Professional Documents

Culture Documents

New Income Tax Return BIR Form 1701 - November 2011 Revised

Uploaded by

BusinessTips.PhOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

New Income Tax Return BIR Form 1701 - November 2011 Revised

Uploaded by

BusinessTips.PhCopyright:

Available Formats

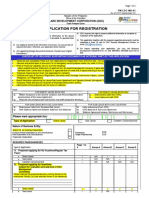

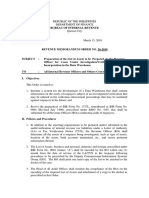

(To be filled up by the BIR) Document Locator Number (DLN): _____________________________ Republika ng Pilipinas Kagawaran ng Pananalapi

Batch Control Sheet (BCS) No./Item No.: __________________________________

Kawanihan ng Rentas Internas All information must be written in CAPITAL LETTERS

Fill in alll blank spaces. Shade all applicable circles.

[For Self-Employed Individuals, Estates and Trusts (Including those with both Business and Compensation Income)]

Annual Income Tax Return

Yes No Background Information Taxpayer/Filer 3

BIR Form No.

November 2011 2 Amended Return? Joint Filing?

1701

TO BE FILED IN THREE (3) COPIES: (1) BIR FILE COPY (2) BIR ENCODING COPY (3) TAXPAYER FILE COPY

1 For the year (YYYY) Part 1 4 Taxpayer Identification Number (TIN) 6 Taxpayer's Name Last Name 7 Registered Address

Yes

No

RDO Code

First Name

Middle Name

(Unit/Room Number/Floor)

(Building Name)

(Lot Number

Block Number

Phase Number

House/Building Number)

(Street Name)

(Subdivision/Village)

(Barangay)

(Municipality/City) 8 Date of Birth (MM/DD/YYYY) 11 Contact Number 13 Line of Business 15 Method of Deduction Itemized Deduction [Secs. 34 (A to J), NIRC] 9 Gender 12 E-mail Address 14 Alphanumeric Tax Code (ATC) Optional Standard Deduction (OSD) - 40% of Gross Sales/Receipts/ Revenues/ Fees [Section 34(L), NIRC, as amended by R.A. No. 9504] Spouse 18 Spouse's Name Last Name 19 Taxpayer Identification Number (TIN) 21 Date of Birth (MM/DD/YYYY) 24 Line of Business 26 Method of Deduction

29 -

(Province) Male Female 10 Civil Status Single Married Separated Widow/er

(Zip Code)

II 011

Compensation Income

II 012

Business Income/Income from Profession Yes No

II 013

Mixed Income

16 Claiming for Additional Exemptions?

17 If yes, number of Qualified Dependent Children

First Name 20 RDO Code 23 E-mail Address 25 Alphanumeric Tax Code (ATC) Optional Standard Deduction (OSD) - 40% of Gross Sales/Receipts/ Revenues/Fees [Section 34(L), NIRC, as amended by R.A. No. 9504] II 011 Compensation Income II 012 Business Income/Income from Profession Yes No

Middle Name

22 Contact Number

II 013

Mixed Income

Itemized Deduction [Secs. 34 (A to J), NIRC]

27 Claiming for Additional Exemptions?

28 If yes, number of Qualified Dependent Children

Qualified Dependent Children Last Name First Name Middle Name Date of Birth (MM/DD/YYYY) Mark, if Physically/Mentally Incapacitated

1 2 3 4 30 Are you availing of tax relief under Special Law or International Tax Treaty? Yes No

BIR Form No. 1701 - page 2

Part II 31 Income Tax Due under Regular Rate (from Item 69C/ 69D of Part V) 32 Add: Income Tax Due under Special Rate (from Item 69A/ 69B of Part V) 33 Total Income Tax Due (Sum of Items 31A & 32A/ 31B & 32B) 34 Aggregate Income Tax Due (Sum of Item 33A & 33B) 35 Less: Tax Credits/Payments (attach proof) 35A/B Prior Year's Excess Credits 35C/D Tax Payment for the First Three Quarters 35E/F Creditable Tax Withheld for the First Three Quarters 35G/H Creditable Tax Withheld per BIR Form No. 2307 for the 4th Quarter 35I/J Tax withheld per BIR Form No. 2316 35K/L Tax Paid in Return Previously Filed, if this is an Amended Return 36M/N Foreign Tax Credits 35O/P Other Payments/Credits, specify____________________________ 35Q/R Total Tax Credits/Payments (Sum of Items 35A, C, E, G, I, K, M & O/ 35B, D, F, H, J, L, N & P) 36 Net Tax Payable/(Overpayment) (Item 33A less 35Q/ 33B less 35R) 37 Aggregate Tax Payable/(Overpayment) (Sum of Item 36A & 36B) 38 Add: Penalties 35A 35C 35E 35G 35I 35K 35M 35O 35Q 36A 37 Computation of Tax Taxpayer/Filer 31A 32A 33A 34 Spouse

31B 32B 33B

35B 35D 35F 35H 35J 35L 35N 35P 35R 36B

Taxpayer/Filer 38A

Spouse 38E

38B 38F

38C 38G

38D

38H 39

39 Aggregate Penalties (Sum of Item 38D & 38H) 40 Total Amount Payable/(Creditable/Refundable) (Sum of Item 36A & 38D/ 36B & 38H) 41 Aggregate Amount Payable/(Creditable/Refundable) (Sum of Item 40A & 40B) 42 Less Portion of Tax Payable Allowed for 2nd Installment Payment to be paid on or before July 15 (not less than 50% of Item 33A/ 33B) 43 Amount of Tax Required to be Paid Upon Filing this Return (Item 40A less 42A/ 40B less 42B) 44 Net Aggregate Amount of Tax Required to be Paid/(Creditable/Refundable) Upon Filing of this Return (Sum of Item 43A & 43B) If overpayment, mark one box only: Part III 45 Total Tax Relief/Savings (from Item 98J/ 98K of Part VII) 46 Aggregate Amount of Tax Relief/Savings (Sum of Item 45A & 45B) Part IV Particulars Cash/Bank 47 Debit Memo 48 Check 49 Tax Debit Memo 50 Others 50A Details of Payment Drawee Bank/Agency 47A 48A 47B 48B 49A 50B Number 47C 48C 49B 50C Date (MM/DD/YYYY) 47D 48D 49C 50D To be Refunded To be issued a Tax Credit Certificate (TCC) To be carried over, as tax credit for the next year/quarter 42A 43A 40A

41

40B

44

42B 43B

Availment of Tax Income Incentives/Exemptions Taxpayer/Filer 45A 46 Spouse

45B

Stamp of Receiving Office/AAB and Date of Receipt

Amount

(RO's Signature/Bank Teller's Initial)

BIR Form No. 1701 - page 3

Part V Taxpayer/Filer 51 Gross Compensation Income (from Schedule 1) 52 Less: Non-Taxable/Exempt Compensation 53 Gross Taxable Compensation Income (Item 51A less 52A/ 51B less 52B) 54 Less: Deductions 54A/B Premium on Health and/or Hospitalization Insurance (not to exceed P 2,400/year) 54C/D Personal Exemption/Exemption for Estate and Trust 54E/F Additional Exemption 54G/H Total Deductions (Sum of Items 54A, C & E/ 54B, D & F) 55 Total Compensation Income/(Excess of Deductions) (Item 53A less 54G/ 53B less 54H) 56 Sales/Revenues/Receipts/Fees (net of sales returns, allowances and discounts) 57 Add: Other Taxable/Exempt Income from Operations, not subject to Final Tax

56A 54A 54C 54E 54G 55A

Breakdown of Income (attach additional sheet/s, if necessary) EXEMPT SPECIAL RATE Spouse Taxpayer/Filer

Spouse

51A 52A 53A

REGULAR Taxpayer/Filer

RATE Spouse

51B 52B 53B

54B 54D 54F 54H 55B 56F

56B

56C

56D

56E

57A/B/C/D/E/F

57G/H/I/J/K/L

57A 57G 57M 58A 59A 60A 61A 62A

57B 57H 57N 58B 59B 60B 61B 62B

57C 57I 57O 58C 59C 60C 61C 62C

57D 57J 57P 58D 59D 60D 61D 62D

57E 57K 57Q 58E 59E 60E 61E 62E

57F 57L 57R 58F 59F 60F 61F 62F

57M/N/O/P/Q/R Total (Sum of Item 57A & 57G/ 57B & 57H/ 57C & 57I/ 57D & 57J/ 57E & 57K/ 57F & 57L)

58 Total Sales/Revenues/Receipts/Fees (Sum of Item 56A & 57M/ 56B & 57N/ 56C & 57O/ 56D & 57P/ 56E & 57Q/ 56F & 57R) 59 Less: Cost of Sales/Services 60 Net Sales/Revenues/Receipts/Fees (Item 58 less 59) 61 Add: Non-0perating Taxable Income 62 Gross Income (Sum of Item 60 & 61) 63 Less: Deductions 63A/B Optional Standard Deduction (OSD) OR 63C/D/E/F/G/H Regular Allowable Itemized Deductions Special Allowable Itemized Deductions Description 63I/J/K/L/M/N 63O/P/Q/R/S/T 63U/V/W/X/Y/Z Allowance for NOLCO (from Item 83) Legal Basis

63A

63B

63C

63D

63E

63F

63G

63H

63I 63O 63U 63AA 64A

63J 63P 63V 63AB 64B

63K 63Q 63W 63AC 64C

63L 63R 63X 63AD 64D

63M 63S 63Y 63AE 64E 65A

68C

63N 63T 63Z 63AF 64F 65B 66F 67F

68D

Total Allowable Itemized Deductions (Sum of Items 63C, I, O & U/ 63D, J, P & V/ 63E, K, Q & W/ 63F, L, R & X/ 63G, M, S & Y/ 63H, N, T & Z) Net Income (Item 62A less 63AA/ 62B less 63AB/ 62C less 63AC/ 62D less 63AD/ 64 62E less 63AE/ 62F less 63AF) (to Item 90 of Part VI-Schedule 3) Less: Excess of Deductions over Taxable Compensation Income (from Item 55A/55B) 65 63AA/AB/AC/AD/AE/AF

OR the Total Deductions (from Item 54G/54H) , if there is no Compensation Income

66 Taxable/Exempt Business Income/Income from Profession (Item 64 less 65) 67 Total Taxable Income (Sum of Item 55 & 66) 68 Applicable Tax Rate (i.e. special/regular rate) 69 Income Tax Due (refer to Tax Table below) (to Item 32A & 32B/ 31A & 31B) 70 Less: Share of Other Agencies 71 Income Tax Due to National Government Under Special Rate (Item 69A less 70A/ 69B less 70B)

66A 67A

66B 67B

66C 67C 68A 69A 70A 71A

66D 67D 68B 69B 70B 71B

66E 67E

%

69D

69C

If Taxable Income is: Not over P 10,000 Over P 10,000 but not over P 30,000 Over P 30,000 but not over P 70,000 Over P 70,000 but not over P 140,000

Tax Due is: 5% P 500 + 10% of the excess over P 10,000 P 2,500 + 15% of the excess over P 30,000 P 8,500 + 20% of the excess over P 70,000

TAX TABLE If Taxable Income is: Over P 140,000 but not over P 250,000 Over P 250,000 but not over P 500,000 Over P 500,000

Tax Due is: P 22,500 + 25% of the excess over P 140,000 P 50,000 + 30% of the excess over P 250,000 P 125,000 + 32% of the excess over P 500,000

NOTE: Read Guidelines and Instructions on page 6

- THIS FORM IS NOT FOR SALE -

BIR Form No. 1701 - page 4

Part VI Schedule 1 Name of Employer 72 73 74 75 Total Compensation Income/Tax Withheld (Sum of Item 72 to 74) (to Item 51) Schedule 2 76 Gross Income 77 Less: Total Deductions exclusive of NOLCO & Deductions under Special Laws 78 Net Operating Loss Carry Over (to Schedule 2A) Schedule 2A Net Operating Loss Year Incurred 79 80 81 82 79A 80A 81A 82A Amount 79B 80B 81B 82B Computation of Available Net Operating Loss Carry Over (NOLCO) (attach additional sheet/s, if necessary) Net Operating Loss Carry Over (NOLCO) Applied Previous Year Applied Current Year SCHEDULES Gross Compensation Income and Tax Withheld (attach additional sheet/s, if necessary) TAXPAYER/FILER Taxpayer Identification Number (TIN) Compensation Income 72A 73A 74A 72B 73B 74B 75A Computation of Net Operating Loss Carry Over (NOLCO) 76 77 78

SPOUSE Tax Withheld Compensation Income Tax Withheld 72E 73E 74E 75D 72D 73D 74D 75C

72C 73C 74C 75B

Expired

Net Operating Loss Unapplied

79C 80C 81C 82C 83

79D 80D 81D 82D

79E 80E 81E 82E

83 Total (Sum of Items 79C, 80C, 81C & 82C) (to Item 63U/V/W/X/Y/Z) Schedule 3

Reconciliation of Net Income per Books Against Taxable Income (attach additional sheet/s, if necessary) Special Rate Taxpayer/Filer Spouse 84A

Regular Rate Taxpayer/Filer Spouse 84D

84 Net Income/(Loss) per Books 85 Add: Other Taxable Income/Non-deductible Expenses

84B

84C

85A 86 Total (Sum of Items 84A & 85A/ 84B & 85B/ 84C & 85C/ 84D & 85D) 87 Less: Total Non-taxable Income and Income Subjected to Final Tax 87A 88 Special Deductions (e.g. direct labor, training, etc.) 88A 89 Total (Sum of Items 87A & 88A/ 87B & 88B/ 87C & 88C/ 87D & 88D) 90 Net Income (Item 86A less 89A/ 86B less 89B/ 86C less 89C/ 86D less 89D) (from Item 64C & 64D/ 64E & 64F) Part VII Certificate of Registration/BIR Ruling/MOA/Others (A) 91 92 93 94 95 96 97 98 Total (Sum of Items 91J to 97J/ 91K to 97K) (to Item 45)

Legal Basis (Special Law-R.A. No./Particular Sec. in the Tax Code of 1997, as amended

85B 86B

85C 86C

85D 86D

86A

87B

87C

87D

88B 89B 90B

88C 89C 90C

88D 89D 90D

89A 90A

Details of Income Tax Incentives/Exemptions (attach additional sheet/s, if necessary) Effectivity Date of Incentive Exemption (state exact dates) From (MM/DD/YYYY) To (MM/DD/YYYY) (C) (D) Nature and Extent of Incentive/Exemption (E) Amount of Income Tax Payable under Regular Rate Taxpayer/Filer (F) Spouse (G) Amount of Actual Income Tax Paid Taxpayer/Filer (H) Spouse (I) Amount of Tax Relief/Savings Taxpayer/Filer ( J ) = (F less H) Spouse ( K ) = (G less I)

(B)

98

BIR Form No. 1701 - page 5

Part VIII For Eatate and Trust (Engaged in Trade and Business) Name 99A 100A 101A Payments to Heirs/Beneficiaries (attach additional sheet/s, if necessary) Taxpayer Identification Number (TIN) 99B 100B 101B 102 Amount Tax Withheld

99 100 101 102 Total Payment to Heirs/Beneficiaries (Sum of Items 115B, 116B & 117B)

99C 100C 101C

I declare, under the penalties of perjury, that this annual return has been made in good faith, verified by me, and to the best of my knowledge and belief, is true and correct, pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof.

103 Signature over Printed Name of Taxpayer/Authorized Representative (attach authorization) /Accredited Tax Agent (ATA) Position and TIN of Authorized Representative/ATA Tax Agent Accreditation No./Atty's Roll No. (if applicable) Issue Date Expiry Date 106 Date of Issue (MM/DD/YYYY) 107 Amount

104 Community Tax Certificate Number Part IX

Gross Income/Receipts Subjected to Final W/holding Tax on Income Actual Amount

108A

105

Place of Issue

Supplemental Information (attach additional sheet/s, if necessary) TAXPAYER/FILER Final Tax Withheld/paid Exempt

108B

Actual Amount

108E

SPOUSE Final Tax Withheld/Paid Actual Amount/Fair Market Value/Net Capital Gains

109C 110C 111C 112C 113C 108F

Exempt Final Tax Withheld/Paid

109D 110D 111D 112D 113D

108 Interests

108C

108D TAXPAYER/FILER Actual Amount/Fair Market Final Tax Withheld/Paid Value/Net Capital Gains

SPOUSE

109 Royalties 110 Dividends 111 Prizes and Winnings 112 Fringe Benefits 113 Compensation Subject to 15% Preferential Rate 114 Sale/Exchange of Real Properties

Description of Property (e.g., land, building, improvement)

114A 114H 114B 114I

109A 110A 111A 112A 113A

109B 110B 111B 112B 113B

OCT/TCT/CCT/Tax Declaration Number

114C 114J

Certificate Authorizing Registration (CAR) Number

114D 114K

114E 114L

114F 114M

114G 114N

115 Sale/Exchange of Shares of Stocks

Kind of Stocks*

115A 115J 115B 115K

Stock Certificate Series Number

115C 115L

Certificate Authorizing Registration (CAR) Number

115D 115M

Number of Shares

115E 115N

Date of Issue (MM/DD/YYYY)

115F 115O

115G 115P

115H 115Q

115I 115R

[*e.g., preferred (PS), common (CS)]

116 Other Income Subject to Final Tax Under Sec. 57(A) of the Tax Code, as amended (specify)

116A 116B

116C 117A

116D

116E 117B

117 Total Final Tax Withheld/Paid (Sum of Items 108b to 113B, 114E, 114L, 115G, 115P & 116C/ 108E, 109D to 113D, 114G, 114N, 115I, 115R & 116E)

Gross Income/Receipts Exempt from Income Tax

Actual Amount/Fair Market Value

118A 119A 120A

Actual Amount/Fair Market Value

118B 119B 120B

118 Proceeds of Life Insurance Policy 119 Return of Premium 120 Retirement Benefits, Pensions, Gratuities, etc. 121 Personal/Real Properties Received thru Gifts, Bequests, and Devises

Description of Property (e.g., cash, land, building, improvement)

121A 122A 121B

Mode of Transfer (e.g., inheritance, donation)

121C

Certificate Authorizing Registration (CAR) Number

121D 122B 123A

121E 122C 123B

122 Other Exempt Income/Receipts Under Sec. 32 (B) of the Tax Code, as amended (specify) 123 Total Income/Receipts Exempt from Income Tax (Sum of Items 63A to 65A, 66D & 67B/ 63B to 65B, 66E & 67C)

BIR Form No. 1701 page 6

GUIDELINES AND INSTRUCTIONS

Who Shall File This Form This return shall be filed by the following individuals regardless of amount of gross income: 1.) A resident citizen engaged in trade, business, or practice of profession within and without the Philippines. 2.) A resident alien, non-resident citizen or non-resident alien individual engaged in trade, business or practice of profession within the Philippines. 3.) A trustee of a trust, guardian of a minor, executor/administrator of an estate, or any person acting in any fiduciary capacity for any person, where such trust, estate, minor, or person is engaged in trade or business. 4.) An individual engaged in trade or business or in the exercise of their profession and receiving compensation income as well. All individuals, estates and trusts above required under the law and existing issuances to file this return should also fill up Part IX hereof. Said individuals, estates and trusts shall declare such income subject to final tax and those exclusions from gross income under Section 32(B) of the Tax Code, as amended. Married individuals shall file a return for the taxable year to include the income of both spouses, computing separately their individual income tax based on their respective total taxable income. Where it is impracticable for the spouses to file one return, each spouse may file a separate return of income. If any income cannot be definitely attributed to or identified as income exclusively earned or realized by either of the spouses, the same shall be divided equally between the spouses for the purpose of determining their respective taxable income. The income of unmarried minors derived from property received from a living parent shall be included in the return of the parent except (1) when the donors tax has been paid on such property, or (2) when the transfer of such property is exempt from donors tax. If the taxpayer is unable to make his own return, the return may be made by his duly authorized agent or representative or by the guardian or other person charged with the care of his person or property, the principal and his representative or guardian assuming the responsibility of making the return and incurring penalties provided for erroneous, false or fraudulent returns. When and Where to File and Pay 1. For Electronic Filing and Payment System (eFPS) Taxpayer The return shall be e-filed and the tax shall be e-paid on or before the 15th day of April of each year covering income for the preceding taxable year using the eFPS facilities thru the BIR website http://www.bir.gov.ph. 2. For Non-Electronic Filing and Payment System (non-eFPS) Taxpayer The return shall be filed and the tax shall be paid on or before the 15th day of April of each year covering income for the preceding taxable year with any Authorized Agent Bank (AAB) located within the territorial jurisdiction of the Revenue District Office (RDO) where the taxpayer is registered. In places where there are no AABs, the return shall be filed and the tax shall be paid with the concerned Revenue Collection Officer (RCO) under the jurisdiction of the RDO where the taxpayer is registered. In case of NO PAYMENT RETURNS, the same shall be filed with the RDO where the taxpayer is registered/has his legal residence or place of business in the Philippines or with the concerned RCO under the same RDO. 3. For Installment Payment When the tax due exceeds Two Thousand Pesos (P2,000), the taxpayer may elect to pay in two equal installments, the first installment to be paid at the time the return is filed and the second, on or before July 15 of the same year. 4. For Non-Resident Taxpayer In case taxpayer has no legal residence or place of business in the Philippines, the return shall be filed with the Office of the Commissioner or Revenue District Office No. 39, South Quezon City. Gross Taxable Compensation Income The gross taxable compensation income of the taxpayer does not include SSS, GSIS, Medicare and PAG-IBIG Contributions, and Union Dues. Taxable Income Taxable income means the pertinent items of gross compensation and/or business income specified in the Tax Code of 1997, as amended, less the deductions and/or additional exemptions, if any, authorized for such types of income by the Code or other special laws. Premiums on Health and/or Hospitalization Insurance The amount of premiums not to exceed Two Thousand Four Hundred Pesos (P 2,400) per family or Two Hundred Pesos (P 200) a month paid during the taxable year for health and/or hospitalization insurance taken by the taxpayer for himself, including his family, shall be allowed as a deduction from his gross income: Provided, That said family has a gross income of not more than Two Hundred Fifty Thousand Pesos (P 250,000) for the taxable year: Provided, finally, That in the case of married taxpayers, only the spouse claiming the additional exemption for dependents shall be entitled to this deduction. Personal and Additional Exemptions Individual taxpayer, whether single or married, shall be allowed a basic personal exemption amounting to Fifty Thousand Pesos (P50,000). In the case of married individuals where only one of the spouses is deriving gross income, only such spouse shall be allowed the personal exemption. An individual, whether single or married, shall be allowed an additional exemption of Twenty Five Thousand Pesos (P 25,000) for each qualified dependent child, not exceeding four (4). The additional exemption for dependents shall be claimed by the husband, who is deemed the proper claimant unless he explicitly waives his right in favor of his wife. Dependent Child means a legitimate, illegitimate or legally adopted child chiefly dependent upon and living with the taxpayer if such dependent is not more than twenty-one (21) years of age, unmarried and not gainfully employed or if such dependent, regardless of age, is incapable of selfsupport because of mental or physical defect. In the case of legally separated spouses, additional exemptions may be claimed only by the spouse who has custody of the child or children: Provided, That the total amount of additional exemptions that may be claimed by both shall not exceed the maximum additional exemptions allowed by the Tax Code. Exemption Allowed to Estates and Trusts There shall be allowed an exemption of Twenty thousand pesos (P 20,000) from the income of the estate and trust. Part IX Items 108 to 123 The filling-up of these fields is optional. The figures placed therein should be properly documented and/or substantiated. Change of Status If the taxpayer marries or should have additional dependent(s) as defined above during the taxable year, the taxpayer may claim the corresponding personal or additional exemption, as the case may be, in full for such year. If the taxpayer dies during the taxable year, his estate may still claim the personal and additional exemptions for himself and his dependent(s) as if he died at the close of such year. If the spouse or any of the dependents dies or if any of such dependents marries, becomes twenty-one (21) years old or becomes gainfully employed during the taxable year, the taxpayer may still claim the same exemptions as if the spouse or any of the dependents died, or as if such dependents married, became twenty-one (21) years old or became employed at the close of such year. Allowable Deductions A taxpayer engaged in business or in the practice of profession shall choose either the optional or itemized deduction (described below). He shall indicate his choice by marking with X the appropriate box, otherwise, he shall be deemed to have chosen itemized deduction. The choice made in the return is irrevocable for the taxable year covered. Optional Standard Deduction (OSD) A maximum of 40% of their gross sales or gross receipts shall be allowed as deduction in lieu of the itemized deduction. This type of deduction shall not be allowed for non-resident aliens engaged in trade or business. An individual who opts to avail of this deduction need not submit the Account Information Form (AIF)/Financial Statements. Regular Allowable Itemized Deductions - There shall be allowed as deduction from gross income all the ordinary and necessary expenses paid or incurred during the taxable year in carrying on or which are directly attributable to, the development, management, operation and/or conduct of the trade, business or exercise of a profession including a reasonable allowance for salaries, travel, rental and entertainment expenses. Itemized deductions include also interest, taxes, losses, bad debts, depreciation, depletion, charitable and other contributions, research and development, pension trust, premium payments on health and/or hospitalization insurance. Special Allowable Itemized Deductions There shall be allowable deduction from gross income in computing taxable income, in addition to the regular allowable itemized deduction, as provided under existing regular and special laws, rules and issuances such as, but not limited to Rooming-in and Breast-feeding Practices under RA 7600, Adopt-a-School Program under RA 8525, Senior Citizen Discount under RA 9257, Free Legal Assistance under RA 9999. Tax Relief Availment Taxpayer availing of any tax relief under the Tax Code and/or any prevailing special laws [e.g., Income Tax Holiday (ITH), preferential income tax rate, income tax exemption, additional special deductions, etc.] must completely fill up Part VII hereof. Fair market value Fair market value as determined in accordance with Section 6(E) of the Tax Code, as amended, shall be used in reporting the non-cash income and receipts in Part IX. Individual whose compensation income has been subjected to final withholding tax The term "individual whose compensation income has been subjected to final withholding tax shall include aliens or Filipino citizens occupying the same positions as the alien employees, as the case may be, who are employed by regional operating headquarters, regional or area headquarters, offshore banking units, petroleum service contractors and sub-contractors, pursuant to pertinent provisions of Sections 25 (C), (D), E) and 57(A), including those subject to Fringe Benefit Tax (FBT) under Section 33 of the Tax Code, as amended, Republic Act No. 8756, Presidential Decree No. 1354, and other pertinent laws. Penalties There shall be imposed and collected as part of the tax: 1. A surcharge of twenty five percent (25%) for each of the following violations: a) Failure to file any return and pay the amount of tax or installment due on or before the due dates; b) Filing a return with a person or office other than those with whom it is required to be filed; c) Failure to pay the full or part of the amount of tax shown on the return, or the full amount of tax due for which no return is required to be filed, on or before the due date; d) Failure to pay the deficiency tax within the time prescribed for its payment in the notice of Assessment (Delinquency Surcharge). 2. A surcharge of fifty percent (50%) of the tax or of the deficiency tax shall be imposed in case of willful neglect to file the return within the period prescribed by the Tax Code and/or by rules and regulations or in case a false or fraudulent return is filed. 3. Interest at the rate of twenty percent (20%) per annum, or such higher rate as may be prescribed by rules and regulations, on any unpaid amount of tax, from the date prescribed for the payment until it is fully paid. 4. Compromise penalty, pursuant to existing/applicable revenue issuances. Excess Withholding Tax Over withholding of income tax on compensation shall be refunded by the employer, except if the over withholding is due to the employees failure or refusal to file the withholding exemption certificate, or supplies false or inaccurate information, the excess shall not be refunded but shall be forfeited in favor of the government. Attachments Required 1. Account Information Form and the Certificate of the independent CPA duly accredited by the BIR except for taxpayers who opted for the Optional Standard Deduction. (The CPA Certificate is required if the gross quarterly sales, earnings, receipts or output exceed P 150,000). 2. Certificate of Income Tax Withheld on Compensation (BIR Form No. 2316). 3. Certificate of Income Payments Not Subjected to Withholding Tax (BIR Form No. 2304). 4. Certificate of Creditable Tax Withheld at Source (BIR Form No. 2307). 5. Duly Approved Tax Debit Memo, if applicable. 6. Waiver of husband's right to claim additional exemption, if applicable. 7. Proof of prior years' excess credits, if applicable. 8. Proof of Foreign Tax Credits, if applicable. 9. For amended return, proof of tax payment and the return previously filed. 10. Authorization letter, if filed by authorized representative. 11. Proof of other tax payments/credit, if applicable. 12. Proof of Tax Payments for the First Three Quarters 13. Summary Alphalist of Withholding Agents of Income Payments Subjected to Withholding Tax at Source (SAWT), if applicable. 14. Statement of Managements Responsibility (SMR) for Annual Income Tax Return. 15. Schedules of the following which must be part of the Notes to the audited Financial Statements: a. Sales/Receipts/Fees b. Other Taxable Income c. Cost of Sales/Services d. Taxes and Licenses e. Itemized Deductions (if taxpayer did not avail of OSD) f. Other information prescribed to be disclosed in the Notes to Financial Statements Note: All Background information must be properly filled up. All returns filed by an accredited tax agent on behalf of a taxpayer shall bear the following information: A. For CPAs and others (individual practitioners and members of GPPs); a.1 Taxpayer Identification Number (TIN); and a.2 Certificate of Accreditation Number, Date of Issuance, and Date of Expiry. B. For members of the Philippine Bar (individual practitioners, members of GPPs); b.1 Taxpayer Identification Number (TIN); and b.2 Attorneys Roll number or Accreditation Number, if any. ENCS

You might also like

- General Ledger SampleDocument3 pagesGeneral Ledger SampleBusinessTips.Ph80% (15)

- BIR Form 2316Document1 pageBIR Form 2316edz_ramirez87% (15)

- Overview of Handling BIR Tax Audit in The PhilippinesDocument3 pagesOverview of Handling BIR Tax Audit in The PhilippinesMarietta Fragata Ramiterre100% (2)

- Accreditation of Printers For ATP (RR 15-2012)Document5 pagesAccreditation of Printers For ATP (RR 15-2012)Romer Lesondato67% (3)

- 2307Document2 pages2307Nephy Bersales Taberara67% (3)

- CPA UNDERTAKES TO COOPERATE WITH BIRDocument1 pageCPA UNDERTAKES TO COOPERATE WITH BIRLimuel Balestramon RazonalesNo ratings yet

- 1701 Bir FormDocument12 pages1701 Bir Formbertlaxina0% (1)

- Co-Working Space Business PlanDocument35 pagesCo-Working Space Business PlanGaël MukendiNo ratings yet

- Philippines New Annual Income Tax Return Form 01 IAF JUNE 2013Document12 pagesPhilippines New Annual Income Tax Return Form 01 IAF JUNE 2013Danilla Navarro VelasquezNo ratings yet

- Affidavit Sole PropDocument2 pagesAffidavit Sole PropJoni Aquino50% (2)

- General Journal SampleDocument2 pagesGeneral Journal SampleBusinessTips.Ph89% (19)

- 1604-CF FormDocument2 pages1604-CF Formjenie_rojen200423100% (2)

- Coffee Roaster Business PlanDocument37 pagesCoffee Roaster Business PlanAhsan Habib100% (6)

- For BIR Use Only Annual Income Tax ReturnDocument12 pagesFor BIR Use Only Annual Income Tax Returnmiles1280No ratings yet

- Board Reso LandbankDocument2 pagesBoard Reso LandbankAlex TayaoNo ratings yet

- SWORN REAL PROPERTY VALUESDocument1 pageSWORN REAL PROPERTY VALUESAngela I.No ratings yet

- Secretary'S Certificate: (Authorized Filer For Securities and Exchange Commission)Document1 pageSecretary'S Certificate: (Authorized Filer For Securities and Exchange Commission)Mark John JovenNo ratings yet

- Bir Forms PDFDocument4 pagesBir Forms PDFgaryNo ratings yet

- 2316 Sample TransmittalDocument1 page2316 Sample TransmittalCY LeeNo ratings yet

- Sworn Statement 1Document2 pagesSworn Statement 1Alessandra SisonNo ratings yet

- Traditional Models of Financial Statements AnalysisDocument4 pagesTraditional Models of Financial Statements AnalysisMary LeeNo ratings yet

- Application Letter For Authority To Establish and Operate As Money Service BusinessDocument2 pagesApplication Letter For Authority To Establish and Operate As Money Service Businesssubscription jdbsNo ratings yet

- (BIR Form 1706) Capital Gains Tax ReturmDocument2 pages(BIR Form 1706) Capital Gains Tax Returmjongsn70057% (7)

- CDA guidelines for cooperative external auditor accreditationDocument11 pagesCDA guidelines for cooperative external auditor accreditationAndres Lorenzo III50% (2)

- CDC Application for RegistrationDocument13 pagesCDC Application for RegistrationPaolo LimNo ratings yet

- 2017 REVISED PASIG REVENUE CODE-min202019 - 05745 PDFDocument191 pages2017 REVISED PASIG REVENUE CODE-min202019 - 05745 PDFRamon PamosoNo ratings yet

- Rmo 40-2004Document21 pagesRmo 40-2004simey_kizhie07No ratings yet

- Financial Statement DraftDocument8 pagesFinancial Statement DraftFlorivee EreseNo ratings yet

- Annual Income Tax ReturnDocument6 pagesAnnual Income Tax ReturnZweetzzy PenafloridaNo ratings yet

- 1701Document6 pages1701Dolly BringasNo ratings yet

- Affidavit Cessation Business Operation PhilippinesDocument1 pageAffidavit Cessation Business Operation Philippinesjamilove20100% (1)

- BIR Form 1702 (November 2011)Document18 pagesBIR Form 1702 (November 2011)Jecon BonsucanNo ratings yet

- Sample Trial BalanceDocument1 pageSample Trial BalanceBusinessTips.PhNo ratings yet

- Affidavit of Gross Sales-AIDA Q. MANANQUILDocument1 pageAffidavit of Gross Sales-AIDA Q. MANANQUILbrian jay hernandezNo ratings yet

- Contract of SubscriptionDocument2 pagesContract of SubscriptionLei CGNo ratings yet

- Statement of Management's Responsibility For Annual Income Tax ReturnDocument1 pageStatement of Management's Responsibility For Annual Income Tax ReturnAlice Ordoño LedamaNo ratings yet

- BIR Document RequirementsDocument15 pagesBIR Document RequirementsJason Cabrera100% (1)

- Good Moral Character - CPA Public PracticeDocument1 pageGood Moral Character - CPA Public PracticeArchie Lazaro100% (2)

- Requirements for securing tax clearanceDocument1 pageRequirements for securing tax clearanceDenzel Edward Cariaga100% (2)

- BIR Application RequirementsDocument7 pagesBIR Application RequirementsValueWin Solutions100% (2)

- Request Letter For Tax ClearanceDocument1 pageRequest Letter For Tax ClearanceFrintz De la TorreNo ratings yet

- 1601E BIR FormDocument7 pages1601E BIR FormAdonis Zoleta AranilloNo ratings yet

- PhilGEPS Sworn StatementDocument2 pagesPhilGEPS Sworn Statementsevera martinNo ratings yet

- Affidavit of Gross SalesDocument1 pageAffidavit of Gross Salesbrian jay hernandezNo ratings yet

- Protesting The Deficiency Tax AssessmentDocument2 pagesProtesting The Deficiency Tax AssessmentbutowskiNo ratings yet

- Lost ATM AffidavitDocument1 pageLost ATM AffidavitaldinNo ratings yet

- New Income Tax Return BIR Form 1702 - November 2011 RevisedDocument6 pagesNew Income Tax Return BIR Form 1702 - November 2011 RevisedBusinessTips.Ph100% (4)

- Bir Form 1906Document3 pagesBir Form 1906Wacky LarimNo ratings yet

- Commissioner of Internal Revenue v. First Global Byo Corp., C.T.A. EB Case No. 2168 (C.T.A. Case Nos. 9172, 9212 & 9242), (July 1, 2021)Document16 pagesCommissioner of Internal Revenue v. First Global Byo Corp., C.T.A. EB Case No. 2168 (C.T.A. Case Nos. 9172, 9212 & 9242), (July 1, 2021)Kriszan ManiponNo ratings yet

- Secretary's CertificateDocument1 pageSecretary's CertificateJil MacasaetNo ratings yet

- Bpi Endorsement LetterDocument1 pageBpi Endorsement LetterLawrence MangaoangNo ratings yet

- Revenue regulations on bookkeepingDocument21 pagesRevenue regulations on bookkeepingmj villa100% (1)

- Revenue Memorandum Order 26-2010Document2 pagesRevenue Memorandum Order 26-2010Jayvee OlayresNo ratings yet

- Deed of Absolute Sale of MotorcycleDocument1 pageDeed of Absolute Sale of MotorcyclerhvividcreationsNo ratings yet

- Affidavit of LossDocument2 pagesAffidavit of LossVin SarinoNo ratings yet

- (2018) New BIR Income Tax Rates andDocument31 pages(2018) New BIR Income Tax Rates andGlenn Cacho Garce100% (1)

- Annual Income Tax Return: 0 5 1 SaleDocument6 pagesAnnual Income Tax Return: 0 5 1 Salecaitlin888No ratings yet

- Annual Income Tax Return for CorporationDocument9 pagesAnnual Income Tax Return for CorporationMarvin CeledioNo ratings yet

- New Income Tax Return BIR Form 1700 - November 2011 RevisedDocument4 pagesNew Income Tax Return BIR Form 1700 - November 2011 RevisedBusinessTips.Ph100% (2)

- 1702 Ghai2011Document5 pages1702 Ghai2011Janice CarridoNo ratings yet

- Annual Income Tax Return: (To Be Filled Up by The BIR)Document6 pagesAnnual Income Tax Return: (To Be Filled Up by The BIR)keir17No ratings yet

- Annual Income Tax ReturnDocument19 pagesAnnual Income Tax ReturnMarjorie BetchaydaNo ratings yet

- 1702 June 2011Document18 pages1702 June 2011fatmaaleahNo ratings yet

- Information Return/Annual Income Tax Return: Republika NG Pilipinas Kagawaran NG PananalapiDocument12 pagesInformation Return/Annual Income Tax Return: Republika NG Pilipinas Kagawaran NG PananalapifatmaaleahNo ratings yet

- Annual Income Tax Return for Individuals Earning Purely Compensation IncomeDocument10 pagesAnnual Income Tax Return for Individuals Earning Purely Compensation IncomeLouie De La TorreNo ratings yet

- BIR Form 1702 Filing GuideDocument18 pagesBIR Form 1702 Filing GuideBeatriceChuNo ratings yet

- BIR Form 1702 Annual Income Tax Return GuideDocument6 pagesBIR Form 1702 Annual Income Tax Return GuideMary Monique Llacuna Lagan100% (1)

- Sample Adjusted Trial Balance - BusinessTips - PHDocument1 pageSample Adjusted Trial Balance - BusinessTips - PHBusinessTips.Ph50% (6)

- New Income Tax Return BIR Form 1700 - November 2011 RevisedDocument4 pagesNew Income Tax Return BIR Form 1700 - November 2011 RevisedBusinessTips.Ph100% (2)

- BIR Revenue Regulation No-19-2011Document2 pagesBIR Revenue Regulation No-19-2011BusinessTips.PhNo ratings yet

- Kotak Mahindra Bank Q2 FY18 Earnings Conference Call: October 25, 2017Document18 pagesKotak Mahindra Bank Q2 FY18 Earnings Conference Call: October 25, 2017divya mNo ratings yet

- Chap 022Document42 pagesChap 022Mohamed AlyNo ratings yet

- Partnership Liquidation and Capital Account DistributionsDocument7 pagesPartnership Liquidation and Capital Account DistributionsMaria Beatriz Munda0% (1)

- Petroleum Agreements and BiddingDocument12 pagesPetroleum Agreements and BiddingKaoru AmaneNo ratings yet

- AEC 6 - Financial ManagementDocument6 pagesAEC 6 - Financial ManagementRhea May BaluteNo ratings yet

- HKICPA QP Exam (Module A) Sep2008 Question PaperDocument9 pagesHKICPA QP Exam (Module A) Sep2008 Question Papercynthia tsui67% (3)

- Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument6 pagesManila Cavite Laguna Cebu Cagayan de Oro Davaovane rondinaNo ratings yet

- What is a business taxDocument18 pagesWhat is a business taxClaire diane CraveNo ratings yet

- Statement of Profit or Loss For The Year Ended 31 March 2009Document1 pageStatement of Profit or Loss For The Year Ended 31 March 2009Plawan GhimireNo ratings yet

- Operating and Financial LeverageDocument64 pagesOperating and Financial LeverageMohammad AtherNo ratings yet

- Assignemnt Analysis of FS 03.22.2021Document3 pagesAssignemnt Analysis of FS 03.22.2021Eva Ruth MedilloNo ratings yet

- Limited Companies Financial StatementsDocument4 pagesLimited Companies Financial Statementskaleem khanNo ratings yet

- Room Tariff Structure ADocument2 pagesRoom Tariff Structure AsathishNo ratings yet

- MBA Pre-Term - Ch3 - BSDocument83 pagesMBA Pre-Term - Ch3 - BSJoe YunNo ratings yet

- Financial Accounting and Analysis: Unit-1Document71 pagesFinancial Accounting and Analysis: Unit-1subham singhNo ratings yet

- Wells Technical Institute (WTI), A School Owned by Tristana Wells, Provides Training To Individuals Who Pay Tuition Directly To The School. Part 1Document2 pagesWells Technical Institute (WTI), A School Owned by Tristana Wells, Provides Training To Individuals Who Pay Tuition Directly To The School. Part 1Fanny SosrosandjojoNo ratings yet

- Invoice Sample 5Document1 pageInvoice Sample 5Rammohanreddy RajidiNo ratings yet

- Group Assignment 2 Case Studies ConsolidatedDocument6 pagesGroup Assignment 2 Case Studies ConsolidatedSayang MeilyNo ratings yet

- UCP Faisalabad Financial Accounting AssignmentDocument1 pageUCP Faisalabad Financial Accounting AssignmentAzmat EhsanNo ratings yet

- Midterm Solutions 2018Document13 pagesMidterm Solutions 2018Manan ShahNo ratings yet

- Economics Paper-I 1. Advanced Micro EconomicsDocument3 pagesEconomics Paper-I 1. Advanced Micro EconomicsMr. Kk NayakNo ratings yet

- Week 004 - Module Statement of Comprehensive Income IDocument7 pagesWeek 004 - Module Statement of Comprehensive Income IJulia AcostaNo ratings yet

- FA Consolidation Test - Questions S20-A21 PDFDocument16 pagesFA Consolidation Test - Questions S20-A21 PDFAlpha MpofuNo ratings yet

- Company Car Tax in Hungary - ACCA GlobalDocument6 pagesCompany Car Tax in Hungary - ACCA GlobalhfdghdhNo ratings yet

- Accounting For Income Tax ReviewerDocument6 pagesAccounting For Income Tax ReviewerNJ TamdangNo ratings yet

- 11.08.2020 - F7 - Interpretation of FS - Sept Dec 2019 ExamDocument12 pages11.08.2020 - F7 - Interpretation of FS - Sept Dec 2019 ExamAliNo ratings yet

- Stats 4Document4 pagesStats 4ChiragNarulaNo ratings yet