. 02-11-10-SCDocument6 pagesA.M. No. 02-11-10-SCJunery BagunasNo ratings yet

- Members of The Commission of Enquiry On The Video Clip V Tun Dato' Seri Ahmad Fairuz (2011) 6 MLJ 490Document17 pagesMembers of The Commission of Enquiry On The Video Clip V Tun Dato' Seri Ahmad Fairuz (2011) 6 MLJ 490Wei SiangNo ratings yet

- Transfer of Property Act 1882: (Mportant Definition)Document39 pagesTransfer of Property Act 1882: (Mportant Definition)ZeesahnNo ratings yet

- Comedk and Uni-Gauge Uget 2022Document3 pagesComedk and Uni-Gauge Uget 2022raman dalalNo ratings yet

- Dr. Ram Mahohar Lohiya National Law UniversityDocument15 pagesDr. Ram Mahohar Lohiya National Law UniversityShailesh KumarNo ratings yet

- Summit Point FaqDocument3 pagesSummit Point Faqapi-255112852No ratings yet

- Tax Transcription Complete Lumbera PDFDocument97 pagesTax Transcription Complete Lumbera PDFJohn100% (1)

- CIPS Presentation - 25th October - Draft Smarter ContractsDocument26 pagesCIPS Presentation - 25th October - Draft Smarter Contractssandu2007No ratings yet

- Deed of Waiver of RightsDocument2 pagesDeed of Waiver of RightsAnna Ray Eleanor De Guia100% (3)

- JV Agreement for Expressway ProjectDocument5 pagesJV Agreement for Expressway ProjectWADD NandakumaraNo ratings yet

- ESTAFA 315 1 (B) CollectionDocument4 pagesESTAFA 315 1 (B) CollectionStephanie ViolaNo ratings yet

- Vda. de Manalo Vs Court of Appeals PDFDocument9 pagesVda. de Manalo Vs Court of Appeals PDFCzarina Lynne YeclaNo ratings yet

- Aowa v. DTIDocument8 pagesAowa v. DTIbrownboomerangNo ratings yet

- Samson v. AguirreDocument2 pagesSamson v. AguirreCristelle Elaine Collera100% (3)

- Daily Routines Esl Vocabulary Game Cards For KidsDocument7 pagesDaily Routines Esl Vocabulary Game Cards For KidsIsabella IsaBellaNo ratings yet

- Issue Spotter OutlineDocument15 pagesIssue Spotter Outlinenathanlawschool86% (7)

- Standard Contract For Kenya (Architect and Employer)Document52 pagesStandard Contract For Kenya (Architect and Employer)Jim Taubitz100% (2)

- Annexure Iv Lease Deed For Hiring Shop Premises For Apsbcl OutletDocument2 pagesAnnexure Iv Lease Deed For Hiring Shop Premises For Apsbcl OutletSwathi SwathiNo ratings yet

- Alcaraz V Tangga-AnDocument6 pagesAlcaraz V Tangga-AnJustine Bette ParroneNo ratings yet

- San Sebastian College-Recoletos - Master of LawsDocument3 pagesSan Sebastian College-Recoletos - Master of LawsGil Mae HuelarNo ratings yet

- Ch1. Law of ContractDocument24 pagesCh1. Law of ContractTaha GargoumNo ratings yet

- Philtranco Not Liable for DelictDocument1 pagePhiltranco Not Liable for Delictrgtan3No ratings yet

- Syntel Employment ApplicationDocument2 pagesSyntel Employment ApplicationrusofranklinNo ratings yet

- Validity of Marital Unions and Land Ownership by PrescriptionDocument19 pagesValidity of Marital Unions and Land Ownership by PrescriptionMirella90% (21)

- 100 Supreme Court Reports Annotated: Acain vs. Intermediate Appellate CourtDocument14 pages100 Supreme Court Reports Annotated: Acain vs. Intermediate Appellate CourtTammy YahNo ratings yet

- TrademarksDocument28 pagesTrademarksLusajo MwakibingaNo ratings yet

- Joint PRC&PRG MeetingDocument4 pagesJoint PRC&PRG MeetingJennifer Marie Columna BorbonNo ratings yet

- Release and QuitclaimDocument1 pageRelease and QuitclaimMilli ReyesNo ratings yet

- Sample Notice of Lawsuit and Request For Waiver of Service of SummonsDocument5 pagesSample Notice of Lawsuit and Request For Waiver of Service of SummonsStan Burman100% (2)