Professional Documents

Culture Documents

New Income Tax Return BIR Form 1702 - November 2011 Revised

Uploaded by

BusinessTips.PhOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

New Income Tax Return BIR Form 1702 - November 2011 Revised

Uploaded by

BusinessTips.PhCopyright:

Available Formats

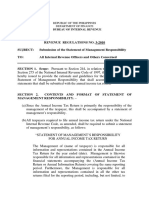

(To be filled up by the BIR) Document Locator Number (DLN): _______________________

Republika ng Pilipinas Kagawaran ng Pananalapi

Batch Control Sheet (BCS) No./Item No.:

________________________________

Kawanihan ng Rentas Internas

All information must be written in CAPITAL LETTERS. Fill in all blank spaces. Shade all applicable circles.

Annual Incomeand Other Non-Individual Taxpayer Tax Return For Corporation, Partnership

Fiscal 3 Amended Return? Yes No 4 Short Period Return? Yes Background Information 7 RDO Code No 5 Alphanumeric Tax Code (ATC) IC 055

BIR Form

November 2011 (ENCS) TO BE FILED IN THREE (3) COPIES: (1) BIR FILE COPY (2) BIR ENCODING COPY (3) TAXPAYER FILE COPY Minimum Corporate Income Tax (MCIT)

1 2

For the Year Ended

Calendar

(MM/YYYY) Part 1 6 Taxpayer Identification Number (TIN) 9 Taxpayer's Name 10 Registered Address

8 Date of Incorporation (MM/DD/YYYY)

(Unit/Room Number/Floor) (Lot Number Block Number Phase Number (Subdivision/Village) (Municipality/City) 12 E-mail Address 14 Method of Deduction Itemized Deduction 15 Are you availing of Tax Relief under Special or International Tax Treaty? 15A/B 15C/D/E 15F/G/H 15I/J Investment Promotion Agency (IPA) Legal Basis Registered Activity/Program (Registration Number) Special Tax Rate Effectivity Date of Tax Relief 15K/L/M From (MM/DD/YYYY) (MM/DD/YYYY) 15N/O/P To 15A 15C 15F No Yes If yes, fill out spaces below: Exempt 15B 15D 15G 15I % 15L 15O Computation of Tax Exempt 16 17 18 19 20 Special Rate (Province) Building Number)

(Building Name) (Street Name) (Barangay) (Zip Code)

11 Contact Number 13 Line of Business

Optional Standard Deduction (OSD)

Special Rate 15E 15H 15J

Regular/Normal Rate (Special Tax Relief)

% 15M 15P Regular/Normal Rate

15K 15N

Part II

Sales/Revenues/Receipts/Fees (from Item 80J/K/L)* Less: Cost of Sales/Services (from Item 81J/K/L)* Gross Income from Operation (Item 16 less Item 17) (from Item 82J/K/L)* Add: Other Taxable Income not Subjected to Final Tax (from Item 83J/K/L)* Total Gross Income (Sum of Item 18 & 19)(from Item 84J/K/L)* Less: Allowable Deductions 21 Optional Standard Deduction (40% of Item 20)(from Item 85J/K/L)*

OR

16A 17A 18A 19A 20A 21A 22A

16B 17B 18B 19B 20B 21B 22B

16C 17C 18C 19C 20C 21C 22C

22 Regular Allowable Itemized Deductions (from Item 86J/K/L)* 23 Special Allowable Itemized Deductions (specify) (from Item 87J/K/L/V/W/X)*

Incentive Legal Basis

23A/B/C 23D/E/F 24 Allowance for NOLCO (from Item 57) 25 Total Itemized Deductions (Sum of Items 22, 23 & 24)(from Ite 89J/K/L)*

*If with multiple activities per tax regime, use Supplemental Form (Schedule 4)

23A 23D 24A 25A

23B 23E 24B 25B

23C 23F 24C 25C

Exempt 26 Net Taxable Income (Item 20 less Item 21 OR Item 25) (from Item 90J/K/L)* 27 Applicable Income Tax Rate (i.e., special rate or regular/normal rate) 28 Income Tax Due other than MCIT (Item 26 x Item 27) 29 Less: Share of Other Agencies 30 Net Income Tax Due to National Government (Item 28B less Item 29) 31 MCIT (2% of Gross Income in Item 20C) 32 Income Tax Due (MCIT in Item 31 or Normal Income Tax in Item 28C, whichever is higher) 33 Less: Tax Credits/Payments (attach proof) 33A Prior Year's Excess Credits Other Than MCIT 33B 33C 33D Income Tax Payment under MCIT from Previous Quarter/s Income Tax Payment under Regular/Normal Rate from Previous Quarter/s Excess MCIT Applied this Current Taxable Year 33E 33G 33I 33K 33M 33N 33O 33Q 34A 26A 27A 28A

Special Rate

BIR Form No. 1702 - page 2 Regular/Normal Rate 27B

26B % 28B 29 30

26C % 28C 27C

31 32 33A 33B 33C 33D

33E/F Creditable Tax Withheld from Previous Quarter/s 33G/H Creditable Tax Withheld per BIR Form No. 2307 for the Fourth Quarter 33I/J 33M 33N Foreign Tax Credits, if applicable Income Tax Payment under Special Rate from Previous Quarter/s Special Tax Credits (from Item 44) (from Item 103J/K/L)* 33K/L Tax Paid in Return Previously Filed, if this is an Amended Return

33O/P Other Credits/Payments, specify________________________ 33Q/R Total Tax Credits/Payments (Sum of Items 33E, G, I, K, M, N & O/ 33A, B, C, D, F, H, J, L & P) 34 Net Tax Payable/(Overpayment) (Item 30 less Item 33Q/ Item 32 less Item 33R) 35 Aggregate Tax Payable/(Overpayment) (Sum of Item 34A & 34B) 36 Add: Penalties 36A Surcharge 36B Interest 36C Compromise 36D Total Penalties (Sum of Items 36A, 36B & 36C)

35 36A 36B 36C 36D 37

33F 33H 33J 33L

33P 33R 34B

37 Total Amount Payable/(Overpayment) (Sum of Item 35 & 36D) If overpayment, shade one circle only (once the choice is made, the same is irrevocable): To be refunded To be issued a Tax Credit Certificate (TCC) Tax Relief Availment Part III Exempt 38A 38 Regular Income Tax Otherwise Due (30% of the Total of Item 23 & 26) (from Item 97J/K/L)* 38B 39B 39A 39 Less: Income Tax Due (from Item 28) (from Item 98J/K/L)* 40A 40 Tax Relief Availment before Special Tax Credit (Item 38 less Item 39) (from Item 99J/K/L) 40B Breakdown of Item 40 41 Tax Relief Availment on Gross/Net Income (Item 26 x 30% less Item 28) (from Item 100J/K/L) 41B 41A 42A 42B 42 Tax Relief on Special Allowable Itemized Deductions (Item 23 x 30%) (from Item 101J/K/L) 43 Sub Total of Item 41 & 42 which is equal to Item 40 (from Item 102J/K/L) 43A 43B 44 Special Tax Credit (from Item 103J/K/L) 45 Total Tax Relief Availment (Sum ot Item 43 & 44) (from Item 104J/K/L) Part IV Particulars 46 47 48 49

Cash/Bank Debit Memo 46A

To be carried over as tax credit for next year/quarter Special Rate Regular/Normal Rate

Amount

38C 39C 40C 41C 42C 43C 44C 45C

Stamp of Receiving Office/AAB and Date of Receipt (RO's Signature/Bank Teller's Initial)

44A 45A Details of Payment Number 46B 47B 48A 49B 46C 47C 48B 49C

Date (MM/DD/YYYY)

44B 45B

Drawee Bank/Agency 47A 49A

Check Tax Debit Memo Others

46D 47D 48C 49D

NOTE: Read Guidelines and Instructions on Page 4. *If with multiple activities per tax regime, use Supplemental Form (Schedule 4)

- THIS FORM IS NOT FOR SALE -

BIR Form No. 1702 - page 3

Schedule 1 50 Gross Income 51 Less: Total Deductions exclusive of NOLCO & Deductions under Special Laws 52 Net Operating Loss Carry Over (to Schedule 1A) Schedule 1A Year Incurred 53 54 55 56 53A 54A 55A 56A Net Operating Loss Amount Computation of Available Net Operating Loss Carry Over (NOLCO) (attach additional sheet/s, if necessary) Net Operating Loss Carry Over (NOLCO) Applied Previous Year Applied Current Year Computation of Net Operating Loss Carry Over (NOLCO) 50 51 52

Expired

Net Operating Loss (Unapplied)

53B 54B 55B 56B

53C 54C 55C 56C 57

57 Total (Sum of Items 53C, 54C, 55C & 56C) (to Item 24) Schedule 2 Year 58 59 60 61 Schedule 3 62 Net Income/(Loss) per books Add: Non-deductible Expenses/Taxable Other Income 63 64 65 Total (Sum of Items 62, 63 & 64) Less: Non-taxable Income and Income Subjected to Final Tax 66 67 Special Deductions 68 69 70 Total (Sum of Items 66, 67, 68 & 69) 71 Net Taxable Income/(Loss) (Item 65 less Item 70) Normal Income Tax as adjusted MCIT

53D 54D 55D 56D

53E 54E 55E 56E

Computation of Excess Minimum Corporate Income Tax (MCIT) of Previous Year Excess MCIT over Normal Income Tax as adjusted Balance MCIT Still Allowable as Tax Credit

Expired/Used Portion of Excess MCIT

Excess MCIT Applied this Current Taxable Year

Regular/Normal Rate 62B 63B 64B 65B 66B 67B 68B 69B 70B 71B

Reconciliation of Net Income Per Books Against Taxable Income (attach additional sheet/s, if necessary) Special Rate 62A 63A 64A 65A 66A 67A 68A 69A 70A 71A

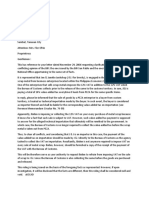

We declare under the penalties of perjury, that this annual return has been made in good faith, verfied by us, and to the best of our knowledge and belief, is true and correct, pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof. 72 President/Vice President/Principal Officer/Accredited Tax Agent (Signature over Printed Name) Title/Position of Signatory Tax Agent Accreditation No./Atty's Roll No. (if applicable) Date of Issuance 75 Place of Issue TIN of Signatory Date of Expiry 73 Treasurer/Assistant Treasurer (Signature over Printed Name) Title/Position of Signatory TIN of Signatory 76 Date of Issue (MM/DD/YYYY) 77 Amount ATC

DESCRIPTION DOMESTIC CORPORATION

74 Community Tax Certificate Number

TAX RATE

30% 2% 10% 30% 2% 10% 30% 2% 30% 2% 30% 2% 30% 2%

TAX BASE

Taxable Income from All Sources Gross Income Taxable Income from All Sources Taxable Income from All Sources Gross Income Taxable Income from All Sources Taxable Income from All Sources Gross Income Taxable Income from All Sources Gross Income Taxable Income from Proprietary Activities Gross Income Taxable Income from All Sources Gross Income

ATC IC 011 IC 010 IC 021 IC 070 IC 055 IC 080 IC 101 IC 190 IC 191

DESCRIPTION DOMESTIC CORPORATION

TAX RATE

0% 30% exempt

TAX BASE

IC 010 1. a. In General IC 055 b. Minimum Corporate Income Tax IC 030 2. Proprietary Educational Institutions a. Proprietary Educational Institution whose gross income from unrelated trade, business or other activity exceeds fifty percent (50%) of the total gross income from all sources. IC 055 b. Minimum Corporate Income Tax IC 031 3. Non-Stock, Non-Profit Hospitals a. Non-Stock, Non-Profit Hospirals whose gross income from unrelated trade, business or other activity exceeds fifty percent (50%) of the total gross income from all sources. IC 055 b. Minimum Corporate Income Tax IC 040 4. a. Government Owned and Controlled Corporations(GOCC), Agencies & Instrumentalities IC 055 b. Minimum Corporate Income Tax IC 041 5. a. National Government and Local Government Units (LGU) IC 055 b. Minimum Corporate Income Tax IC 020 6. a. Taxable Partnership IC 055 b. Minimum Corporate Income Tax *Please refer to Revenue District Offices

7. Exempt Corporation a. On Exempt Activities b. On Taxable Activities 8. General Professional Partnership 9. Corporation covered by Special Law* RESIDENT FOREIGN CORPORATION 1. a. In General b. Minimum Corporate Income Tax 2. International Carriers 3. Regional Operating Headquarters* 4. Corporation covered by Special Law* 5. Offshore Banking Units (OBUs) a. Foreign Currency Transaction not subjected to Final Tax b. Other than Foreign Currency Transaction 6. Foreign Currency Deposit Units (FCDU) a. Foreign Currency Transacti.on not subjected to Final Tax b. Other than Foreign Currency Transaction

Taxable Income from All Sources

30% 2% 2.5% 10%

Taxable Income from Within the Philippines Gross Income Gross Philippine Billing Taxable Income

10% 30% 10% 30%

Gross Taxable Income on Foreign Currency Transactions not subjected to Final Tax Taxable Income Other Than Foreign Currency Transaction Gross Taxable Income on Foreign Currency Transactions not subjected to Final Tax Taxable Income Other Than Foreign Currency Transaction

Supplemental Form for BIR Form No. 1702 - page 1

Schedule 4 Section 1 74 Tax Regime (e.g., Exempt, Special, Regular) 75 Investment Promotion Agency (IPA) 76 Legal Basis 77 Registered Activity/Program (Registration Number) 78 Special Tax Rate 79 Effectivity Date of Tax Relief From (MM/DD/YYYY) To Section 2 80 Sales/Revenues/Receipts/Fees (net of Sales Return, Allowances & Discounts) 81 Less: Cost of Sales/Services 82 Gross Income from Operation (Item 80 less Item 81) 83 Add: Other Taxable Income not Subjected to Final Tax 84 Total Gross Income/Gross Taxable Income (Sum of Items 82 & 83) Less: Allowable Deductions 85 Optional Standard Deduction (OSD) (40% of Gross Income in Item 84) OR Allowable Itemized Deductions 86 Regular Allowable Itemized Deductions 87 Special Allowable Itemized Deductions (specify) Legal Basis Incentive 87A 87M 88 Allowance for NOLCO (from Item 57) 89 Total Itemized Deductions (Sum of Items 86, 87 & 88) 90 Net Taxable Income/Net Income (Item 84 less Item 85 OR Item 89) 91 Applicable Income Tax Rate (i.e., special or regular/normal rate) 92 Income Tax Due other than MCIT (Item 90 x Item 91) 93 Less: Share of Other Agencies 94 Net Income Tax Due to National Government (Item 92 less Item 93) 95 MCIT (2% of Gross Income in Item 84) 96 Income Tax Due (Normal Income Tax in Item 92 or MCIT in Item 95, whichever is higher) Section 3 97 Regular Income Tax Otherwise Due (30% of the total of Items 87 & 90) 98 Less: Income Tax Due (from Item 92) 99 Tax Relief Availment before Special Tax Credit (Item 97 less Item 98) Breakdown of Item 99 97A 98A 99A 92A 93A 94A 95A 96A 88A 89A 90A 91A 86A 85A 80A 81A 82A 83A 84A (MM/DD/YYYY) 79A 79J 79B 79K 79C 79L Computation of Tax per Activity 80B 81B 82B 83B 84B 85B 86B 80C 81C 82C 83C 84C 85C 86C 80D 81D 82D 83D 84D 85D 86D 80E 81E 82E 83E 84E 85E 86E 80F 81F 82F 83F 84F 85F 86F 79D 79M 79E 79N 79F 79O 74A 75A 76A 77A 78A 74B 75B 76B 77B Tax Relief Under Special Law/International Tax Treaty Taxpayer's Activity Profile 74C 75C 76C 77C 78B 74D 75D 76D 77D 78C 74E 75E 76E 77E 78D 74F 75F 76F 77F 78E

78F

87B 87N 88B 89B 90B 91B 92B 93B 94B 95B 96B

87C 87O 88C 89C 90C 91C 92C 93C 94C 95C 96C Tax Relief Availment

87D 87P 88D 89D 90D 91D 92D 93D 94D 95D 96D

87E 87Q 88E 89E 90E 91E 92E 93E 94E 95E 96E

87F 87R 88F 89F 90F 91F 92F 93F 94F 95F 96F

97B 98B 99B

97C 98C 99C

97D 98D 99D

97E 98E 99E

97F 98F 99F

100 Tax Relief Availment on Gross/Net Income [Item 90 x 30% less Item 92) 101 Tax Relief on Special Allowable Itemized Deductions (Item 87 x 30%) 102 Sub Total of Item 100 & 101 which is equal to Item 99 103 Special Tax Credit 104 Total Tax Relief Availment (Sum ot Item 102 & 103)

100A 101A 102A 103A 104A

100B 101B 102B 103B 104B

100C 101C 102C 103C 104C

100D. 101D 102D 103D 104D

100E 101E 102E 103E 104E

100F 101F 102F 103F 104F

Supplemental for BIR Form No. 1702 - page 2

Continuation of Schedule 4 Section 1 74 Tax Regime (e.g., Exempt, Special, Regular) 75 Investment Promotion Agency (IPA) 76 Legal Basis 77 Registered Activity/Program (Registration Number) 78 Special Tax Rate 79 Effectivity Date of Tax Relief From (MM/DD/YYYY) To Section 2 80 Sales/Revenues/Receipts/Fees (net of Sales Return, Allowances & Discounts) 81 Less: Cost of Sales/Services 82 Gross Income from Operation (Item 80 less Item 81) 83 Add: Other Taxable Income not Subjected to Final Tax 84 Total Gross Income/Gross Taxable Income (Sum of Items 82 & 83) Less: Deductions 85 Optional Standard Deduction (OSD) (40% of Gross Income in Item 84) OR Allowable Itemized Deductions 86 Regular Allowable Itemized Deductions 87 Special Allowable Itemized Deductions (specify) Legal Basis Incentive 87G 87S 88 Allowance for NOLCO (from Item 57) 89 Total Itemized Deductions (Sum of Items 86, 87 & 88) 90 Net Taxable Income/Net Income (Item 84 less Item 85 OR Item 89) 91 Applicable Income Tax Rate (i.e., special or regular/normal rate) 92 Income Tax Due other than MCIT (Item 90 x Item 91) 93 Less: Share of Other Agencies 94 Net Income Tax Due to National Government (Item 92 less Item 93) 95 MCIT (2% of Gross Income in Item 84) 96 Income Tax Due (Normal Income Tax in Item 92 or MCIT in Item 95, whichever is higher) Section 3 97 Regular Income Tax Otherwise Due (30% of the total of Items 87 & 90) 98 Less: Income Tax Due (from Item 92) 99 Tax Relief Availment before Special Tax Credit (Item 97 less Item 98) Breakdown of Item 99 97G 98G 99G 92G 93G 94G 95G 96G 88G 89G 90G 91G 86G 85G 80G 81G 82G 83G 84G (MM/DD/YYYY) 79G 79P 79H 79Q 79I 79R Computation of Tax per Activity TOTAL EXEMPT TOTAL SPECIAL TOTAL REGULAR 80H 81H 82H 83H 84H 85H 86H 80I 81I 82I 83I 84I 85I 86I 80J 81J 82J 83J 84J 85J 86J 80K 81K 82K 83K 84K 85K 86K 80L 81L 82L 83L 84L 85L 86L 74G 75G 76G 77G 78G 74H 75H 76H 77H Tax Relief Under Special Law/International Tax Treaty Taxpayer's Activity Profile 74I 75I 76I 77I 78H

78I

87H 87T 88H 89H 90H 91H 92H 93H 94H 95H 96H

87I 87U 88I 89I 90I 91I 92I 93I 94I 95I 96I Tax Relief Availment

87J 87V 88J 89J 90J 91J 92J

87K 87W 88K 89K 90K 91K 92K 93J 94J

87L 87X 88L 89L 90L 91L 92L

95J 96J

97H 98H 99H

97I 98I 99I

97J 98J 99J

97K 98K 99K

97L 98L 99L

100 Tax Relief Availment on Gross/Net Income [Item 90 x 30% less Item 92) 101 Tax Relief on Special Allowable Itemized Deductions (Item 87 x 30%) 102 Sub Total of Item 100 & 101 which is equal to Item 99 103 Special Tax Credit 104 Total Tax Relief Availment (Sum ot Item 102 & 103)

100G 101G 102G 103G 104G

100H 101H 102H 103H 104H

100I 101I 102I 103I 104I

100J 101J 102J 103J 104J

100K 101K 102K 103K 104K

100L 101L 102L 103L 104L

BIR Form No. 1702 - page 4

GUIDELINES AND INSTRUCTIONS

Who Shall File Every corporation, partnership no matter how created or organized, joint stock companies, joint accounts, associations (except foreign corporation not engaged in trade or business in the Philippines and joint venture or consortium formed for the purpose of undertaking construction projects or engaging in petroleum, coal, geothermal and other energy operations), government-owned or controlled corporations, agencies and instrumentalities shall render a true and accurate income tax return in accordance with the provisions of the Tax Code. The return shall be filed by the president, vice-president or other principal officer, and shall be sworn to by such officer and by the treasurer or assistant treasurer. Every general professional partnership (GPP) shall file this return setting forth the items of gross income and of deductions and the names, TINs, addresses and shares of each of the partners. When and Where to File and Pay A. For Electronic Filing and Payment System (eFPS) Taxpayer The return shall be e-filed and the tax shall be e-paid on or before the 15th day of the fourth month following the close of the taxpayers taxable year using the eFPS facilities thru the BIR website http//www.bir.gov.ph. B. For Non-Electronic Filing and Payment System (Non-eFPS) Taxpayer The return shall be filed and the tax shall be paid on or before the 15th day of the fourth month following the close of the taxpayer's taxable year with any Authorized Agent Bank (AAB) located within the territorial jurisdiction of the Revenue District Office (RDO) where the taxpayers principal office is registered. In places where there are no AABs, the return shall be filed and the tax shall be paid with the concerned Revenue Collection Officer (RCO) under the jurisdiction of the RDO. In case of NO PAYMENT RETURNS the same shall be filed with the RDO where the taxpayers principal office is registered or with the concerned RCO under the same RDO. Rate of Income Tax The regular/normal rate of income tax is 30% of net taxable income. However, preferential/special rate is accorded to a taxpayer pursuant to the provisions of the Tax Code and/or any prevailing special laws. Minimum Corporate Income Tax (MCIT) A minimum corporate income tax (MCIT) of two percent (2%) of the gross income is imposed upon any domestic corporation and resident foreign corporation beginning on the fourth (4th) taxable year (whether calendar or fiscal year, depending on the accounting period employed) immediately following the taxable year in which such corporation commenced its business operation. The MCIT shall be imposed whenever the corporation has zero or negative taxable income or whenever the amount of minimum corporate income tax is greater than the normal income tax due from such corporation. Any excess of the MCIT over the normal income tax shall be carried forward and credited against the normal income tax for the three (3) immediate succeeding taxable years. The computation and the payment of MCIT shall apply each time a corporate income tax return is filed, whether quarterly or annual basis. Deductions A corporation shall choose either the itemized or optional standard deduction. It shall indicate the choice by marking with X the appropriate box, otherwise, the corporation shall be considered as having availed of the itemized deduction. Such choice made in the initial quarterly return during the taxable year is irrevocable for the said year for which the return is made. Optional Standard Deduction (OSD) A maximum of 40% of the gross income shall be allowed as deduction in lieu of the itemized deduction. However, a corporation who availed and claimed this deduction is still required to submit its financial statements when it files its annual tax return and to keep such records pertaining to its gross income. Regular Allowable Itemized Deduction There shall be allowed as deduction from gross income all the ordinary and necessary trade and business expenses paid or incurred during the taxable year in carrying on or which are directly attributable to the development, management, operation and/or conduct of the trade and business. Itemized deduction includes also interest, taxes, losses, bad debts, depreciation, depletion, charitable and other contributions, research and development and pension trust. Special Allowable Itemized Deduction There shall be allowable deduction from gross income in computing taxable income, in addition to the regular allowable itemized deduction, as provided under the existing regular and special laws, rules and issuances such as, but not limited to, Rooming-in and Breastfeeding Practices under R.A. 7600, Adopt-a-School Program under R.A. 8525, Senior Citizen Discount under R.A. 9257, Free Legal Assistance under R.A. 9999. Tax Relief Availment Taxpayer availing of any tax relief under the Tax Code and/or any prevailing special laws [e.g., Income Tax Holiday (ITH), preferential income tax rate, income tax exemption, additional special deductions, etc.] must completely fill-up Schedule 1 showing the details for each and every registered activity and/or program. In case the columns provided in Schedule 1 in the tax form proper are not adequate to cover all the registered activities, additional sheets of Schedule 1 must be accomplished, clearly indicating therein the number of sheets used in the said schedules, and the same must be filed together with the tax form proper. Other Special Tax Credit refers to tax credit allowed under special laws, rules and issuances such as, but not limited to, 50% of training expenses under R.A. 7916. Tax Refund/Credit An excess of the total tax credits/payments over the actual income tax due computed in the final adjusted return may be refunded or issued with the Tax Credit Certificate to the taxpayer or credited against its estimated income tax liabilities for the quarters of the succeeding taxable years. The taxpayer shall exercise its option by marking with an "x" the appropriate box, which option shall be considered irrevocable for that taxable period. Thus, once the taxpayer opted to carry-over and apply the excess income tax against income tax due for the succeeding taxable year, no application for cash refund or issuance of a tax credit certificate shall be allowed. In case the taxpayer fails to signify its choice, the excess payment shall be automatically carried-over to the next taxable period. Penalties There shall be imposed and collected as part of the tax: 1. A surcharge of twenty five percent (25%) for each of the following violations: a) Failure to file any return and pay the amount of tax or installment due on or before the due dates; b) Unless otherwise authorized by the Commissioner, filing a return with a person or office other than those with whom it is required to be filed; c) Failure to pay the full or part of the amount of tax shown on the return, or the full amount of tax due for which no return is required to be filed, on or before the due date; d) Failure to pay the deficiency tax within the time prescribed for its payment in the notice of assessment. 2. A surcharge of fifty percent (50%) of the basic tax or of the deficiency tax shall be imposed in case of willful neglect to file the return within the period prescribed by the Tax Code and/or by rules and regulations or in case a false or fraudulent return is filed. 3. Interest at the rate of twenty percent (20%) per annum on any unpaid amount of tax, from the date prescribed for the payment until it is fully paid. 4. Compromise penalty, pursuant to existing/applicable revenue issuances. Attachments Required 1. Certificate of independent CPA duly accredited by the BIR (The CPA Certificate is required if the gross quarterly sales, earnings, receipts or output exceed P 150,000). 2. Supplemental Form (Schedule 4) for taxpayers with multiple activities per tax regime. 3. Account Information Form (AIF) and/or Financial Statements (FS), including the following schedules prescribed under existing revenue issuances which must form part of the Notes to the audited FS: a. Sales/Receipts/Fees b. Cost of Sales/Services c. Non-Operating and Taxable Other Income d. Itemized Deductions (if taxpayer did not avail of OSD) e. Taxes and Licenses f. Other information prescribed to be disclosed in the notes to FS 4. Statement of Managements Responsibility (SMR) for Annual Income Tax Return. 5. Certificate of Income Payments not subjected to Withholding Tax (BIR Form No. 2304). 6. Certificate of Creditable Tax Withheld at Source (BIR Form No. 2307). 7. Duly approved Tax Debit Memo, if applicable. 8. Proof of prior years' excess credits, if applicable. 9. Proof of Foreign Tax Credits, if applicable. 10. For amended return, proof of tax payment and the return previously filed. 11. Certificate of Tax Treaty Relief/Entitlement issued by the concerned Investment Promotion Agency (IPA). 12. Summary Alphalist of Withholding Agents of Income Payments Subjected to Withholding Tax at Source (SAWT), if applicable. 13. Proof of other tax payment/credit, if applicable. 14. Schedule for returns filed by General Professional Partnership. NAME TIN ADDRESS SHARE OF EACH PARTNER

Note: All Background information must be properly filled up. All returns filed by an accredited tax agent on behalf of a taxpayer shall bear the following information: A. For CPAs and others (individual practitioners and members of GPPs); a.1 Taxpayer Identification Number (TIN); and a.2 Certificate of Accreditation Number, Date of Issuance, and Date of Expiry. B. For members of the Philippine Bar (individual practitioners, members of GPPs); b.1 Taxpayer Identification Number (TIN); and b.2 Attorneys Roll number or Accreditation Number, if any. ENCS

You might also like

- General Ledger SampleDocument3 pagesGeneral Ledger SampleBusinessTips.Ph80% (15)

- Civil Law Golden NotesDocument846 pagesCivil Law Golden NotesAnnie Mendes90% (20)

- 2307Document2 pages2307Nephy Bersales Taberara67% (3)

- GAD Plan and Budget - DepEdDocument44 pagesGAD Plan and Budget - DepEdverneiza balbastroNo ratings yet

- Partnership and CorporationDocument15 pagesPartnership and CorporationXyrene Keith MedranoNo ratings yet

- General Journal SampleDocument2 pagesGeneral Journal SampleBusinessTips.Ph89% (19)

- 1604C Alphalist Format Jan 2018 Final2Document2 pages1604C Alphalist Format Jan 2018 Final2Mikho RaquelNo ratings yet

- Payment Form: Kawanihan NG Rentas InternasDocument3 pagesPayment Form: Kawanihan NG Rentas InternasglydelNo ratings yet

- Bir Forms PDFDocument4 pagesBir Forms PDFgaryNo ratings yet

- New Income Tax Return BIR Form 1701 - November 2011 RevisedDocument6 pagesNew Income Tax Return BIR Form 1701 - November 2011 RevisedBusinessTips.Ph100% (4)

- New Income Tax Return BIR Form 1701 - November 2011 RevisedDocument6 pagesNew Income Tax Return BIR Form 1701 - November 2011 RevisedBusinessTips.Ph100% (4)

- Annex B-2 RR 11-2018Document1 pageAnnex B-2 RR 11-2018Princess RegalaNo ratings yet

- GFFS General Form Rev 20061Document14 pagesGFFS General Form Rev 20061Genesis Manalili100% (1)

- PFF053 MembersContributionRemittanceForm V02-FillableDocument2 pagesPFF053 MembersContributionRemittanceForm V02-FillableCYvelle TorefielNo ratings yet

- Annex B-2 RR 11-2018Document1 pageAnnex B-2 RR 11-2018Kristine JoyceNo ratings yet

- Particulars As Furnished by The Shipper: Carrier'S ReceiptDocument1 pageParticulars As Furnished by The Shipper: Carrier'S ReceiptMOUSTAPHA gueyeNo ratings yet

- Annual Income Tax ReturnDocument6 pagesAnnual Income Tax ReturnZweetzzy PenafloridaNo ratings yet

- BIR Form 1702 (November 2011)Document18 pagesBIR Form 1702 (November 2011)Jecon BonsucanNo ratings yet

- Sample Trial BalanceDocument1 pageSample Trial BalanceBusinessTips.PhNo ratings yet

- Requirements for securing tax clearanceDocument1 pageRequirements for securing tax clearanceDenzel Edward Cariaga100% (2)

- David V AgbayDocument3 pagesDavid V AgbayKyle BanceNo ratings yet

- Sample SMRDocument3 pagesSample SMRArjam B. BonsucanNo ratings yet

- Sworn Statement For Tax Clearance SampleDocument1 pageSworn Statement For Tax Clearance SampleRachel ChanNo ratings yet

- 2004 BIR Ruling on Property TransferDocument2 pages2004 BIR Ruling on Property TransferPhoebe SpaurekNo ratings yet

- REM 5 Real Estate Planning and DevelopmentDocument40 pagesREM 5 Real Estate Planning and Developmentrochel100% (12)

- Guidelines On Applying For BOI RegistrationDocument12 pagesGuidelines On Applying For BOI RegistrationCarol DonsolNo ratings yet

- 1601E BIR FormDocument7 pages1601E BIR FormAdonis Zoleta AranilloNo ratings yet

- Pbcom V CirDocument9 pagesPbcom V CirAbby ParwaniNo ratings yet

- Promissory Note For The City TreasurerDocument1 pagePromissory Note For The City Treasurerfaith rollanNo ratings yet

- 0619-E Jan 2018 Rev Final - FFDocument1 page0619-E Jan 2018 Rev Final - FFthis is my nameNo ratings yet

- Sworn Application For Tax Clearance: Annex CDocument1 pageSworn Application For Tax Clearance: Annex CJose Edmundo DayotNo ratings yet

- Case Digest Jaca V People - G.R. No. 166967 - Case DigestDocument2 pagesCase Digest Jaca V People - G.R. No. 166967 - Case DigestJamesHarvey100% (1)

- 1702 NewDocument11 pages1702 NewDIVINE WAGTINGANNo ratings yet

- 1601EDocument7 pages1601EEnrique Membrere SupsupNo ratings yet

- 1601e Form PDFDocument3 pages1601e Form PDFLee GhaiaNo ratings yet

- AUTHORIZATION TO QUERY BSP RECORDSDocument1 pageAUTHORIZATION TO QUERY BSP RECORDSApril NNo ratings yet

- Tax Bulletin by SGV As of Oct 2014Document18 pagesTax Bulletin by SGV As of Oct 2014adobopinikpikanNo ratings yet

- China Banking Corporation Bir E-Fps Payment Manual: May 2011 V 6.0Document48 pagesChina Banking Corporation Bir E-Fps Payment Manual: May 2011 V 6.0KyonNo ratings yet

- BTAC Course Provides Tax Basics for New BIR EmployeesDocument7 pagesBTAC Course Provides Tax Basics for New BIR EmployeesRommel Cabalhin100% (1)

- Short-Term Loan Remittance Form (STLRF) : HQP-SLF-017Document2 pagesShort-Term Loan Remittance Form (STLRF) : HQP-SLF-017Jo Sh100% (1)

- Annex A.1.1 - Sworn Declaration of Taxpayers ProfileDocument2 pagesAnnex A.1.1 - Sworn Declaration of Taxpayers ProfileKimberly MayNo ratings yet

- SMR - FSDocument1 pageSMR - FSBaldovino VenturesNo ratings yet

- Annual Income Tax Return: I I 0 1 1 I I 0 1 2 I I 0 1 1 I I 0 1 2 I I 0 1 3Document9 pagesAnnual Income Tax Return: I I 0 1 1 I I 0 1 2 I I 0 1 1 I I 0 1 2 I I 0 1 3albertNo ratings yet

- HDMF Contributions and Loan PaymentDocument29 pagesHDMF Contributions and Loan PaymentRocelle IndicoNo ratings yet

- Philippine Council for Agriculture Disallowance NoticeDocument3 pagesPhilippine Council for Agriculture Disallowance NoticeAndrew GarciaNo ratings yet

- Checklist PcabDocument5 pagesChecklist PcabLyka Amascual ClaridadNo ratings yet

- SBMA ID Application FormDocument1 pageSBMA ID Application Formzab04148114No ratings yet

- 1902 - BirDocument2 pages1902 - BirLilian Laurel Cariquitan0% (1)

- Bir Ruling (Da-031-07)Document2 pagesBir Ruling (Da-031-07)Stacy Liong BloggerAccountNo ratings yet

- Prulink Withdrawal Form: Individual PolicyownerDocument3 pagesPrulink Withdrawal Form: Individual PolicyownerMichelle NavaNo ratings yet

- CMO 7-2012 Supplemental Guidelines Automated Export Documentation System Implementation Under E2mDocument9 pagesCMO 7-2012 Supplemental Guidelines Automated Export Documentation System Implementation Under E2mMichael Joseph IgnacioNo ratings yet

- Random Drug Testing Acknowledgment FormDocument2 pagesRandom Drug Testing Acknowledgment FormBudong BernalNo ratings yet

- Esrs Employer Enrollment Form: Employer ID Number Employer/Business Name Pag-IBIG Servicing Branch Employer TypeDocument1 pageEsrs Employer Enrollment Form: Employer ID Number Employer/Business Name Pag-IBIG Servicing Branch Employer TypeGina Garcia100% (1)

- Application For Registration: BIR Form NoDocument2 pagesApplication For Registration: BIR Form NoBernardino PacificAceNo ratings yet

- RR No. 13-98Document16 pagesRR No. 13-98Ana DocallosNo ratings yet

- 1701Q Jan 2018 Final Rev2Document2 pages1701Q Jan 2018 Final Rev2Balot EspinaNo ratings yet

- What is Net Operating Loss Carry-Over (NOLCO)? - Understand NOLCO Deduction RulesDocument9 pagesWhat is Net Operating Loss Carry-Over (NOLCO)? - Understand NOLCO Deduction RulesfebwinNo ratings yet

- Strengthening LGU Role in Mindoro Property Tax CollectionDocument12 pagesStrengthening LGU Role in Mindoro Property Tax CollectionNONI ZERIMARNo ratings yet

- 1702 QDocument3 pages1702 Qappipinnim50% (2)

- Guidelines and Instruction For BIR Form No 1702 RTDocument2 pagesGuidelines and Instruction For BIR Form No 1702 RTRahrahrahn100% (2)

- BIR Form 2316 UndertakingDocument1 pageBIR Form 2316 UndertakingJan Paolo CruzNo ratings yet

- Efps Letter 009Document1 pageEfps Letter 009ElsieJhadeWandasAmandoNo ratings yet

- Expanded Withholding Taxes On Government Income PaymentsDocument172 pagesExpanded Withholding Taxes On Government Income PaymentsBien Bowie A. CortezNo ratings yet

- Annual Income Tax ReturnDocument19 pagesAnnual Income Tax ReturnMarjorie BetchaydaNo ratings yet

- Annual Income Tax Return for CorporationDocument9 pagesAnnual Income Tax Return for CorporationMarvin CeledioNo ratings yet

- Annual Income Tax Return: (To Be Filled Up by The BIR)Document6 pagesAnnual Income Tax Return: (To Be Filled Up by The BIR)keir17No ratings yet

- 1702 Ghai2011Document5 pages1702 Ghai2011Janice CarridoNo ratings yet

- BIR Form 1702 Filing GuideDocument18 pagesBIR Form 1702 Filing GuideBeatriceChuNo ratings yet

- 1702 June 2011Document18 pages1702 June 2011fatmaaleahNo ratings yet

- BIR Form 1702 Annual Income Tax Return GuideDocument6 pagesBIR Form 1702 Annual Income Tax Return GuideMary Monique Llacuna Lagan100% (1)

- Annual Income Tax Return: 0 5 1 SaleDocument6 pagesAnnual Income Tax Return: 0 5 1 Salecaitlin888No ratings yet

- New Income Tax Return BIR Form 1700 - November 2011 RevisedDocument4 pagesNew Income Tax Return BIR Form 1700 - November 2011 RevisedBusinessTips.Ph100% (2)

- Sample Adjusted Trial Balance - BusinessTips - PHDocument1 pageSample Adjusted Trial Balance - BusinessTips - PHBusinessTips.Ph50% (6)

- New Income Tax Return BIR Form 1700 - November 2011 RevisedDocument4 pagesNew Income Tax Return BIR Form 1700 - November 2011 RevisedBusinessTips.Ph100% (2)

- BIR Revenue Regulation No-19-2011Document2 pagesBIR Revenue Regulation No-19-2011BusinessTips.PhNo ratings yet

- Chapter 7 - Good GovernanceDocument13 pagesChapter 7 - Good GovernanceLeonard DavinsonNo ratings yet

- 10 General Accepted Auditing StandardsDocument7 pages10 General Accepted Auditing StandardsAureen TabamoNo ratings yet

- Addendum Number 1 For Module 1 - Camille RamossDocument8 pagesAddendum Number 1 For Module 1 - Camille RamossCamille Rose B RamosNo ratings yet

- ADR Nego PlanDocument4 pagesADR Nego PlanDeeshaNo ratings yet

- 01 of 1995 Rules (E)Document36 pages01 of 1995 Rules (E)Yogeesh VinuNo ratings yet

- Demand and SupplyDocument16 pagesDemand and SupplyGA ahuja Pujabi aaNo ratings yet

- Guide To Complete Joining FormDocument20 pagesGuide To Complete Joining FormAnto JoisenNo ratings yet

- ACCIDENT Sahil Final IpcDocument26 pagesACCIDENT Sahil Final IpcRohit KumarNo ratings yet

- Kajokoto R0002Document104 pagesKajokoto R0002Jacob KasambalaNo ratings yet

- Authorization To Release Medical CertificateDocument1 pageAuthorization To Release Medical CertificatePsychology TodayNo ratings yet

- CMKX ProgramDocument3 pagesCMKX ProgramVincent J. CataldiNo ratings yet

- Show Dont Tell Descriptive Writing Practice WorksheetDocument10 pagesShow Dont Tell Descriptive Writing Practice WorksheetNisa KamaruddinNo ratings yet

- HIS347N2020938180Document8 pagesHIS347N2020938180adrianNo ratings yet

- Pacific University Response To American Association of University ProfessorsDocument3 pagesPacific University Response To American Association of University ProfessorsThe College FixNo ratings yet

- Dashboard - Ethermine - Ethereum (ETH) Mining PoolDocument1 pageDashboard - Ethermine - Ethereum (ETH) Mining PoolkiatolokNo ratings yet

- Pakistan Security ChallengesDocument3 pagesPakistan Security ChallengesSamina HaiderNo ratings yet

- Remedies Lecture One (Only Notes at End of Lecture)Document5 pagesRemedies Lecture One (Only Notes at End of Lecture)Adam 'Fez' FerrisNo ratings yet

- 1 - Growth and Direction of International Trade - PPT - 1Document18 pages1 - Growth and Direction of International Trade - PPT - 1Rayhan Atunu67% (3)

- Course Registration FormDocument1 pageCourse Registration FormaleepNo ratings yet

- Inter Country Adoption SPECPRO PDFDocument56 pagesInter Country Adoption SPECPRO PDFLourd MantaringNo ratings yet

- SBMA Rules and Powers SummaryDocument6 pagesSBMA Rules and Powers SummaryElvira Baconga NeriNo ratings yet

- Judge Flanagan MemoDocument3 pagesJudge Flanagan MemoTodd FeurerNo ratings yet

- Supreme Court rules on employment statusDocument8 pagesSupreme Court rules on employment statusJoshua OuanoNo ratings yet