Professional Documents

Culture Documents

Module D

Uploaded by

Rich B EzOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Module D

Uploaded by

Rich B EzCopyright:

Available Formats

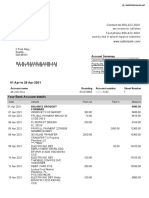

D Key

1. The definition of internal audit includes all of the following except A. Independent and objective. B. Assurance and consulting activity. C. Determine efficient and effective performance. D. Add value and improve an organization's operations. 2. Of the following: I. More expertise II. Improved control over audit costs III. Improved alignment with company goals The reasons for outsourcing an internal audit include A. I Only. B. I & II. C. II & III. D. I, II, & III. Original 3. The primary difference between operational auditing and financial auditing is that in operational auditing A.The auditor is only concerned with the audited activity's adherence to company policy and procedures. B. The auditor is seeking to help management use resources in the most effective manner possible. C. The auditor starts with the financial statements of an activity being audited and works backward to the basic processes involved in producing them. D. The auditor can use analytical skills and tools that are not necessary in financial auditing. Original 4. Independence permits internal auditors to render impartial and unbiased judgments. The best way for internal audit departments to achieve independence is through A. Individual knowledge and skills. B. Organizational knowledge and skills. C. Supervision within the organization. D. Organizational status and individual objectivity. Original 5. The proper organizational role of internal auditing is to A. Assist external auditors in order to reduce external audit fees B. Perform studies to assist in the attainment of more efficient operations C. Serve as an investigative arm of senior management and the board of directors D.Serve as an independent, objective assurance and consulting activity that adds value to the organization 6. During an audit of the quality control area, an auditor has identified that a specific product has a 3% failure rate when tested. The specification calls for a failure rate of less than 1.8%. Product failure might lead to customer injury and in turn lawsuits against the company. The auditor has communicated this to management. Which of the following is NOT an acceptable response from management with regard to this risk? A. Management is aware of the risk and has decided the risk is acceptable. B. Management has decided not to continue the manufacture of this product. C.Management has decided to increase the quality control activity to reduce the manufacture of unacceptable product to an acceptably low level. D.Management has decided that the test data is unreliable and has decided not to respond to the audit findings. Original 7. Audit charters are important for internal audit departments. Which of the following items is generally NOT a reason to have an audit charter? A.Audit charters provide a commitment from management to support the internal audit department's activities

B. Audit charters define the skills and competencies required by the internal audit department C. Audit charters define the department's authority and responsibility D. Audit charters define the reporting requirements for internal audit departments Original 8. Your organization has selected you to develop an internal audit activity. Your approach will most likely be to hire A. Internal auditors each of whom possess all the skills required to handle all engagements. B. Inexperienced personnel and train them the way the organization wants them trained. C. Degreed accountants because most internal audit work is accounting related. D.Internal auditors who collectively have the knowledge and skills needed to perform the responsibilities of the internal audit activities. 9. The purpose of internal audit's evaluation of the effectiveness of existing risk management processes is to determine that A.Management has planned and designed so as to provide reasonable assurance of achieving objectives and goals. B.Management directs processes so as to provide reasonable assurance of achieving objectives and goals. C. The organization's objectives and goals will be achieved efficiently and economically. D.The organization's objectives and goals will be achieved in an accurate and timely manner and with minimal use of resources. 10. Senior management has ordered a compliance audit of the organization employee benefits package. Which of the following is considered a primary engagement objective by both the chief audit executive and senior management? A. The level of the organizational contributions is adequate to meet the program's demands B.Individual programs are operating in accordance with contractual requirements and government regulations C. Participation levels support continuation of individual programs D. Benefits payments, when appropriate, are accurate and timely 11. The Standards for the Professional Practice of Internal Audit are classified in three major categories. Which of the following is NOT one of these categories? A. Attribute Standards B. Performance Standards C. Governance Standards D. Implementation Standards Original 12. Which of the following is a requirement of the Standards for the Professional Practice of Internal Audit that is not a requirement of an external auditor performing a financial statement audit? A. Due care B. Internal control evaluation C. Reporting to the audit committee D. Performing a follow-up on audit findings 13. When preparing an audit report, an internal auditor must convince management to take action concerning its findings. When reporting on an audit finding an auditor must include some key elements about that finding in the report. These key elements are A. Condition, criteria, cause, effect, and recommendation. B. Condition, criteria, cause, effect, and requirement. C. Condition, source, cause, effect, and recommendation. D. Location, criteria, cause, effect, and recommendation. 14. Program audits include determining A. Whether the entity is acquiring, protecting, and using its resources effectively. B. The effectiveness of organization, programs, activities, or functions. C. The causes of inefficiencies or uneconomical practices. D. Whether the entity has complied with laws and regulations concerning matters of efficiency. 15. The IIA Standards for the Professional Practice of Internal Auditing do not include the broad category

of A. Proficiency and Due care. B. Nature of Work. C. Performing the Engagement. D. Quality Control. 16. Which of the following internal audits is generally NOT a type of government audit? A. Review of compliance with policies, plans, procedures, laws, and regulations. B. Review of economy and efficiency in the use of resources. C. Review of the means of safeguarding assets. D. Review of the results of programs. 17. The GAO standards do not specifically require a written report in financial statement audits for A. Recommendations for actions to improve operations. B. All instances of illegal acts that could result in criminal prosecution. C. Compliance with applicable laws and regulations. D. Internal control structure and the control risk assessment. 18. The federal law that established uniform requirements for audits of federal assistance provided to state and local governments is called A. The Single Audit Act of 1984 B. Uniform Requirements Act of 1992 C. Sarbanes-Oxley Act or 2002 D. Audit Reduction Act of 1985 19. The definition of administrative control does not include reference to A. Operational efficiency. B. Accounting errors. C. Adherence to managerial policies. D. Plan of organization. 20. When dealing with standards, measurements, and comparisons, input measurements are most important for audits of A. Economy. B. Efficiency. C. Program results. D. Financial statements. 21. Which of the following is not required to become a Certified Internal Auditor (CIA)? A. Hold a college degree. B. Pass a two-day examination. C. Have a fulltime position as an internal auditor. D. Meet an experience requirement. 22. When considering the competence of internal auditors, external auditors should obtain evidence about A. Educational and experience qualifications of the internal auditors. B. Organizational status of the internal auditors. C. Lines of communication within the entity of the internal auditors. D. The size of the internal audit department. 23. When independent CPAs in public practice take engagements to audit government units or financial assistance recipients, they must follow A. GAAS only. B. GAAS and GAGAS. C. GAGAS only. D. Internal auditing standards. 24. Which of the following statements is true? A . External auditors must consider the internal audit function as part of obtaining an understanding of a company's internal control structure.

B. External auditors must review all work performed by internal auditors. C. External auditors must investigate the competence and objectivity of internal auditors. D.External auditors must share responsibility for the work of internal auditors if it is used for evidence for the financial statement audit. Original 25. Which of the following is a difference between performing an audit and performing a fraud examination? A. Auditors are not concerned with the nature of a financial misstatement, while fraud examiners are concerned with the nature of the misstatement. B. Auditors use analytical procedures, such as trend analysis to identify risks of misstatements, while fraud examiners are not interested in analytical procedures since they must identify specific items that prove the occurrence of fraud. C . Auditors are generally not concerned with small immaterial misstatements, while fraud examiners generally do not believe that any fraud is immaterial. D . Auditors are only concerned with financial statement errors, while fraud examiners are only concerned with the theft of assets by employees. 26. Fraud examiners have four main objectives in performing an investigation. Which of the following is NOT one of those objectives? A. Determine if a fraud exists. B. Determine who was involved in the fraud. C. Determine how the fraud occurred. D. Determine the effect on financial statement users. 27. In performing a financial statement audit in accordance with Government Auditing Standards, an auditor is required to report on the entity's compliance with laws and regulations. This report should A. State that compliance with laws and regulations is the responsibility of the entity's management. B. Describe the laws and regulations that the entity must comply with. C. Provide an opinion on overall compliance with laws and regulations. D. Indicate that the auditor does not possess legal skills and cannot make legal judgments. 28. Which of the following statements is a standard applicable to financial statement audits in accordance with Government Auditing Standards? A.An auditor should assess whether the entity has reportable measures of economy and efficiency that are valid and reliable. B. An auditor should report on the scope of the auditor's testing of internal controls. C. An auditor should briefly describe in the auditor's report the method of statistical sampling used in performing tests of controls and substantive tests. D.An auditor should determine the extent to which the entity's programs achieve the desired level of results. 29. The U.S. Government Accountability Office is an agency of: A. U.S. Congress B. Executive Office of Management and Budget C. U.S. Supreme Court D. Federal Accounting Standards Board 30. The demand for compliance auditing in GAGAS terms is generated by: A. Acts discreditable to the profession. B. Financial statement audits performed in accordance with generally accepted auditing standards. C. Governmental managers' obligations to follow laws and regulations. D. Public reports on government managers' following laws and regulations. 31. After performing work in a compliance attestation engagement and finding that a governmental

agency's managers failed to install and perform even the most elementary controls to ensure compliance with laws and regulations and in fact committed numerous violations, an auditor most likely would: A. Write an adverse report on actual compliance. B. Write an unqualified report on actual compliance. C.Write a report modified to disclose particular noncompliance events (specific violations of laws and regulations). D. Write a disclaimer of opinion related to knowledge of noncompliance. 32. A GAO audit report entitled Aviation Safety: Safer Skies Initiative Has Taken Initial Steps to Reduce Accident Rates by 2007 is most likely a report based on work the auditors performed in a: A. Financial statement audit. B. Compliance audit of air safety regulations. C. Performance audit of program goal achievement. D. Performance audit of air control regulation effectiveness. 33. The Single Audit Act of 1984 requires an annual audit of all governments, agencies, and nonprofit organizations that: A. Receive $300,000 or more federal funds. B. Receive $500,000 or more federal funds. C. Spend $300,000 or more federal funds. D. Spend $500,000 or more federal funds. 34. When auditors report on a financial audit engagement in accordance with GAGAS, the basic report(s) include: A. Disclaimer of opinion on financial statements, report on internal control, and report on compliance audit regarding laws and regulations. B.Report (opinion) on financial statements, report on internal control, and report on compliance audit regarding laws and regulations. C. Report on internal control and report(s) on efficiency and effectiveness of operations. D.Report on compliance audit of audit regarding laws and regulations and report(s) on program goal(s) achievement. 35. GAGAS performance audit reporting standards requires the reports to tell about which of the following: I. Presentation of financial statements in accordance with GAAP. II. Abuse of public money and property. III. Management's noteworthy good accomplishments. IV. Internal control design and strength of operation. A. I & II B. I & IV C. II & III D. II & IV 36. In assessing the objectivity of internal auditors, an independent auditor should A. Evaluate the quality control program in effect for the internal auditors. B. Examine documentary evidence of the work performed by the internal auditors. C. Test a sample of the transactions and balances that the internal auditors examined. D. Determine the organizational level to which the internal auditors report. 37. The work of internal auditors may affect the independent auditor's I. Procedures performed in obtaining an understanding of the internal control structure. II. Procedures performed in assessing the risk of material misstatement. III. Substantive tests performed in gathering direct evidence. A. I and II only. B. I and III only. C. II and III only. D. I, II, and III. AICPA 38. When performing a fraud examination, the fraud examiner takes great care to preserve and identify any documents that may indicate fraud. This is called A. Preserving the chain of custody of the evidence

B. Establishing evidential procedure C. Marking an evidential exhibit D. Forensic auditing 39. Which of the following would be considered in determining if an internal audit department is independent? A. The organizational level of the chief audit officer and the objectivity of the audit staff. B. That the auditors report to the audit committee and the composition of the audit committee. C.The organizational status of the audit committee and the individual independence of internal auditors in the department. D. The nature of the audit charter and the objectivity of the audit staff. 40. Which of the following would be considered the greatest problem for internal audit if the chief audit executive reported to the controller? A. The controller would amend the audit schedule so more audit time was spent on accounting issues. B. The controller may have no training as an internal auditor. C. During times when the budget needs to be cut, internal audit would likely be the first to lose funding. D.The controller can control the scope of audits and censor audit reports before being sent to management and the audit committee. 41. Which of the following is not an internal audit objective designed to add value to a purchasing department? A. A review of the bidding process indicates that copies may be operating under two different names and therefore purchasing is not getting the three independent bids required by policy. B. The purchasing process is causing unnecessary delays in ordering product. C. The purchasing department is not following a new human resource policy requiring a six month performance review for new employees. D. The director of purchasing is new to the organization and has made several decisions regarding vendor approvals with which the auditor does not agree. 42. In an internal auditor's report audit findings would include all of the following except A. The effect of the audit finding on the budget of the internal audit department. B. The cause of the audit finding. C. The conclusions about the audit finding. D. The recommendation to correct the audit finding. 43. Governmental auditors' independence and objectivity are enhanced when they report the results of an audit assignment directly to A. Managers of the government agency under audit and in which the auditors are employed. B. The audit committee of directors of the agency under audit. C. Political action committees of which they are members. D. The congressional committee that ordered the audit. 44. In all audits of governmental units performed according to GAGAS, the most important work is A. Compliance auditing. B. Obtaining a sufficient understanding of internal control. C. Documentation of the audit. D. Exit interviews with managers in the governmental unit. 45. Which of the following is considered different and more limited in objectives than the others? A. Operational auditing. B. Performance auditing. C. Management auditing. D. Financial statement auditing. 46. A typical objective of an operational audit is for the auditor to A. Determine whether the financial statements fairly present the company's operations. B. Evaluate the feasibility of attaining the company's operational objectives. C. Make recommendations for achieving company objectives.

D. Report on the company's relative success in attaining profit maximization. 47. A governmental auditor assigned to audit the financial statements of the state highway department would not be considered independent if the auditor A. Also held a position as a project manager in the highway department. B.Was the state audit official elected in a general statewide election with responsibility to report to the legislature. C. Normally works as a state auditor employed in the department of human services. D. Was appointed by the state governor with responsibility to report to the legislature. 48. Governmental auditing can extend beyond audits of financial statements to include audits of an agency's efficient and economical use of resources and A. Constitutionality of laws and regulations governing the agency. B. Evaluation of the personal managerial skills shown by the agency's leaders. C.Correspondence of the agency's performance with public opinion regarding the social worth of its mission. D.Evaluations concerning the agency's achievements of the goals set by the legislature for the agency's activities. 49. Which of the following best describes how the detailed audit plan of the external auditor who is engaged to audit the financial statements of a large publicly held company compares with the audit client's comprehensive internal audit plan? A.The comprehensive internal audit plan covers areas that would normally not be reviewed by an external auditor. B.The comprehensive internal audit plan is more detailed although it covers fewer areas than would normally be covered by an external auditor. C. The comprehensive internal audit plan is substantially identical to the audit plan used by an external auditor because both review substantially identical areas. D.The comprehensive internal audit plan is less detailed and covers fewer areas than would normally be reviewed by an external auditor. 50. Which of the following is usually not part of an internal audit department's audit charter? A. A commitment from management to ensure the independence of the internal audit department. B. A definition of the scope of the audit department's activities. C. The organizational structure of the internal audit department. D. The reporting requirements of the internal audit department. 51. Which of the following would you not expect to see in an auditor's report(s) on the financial statements of an independent government agency? A.A statement that the audit was conducted in accordance with generally accepted government audit standards. B. A report on the agency's compliance with applicable laws and regulations. C. Commentary by the agency's managers on the audit findings and recommendations. D. A report on the agency's internal controls. 52. The federal Single Audit Act of 1984 requires auditors to determine and report several things about state and local governments that receive federal funds. Which of the following is not normally required to be reported? A.An opinion on the fair presentation of the financial statements in accordance with generally accepted accounting principles. B. A report on the government's internal control related to federal funds. C. The government's performance in meeting goals set in enabling legislation. D. A report on the government's compliance with applicable laws and regulations. 53. The Government Accountability Office (GAO) describes expanded-scope governmental auditing to include all of the following except A. Financial statement audits. B. Attestation engagements. C. Compliance audits. D. Performance audits.

54. In government and internal performance auditing, which of the following is the least important consideration when performing the field work? A.Determining the applicable generally accepted government accounting principles pronounced by the GASB. B. Defining problem areas or opportunities for improvement and defining program goals. C.Selecting and performing procedures designed to obtain evidence about operational problems and production output. D. Evaluating evidence in terms of economy, efficiency, and achievement of program goals. 55. Which of the following is the least important consideration for a governmental auditor who needs to be objective when auditing and reporting on an agency's achievement of program goals? A. Measure the actual output results of agency activities. B. Compare the agency's actual output results to quantitative goal standards. C. Perform a comprehensive review of management controls. D. Determine quantitative standards that describe goals the agency was supposed to achieve. 56. Compliance auditing in audits performed under the Single Audit Act of 1984 in accordance with GAGAS is necessary for an auditor's A. Report on the auditee's internal control, including reportable conditions and material weaknesses. B. Opinion on the auditee's observance, or lack thereof, of applicable laws and regulations. C. Opinion on the auditee's financial statements. D. Report of a supplementary schedule of federal assistance programs and amounts. 57. Which two of the following characterize the work of fraud examiners? A. Analysis of control weaknesses for determination of acceptable fraud risk. B. Analysis of control strengths as a basis for planning other audit procedures. C.Determination of a materiality amount that represents a significant misstatement of the financial statements. D.Thinking of a materiality amount in cumulative termsthat is, becoming large over a number of years. E. A & D 58. When auditing with "fraud awareness," auditors should especially notice and review employee activities under which of these conditions? A. The company always estimates the inventory but never takes a complete physical count. B. The petty cash box is always locked in the desk of the custodian. C.Management has published a company code of ethics and sends frequent communication newsletters about it. D. The board of directors reviews and approves all investment transactions. 59. The best way to enact a broad fraud-prevention program is to A. Install airtight control systems of checks and supervision. B. Name an "ethics officer" who is responsible for receiving and acting upon fraud tips. C.Place dedicated "hotline" telephones on walls around the workplace with direct communication to the company ethics officer. D.Practice management "of the people and for the people" to help them share personal and professional problems. 60. A reason to believe that a fraud has occurred is called A. Deliberation B. Forensics C. Predication D. Restitution 61. In a fraud audit original documents must be protected from damage and tampering to A. Establish motive B. Develop documentation for employee dismissal C. Protect the chain of custody D. Ensure suspects are unaware of an investigation in progress 62. An environmental audit might include all of following except A. Determining that proper tracking of waste material is being maintained by the organization.

B. Reviewing the liability account established for pending environmental claims against the company. C.Reviewing the environmental history of another company that the internal auditor's organization is interested in purchasing. D. All of the above are appropriate issues for an environmental audit. Question also found in Study Guide 63. Auditors of governmental units would not be presumed to be independent if they are A. Free from sources of personal impairment. B. Independent under AICPA Code of Professional Conduct rules. C. Auditing the branch of government to which they are assigned. D. Elected or appointed and reporting to a legislative body of government. 64. The services provided by internal auditors do not include A. Audits of financial statements for security registration statements. B. Review of control systems that ensure compliance with company policies, laws, and regulations. C.Review of effectiveness in achieving program results in comparison to pre-established objectives and goals. D. Appraisals of the economy and efficiency of operations. 65. Operational audits do not include determining A. Whether the entity is acquiring, practicing, and using resources economically and efficiently. B. Review of control systems to ensure compliance with company policies. C. The causes of inefficiencies or uneconomical practices. D. Whether the department's goals are aligned with the organization's goals. 66. Program audits do not include determining A. The extent to which the desired results or benefits established by the legislature are being achieved. B. The effectiveness of organizations, programs, activities, or functions. C. Whether the agency has complied with laws and regulations applicable to the program. D.Whether the financial statements of an audited entity fairly present the financial position in accordance with GAAP. 67. The IIA Performance Standards would not include the standard for A. Managing the internal audit activity. B. Nature of work. C. Compliance with policies, plans, procedures, laws and regulations. D. Engagement planning. 68. The GAO Government Auditing Standards requirements for written reports in financial statement audits do not include A. Audit report on financial statements. B. A report of any significant accomplishments and management improvements. C. A report on the auditee's internal control structure and the control risk assessment. D. A report on the auditee's compliance with applicable laws and regulations. 69. In a single audit of federal financial assistance programs, which of the following does the auditor not need to determine and report for each organization? A. An expanded scope audit of economy, efficiency, and program results. B. That the financial statements are presented fairly in accordance with GAAP. C. That an adequate internal control system is in place. D. That the laws and regulations have been complied with. 70. Which of the following auditors is responsible for designing and planning an audit to detect material illegal acts and frauds? A. External auditors B. Internal auditors C. Governmental auditors D. All of the above

71. Generally, fraud examiners are called when a fraud is already known or suspected. The term that means a reason to believe a fraud has occurred is A. Prediction B. Suspicion C. Predication D. Admonition 72. Fraud examiners must be concerned with the integrity of the evidence that they find. Preserving the evidence is called A. Expert identification B. Chain of custody C. Evidence conservation D. Admissibility of testimony

You might also like

- Audit Risk Alert: Government Auditing Standards and Single Audit Developments: Strengthening Audit Integrity 2018/19From EverandAudit Risk Alert: Government Auditing Standards and Single Audit Developments: Strengthening Audit Integrity 2018/19No ratings yet

- Audit Risk Alert: General Accounting and Auditing Developments 2018/19From EverandAudit Risk Alert: General Accounting and Auditing Developments 2018/19No ratings yet

- UntitledDocument5 pagesUntitledKriztel Loriene TribianaNo ratings yet

- Tqs Finals Operations-AuditDocument46 pagesTqs Finals Operations-AuditCristel TannaganNo ratings yet

- Long Quiz On Internal AuditingDocument4 pagesLong Quiz On Internal Auditingrizzamaybacarra.birNo ratings yet

- Iath PrelimDocument7 pagesIath PrelimMara LacsamanaNo ratings yet

- At.02 Introduction To Audit of Historical Financial InformationDocument4 pagesAt.02 Introduction To Audit of Historical Financial InformationAngelica Sanchez de VeraNo ratings yet

- Unit TestDocument6 pagesUnit TestMajoy BantocNo ratings yet

- Intro To IA Quiz 1Document16 pagesIntro To IA Quiz 1Jao FloresNo ratings yet

- Audit Assessment True or False and MCQ - CompressDocument8 pagesAudit Assessment True or False and MCQ - CompressHazel BawasantaNo ratings yet

- Short Quiz 1Document11 pagesShort Quiz 1AMNo ratings yet

- AUDITTHEODocument13 pagesAUDITTHEOAlisonNo ratings yet

- Practice PeDocument12 pagesPractice PeRhea EnocNo ratings yet

- Acctg 14 Final ExamDocument8 pagesAcctg 14 Final ExamErineNo ratings yet

- 111年會考 審計學題庫Document15 pages111年會考 審計學題庫張巧薇No ratings yet

- Auditing Theory Quiz Final PrintDocument6 pagesAuditing Theory Quiz Final Printnda0403No ratings yet

- Final Exam Gbermic Multiple ChoiceDocument5 pagesFinal Exam Gbermic Multiple ChoiceMarie GarpiaNo ratings yet

- AUDITINGDocument20 pagesAUDITINGAngelieNo ratings yet

- Quizzer GOvernance Student Copy 1Document9 pagesQuizzer GOvernance Student Copy 1Mella FranciscoNo ratings yet

- Practice Questions - Module 5Document8 pagesPractice Questions - Module 5Rosda DhangNo ratings yet

- Irector's First Task Is To Develop A Charter. Identify The Item That Should BeDocument105 pagesIrector's First Task Is To Develop A Charter. Identify The Item That Should BeNICELLE TAGLENo ratings yet

- Questions and AnswersDocument20 pagesQuestions and AnswersJi YuNo ratings yet

- 01 Definition of Internal AuditingDocument11 pages01 Definition of Internal AuditingMhmd Habbosh100% (2)

- Audit 1Document1 pageAudit 1zennongraeNo ratings yet

- Trắc nghiệm kiểmDocument8 pagesTrắc nghiệm kiểmJF FNo ratings yet

- Auditing Theory-2018Document26 pagesAuditing Theory-2018Suzette VillalinoNo ratings yet

- Considerations of Internal Control Psa-Based QuestionsDocument28 pagesConsiderations of Internal Control Psa-Based QuestionsNoro75% (4)

- Introduction To Internal Auditing: Practice Questions and AnswersDocument3 pagesIntroduction To Internal Auditing: Practice Questions and AnswersPeter CR7No ratings yet

- Asr-Prelim ExamDocument11 pagesAsr-Prelim ExamCyndy VillapandoNo ratings yet

- Auditing TheoryDocument6 pagesAuditing TheoryJoy AbingNo ratings yet

- Consideration of Internal ControlDocument4 pagesConsideration of Internal ControlMary Grace SalcedoNo ratings yet

- CHAP 26. Internal and Government Financial Auditing and Operational AuditinDocument16 pagesCHAP 26. Internal and Government Financial Auditing and Operational AuditinNoroNo ratings yet

- Auditing Theory - Quiz 1Document5 pagesAuditing Theory - Quiz 1MA ValdezNo ratings yet

- Long Quiz 2Document8 pagesLong Quiz 2KathleenNo ratings yet

- Aud 1.1.1Document3 pagesAud 1.1.1Marjorie BernasNo ratings yet

- Auditing 2nd Sem AY 2020-2021 Institutional Mock Board ExamDocument10 pagesAuditing 2nd Sem AY 2020-2021 Institutional Mock Board ExamGet BurnNo ratings yet

- Department of Accounting Education: JULY 17, 2017Document4 pagesDepartment of Accounting Education: JULY 17, 2017Jao FloresNo ratings yet

- AT Quiz 1Document2 pagesAT Quiz 1CattleyaNo ratings yet

- IIa CIA Part1Document7 pagesIIa CIA Part1AMIT_AGRAHARI111987No ratings yet

- Quiz 2 Set ADocument3 pagesQuiz 2 Set AShiela RengelNo ratings yet

- AT ReviewerDocument10 pagesAT Reviewerfer maNo ratings yet

- Auditing ReviewerDocument8 pagesAuditing ReviewerSeanaNo ratings yet

- AUD ReviewerDocument9 pagesAUD ReviewerMhaybelle JovellanoNo ratings yet

- Quiz 1 & 2 (Aud) - MarcoletaDocument4 pagesQuiz 1 & 2 (Aud) - MarcoletaLeane MarcoletaNo ratings yet

- Question in Auditing TheoryDocument20 pagesQuestion in Auditing TheoryJeric YangNo ratings yet

- Auditing Theory Q and ADocument28 pagesAuditing Theory Q and ANyra BeldoroNo ratings yet

- Reviewer Auditing TheoryDocument59 pagesReviewer Auditing Theoryunexpected thingsNo ratings yet

- Auditing Theory SalosagcolDocument4 pagesAuditing Theory SalosagcolYuki CrossNo ratings yet

- Basic AudDocument3 pagesBasic AudMary Rose JuanNo ratings yet

- Seatwork#1Document14 pagesSeatwork#1Tricia Mae FernandezNo ratings yet

- Operations Auditing Quiz #1: A. Exercise Their Individual JudgmentDocument5 pagesOperations Auditing Quiz #1: A. Exercise Their Individual JudgmentCharleene GutierrezNo ratings yet

- Chapter 6 MC Bank For Opportunity-Student VersionDocument8 pagesChapter 6 MC Bank For Opportunity-Student VersionLivia WangNo ratings yet

- CPAR 1stPBDocument12 pagesCPAR 1stPBMae Danica CalunsagNo ratings yet

- Comprehensive Reviewer Auditing TheoryDocument91 pagesComprehensive Reviewer Auditing TheoryMary Rose JuanNo ratings yet

- Auditing Theory - 1Document9 pagesAuditing Theory - 1Kageyama HinataNo ratings yet

- True / False QuestionsDocument19 pagesTrue / False QuestionsRizza OmalinNo ratings yet

- Annual Update and Practice Issues for Preparation, Compilation, and Review EngagementsFrom EverandAnnual Update and Practice Issues for Preparation, Compilation, and Review EngagementsNo ratings yet

- Mastering Internal Audit Fundamentals A Step-by-Step ApproachFrom EverandMastering Internal Audit Fundamentals A Step-by-Step ApproachRating: 4 out of 5 stars4/5 (1)

- Acceptance Payment Form: Tax Amnesty On DelinquenciesDocument1 pageAcceptance Payment Form: Tax Amnesty On DelinquenciesJennyMariedeLeonNo ratings yet

- C2 PPT Pipe Jacking PVCDocument43 pagesC2 PPT Pipe Jacking PVCvroogh primeNo ratings yet

- MGP Paranoia - Troubles by The BoxloadDocument26 pagesMGP Paranoia - Troubles by The BoxloadAurik Frey100% (1)

- 200400: Company Accounting Topic 3: Accounting For Company Income TaxDocument15 pages200400: Company Accounting Topic 3: Accounting For Company Income TaxEhtesham HaqueNo ratings yet

- BioplasticDocument5 pagesBioplasticclaire bernadaNo ratings yet

- Sample Fryer Rabbit Budget PDFDocument2 pagesSample Fryer Rabbit Budget PDFGrace NacionalNo ratings yet

- Role of Financial Markets and InstitutionsDocument15 pagesRole of Financial Markets and Institutionsনাহিদ উকিল জুয়েলNo ratings yet

- Sutton Bank StatementDocument2 pagesSutton Bank StatementNadiia AvetisianNo ratings yet

- Awnser KeyDocument3 pagesAwnser KeyChristopher FulbrightNo ratings yet

- JPM - Economic Data AnalysisDocument11 pagesJPM - Economic Data AnalysisAvid HikerNo ratings yet

- Guidance Note On GSTDocument50 pagesGuidance Note On GSTkjs gurnaNo ratings yet

- Dao29 2004Document17 pagesDao29 2004Quinnee VallejosNo ratings yet

- 2010-02-01 IAPMO Green Plumbing and Mechanical Code SupplementDocument1 page2010-02-01 IAPMO Green Plumbing and Mechanical Code SupplementnedalmasaderNo ratings yet

- Case AnalysisDocument3 pagesCase AnalysisAnurag KhandelwalNo ratings yet

- 5% Compound PlanDocument32 pages5% Compound PlanArvind SinghNo ratings yet

- Education and Social DevelopmentDocument30 pagesEducation and Social DevelopmentMichelleAlejandroNo ratings yet

- Travel and Expense Policy: PurposeDocument9 pagesTravel and Expense Policy: Purposeabel_kayelNo ratings yet

- Annexure - VI Deed of Hypothecation (To Be Executed On Non Judicial Stamp Paper of Appropriate Value)Document3 pagesAnnexure - VI Deed of Hypothecation (To Be Executed On Non Judicial Stamp Paper of Appropriate Value)Deepesh MittalNo ratings yet

- AssignmentDocument13 pagesAssignmentabdur RahmanNo ratings yet

- 140 048 WashingtonStateTobaccoRetailerListDocument196 pages140 048 WashingtonStateTobaccoRetailerListAli MohsinNo ratings yet

- Indian MFTrackerDocument1,597 pagesIndian MFTrackerAnkur Mittal100% (1)

- Folder Gründen in Wien Englisch Web 6-10-17Document6 pagesFolder Gründen in Wien Englisch Web 6-10-17rodicabaltaNo ratings yet

- Aid For TradeDocument6 pagesAid For TradeRajasekhar AllamNo ratings yet

- Biznis Plan MLIN EngDocument16 pagesBiznis Plan MLIN EngBoris ZecNo ratings yet

- Macroeconomics - Assignment IIDocument6 pagesMacroeconomics - Assignment IIRahul Thapa MagarNo ratings yet

- SaleDocument1 pageSaleMegan HerreraNo ratings yet

- Mackinac Center Exposed: Who's Running Michigan?Document19 pagesMackinac Center Exposed: Who's Running Michigan?progressmichiganNo ratings yet

- The Simple Keynesian ModelDocument9 pagesThe Simple Keynesian ModelRudraraj MalikNo ratings yet

- Project Profile ON Roasted Rice FlakesDocument7 pagesProject Profile ON Roasted Rice FlakesPrafulla ChandraNo ratings yet

- Assignment - Engro CorpDocument18 pagesAssignment - Engro CorpUmar ButtNo ratings yet