Professional Documents

Culture Documents

Different Kinds of Gifts

Uploaded by

Ashok K PandeyOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Different Kinds of Gifts

Uploaded by

Ashok K PandeyCopyright:

Available Formats

Different Kinds of Gifts

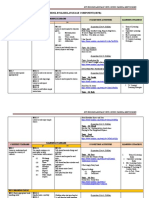

CONTENTS 1. INTRODUCTION 2. GIFTS UNDER MUSLIM LAW 2. ESSENTIALS OF VALID GIFT 3. CONDITIONS FOR REVOCATION OF GIFT 4. DIFFERENT KINDS OF GIFTS (i) (ii) (iii) (iv) (v) (vi) PRINCIPLE OF MUSHA HIBA-BIL-IWAZ HIBA-BA-SHARTULIWAZ ARIYAT OR ARIYA SADAQA WAKF OF MUSHA

5. CONCEPT OF GIFT UNDER HINDU LAW

INTRODUCTION Gift is a relinquishment without consideration of ones own right in property and the creation of the right of another. A gift is completed only on the others acceptance of the gift. A gift or a present is the transfer of something without the expectation of receiving something in return. Although gift-giving might involve an expectation of reciprocity, a gift is meant to be free. In many human societies, the act of mutually exchanging money[1], goods, etc. may contribute to social cohesion. Economists have elaborated the economics[of gift-giving into the notion of a gift economy. By extension the term gift can refer to anything that makes the other happier or less sad, especially as a favor, including forgiveness and kindness . At common law], for a gift to have legal effect, it was required that there be (1) Intent by the donor to give a gift, and (2) Delivery to the recipient of the item to be given as a gift. Gifts can be either:

lifetime gifts (inter vivos gift, donatio inter vivos) a gift of a present or future interest made and delivered in the donors lifetime; or deathbed gifts (gift causa mortis, donatio mortis causa[7]) a future gift made in expectation of the donors imminent death. A gift causa mortis is not effective unless the donor actually dies of the impending peril that he or she had contemplated when making the gift, i.e. these gifts can only be made when the donor is in a terminable condition.

Gifts can also be:

y y y

outright made free of any restrictions, such as being subject to a trust; onerous made with a burden or obligation imposed on the donee; or remunerative made to compensate for services rendered.

GIFTS UNDER MUSLIM LAW The English term gift is much wider than the Islamic word hiba and the two must not be confused. 1 The term gift is generic and is applied to a large group of transfers. The word hiba, however, is narrow and well-defined legal concept. Hiba is the immediate and unqualified transfer of the corpus of the property without any return. The Durra I-Mukhtar defines hiba as the transfer of the right of the property in in substance (tamlik al-ain) by one person to another without return (iwad).2 To make a person the owner of the substance of a thing (tamlik al-ain) without consideration is a hiba (gift), while to make him the owner of the profits only (tamlik aI-manafe) without consideration is a hiba (gift), while to make him the owner of the profits only (tamlik aI-manafe) without consideration is an ariya.3 According to MULLA, a hiba or gift is a transfer of property made immediately, and without exchange , by one person to another , and accepted by or on the behalf of the later. It is the immediate and unqualified transfer of the corpus of the property without any return. In other words, to make a person the owner of the substance of a thing without consideration is hiba or gift. Literally the gift means the donation of a thing from which the done may derive benefits. In its technical sense it is defined as an unconditional transfer of property, made immediately and without any exchange or consideration, by one person to another and accepted by or on behalf of the later, It is conferring of the property without consideration. In accordance with the provisions provided under Muslim law are of two types Hiba and Aria. Hiba (Tamlik al ain) , is an immediate and unconditional transfer of the ownership of some property or of some right, without any consideration or with some return (ewaz); and Aria ( Tamlik al manafe) the grant of some limited interest in respect of the use or usufruct of some property or right. Where a gift of any

property or right is made without consideration with the object of acquiring religious merit, it is called sadaqah. The terms hiba and gift are often indiscriminately used but the term hiba is only one of the kinds of transactions which are covered by the general term gift. A gift by a Muslim man in favour of his co-religionist must be under the Muslim Law. Muslim law recognizes the difference between the corpus and the usufructs of a property. Corpus or Ayn means the absolute right of ownership of the property which is heritable and is unlimited in point of time, while, usufructs, or Manafe, means the right to use and enjoy the property. It is limited and is not heritable. The gift of the corpus of a thing is called Hiba and the gift of only the usufructs of a property is called Ariya. Gift as defined under Sec. 122 of the Transfer of Property Act is the transfer of certain existing moveable or immoveable property made voluntarily and without consideration, by one person, called the donor, to another, called the donee , and accepted by or on behalf of the donee. It is required to be a voluntary transfer of property to another made gratuitously and without consideration. This section applies to those gifts that are gifts inter vivos or an absolute gift. Property under the above section can be both movable and immovable but however have to be tangible in nature. In order to constitute a valid gift, there must be an existing property as already earlier elaborated. ESSENTIALS OF VALID GIFT Since Muslim law views the law of Gift as a part of law of contract without consideration, there must be an offer (ijab), an acceptance (qabul), and transfer (qabza). The delivery of possession is the most essential condition to complete the gift. Until the delivery of possession is effected , the property remains at the disposal of the donor and on his death it will descent to his heirs, but the words of gift are not treated as entirely ineffective before possession, so if possession is given afterwards , in pursuance thereof, renewal of gift is not necessary. Therefore three requirements of the valid gift are as follows: 1. There must be clear and unambiguous intention of the donor to make a gift i.e., relinquishment on the part of the donor. 2. There must be acceptance of the gift, express or implied, on the part of the donee. 3. There must be delivery of possession, either actual or constructive of the property which is the subject matter of the gift. Under the Mohammadan law for validity of the deed of Gift four elements are necessary. a) declaration of gift by donor.

b) c)

Relinquishment by doner of ownership and dominion. Acceptance of the gift by donee, and

d) Delivery of possession of the property by donor. The relinquishment of control and ownership by the donor is necessary to complete the gift. CONDITIONS FOR REVOCATION OF GIFT According to MULLA, Once possession is delivered nothing short of a decree of the court is sufficient to revoke the giftuntil the decree is passed , the donee is entitled to use and dispose of the subject of the gift. A gift can be revoked1. Before the delivery of possession, a gift may be revoked at any time, by a mere declaration. 2. After delivery of possession, a gift may be revoked (but only through court) except in the following casesa) Where the donor is the husband or the wife of the donee and the gift is made during the marital relationship. b) Where the donee and the donor are related to one another within prohibited degrees. c) Where the donee or the donar is dead.

d) Where the subject of the gift cannot be restored in its original form for any of the following reasons:i. ii. iii. iv. That the property has passed out of the donees possession. That it has been lost or destroyed. That the value of property has increased. That the property has changed beyond identification.

The revocation of gift is permissible if donor has not relinquished is control and donee has not been put in possession. DIFFERENT KINDS OF GIFTS There are several variations of Hiba or Gift. For example, Hiba bil Iwaz, Hiba ba Shart ul Iwaz, Sadkah, and Ariyat, Musha, Wakf of Musha.

(i) Principle of Musha The word Musha means undivided part or share, a common building or land. The general rule is laid down in the Hedaya: A gift of a part of a thing which is capable of division is not valid unless the said part is divided off and separated from the property of the donor; but a gift of an indivisible thing is valid. An undivided share may be capable of division or otherwise; if it is divisible then an undivided part cannot form the subject of gift; if it is not divisible an undivided part can form the subject of gift. The gift of an undivided share in any property which does not admit of partition is valid.10 An undefined share in a small house or a small bath are mentioned as cases of Musha a gift of which would be valid.11 A, who owns a house, makes a gift to B of the house and of the right to use staircase used by him jointly with the owner of an adjoining house. The gift of As undivided share in the use of the staircase is not capable of division; therefore it is valid. The gift of an undivided share in any property capable of division is, with certain exceptions, incomplete and irregular (fasid) although it can be rendered valid by subsequent separation and delivery of possession. EXCEPTIONS i. Gift of Mushaa is a property which is incapable of division. ii. Gift by one heir to a co-heir iii. Gift of a share in the zamindari. iv. Gift of a share in a company. v. Gift of a share in free-hold property. vi. Gift of ashare in which donee is in joint possession. vii. When possession is taken under invalid gift. viii. When gift is for poor or in the nature of sadquas. ix. The gift of an undivided share in anything, which is of such a nature that it can be used to better advantage in the undivided condition, is valid.

(ii)

HIBA-BIL-IWAZ

A hiba bil-iwaz is in reality a transaction consisting of two separate and distinct parts a hiba (original gift by the donor of the donee) and an iwaz (return gift by the donor to the donee) and an iwaz (return gift by the donee to the donor)14 . The term means gift with return.The gift and the return gift are separate and distinct acts,and where both are completed the transaction is called hiba bil-iwaz. For example, A makes a gift of a horse to B, and later makes a gift of a camel to A .If B says that the camel is given as and by way of a return or exchange then both the gifts are irrevocable. The law requires thet all the formalities of the law of hiba should be strictly followed in each of the two gifts.15 Mahmood, J.says: The fundamental conception of a hiba bil-iwaz in Muhammadan law is that it is a transaction made up of two separate acts of donation, that is, it is transaction made up of mutual or reciprocal gifts between two persons, each of whom is alternately the donor of one gift and the donee of the other. Baillie, however , mentions that there is an Indian form of hiba bil-iwaz: But in the hiba bil-iwaz of India there is only one act; the iwaz or exchange being involved in the contract of gift as its direct consideration. The transaction which goes by the name of hiba bil-iwaz in India is, therefore, in reality not a proper hiba bil-iwaz of either kind but a sale and has all the incidents of the latter contract. Hence delivery of possession is not necessary in this case, and an undivided share in property capable of division (musha) may be lawfully transferred. The Indian form is to be distinguished from the ancient and classical form of hiba-bil-iwaz. A transaction having all the attributes of a true hiba-bil-iwaj can be recognized in India. Where the delivery of possession has taken place and transaction is not affected by the doctrine of musha, it can be upheld as hiba-bil-iwaz even though the gifts were made by the words of mouth. If these conditions are fulfilled, the transaction amounts to a hiba-bil-iwaz and it is valid though by not registered instrument, registration not being made compulsory either by the transfer of property act or any other law. (iii) HIBA-BI-SHARTILIWAZ

When a gift (hiba) is made with a stipulation (shart) for a return (iwaz) the transaction as a whole is called hiba-bi-shartil-iwaz 18. The return stipulated for may or may not be specified. The main distinction is that hiba-bil-iwaz a voluntary gift is followed by a voluntary return ; in the hiba-bi-shartil-iwaz in their inception is that

1. The intention to make an iwaz is an afterthought in hiba-bil-iwaz, whereas in hiba-bi-shartil-iwaz the two (gift and return) go hand in hand not one before the other ; and 2. The return is in contemplation by both parties in hiba-bi-shartil-iwaz 19 .

The kinds of property that can be given away by way of hiba can also be given by way of return gift (iwaz) ; 20 and the return gift must be made with all the formalities necessary for the hiba. 21 After the gift and the return have been completed by delivery of possession, neither of them can be revoked.22, for example, D makes a gift of a house to S and puts him in possession. Thereafter as gives D a horse as an iwaz and D accepts it. Later, D purports to sell the house to T. The sale has no effect. (iv) ARIYAT OR ARIYA

Ariya is to transfer the right to enjoy the use or profits without any return. 24 According to the Durr al-Mukhtar to make a person the owner of the substance of a thing without consideration is a hiba (gift),while to make him the owner of the profits only without consideration is an Ariya or accomodatum. 25 In the classical definition of the Hedaya and the Alamgiri it is the giving (tamlik) of the usufruct (manafe) without any return.26 For instance, I have lent this thing to you or I have given you the use of this garment or house or my house is your residence. In hiba the transferee acquires the right to the property itself; in ariya, he only obtains the use or beneficial enjoyment for a limited time, and the property does not pass to him. The chief incidents of this form of gift are that the period for which the gift is made may or may not be specified; and it is revocable at will. The law of ariya has been somewhat neglected in India but since the passing of the Shariat Act 1937 it is likely to assume greater importance. (V) SADAQA The word sadaaqa in the widest sense means a pious and charitable act; to help the weary is sadaqa. But in muslim law it means a gift made with the object of obtaining married in the eyes of god. 27 the motive of hiba is secular; the motive of sadaqa is religious. Delivery of possession is necessary in sadaqa; but it is doubtful if the rule against musa applies to it in its strictness. Thus, if a man were to give ten dirhrams to two poor men, according to abbu hanifa the gift by way of sadaqa is perfectly valid. 28 In the legal text of Islamic law the term sadaqa dearly applied both to( permanent foundations) and to ordinary gift (were the substance is consumed); 29 But in modern usage it is best to keep the two terms distinct applying sadaqa to gift which are consumed in use and wakfs to permanent foundation. If A gives Rs.

10,000 for purchasing books for the poor it would be sadaqa; but if the same sum is invested in a permanent form and a wakfs made for purchasing books for the poor from its income it would be a wakf. (VI) WAKF Wakf is a permanent foundation for religious and pious object; the corpus belongs toi God and cannot be consumed. The similarity between a sadaqa and wakfs is that in both the motive it is religious. But while the term sadaqa could in certain cases be applied to a wakfs as well, it is best to restrict sadaqa to a charity the substance whereof is consumed. 30 The word habs is an infinitive meaning to prevent or restrain. 31 it is therefore synonymous with wakfs. 32 Some authority in india for instance AMIR ALI 33 and TAYAB JI 34, however used the term habs as it is to be restricted to limited estate as shia law of a secular character. This is hardly justifiable and the eminent orders have apparently been mislead by Baillie;35 for in the shara I and other authoritative shia text no evidence of such a use can be found. 5. CONCEPT OF GIFT UNDER HINDU LAW

Under Hindu law Gift is a relinquishment without consideration of ones own right in property and the creation of the right of another. A gift is completed only on the others acceptance of the gift. What property may be gifted

y

A Hindu may dispose of by gift his separate or self acquired property, subject in certain cases to the claims for maintenance of those he is legally bound to maintain. A coparcerner, may dispose of his coparcernary interest by gift subject to the claims of those who are entitled to be maintained by him. A father may by gift dispose of the whole of his property, whether ancestral or self acquired, subject the claims of those he is entitled to be maintained by him. A female may dispose of her stridhana by gift or will, subject in certain cases to the consent of her husband. A widow may in certain cases by gift dispose of a small portion of the property inherited by her from her husband, but she cannot do so by will.

The owner of an impartible estate may dispose of the estate by gift or will, unless there is a special custom prohibiting alienation or the tenure is of such a nature that it cannot be alienated.

A gift under Hindu law need not be in writing. However, a gift under the law is not valid unless it is accompanied by delivery of possession of the subject of the gift from the donor to the donee. However where physical possession cannot be delivered, it is enough to validate a gift, if the donor has done all that he could do to complete the gift, so as to entitle the donee to obtain possession. Gifts by Hindus where transfer of property act applies. A gift under the above act can only be affected in the following manner. 1. For the purpose of making a gift of immovable property, the transfer must be affected by a registered instrument signed by or on behalf of the donor, and attested by at least two witnesses. 2. For the purpose of making a gift of a movable property, the transfer may be affected by a registered document signed by the donor or by delivery. Gifts to unborn persons Under pure Hindu law, a gift cannot be made in favor of a person who was not in existence at the date of the gift. This rule has been altered by 3 acts namely; The Hindu Transfers and Bequests Act 1914, Hindu Disposition of Property act 1916, and the Hindu Transfers and Bequests (City of Madras) Act 1921 Reservation of life interest. A gift of property is not invalid because the donor reserves the usufruct of the property to himself for life. Conditions restraining alienation or partition Where property is given subject to a condition absolutely restraining the donee from alienating it, or it is given to two or more persons subject to a condition restraining them from restraining it, the condition is void, but the gift itself remains good. Revocation of gift A gift once completed is binding on the donor, and it cannot be revoked by him unless it is obtained by fraud or undue influence.

Gift in fraud of creditors A gift made with the intent to defeat or defraud creditors is voidable at the option of the creditors.

You might also like

- ISLAMIC PERSONAL LAW GIFT LECTUREDocument45 pagesISLAMIC PERSONAL LAW GIFT LECTUREUzma SheikhNo ratings yet

- Vicarious Liability 2Document37 pagesVicarious Liability 2natalia malikNo ratings yet

- Offence of Cheating Case ExplainedDocument3 pagesOffence of Cheating Case ExplainedNaman KumarNo ratings yet

- List of Abbreviations and CasesDocument11 pagesList of Abbreviations and CasesVivaswan Shipra DeekshitNo ratings yet

- Evidence of Conspiracy ActsDocument16 pagesEvidence of Conspiracy ActsAnusha V RNo ratings yet

- Sources of Muslim LawDocument2 pagesSources of Muslim LawThiru GanesanNo ratings yet

- Theories of DivorceDocument22 pagesTheories of DivorceAbhidhaNo ratings yet

- By: Rashmi Dubey Faculty of LawDocument31 pagesBy: Rashmi Dubey Faculty of LawKevin JoyNo ratings yet

- Search and seizure principles under CrPCDocument7 pagesSearch and seizure principles under CrPCketanrana2100% (1)

- Perfect CV For 1st Year Law StudenyDocument2 pagesPerfect CV For 1st Year Law Studenysanket jamuarNo ratings yet

- Marriage As A Civil Contract or A SacramDocument3 pagesMarriage As A Civil Contract or A SacramThe Abdul Qadeer ChannelNo ratings yet

- Case Summary - Sheela BarseDocument4 pagesCase Summary - Sheela BarsePragyaNo ratings yet

- Chennammal V1Document19 pagesChennammal V1Aditi Soni100% (1)

- Jamia Millia Islamia: Evidence Law AssignmentDocument13 pagesJamia Millia Islamia: Evidence Law AssignmentUjjwal MishraNo ratings yet

- Law of Waqf by Syed HaroonDocument14 pagesLaw of Waqf by Syed HaroonSyed HaroonNo ratings yet

- Status of Unpaid Dower in IndiaDocument6 pagesStatus of Unpaid Dower in IndiaShalenderNo ratings yet

- State SuccessionDocument3 pagesState SuccessionzershanNo ratings yet

- Shayara Bano v. Union of India: The Triple Talaq CaseDocument34 pagesShayara Bano v. Union of India: The Triple Talaq CaseUnnatiNo ratings yet

- Differences Custom Precedent LegislationDocument7 pagesDifferences Custom Precedent LegislationParth Rastogi0% (1)

- Importance of Dharmashastra On LegislationDocument7 pagesImportance of Dharmashastra On LegislationSandesh S BhasriNo ratings yet

- Transfer Property Unborn ChildDocument12 pagesTransfer Property Unborn ChildAdnan KhanNo ratings yet

- Family Law II Modules on Hindu and Muslim Adoption, Maintenance, Joint Family, Coparcenary, Partition, Succession and InheritanceDocument4 pagesFamily Law II Modules on Hindu and Muslim Adoption, Maintenance, Joint Family, Coparcenary, Partition, Succession and InheritanceMuskan KhatriNo ratings yet

- Indies". The Said Company Is Known As The East India Company. The CompanyDocument4 pagesIndies". The Said Company Is Known As The East India Company. The CompanyAnkit VardhanNo ratings yet

- State of Kerala v. M.A. Mathai: Cases - Voidable Contracts Case Name Citation JudgementDocument4 pagesState of Kerala v. M.A. Mathai: Cases - Voidable Contracts Case Name Citation JudgementAishwarya ShankarNo ratings yet

- Administration of Waqf in IndiaDocument12 pagesAdministration of Waqf in Indiasuboor hussainNo ratings yet

- Marriage Under Muslim LawDocument15 pagesMarriage Under Muslim LawSanya ShrivastavaNo ratings yet

- IPC - Case CommentaryDocument12 pagesIPC - Case CommentarySanyam MishraNo ratings yet

- LL.B Notes on Muslim Family Law Dower ProvisionsDocument40 pagesLL.B Notes on Muslim Family Law Dower ProvisionsMASALAMNo ratings yet

- Concept of Will Under Muslim LawDocument8 pagesConcept of Will Under Muslim LawMohammad Rehan SiddiquiNo ratings yet

- Sale of Immovable Property ProjectDocument20 pagesSale of Immovable Property ProjectSyed renobaNo ratings yet

- Inter Country Adoptions, Indian PerspectiveDocument41 pagesInter Country Adoptions, Indian PerspectiveHell rockarNo ratings yet

- Property Law Ii - Internal Assesment Iii Case Comment On Shyam Narayan Prasad V. Krishna Prasad & Ors. AIR 2018 SC 3152Document11 pagesProperty Law Ii - Internal Assesment Iii Case Comment On Shyam Narayan Prasad V. Krishna Prasad & Ors. AIR 2018 SC 3152aayush chchaturvediNo ratings yet

- PPC 84 PDFDocument16 pagesPPC 84 PDFBook World For YouNo ratings yet

- E-Lawyering and Use of Computers in LegalDocument3 pagesE-Lawyering and Use of Computers in LegalateeshboroleNo ratings yet

- Schools of Muslim LawDocument7 pagesSchools of Muslim Lawmihir khannaNo ratings yet

- Group Liability or Joint LiablityDocument18 pagesGroup Liability or Joint LiablityVivek rajNo ratings yet

- The Land Acquisition Act, 1894Document9 pagesThe Land Acquisition Act, 1894Atif RehmanNo ratings yet

- Nawab Khawaja Mohhamad Khan CaseDocument8 pagesNawab Khawaja Mohhamad Khan CasePriyaranjan Singh50% (2)

- Jamia Millia Islamia University: Page - 1Document24 pagesJamia Millia Islamia University: Page - 1altmashNo ratings yet

- Before The Hon'Ble Supreme Court of IndicaDocument15 pagesBefore The Hon'Ble Supreme Court of IndicaJustice RaghunathNo ratings yet

- Stridhan and Woman'sDocument10 pagesStridhan and Woman'sSanjeev PalNo ratings yet

- Mis Conduct CaseDocument9 pagesMis Conduct CaseBandana Pha Go LimbooNo ratings yet

- Chapter-4 Mens Rea, Its Origin and DevelopmentDocument9 pagesChapter-4 Mens Rea, Its Origin and DevelopmentR Sowmya ReddyNo ratings yet

- Supreme Court Upholds Muslim Divorced Woman's Right to MaintenanceDocument7 pagesSupreme Court Upholds Muslim Divorced Woman's Right to MaintenanceMehek Chowatia100% (1)

- Waging War Against The Goverment of IndiaDocument13 pagesWaging War Against The Goverment of IndiaChoudhary Shadab phalwanNo ratings yet

- Sher Shah Suri's Land Revenue SystemDocument15 pagesSher Shah Suri's Land Revenue SystemDhriti SharmaNo ratings yet

- Topic: Injuria Sine Damnum and Damnum Sine Injuria: Session ReportDocument5 pagesTopic: Injuria Sine Damnum and Damnum Sine Injuria: Session Reportanushka kashyapNo ratings yet

- An analytical study on remoteness of damage in tort lawDocument10 pagesAn analytical study on remoteness of damage in tort lawFida Fathima S 34No ratings yet

- Section 84 IpcDocument11 pagesSection 84 IpcGauri ChuttaniNo ratings yet

- 2017-2018 Property Law-Ii Final Draft Topic - Comparative Study of Gift As Under The Transfer of Property Act, 1882Document14 pages2017-2018 Property Law-Ii Final Draft Topic - Comparative Study of Gift As Under The Transfer of Property Act, 1882Bharat JoshiNo ratings yet

- Babui Panmato Kuer Vs Ram Agya SinghDocument6 pagesBabui Panmato Kuer Vs Ram Agya SinghIshikaNo ratings yet

- Hukumchand Insurance Company LimitedDocument2 pagesHukumchand Insurance Company LimitedBrena GalaNo ratings yet

- The 1 Uol National Moot Court Competition-2019: Team Code-J1Document23 pagesThe 1 Uol National Moot Court Competition-2019: Team Code-J1Ahsan Ali ButroNo ratings yet

- Sarla Mudgal v. Union of IndiaDocument12 pagesSarla Mudgal v. Union of IndiaAshish RajNo ratings yet

- Chanakya National Law University, Patna: Jurisprudence-IDocument3 pagesChanakya National Law University, Patna: Jurisprudence-Iabhishek kumar100% (1)

- Analysis of The Judgment Shriomani Prabhandak Committee Versus SomnathDocument5 pagesAnalysis of The Judgment Shriomani Prabhandak Committee Versus SomnathGitika AroraNo ratings yet

- Mamta Mam Case StudyDocument6 pagesMamta Mam Case Studysandybhai1No ratings yet

- Human Rights: Previous Year's MCQs of Tripura University and Answers with Short ExplanationsFrom EverandHuman Rights: Previous Year's MCQs of Tripura University and Answers with Short ExplanationsNo ratings yet

- Confessions of A Comma Queen (PDFDrive)Document168 pagesConfessions of A Comma Queen (PDFDrive)Magizh SelvanNo ratings yet

- Teacher's Home Visit FormDocument2 pagesTeacher's Home Visit FormPatzAlzateParaguyaNo ratings yet

- Intro Think Ahead BackwardDocument14 pagesIntro Think Ahead BackwardNikkiNolanNo ratings yet

- Julia Donaldson Reading Comprehension QuestionsDocument18 pagesJulia Donaldson Reading Comprehension QuestionsJasminaNo ratings yet

- Concise AACR2Document199 pagesConcise AACR2Allan Jay MonteclaroNo ratings yet

- RPT Suggestion Activities For Cefr Created by Nurul FazeelaDocument7 pagesRPT Suggestion Activities For Cefr Created by Nurul FazeelaIna NaaNo ratings yet

- Tort Moot 11 AdityaDocument9 pagesTort Moot 11 Adityaaditya yadav100% (1)

- Sophie's Daily Routine in BrightonDocument1 pageSophie's Daily Routine in BrightonMaria YordanovaNo ratings yet

- Tips and Tricks ANSYSDocument62 pagesTips and Tricks ANSYSnuvanNo ratings yet

- Moduler Pipe RackDocument29 pagesModuler Pipe RackNoman Abu-Farha100% (1)

- In-Flight Upset, 154 KM West of Lear Month, WA, 7 October 2008, VH-QPA, Airbus A330-303Document65 pagesIn-Flight Upset, 154 KM West of Lear Month, WA, 7 October 2008, VH-QPA, Airbus A330-303Glenn BergmanNo ratings yet

- Principles of Design & Elements of ArtsDocument43 pagesPrinciples of Design & Elements of ArtsJF BatucalNo ratings yet

- Molecular and Cellular Basis of Immune Protection of Mucosal SurfacesDocument39 pagesMolecular and Cellular Basis of Immune Protection of Mucosal SurfacesnnnaaaNo ratings yet

- Subamniotic Hematoma: Case Report and Review of LiteratureDocument3 pagesSubamniotic Hematoma: Case Report and Review of LiteratureIJAR JOURNALNo ratings yet

- Understanding Market EquilibriumDocument25 pagesUnderstanding Market EquilibriumArchill YapparconNo ratings yet

- IQRA University Sample PaperDocument9 pagesIQRA University Sample PaperFaryal Mughal100% (1)

- Tadevosyan 2021Document26 pagesTadevosyan 2021W Antonio Rivera MartínezNo ratings yet

- Jiajing Zhneg ResumeDocument1 pageJiajing Zhneg Resumeapi-534374168No ratings yet

- Integrated Communications Systems Modeling: A Model-Based Engineering ApproachDocument5 pagesIntegrated Communications Systems Modeling: A Model-Based Engineering ApproachRaghavan MuralidharanNo ratings yet

- Database UpdatesDocument7 pagesDatabase UpdatesroxgotmadNo ratings yet

- Ieee 99-1980Document11 pagesIeee 99-1980juaninjaNo ratings yet

- What Is A Process Scheduler? State The Characteristics of A Good Process Scheduler? Which Criteria Affect The Schedulers Performance?Document6 pagesWhat Is A Process Scheduler? State The Characteristics of A Good Process Scheduler? Which Criteria Affect The Schedulers Performance?partha deyNo ratings yet

- Auden's poem compares law and loveDocument1 pageAuden's poem compares law and loveDev AgrawalNo ratings yet

- Bloom's Taxonomy: The Psychomotor Domain: Category Example and Key Words (Verbs) Examples: Detects Non-VerbalDocument6 pagesBloom's Taxonomy: The Psychomotor Domain: Category Example and Key Words (Verbs) Examples: Detects Non-VerbalFlorina Nadorra RamosNo ratings yet

- RFID Based Attendance SystemDocument7 pagesRFID Based Attendance SystemAdvanced Research PublicationsNo ratings yet

- Contributions of The Negro To Human Civilization, ChamberlainDocument22 pagesContributions of The Negro To Human Civilization, ChamberlainLuis GrailletNo ratings yet

- Daniel Mathew Divorce PetitionDocument4 pagesDaniel Mathew Divorce PetitionDinesh Patra100% (1)

- 30 91 1 PBasdjhasjdgasyfgaydgaydgawuDocument10 pages30 91 1 PBasdjhasjdgasyfgaydgaydgawuWilkus ParconNo ratings yet

- Language Practice 4Document4 pagesLanguage Practice 4Марияна БоневаNo ratings yet

- PE - Assessment of Physical Activities and Physical FitnessDocument2 pagesPE - Assessment of Physical Activities and Physical FitnesspatoleangNo ratings yet