Professional Documents

Culture Documents

Sol. Ch. 8

Uploaded by

phoopoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sol. Ch. 8

Uploaded by

phoopoCopyright:

Available Formats

Chapter 8

CHAPTER 8

Chapter 8

235

EXERCISES

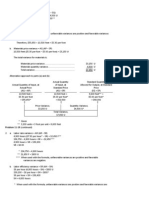

E8-1

a.

Standard Cost Summary

Materials2 lbs. @ $8 ............................................

Labor1 hr. @ $10 .................................................

Factory overhead$4,000 1,000 units.................

$16

10

4

Standard unit cost....................................................

$30

Note: The standard cost is the same for E8-2 through E8-5.

b. Materials price variance = AQ (AP-SP)

= 2,000 ($8.50-$8.00)

= $1,000 unfav.

Materials quantity variance = SP (AQ-SQ)

= $8 [1,900 - (1,000 x 2)]

= $800 fav.

c.

Case 1

(1)

(2)

(3)

Case 2

(1)

(2)

(3)

d.

Work in Process (2,000$8) ..........................

Materials Price Variance (Unfavorable)

(2,000$0.50) ................................................

Materials (2,000$8.50) ...........................

16,000

Work in Process (1,000 hrs.$10) .................

Payroll ........................................................

10,000

Work in Process ..............................................

Factory Overhead ......................................

4,000

Work in Process ..............................................

Materials Quantity Variance (Favorable)

(100 $8). ..................................................

Materials (1,900 $8).................................

16,000

Work in Process ..............................................

Payroll ........................................................

10,000

Work in Process ..............................................

Factory Overhead ......................................

4,000

Cases 1 and 2

Finished Goods ...............................................

Work in Process .........................................

Note: This entry is the same for E8-2 and E8-3.

1,000

17,000

10,000

4,000

800

15,200

10,000

4,000

30,000

30,000

236

Chapter 8

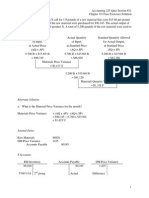

E8-2

a.

Same as E8-1.

b.

Labor rate variance = AQ (AP SP)

= 1,000 ($10.20 - $10.00)

= $200 unfav.

Labor efficiency variance = SP (AQ SQ)

= $10 [ 900 (1000 x 1)]

= $1,000 fav.

c.

Case 1

(1)

(2)

(3)

Case 2

(1)

(2)

(3)

d.

Work in Process ..............................................

Materials ....................................................

16,000

Work in Process ..............................................

Labor Rate Variance (Unfavorable)

(1,000$0.20) ................................................

Payroll (1,000$10.20) .............................

10,000

Work in Process ..............................................

Factory Overhead ......................................

4,000

Work in Process ..............................................

Materials ....................................................

16,000

Work in Process ..............................................

Labor Efficiency Variance (Favorable)

(100$10) .................................................

Payroll (900$10) .....................................

10,000

Work in Process ..............................................

Factory Overhead ......................................

4,000

Same as E8-1

16,000

200

10,200

4,000

16,000

1,000

9,000

4,000

Chapter 8

237

E8-3

a.

Same as E8-1.

b.

Materials price variance = AQ (AP SP)

= 1,900 ($8.50 - $8.00)

= $950 unfav.

Materials quantity variance --- same as in E8-1 ($800 . fav)

Labor rate variance = AQ (AP SP)

= 900 ($10.20 - $10.00)

= $180 unfav.

Labor efficiency variance = same as in E8-2 ($1,000 fav.)

c.

(1)

(2)

(3)

Work in Process ..............................................

Materials Price Variance (Unfavorable)

(1,950$0.50) ................................................

Materials Quantity Variance (Favorable)

(100 $8) ...................................................

Materials (1,900$8.50) ...........................

16,000

Work in Process ..............................................

Labor Rate Variance (Unfavorable)

(900$0.20) ...................................................

Labor Efficiency Variance (Favorable)

(100$10) .................................................

Payroll (900$10.20) ................................

10,000

Work in Process ..............................................

Factory Overhead ......................................

4,000

d. Same as E8-1.

950

800

16,150

180

1,000

9,180

4,000

238

Chapter 8

E8-4

a.

Same as E8-1.

b.

Materials price variancesame as in E 8-3.

Materials quantity variance = SP (AQ SQ)

= $8 [1,900 (950 x 2)]

= $-0Labor rate variance --- same as in E8-3

Labor efficiency variance = SP (AQ SQ)

= $10 [ 900 (950 x 1)]

= $500 fav.

c.

(1)

(2)

(3)

d.

Work in Process (950$16) ...........................

Materials Price Variance (Unfavorable)

(1,900$0.50) ................................................

Materials (1,900$8.50) ...........................

15,200

Work in Process (950$10) ...........................

Labor Rate Variance (Unfavorable)

(900$0.20) ...................................................

Labor Efficiency Variance (Favorable)

(50$10) ...................................................

Payroll (900$10.20) ................................

9,500

Work in Process ..............................................

Factory Overhead (950$4) .....................

3,800

Finished Goods (950$30) ............................

Work in Process .........................................

28,500

950

16,150

180

500

9,180

3,800

28,500

Chapter 8

239

E8-5

a.

Same as E8-1.

b.

Materials price variance--- same as in E8-3.

Materials quantity variance = SP (AQ SQ)

= $8 [ 1,900 (1,050 x 2)]

= $1,600 fav.

Labor rate variance--- same as in E8-3.

Labor efficiency variance = SP (AQ SQ)

= $10 [ 900 (1,050 x 1)]

= $1,500 fav.

c.

(1)

(2)

(3)

d.

Work in Process (1,050$16) ........................

Materials Price Variance (Unfavorable)

(1,900$0.50) ................................................

Materials Quantity Variance (Favorable)

(200$8) ...................................................

Materials (1,900$8.50) ...........................

16,800

Work in Process (1,050$10) ........................

Labor Rate Variance (Unfavorable)

(900$0.20) ...................................................

Labor Efficiency Variance (Favorable)

(150$10) .................................................

Payroll (900$10.20) ................................

10,500

Work in Process ..............................................

Factory Overhead (1,050$4) ..................

4,200

Finished Goods (1,050$30) .........................

Work in Process .........................................

31,500

950

1,600

16,150

180

1,500

9,180

4,200

31,500

240

Chapter 8

E8-6

1. Actual quantityactual price = total cost of purchases

200,000 $0.175 = $35,000

2. (Actual price Standard price) x Actual quantity purchased = Materials Pr. Var.

($.175 - $.17) x 200,000 = $1,000 unfav.

3. (Actual quantity standard quantity) x Standard price = Materials Qty. Var.

(185,000 170,000) x $.17 = $2,550 unfav.

4. Materials price variance +/- Materials quantity variance = Net materials variance

$1,000 unfav. + $2,550 unfav. = $3,550 unfav.

E8-7

Actual labor cost

31,110 hrs.$13.05* =

$405,985.50

Actual labor hours

standard rate per hour

Units producedstandard

labor hours per unit

standard rate per hour

31,110 hrs.$12.50 =

$388,875

6,1004.5 hrs.$12.50 =

$343,125

Labor Rate

Variance

1. $17,110.50 (unfav)

3.

* $405,985.50

Labor Efficiency

Variance

2. $45,750 (unfav)

Net Labor Variance

$62,860.50 (unfav)

31,110 hours = $13.05

Chapter 8

241

E8-8

1.

Standard Cost Summary

Materials1 lb. @ $4 per lb. ..........................................................................

Labor2 hrs. @ $9.00 per hr. .......................................................................

Factory overhead$10,000 10,000 units ...................................................

Standard cost per unit ....................................................................................

2.

(Actual price Standard price) Actual quantity = Materials price variance

($ 4.20* - $4.00) 9,400 = $1,880 (unfav)

(Actual quantity Standard quantity) Standard price = Materials quantity variance

(9,400 9,500) $4 = $400 (fav)

(Actual rate Standard rate) Actual hours = Labor rate variance

($8.90** - $9.00) 20,000 = $2,000 (fav)

(Actual hours Standard hours) Standard rate = Labor efficiency variance

(20,000 19,000) $9 = $9,000 (unfav)

*$39,480 9,400 pounds

**$178,000 20,000 hours

$ 4.00

18.00

1.00

$23.00

242

Chapter 8

E8-9

Case 1

Units produced

Standard hours per unit

Standard hours allowed

Standard rate per hour

Actual hours used

Actual labor cost

Labor rate variance

Labor efficiency variance

1,200

2

2,400

$5

2,340

$12,425

$725 U

$300 F

Case 2

2,000

0.6

1,200

$2

1,220

$2,730

$290 U

$40 U

Case 1

Standard hours allowed = 1,2002 = 2,400 hours

Actual Labor Cost

=

(Actual hours used x Standard rate per hour) +/- Labor rate variance

(2,340 x $5) + $725 = $12,425

Labor Efficiency Variance = SP (AQ SQ)

Labor Efficiency Variance = $5 (2,340 2,400) = $300 F

Case 2

Units produced = 1,200 0.6 = 2,000

Labor Efficiency Variance

$40

$40

$2

=

=

=

=

SP (AQ SQ)

SP (1,220 1,200)

20 SP

Standard rate per hour

Actual Labor Cost =

(Actual hours used x Standard rate per hour) +/- Labor rate variance

(1,220 x $2) + $290 = $2,730

Chapter 8

243

E8-10

1.

2.

Materials6 lbs. @ $2.00 per lb. ............................................

Labor2 hrs. @ $10 per hr.....................................................

Factory overhead$40,000 20,000 units ............................

$12.00

20.00

2.00

Standard cost per unit .............................................................

$34.00

Work in Process (18,000$12) ......................................

Materials Price Variance (Unfavorable)

(105,000$0.04) ............................................................

Materials Quantity Variance (Favorable)

(3,000$2)...............................................................

Materials (105,000$2.04) ......................................

216,000

Work in Process (18,000$20.00) .................................

Labor Efficiency Variance (Favorable)

(1,200$10) ............................................................

Labor Rate Variance (Favorable)

(34,800$0.50) ........................................................

Payroll (34,800$9.50) ............................................

360,000

4,200

6,000

214,200

12,000

17,400

330,600

E8-11

Work in Process (21,000$12) .............................................

Materials Quantity Variance (Unfavorable)

(4,000$2) ............................................................................

Materials Price Variance (Favorable)

(130,000$0.02) ............................................................

Materials (130,000$1.98).............................................

252,000

Work in Process (21,000$20) .............................................

Labor Rate Variance (Unfavorable)

(41,000$0.04) .....................................................................

Labor Efficiency Variance (Favorable)

(1,000$10) ........................................................ 10,000

Payroll (41,000 $10.04) ................................................

420,000

8,000

2,600

257,400

1,640

411,640

244

Chapter 8

E8-12

Conclusions to be drawn from the four variances:

Materials price varianceindicates that materials were purchased at a price above

standard.

Materials quantity varianceindicates fewer materials were used in the product

than called for by the standard.

Labor rate varianceindicates that the wage rate paid to production workers was

less than the standard.

Labor efficiency varianceindicates that less time was spent on production than

was called for by the standard.

E8-13

1.

Work in Process Mixing .......................................................

Work in Process Blending ...................................................

Materials Price Variance Mixing ..........................................

Materials Quantity Variance Mixing ..............................

Materials Price Variance Blending ...............................

Materials Quantity Variance Blending ..........................

Materials ........................................................................

185,000

130,000

10,000

2,000

4,000

2,000

317,000

2.

Work in Process Mixing .......................................................

Work in Process Blending ...................................................

Labor Rate Variance Mixing ................................................

Labor Efficiency Variance Mixing .................................

Labor Rate Variance Blending .....................................

Labor Efficiency Variance Blending..............................

Payroll .............................................................................

110,000

95,000

10,000

3,000

8,000

7,000

197,000

3.

Factory Overhead...................................................................

Various Credits................................................................

145,000

Work in Process Mixing .......................................................

Work in Process Blending ...................................................

Factory Overhead ...........................................................

85,000

70,000

145,000

155,000

Chapter 8

245

E8-13 Concluded

4.

Work in Process Blending ...................................................

Work in Process Mixing ................................................

380,000*

Finished Goods ......................................................................

Work in Process Blending ............................................

675,000**

380,000

675,000

*$185,000 + $110,000 + $85,000

**$380,000 + $130,000 + $95,000 + $70,000

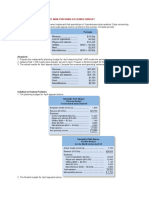

E8-14

Calculation of factory overhead allowed:

Fixed overhead ...........................................

Variable overhead ($1.50 per unit) .............

Total ...........................................................

Standard

8,000

Units

$ 4,000*

12,000

$ 16,000

Month 1

7,200

Units

$ 4,000

10,800

$ 14,800

Month 2

8,400

Units

$ 4,000

12,600

$ 16,600

* $0.50 per unit x 8,000 standard units

Month 1

Month 2

Budget

Actual

Variance

Budget

Actual

Variance

$14,800

$14,500

$300 F

$16,600

$17,600

$1,000 U

246

Chapter 8

E8-15

a. and b.

Actual factory overhead

Fixed costs ...... $ 52,000

Variable costs .....

28,500

Standard hours standard rate

Budget based on standard hours

Fixed cost:

10,000 x $5.00 =

Variable cost:

9,000 $3.00 =

$ 80,500

Controllable Variance

(a) $3,500 (unfavorable)

9,000 units $8 /unit =

$50,000

27,000

$ 77,000

$ 72,000

Volume Variance

(b) $5,000 (unfavorable)

Net Factory Overhead Variance

$8,500 (unfavorable)

c.

Actual factory overhead (total) ........................................

Applied factory overhead (18,000 hours $4*) ...............

Underapplied factory overhead .......................................

Net variance:

Controllable variance (unfavorable) .............................

Volume variance (unfavorable) ....................................

Net variance (underapplied) ............................................

*$8 /unit 2 hrs/unit = $4 /hr

$ 80,500

72,000

$ 8,500

$ 3,500

5,000

$ 8,500

Chapter 8

247

E8-16

June 30 Work in Process ........................................................

Factory OverheadVolume Variance (Unfavorable)

Factory OverheadControllable Variance

(Favorable) ..........................................................

Factory Overhead ................................................

Calculation of the variances for June:

Budgeted overhead for

90% (18,000/20,000) of

Actual overhead

normal capacity

Fixed:

Variable:

(90% of $12,000)

$ 16,500

16,200

600

300

16,500

Applied overhead

$ 6,000

18,000 units $0.90* =

$ 16,200

10,800

$ 16,800

Controllable Variance

$300 (favorable)

Volume Variance

$600 (unfavorable)

*Calculation of standard overhead cost per unit:

Fixed overhead ............................................................

Variable overhead .......................................................

Total ............................................................................

Per unit ($18,000 20,000 units) .......................................

July 31 Work in Process ............................................................

Factory OverheadControllable Variance

(Unfavorable) ............................................................

Factory OverheadVolume Variance (Favorable)

Factory Overhead ................................................

$ 6,000

12,000

18,000

$ 0.90

18,900

400

300

19,000

Calculation of the variances for July:

Actual overhead

$ 19,000

Budgeted overhead for

105% (21,000/20,000)

of normal capacity

Fixed:

$ 6,000

Variable:

(105% of $12,000) 12,600

$ 18,600

Controllable Variance

$400 (unfavorable)

Applied overhead

21,000 units $0.90 =

$ 18,900

Volume Variance

$300 (favorable)

248

Chapter 8

E8-17

The usual formula for calculating variances is shown below. Each step in developing the

figures is numbered in order.

(1) Actual cost

(2) Budget for actual level

$27,000

$26,800

Controllable Variance

$200 (unfavorable)

1. Data given.

2. The unfavorable controllable variance of $200 indicates that actual cost was

$200 more than the budget for this level of production; therefore, budgeted cost

was $26,800 ($27,000 $200). (Note that you cannot use the budget formula

to compute the budgeted overhead because the actual level of production is not

given.)

Chapter 8

249

E8-18 (Appendix)

Computation of Budgeted Fixed Overhead:

Total budgeted overhead ................................................

Variable overhead (8,000 $2) .......................................

Budgeted fixed overhead ................................................

$20,000

16,000

$ 4,000

Variable Overhead Variances:

Actual hours

Actual variable overhead

$16,100

Actual hours

standard rate

7,640 hrs $2 =

$15,280

Spending Variance

$820 (unfavorable)

Standard hours standard rate

2,500 units 3 hrs $2 =

$15,000

Efficiency Variance

$280 (unfavorable)

Fixed Overhead Variances:

Actual fixed overhead

$3,920

Budgeted overhead

$4,000

Actual units

standard hours standard rate

2,500 units 3 hrs $0.50* =

$3,750

Budget Variance

Volume Variance

$80 (favorable)

$250 (unfavorable)

*[ $20,000 (8,000 x $2) = $4,000/ 8,000 hrs. = $.50 per direct labor hour

Net Factory Overhead Variance:

Spending .........................................................................

Efficiency .........................................................................

Budget ............................................................................

Volume ............................................................................

Net overhead variance ...........................................................

$ 820

280

80

250

$1,270

(unfavorable)

(unfavorable)

(favorable)

(unfavorable)

(unfavorable)

250

Chapter 8

E8-19 (Appendix)

a-c.

Actual

overhead

Fixed:

Var:

$52,000

28,500

$ 80,500

Budget based on

actual hours

Fixed: $52,000

Variable:

18,500 $1.50 =27,750

$79,750

Actual hours

standard rate

Standard hours

standard rate

18,500 $4*

9,000 units 2 hrs $4

$ 74,000

72,000

Budget Variance

Capacity Variance

Efficiency Variance

(a) $750 (unfav)

(b) $5,750 (unfav)

(c) $2,000 (unfav)

Net Factory Overhead Variance $8,500 (unfav)

*($5 + $3) 2 hours per unit = $4 per direct labor hour.

d.

Actual factory overhead ..................................................

Applied factory overhead (18,000 $4) ..........................

Underapplied factory overhead .......................................

$ 80,500

72,000

$ 8,500

Net variance:

Efficiency variance (unfavorable).................................

Capacity variance (unfavorable) ..................................

Budget variance (unfavorable).....................................

Net variance (underapplied) ............................................

$ 2,000

5,750

750

$ 8,500

Chapter 8

251

PROBLEMS

P8-1

(Actual price Standard price) Actual quantity = Materials price variance

($27.50 - $25.00) 5.5 = $13.75 (unfav)

(Actual quantity Standard quantity) Standard price = Materials qty. var

(5.5 -5.0) $25 = $12.50 (unfav)

(Actual rate Standard rate) Actual hours = Labor rate variance

($17.50 - $18.00) 80 = $40.00 (fav)

(Actual hours Standard hours) Standard rate = Labor efficiency variance

(80 60) $18 = $360 (unfav)

252

Chapter 8

P8-2

1-3. Materials:

Actual quantity

standard price

Actual cost

51,680$0.045 =

$2,325.60

51,680$0.05 =

$2,584.00

Materials Price

Variance

$258.40 (fav)

1.

3.

2.

Standard quantity

standard price

*6,400 units8$0.05 =

$2,560.00

Materials Quantity

Variance

$24 (unfav)

Net Materials Variance

$234.40 (fav)

*Equivalent Production:

Completed units ...................

In processAll materials .....

5,600

800

Total equivalent units ...........

6,400

4-6. Labor:

Actual hours

standard rate

Actual cost

38,000* hours$5.68 =

$215,840.00

4.

38,000 hours$5.60 =

$212,800.00

Labor Rate Variance

$3,040.00 (unfav)

6.

Standard hours

standard rate

6,240** units6$5.60 =

$209,664.00

Labor Efficiency Variance

5.

$3,136.00 (unfav)

Net Labor Variance

$6,176.00 (unfav)

*Actual hours = $215,840/$5.68 = 38,000 hours

**Equivalent ProductionLabor:

Units completed ...................

In process (80080%) ........

5,600

640

Total equivalent units ...........

6,240

253

P8-3

Standard

Quantity

or Hours

1. Materials quantity variance:

Stomp .........................................

Empty drums ..............................

3. Labor efficiency variance ..............

640,000 gal.*

80,000 drums

80,000 hrs.

Standard

Cost

Actual

Quantity

or Hours

645,000 gal.

80,000 drums

81,000 hrs.

Actual

Cost

2. Materials purchase price variance:

Stomp .........................................

$2.00/gal.

$1.90/gal.**

Empty drums ..............................

4. Labor rate variance .......................

$1.00/drum

$8.00/hr.

$1.00/drum

$8.08 hr.***

Difference

5,000 gal.

(unfav)

-01,000 hrs.

(unfav)

Difference

$0.10

(fav)

-0$0.08

(unfav)

Standard

Cost

$2.00/gal.

$1.00/drum

$8.00/hr.$

Actual

Quantity

or Hours

600,000 gal.

94,000 drums

81,000 hours

Chapter 8

Chapter 8

Variance

$10,000

(unfav)

-08,000

(unfav)

Variance

$60,000

(fav)

-0$ 6,480

(unfav)

*80,000 drums produced8 gallons per drum = 640,000 gallons

**1,140,000 600,000 = $1.90 per gallon

***654,480 81,000 hours = $8.08 per hour

253

254

Chapter 8

254

P8-4

Standard

Quantity

or Hours

Actual

Quantity

or Hours

1. Materials quantity variance ...........

5,000 lbs.

5,300 lbs.

3. Labor efficiency variance ..............

8,000 hrs.

8,200 hrs.

Standard

Cost

2. Materials purchase price variance

4. Labor rate variance .......................

$ 3.00/lb.

$10.00/hr.

Actual

Cost

$ 2.90/lb.

$9.80/hr.

Difference

300 lbs.

(unfav)

200 hrs.

(unfav)

Difference

$0.10

(fav)

$0.20

(fav)

Standard

Cost

$3.00/lb.

$10.00/hr.

Actual

Quantity

or Hours

5,200 lbs.

8,200 hrs.

Variance

$ 900

(unfav)

$2,000

(unfav)

Variance

$ 520

(fav)

$1,640

(fav)

Chapter 8

255

P8-5

Standard

Quantity

or Hours

1. Materials quantity variance

for Class . ...................................

80,000 ft.*

Actual

Quantity

or Hours

Difference

Standard

Cost

Variance

78,000 ft.

2,000 ft.

(fav)

$0.75/ft.

$1,500

(fav)

2,000 ft.

(unfav)

1,000 hrs.

(fav)

$ 1.00/ft.

$2,000

(unfav)

$8,000

(fav)

2. Materials quantity variance for

Chic ............................................

24,000 ft.**

26,000 ft.

5. Labor efficiency variance ..............

32,000 hrs.***

31,000 hrs.

$8.00/hr.

Chapter 8

Chapter 8

*10 ft (8,000 units)

**3 ft (8,000 units)

***4 hours (8,000 units)

Standard

Cost

Actual

Cost

Difference

3. Materials purchase price

variance for Class ......................

$0.75/ft.

$0.72/ft.

$0.03

(fav)

4. Materials purchase price

variance for Chic ........................

$1.00/ft.

$1.05/ft.

6. Labor rate variance .......................

$8.00/hr.

$7.80/hr.

$0.05

(unfav)

$0.20

(fav)

Actual

Quantity

or Hours

Variance

100,000 ft.

$3,000

(fav)

30,000 ft.

$1,500

(unfav)

$6,200

(fav)

31,000 hrs.

255

256

Chapter 8

P8-6

Materials quantity variance:

Standard

Quantity

Aluminum .......

Plastic.............

Actual

Quantity

1,700 *

8,500

1,900

9,500

Difference

Standard

Cost

per Pound

200 (unfav)

1,000 (unfav)

$0.40

$0.38

Variance

$ 80 (unfav)

$380 (unfav)

*8,500 units.2 lb per unit = 1,700 lbs

Materials purchase price variance:

Standard

Cost

per Pound

Aluminum .......

Plasticregular

grade ...........

Plasticlow

grade ...........

Actual

Cost

per Pound

Difference

Quantity

Purchased

Variance

$0.40

$0.48

$0.08 (unfav)

1,800

$144 (unfav)

$0.38

$0.50

$0.12 (unfav)

3,000

$360 (unfav)

$0.38

$0.29

$0.09 (fav)

6,000

$540 (fav)

Labor efficiency variance:

Standard

Cost

per Hour

Standard

Hours

Actual

Hours

Difference

2,550**

2,700

150 (unfav)

$8.00

Difference

Actual

Hours

$0.60 (unfav)

2,700

Variance

$1,200 (unfav)

**8,500 units.3 hrs per unit = 2,550

Labor rate variance:

Standard

Cost

per Hour

Actual

Cost

per Hour

$8.00

$8.60

Variance

$1,620 (unfav)

Chapter 8

257

P8-7

1.

2.

Equivalent production

Units

Materials:

Completed during the month.........................................................

Equivalent units in ending work in process (2,0001/2) ..............

9,000

1,000

Total ........................................................................................

10,000

Labor and overhead:

Completed during the month.........................................................

Equivalent units in ending work in process (2,0001/4) ..............

9,000

500

Total ........................................................................................

9,500

Liquid Lead:

Actual quantity

standard price

Actual cost

21,000 gal.$1.96 =

$41,160

Standard quantity

standard price

21,000 gal.$2.00 =

$42,000

Material Price

Variance

$840 (fav)

(10,000 units2 gal/unit)$2.00 =

$40,000

Material Quantity

Variance

$2,000 (unfav)

Net Liquid Lead Variance

$1,160 (unfav)

258

Chapter 8

P8-7 Continued

Varnish:

Actual quantity

standard price

Actual cost

20,000 gal. $3.00 =

$60,000

20,000 gal.$3.00 =

$60,000

Material Price

Variance

0

Standard quantity

standard price

(10,000 units2 gal/unit)$3.00 =

$60,000

Material Quantity

Variance

0

Labor:

Actual cost

10,000 hours$11.70 =

$117,000

Actual hours

standard rate

Standard hours

standard rate

10,000 hours$12.00 =

$120,000

(9,500 units1 hr/unit)$12.00 =

$114,000

Labor Rate Variance

$3,000 (fav)

Labor Efficiency Variance

$6,000 (unfav)

Net Labor Variance

$3,000 (unfav)

Chapter 8

259

P8-7 Concluded

3.

Ending Work in Process

2,000 units, one-half complete as to materials (2,0001/2$10) ...............

2,000 units, one-fourth complete as to labor (2,0001/4$12) ..................

$ 10,000

6,000

Materials and labor costs in work in process at end of month .......................

$ 16,000

4.

Cost of production for month (materials and labor):

Liquid Lead ................................................................. ......................

Varnish ....................................................................... ......................

Labor .......................................................................... ......................

$ 41,160

60,000

117,000

Total costs to be accounted for ............................. ......................

$ 218,160

Costs accounted for (materials and labor):

Transferred to finished goods (9,000$22) ...............

Ending work in process* .............................................

Net varianceLiquid Lead (unfavorable) ...................

Net varianceLabor (unfavorable) ............................

$198,000

16,000

$

1,160

3,000

Total costs accounted for ....................................

*$10.001,000 equivalent units .....................

$12.00 500 equivalent units .....................

$ 214,000

4,160

$ 218,160

$10,000

6,000

$ 16,000

P8-8

1.

Raw Materials Inventory (55,000$2.20) .......................

Materials Purchase Price Variance ($0.05*55,000) .....

Accounts Payable .......................................................

121,000

2,750

123,750

*$123,750/55,000 = $2.25; $2.25 $2.20 = $0.05

2.

Work in Process (8,8005.5 lbs.$2.20) ......................

Materials Quantity Variance [(54,305 48,400)$2.20]

Raw Materials Inventory (54,305 $2.20) ..................

106,480

12,991

Work in Process (8,8001.8 hours$6.25) ..................

Labor Efficiency Variance (2,360 hours*$6.25) ...........

Labor Rate Variance (18,200$.75)** ...........................

Payroll ........................................................................

99,000

14,750

13,650

*18,200 (8,8001.8 hrs.) = 2,360 hrs.

**($127,400 18,200) $6.25 = $.75 hr.

119,471

127,400

260

Chapter 8

P8-9

1.

2.

3.

Direct materials cost in finished goods inventory ................

Direct materials cost in cost of goods sold ..........................

Total ....................................................................................

$ 87,000

348,000

$ 435,000

20%

80

100%

Materials price variance ......................................................

Ratio of direct materials cost in finished goods inventory ....

Amount to be prorated to finished goods inventory .............

$ 10,000

20%

$ 2,000

Materials price variance ......................................................

Materials quantity variance..................................................

$ (10,000)

15,000

(unfav)

(fav)

Net materials cost variance .................................................

Ratio of direct materials cost in finished goods inventory ....

5,000

20%

(fav)

Net variance prorated to finished goods inventory ..............

Direct materials cost in finished goods inventory before

variances are prorated ......................................................

1,000

(Cr.)

87,000

(Dr.)

Total amount of direct materials cost in finished goods

inventory ...........................................................................

$ 86,000

Direct labor cost in finished goods inventory .......................

Direct labor cost in cost of goods sold .................................

Total ....................................................................................

$ 130,500

739,500

$ 870,000

15%

85

100%

Labor rate variance .............................................................

Labor efficiency variance ....................................................

$ (20,000)

5,000

(unfav)

(fav)

Net labor cost variance .......................................................

Ratio of direct labor cost in finished goods inventory ..........

$ (15,000)

15%

(unfav)

Net variance prorated to finished goods inventory ..............

Direct labor cost in finished goods inventory before

variances are prorated ......................................................

2,250

(Dr.)

130,500

(Dr.)

Total amount of direct labor cost in finished goods

inventory ...........................................................................

$ 132,750

Chapter 8

261

P8-9 Concluded

4.

Beginning balance of cost of goods sold:

Direct materials ..................................

Direct labor .........................................

Applied manufacturing overhead ........

Net materials cost variance .....................

Ratio of direct materials cost in cost

of goods sold ........................................

$348,000

739,500

591,600

$

5,000

$1,679,100

(Dr.)

4,000

(Cr.)

12,750

$ 1,687,850

(Dr.)

(Dr.)

(Cr.)

80%

Materials cost variances prorated to

cost of goods sold .................................

Net labor cost variance ...........................

Ratio of direct labor cost in cost

of goods sold ........................................

$ 15,000

(Dr.)

85%

Labor cost variance prorated to cost of

goods sold ............................................

Total cost of goods sold ..........................

Note: There is no overhead variance.

P8-10

1. Standard quantity of materials allowed:

Actual production .........................................................

Standard materials per unit .........................................

Standard quantity of materials allowed .......................

4,000 units

5 pounds

20,000 pounds

2. Actual quantity of materials used:

Standard quantity ..............................................................

Add unfavorable (debit) materials quantity

variance standard price per lb. ($1,000 $1 per lb.) ..

Actual quantity of materials used .......................................

3.

Standard direct labor hours allowed:

Actual production ...............................................................

Standard hours per unit .....................................................

Standard hours allowed .....................................................

20,000 pounds

1,000

21,000 pounds

4,000 units

1

4,000

262

Chapter 8

P8-10 Concluded

4.

5.

6.

Actual direct labor hours worked:

Standard hours allowed .....................................................

Less favorable (credit) direct labor efficiency

variance standard rate ($1,200 $8/hr) .....................

Actual hours worked ..........................................................

Actual direct labor rate:

Standard direct labor rate ..................................................

Add unfavorable (debit) direct labor rate

variance actual hours worked ($770 3,850 hrs) .......

Actual direct labor rate .......................................................

Actual total overhead:

Standard overhead (4,000 units produced $4

standard overhead rate per unit) ...................................

Unfavorable (debit) overhead variance..............................

Actual total overhead .........................................................

4,000

(150)

3,850

$ 8.00

.20

$ 8.20

$ 16,000

500

$ 16,500

P8-11

FACTORY OVERHEAD VARIANCES

Actual factory

overhead

2,500 units 4 hrs =

$30,305

Units produced standard

quantity standard rate

Budget at standard hours

allowed

10,000

10,000 hrs $1.00 = $ 10,000

Fixed cost

= 20,000

Budget at standard hrs $ 30,000

Controllable Variance

$305 (unfavorable)

2,500 units 4 $3.38

$33,800

Volume Variance

$3,800 (favorable)

Chapter 8

263

P8-12

1.

Work in Process Mixing (1,100 eq. units $4) ...................

Work in Process Blending (950 eq. units $2) ....................

Factory Overhead (indirect materials) ($1,000 + $500) ...........

Materials Quantity Variance Mixing .....................................

Materials Price Variance Mixing ..........................................

Materials Quantity Variance Blending. .............................

Materials Price Variance Blending ...................................

Materials ($4,715 + $1,813 + $1,000 + $500)......................

4,400

1,900

1,500

200*

115*

Work in Process Mixing (1,100 eq. units $10) ..................

Work in Process Blending (950 eq. units $6) ....................

Factory Overhead (indirect labor) ($1,300 + $1,000) ..............

Labor Rate Variance Mixing ................................................

Labor Efficiency Variance Blending .....................................

Labor Efficiency Variance Mixing .....................................

Labor Rate Variance Blending .........................................

Payroll ($10,965 + $5,900 + $1,300 + $1,000) ....................

11,000

5,700

2,300

215*

300**

Work in ProcessMixing (1,100 eq. units $6) .....................

Work in Process Blending (950 eq. units $4) ....................

Factory Overhead, Controllable Variance Mixing ................

Factory Overhead, Volume Variance Blending ....................

Factory Overhead, Volume Variance Mixing ....................

Factory Overhead, Controllable Variance Blending. ........

Factory Overhead Mixing .................................................

Factory Overhead Blending .............................................

6,600

3,800

500**

50**

Factory Overhead ($4,400 + $2,250) ......................................

Various credits .....................................................................

6,650

Factory Overhead Mixing.....................................................

Factory Overhead Blending .................................................

Factory Overhead ................................................................

6,700

3,750

50*

37*

8,028

250*

100**

19,165

400**

100**

6,700

3,750

6,650

10,450

*See page 262

**See page 263

Work in Process Blending (1,000 units $20) .....................

Work in Process Mixing....................................................

20,000

Finished Goods (900 units $32) ...........................................

Work in ProcessDept. Blending .......................................

28,800

Accounts Receivable (850 units $50) ...................................

Sales ...................................................................................

Cost of Goods Sold (850 units $32) .....................................

Finished Goods ...................................................................

42,500

20,000

28,800

42,500

27,200

27,200

264

Chapter 8

P8-12 Continued

Variances are calculated as follows:

Materials

Mixing

Actual cost

2,300 lbs. $2.05 =

$4,715

Actual quantity standard price

2,300 lbs. $2.00 =

$4,600

Materials Price Variance

$115 (unfavorable)

Standard cost

2,200 lbs. $2.00 =

$ 4,400

Materials Quantity Variance

$200 (unfavorable)

Net Materials Variance

$315 (unfavorable)

Blending

Actual cost

1,850 lbs. $0.98 =

$1,813

Actual quantity standard price

1,850 lbs. $1.00 =

$1,850

Materials Price Variance

$37 (favorable)

Standard cost

1,900 lbs. $1.00 =

$1,900

Materials Quantity Variance

$50 (favorable)

Net Materials Variance

$87 (favorable)

Labor

Mixing

Actual cost

Actual hours standard price

2,150 hrs $5.10 =

$10,965

2,150 hrs $5.00 =

$10,750

Labor Rate Variance

$215 (unfavorable)

Net Labor Variance

$35 (favorable)

Standard cost

2,200 hrs $5.00 =

$11,000

Labor Efficiency Variance

$250 (favorable)

Chapter 8

265

P8-12 Continued

Blending

Actual cost

Actual hours standard rate

Standard cost

1,000 hours $5.90 =

$5,900

1,000 hours $6.00 =

$6,000

950 hours $6.00 =

$5,700

Labor Rate Variance

$100 (favorable)

Labor Efficiency Variance

$300 (unfavorable)

Net Labor Variance

$200 (unfavorable)

Factory Overhead

Mixing

Actual overhead

$6,700

Budget at standard hours

Fixed: 2,000 hrs $2 = $ 4,000

Var: 2,200 hrs $1 = 2,200

$ 6,200

Controllable Variance

$500 (unfavorable)

Standard cost

2,200 hrs $3.00 =

$ 6,600

Volume Variance

$400 (favorable)

Net Factory Overhead Variance

$100 (unfavorable)

Blending

Actual overhead

$3,750

Budget at standard hours

Standard cost

Fixed: 1,000 hrs $1 = $ 1,000

Var:

950 hrs $3 = 2,850

$ 3,850

Controllable Variance

$100 (favorable)

950 hrs $4.00 =

$ 3,800

Volume Variance

$50 (unfavorable)

Net Factory Overhead Variance

$50 (favorable)

266

Chapter 8

P8-12 Concluded

2.

Mixing 200 units, one-half completed)

Materials (200 1/2 $4) ..................................................................

Labor (200 1/2 $10) .....................................................................

Factory overhead (200 1/2 $6) ....................................................

Work in processMixing..............................................................

Blending (100 units, one-half completed)

Cost from Mixing (100 $20) ..............................................

Cost in Blending:

Materials (100 1/2 $2) ................................................

Labor (100 1/2 $6) .....................................................

Factory overhead (100 1/2 $4) ..................................

Work in processBlending .........................................

3.

400

1,000

600

$ 2,000

$ 2,000

100

300

200

600

$ 2,600

Costs to be accounted for:

Material I ............................................................................................

Material II ...........................................................................................

LaborMixing ...................................................................................

LaborBlending ................................................................................

Factory overheadMixing .................................................................

Factory overheadBlending .............................................................

Total ..............................................................................................

$ 4,715

1,813

10,965

5,900

6,700

3,750

$33,843

Costs accounted for:

Transferred to finished goods (900 units $32) ................................

Work in processMixing ...................................................................

Work in processBlending ...............................................................

Net unfavorable variance ...................................................................

Total ..............................................................................................

$28,800

2,000

2,600

443

$33,843

Chapter 8

267

P8-13

1.

Standard Cost of Production for October

QuantityStandard Cost

Total

Lot

(Dozens)per Dozen

Standard Cost

30

1,000

$41.25

31

1,700

41.25

32

1,200

35.64*

Standard cost of production ............................................................

$ 41,250

70,125

42,768

$154,143

*Standard materials cost plus 80% complete as to standard cost of labor and overhead: $13.20 + (80%

$28.05)

2.

Schedule Computing Materials Price Variance

Actual cost of materials purchased ........................................................

Standard cost of materials purchased (95,000 $0.55) .........................

Materials price variance (unfavorable) ...................................................

3.

$ 53,200

52,250

$

950

Schedule of Materials and Labor Variances for October

a. Materials quantity variance

Standard yards:

Dozens in lot .................................

Standard yards per dozen .............

Total standard quantity .............

Actual yards used .............................

Variance in yards ..............................

Lot 30

Lot 31

Lot 32

Total

1,000

24

24,000

24,100

(100)

1,700

24

40,800

40,440

360

1,200

24

28,800

28,825

(25)

3,900

24

93,600

93,365

235

268

Chapter 8

P8-13 Concluded

b. Labor efficiency variance

Standard hours:

Dozens in lot .................................

Standard hours per dozen ............

1,000

3

1,700

3

1,200

3

3,000

100%

5,100

100%

3,600

80%

Total standard hours .................

Actual hours worked .........................

3,000

2,980

5,100

5,130

2,880

2,890

Variance in hours ..............................

20

Total standard quantity .............

Percentage of completion .............

(30)

(10)

10,980

11,000

(20)

( ) indicates unfavorable variance

c. Labor rate variance

Lot 30

Lot 31

Lot 32

Total

Actual hours worked .........................

2,980

5,130

2,890

11,000

Rate paid in excess of standard

($7.40 $7.35) ............................. $ 0.05 $ 0.05 $ 0.05 $ 0.05

Labor rate variance (unfavorable) ..... ($ 149.00) ($ 256.50) ($ 144.50) ($ 550.00)

4.

Schedule of Overhead Variances for October

Controllable variance

Actual overhead ...................................................................

Budgeted overhead for level of production attained:

Fixed overhead (.40 $288,000/12)............................... $9,600

Variable overhead ($2 .60 10,980 standard hours) .. 13,176

Total budgeted overhead ..........................................

Controllable variance (unfavorable) .....................................

$ 22,800

22,776

($

24)

Volume variance

Budgeted overhead for level of production attained .............

Overhead applied to production

(10,980 standard hours $2) ...............................................

Volume variance (unfavorable) ............................................

$ 22,776

21,960

($ 816)

Chapter 8

269

P8-14

MATERIALS VARIANCES

Actual cost

Actual gal. standard price

40,743 gal. $0.38* =

40,743 gal. ($32/80 gal.) =

$15,482.34

Standard

gallons standard price

503 batches x $32 =

$16,297.20

Materials Price Variance

$814.86 (favorable)

$16,096.00

Materials Quantity Variance

$201.20 (unfavorable)

Net Materials Variance

$613.66 (favorable)

*Actual materials cost $15,482.34 40,743 gallons = $0.38 per gallon.

LABOR VARIANCES

Actual cost

29,677 hrs $3.65 =

$108,321.05

Actual hours standard rate

29,677 hrs $216/60 =

29,677 $3.60 =

$106,837.20

Labor Rate Variance

$1,483.85 (unfavorable)

Standard

hours standard rate

503 batches $216 =

$108,648.00

Labor Efficiency Variance

$1,810.80 (favorable)

Net Labor Variance

$326.95 (favorable)

270

Chapter 8

P8-14 Concluded

FACTORY OVERHEAD VARIANCES

Actual factory

overhead

Budgeted overhead

at standard hours

Standard

hours standard rate

Variable + Fixed Var. = 30,180 hrs* $2.20** = $ 66,396

$67,080 + $60,500 =

Fixed cost =....................... 60,000

$127,580

Budget at standard hrs

$126,396

Controllable Variance

$1,184.00 (unfavorable)

30,180 $4.20 =

$126,756

Volume Variance

$360.00 (favorable)

Net factory overhead variance

$824.00 (unfavorable)

*503 batches 60 hours = 30,180 hours

**Variable overhead rates:

Per hour

Total overhead rate .................... $4.20

Less:

$60,000 fixed overhead

= 2.00

30,000 budgeted hours * * *

Variable overhead rate ........

$2.20

***500 batches 60 hours = 30,000 budgeted hours

($252 60 hours)

fixed overhead rate

Chapter 8

271

P8-15 (Appendix)

1. Factory OverheadVariable Costs:

Actual variable cost

Actual hours standard rate

Standard hrs standard rate

18,375 hrs $2 =

$36,750

$33,710

Spending Variance

$3,040 (favorable)

3,500 units 5 hrs $2 =

$35,000

Efficiency Variance

$1,750 (unfavorable)

Factory OverheadFixed Cost:

Actual cost

$61,950

Budgeted fixed cost

$60,000

Budget Variance

$1,950 (unfavorable)

2.

Standard hours standard rate

3,500 units 5 hrs $4 =

$70,000

Volume Variance

$10,000 (favorable)

Net Factory Overhead Variance:

Spending ..................................................................... $ 3,040 (favorable)

Efficiency .....................................................................

1,750 (unfavorable)

Budget .........................................................................

1,950 (unfavorable)

Volume ........................................................................

10,000 (favorable)

Net factory overhead variance ............................... $ 9,340 (favorable)

Since the net variance is favorable, it represents overapplied factory overhead.

272

Chapter 8

P8-16 (Appendix)

1.

MATERIAL VARIANCES

Actual cost

1,800 4 = 7,200 parts

7,200 108% = 7,776 parts

$2.00/4 parts = $0.50 each

$0.50 105% = $0.525 cost

7,776 $0.525 =

$4,082.40

Actual parts

standard price

7,776 $0.50 =

Units produced standard

parts standard price

1,800 4 = 7,200 parts

7,200 $0.50 =

$3,888.00

Materials Price

Variance

$194.40 (unfavorable)

$3,600.00

Materials Quantity

Variance

$288.00 (unfavorable)

Net Materials Variance

$482.40 (unfavorable)

LABOR VARIANCES

Actual cost

1,800 units 2 hrs = 3,600

3,600 106% = 3,816 act. hrs

3,816 $3.30 (110% $3) =

$12,592.80

Actual hours

standard rate

Units produced standard

hours standard rate

3,816 $3 =

1,800 2 hrs = 3,600

3,600 $3 =

$11,448

Labor Rate

Variance

$1,144.80 (unfavorable)

$10,800

Labor Efficiency

Variance

$648.00 (unfavorable)

Net Labor Variance

$1,792.80 (unfavorable)

Chapter 8

273

P8-16 Concluded

FACTORY OVERHEAD VARIANCES

2. Factory Overhead

$4,000 fixed cost

$4,000

=

2,000 units 2 hours

4,000 hours

$3

Variable rate =

= $1.50 per hour

2 hours

Fixed rate =

= $1.00 per hour

Factory OverheadVariable Cost

Actual variable cost

$4,800

Actual hrs standard rate

3,816 hrs $1.50 =

$5,724

Spending Variance

$924 (favorable)

Standard hrs standard rate

3,600 hrs $1.50 =

$5,400

Efficiency Variance

$324 (unfavorable)

Budget VarianceFixed Cost

Actual fixed overhead

Budgeted fixed cost

$4,100

Budget Variance

$100 (unfavorable)

$4,000

Standard hours standard rate

3,600 hrs $1.00 =

$3,600

Volume Variance

$400 (unfavorable)

Net Factory Overhead Variance:

Spending variance ........................................................

Efficiency variance ........................................................

Budget variance ............................................................

Volume variance ...........................................................

Net factory overhead variance ...................................

$924

324

100

400

(favorable)

(unfavorable)

(unfavorable)

(unfavorable)

$100 (favorable)

274

Chapter 8

P8-17 (Appendix)

Budgeted hours = 500 units 26 hours = 13,000 hours

$44,200

Variable overhead rate =

= $3.40 per hour

13,000 hours

$50,050

Fixed overhead rate =

= $3.85 per hour

13,000 hours

Standard hours allowed = 510 units 26 hours = 13,260 standard hours

Factory OverheadVariable Costs:

Actual variable costs

$45,009

Actual hrs standard rate

13,015 hrs $3.40 =

$44,251

Spending Variance

$758 (unfavorable)

Standard hrs standard rate

13,260 hrs $3.40 =

$45,084

Efficiency Variance

$833 (favorable)

Factory OverheadFixed Costs:

Actual fixed overhead

Budgeted fixed cost

$50,125

Budget Variance

$75 (unfavorable)

$50,050

Standard hours standard rate

13,260 hrs $3.85 =

$51,051

Volume Variance

$1,001 (favorable)

Net Factory Overhead Variance:

Spending .......................................................................

Efficiency .......................................................................

Budget ..........................................................................

Volume ..........................................................................

Net overhead variance ..............................................

Proof:

Applied overhead (13,260 hrs $7.25) ................................

Actual total overhead ($45,009 + $50,125) ..........................

Overapplied factory overhead .......................................

758

833

75

1,001

$ 1,001

(unfavorable)

(favorable)

(unfavorable)

(favorable)

(favorable)

$ 96,135

95,134

$ 1,001 (favorable)

Chapter 8

275

P8-17 Concluded

Labor Variances:

Actual labor cost

Actual hrs standard rate

Standard hrs standard rate

13,015 hrs $5.00 =

$65,075.00

13,260 hrs $5.00 =

$66,300.00

13,015 hrs $5.08 =

$66,116.20

Labor Rate Variance

$1,041.20 (unfavorable)

Labor Efficiency Variance

$1,225.00 (favorable)

Net Labor Variance

$183.80 (favorable)

P8-18 (Appendix)

Mixing:

Actual

overhead

Actual hours

standard rate

Budgeted overhead

Fixed:

Variable:

2,150 hrs $1 =

$6,700

$ 4,000

2,150 hrs $3 =

2,150

$ 6,150

$6,450

Budget Variance

$550 (unfavorable)

Capacity Var.

$300 (favorable)

Applied

overhead

2,200 hrs $3 =

$6,600

Efficiency Var.

$150 (favorable)

Net Factory Overhead Variance

$100 (unfavorable)

Blending:

Actual

overhead

Budgeted overhead

Fixed:

Variable:

1,000 hrs $3 =

$3,750

Budget Variance

$250 (favorable)

Actual hours

standard rate

Applied

overhead

$1,000

1,000 hrs $4 =

3,000

$ 4,000

$4,000

Capacity Var.

$0

Net Factory Overhead Variance

$50 (favorable)

950 hrs $4 =

$3,800

Efficiency Var.

$200 (unfavorable)

276

Chapter 8

P8-19 (Appendix)

Schedule of Variances from Standard Cost for December

Three-Variance Method

Favorable variances:

Materials price [110 ft. ($0.15 $0.12) 1,200 units] ........ $ 3,960

Capacity [(5,100 hrs* $4.50**) $21,300***] ......................

1,650

Overhead budget ($21,300 $21,120) .................................

180

Total favorable variances ..................................................

Unfavorable variances:

Materials quantity [$0.15 (110 ft. 100 ft.) 1,200 units]... $ 1,800

Labor rate [4 1/4 hrs ($10.24 $10.00) 1,200 units] .......

1,224

Labor efficiency [$10.00 (4 1/4 4) 1,200 units] .............

3,000

Overhead efficiency [$4.50 (4 1/4 4) 1,200 units] .........

1,350

Total unfavorable variances...............................................

Net variance (unfavorable) ............................................

Proof of computation:

Total standard cost of 1,200 units $73.00 .................................................

Total actual cost of 1,200 units $74.32 ......................................................

Total variance........................................................................................

5,790

7,374

1,584

$ 87,600

89,184

$ 1,584

* Actual labor hours1,200 units 4 1/4 hrs = 5,100 hrs

** Overhead application rate$10 45% = $4.50 per direct labor hour

*** Computation of overhead budget at 5,100 hours:

Actual hours worked4 1/4 per unit 1,200 units .......................................

Fixed overhead15/45 of estimated overhead at normal capacity

(15/45 $18,000) ..................................................................................

Variable overhead30% $10.00, or $3.00 per hour

(5,100 hours $3.00) ............................................................................

Budget at 5,100 hours ..................................................................................

or

Budget at 5,200 hours ..................................................................................

Budget at 4,800 hours ..................................................................................

5,100

$

6,000

15,300

$ 21,300

$ 21,600

20,400

Difference ..............................................................................................

$ 1,200

Range between hour levels ..........................................................................

400 hrs

Dividing the difference of $1,200 by 400 hours determines an additional cost of $3.00 for each

one-hour increase in the budget.

Budget at 4,800 hours ..................................................................................

Add increase in budgeted cost necessary to attain 5,100 hour level

($3.00 300 hours) ...............................................................................

Budget at 5,100 hours ..................................................................................

$ 20,400

900

$ 21,300

Chapter 8

revenues in 2004 versus 10.9% in 2005.

277

You might also like

- 4 Th. Sem. Standard Costing Problems SolutionsDocument12 pages4 Th. Sem. Standard Costing Problems SolutionsCh Sam100% (2)

- Standard CostingDocument12 pagesStandard CostingKUNAL GOSAVINo ratings yet

- Hite Company Has Developed The Following Standard Costs For Its Product For 2009Document6 pagesHite Company Has Developed The Following Standard Costs For Its Product For 2009Ghaill CruzNo ratings yet

- All Solutions of Chapter 10Document11 pagesAll Solutions of Chapter 10Monjur Morshed RahatNo ratings yet

- Standard Costing - Problem SolutionsDocument10 pagesStandard Costing - Problem Solutionsallen1191919No ratings yet

- Acc349 P8-2A P11-4ADocument3 pagesAcc349 P8-2A P11-4AkskimblerNo ratings yet

- Assignment #2 DM&DL L Variance With SolutionDocument9 pagesAssignment #2 DM&DL L Variance With SolutionJeannet LagcoNo ratings yet

- Problem10 18 and 10 20Document9 pagesProblem10 18 and 10 20DhanushaNo ratings yet

- BACOSTMX Module 8 Self-ReviewerDocument10 pagesBACOSTMX Module 8 Self-ReviewerAlyssa CaddawanNo ratings yet

- Standard Costing and Variance AnalysisDocument38 pagesStandard Costing and Variance AnalysisAlexis Kaye DayagNo ratings yet

- Acct Bah WDocument4 pagesAcct Bah WAbby Sta AnaNo ratings yet

- HbjhjhjhujuhjDocument14 pagesHbjhjhjhujuhjnjkjhNo ratings yet

- Item To Classify Standard Actual Type of VarianceDocument7 pagesItem To Classify Standard Actual Type of Variancedavid johnsonNo ratings yet

- $3,200 Units X 3 Foot Per Unit $55,650 / 10,500 Feet $5.30 Per FootDocument41 pages$3,200 Units X 3 Foot Per Unit $55,650 / 10,500 Feet $5.30 Per FootLyra EscosioNo ratings yet

- Standard Costing Quiz 2Document2 pagesStandard Costing Quiz 2Shafni DulnuanNo ratings yet

- QS11 - Class Exercises SolutionDocument8 pagesQS11 - Class Exercises Solutionlyk0tex100% (2)

- Presentasi Kelompok 12 Bab 11 ADocument18 pagesPresentasi Kelompok 12 Bab 11 AsimsonNo ratings yet

- Problem10 18 and 10 20Document10 pagesProblem10 18 and 10 20roseNo ratings yet

- Chapter 10 Solutions - Inclass ExercisesDocument12 pagesChapter 10 Solutions - Inclass ExercisesSummerNo ratings yet

- M11 CHP 10 1 Standard Costs 2011 0524Document58 pagesM11 CHP 10 1 Standard Costs 2011 0524Rose Ann De Guzman67% (3)

- Chapter 8 Homework MADocument13 pagesChapter 8 Homework MAErvin Jello Rosete RagonotNo ratings yet

- Class Work For Chapter 10Document3 pagesClass Work For Chapter 10Madiha Abu Saied Tazul Islam 1721217No ratings yet

- Review Problem 1: Variance Analysis Using A Flexible Budget: RequiredDocument12 pagesReview Problem 1: Variance Analysis Using A Flexible Budget: RequiredGraieszian LyraNo ratings yet

- Standard Costing and Variance Analysis ProblemsDocument5 pagesStandard Costing and Variance Analysis Problemszyclone77No ratings yet

- Evaluating Personnel and DivisionsDocument37 pagesEvaluating Personnel and DivisionsGaluh Boga KuswaraNo ratings yet

- DocumentDocument5 pagesDocumentCurrent ShirtsNo ratings yet

- Standard Costing ExercisesDocument6 pagesStandard Costing ExercisesVatchdemonNo ratings yet

- Chapter 10 PDFDocument84 pagesChapter 10 PDFSyed Atiq TurabiNo ratings yet

- Tutorial 4 AnswerDocument7 pagesTutorial 4 AnswernajihahNo ratings yet

- Solutions Guide: Please Reword The Answers To Essay Type Parts So As To Guarantee That Your Answer Is An Original. Do Not Submit As Your OwnDocument4 pagesSolutions Guide: Please Reword The Answers To Essay Type Parts So As To Guarantee That Your Answer Is An Original. Do Not Submit As Your OwnMohammed Al DhaheriNo ratings yet

- Exercise 9-10: Solutions (12/01)Document8 pagesExercise 9-10: Solutions (12/01)ppaulyni33No ratings yet

- Solution Chapter 10: Exercise 10-1Document16 pagesSolution Chapter 10: Exercise 10-1AHMED MOHAMED YUSUFNo ratings yet

- Aashita - Inventory Management Homework PDFDocument6 pagesAashita - Inventory Management Homework PDFAashita JainNo ratings yet

- UntitledDocument9 pagesUntitledAhmad GilaniNo ratings yet

- Standard Costing or Variance AnalysisDocument11 pagesStandard Costing or Variance Analysisgull skNo ratings yet

- ÔN THI CK KTQT2 - GiảiDocument7 pagesÔN THI CK KTQT2 - GiảiNguyễn Thùy LinhNo ratings yet

- Standard Costing and Variance Analysis: 22. A. Total Purchases AP × AQDocument7 pagesStandard Costing and Variance Analysis: 22. A. Total Purchases AP × AQShaira UnggadNo ratings yet

- Hilton MAcc Ch10 SolutionDocument8 pagesHilton MAcc Ch10 Solutionokquan33% (3)

- Jawab Tugas Standard Costing-2Document4 pagesJawab Tugas Standard Costing-2FitriNo ratings yet

- Standard Costing and Balanced ScorecardDocument25 pagesStandard Costing and Balanced ScorecardMary Joy BalangcadNo ratings yet

- Unit 6 Module 10 Standard Costing: Practical ProblemsDocument14 pagesUnit 6 Module 10 Standard Costing: Practical ProblemsShubham NamdevNo ratings yet

- Unit 6 Module 10 Standard Costing: Practical ProblemsDocument14 pagesUnit 6 Module 10 Standard Costing: Practical ProblemsRuchi pariharNo ratings yet

- 18-10-SA-V1-S1 Solved Problems SC PDFDocument14 pages18-10-SA-V1-S1 Solved Problems SC PDFAlbsNo ratings yet

- Unit 6 Module 10 Standard Costing: Practical ProblemsDocument14 pagesUnit 6 Module 10 Standard Costing: Practical Problemsyousuf AhmedNo ratings yet

- Unit 6 Module 10 Standard Costing: Practical ProblemsDocument14 pagesUnit 6 Module 10 Standard Costing: Practical ProblemsNeelima Varma NadimpalliNo ratings yet

- Unit 6 Module 10 Standard Costing: Practical ProblemsDocument14 pagesUnit 6 Module 10 Standard Costing: Practical ProblemsAfsahNo ratings yet

- Unit 6 Module 10 Standard Costing: Practical ProblemsDocument14 pagesUnit 6 Module 10 Standard Costing: Practical ProblemsAlbsNo ratings yet

- Unit 6 Module 10 Standard Costing: Practical ProblemsDocument14 pagesUnit 6 Module 10 Standard Costing: Practical ProblemsyanbladeNo ratings yet

- Unit 6 Module 10 Standard Costing: Practical ProblemsDocument14 pagesUnit 6 Module 10 Standard Costing: Practical Problemskiran shettyNo ratings yet

- 18 10 SA V1 S1 Solved Problems SC PDFDocument14 pages18 10 SA V1 S1 Solved Problems SC PDFTheVagabond HarshalNo ratings yet

- Unit 6 Module 10 Standard Costing: Practical ProblemsDocument14 pagesUnit 6 Module 10 Standard Costing: Practical ProblemsDerrick de los ReyesNo ratings yet

- Unit 6 Module 10 Standard Costing: Practical ProblemsDocument14 pagesUnit 6 Module 10 Standard Costing: Practical ProblemsShruti BannerjeeNo ratings yet

- CHAPTER 9 StandardDocument6 pagesCHAPTER 9 Standardsarahayeesha1No ratings yet

- Managerial Accounting by Garrison Appendix 12B34 MASDocument29 pagesManagerial Accounting by Garrison Appendix 12B34 MASJoshua Hines0% (1)

- Standard Costing & Variances ProblemDocument15 pagesStandard Costing & Variances Problemtaurus100% (4)

- Practice Problems 2-Standard Costing and Variance Analysis-1Document2 pagesPractice Problems 2-Standard Costing and Variance Analysis-1Unknowingly AnonymousNo ratings yet

- Unit 7 - Wiley Plus ExamplesDocument14 pagesUnit 7 - Wiley Plus ExamplesMohammed Al DhaheriNo ratings yet

- Chapter 12Document13 pagesChapter 12mikeNo ratings yet

- D4462045416 PDFDocument3 pagesD4462045416 PDFSamir MazafranNo ratings yet

- BraunDocument69 pagesBraunLouise Alyssa SazonNo ratings yet

- Finite Element Modeling Analysis of Nano Composite Airfoil StructureDocument11 pagesFinite Element Modeling Analysis of Nano Composite Airfoil StructureSuraj GautamNo ratings yet

- Veerasaiva Pantha in 12th Century MaharashtraDocument2 pagesVeerasaiva Pantha in 12th Century MaharashtrarathkiraniNo ratings yet

- CN Blue Love Rigt Lyrics (Romanized)Document3 pagesCN Blue Love Rigt Lyrics (Romanized)Dhika Halet NinridarNo ratings yet

- Pavlishchuck Addison - 2000 - Electrochemical PotentialsDocument6 pagesPavlishchuck Addison - 2000 - Electrochemical PotentialscomsianNo ratings yet

- FRQ Vocabulary ReviewDocument1 pageFRQ Vocabulary ReviewDrew AbbottNo ratings yet

- KRPL Shahjahanpur Check List For Arc Welding MachineDocument1 pageKRPL Shahjahanpur Check List For Arc Welding MachineA S YadavNo ratings yet

- RG-RAP6260 (G) Hardware InstallationDocument26 pagesRG-RAP6260 (G) Hardware InstallationrazuetNo ratings yet

- Understanding PumpDocument113 pagesUnderstanding Pumpnyr1981_942955963100% (5)

- Directorate of Technical Education, Maharashtra StateDocument47 pagesDirectorate of Technical Education, Maharashtra StatePandurang GunjalNo ratings yet

- Contemplation (Murāqaba) and Spiritual Focus/attention (Tawajjuh) in The Pre-Mujaddidi Naqshibandi OrderDocument5 pagesContemplation (Murāqaba) and Spiritual Focus/attention (Tawajjuh) in The Pre-Mujaddidi Naqshibandi OrderShahmir ShahidNo ratings yet

- Cover PageDocument10 pagesCover PageAvijit GhoshNo ratings yet

- Proac Studio 100: Monitor Level Performance From An Established Compact DesignDocument2 pagesProac Studio 100: Monitor Level Performance From An Established Compact DesignAnonymous c3vuAsWANo ratings yet

- Pamphlet On Arrangement of Springs in Various Casnub Trolleys Fitted On Air Brake Wagon PDFDocument9 pagesPamphlet On Arrangement of Springs in Various Casnub Trolleys Fitted On Air Brake Wagon PDFNiKhil GuPtaNo ratings yet

- Decs vs. San DiegoDocument7 pagesDecs vs. San Diegochini17100% (2)

- TPT 510 Topic 3 - Warehouse in Relief OperationDocument41 pagesTPT 510 Topic 3 - Warehouse in Relief OperationDR ABDUL KHABIR RAHMATNo ratings yet

- AMC Middle Primary Years 3 and 4 - SolutionsDocument6 pagesAMC Middle Primary Years 3 and 4 - SolutionsSherry JiangNo ratings yet

- Tutorial Letter 101/0/2022: Foundations in Applied English Language Studies ENG1502 Year ModuleDocument17 pagesTutorial Letter 101/0/2022: Foundations in Applied English Language Studies ENG1502 Year ModuleFan ele100% (1)

- თინათინ ზურაბიშვილი, თვისებრივი მეთოდებიDocument111 pagesთინათინ ზურაბიშვილი, თვისებრივი მეთოდებიNino LomaiaNo ratings yet

- Menu Planning in HospitalDocument4 pagesMenu Planning in HospitalERva Soelkarnaen100% (1)

- Research Paper OutlineDocument2 pagesResearch Paper Outlineapi-270769683No ratings yet

- Omega 900 InstructionsDocument27 pagesOmega 900 InstructionsRA Dental LaboratoryNo ratings yet

- PCNSE DemoDocument11 pagesPCNSE DemodezaxxlNo ratings yet

- Citadel Securities Australia Pty LTD - Company DetailsDocument5 pagesCitadel Securities Australia Pty LTD - Company DetailsBrendan OswaldNo ratings yet

- Resume LittletonDocument1 pageResume Littletonapi-309466005No ratings yet

- Store Docket - Wood PeckerDocument89 pagesStore Docket - Wood PeckerRakesh KumarNo ratings yet

- Environmental and Chemical Policy Module3Document47 pagesEnvironmental and Chemical Policy Module3jahazi1No ratings yet

- BROMINE Safety Handbook - Web FinalDocument110 pagesBROMINE Safety Handbook - Web Finalmonil panchalNo ratings yet

- Lesson Plan - Sight Word ObservationDocument2 pagesLesson Plan - Sight Word Observationapi-253277023No ratings yet