Professional Documents

Culture Documents

Dividend Policy at Linear Technology - Case Analysis - G05

Uploaded by

Srikanth Kumar KonduriOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Dividend Policy at Linear Technology - Case Analysis - G05

Uploaded by

Srikanth Kumar KonduriCopyright:

Available Formats

Dividend policy at Linear Technology analysis

Group: G05

Case Submission by: Tarun KSG (10DM-162), Saurabh Thadani (10FN-102), Srikanth Konduri (10FN-109), Tushar Gupta (10FN-115), Nikhil Gupta (10FN-121) 1. Management is debating on the amount of dividend to be paid, corresponding to Q3 FY2003 Purpose: To create a perception (+ve) of its growth prospects among investors Its a sign of strong +ve cash flows, profitability of the firm So firms remain cautious about their pay-out ratio, to sustain their payments in long-run Ultimately, to maximize the value of shareholders 2. Findings of Academic research: A +ve link between dividend yields & future returns Probably because: Paying out dividends increases tax burden on the firm Which encourages management to make better investments with available cash 3. Incentivised to pay dividend only when firm is confident of the future So that investors will be sure of receiving regular dividend even during downturns As during downturns interest rates outside fall to low-levels, even 1% dividend yield looks gr8 Propels to increase its market/book ratio relative to non-paying ones Many Mutual Fund companies & Euro Investment firms prefer stocks with regular dividends 4. Restraint from Executive level employees: These days technology companies follow a variable cost structure By making ESOPs as a considerable portion of their compensation & pay as per earnings So, those guys will try to exercise their options only when the stock price is at higher levels They will not be interested in the incentive of dividend payment As that exercise creates dilution, firms will buy-back the shares to offset that effect 5. It will not pay dividends if there are not enough cash-earnings (after off-setting dilution ) Paying dividends without buy-backs will suffer its EPS, though provides cash to investors 6. Restraint generated from its own dividend payment policy during downturns: (along with Iraq war) For paying dividends, firms need cash reserves During economic slowdowns, interest rates will be pretty low, rules out short-term investments In order to maintain cash position even at that time, firms will tend to buy-back shares 7. Restraint to dividend pay-out ratio from its strategic growth pursuit: (Analog-semiconductors) Looking out for opportunities in Asia while being cautious about bottom-line margin Investment in R&D($102mn in FY 2001), retaining talent, building fabrication facilities($200mn) 8. In the wake of tax reforms, institutional investors welcome dividend payment As it reduces the equity risk premium associated with the stock Corporate scandals like ENRON,WORLDCOM have reinforced this notion 9. If the tax rates are expected to be constant at least for a complete financial year Institutional investors would rather prefer buy-back than dividend payments(to prevent tax) Putting it in other way, they expect special dividends if firms cash reserves are huge 1|Page CF-2 Assignment

Dividend policy at Linear Technology analysis

Group: G05

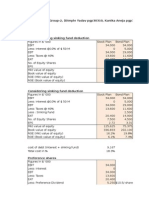

10. Few feel dividend policy as companys acceptance of the fact investors can gain more elsewhere 11. Lets see the policy of its benchmark competitors: Intel, Maxim & Microsoft all have been following regular stock splits Maxim & Linear have got many similarities, along with institutional investors Microsoft promised to shift towards dividends after settling its legal claim worth $1.1bn Linears position is 7th in terms of Market Capitalization on Philadelphia SOP index 12. Keeping in mind its objective of maximizing share-holder value: For long-term relationship maintenance with investors who are bottom-line concerned Share price of Linear Technology at the end of Q3 FY2003: $30.87 Market Capitalization at the end of Q3 FY2003 is: 312.4*30.87 = $9643.788mn Net Cash flow during Q1-Q3 of FY2003: $13.2mn; (POR) 2002=54/197.6=27.33% Total Cash & Short-Term Investments till Q3 FY2003: $1565.2mn EPS during (Q1-Q3) = 170.6/312.4 = 0.5461 If the Cash flow is used to buy-back shares: No. of shares brought back = 13.2mn30.87 = 427,600 New No. of shares=312.4-0.4276 = 311.9724mn As share price remains intact, new Mkt. Cap. = 311.9724mn*30.87 = $9630.588mn Post buy-back EPS = 170.6/311.9724 = 0.5468 (EPS) post buy-back = 0.00075;(Mkt. Cap.) post buy-back = -$13.2mn As Mkt. Cap. Is reducing with this option, only buy-back policy is ruled out If the cash reserves are used to declare special dividend: Lets assume special DPS to be $2.5 2.5*312.4mn=$781mn has to be taken out of their cash reserves Share price will fall by $2.5 and new share price = 30.87-2.5 = $28.37 (EPS) post buy-back = 0; (Mkt. Cap.) post buy-back = -(311.924mn*2.5)= -$779.81mn As Mkt. Cap. Is reducing with this option, only special dividend policy is ruled out If part of cash reserves are used to buy-back & part to declare special dividend: Lets assume that $500mn is used each for dividend payments & buy-backs For a person holding 100 shares of LLTC, now 5.18 shares will be brought back (Calculations are present in the attached excel), persons initial stock value:$3087 Cash obtained from buy-back: 5.18*30.87 = $159.9066 Now, cash earned from dividends declared for remaining 94.82 shares is: $160.06 Ex-dividend date value of the stocks held =94.82*(30.87-1.688)=$2767.04 Persons new share capital value:159.90+160.06+2767.04= $3087 As the shareholder value is remained same, while holders risk premium associated with LLTC is reduced, part buy-back & part dividend payment policy is most welcomed However, if the Bushs 2003 tax reforms were delayed, this option may not be attractive than that of share repurchase

2|Page

CF-2 Assignment

You might also like

- Session 19 - Dividend Policy at Linear TechDocument2 pagesSession 19 - Dividend Policy at Linear TechRichBrook7No ratings yet

- Linear Technology Case - Ashmita SrivastavaDocument4 pagesLinear Technology Case - Ashmita SrivastavaAshmita Srivastava0% (1)

- Linear TechnologyDocument6 pagesLinear Technologyprashantkumarsinha007100% (1)

- Questions - Linear Technologies CaseDocument1 pageQuestions - Linear Technologies CaseNathan Toledano100% (1)

- Dividend Policy at Linear TechnologyDocument9 pagesDividend Policy at Linear TechnologySAHILNo ratings yet

- Linear TechnologyDocument4 pagesLinear TechnologySatyajeet Sahoo100% (2)

- Linear Tech Dividend PolicyDocument25 pagesLinear Tech Dividend PolicyAdarsh Chhajed0% (2)

- Case Study - Linear Tech - Christopher Taylor - SampleDocument9 pagesCase Study - Linear Tech - Christopher Taylor - Sampleakshay87kumar8193No ratings yet

- Uttam Kumar Sec-A Dividend Policy Linear TechnologyDocument11 pagesUttam Kumar Sec-A Dividend Policy Linear TechnologyUttam Kumar100% (1)

- Dividend Policy at Linear TechnologyDocument8 pagesDividend Policy at Linear TechnologyNikhilaNo ratings yet

- Reversing The AMD Fusion Launch (Case Study)Document6 pagesReversing The AMD Fusion Launch (Case Study)SanyamRajvanshiNo ratings yet

- Debt Policy at Ust IncDocument18 pagesDebt Policy at Ust InctutenkhamenNo ratings yet

- Ust SolutionDocument3 pagesUst SolutionAdeel_Akram_Ch_9271No ratings yet

- SpyderDocument3 pagesSpyderHello100% (1)

- SIEMENSDocument7 pagesSIEMENSGian Carlos Avila100% (1)

- LinearDocument6 pagesLinearjackedup211No ratings yet

- Group 2I - Dividend Policy at Linear TechnologyDocument4 pagesGroup 2I - Dividend Policy at Linear TechnologyRishabh KothariNo ratings yet

- Airthread Connections Case Work SheetDocument45 pagesAirthread Connections Case Work SheetBhuvnesh Prakash100% (1)

- Transworld Xls460 Xls EngDocument6 pagesTransworld Xls460 Xls EngAman Pawar0% (1)

- Linear Technology Payout Policy Case 3Document4 pagesLinear Technology Payout Policy Case 3Amrinder SinghNo ratings yet

- Debt Policy at Ust Case SolutionDocument2 pagesDebt Policy at Ust Case Solutiontamur_ahan50% (2)

- Blaine Kitchenware Inc. Written Case AnalysisDocument1 pageBlaine Kitchenware Inc. Written Case AnalysisomirNo ratings yet

- USTDocument4 pagesUSTJames JeffersonNo ratings yet

- Spyder Case Intro: See Templates On Blackboard For WACC and DCF OutputDocument11 pagesSpyder Case Intro: See Templates On Blackboard For WACC and DCF Outputrock sinhaNo ratings yet

- Hbs Case - Ust Inc.Document4 pagesHbs Case - Ust Inc.Lau See YangNo ratings yet

- Hill Country SnackDocument8 pagesHill Country Snackkiller dramaNo ratings yet

- Case Study On Tottenham Hotspur PLCDocument5 pagesCase Study On Tottenham Hotspur PLCClaudia CarrascoNo ratings yet

- Oracle's Acquisition of Sun MicrosystemsDocument12 pagesOracle's Acquisition of Sun MicrosystemsVarun Rana50% (2)

- Debt Policy at Ust IncDocument18 pagesDebt Policy at Ust Incapi-371968794% (16)

- Dropbox Q4, Q5Document2 pagesDropbox Q4, Q5Venkatesh KambhayatugharNo ratings yet

- Sealed Air Corporation's Leveraged Recapitalization (A)Document7 pagesSealed Air Corporation's Leveraged Recapitalization (A)Jyoti GuptaNo ratings yet

- Financial Management - Case - Sealed AirDocument7 pagesFinancial Management - Case - Sealed AirAryan AnandNo ratings yet

- Case StudyDocument10 pagesCase StudyEvelyn VillafrancaNo ratings yet

- Wesco Distribution IncDocument2 pagesWesco Distribution IncJiswanath MondalNo ratings yet

- Froid Accounting CaseDocument11 pagesFroid Accounting Caselouiegoods2450% (2)

- 9-204-066 Dividend Policy - 204702-XLS-ENGDocument17 pages9-204-066 Dividend Policy - 204702-XLS-ENGValant Rivas DerteNo ratings yet

- PunchTab - Group 10Document2 pagesPunchTab - Group 10Sudhanshu VermaNo ratings yet

- Subject: Fm-07 Assignment: S B Decker, Inc.: Tanley Lack ANDDocument3 pagesSubject: Fm-07 Assignment: S B Decker, Inc.: Tanley Lack ANDSuryakant BurmanNo ratings yet

- JetBlue Airways IPO ValuationDocument9 pagesJetBlue Airways IPO ValuationMuyeedulIslamNo ratings yet

- FPL Dividend Policy-1Document6 pagesFPL Dividend Policy-1DavidOuahba100% (1)

- Midland CaseDocument5 pagesMidland CaseJessica Bill100% (3)

- Springfield Nor' EastersDocument5 pagesSpringfield Nor' EastersLiNo ratings yet

- Facebook IPO Valuation AnalysisDocument13 pagesFacebook IPO Valuation AnalysisMegha BepariNo ratings yet

- Continental CarriersDocument6 pagesContinental CarriersVishwas Nandan100% (1)

- 2839 MEG CV 2 CaseDocument10 pages2839 MEG CV 2 CasegueigunNo ratings yet

- Drop Box Case Slides I and eDocument4 pagesDrop Box Case Slides I and etalwararjunNo ratings yet

- Corp Gov Group1 - Sealed AirDocument5 pagesCorp Gov Group1 - Sealed Airdmathur1234No ratings yet

- MonmouthDocument16 pagesMonmouthjamn1979100% (1)

- Compagnie Du Froid S ADocument8 pagesCompagnie Du Froid S Avtiwari10% (3)

- Chapter 13 Dividend Policy DecisionDocument23 pagesChapter 13 Dividend Policy DecisionMd. Sohel BiswasNo ratings yet

- Dividend PolicyDocument70 pagesDividend Policyluv silenceNo ratings yet

- Dividend Policy: e As Cost of Equity in TheDocument43 pagesDividend Policy: e As Cost of Equity in TheVelayudham ThiyagarajanNo ratings yet

- Dividend Decisions3Document13 pagesDividend Decisions3PUTTU GURU PRASAD SENGUNTHA MUDALIARNo ratings yet

- Pile cp4Document25 pagesPile cp4casarokarNo ratings yet

- Dividend Decision Part 1Document10 pagesDividend Decision Part 1avinashchoudhary2043No ratings yet

- Financial Management 2 Assignment 1: Dividend Policy at FPL GroupDocument9 pagesFinancial Management 2 Assignment 1: Dividend Policy at FPL GroupDiv_nNo ratings yet

- Dividend Policy AssignmentDocument8 pagesDividend Policy Assignmentgeetikag2018No ratings yet

- AFM NotesDocument55 pagesAFM NotesrenesanitaNo ratings yet

- Dividend Decision: Vishal Tanwar Room 32 Roll No. 506 St. Xavier's CollegeDocument8 pagesDividend Decision: Vishal Tanwar Room 32 Roll No. 506 St. Xavier's CollegeVishal TanwarNo ratings yet

- FinanceDocument34 pagesFinanceAmrinder KhuralNo ratings yet

- Summer Project Report Srikanth 10FN-109Document36 pagesSummer Project Report Srikanth 10FN-109Srikanth Kumar KonduriNo ratings yet

- Final PPT of MarutiDocument21 pagesFinal PPT of MarutiSrikanth Kumar KonduriNo ratings yet

- Wintel AnalysisDocument11 pagesWintel AnalysisSrikanth Kumar Konduri100% (2)

- IREF Project ReportDocument10 pagesIREF Project ReportSrikanth Kumar KonduriNo ratings yet

- Durban Summit 2011 - EnVM Project Report - Sec.GDocument8 pagesDurban Summit 2011 - EnVM Project Report - Sec.GSrikanth Kumar KonduriNo ratings yet

- Meet Mate INTM ProjectDocument22 pagesMeet Mate INTM ProjectSrikanth Kumar KonduriNo ratings yet

- At&T - Equity Research ReportDocument12 pagesAt&T - Equity Research ReportSrikanth Kumar Konduri0% (1)

- QMM 2nd Assignment 10FN-109Document3 pagesQMM 2nd Assignment 10FN-109Srikanth Kumar KonduriNo ratings yet

- FIS Empirical Project Macro Factors Vs Yield CurveDocument2 pagesFIS Empirical Project Macro Factors Vs Yield CurveSrikanth Kumar KonduriNo ratings yet

- Tailor-Made Portfolio Design Using Markowitz Efficient Frontier ThoeryDocument3 pagesTailor-Made Portfolio Design Using Markowitz Efficient Frontier ThoerySrikanth Kumar KonduriNo ratings yet

- MACR Igate Patni Ver4.0Document14 pagesMACR Igate Patni Ver4.0Srikanth Kumar KonduriNo ratings yet

- Bitc Mfi ProjectDocument13 pagesBitc Mfi ProjectSrikanth Kumar KonduriNo ratings yet

- FSABV Final ReportDocument3 pagesFSABV Final ReportSrikanth Kumar KonduriNo ratings yet

- Panel Data Analysis: Indian Pharmacy IndustryDocument11 pagesPanel Data Analysis: Indian Pharmacy IndustrySrikanth Kumar KonduriNo ratings yet

- IB - Doing Business in China - 2011Document27 pagesIB - Doing Business in China - 2011Srikanth Kumar KonduriNo ratings yet

- Modeling of Risk Using Monte Carlo SimulationDocument16 pagesModeling of Risk Using Monte Carlo SimulationSrikanth Kumar KonduriNo ratings yet

- Trading StrategyDocument1 pageTrading StrategySrikanth Kumar KonduriNo ratings yet

- Camel Ratio AnalysisDocument15 pagesCamel Ratio AnalysisSrikanth Kumar Konduri90% (10)

- Spyder Active Sports Case AnalysisDocument2 pagesSpyder Active Sports Case AnalysisSrikanth Kumar Konduri100% (3)

- Erp V4Document37 pagesErp V4Srikanth Kumar KonduriNo ratings yet

- Escorts Optimization of ProductionDocument20 pagesEscorts Optimization of ProductionSrikanth Kumar KonduriNo ratings yet

- Strategic HRM - SecGDocument20 pagesStrategic HRM - SecGSrikanth Kumar KonduriNo ratings yet

- Prevention of Oppression & Mismanagement - Group04 - Sec.G - LAB2011 - IMTGDocument29 pagesPrevention of Oppression & Mismanagement - Group04 - Sec.G - LAB2011 - IMTGSrikanth Kumar KonduriNo ratings yet

- TVS Motors ValuationDocument2 pagesTVS Motors ValuationSrikanth Kumar KonduriNo ratings yet

- Dell's Working Capital - Case Analysis - G05Document2 pagesDell's Working Capital - Case Analysis - G05Srikanth Kumar Konduri100% (11)

- BRM Project - Currency Derivatives Trading - Lighter VersionDocument30 pagesBRM Project - Currency Derivatives Trading - Lighter VersionSrikanth Kumar KonduriNo ratings yet

- Dividend Policy at Linear Technology - Case Analysis - G05Document2 pagesDividend Policy at Linear Technology - Case Analysis - G05Srikanth Kumar Konduri60% (5)

- LPO in IndiaDocument14 pagesLPO in IndiaSrikanth Kumar KonduriNo ratings yet

- Adarsh Cooperative Housing Society ScamDocument14 pagesAdarsh Cooperative Housing Society ScamSrikanth Kumar KonduriNo ratings yet

- BC-2 Interaction With Foreign ClientsDocument24 pagesBC-2 Interaction With Foreign ClientsSrikanth Kumar KonduriNo ratings yet

- Assignment On: World Bond Market Vs Bangladesh Bond MarketDocument14 pagesAssignment On: World Bond Market Vs Bangladesh Bond Marketswapnil swadhinataNo ratings yet

- Buy Back Article PDFDocument12 pagesBuy Back Article PDFRavindra PoojaryNo ratings yet

- Angel Tax On Start-UpsDocument35 pagesAngel Tax On Start-UpsAkash MehtaNo ratings yet

- E-Forex Magazine Middle East Regional PerspectiveDocument7 pagesE-Forex Magazine Middle East Regional PerspectiverichardwillsherNo ratings yet

- Stein Stan - Secrets For Profiting in Bull and Bear MarketsDocument5 pagesStein Stan - Secrets For Profiting in Bull and Bear MarketsAnmol Bajaj100% (3)

- Solved Xyz Exchanged Old Equipment For New Like Kind Equipment Xyz S AdjustedDocument1 pageSolved Xyz Exchanged Old Equipment For New Like Kind Equipment Xyz S AdjustedAnbu jaromiaNo ratings yet

- Fin4002 MCDocument10 pagesFin4002 MCYMC SOEHKNo ratings yet

- Pricing Model Definitions Be 156670Document14 pagesPricing Model Definitions Be 156670Jayasankar NairNo ratings yet

- Jyske Bank Jul 23 Equities DailyDocument7 pagesJyske Bank Jul 23 Equities DailyMiir ViirNo ratings yet

- MPT PaperDocument13 pagesMPT PaperAna ShehuNo ratings yet

- VSA Signs of WeaknessDocument49 pagesVSA Signs of Weaknesskamaal100% (2)

- The Effects of Changes in Foreign Exchange RatesDocument19 pagesThe Effects of Changes in Foreign Exchange RatesAlyssa CasimiroNo ratings yet

- Real Time Data Get From Stock Exchange Using PHPDocument6 pagesReal Time Data Get From Stock Exchange Using PHPAsad Ullah KhanNo ratings yet

- Mauboussin - What You See and What You Get PDFDocument39 pagesMauboussin - What You See and What You Get PDFRob72081No ratings yet

- Functions of Financial ManagementDocument21 pagesFunctions of Financial ManagementAmanNo ratings yet

- Theories ExerciseDocument1 pageTheories ExerciseZeneah MangaliagNo ratings yet

- OECD Economic Outlook - June 2023Document253 pagesOECD Economic Outlook - June 2023Sanjaya AriyawansaNo ratings yet

- Training 2.1Document17 pagesTraining 2.1Sarah MadhiNo ratings yet

- Consolidated Income Statement or Statement of Profit or Loss and Other Comprehensive IncomeDocument4 pagesConsolidated Income Statement or Statement of Profit or Loss and Other Comprehensive IncomeOmolaja IbukunNo ratings yet

- Financial Education and Invesemtn Awareness Question BankDocument19 pagesFinancial Education and Invesemtn Awareness Question BankSyedNo ratings yet

- Allahabad BankDocument9 pagesAllahabad BankMegha JainNo ratings yet

- Alumex Prospectus On CSE SiteDocument115 pagesAlumex Prospectus On CSE SiteRandora Lk100% (1)

- Dabur Consolidated Balance Sheet PDFDocument1 pageDabur Consolidated Balance Sheet PDFRupasingh33% (3)

- Chapter 8 - Operations of Insurance CompaniesDocument11 pagesChapter 8 - Operations of Insurance CompaniesFrancis Gumawa100% (1)

- Financial Markets and Services (F) (5 Sem) : Unit-3 Leasing and Hire PurchaseDocument9 pagesFinancial Markets and Services (F) (5 Sem) : Unit-3 Leasing and Hire Purchasedominic wurdaNo ratings yet

- Submission1 - P&G Acquisition of GilletteDocument9 pagesSubmission1 - P&G Acquisition of GilletteAryan AnandNo ratings yet

- Money Market InstrumentDocument30 pagesMoney Market Instrumentdont_forgetme2004No ratings yet

- Summer Internship Report.................. Docx132Document37 pagesSummer Internship Report.................. Docx132Rashmin TomarNo ratings yet

- Research in International Business and Finance: Tanveer Hussain, Gilberto LoureiroDocument17 pagesResearch in International Business and Finance: Tanveer Hussain, Gilberto LoureiroDyah PutriNo ratings yet

- The Best Investment Advice You'll Never Get: As Google's Historic August 2004 IPO Approached, The Company'sDocument13 pagesThe Best Investment Advice You'll Never Get: As Google's Historic August 2004 IPO Approached, The Company'sSally GucciNo ratings yet