Professional Documents

Culture Documents

Salary Tax

Uploaded by

api-3810632Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Salary Tax

Uploaded by

api-3810632Copyright:

Available Formats

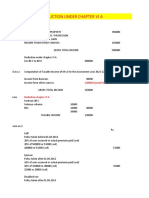

INCOME TAX STATEMENT FOR THE YEAR 2005-06 ASSESSMENT YEAR 2006-07

NAME OF THE OFFICIAL:- SHRI. A .SARKAR, JUNIOR ENGINEER (ELECT.)

DEPARTMENT:- C.P.W.D. / CESD-IV / MCED-III / Mumbai - 99.

GROSS SALARY:- 155442.00

INCOME FROM OTHER SOURCES:-

(a) Interest on S.B. A/c 122.00

TRAVELLING ALLOWANCE:- -4800.00

PROFESSIONAL TAX:- -2500.00

HBA INTEREST (UNDER SECTION 24(b):- -16825.00

NET SALARY:- 131439.00

DEDUCTION:-

1 C.G.E.I.S. 360.00

2 GENERAL PROVIDENT FUND 12000.00

3 LIC PREMIUM (limited to 20% of sum assured) (10266+10266+3300) 23832.00

4 Postel Life Insurance (PLI) 0.00

5 Tution fee paid (limited to 2 children) 5400.00

6 Contribution to ULIP 0.00

7 National Saving certificate 0.00

8 Subscription to units of any mutual fund 0.00

9 Any installment or part-payment of the amount borrowed for const./ purchase of

resdl. Property from Govt./Bank/LIC/Cooperative Bank/ Housing Board/

Development authority etc. 0.00

(a) Principal amount (Upto 20000) (Under Section 80C) 7163.00

10

Contribution upto Rs. 10,000/- per annum to the new pension fund introduced by

LIC or any other insurer notified by the Central Govt.

0.00

11 Contribution upto the new pension scheme limited to 10% of salary 0.00

12 Deduction of premium amount upto Rs. 10,000/- paid by cheque for medical

insurance under any scheme framed by Gen. Insurance Corp. or any other

insurer notified by the Central Govt. if the assessee/spouse or dependent parents

or any member of the family is a senior citizen covered by the policy. Premium

upto Rs. 15000.00 can be deducted (Section 80-D) 0.00

13 Any donation for charitable purpose 0.00

14 Rs. 50,000.00 in case of assessee who is a person with disability or Rs.

75,000.00 if he is a person with severve disability. 0.00

TOTAL DEDUCTION 48755.00

TAXABLE INCOME (rounded off to nearest multiple of ten rupee) 0.00

INCOME TAX RATES

Category Amount Rate

OTHERS

a) 100000 to 150000 10% of income exceeding Rs. 100000.00 NIL

b) 150001 to 250001 Rs. 5000.00 plus 20% of income exceeding Rs. 150000.00 -

c) 250000 and above 25000.00 plus 30% of income exceeding Rs. 250000.00 -

WOMEN

a) 135000 to 150000 10% of income exceeding Rs. 150000.00 -

b) 150000 to 250000 1500 plus 20% of income exceeding Rs. 150000.00 -

c) 250000 and above Rs.21500/- plus 30% of income exceeding Rs.150000/- Rs. 250000/- -

TAX PAYABLE 0.00

Jan-06

Feb-06

TOTAL TAX PAID

SIGNATURE OF THE OFFICIAL.

$550.00

You might also like

- Periyar University: (NAAC Reaccredited With 'A++' Grade - State University-NIRF Rank 73-ARIIA RANK 10)Document2 pagesPeriyar University: (NAAC Reaccredited With 'A++' Grade - State University-NIRF Rank 73-ARIIA RANK 10)Indumadhi SalemNo ratings yet

- IT Calculation New RegimeDocument4 pagesIT Calculation New Regimeyelrihs23No ratings yet

- UntitledDocument45 pagesUntitledWS KNIGHTNo ratings yet

- Income Tax Calculation SheetDocument8 pagesIncome Tax Calculation SheetArajrubanNo ratings yet

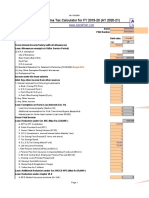

- Income Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaDocument7 pagesIncome Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaSARAVANAN PNo ratings yet

- Amma Income TaxDocument5 pagesAmma Income Taxraghuraman1511No ratings yet

- Income Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaDocument8 pagesIncome Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaGeetanjali BarejaNo ratings yet

- Income Tax Calculator Fy 2020 21 v1Document8 pagesIncome Tax Calculator Fy 2020 21 v1Yogesh BajajNo ratings yet

- Income Tax Calculator Fy 2021 22 v2Document15 pagesIncome Tax Calculator Fy 2021 22 v2KumardasNsNo ratings yet

- Faq'S & Guidlines On Income TaxDocument50 pagesFaq'S & Guidlines On Income TaxRavikarthik GurumurthyNo ratings yet

- Deductions Dec 21Document26 pagesDeductions Dec 21snowbell 95No ratings yet

- Wa0016Document3 pagesWa0016Vinay DahiyaNo ratings yet

- Income TaxDocument11 pagesIncome Taxci_balaNo ratings yet

- Computation of Toatal IncomeDocument4 pagesComputation of Toatal IncomePRITAM PATRANo ratings yet

- Sols-Dr RajniDocument5 pagesSols-Dr Rajnialex breymannNo ratings yet

- IPCC Gr.I Paper 4 TaxationDocument10 pagesIPCC Gr.I Paper 4 TaxationAyushi RajputNo ratings yet

- Income Tax CalculatorDocument9 pagesIncome Tax Calculatorchandu halwaeeNo ratings yet

- Old Vs New Tax Rates Regime (6 Cases)Document6 pagesOld Vs New Tax Rates Regime (6 Cases)Jigeesha BhargaviNo ratings yet

- Income Tax Calculator Fy 2020 21 v2Document12 pagesIncome Tax Calculator Fy 2020 21 v2Anonymous Clm40C1No ratings yet

- It Return BHK 2022-23Document2 pagesIt Return BHK 2022-23Ganesh PawarNo ratings yet

- 1.80C, 80Cc Details: - Amount: Empno/Pernr Cadre Pan No. Branch Position/Desig Office NameDocument3 pages1.80C, 80Cc Details: - Amount: Empno/Pernr Cadre Pan No. Branch Position/Desig Office NameJeeban MishraNo ratings yet

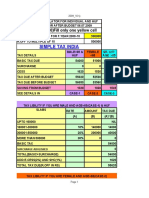

- Simple Tax India: (F.YEAR 2009-10) Fill Only One Yellow CellDocument4 pagesSimple Tax India: (F.YEAR 2009-10) Fill Only One Yellow CellRaj PatilNo ratings yet

- Simple Tax India: (F.YEAR 2009-10) Fill Only One Yellow CellDocument4 pagesSimple Tax India: (F.YEAR 2009-10) Fill Only One Yellow CellPradip ShawNo ratings yet

- Tax Calculator AY 09-10Document4 pagesTax Calculator AY 09-10madhuamsNo ratings yet

- Case Study 2Document2 pagesCase Study 2Anil NagarajNo ratings yet

- IGA69636 SalSlipWithTaxDetailsMiscDocument1 pageIGA69636 SalSlipWithTaxDetailsMiscHrithik ghoshNo ratings yet

- Tax Calculator - Indian Income Tax 2008-09Document7 pagesTax Calculator - Indian Income Tax 2008-09Jayamohan100% (29)

- AMJITHDocument2 pagesAMJITHplacementcell Govt ITI AttingalNo ratings yet

- IGA61306 SalSlipWithTaxDetailsMiscDocument1 pageIGA61306 SalSlipWithTaxDetailsMiscSanthoshNo ratings yet

- Model Solution: Page 1 of 6Document6 pagesModel Solution: Page 1 of 6ShuvonathNo ratings yet

- Income Tax Statement For The Financial Year 2022-23 of K.sasiDHAR On 09-01-2023Document8 pagesIncome Tax Statement For The Financial Year 2022-23 of K.sasiDHAR On 09-01-2023Katari SasidharNo ratings yet

- F0RM NO. 16 (See Rule 31 (1) (A) ) (Annexure-B) : (B) Tax On EmploymentDocument1 pageF0RM NO. 16 (See Rule 31 (1) (A) ) (Annexure-B) : (B) Tax On EmploymentSourabhthakral_1No ratings yet

- Vetan Deyak Praptra Vittiya Niyam Sangrah, Khand-5, Bhag-1 See Chapter 6 Para-108, Chapter 7 Para-131Document18 pagesVetan Deyak Praptra Vittiya Niyam Sangrah, Khand-5, Bhag-1 See Chapter 6 Para-108, Chapter 7 Para-131Arjun VermaNo ratings yet

- Luminous Power Technologies Private Limited: Earnings DeductionsDocument1 pageLuminous Power Technologies Private Limited: Earnings Deductionssathish kumar.kNo ratings yet

- Income Tax CalculatorDocument11 pagesIncome Tax Calculatorsaty_76No ratings yet

- 1663274292-Tax Cals-1Document1 page1663274292-Tax Cals-1Kriti GandhiNo ratings yet

- Income Tax Form 2020 IDocument1 pageIncome Tax Form 2020 ISuvashreePradhanNo ratings yet

- Union Budget-2020-21 New Tax Rates Vs Existing Tax Rates For IndividualDocument2 pagesUnion Budget-2020-21 New Tax Rates Vs Existing Tax Rates For IndividualCA Upendra Singh ThakurNo ratings yet

- Tutorial 6 - Salaries TaxDocument5 pagesTutorial 6 - Salaries Tax周小荷No ratings yet

- Income Tax Planner FY 2020-21Document12 pagesIncome Tax Planner FY 2020-21RedNo ratings yet

- Anwar Group of IndustriesDocument1 pageAnwar Group of IndustriesMoment RevealersNo ratings yet

- Bose Tax 2024Document2 pagesBose Tax 2024placementcell Govt ITI AttingalNo ratings yet

- ASWATHYDocument2 pagesASWATHYplacementcell Govt ITI AttingalNo ratings yet

- Tax Calculator FY-2020-21Document12 pagesTax Calculator FY-2020-21Naveen Narasimha MurthyNo ratings yet

- Salary On IncomeDocument22 pagesSalary On IncomeManjunathNo ratings yet

- Sunil BDocument2 pagesSunil Bplacementcell Govt ITI AttingalNo ratings yet

- S Income Tax Declaration April 2017Document2 pagesS Income Tax Declaration April 2017HanumanthNo ratings yet

- Income Tax Calculator Fy 2021 22 v2Document11 pagesIncome Tax Calculator Fy 2021 22 v2yuvirocksNo ratings yet

- Afsal TaxDocument2 pagesAfsal Taxplacementcell Govt ITI AttingalNo ratings yet

- Income Tax Calculator Fy 2019 20 v4Document9 pagesIncome Tax Calculator Fy 2019 20 v4Anil KesarkarNo ratings yet

- Idf 1025279Document3 pagesIdf 1025279tamaldNo ratings yet

- Developed By-Office Automation Division, IIT Kanpur Page No.1Document2 pagesDeveloped By-Office Automation Division, IIT Kanpur Page No.1Kishan OmarNo ratings yet

- Income Tax Calculator 2018-19Document15 pagesIncome Tax Calculator 2018-19Raju Ranjan SinghNo ratings yet

- Latest Tax CalculatIor 3.3.2Document16 pagesLatest Tax CalculatIor 3.3.2Bijender Pal Choudhary100% (3)

- E-Filling of Returns (Shivdas 10 Years)Document122 pagesE-Filling of Returns (Shivdas 10 Years)Unicorn SpiderNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Rewiring of Flat No G-41 and Minor Repair at F-19, A-17 EtcDocument3 pagesRewiring of Flat No G-41 and Minor Repair at F-19, A-17 Etcapi-3810632No ratings yet

- Pump RepairDocument3 pagesPump Repairapi-3810632No ratings yet

- Pay& Accounts OfficeDocument2 pagesPay& Accounts Officeapi-3810632No ratings yet

- Pay 2006Document1 pagePay 2006api-3810632No ratings yet

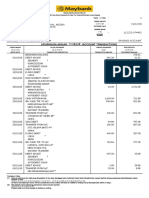

- P L I Premium ReceiptDocument4 pagesP L I Premium Receiptapi-3810632No ratings yet

- MSEBDocument1 pageMSEBapi-3810632No ratings yet

- Monthly Report of LiftDocument1 pageMonthly Report of Liftapi-3810632No ratings yet

- GPRA1Document892 pagesGPRA1api-3810632No ratings yet

- New Balance CR$46.79 Amount Due $0.00 Payment Not Required: American Express® Gold CardDocument10 pagesNew Balance CR$46.79 Amount Due $0.00 Payment Not Required: American Express® Gold CardJohn RoyNo ratings yet

- Jeremyybardolazacabillo: Page1of4 016palentintostbrgypansol 9 0 0 9 - 0 7 6 4 - 4 9 Calambalaguna 4 0 2 7Document4 pagesJeremyybardolazacabillo: Page1of4 016palentintostbrgypansol 9 0 0 9 - 0 7 6 4 - 4 9 Calambalaguna 4 0 2 7Jeremy CabilloNo ratings yet

- 112223-074492 20181231 PDFDocument3 pages112223-074492 20181231 PDFKamarul AzmiNo ratings yet

- List of Importables ExcelDocument4 pagesList of Importables ExcelRACNo ratings yet

- Statement Sylvester Chidozie Agunwa 0072388159Document1 pageStatement Sylvester Chidozie Agunwa 0072388159AgunwaNo ratings yet

- Custom Clearnence ProcedureDocument7 pagesCustom Clearnence ProcedureAdeeb AkmalNo ratings yet

- Form 16 WORD FORMATEDocument2 pagesForm 16 WORD FORMATEJay83% (46)

- Purchase Order Purchase Order: Item Details Item DetailsDocument1 pagePurchase Order Purchase Order: Item Details Item Detailsnagesh99No ratings yet

- Payslip May2017 SF396Document1 pagePayslip May2017 SF396abhilash H100% (1)

- Blank IRP6 CompanyDocument3 pagesBlank IRP6 CompanyNozipho Mpofu100% (1)

- ERACTS Complaints ListDocument253 pagesERACTS Complaints ListNambirajanNo ratings yet

- Airport TaxesDocument16 pagesAirport TaxestiecvuibatngoNo ratings yet

- Invoice: Kubang Pasu 06050 Bukit Kayu Hitam Kedah Darul Aman S Berasrama Penuh IntegrasiDocument1 pageInvoice: Kubang Pasu 06050 Bukit Kayu Hitam Kedah Darul Aman S Berasrama Penuh IntegrasiGerik VaporNo ratings yet

- 1909200284Document1 page1909200284Roni WibowoNo ratings yet

- At Io N at Et: The Polytechnic Ibadan IRSDocument1 pageAt Io N at Et: The Polytechnic Ibadan IRSadegbola hamzatNo ratings yet

- Visa Lounge List PDFDocument2 pagesVisa Lounge List PDFShivaNo ratings yet

- NTUC Supply Chain ManagementDocument26 pagesNTUC Supply Chain ManagementPatRick NgNo ratings yet

- Income-Tax Banggawan2019 CR7Document10 pagesIncome-Tax Banggawan2019 CR7Noreen Ledda11% (9)

- Hourly Invoice: Description Hours Rate ($) Total ($)Document2 pagesHourly Invoice: Description Hours Rate ($) Total ($)Heptagon AutomotiveNo ratings yet

- MINOR PROJECT Bharat PeDocument39 pagesMINOR PROJECT Bharat PeKrish Pahuja75% (4)

- PLDT AcoDocument1 pagePLDT AcoWesNo ratings yet

- Institute of Distance and Open Learning, University of MumbaiDocument1 pageInstitute of Distance and Open Learning, University of MumbaiVivek ChauhanNo ratings yet

- 99 Ott 12326587075Document1 page99 Ott 12326587075Bransun InternationalNo ratings yet

- 164017-073241 20190331 PDFDocument5 pages164017-073241 20190331 PDFjalaluddinNo ratings yet

- This Is A System-Generated Statement. Hence, It Does Not Require Any SignatureDocument16 pagesThis Is A System-Generated Statement. Hence, It Does Not Require Any SignaturemohitNo ratings yet

- Transaction StatementDocument10 pagesTransaction StatementSUVODEEP SARKARNo ratings yet

- 3063 20170921 Statement PDFDocument4 pages3063 20170921 Statement PDFAinur RahmanNo ratings yet

- Tampa Rail Recommendation & Feasibility ReportDocument16 pagesTampa Rail Recommendation & Feasibility ReportBill WalshNo ratings yet

- 3Document1 page3Primadani DaniNo ratings yet

- CPPDSM4006A Establish and Manage Agency Trust Accounts Written AssessmentDocument10 pagesCPPDSM4006A Establish and Manage Agency Trust Accounts Written AssessmentYasir Abdul Karim suriyaNo ratings yet