Professional Documents

Culture Documents

CMA Format

Uploaded by

api-3771238Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CMA Format

Uploaded by

api-3771238Copyright:

Available Formats

ICICI Banking Corporation Ltd.

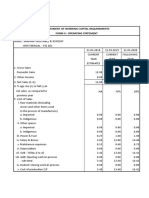

ASSESSMENT OF WORKING CAPITAL REQUIREMENTS

FORM II - OPERATING STATEMENT

Name:

Amounts in Rs. Crore

Last 2 Years Actuals Current Yr. Next Year

(As per audited accounts) Estimates Projections

Year 1999 2000 2001 2002

No.of months 12 12 12 12

1. Gross Sales

i. Domestic Sales

ii. Export Sales

Total 0.00 0.00 0.00 0.00

2. Less Excise Duty 0.00 0.00 0.00 0.00

3. Net Sales (1 - 2) 0.00 0.00 0.00 0.00

4. % age rise (+) or fall (-) in net sales

as compared to previous year (annualised) N/A N/A N/A N/A

5. Cost of Sales

i. Raw materials (including stores and

other items used in the process of

manufacture) 0.00 0.00 0.00 0.00

a. Imported

b. Indigenous

ii. Other Spares

a. Imported 0.00 0.00 0.00 0.00

b. Indigenous

iii. Power and Fuel

iv. Direct Labour (Factory wages & salaries)

v. Other manufacturing expenses

vi. Depreciation

vii. Sub-total (i to vi) 0.00 0.00 0.00 0.00

viii. Add: Opening Stock-in-process 0.00 0.00 0.00 0.00

Sub-total (vii + viii) 0.00 0.00 0.00 0.00

ix. Deduct: Closing Stock-in-process 0.00 0.00 0.00 0.00

x. Cost of Production 0.00 0.00 0.00 0.00

10/15/2008 8960164.xls (Form_II) Page 1

ICICI Banking Corporation Ltd.

xi. Add: Opening Stock of finished goods 0.00 0.00 0.00 0.00

Sub-total (x + xi) 0.00 0.00 0.00 0.00

xii. Deduct: Closing Stock of finished goods 0.00 0.00 0.00 0.00

xiii. Sub-total (Total Cost of Sales) 0.00 0.00 0.00 0.00

6. Selling, general and administrative expenses

7. Sub-total (5 + 6) 0.00 0.00 0.00 0.00

8. Operating Profit before Interest (3 - 7) 0.00 0.00 0.00 0.00

9. Interest

10. Operating Profit after Interest (8 - 9) 0.00 0.00 0.00 0.00

11. i. Add: Other non-operating Income

a.

b.

c. 0.00 0.00

d.

Sub-total (Income) 0.00 0.00 0.00 0.00

ii. Deduct: Other non-operating expenses

a. 0.00 0.00 0.00

b.

c. 0.00 0.00

d.

Sub-total (Expenses) 0.00 0.00 0.00 0.00

iii. Net of other non-operating income /

expenses [net of 11(i) & 11(ii)] 0.00 0.00 0.00 0.00

12. Profit before tax/loss [10 + 11(iii)] 0.00 0.00 0.00 0.00

13. Provision for taxes

14. Net Profit / Loss (12 -13) 0.00 0.00 0.00 0.00

15. a. Equity dividend paid-amount

(Already paid + B.S. provision)

b. Dividend Rate (% age) 0.00 0.00 0.00 0.00

16. Retained Profit (14 - 15) 0.00 0.00 0.00 0.00

17. Retained Profit / Net Profit (% age)

10/15/2008 8960164.xls (Form_II) Page 2

ICICI Banking Corporation Ltd.

FORM III - ANALYSIS OF BALANCE SHEET

LIABILITIES

Name: 0

Amounts in Rs. Crore

Last 2 Years Actuals Current Yr. Next Year

(As per audited BS) Estimates Projections

Year 1999 2000 2001 2002

No.of months 12 12 12 12

CURRENT LIABILITIES

1. Short-term borrowing from banks (including

bills purchased, discounted & excess

borrowing placed on repayment basis)

i. From applicant bank 0.00 0.00 0.00 0.00

ii. From other banks 0.00

iii. (of which BP & BD) 0.00

Sub-total [i + ii] (A) 0.00 0.00 0.00 0.00

2. Short term borrowings from others

3. Sundry Creditors (Trade)

4. Advance payments from customers /

deposits from dealers

5. Provision for taxation

6. Dividend payable

7. Other statutory liabilities (due within 1 year) 0.00

8. Deposits / instalments of term loans /

DPGs / debentures etc. (due within 1 year) 0.00

9. Other current liabilities & provisions

(due within 1 year) - specify major items 0.00 0.00 0.00 0.00

a.

b.

c.

d.

Sub total [2 to 9] (B) 0.00 0.00 0.00 0.00

10. Total current liabilities [A + B] 0.00 0.00 0.00 0.00

10/15/2008 8960164.xls (Form_III) Page 3

ICICI Banking Corporation Ltd.

TERM LIABILITIES

11. Debentures (not maturing within 1 year) 0.00 0.00

12. Preference Shares (redeemable after 1 year)

13. Term loans (excluding instalments

payable within 1 year) 0.00 0.00

14. Deferred Payment Credits (excluding

instalments due within 1 year)

15. Term deposits (repayable after 1 year) 0.00 0.00 0.00

16. Other term liabilities

17. Total Term Liabilities [11 to 16] 0.00 0.00 0.00 0.00

18. Total Outside Liabilities [10 + 17] 0.00 0.00 0.00 0.00

NET WORTH

19. Ordinary Share Capital

20. General Reserve

21. Revaluation Reserve 0.00 0.00 0.00 0.00

22. Other Reserves (excluding Provisions)

23. Surplus (+) or deficit (-) in Profit & Loss a/c

23. a. Others

Share Premium

Capital Redemption Reserve

24. Net Worth 0.00 0.00 0.00 0.00

25. TOTAL LIABILITIES [18 + 24] 0.00 0.00 0.00 0.00

10/15/2008 8960164.xls (Form_III) Page 4

ICICI Banking Corporation Ltd.

FORM III - ANALYSIS OF BALANCE SHEET (Continued)

ASSETS

Name: 0

Amounts in Rs. Crore

Last 2 Years Actuals Current Yr. Next Year

(As per audited BS) Estimates Projections

Year 1999 2000 2001 2002

No.of months 12 12 12 12

CURRENT ASSETS

26. Cash and Bank Balances

27. Investments (other than long term)

i. Govt. and other trustee securities 0.00 0.00 0.00 0.00

ii. Fixed Deposits with banks

28. i. Receivables other than deferred &

exports (incldg. bills purchased and

discounted by banks)

ii. Export receivables (incldg. bills

purchased/discounted by banks) 0.00 0.00

29. Instalments of deferred receivables

(due within 1 year)

30. Inventory: 0.00 0.00 0.00 0.00

i. Raw materials (including stores and

other items used in the process of

manufacture) 0.00 0.00 0.00 0.00

a. Imported 0.00 0.00 0.00 0.00

b. Indigenous

ii. Stocks-in-process 0.00 0.00 0.00 0.00

iii. Finished goods 0.00 0.00 0.00 0.00

iv. Other consumable spares 0.00 0.00 0.00 0.00

a. Imported

b. Indigenous 0.00 0.00 0.00 0.00

31. Advances to suppliers of raw materials

and stores/spares 0.00 0.00 0.00 0.00

32. Advance payment of taxes

33. Other current assets (specify major items) 0.00 0.00 0.00 0.00

a. Interest Receivable

b. Prepaid Expenses

c. Loans and Advances

d. 0.00 0.00 0.00 0.00

34. Total Current Assets (26 to 33) 0.00 0.00 0.00 0.00

10/15/2008 8960164.xls (Form_III) Page 5

ICICI Banking Corporation Ltd.

FIXED ASSETS

35. Gross Block (land, building, machinery,

work-in-progress)

36. Depreciation to date

37. Net Block (35 - 36) 0.00 0.00 0.00 0.00

OTHER NON-CURRENT ASSETS

38. Investments/book debts/advances/deposits

which are not current assets 0.00 0.00 0.00 0.00

i. a. Investments in subsidiary

companies / affiliates

b. Others

ii. Advances to suppliers of capital goods

and contractors 0.00

iii. Deferred receivables (maturity

exceeding 1 year) 0.00 0.00 0.00 0.00

iv. Others 0.00 0.00 0.00 0.00

a. Security Deposits

b. Loans to Subsidiaries

c. Receivables over 6 months

d.

39. Non-consumable stores and spares

40. Other non-current assets including

dues from directors

41. Total Other Non-current Assets (38 to 40) 0.00 0.00 0.00 0.00

42. Intangible Assets (patents, good will,

prelim.expenses, bad / doubtful debts not

provided for, etc.

43. Total Assets (34+37+41+42) 0.00 0.00 0.00 0.00

44. Tangible Net Worth (24 - 42) 0.00 0.00 0.00 0.00

45. Net Working Capital (34 - 10) 0.00 0.00 0.00 0.00

46. Current Ratio (34 / 10)

47. Total OUTSIDE Liabilities / Tangible

Net Worth (18 / 44)

48. Total TERM Liabilities / Tangible

Net Worth (17 / 44)

ADDITIONAL INFORMATION

A. Arrears of depreciation

B. Contingent Liabilities:

i. Arrears of cumulative dividends

ii. Gratuity liability not provided for

iii. Disputed excise / customs /

tax liabilities

iv. Other liabilities not provided for

10/15/2008 8960164.xls (Form_III) Page 6

ICICI Banking Corporation Ltd.

10/15/2008 8960164.xls (Form_III) Page 7

ICICI Banking Corporation Ltd.

FORM IV

COMPARATIVE STATEMENT OF CURRENT ASSETS AND CURRENT LIABILITIES

Name: 0

Amounts in Rs. Crore

Last Year Current Yr. Next Year Peak

Norms Actuals Estimates Projections Requirement

Year 2000 2001 2002

A. CURRENT ASSETS

1. Raw materials (incl. stores & other items

used in the process of manufacture)

a. Imported 0.00 0.00 0.00

Month's Consumption

b. Indigenous 0.00 0.00 0.00

Month's Consumption

2. Other Consumable spares, excluding

those included in 1 above

a. Imported 0.00 0.00 0.00

Month's Consumption

b. Indigenous 0.00 0.00 0.00

Month's Consumption

3. Stock-in-process 0.00 0.00 0.00

Month's cost of production

4. Finished goods 0.00 0.00 0.00

Month's cost of sales

5. Receivables other than export & deferred

receivables (incl. bills purchased &

discounted by bankers) 0.00 0.00 0.00

Month's domestic sales: excluding

deferred payment sales

6. Export receivables (incl. bills purchased

and discounted) 0.00 0.00 0.00

Month's export sales

7. Advances to suppliers of raw materials &

stores / spares, consumables 0.00 0.00 0.00

8. Other current assets incl. cash & bank

balances & deferred receivables due

within one year 0.00 0.00 0.00

Cash and Bank Balances 0.00 0.00 0.00

Investments (other than long term):

i. Govt. and other trustee securities 0.00 0.00 0.00

ii. Fixed Deposits with banks 0.00 0.00 0.00

Instalments of deferred receivables

(due within 1 year) 0.00 0.00 0.00

Advance payment of taxes 0.00 0.00 0.00

Other current assets 0.00 0.00 0.00

10/15/2008 8960164.xls (Form_IV) Page 8

ICICI Banking Corporation Ltd.

9. Total Current Assets 0.00 0.00 0.00

(To agree with item 34 in Form III)

10/15/2008 8960164.xls (Form_IV) Page 9

ICICI Banking Corporation Ltd.

FORM IV

COMPARATIVE STATEMENT OF CURRENT ASSETS AND CURRENT LIABILITIES

Name: 0

Amounts in Rs. Crore

Last Year Current Yr. Next Year Peak

Norms Actuals Estimates Projections Requirement

Year 2000 2001 2002

B. CURRENT LIABILITIES

(Other than bank borrowings for working capital)

10. Creditors for purchase of raw materials,

stores & consumable spares 0.00 0.00 0.00

Month's purchases 0

11. Advances from customers 0.00 0.00 0.00

12. Statutory liabilities 0.00 0.00 0.00

13. Other current liabilities: 0.00 0.00 0.00

Short term borrowings from others 0.00 0.00 0.00

Provision for taxation 0.00 0.00 0.00

Dividend payable 0.00 0.00 0.00

Deposits / instalments of term loans / DPGs

/ debentures etc. (due within 1 year) 0.00 0.00 0.00

Other current liabilities & provisions

(due within 1 year) 0.00 0.00 0.00

14. Total (To agree with total B of Form-III) 0.00 0.00 0.00

10/15/2008 8960164.xls (Form_IV) Page 10

I C I C I Banking Corporation Ltd.

FORM V

COMPUTATION OF MAXIMUM PERMISSIBLE BANK FINANCE FOR WORKING CAPITAL

Name: 0

Amounts in Rs. Crore

Last Year Current Yr. Next Year Peak

First Method of Lending Actuals Estimates Projections Requirement

Year 2000 2001 2002

1. Total Current Assets (Form-IV-9) 0.00 0.00 0.00

2. Other Current Liabilities (other than

bank borrowings (Form-IV-14) 0.00 0.00 0.00

3. Working Capital Gap (WCG) (1-2) 0.00 0.00 0.00

4. Min. stipulated net working capital:

(25% of WCG excluding export receivables) 0.00 0.00 0.00

5. Actual / Projected net working capital

(Form-III-45) 0.00 0.00 0.00

6. Item-3 minus Item-4 0.00 0.00 0.00

7. Item-3 minus Item-5 0.00 0.00 0.00

8. Max. permissible bank finance

(item-6 or 7, whichever is lower) 0.00 0.00 0.00

9. Excess borrowings representing

shortfall in NWC (4 - 5)

Second Method of Lending

1. Total Current Assets (Form-IV-9) 0.00 0.00 0.00

2. Other Current Liabilities (other than

bank borrowings (Form-IV-14) 0.00 0.00 0.00

3. Working Capital Gap (WCG) (1-2) 0.00 0.00 0.00

4. Min. stipulated net working capital:

(25% of total Current Assets excluding

export receivables) 0.00 0.00 0.00

5. Actual / Projected net working capital

(Form-III-45) 0.00 0.00 0.00

6. Item-3 minus Item-4 0.00 0.00 0.00

7. Item-3 minus Item-5 0.00 0.00 0.00

8. Max. permissible bank finance

(item-6 or 7, whichever is lower) 0.00 0.00 0.00

9. Excess borrowings representing

shortfall in NWC (4 - 5)

10/15/2008 8960164.xls (Form_V) Page 11

ICICI Banking Corporation Ltd.

FORM VI

FUNDS FLOW STATEMENT

Name: 0

Amounts in Rs. Crore

Last Year Current Yr. Next Year

Actuals Estimates Projections

Year 2000 2001 2002

1. SOURCES

a. Net Profit 0.00 0.00 0.00

b. Depreciation 0.00 0.00 0.00

c. Increase in Capital 0.00 0.00 0.00

d. Increase in Term Liabilities

(including Public Deposits) 0.00 0.00 0.00

e. Decrease in

i. Fixed Assets

ii. Other non-current Assets

f. Others 0.00 0.00 0.00

g. TOTAL 0.00 0.00 0.00

2. USES

a. Net loss

b. Decrease in Term Liabilities

(including Public Deposits)

c. Increase in

i. Fixed Assets 0.00 0.00 0.00

ii. Other non-current Assets 0.00 0.00 0.00

d. Dividend Payments 0.00 0.00 0.00

e. Others

f. TOTAL 0.00 0.00 0.00

3. Long Term Surplus (+) / Deficit (-) [1-2] 0.00 0.00 0.00

10/15/2008 8960164.xls (Form_VI) Page 12

ICICI Banking Corporation Ltd.

4. Increase/decrease in current assets

* (as per details given below) 0.00 0.00 0.00

5. Increase/decrease in current liabilities

other than bank borrowings 0.00 0.00 0.00

6. Increase/decrease in working capital gap 0.00 0.00 0.00

7. Net Surplus / Deficit (-) [3-6] 0.00 0.00 0.00

8. Increase/decrease in bank borrowings 0.00 0.00 0.00

9. Increase/decrease in NET SALES N/A 0.00 0.00

* Break up of item-4

i. Increase/decrease in Raw Materials 0.00 0.00 0.00

ii. Increase/decrease in Stocks-in-Process 0.00 0.00 0.00

iii. Increase/decrease in Finished Goods 0.00 0.00 0.00

iv. Increase/decrease in Receivables

a) Domestic 0.00 0.00 0.00

b) Export 0.00 0.00 0.00

v. Increase/decrease in Stores & Spares 0.00 0.00 0.00

vi. Increase/decrease in other current assets 0.00 0.00 0.00

TOTAL 0.00 0.00 0.00

10/15/2008 8960164.xls (Form_VI) Page 13

I C I C I Banking Corporation Ltd.

Key Indicators

S. No For year ended / ending 1999 2000 2001 2002

September 30, Actual Actual Estimate Projection

1 Net Sales 0.00 0.00 0.00 0.00

2 PBILDT 0.00 0.00 0.00 0.00

3 PBT 0.00 0.00 0.00 0.00

4 PAT 0.00 0.00 0.00 0.00

5 Net Cash Accruals 0.00 0.00 0.00 0.00

6 P B I L D T/ Net Sales (%) #DIV/0! #DIV/0! #DIV/0! #DIV/0!

7 PAT/ Net Sales (%) #DIV/0! #DIV/0! #DIV/0! #DIV/0!

8 Dividend/PAT (%) #DIV/0! #DIV/0! #DIV/0! #DIV/0!

9 Gross Block 0.00 0.00 0.00 0.00

10 Net Block 0.00 0.00 0.00 0.00

11 Paid up Capital 0.00 0.00 0.00 0.00

12 Tangible Networth (TNW) 0.00 0.00 0.00 0.00

13 Group Invetsments 0.00 0.00 0.00 0.00

14 Adjusted T N W 0.00 0.00 0.00 0.00

15 L T D / T N W #DIV/0! #DIV/0! #DIV/0! #DIV/0!

16 D F S / T N W #DIV/0! #DIV/0! #DIV/0! #DIV/0!

17 T O L / T N W #DIV/0! #DIV/0! #DIV/0! #DIV/0!

18 Current Assets 0.00 0.00 0.00 0.00

19 Current Liabilities 0.00 0.00 0.00 0.00

20 Net Working Capital 0.00 0.00 0.00 0.00

21 Current Ratio

Other Indicators

22 R O C E (%) #DIV/0! #DIV/0! #DIV/0! #DIV/0!

23 Interest Coverage Ratio #DIV/0! #DIV/0! #DIV/0! #DIV/0!

24 DSCR #DIV/0! #DIV/0! #DIV/0!

Fund Flow Analysis

Year Ended / Ending September 30, 2000 2001 2002

Long Term Sources 0.00 0.00 0.00

Long Term uses 0.00 0.00 0.00

Surplus/Deficit 0.00 0.00 0.00

10/15/2008 8960164.xls (Financials) Page 14

I C I C I Banking Corporation Ltd.

Surplus / Incremental build up of current

#DIV/0! #DIV/0! #DIV/0!

assets (%)

Pattern of TCA Funding

Year ended / Ending 30 1999 2000 2001 2002

September

Sundry Creditors #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Other Current Liabilities #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Bank Borrowings #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Long Term funds #DIV/0! #DIV/0! #DIV/0! #DIV/0!

10/15/2008 8960164.xls (Financials) Page 15

I C I C I Banking Corporation Limited

Sensitivity Ananlysis

Trend Analysis of Components of Cost of Sales

(Rs in crore)

2001 5% inc 5% dec 2002 5% inc 5% dec 1999 2000 2001 2002

Net Sales - - - - - - Actuals Actuals Estimates Projections

Variable Cost* - #DIV/0! #DIV/0! - #DIV/0! #DIV/0! RM / Net Sales #DIV/0! #DIV/0! #DIV/0! #DIV/0!

* RM, Packing material, Consumable stores & spares, stock adj and other mfg

expenses

Spares / Net Sales #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Contribution - #DIV/0! #DIV/0! - #DIV/0! #DIV/0! P & F / Net Sales #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Fixed Costs** - - - - - - Labour / Net Sales #DIV/0! #DIV/0! #DIV/0! #DIV/0!

**Power & fuel, Direct labour, Depreciation, SGA and Interest SGA / Net Sales #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Operating Profit - #DIV/0! #DIV/0! - #DIV/0! #DIV/0! OME / Net Sales #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Operating Change in SIP / Net

#DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Profit/Sales Sales

Change in FG/ Net

#DIV/0! #DIV/0! #DIV/0! #DIV/0!

Sales

Depreciation / Net

Break Even Sales #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Sales

Total (Excl Dep) #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Cash Breakeven #DIV/0! #DIV/0! Operating Margin #DIV/0! #DIV/0! #DIV/0! #DIV/0!

10/15/2008 8960164.xls (Sensitivity _ costing) Page 16

I C I C I Banking Corporation Limited

SCENARIOS FOR OPERATIONS FOR FY ENDING 30/9/2001

Scenario 1 Scenario 2 Scenario 3 Scenario 4 Scenario 5 Scenario 6

Change In Net Sales 5% - 0% - 5% - 10% - 0% - 10% -

Change In Variable costs 0% - 5% - 5% - 0% - 10% - 10% -

Contribution - - - - - -

PBILDT - - - - - -

PBT - - - - - -

PBILDT / Net Sales #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Scenario 7 Scenario 8 Scenario 9 Scenario 10 Scenario 11 Scenario 12

Change In Net Sales 20% - 0% - 20% - -5% - 0% - -5% -

Change In Variable costs 0% - 20% - 20% - 0% - -5% - -5% -

Contribution - - - - - -

PBILDT - - - - - -

PBT - - - - - -

PBILDT / Net Sales #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Scenario 13 Scenario 14 Scenario 15 Scenario 16 Scenario 17 Scenario 18

Change In Net Sales -10% - 0% - -10% - -20% - 0% - -20% -

Change In Variable costs 0% - -10% - -10% - 0% - -20% - -20% -

Contribution - - - - - -

PBILDT - - - - - -

PBT - - - - - -

PBILDT / Net Sales #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

10/15/2008 8960164.xls (Sensitivity _ costing) Page 17

I C I C I Banking Corporation Limited

SCENARIOS FOR OPERATIONS FOR FY ENDING 30/9/2002

Scenario 1 Scenario 2 Scenario 3 Scenario 4 Scenario 5 Scenario 6

Change In Net Sales 5% - 0% - 5% - 10% - 0% - 10% -

Change In Variable costs 0% - 5% - 5% - 0% - 10% - 10% -

Contribution - - - - - -

PBILDT - - - - - -

PBT - - - - - -

PBILDT / Net Sales #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Scenario 7 Scenario 8 Scenario 9 Scenario 10 Scenario 11 Scenario 12

Change In Net Sales 20% - 0% - 20% - -5% - 0% - -5% -

Change In Variable costs 0% - 20% - 20% - 0% - -5% - -5% -

Contribution - - - - - -

PBILDT - - - - - -

PBT - - - - - -

PBILDT / Net Sales #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Scenario 13 Scenario 14 Scenario 15 Scenario 16 Scenario 17 Scenario 18

Change In Net Sales -10% - 0% - -10% - -20% - 0% - -20% -

Change In Variable costs 0% - -10% - -10% - 0% - -20% - -20% -

Contribution - - - - - -

PBILDT - - - - - -

PBT - - - - - -

PBILDT / Net Sales #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

10/15/2008 8960164.xls (Sensitivity _ costing) Page 18

I C I C I Banking Corporation Limited

10/15/2008 8960164.xls (Sensitivity _ costing) Page 19

I C I C I Banking Corporation Limited

10/15/2008 8960164.xls (Sensitivity _ costing) Page 20

I C I C I Banking Corporation Limited

10/15/2008 8960164.xls (Sensitivity _ costing) Page 21

You might also like

- Equity Valuation - Case Study 2Document5 pagesEquity Valuation - Case Study 2sunjai100% (6)

- Go Speedy Go: InternshipDocument1 pageGo Speedy Go: InternshipSandeep KumarNo ratings yet

- Role of Agriculture Processing in Export Growth of Agricultural ProductsDocument8 pagesRole of Agriculture Processing in Export Growth of Agricultural ProductsAwadhesh YadavNo ratings yet

- Britannia Financial Results for Year Ending March 2020Document3 pagesBritannia Financial Results for Year Ending March 2020Art beateNo ratings yet

- Ground and Processed Spices and Cereals Project ReportDocument5 pagesGround and Processed Spices and Cereals Project ReportGirish DaryananiNo ratings yet

- Business Plan CHPTR 1Document10 pagesBusiness Plan CHPTR 1Deepali SaxenaNo ratings yet

- Olympic Industries LimitedDocument18 pagesOlympic Industries LimitedRakib HasanNo ratings yet

- Cera Sanitaryware - CRISIL - Aug 2014Document32 pagesCera Sanitaryware - CRISIL - Aug 2014vishmittNo ratings yet

- Guidelines For TEV Consultant PDFDocument6 pagesGuidelines For TEV Consultant PDFSatyanarayana Moorthy PiratlaNo ratings yet

- Devyani International IPO previewDocument12 pagesDevyani International IPO previewgbNo ratings yet

- Business PlanDocument20 pagesBusiness PlanArchana JhaNo ratings yet

- Case Study of Hand Made Silver Filigree / Jewellery Cluster at Cuttak - OrrisaDocument5 pagesCase Study of Hand Made Silver Filigree / Jewellery Cluster at Cuttak - OrrisasupriyadhageNo ratings yet

- LG (Electronics) ,: Total 102260Document2 pagesLG (Electronics) ,: Total 102260Ben HiranNo ratings yet

- Initiating Coverage - Indian Hume Pipe Co.Document38 pagesInitiating Coverage - Indian Hume Pipe Co.rroshhNo ratings yet

- Unit - Iii Profit Prior To IncorporationDocument33 pagesUnit - Iii Profit Prior To IncorporationShah RukhNo ratings yet

- Project Report Mandap DecorationDocument17 pagesProject Report Mandap Decorationkushal chopda100% (1)

- Presentation Report of Britannia Industries LimitedDocument54 pagesPresentation Report of Britannia Industries LimitedRahul Sarkar0% (2)

- Competitor Analysis DaburDocument29 pagesCompetitor Analysis DaburBabasab Patil (Karrisatte)67% (3)

- Tax Planning and Compliances Suggested Answers (Exam Nov-Dec, 2020) Question No.1Document17 pagesTax Planning and Compliances Suggested Answers (Exam Nov-Dec, 2020) Question No.1Tariqul IslamNo ratings yet

- Apollo Hospital Case 2 Study 020522Document9 pagesApollo Hospital Case 2 Study 020522Vagabond DonNo ratings yet

- Consumer Durables Industry in IndiaDocument11 pagesConsumer Durables Industry in IndiaSiba PrasadNo ratings yet

- NABARD Dairy Farming Project - PDF - Agriculture - Loans PDFDocument7 pagesNABARD Dairy Farming Project - PDF - Agriculture - Loans PDFshiba prasad panjaNo ratings yet

- (A) Value of The Marginal Propensity To Save Decreases.: Income 100 150Document4 pages(A) Value of The Marginal Propensity To Save Decreases.: Income 100 150Ashutosh SharmaNo ratings yet

- Stove Kraft Initiating CoverageDocument30 pagesStove Kraft Initiating Coverageprat wNo ratings yet

- DaburDocument27 pagesDaburPriyanka Kale100% (1)

- Strategies Adopted by SwiggyDocument3 pagesStrategies Adopted by SwiggyStuti JainNo ratings yet

- Unit 1Document35 pagesUnit 1Monika SaxenaNo ratings yet

- A Study of The Credit Appraisal System at Indusind Bank, Business Banking Division, BangaloreDocument74 pagesA Study of The Credit Appraisal System at Indusind Bank, Business Banking Division, BangaloreRahul NandiNo ratings yet

- DDM Federal BankDocument15 pagesDDM Federal BankShubhangi 16BEI0028No ratings yet

- Net Profit As Per Section 198 and 309 (5) of The ActDocument2 pagesNet Profit As Per Section 198 and 309 (5) of The ActIsha ShahNo ratings yet

- GCPL strategic positioning and value chain analysisDocument12 pagesGCPL strategic positioning and value chain analysissaitama goku100% (1)

- Strategic ManagementDocument5 pagesStrategic Managementgmb117No ratings yet

- Acc301 Ca 2Document9 pagesAcc301 Ca 2Kathuria AmanNo ratings yet

- CCD FailureDocument5 pagesCCD FailureSajan BhuvadNo ratings yet

- RSPL Limited - R - 16102020Document8 pagesRSPL Limited - R - 16102020DarshanNo ratings yet

- Chapter 2 - Solved ProblemsDocument26 pagesChapter 2 - Solved ProblemsDiptish RamtekeNo ratings yet

- LaxmiDocument11 pagesLaxmikattyperrysherryNo ratings yet

- Licious Meat Market StrategyDocument5 pagesLicious Meat Market Strategyakanksha0% (1)

- Leverage Unit-4 Part - IIDocument34 pagesLeverage Unit-4 Part - IIAstha ParmanandkaNo ratings yet

- Zomato Annual Report 2022 1659701415938Document5 pagesZomato Annual Report 2022 1659701415938Mahak SarawagiNo ratings yet

- Kumar Proposal For Enhancement 27-32Document34 pagesKumar Proposal For Enhancement 27-32Chanderparkash Arora0% (1)

- School of Business and Management Christ (Deemed To Be University) BangaloreDocument8 pagesSchool of Business and Management Christ (Deemed To Be University) BangaloreMedha Singh100% (1)

- Designing Global Market StrategiesDocument6 pagesDesigning Global Market StrategiesGeraNo ratings yet

- GodrejDocument19 pagesGodrejTejasvi VoraNo ratings yet

- Pay1 - Proposal For Merchant LendingDocument6 pagesPay1 - Proposal For Merchant LendingAdhe IdhiNo ratings yet

- Export Performance of IndiaDocument31 pagesExport Performance of IndiaJeevan JainNo ratings yet

- VMOGSWS Strategies Report on ITC LtdDocument14 pagesVMOGSWS Strategies Report on ITC Ltdsamarth agarwalNo ratings yet

- Cost Accounting: Cia 3 Component 2 Aditya Jain 1620203 4 BBA B'Document9 pagesCost Accounting: Cia 3 Component 2 Aditya Jain 1620203 4 BBA B'Aditya JainNo ratings yet

- Understanding Safal's retail business and distribution channelDocument63 pagesUnderstanding Safal's retail business and distribution channelNishtha TanejaNo ratings yet

- Pmmy Medical StoreDocument12 pagesPmmy Medical StoreARIFNo ratings yet

- Disbursement Letter-BML Uttara FinanceDocument2 pagesDisbursement Letter-BML Uttara FinanceZahed IbrahimNo ratings yet

- Godrej PropertiesDocument18 pagesGodrej PropertiesAnjali ShergilNo ratings yet

- Mr. Aniket Chandanshiv e Dr. Ravi JaiswalDocument72 pagesMr. Aniket Chandanshiv e Dr. Ravi JaiswalAnup PatraNo ratings yet

- Assessment of Working Capital Requirements Form Ii - Operating Statement Sanoj Kumar Potdar Amounts in Rs. LacsDocument34 pagesAssessment of Working Capital Requirements Form Ii - Operating Statement Sanoj Kumar Potdar Amounts in Rs. LacsRakesh YadavNo ratings yet

- Annexure II-IV Forms Operating Statement Analysis Balance SheetDocument21 pagesAnnexure II-IV Forms Operating Statement Analysis Balance SheetShushant ShekharNo ratings yet

- Bank of India Fund BasedDocument33 pagesBank of India Fund Basedhariram v choudharyNo ratings yet

- Instruction for filling blue fields in rupees formatDocument38 pagesInstruction for filling blue fields in rupees formatsanket1892No ratings yet

- CMA Blank FormDocument34 pagesCMA Blank FormbipinNo ratings yet

- BHAGYALAKSMI CMA LOAN BHBHJDocument15 pagesBHAGYALAKSMI CMA LOAN BHBHJbal balreddyNo ratings yet

- Assessment of Working Capital Requirements Form Ii: Operating StatementDocument12 pagesAssessment of Working Capital Requirements Form Ii: Operating StatementMD.SAFIKUL MONDALNo ratings yet

- 62587e780fb87a39714debb0 - Workday Payroll File QRG and Earnings Deduction CodesDocument4 pages62587e780fb87a39714debb0 - Workday Payroll File QRG and Earnings Deduction CodesHarithaNo ratings yet

- Manual MarkstratDocument186 pagesManual MarkstratValentin Stefan MitoiNo ratings yet

- 麺印胱tm飢t O章⑲師的t近地: p藍鍋肌N, 。BS。 ⅤDocument4 pages麺印胱tm飢t O章⑲師的t近地: p藍鍋肌N, 。BS。 ⅤALEX SARAOSOSNo ratings yet

- WORKING CAP MGMT AND FIN STATEMNTS ANALYSIS PDF 8708Document12 pagesWORKING CAP MGMT AND FIN STATEMNTS ANALYSIS PDF 8708lena cpa0% (1)

- Types of LettersDocument9 pagesTypes of LettersTrisha CabralNo ratings yet

- Call Center Business Plan ExampleDocument33 pagesCall Center Business Plan ExamplemeozenemyNo ratings yet

- PARALEL QUIZ - Introduction of AccountingDocument5 pagesPARALEL QUIZ - Introduction of AccountingCut Farisa MachmudNo ratings yet

- Full Download Financial Accounting A Business Process Approach 3rd Edition Reimers Solutions ManualDocument36 pagesFull Download Financial Accounting A Business Process Approach 3rd Edition Reimers Solutions Manualdrizitashao100% (43)

- Strategic Management Term Paper On Mico BoschDocument46 pagesStrategic Management Term Paper On Mico BoschSandeep KulkarniNo ratings yet

- 01multiple ChoiceDocument12 pages01multiple ChoicePRINCESS MAY ADAMNo ratings yet

- Borrowing CostsDocument17 pagesBorrowing CostsJatin SunejaNo ratings yet

- B01028 - Chapter 6 - Lending To Business Firms and Pricing Business LoansDocument57 pagesB01028 - Chapter 6 - Lending To Business Firms and Pricing Business LoansNguyen GodyNo ratings yet

- I-Great TerasDocument23 pagesI-Great Terasapi-240706460No ratings yet

- Advanced Accounting Baker Test Bank - Chap010Document67 pagesAdvanced Accounting Baker Test Bank - Chap010donkazotey50% (2)

- 67078bos54071 Inter gp1Document104 pages67078bos54071 Inter gp1Hari AdabalaNo ratings yet

- 02-FI-02 - SDD - MSRDC - VBSL - Funds Creation Allocation - V1Document13 pages02-FI-02 - SDD - MSRDC - VBSL - Funds Creation Allocation - V1DanielpremassisNo ratings yet

- JAIIB Accounts MODULE - CDocument149 pagesJAIIB Accounts MODULE - CShashank Shekhar100% (1)

- Cold Storage FeasibilityDocument13 pagesCold Storage FeasibilitySahib JanNo ratings yet

- Revised Tax QuestionsDocument25 pagesRevised Tax QuestionssophiaNo ratings yet

- Lecture Notes On Financial ForecastingDocument7 pagesLecture Notes On Financial Forecastingpalkee100% (3)

- Topic 1 Introduction To TaxationDocument28 pagesTopic 1 Introduction To TaxationZebedee Taltal0% (1)

- IA Prefinal Exam Submissions: Intermediate Accounting II Pre-FinalDocument10 pagesIA Prefinal Exam Submissions: Intermediate Accounting II Pre-FinalClaire BarbaNo ratings yet

- Soal Dan Jawaban Tugas Lab 1 - Home Office and Branch OfficeDocument6 pagesSoal Dan Jawaban Tugas Lab 1 - Home Office and Branch OfficePUTRI YANINo ratings yet

- Standalone Balance Sheet: As at March 31, 2019Document40 pagesStandalone Balance Sheet: As at March 31, 2019Ashutosh BiswalNo ratings yet

- Chapter 09 Testbank Questions and AnswersDocument47 pagesChapter 09 Testbank Questions and AnswersTrinh LêNo ratings yet

- Ivan Madrigals Comprehensive Master Budget Project Version ADocument5 pagesIvan Madrigals Comprehensive Master Budget Project Version Aapi-315768301No ratings yet

- Iexpenses GuideDocument89 pagesIexpenses GuideVijay VinnakotaNo ratings yet

- Business ProfileDocument6 pagesBusiness ProfileMarianne SevillaNo ratings yet

- Laxmi Bank Annual Report 2073 - 74 English PDFDocument62 pagesLaxmi Bank Annual Report 2073 - 74 English PDFPrashant McFc AdhikaryNo ratings yet

- Deffered Tax and Tax Expense and Owner - Cheat SheetDocument5 pagesDeffered Tax and Tax Expense and Owner - Cheat SheetSayorn Monanusa ChinNo ratings yet