Professional Documents

Culture Documents

+-LCCI Level 1 - How To Pass Book-Keeping (Recommeded Book) - +

Uploaded by

rock3007Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

+-LCCI Level 1 - How To Pass Book-Keeping (Recommeded Book) - +

Uploaded by

rock3007Copyright:

Available Formats

prelims

15/3/03

12:36 pm

Page iii

How to Pass

Book-keeping

FIRST LEVEL Teachers Guide

Keith F Bird

MSc BSc (Econ) ACIS

prelims

15/3/03

12:36 pm

Page iv

First published 1999 LCCI CET 1999 British Library Cataloguing-in-Publication Data Bird, Keith F How to Pass Book-keeping, First Level 2nd ed. Teachers guide 1. Book-keeping Study and teaching I.Title 657.20071 ISBN 1 86247 060 X All rights reserved; no part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise without the prior written permission of the Publisher. This book may not be lent, resold, hired out, or otherwise disposed of by way of trade in any form of binding or cover, other than that in which it is published, without the prior consent of the Publisher. 10 9 8 7 6 5 4 3 2 1

Typeset by the London Chamber of Commerce and Industry Examinations Board Printed and bound in Hong Kong by Peninsula Publishers

prelims

15/3/03

12:36 pm

Page v

Contents

About the author Acknowledgements Introduction Cross-references to How to Pass Book-keeping, First Level (students book) Lesson 1 The accounting equation Transactions through double entry 2 Purchases, sales, and returns 3 Expenses: profit or loss 4 Balancing accounts: the trial balance 5 Trading and Profit & Loss Accounts 6 The balance sheet 7 Final accounts: more features 8 The division of the ledger 9 Bank facilities Cash Book: 2 columns 10 Cash Book: 3 columns cash discount 11 Purchases and Sales Day Books 12 Returns Day Books 13 Accruals and prepayments expenses 14 Accruals and prepayments income 15 Depreciation of fixed assets 16 Bad debts and provision for doubtful debts 17 Bank reconciliation statements 18 Petty Cash Book imprest system 19 Capital and revenue expenditure 20 The journal 21 Errors in the accounts 1 22 Errors in the accounts 2 23 Final accounts and adjustments further considered Stock valuation 24 Club and society accounts 25 The presentation of answers Page vii vii viii x

1 11 19 23 27 32 36 44 49 60 70 78 88 99 105 120 132 141 151 158 168 174 178 188 198

prelims

15/3/03

12:36 pm

Page vi

Contents

Appendix 1: Exercises, some worked solutions, and support material Appendix 2: Summarized answers to selected exercises Appendix 3: Glossary Notes

201 312 321 326

vi

prelims

15/3/03

12:36 pm

Page vii

About the author

Keith Bird has had over 35 years experience lecturing in business studies in further and higher education and has taught professional courses at all levels. He is the author of the students book How to Pass Book-keeping, First Level, published by the London Chamber of Commerce and Industry Examinations Board (LCCIEB). He has also written several study manuals that have been published for professional courses. Keith Birds association with the LCCIEB extends over 25 years and, for much of that time, he has served as a Chief Examiner in First Level Book-keeping and Second Level Book-keeping and Accounts. Acknowledgements In the preparation of this book, my thanks are due to Derek Skidmore MSc, FCCA, ACMA, co-author of How to Pass Book-keeping and Accounts, Second Level, for his review of the draft of the book and for his helpful suggestions. My thanks are also due to the staff of the LCCIEB Publishing Department for preparing this text for publication.

vii

prelims

15/3/03

12:36 pm

Page viii

Introduction

The How to Pass Book-keeping, First Level:Teachers Guide is closely geared to the LCCIEB First Level Book-keeping Extended Syllabus. It is intended for a teaching course that extends over 60 hours.There are 24 lessons concerning book-keeping, each of 2 1/4 hours duration. The remaining teaching time should be used for Lesson 25, which covers the important topic of presenting examination answers, together with revision and pre-examination preparation. The book is addressed to the teacher. It indicates the importance of particular topics and subject points and provides hints about how to present material. The Teachers Guide is intended to complement the students book How to Pass Book-keeping, First Level. At the same time, with a few exceptions, the explanations, examples, and exercises are free standing, providing the teacher with a store of additional teaching resource. The Teachers Guide should be used in combination with the students book and, for this purpose, cross-references between the two books are provided on page x. Individual cross-references are also given at certain points within the text. The approach adopted in the Teachers Guide is that of keeping in mind the question Why? At each stage, the stress should be on developing the students understanding of the need for, and effect of, the various book-keeping entries, as well as of the subject as a whole. Only by this means can inappropriate examination answers be prevented and a sound basis be provided for applying knowledge in the business world and/or for further accounting studies. As the book progresses, the material becomes more difficult. The early stages of the book assume that the student has only a limited knowledge of business and accounts. Gradually, more elements, features, and terms are introduced that sometimes require the modification of methods for recording transactions already learnt. For example, at first, transactions are recorded in the ledger only. With the introduction of day books, the system of recording transactions changes. The time spent on the ledger only entries is not, however, wasted because it enables the student to appreciate the relationship between the ledger and the day books. Inevitably, some students will come to the course with some knowledge or awareness of aspects of book-keeping and, understandably, they might question why a particular matter is not taken account of at a certain stage.This situation might apply in the case of the depreciation of fixed assets, which is not dealt with until Lesson 15. The progressive nature of the course is discussed at the beginning of Lesson 2. At that stage, the teacher might find it helpful to explain to the class that different features are to be included as the course develops. The text includes numerous examples, together with short reinforcement exercises. Appendix 1 contains exercises for Lessons 124 and support material. Certain of the exercises are immediately followed by worked solutions; they are marked with an asterisk (*) both in the Appendix and in the main part of the book. The exercises are suitable for photocopying as required.Appendix 2 contains summarized answers, where appropriate, to questions for which solutions are not provided. These summarized answers include the

viii

prelims

15/3/03

12:36 pm

Page ix

Introduction

results of certain calculations, key account entries, and other significant figures such as gross profit, net profit, asset totals, and trial balance totals. Other answers or parts of answers, too detailed for inclusion, such as account or journal entries, may be established by reference to the text of the book as well as by reference to the fully worked solutions in Appendix 1. It is advisable to make full use of the Glossary.

ix

prelims

15/3/03

12:36 pm

Page x

Cross-references to How to Pass Book-keeping, First Level (students book)

Teachers Guide Page Lesson 1 1 The accounting equation Transactions through double entry 10 2 Purchases, sales, and returns 17 3 Expenses: profit or loss 21 4 Balancing accounts: the trial balance 25 5 Trading and Profit & Loss Accounts 30 6 The balance sheet 33 7 Final accounts: more features 43 8 The division of the ledger Vertical layout of the balance sheet 49 9 Bank facilities Cash Book: 2 columns 56 10 Cash Book: 3 columns cash discount 65 11 Purchases and Sales Day Books 73 12 Returns Day Books 83 13 Accruals and prepayments expenses 94 14 Accruals and prepayments income 99 15 Depreciation of fixed assets 113 16 Bad debts and provision for doubtful debts 124 17 Bank reconciliation statements 132 18 Petty Cash Book imprest system 142 19 Capital and revenue expenditure 148 20 The journal 157 21 Errors in the accounts 1 (types of error) 163 22 Errors in the accounts 2 (adjusting for errors; the effects of errors) 167 23 Final accounts and adjustments further considered Stock valuation 177 24 Club and society accounts 187 25 The presentation of answers How to Pass Book-keeping, First Level Chapter Page 1 1 2 9 3 15 4 22 5 30 6 38 7 49 8 54 9 66 8 60 10 73 11 79 12 85 13 96 14 104 15 120 15 120 16 133 17 18 19 20 21 22 152 164 180 189 201 210

22 23 23 24 Appendices 1, 2, and 3

210 231 237 246 27284

pages1-59

15/3/03

11:14 am

Page 1

Lesson 1: The accounting equation Transactions through double entry

Topic summary

The need for accounting records The information that needs to be recorded The means of obtaining resources, ie assets: ownership v. external sources of funds The business as an entity The dual effect of a business transaction Double-entry recording of transactions

Extended Syllabus references

1.1 1.2 1.3 1.4 Explanation and use of the terms debtor, creditor, asset, liability, capital The accounting equation: assets = capital + liabilities and its expression in the balance sheet The effect upon the accounting equation of basic business transactions (including the single-side transaction, eg use of bank balance to buy fixed assets) The effect upon the accounting equation of the dual-type transaction, ie where the effect upon one side of the equation is matched by a combination of 2 (or possibly more) effects on the other side Purpose of the use of debit and credit for the recording of transactions The preparation of T-type accounts Specifying a transaction/entry within an account, ie date together with, normally, the name of the other account/day book involved in that particular transaction/ entry Completion of debit and credit entries recording individual transactions

2.1 2.2 2.3

2.4

The underlying purpose of this lesson is to develop recognition of the need for, and purpose of, recording business transactions and their effects. Understanding the two-fold aspect of any transaction (benefit and detriment, and plus and minus) is essential for a grasp of double-entry book-keeping. In the earlier stages of the lesson especially in meeting the aims of Steps 1 to 3 much can be done by using the question-and-answer method with the class, including a brief discussion of the students responses. The varied backgrounds and experiences of class members should be drawn on whenever possible. Always relate the discussion to a particular aim, listing points on the whiteboard or overhead projector as appropriate.

pages1-59

15/3/03

11:14 am

Page 2

The accounting equation

Step 1

Aim: to develop an appreciation of the need for business records of account Following a brief introductory chat with the class, ask the students to form pairs and to discuss and write down answers to the question:Why does a business need to keep records of account? At this stage, the students are likely to give broadly based answers, such as:

to to to to to to to

run (more) effectively and efficiently; know what money is coming in and going out; know what the business is earning and spending; control the business: to make adjustments as necessary; make decisions about the future; provide information for making decisions about the future; deal with the tax authorities.

Step 2

Aim: to recognize the key areas of information that need to be recorded From the answers to the questions in Step 1, identify areas of information that will be required; for example: Cash: availability and movements Amounts owed by the business Amounts owed to the business The possessions - assets Amount of money invested in the business Purchases Sales Expenses Profit Capital

Step 3

Aim: to recognize the resources needed and, broadly, the means of obtaining them: proprietor versus external sources While the students remain in pairs, 1 Ask them to imagine that they are establishing a business, such as a shop or factory. Ask them to write down the resources that they would need.

pages1-59

15/3/03

11:14 am

Page 3

The accounting equation

2 As the students suggest the resources, list these on the whiteboard in two categories, those that are: (a) measurable in money terms, eg cash, premises, machines, and motor vehicles; and (b) less measurable, eg skills, contacts, and experience. Show that category (a) is recorded in the accounts as assets. Category (b) is less easily recorded, but may be, for example, as skills as part of wage payments. It will be dealt with at a later stage. Explain how the assets might be obtained. Show that, in establishing a business, a proprietor might: (a) treat his or her own motor vehicle to be for use within the business; (b) put his or her money into the business, so that assets can be bought; (c) borrow money, ie obtain a loan. Emphasize that (a) + (b) = capital, ie the proprietors stake; and that (c) = liability.

Step 4

Aim: to understand the business as an entity and to appreciate the accounting equation

1 Explain to the students that a business is an entity that is distinct from its owner. As a result, the accounts are to be kept for the business and they are separate from the owners accounts.You may illustrate the concept like this:

invests in Business accounts withdraws from Personal accounts

2 Explain, with reference to Step 3, that the money a proprietor invests to set up and run a business is usually supplemented by borrowed money. The means of financing a business may be expressed as the accounting equation:

eg Assets = capital + liability (eg a loan) Assets 15,000 = capital 12,000 + liability 3,000

Alternatively, the equation may be expressed as:

eg Assets less liabilities = capital Assets 15,000 less 3,000 = 12,000

pages1-59

15/3/03

11:14 am

Page 4

The accounting equation

3 Ask the students to work through the following exercise, inserting the missing figure in each of the columns.

Assets 2,430 Capital 1,920 3,060 2,500 4,120 Liabilities 1,040 780 0

(1) (2) (3) (4) (5)

6,530 5,830

Step 5

Aim: to understand the effect of business transactions; their double aspect

1 Show that the financial position of a business at any point in time the accounting equation can be expressed in the form of a balance sheet, eg:

F Lim Balance sheet at 1 March Year 3 Office furniture Motor vehicle Cash at bank 800 5,300 1,900 8,000 Capital Loan from J Black 7,000 1,000 8,000

2 Explain the term business transaction. Show, using the following example, the effect of transactions, stage by stage, upon a balance sheet. It is important not to confuse the students with transaction moves that are too rapid. Ensure they fully understand the effect of each transaction before you move onto the next. The transactions (which are defined in brackets) of F Lim in Year 3 are as follows: (a) On 2 March, a typewriter (classed as office equipment) is bought by drawing a cheque on the bank for 150. (Purchase of an asset, with payment by cheque.) (b) On 4 March, goods are bought from T Smith on credit for 500. (Purchase of an asset on credit.) (c) On 9 March, Lim sells some of the goods that had cost 200 for the same amount, receiving a cheque in exchange. (Sale of asset, with immediate payment.)

pages1-59

15/3/03

11:14 am

Page 5

The accounting equation

(d) On 12 March, Lim sells some goods that had cost 200 to K Woolf on credit for the same amount. (Sale of asset on credit.) (e) On 16 March, Lim sends a cheque for 300 towards the amount owing to T Smith. (Payment of an amount owing.) (f) On 21 March, Lim receives a cheque for 200 from his debtor, K Woolf. (Receipt of money from a debtor.) 3 Use the following example to show the effect of transaction (a) on F Lims balance sheet:

F Lim Balance sheet at 2 March Year 3 Office furniture 800 Office equipment (+ 150) 150 Motor vehicle 5,300 Cash at bank (- 150) 1,750 8,000 Capital Loan from J Black 7,000 1,000

8,000

This example shows that only the assets have changed. 4 Use the following example to show the effect of transaction (b) on the balance sheet:

F Lim Balance sheet at 4 March Year 3 Office furniture Office equipment Motor vehicle Goods Cash at bank 800 150 5,300 500 1,750 8,500 Capital Loan from J Black Creditor T Smith 7,000 1,000 500

8,500

This balance sheet shows that both the assets and liabilities have increased. 5 Use the following example to show the effect on the balance sheet after transaction (c):

F Lim Balance sheet at 9 March Year 3 Office furniture Office equipment Motor vehicle Goods (- 200) Cash at bank (+ 200) 800 150 5,300 300 1,950 8,500 Capital Loan from J Black Creditor T Smith 7,000 1,000 500

8,500

Here, there has been a switch between two assets.

pages1-59

15/3/03

11:14 am

Page 6

The accounting equation

6 Use the following to show the effect after transaction (d):

F Lim Balance sheet at 12 March Year 3 Office furniture 800 Office equipment 150 Motor vehicle 5,300 Goods (-200) 100 Debtor K Woolf (+ 200) 200 Cash at bank 1,950 8,500 Capital Loan from J Black Creditor T Smith 7,000 1,000 500

8,500

From this balance sheet, a change of assets can be seen. 7 Use the following to show the effect after transaction (e):

F Lim Balance sheet at 16 March Year 3 Office furniture Office equipment Motor vehicle Goods Debtor K Woolf Cash at bank (- 300) 800 150 5,300 100 200 1,650 8,200 Capital 7,000 Loan from J Black 1,000 Creditor T Smith (-300) 200

8,200

From this balance sheet, a reduction in assets matched by a reduction in liabilities can be seen. 8 Use the following to show the effect after transaction (f ):

F Lim Balance sheet at 21 March Year 3 Office furniture Office equipment Motor vehicle Goods Cash at bank (+ 200) 800 150 5,300 100 1,850 8,200 Capital Loan from J Black Creditor T Smith 7,000 1000 200

8,200

Here, there is a change of assets: an increase in bank and the removal of the debtor balance from the balance sheet.

pages1-59

15/3/03

11:14 am

Page 7

The accounting equation

9 A list of terms and their definitions follows. Explain the terms to the students. credit sales debtor creditor on account goods sold with payment to be received by an agreed future date a person or organization to whom goods have been sold on credit and from whom money is due a person or organization from whom goods have been bought on credit and to whom money is owed payment towards an amount owing; part payment

It is vital that students understand the meaning of terms as they are used. For the following lessons, reference should be made to the Glossary on pages 3215. 10 Explain that a transaction may involve a combination of assets or liabilities. For example, a motor vehicle is bought for 6,000.The purchase is paid for by: (a) drawing on the bank account; and (b) a loan from Birclays Finance Limited. Consequently:

Assets + 6,000 - 2,000 4,000 Motor vehicle Bank Liabilities Birclays Finance Limited + 4,000 4,000

11 Emphasize the equation:

assets = capital + liabilities

12 Give the students each a copy of exercises T/1.1, T/1.2, and T/1.3 in the Appendix (page 201) and ask them to work through them.

Step 6

Aim: to be able to record transactions through double entry

1 Explain the necessity of keeping separate accounts for information and control needs. Updating the balance sheet each time a transaction occurs takes up too much time; keeping separate accounts is a quicker and clearer method of updating records.

pages1-59

15/3/03

11:14 am

Page 8

The accounting equation

2 Explain that the two-sided form of recording accounts (which has long been in use) is to be followed:

Left-hand side = debit side (or Dr) Right-hand side = credit side (or Cr)

3 Set out the rules for double entry, which are as follows, on the overhead projector or whiteboard:

Assets Liabilities Capital an increase a decrease an increase a decrease an increase a decrease debit credit credit debit credit debit

Alternatively, you may show the following layout:

Asset account increases + Liability account decreases Capital account decreases increases + increases + decreases -

4 Emphasize that the purpose of debit and credit is to allow for the two-fold effect of each transaction. Always ensure that, for each transaction, students understand the logic of the entries. By making sure that the logic is clear, the account entries will have meaning, helping the students to avoid making mistakes. 5 Explain the form of entries for T-type accounts thoroughly. Illustrate the following layout on the whiteboard or overhead projector:

Dr Date Cr Details Date Details

The details column should always show the name of the matching account (ie where the double entry is completed) eg:

pages1-59

15/3/03

11:14 am

Page 9

The accounting equation

Bank Year 6 1 Jul Capital 10,000 Capital Year 6 1 Jul Bank 10,000

6 Work through the exercise below with the students. For each transaction: (a) emphasize the transaction effect; (b) stress how the double entry is achieved. Exercise (i) Gladys Lane sets up in business on 1 July Year 6 by placing 10,000 into a new business bank account. (ii) On 4 July Year 6, she buys office equipment, paying 400 by cheque. (iii) On 7 July Year 6, she buys goods from Landau Limited for 360 on credit. (iv) On 26 July Year 6, Gladys Lane pays the amount owing to Landau Limited by cheque. Solution

Bank Year 6 1 Jul Capital 10,000 Year 6 4 Jul 26 Jul Capital Year 6 1 Jul Office equipment Year 6 4 Jul Bank 400 Goods Year 6 7 Jul Landau Ltd 360 Landau Limited Year 6 26 Jul Bank 360 Year 6 7 Jul Goods 360 Bank 10,000 Office equipment Landau Ltd 400 360

pages1-59

15/3/03

11:14 am

Page 10

The accounting equation

7 Emphasize that entries in accounts should not be cramped together, but should be clearly spaced without being too far apart. 8 Remind the students that, in making the entries, they need to: (a) record the date correctly; and (b) correctly enter the name of the related account in the details column. 9 Stress that, in the examination, marks may be lost if account entries are poor.An example of an avoidable error is writing the word Cheque instead of Bank for the name of the matching account, when Cheque is not the name of the account. 10 Ask the students to work through exercises T/1.4 and T/1.5 in the Appendix (page 202).

10

pages1-59

15/3/03

11:14 am

Page 11

Lesson 2: Purchases, sales, and returns

Topic summary

The various meanings of the term purchases Account entries for purchases and sales transactions The return of goods: allowances Account entries for returns inwards and outwards

Extended Syllabus references

5.1 5.2 The various possible accounting meanings of the term purchases The effects on (double-entry) accounts of purchases of goods: 5.2.1 for cash 5.2.2 on credit The effects on (double-entry) accounts of the sale of goods/services: 5.3.1 for cash 5.3.2 on credit The process of the return of goods previously bought or sold (or alternatively of an allowance being made in lieu of actual return of goods) Use of the term Returns, both inwards and outwards; the alternative terms in use The effects on (double-entry) accounts of the return of goods (or of an allowance being made for the defective supply of goods/services)

5.3

5.4 5.5 5.6

The approach adopted in the students book, How to Pass Book-keeping, First Level, is to explain the reasons for particular book-keeping methods and to build up understanding of the subject progressively. This approach may mean using a simplified method on a certain matter at one stage to avoid introducing too many points at once. Later, that simplified method might need to be modified as more features are covered. This approach applies because this session deals with the entries concerning purchases and sales.

Step 1

Aim: to recognize the various meanings of the term purchases 1 Explain that the term goods is used for goods bought as part of trade, for selling in due course. The buying and selling of office furniture, motor vehicles, etc, for use in the business, is not included under goods: they are shown separately.

11

pages1-59

15/3/03

11:14 am

Page 12

Purchases, sales, and returns

2 Goods are now to be divided into:

purchases; and sales

with a separate account for each.This division gives more information and helps to keep control of the business. 3 Describe the various meanings of the term purchases, that they are: (a) goods bought to sell, ie as part of trading; (b) goods bought to use in the manufacture and/or retailing of other goods. Stress that just the word purchases or the words bought goods are referring to a part of trading. 4 You may also give the students the alternative terms below. (a) Purchases for cash which are bought with immediate payment.The payment may be in cash or it may be by drawing on a bank account. (b) Purchases on credit which are bought with payment to be made at a later date.

Step 2

Aim: to be able to record in double-entry form the purchase and the sale of goods for cash and on credit 1 Purchase of goods for cash Show the students the following example to illustrate the account entries made for the purchase of goods for cash. Example In the account entries given below, goods were bought on 15 March Year 3 for 295 and paid for by cheque, which can be understood as immediate payment.

Purchases Year 3 15 Mar Bank 295 Bank Year 3 15 Mar Purchases 295

12

pages1-59

15/3/03

11:14 am

Page 13

Purchases, sales, and returns

This involves:

addition to purchases = debit deduction from bank = credit

2 Purchase of goods on credit Show the students the following example to illustrate the account entries made for the purchase of goods on credit. Example In the account entries that follow, goods were bought on credit, at 19 March Year 3, from L Johnson for 614.

Purchases Year 3 19 Mar L Johnson 614 L Johnson Year 3 19 Mar Purchases 614

A liability has arisen, so a credit entry is made in the account for Johnson, who is a creditor. 3 Work through the following exercise with the students. Exercise

Year 7 3 Mar 12 Mar 30 Mar Purchased goods by cheque 915 Purchased goods from T Watling on credit 736 Paid by cheque the amount due to T Watling

Enter these transactions, as shown below, carefully reviewing each double entry before moving on to the next one.

Purchases Year 7 3 Mar Bank 12 Mar T Watling 915 736 Bank Year 7 3 Mar Purchases 30 Mar T Watling 915 736

(continued)

13

pages1-59

15/3/03

11:14 am

Page 14

Purchases, sales, and returns

T Watling Year 7 30 Mar Bank 736 Year 7 12 Mar Purchases 736

4 Sales Any sale of goods is entered in a separate Sales Account.The account includes both cash sales and credit sales. Remember to point out that the account only includes the sale of goods that the firm trades in. 5 Sales for cash Show the students the following example to illustrate the account entries made for sales for cash. Example At 21 March Year 3, goods were sold for 312 cash.

Sales Year 3 21 Mar Cash Cash Year 3 21 Mar Sales 312 312

Emphasize that the entry in the Sales Account corresponds to what, so far, has been entered in the Goods Account, ie a credit entry. Note The Cash Account is for recording the receipt and payment of bank notes or coins. Transfers between the Bank Account and the Cash Account are made periodically. 6 Sales on credit Show the students the following example to illustrate the account entries made for sales on credit. Example At 23 March Year 3, goods were sold to L Fell on credit for 260.

Sales Year 3 23 Mar L Fell Year 3 23 Mar Sales 260 260

14

pages1-59

15/3/03

11:14 am

Page 15

Purchases, sales, and returns

7 To reinforce the students understanding, show the following summary of the entries below for a credit sale (preferably on the overhead projector): (a) When a credit sale is made, the book-keeper should: debit the customers (debtors) account; and credit the Sales Account. (b) When payment is received from the debtor, the book-keeper should: debit the Bank Account or Cash Account (depending on how the debtor pays, whether by cheque or cash); and credit the debtors account. Note Point out that the Purchases Account and the Sales Account have now replaced the Goods Account. 8 Ask the students to work through the exercise below. Exercise

Year 7 6 Mar 15 Mar 31 Mar Sold goods for cash 327 Sold goods to J Bean on credit 512 Received cheque from J Bean in payment of the amount due

The transactions should be entered by the students as shown below. Review the transactions one by one (see below), ensuring that the concept of double entry is fully understood.

Sales Year 7 6 Mar Cash 15 Mar J Bean Cash Year 7 6 Mar Sales 327 J Bean Year 7 15 Mar Sales 512 Bank Year 7 31 Mar J Bean 512 Year 7 31 Mar Bank 512 327 512

15

pages1-59

15/3/03

11:14 am

Page 16

Purchases, sales, and returns

Step 3

Aim: to understand the nature of returns and to be able to make the required book-keeping entries 1 Explain that purchased goods are sometimes returned to the supplier. Ask why this might be so. 2 Explain that an allowance is made by the supplier, ie that the amount of the return is set against the purchase amount. 3 Show that the returns are recorded in a separate account, called the Returns Outwards Account, using this example: At 24 March Year 3, goods are returned to L Johnson for which 70 is allowed.

Returns outwards Year 3 24 Mar L Johnson L Johnson Year 3 24 Mar Returns outwards 70 Year 3 19 Mar Purchases 614 70

4 Explain that the 70 credit in the Returns Outwards Account offsets the 614 previously shown on the debit of purchases. Ask the students to explain the two entries in Johnsons account. 5 Explain that the opposite can occur: ie goods that have been sold may be returned by a customer, for which an allowance is given. For example, on 27 March Year 3, L Fell returns the goods sold to him on 23 March. This occurrence is the reverse of a sale, so it is termed returns inwards. Ask the students to show the two entries for the returns inwards.Their accounts should look like the one below.

Returns inwards Year 3 27 Mar L Fell 260 L Fell Year 3 23 Mar Sales 260 Year 3 27 Mar Returns inwards 260

16

pages1-59

15/3/03

11:14 am

Page 17

Purchases, sales, and returns

6 Hand out copies of, or show on the overhead projector, exercise T/2.1 in the Appendix (page 203). Ask the students to work through the exercise. 7 Review student answers, drawing attention to items (c) and (f ), in T/2.1, which involve assets for use in the business. Neither of these will be recorded in the Purchases Account. 8 Hand out copies of, or show on the overhead projector, exercise T/2.2 in the Appendix (page 203). Ask the students to work through the exercise.

Step 4

Aim: to strengthen understanding of lesson content Below are a series of questions that you should ask the students, together with the answers. 1 Question (a) What is the difference in wording between the two returns examples? Answers

The example 24 March specifically states that an allowance is made and the amount. The example 27 March merely states that the goods previously sold are returned.

If a question is worded as it is above, the students should assume that the amount of the original sale is fully allowed. 2 Question (b) What is the reason for keeping separate returns accounts instead of making the entries in the Purchases or Sales Accounts? Answer The reason is to have separate totals for returns, otherwise the information would be hidden in the Purchases or Sales Account. 3 Question (c) What might be the various reasons for the return of goods? Answers The goods might be returned because:

the wrong articles were sent; they were damaged in transit; they are not what was shown in the catalogue; parts do not fit.

17

pages1-59

15/3/03

11:14 am

Page 18

Purchases, sales, and returns

4 Question (d) When might an allowance be given although the goods are not returned? Answers When the goods:

are difficult to repack or transport; or are costly to send back.

Stress that, provided an allowance is given, the book-keeping effect is the same as if the goods are actually returned. 5 Check that the students know the alternative names for the accounts, that they may be called:

returns outwards or purchases returns; returns inwards or sales returns.

6 Hand out copies of, or show on the overhead projector, exercises T/2.3 and T/2.4 in the Appendix (pages 203 and 204). Ask the students to work through them.

18

pages1-59

15/3/03

11:14 am

Page 19

Lesson 3: Expenses: profit or loss

Topic summary

The nature and types of expense Combination-type transactions: account entries Recording the withdrawal of profit by drawings Profit as the difference between opening and closing capital

Extended Syllabus references

18.1 Profit (or loss) as the difference between opening and closing capital balances; allowing for any drawings or the introduction of additional capital 18.2 The meaning of the term drawings; the various forms of drawings 18.3 The book-keeping entries for drawings 18.4 The possible effect of drawings upon the amount of capital

This lesson is diverse in its content. All the topics are ones that can feature as elements in examination questions. With careful explanation and the familiarity that follows from practice, these subject areas need not be a cause of major difficulty.

Step 1

Aim: to appreciate the nature and types of business expense and the book-keeping entries required 1 Suggest to the class a small business situation and ask what types of expense would be incurred, such as:

employee wages; rent of the premises; and advertising.

Point out that the aim of setting up a business is to make a profit, ie a surplus:

sales less expenses = profit

19

pages1-59

15/3/03

11:14 am

Page 20

Expenses: profit or loss

2 When you explain about recording expenses in the accounts, develop the concept of paying as you go. Illustrate the concept by contrasting, for example, renting premises and purchasing a building, which ties up money. 3 Liken expenses such as rent to very temporary assets; for instance, a purchased asset is debited to the asset account; similarly, an expense account is debited. 4 Explain that it is necessary to have several expense accounts, eg insurance, wages, office cleaning, office expenses, heating and lighting. One account for each category of expenditure helps to provide more information and improve control. The following example illustrates the basic account entries relating to an expense item: Example At 28 March Year 3, insurance on a motor vehicle, costing 110 for the next 6 months, is paid by cheque.

Insurance Year 3 28 Mar Bank 110 Bank Year 3 28 Mar Insurance 110

This can be explained as: Cr = reduction of an asset (bank) Dr = acquisition of a (temporary) asset, ie insurance cover for a fixed period of time. 5 Copy and hand out or show exercises T/3.1 and T/3.2 in the Appendix (page 204) on the overhead projector. Ask the students to work through them.

Step 2

Aim: to be familiar with combination-type transactions and to be able to make appropriate book-keeping entries 1 In Lesson 1, Step 5, reference was made to the possibility of a transaction involving a combination of assets and/or a combination of liabilities. In a combination-type transaction, the effect on one account side will be matched by a combination of two (or possibly more) effects on the other side. Use the following example to illustrate a combination-type transaction.

20

pages1-59

15/3/03

11:14 am

Page 21

Expenses: profit or loss

Example At 14 April Year 6, a motor vehicle was purchased for 6,800 from Lagonda Garages. A payment of 2,000 was made by cheque and the balance on credit.

Assets + 6,800 - 2,000 + 4,800 Increased by amount of motor vehicle Bank balance is reduced Liabilities Creditor Lagonda Garages + 4,800

+ 4,800

The accounts will appear as follows:

Motor Vehicle Year 6 14 Apr Bank and Lagonda Garages 6,800 Bank Year 6 14 Apr Lagonda Garages Year 6 14 Apr Motor vehicle 4,800 Motor vehicle 2,000

2 Copy and hand out or show exercise T/3.3 in the Appendix (page 205) on the overhead projector. Ask the students to work through the exercise.

Step 3

Aim: to appreciate the meaning of proprietor drawings and the account entries required 1 If the owner takes money out of the business for private use this results in a reduction of capital. Explain that the owner may draw out money in anticipation of the profits for the year, ie to pay for personal living expenses. If the owners withdrawals are more than the businesss profits, then capital is reduced. 2 Drawings are recorded in a separate account, further enabling the accounts to provide as much information as possible. Use the example overleaf to demonstrate this point.

21

pages1-59

15/3/03

11:14 am

Page 22

Expenses: profit or loss

Example At 6 April Year 3, Joe Seng, the owner, withdrew 170 in cash for his own use.

Cash Year 3 6 Apr Drawings Year 3 6 Apr Cash 170 Drawings 170

3 Explain that, at the end of the year, the Drawings Account will be closed off to the Capital Account. 4 Point out that several drawings might be made over the course of the year and that the drawings could take forms other than cash. For example, the owner may take some of the businesss goods for personal use.

Step 4

Aim: to recognize that profit or loss may be calculated through differences in capital 1 The profit of a business for a given year might be obtained as follows:

profit for the year = number of transactions x profit on each transaction less expenses for the year

or as

profit = capital at end of the year less capital at start of the year or increase of capital over the year

Alternatively, give the students the following formula:

start-of-year capital

*or profit after deduction of drawings

plus

profit* (or loss)

end-of-year capital

2 Hand out copies of, or show on the overhead projector, exercise T/3.4 in the Appendix (page 205). Ask the students to work through the exercise.

22

pages1-59

15/3/03

11:14 am

Page 23

Lesson 4: Balancing accounts: the trial balance

Topic summary

The balancing of accounts Running balance account format The preparation of a trial balance

Extended Syllabus references

3.1 The meaning of the term account balance 3.2 Balancing the T-type ledger account, including: 3.2.1 bringing the balance down for the start of the next accounting period 3.2.2 dealing with the nil balance 3.3 The significance of any particular account balance, eg a credit balance on a creditor account, a debit balance on an expense account 3.4 The significance of the term running balance account 3.5 The preparation of accounts in running balance form 3.7 The procedure for other end-of-period balancing, and ruling off, of accounts 11.1 The purpose of the trial balance 11.2 The preparation of a trial balance from a list of account balances

This lesson deals with the practical matter of the layout of accounts, including an alternative format. It is worthwhile giving time to this topic: marks may be lost in the examination if accounts are presented poorly. The lesson also discusses a straightforward method of checking that all double entries have been completed satisfactorily.This checking is done by the preparation of a trial balance.

Step 1

Aim: to be able to balance accounts and to recognize the significance of individual balances 1 Show that the balance on an account is the amount by which one side is greater than the other:

23

pages1-59

15/3/03

11:14 am

Page 24

Balancing accounts: the trial balance

X expense account Dr Year 3 Entries totalling 680 Year 3 Entries totalling Cr 600

Here, there is a debit (Dr) balance of 80. The full balancing of this account at 31 March Year 3 is as follows:

X expense account Year 3 Entries 680 Year 3 Entries 31 Mar Balance c/d 680 1 Apr Balance b/d 80 600 80 680

The balance is first carried down (c/d) and then brought down (b/d), which should always be done and not merely entered on one side.To fail to bring down the balance is to break the double-entry rule. 2 Ask the students to write out and then balance the following creditor account:

K Jacques Year 5 7 May Returns outwards 28 May Bank 50 570 Year 5 3 May Purchases 21 May Purchases 620 415

3 Explain a nil balance:

F Wiles Year 6 4 July Sales 370 370 Year 6 12 July Returns inwards 29 July Bank 40 330 370

Or a variation on the nil balance:

T Stone Year 6 9 Aug 470 Year 6 26 Aug Bank 470

Point out that no totals are required in this instance; just two lines under the figures. 4 Hand out copies of, or show on the overhead projector, exercises T/4.1 and T/4.2 in the Appendix (page 206). Ask the students to work through them.

24

pages1-59

15/3/03

11:14 am

Page 25

Balancing accounts: the trial balance

Step 2

Aim: to appreciate and to be able to apply the running-balance format 1 Emphasize that, so far, the format used for the accounts has been two-sided, ie:

Left-hand side debits (Dr) Right-hand side credits (Cr)

Balances are calculated at the end of a fixed period usually monthly for debtors and creditors; annually in some other cases; and so on.This layout does not reveal the balance easily or quickly. However, the running-balance format, which is a three-column layout, shows the balance after each transaction is entered. It is used by banks in the (monthly) statements they issue to customers. 2 An example of an account in running-balance format is included in the Appendix (see T/4.3, page 207). Point out that this example is not a specimen of the statements issued by banks. It is an example of the bank account as kept by the customer of the bank. 3 Explain the format, emphasizing that as each transaction is entered the balance on the account is brought up to date. Stress that the notation, either Dr or Cr, must be shown beside the balance figure. 4 Ask the students to show T/4.3 as a two-sided layout, ie the format previously used in this course.Then compare running-balance format with the two-sided layout. 5 Ask the students to work through the exercise below. Exercise Required Using the information in T/4.2 (page 206), prepare debtor and creditor accounts in running-balance format.

Step 3

Aim: to be able to prepare a trial balance 1 Work through exercise T/4.4 in the Appendix (page 207) with the students, following the instructions below. (a) Enter the transactions in appropriate accounts.

25

pages1-59

15/3/03

11:14 am

Page 26

Balancing accounts: the trial balance

(b) Check with the class that the total of the debit entries equals the total of the credit entries.The total should be 27,220. (c) Next ask the students to enter in pencil, in the margin, the balance on each account either debit or credit. (d) Now list these balances; the total of the debit balances should agree with the total of the credit balances. A trial balance has been produced. 2 Explain that the trial balance is used to check that double entry has been done correctly. If the totals of the two sides of the trial balance are in agreement, then entries have been made accurately. It does not, however, prove that. For example, transactions could have been omitted entirely.This limitation will be considered further in Lesson 21 (see entry 11.5 in the Extended Syllabus). 3 Hand out copies of, or show on the overhead projector, exercises T/4.5 and T/4.6 in the Appendix (page 208). Ask the students to work through them. 4 Show the class the following account, which is an example of a candidates solution to an examination question:

F Leonard Year 5 10 Apr Returns outwards 30 Year 5 6 Apr 10 Apr Purchases Returns outwards 418 30

In this case, a candidate has entered the transaction twice a common mistake. One entry cancels the other for returns outwards.The examiner can only conclude that the candidate does not know how to deal with returns outwards. As a result, no marks will be given for either entry for 10 April.

26

pages1-59

15/3/03

11:14 am

Page 27

Lesson 5: Trading and Profit & Loss Accounts

Topic summary

Structure of income, cost, and profit The preparation of Trading and Profit & Loss Accounts

Extended Syllabus references

3.6 The transfer of a balance at period end to Trading Account or Profit & Loss Account, as appropriate 19.1 The Trading and Profit & Loss Accounts as part of the double-entry system 19.2 The basic structure of income, costs, and profit in a business 19.5 The calculation of costs of goods sold 19.7 The difference between trading income and other income 19.8 The difference between gross profit and net profit 19.12 The double entries for expense amounts between the Profit & Loss Account and the individual expense accounts

This lesson reviews the structure of income, cost, and profit, and their relationship to one another. It also deals with the concluding stage of a periods activities, which involves establishing either a profit or a loss. Establishing a profit or loss and showing how they are reached are achieved through final accounts, a broadly used book-keeping term that covers, in part, the Trading and Profit & Loss Account.

Step 1

Aim: to be able to prepare a Trading and Profit & Loss Account 1 Explain the different classes of profit, that they are:

gross profit the excess of sales income over cost of goods sold; and net profit gross profit less other costs.

27

pages1-59

15/3/03

11:14 am

Page 28

Trading and Profit & Loss Accounts

2 Draw the students attention to the structure of income, costs, and profit as it is shown in Figure 5.1. Other income is the income arising from sources other than normal trading activities, eg interest earned on money lent or rent receivable.The composition of total income is as follows:

total income = income from sales + other income (trading income)

Cost of goods sold Income from sales = sales revenue Gross profit

Other income

Running expenses

Net profit Figure 5.1 The structure of income, costs, and profit

3 Ask the students to work through 2 small exercises on the structure of costs, see T/5.1* in the Appendix (page 209).

Step 2

Aim: to be able to prepare a Trading and Profit & Loss Account 1 To show the students how to prepare a Trading and Profit & Loss Account, give them each a copy of the trial balance of T Avis at 31 December Year 5 to work through.The trial balance is labelled T/5.2 in the Appendix (page 210). Work through the example of T Avis with the students as set out below.

28

pages1-59

15/3/03

11:14 am

Page 29

Trading and Profit & Loss Accounts

2 The first stage of working through the trial balance involves preparing a Trading Account. Preparing a Trading Account requires a calculation of the cost of goods sold, which is:

purchases less closing stock both stated at cost price

The closing stock has yet to be brought into the accounts. There is no opening stock in this instance because Year 5 was the first year of trading for T Avis. 3 The significant accounts at this stage are the Purchases and Sales Accounts.These would appear as follows:

Purchases Year 5 Sundries 5,160 Sales Year 5 Sundries 6,320

4 Stress the word account in Trading and Profit & Loss Account: it is part of the doubleentry system. For every entry made in the account, there must be a corresponding entry elsewhere in the account system. 5 Prepare the following Trading and Profit & Loss Account with the class, using the data in T/5.2 in the Appendix (page 210):

T Avis Trading and Profit & Loss Account for the year ended 31 December Year 5 Purchases Gross profit c/d 5,160 3,260 8,420 Sales Stock at 31 December Year 5 Gross profit b/d 6,320 2,100 8,420 3,260

6 Show the double-entry effect in the Purchases and Sales Accounts:

Purchases Year 5 Sundries 5,160 Sales Year 5 31 Dec Trading 6,320 Year 5 Sundries 6,320 Year 5 31 Dec Trading 5,160

29

pages1-59

15/3/03

11:14 am

Page 30

Trading and Profit & Loss Accounts

7 The entry for stock (at 31 December Year 5) requires careful explanation. So far, only a credit entry has been made.To complete the double entry, a new account is opened:

Stock Year 5 31 Dec Trading 2,100

8 It has been stated that purchases less closing stock equals the cost of goods sold. To reflect this fact, it is usual to deduct stock on the debit side in the Trading Account instead of entering the stock on the credit side. The effect on gross profit is the same. Therefore, the Trading Account, together with the Profit & Loss Account, becomes:

T Avis Trading and Profit & Loss Account for the year ended 31 December Year 5 Purchases less Stock, 31 December Year 5 Cost of goods sold Gross profit c/d Rent payable Office expenses Lighting and heating Net profit 5,160 2,100 3,060 3,260 6,320 700 360 420 2,230 3,710 Sales 6,320

6,320 Gross profit b/d Rent receivable 3,260 450

3,710

9 While compiling the above Profit & Loss Account, the expense and income accounts are closed off as follows:

Rent Payable Year 5 Sundries 700 Year 5 31 Dec Office Expenses Year 5 Sundries 360 Year 5 31 Dec Profit and loss 360 Profit and loss 700

Lighting and Heating Year 5 Sundries 420 Year 5 31 Dec Rent Receivable Year 5 31 Dec Profit and loss 450 Year 5 Sundries 450 Profit and loss 420

30

pages1-59

15/3/03

11:14 am

Page 31

Trading and Profit & Loss Accounts

The double entry for gross profit is the credit to the Profit & Loss Account. The double entry for net profit is a credit to the Capital Account: ie profit increases capital. 10 The Drawings Account is closed off to Capital Account.

Capital Year 5 31 Dec 31 Dec Drawings Balance c/d 800 5,430 6,230 Year 6 1 Jan Drawings Year 5 Sundries 800 Year 5 31 Dec Capital 800 Balance b/d Year 5 1 Jan Bank 31 Dec Profit and loss: net profit 4,000 2,230 6,230 5,430

Note Many examination answers show closing stock as a credit entry in the Trading Account, instead of as a deduction on the left-hand side. As a consequence of this error, students lose a mark because they fail to show the cost of goods sold. 11 Copy and hand out or show exercises T/5.3 and T/5.4 in the Appendix (pages 211 and 212) on the overhead projector. Ask the students to work through them. Both exercises involve businesses in their first year of trading. Because the businesses are new, there is no opening stock, a topic that is dealt with in Lesson 7. Explain that the usual practice is to value closing stock at its cost price.This method is considered further in Lesson 23.

31

pages1-59

15/3/03

11:14 am

Page 32

Lesson 6: The balance sheet

Topic summary

The main elements of the balance sheet and its overall purpose The distinction between fixed assets and current assets, and between longer-term liabilities and amounts due within 1 year (current liabilities) The effective grouping of assets and liabilities within the balance sheet

Extended Syllabus references

20.1 The function of the balance sheet and, in particular, the recognition that it stands outside the double-entry system 20.2 The significance and use of the terms fixed assets and current assets 20.3 The difference between longer-term liabilities and amounts payable within 12 months (current liabilities); the naming of accounts which might appear under each of these headings 20.4 The preparation of a balance sheet in effective format 20.5 The appropriate grouping of items within the balance sheet: 20.5.1 fixed assets 20.5.2 current assets 20.5.3 capital (or proprietors interest) 20.5.4 longer-term liabilities 20.5.5 amounts payable within 12 months (current liabilities)

Two aspects of study concerning the balance sheet require attention. First, the students need to be able to appreciate the meaning of the contents of a balance sheet. Second, they should be able to prepare one that is meaningful, ie easily understood by the reader.

Step 1

Aim: to appreciate the main elements of the balance sheet and its overall purpose 1 Refer to the trial balance of T Avis at 31 December Year 5 (see page 210). If it has not already been done, the accounts of those items that have already been closed off (eg transferred to Profit & Loss Account) should be ticked. Those left are Capital and Drawings, together with the Asset and Liability Accounts. These accounts and the closing stock are shown in the following balance sheet.

32

pages1-59

15/3/03

11:14 am

Page 33

The balance sheet

T Avis Balance sheet at 31 December Year 5 Assets Fixtures and fittings Motor vehicle Stock of goods Debtors Cash at bank Cash in office 800 1,600 2,100 750 1,040 50 6,340 Capital Placed in bank account add Net profit less Drawings Liability Creditors 4,000 2,230 800 1,430 5,430 910 6,340

2 Draw out the purpose of the balance sheet; that it is to show the financial position of the business at the date the books are made up. 3 Compare the balance sheet with the Trading and Profit & Loss Account, which is a record of performance over a past fixed period (usually a year). 4 Explain that the two sides of the balance sheet should agree in total if the double-entry rule has been followed fully. Note The accounts that have been entered in the balance sheet have not been closed off, ie the balances remain on the accounts. The balance sheet is only a list of balances, it is a statement. It is not itself part of the double-entry system.

Step 2

Aim: to be able to group effectively the items on a balance sheet 1 Explain why it is necessary to group balance sheet items. Grouping the items:

gives meaning to the balance sheet, showing that it is comprised of significant elements and is not just an array of items; shows long-term versus short-term liabilities; shows different timescales among assets, some of which can be quickly turned into cash (liquidity); others represent money tied up, possibly for many years.

2 In discussing this, refer to the balance sheet above. Using the question-and-answer method, review the terms fixed assets and current assets.Ask the students for examples of each.

33

pages1-59

15/3/03

11:14 am

Page 34

The balance sheet

3 Stress that the recognized sequence of listing assets begins with the most permanent and ends with those most easily turned into cash. Demonstrate the sequence as shown below.

Fixed Assets Land and buildings Fixtures and fittings Machinery Motor vehicles from highly fixed to less fixed Current Assets Stock Debtors Bank Cash

increasing liquidity

Other assets will be introduced in due course. 4 Explain that, with fixed assets, the more permanent the assets are likely to be, the more fixed they are considered to be, eg compare land and buildings with motor vehicles. The more liquid an asset, the more easily it can be turned into cash: eg compare the bank balance with stock. 5 Review the normal sequence for capital and liabilities on the right-hand side of the balance sheet.The sequence appears as follows:

capital; longer-term liabilities: ie amounts payable in more than 1 year, such as a 2-year loan (2 years to repayment from the date of the balance sheet); amounts due within 1 year (or current liabilities), eg creditors, bank overdraft, or short-term bank loan.

6 Present the balance sheet of T Avis, grouping and arranging the items in the way shown below.

T Avis Balance sheet at 31 December Year 5 Fixed Assets Fixtures and fittings Motor vehicle Current Assets Stock Debtors Bank Cash 800 1,600 2,400 2,100 750 1,040 50 Capital Placed in bank account add Net profit less Drawings Amount due within 1 year (current liabilities) Creditors 3,940 6,340 2,230 800 4,000 1,430 5,430

910 6,340

34

pages1-59

15/3/03

11:14 am

Page 35

The balance sheet

7 Stress the importance of a good balance-sheet layout. The items need to be suitably grouped and also in a suitable sequence within each group. Marks are lost when a balance sheet is presented poorly. 8 Hand out copies of, or show on the overhead projector, exercises T/6.1*, T/6.2*, T/6.3*, and T/6.4* in the Appendix (pages 21215).Ask the students to work through them.

35

pages1-59

15/3/03

11:14 am

Page 36

Lesson 7: Final accounts: more features

Topic summary

Period-end entries for returns inwards and outwards The different forms of carriage and how they are recorded in final accounts Opening and closing stock figures in the Stock Account and final accounts The review and application of the end-of-year procedure

Extended Syllabus references

3.6 3.7 19.3 19.6 19.9 19.10 The transfer of a balance at period end to Trading Account and Profit & Loss Account, as appropriate The procedure for other end-of-period balancing, and ruling off, of accounts Showing returns inwards and returns outwards suitably deducted to reveal net sales and net purchases respectively Showing the make-up of cost of goods sold The function of the Stock Account and the double-entry relationship between the Trading Account and the Stock Account End-of-period transfer of balances from the General Ledger to the Trading Account (Purchases Account, Sales Account, Returns Outwards Account, Returns Inwards Account) The difference between carriage inwards and carrriage outwards and recording them in the Trading Account and Profit & Loss Account respectively Showing income and expenses within the final accounts, with related items being suitably brought together

19.11 19.13

This lesson is concerned with some very practical and detailed matters that appear, from the answers elicited in examinations, to be given limited attention during the course of study. Carriage, in particular, would seem to be neglected. The Stock Account is also a major point of weakness. Candidates are usually able to record opening and closing stocks in the Trading Account although not always in the most favourable position in the Trading Account. However, candidates may have difficulty in correctly recording the Stock Account itself.

36

pages1-59

15/3/03

11:14 am

Page 37

Final accounts: more features

Step 1

Aim: to be able to show period-end entries for returns inwards and outwards 1 Remind the students that the Goods Account is divided into Purchases, Sales, Returns Outwards, and Returns Inwards Accounts. This type of division has not yet been brought fully into the Trading Account. Example A trader in Year 3 has total returns outwards and returns inwards of 450 and 610 respectively.The Returns Accounts might appear as follows:

Returns Outwards Year 3 31 Dec Trading 450 Year 3 Sundries Returns Inwards Year 3 Sundries 610 Year 3 31 Dec Trading 610 450

With the debit transfer (to the Trading Account) entry in the Returns Outwards Account, the matching entry would be expected to appear to the credit of the Trading Account. However, the entry does not appear as a credit, but as a deduction from purchases on the debit side. Conversely, returns inwards appears as a deduction from sales on the credit side of the Trading Account. The aim of showing returns as deductions is to provide a neater and more informative picture of what has happened. This might be seen in a Trading Account as follows:

J Blunt Trading Account for the year ended 31 December Year 3 Purchases less Returns outwards less Stock at 31 Dec Year 3 Cost of goods sold Gross profit 10,300 540 9,760 2,100 7,660 12,980 20,640 Sales less Returns inwards 21,400 760 20,640

20,640

Point out that 9,760 is the sum of the net purchases and that 20,640 is the sum of the net sales. Inform the students that the layout shown for returns in J Blunts Trading Account will always be followed from now onwards.

37

pages1-59

15/3/03

11:14 am

Page 38

Final accounts: more features

2 Ask the students to work through the exercise below. Exercise Required Prepare a Trading Account for F Waldron for the year ended 31 December Year 5 from the following details:

Purchases Sales Returns inwards Returns outwards Stock at 31 Dec Year 5 17,300 37,850 1,320 870 3,200

Solution

F Waldron Trading Account for the year ended 31 December Year 5 Purchases less Returns outwards less Stock at 31 Dec Year 5 Cost of goods sold Gross profit 17,300 870 16,430 3,200 13,230 23,300 36,530 Sales less Returns outwards 37,850 1,320 36,530

36,530

Step 2

Aim: to appreciate the different forms of carriage as an expense and how they are recorded in final accounts 1 Explain carefully the nature of carriage; that carriage is an expense incurred in, or charge made for, the delivery of goods. 2 Make the distinction clear between carriage inwards and carriage outwards: (a) Carriage inwards Carriage on goods coming into the firm, ie on purchases. Instead of paying an inclusive price for purchases that covers carriage, a separate charge is made. Therefore, carriage is added to the cost of purchases and is included in the Trading Account.

38

pages1-59

15/3/03

11:14 am

Page 39

Final accounts: more features

(b) Carriage outwards Carriage on goods going out of the firm, ie on sales. It is regarded as a cost of distributing goods to customers and is entered as a separate item in the Profit & Loss Account. The layout of purchases including adjustments (using different figures) is as follows:

12,800 430 13,230 520 12,710 1,980 10,730

Purchases add Carriage inwards less Returns outwards less Closing stock Cost of goods sold

The adjustments for purchases and sales may be summarized as follows: Net sales = Sales less returns inwards Net purchases = Purchase plus carriage inwards less returns outwards 3 Hand out copies of, or show on the overhead projector, exercise T/7.1 in the Appendix (page 216). Ask the students to work through the exercise.

Step 3

Aim: to be able to record opening and closing stock figures in the Stock Account and final accounts

1 So far, these studies have been limited to the first year of trading, ie there has been no opening-stock figure. From the second year, there will be 2 stock figures: for example, the closing stock at 31 December Year 5 becomes the opening stock at 1 January Year 6. 2 Use the situation of T Avis as an example again (see T/7.2 in the Appendix, page 216). T Avis has prepared a trial balance at the end of his second year of trading.Work through the Trading and Profit & Loss Account, and the balance sheet, with the class.

39

pages1-59

15/3/03

11:14 am

Page 40

Final accounts: more features

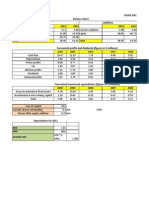

T Avis Trading and Profit & Loss Account for the year ended 31 December Year 6 Stock at 1 Jan Year 6 Purchases add Carriage inwards less Returns outwards less Stock at 31 Dec Year 6 Cost of goods sold Gross profit c/d Rent payable Office expenses Lighting and heating Carriage outwards Net profit 9,260 430 9,690 340 9,350 11,450 2,450 9,000 3,570 12,570 1,100 590 610 380 1,340 4,020 Gross profit b/d Rent receivable 2,100 Sales less Returns inwards 13,050 480 12,570

12,570 3,570 450

4,020

Balance sheet at 31 December Year 6 Fixed Assets Fixtures and fittings Motor vehicle Current Assets Stock Debtors Bank Cash 900 1,600 2,500 2,450 1,170 1,230 70 Capital Balance at 1 Jan Year 6 add Net profit less drawings 5,430 1,340 1,100 240 5,670

Amount due within 1 year Creditors 4,920 7,420

1,750 7,420

3 Show the Stock Account for T Avis for his first and second years as follows:

Stock Year 5 31 Dec Year 6 1 Jan 31 Dec Year 7 1 Jan Trading Balance b/d Trading Balance b/d 2,100 2,100 2,450 2,450 Year 5 31 Dec Balance c/d Year 6 31 Dec Trading 31 Dec Balance c/d 2,100 2,100 2,450

40

pages1-59

15/3/03

11:14 am

Page 41

Final accounts: more features

4 Explain that the Stock Account is used only to carry the figure for the balance of stock from one year to the next. No transactions are entered into this account. It is a holding account only. 5 Draw attention to the entry at 31 December Year 5 (encircled).This entry is frequently entered at 1 January Year 6. The correct way to enter it is as 31 December Year 5 initially and then to carry it down, as shown above. 6 Ask the students to work through the following exercise: Exercise

Stock at 31 Mar Year 6 Stock at 31 Mar Year 7 31,680 34,270

Required Show the Stock Account for the period 31 March Year 6 to 1 April Year 7. Note The stock at 1 April Year 6 is the same as the stock at 31 March Year 6. Solution

Stock Year 6 31 Mar Trading 1 Apr Balance b/d 31,680 31,680 34,270 34,270 Year 6 31 Mar Balance c/d Year 7 31 Mar Trading 31 Mar Balance c/d 31,680 31,680 34,270

Year 7 31 Mar Trading 1 Apr Balance b/d

7 Copy and hand out or show exercises T/7.3 and T/7.4 in the Appendix (page 217) on the overhead projector. Ask the students to work through them.

Step 4

Aim: to review and to be able to apply the end-of-year procedure 1 Review the end-of-year procedure by showing Figure 7.1 (overleaf) on the overhead projector. See also T/7.5 in the Appendix (page 218). 2 Draw the students attention to points (a) to (c) overleaf, which are highlighted by Figure 7.1.

41

pages1-59

15/3/03

11:14 am

Page 42

Final accounts: more features

(a) The accounts for which balances are recorded in the balance sheet have not been closed off . They retain their balances, ready for the next trading period or year. The balance sheet is merely a list of items and is not part of the double entry. (b) Transferring a balance, eg for purchases or insurance, into the Trading Account or Profit & Loss Account is part of double entry. Each amount is being carried in the final accounts instead of in the ledger account. The various amounts are channelled through the final accounts to establish a net profit (or net loss). (c) The net profit, to complete the double entry, is credited to the Capital Account (debit the Profit & Loss Account and credit the Capital Account) and so the process re-emerges in the ledger accounts.

Purchases Sales Returns outwards Returns inwards Opening stock Closing stock

account balances transferred to

(b)

Trading Account

Gross profit to Profit & Loss Account (b) Expense accounts Other income accounts account balances transferred to (b) Profit & Loss Account

Net profit to Capital Account (c) (a) Drawings Account Capital Account

Cash/bank accounts Debtor/creditor accounts Asset accounts (a)

Balanced, ie balances c/d on each account

(a)

Balance sheet Figure 7.1 The end-of-year procedure

42

pages1-59

15/3/03

11:14 am

Page 43

Final accounts: more features

3 The preparation of final accounts is an important element of the First Level Book-keeping Syllabus. It is therefore important that students become practised at systematically answering final accounts questions at an early stage. Encourage the students to adopt the following method when answering such examination questions: (i) to read through the question to get an overall understanding, especially noting the required part of the question; (ii) to go through the trial balance (or any alternative list of balances) and to place next to each item a code representing the final account in which it appears; (iii) to tick each item or figure as it is recorded in the final account concerned. 4 Illustrate this method of answering final accounts by applying it to the trial balance of T Avis at 31 December Year 6 (see below). Leave the codes out and ask the students to enter them alongside the items in the trial balance.

T Avis Trial balance at 31 December Year 6 Dr 9,260 430 1,170 1,750 1,100 590 610 450 480 340 380 900 1,600 1,230 70 2,100 1,100 21,020 Key: BS balance sheet T Trading Account P/L (exp) Profit & Loss Account (expenditure) P/L (inc) Profit & Loss Account (income) 5,430 21,020 Cr 13,050 T T T BS BS P/L P/L P/L P/L T T P/L BS BS BS BS T BS BS

Purchases Sales Carriage inwards Debtors Creditors Rent payable Office expenses Lighting and heating Rent receivable Returns inwards Returns outwards Carriage outwards Fixtures and fittings Motor vehicle Cash at bank Cash in office Stock at 1 January Year 6 Drawings Capital

(exp) (exp) (exp) (inc)

(exp)

Note Stock at 31 December Year 6 was valued at 2,450 T, BS. 5 Hand out copies of, or show on the overhead projector, exercise T/7.6 in the Appendix (page 219). Ask the students to work through the exercise.

43

pages1-59

15/3/03

11:14 am

Page 44

Lesson 8: The division of the ledger

Topic summary

The reasons for dividing the ledger and recognizing the usual divisions The different types of ledger account The possible subdivisions of the ledger Producing a balance sheet with a vertical format

Extended Syllabus references

4.1 The function of the ledger 4.2 The various possible reasons for subdividing the ledger 4.3 How the ledger might be subdivided, eg Sales Ledger, Purchases Ledger, Cash Book, General Ledger 4.4 Alternative names for the different ledgers, eg Debtors Ledger, Creditors Ledger, Nominal Ledger 4.5 The possible use of a Private Ledger 4.6 The naming of (ie classification of ) the different types of ledger account and explaining the accounts within it 4.7 The distinction between personal, real, and nominal accounts 4.8 How the Sales Ledger might be subdivided 4.9 From a list of accounts, or from transaction details, the naming of the ledger(s) in which each would be recorded

The ledger is the set of accounts of business.These accounts may be kept in a book or series of books (as in a manual system) or on computer disc. Dividing the ledger and classifying accounts commonly give students difficulty. Careful explanation and plenty of practice can help students to achieve success in this topic.

Step 1

Aim: to appreciate the reasons for dividing the ledger and to recognize the usual divisions 1 Outline the possible or likely divisions of the ledger. Encourage the students to identify the possible advantages of a division, and the reasons for the division, by asking them

44

pages1-59

15/3/03

11:14 am

Page 45

The division of the ledger

questions. For example, you could ask the students what advantages there could be to having a separate ledger for customers (ie debtors).The possible divisions of the ledger may be as shown below.

Accounts (a) customers personal accounts, ie Debtor Accounts (b) suppliers personal accounts, ie Creditor Accounts (c) the receiving and paying out of money (d) the remaining accounts (unless a Private Ledger exists) (e) accounts requiring confidentiality, eg Capital Account To be found in the following ledger Sales Ledger (or Debtor Ledger) Purchases Ledger (or Bought Ledger or Creditor Ledger) Cash Book (developed in Lesson 9) General Ledger (or Nominal Ledger) Private Ledger

Draw the students attention to the alternative names for the ledgers that are given in brackets. Point out that not all firms have a Private Ledger.The purpose of a Private Ledger is to maintain confidentiality, with access limited to only a few members of staff. 2 Explain that the reasons for dividing the ledger are that: smaller units are managed more easily; the division provides useful information because parts of the ledger are specialized; it helps to keep control of the various accounts. 3 Ask the students to work through the exercise below. Exercise Required State into which ledger each of the following items should be posted: (i) (ii) (iii) (iv) D Light Customer Account Fixtures and Fittings Account F Masters Supplier of Goods Account Wages Account.

Solution (i) (ii) (iii) (iv) Sales Ledger (or Debtor Ledger) General Ledger (or Nominal Ledger) Purchases Ledger (or Bought or Creditor Ledger) General Ledger (or Nominal Ledger).

45

pages1-59

15/3/03

11:14 am

Page 46

The division of the ledger

Step 2

Aim: to be able to distinguish between the different types of ledger account 1 Point out that distinguishing between types of account is commonly referred to as the classification of accounts, which is the arrangement of accounts into distinct classes.

ACCOUNTS Impersonal (of things rather than of people)

Personal

Debtors

Capital Creditors Drawings

Real Asset accounts (including cash and bank)

Nominal Income and expense accounts

Figure 8.1 The classification of accounts

2 Hand out copies of, or show on the overhead projector, exercises T/8.1* and T/8.2* in the Appendix (pages 220 and 221). Ask the students to work through them. 3 Draw the students attention to the difference between: (a) the Sales Ledger and the Sales Account (b) the Nominal Ledger and the Nominal Account a name for the various income and expense accounts the account in the General Ledger which records the income receivable from the sale of goods, whether for cash or on credit an alternative name for the General Ledger the ledger containing debtor accounts

46

pages1-59

15/3/03

11:14 am

Page 47

The division of the ledger

Step 3

Aim: to recognize the various possible subdivisions of the ledger 1 Review the possible sub-divisions of the ledger. Use the students experience to review this topic by asking them questions. For example, you could ask the students why the Sales Ledger might be divided according to sales territories/areas and what advantages might result from this. Suggest that those who are in employment try to find out how the ledger is divided or subdivided within the organizations they work for. A large Sales Ledger might be subdivided for any of the reasons stated in point 2 on page 45. The ways in which the Sales Ledger can be divided are: (a) (b) (c) (d) (e) alphabetically by the customers names; numerically in which each customer is allotted a number; geographically (or territorially) by area or region, eg by sales territories; on a product basis by product categories; by type of customer, eg trade customers, as distinct from private individuals, or according to the level of credit allowed.

2 Hand out copies of, or show on the overhead projector, exercise T/8.3* in the Appendix (page 221). Ask the students to work through the exercise.

Step 4

Aim: to be able to produce a balance sheet with a vertical format 1 Stress that a vertical format is not required for the First Level Book-keeping examination. Explain, however, that a vertical layout offers more scope for presentation, especially when more detail needs to be included concerning fixed assets. More space is provided by this layout, which can greatly help candidates. 2 The balance sheet of T Avis at 31 December Year 6 is presented overleaf in vertical format. See also T/8.4 in the Appendix (page 222). 3 Point out that it is usual to deduct Amounts due within 1 year (current liabilities) from current assets to obtain net current assets. Note Knowledge of working capital (net current assets) is not required by the First Level syllabus.Therefore, students who omit the words net current assets will not be penalized. However, encourage the students to lay out their work well.

47

pages1-59

15/3/03

11:14 am

Page 48

The division of the ledger

T Avis Balance sheet at 31 December Year 6 Fixed Assets Fixtures and fittings Motor vehicle Current Assets Stock Debtors Bank Cash less Amounts due within 1 year Creditors Net current assets Financed by: Capital balance at 1 Jan Year 6 add Net profit less Drawings 5,430 1,340 1,100 240 5,670 900 1,600 2,500 2,450 1,170 1,230 70 4,920 1,750 3,170 5,670

4 Hand out copies of, or show on the overhead projector, exercise T/8.5* in the Appendix (page 223). Ask the students to work through the exercise. Remind the students to apply the examination method outlined in Lesson 7 (page 43). 5 Explain that after the total amount of fixed assets and net current assets has been established, the Amount due in more than 1 year is deducted.This way of positioning entries is preferred by the LCCIEB to the alternative of placing longer-term liabilities as an addition underneath capital.

48

pages1-59

15/3/03

11:14 am

Page 49

Lesson 9: Bank facilities Cash Book: 2 columns

Topic summary

Basic matters concerning methods of payment and cash and bank records The use of a 2-column Cash Book The significance of a bank overdraft and its effect on the Bank Account The book-keeping relationship between the Bank Current Account and the Bank Deposit Account

Extended Syllabus references