Professional Documents

Culture Documents

Asset Demand Theory

Uploaded by

Amr ElalfyOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Asset Demand Theory

Uploaded by

Amr ElalfyCopyright:

Available Formats

Asset demand theory : The theory of asset demand states that there are 4 factors that influence the

quantity demanded for an asset , holding all of the other factors constant:: 1. The quantity demanded of an asset is positively related to wealth. 2. The quantity demanded of an asset is positively related to its expected return relative to alternative assets. 3. The quantity demanded of an asset is negatively related to the risk of its returns relative to alternative assets. 4. The quantity demanded of an asset is positively related to its liquidity relative to alternative assets.

Capital Asset Pricing Model (CAPM): is an important tool used to analyze the relationship between risk and rates of return. The primary conclusion of the CAPM is this: The relevant risk of an individual stock is its contribution to the risk of a well-diversified portfolio. A stock might be quite risky if held by itself, butsince about half of its risk can be eliminated by diversification, the stocks relevant risk is its contribution to the portfolios risk, which is much smaller than its stand-alone risk.

Portfolio theory A strategy for managing a portfolio of investments in order to minimize risk and maximize return by having a variety of types of investments An assets risk has two components:(1) diversifiable risk, which can be eliminated by diversification, and (2) market risk, which cannot be eliminated by diversification. This theory recommends that the risk of a particular stock should not be looked at on a standalone basis, but rather in relation to how that particular stock's price varies in relation to the variation in price of the market portfolio. The theory goes on to state that given an investor's preferred level of risk, a particular portfolio can be constructed that maximizes expected return for that level of risk.

Financial intermediaries also promote risk sharing by helping individuals to diversify and thereby lower the amount of risk to which they are exposed. Diversification entails investing in a collection

(portfolio) of assets whose returns do not always move together, with the result that overall risk is lower than for individual assets. Systematic and nonsystematic risk each have another feature that makes the distinction between these two types of risk important. Systematic risk is the part of an assets risk that cannot be eliminated by holding the asset as part of a diversified portfolio, whereas nonsystematic risk is the part of an assets risk that can be eliminated in a diversified portfolio. Understanding these features of systematic and nonsystematic risk leads to the following important conclusion: The risk of a welldiversified portfolio depends only on the systematic risk of the assets in the portfolio. Reference "The Economics of Money, Banking, and Financial Markets", By Frederick S. Mishkin, Seventh edition ( chapter 2 page 32, chapter 4 page 87 , chapter5 appendix 1 page 7) Financial management by MICHAEL C. EHRHARDT & EUGENE F. BRIGHAM thirteenth edition (chapter 6 page 238) http://www.qfinance.com/dictionary/portfolio-theory http://www.investorwords.com/3083/modern_portfolio_theory.html#ixzz1oSOr75Sn

You might also like

- Grade 5 English Module 1 FinalDocument19 pagesGrade 5 English Module 1 FinalAlicia Nhs100% (4)

- Capital Structure TheoriesDocument47 pagesCapital Structure Theoriesamol_more37No ratings yet

- RMM NotesDocument177 pagesRMM NotesVahni SinghNo ratings yet

- Modern Portfolio TheoryDocument16 pagesModern Portfolio TheoryBernard OkpeNo ratings yet

- Capital Asset Pricing Model and Modern Portfolio TheoryDocument12 pagesCapital Asset Pricing Model and Modern Portfolio TheorylordaiztrandNo ratings yet

- Basics of FinanceDocument46 pagesBasics of Financeisrael_zamora6389No ratings yet

- Nature & Scope of Managerial EconomicsDocument9 pagesNature & Scope of Managerial EconomicsSuksham AnejaNo ratings yet

- Specific Factors and Income Distribution: Eleventh Edition, Global EditionDocument69 pagesSpecific Factors and Income Distribution: Eleventh Edition, Global EditionBilge SavaşNo ratings yet

- Theory of Portfolio Investment: A Review of Literature: Worapot Ongkrutaraksa, PH.DDocument8 pagesTheory of Portfolio Investment: A Review of Literature: Worapot Ongkrutaraksa, PH.Dvouzvouz7127No ratings yet

- Management Theory and PracticeDocument55 pagesManagement Theory and Practicesushainkapoor photoNo ratings yet

- Time Series and ForecastingDocument92 pagesTime Series and ForecastingCarie LangaNo ratings yet

- Volvo Working Capital ManagementDocument108 pagesVolvo Working Capital ManagementRaj MurthyNo ratings yet

- Account Receivable ManagementDocument41 pagesAccount Receivable ManagementUtkarsh Joshi100% (2)

- Buad 821 Business Ethics and Corporate GovernanceDocument16 pagesBuad 821 Business Ethics and Corporate GovernanceYemi Jonathan OlusholaNo ratings yet

- Industrial Relations - Unit - 1Document7 pagesIndustrial Relations - Unit - 1ravideva84No ratings yet

- BW LuxuryDocument2 pagesBW LuxuryRsu KambangNo ratings yet

- Occupational Health & Safety Act: Ontario Regulation 851Document15 pagesOccupational Health & Safety Act: Ontario Regulation 851Divya ThomasNo ratings yet

- Micro Ch05 PresentationDocument76 pagesMicro Ch05 PresentationJeeya NdNo ratings yet

- Portfolio TheoryDocument25 pagesPortfolio Theoryray92100No ratings yet

- Organization Behaviour NotesDocument35 pagesOrganization Behaviour Notesjansami22100% (1)

- Financial Statements 2, ModuleDocument4 pagesFinancial Statements 2, ModuleSUHARTO USMANNo ratings yet

- Top 9 Problems Faced by International MarketingDocument4 pagesTop 9 Problems Faced by International MarketingwondesenNo ratings yet

- The Introduction of Industrial RelationsDocument39 pagesThe Introduction of Industrial RelationsNorsiah ShukeriNo ratings yet

- Globalization and Collective Bargaining in NigeriaDocument7 pagesGlobalization and Collective Bargaining in NigeriaAlexander DeckerNo ratings yet

- Ethical Issues in ManagementDocument5 pagesEthical Issues in ManagementPaul A. Dobiesz IINo ratings yet

- 7 Ethical Issues Faced by Human Resource ProfessionalsDocument4 pages7 Ethical Issues Faced by Human Resource ProfessionalsgaprabaaNo ratings yet

- Types of Entrepreneurs: BY AMBROSE TUBENAWE 0772467417Document4 pagesTypes of Entrepreneurs: BY AMBROSE TUBENAWE 0772467417tubenaweambrose0% (1)

- Evolution of Business EthicsDocument6 pagesEvolution of Business Ethicsjyotz777No ratings yet

- Trade UnionismDocument16 pagesTrade UnionismBhavika BaliNo ratings yet

- Industrial Relations and Labour Laws Trade UnionismDocument27 pagesIndustrial Relations and Labour Laws Trade UnionismSatadru ChakrabortyNo ratings yet

- Quick Notes Financial ManagementDocument29 pagesQuick Notes Financial ManagementBallavi Rani100% (1)

- Self Check ExerciseDocument12 pagesSelf Check ExerciseBhargav D.S.No ratings yet

- Capital Asset Pricing ModelDocument24 pagesCapital Asset Pricing ModelDevikaNo ratings yet

- Institute of Management, Nirma University: Industrial ConflictsDocument7 pagesInstitute of Management, Nirma University: Industrial ConflictsSaransh Sk BagdiNo ratings yet

- Collective BargainingDocument5 pagesCollective BargainingDharmish ShahNo ratings yet

- Collective BargainingDocument9 pagesCollective BargainingCasandra WilliamsNo ratings yet

- Economics For Managerial Decision MakingDocument3 pagesEconomics For Managerial Decision Makingkamalyadav73373No ratings yet

- Wages and Salary AdministrationDocument47 pagesWages and Salary Administrationsaha apurvaNo ratings yet

- Key Differences Between Correlation and RegressionDocument2 pagesKey Differences Between Correlation and RegressionRemigi CosmasNo ratings yet

- Aggregate PlanningDocument3 pagesAggregate PlanningAdityaNo ratings yet

- Corporate FinanceDocument19 pagesCorporate Financer_m_hanif4308No ratings yet

- Bond ValuationDocument3 pagesBond ValuationNoman Khosa100% (1)

- Time Value of MoneyDocument21 pagesTime Value of MoneyNikhil PatilNo ratings yet

- Industrial DisputesDocument2 pagesIndustrial DisputesVishal AgarwalNo ratings yet

- Human Resources and CultureDocument27 pagesHuman Resources and Cultureashwani2084No ratings yet

- Topic 2 Tutorial SolutionsDocument2 pagesTopic 2 Tutorial SolutionsLinusChinNo ratings yet

- Chapter 2: The Demand For Money: Learning ObjectivesDocument12 pagesChapter 2: The Demand For Money: Learning Objectiveskaps2385No ratings yet

- 1 What Is Portfolio Performance EvaluationDocument17 pages1 What Is Portfolio Performance EvaluationDarshan GadaNo ratings yet

- Markowitz and Sharpe Theories of Portfolio ManagementDocument25 pagesMarkowitz and Sharpe Theories of Portfolio ManagementTilottoma ChatterjeeNo ratings yet

- Stock ValuationDocument18 pagesStock Valuationdurgesh choudharyNo ratings yet

- IFDocument18 pagesIFKiran MehfoozNo ratings yet

- Introduction To Managerial AcctgDocument33 pagesIntroduction To Managerial AcctgJeffrey Tolentino100% (1)

- Measurement ScalesDocument6 pagesMeasurement ScalesRohit PandeyNo ratings yet

- The Time Value of MoneyDocument5 pagesThe Time Value of MoneyBijay AgrawalNo ratings yet

- Chapter - 05 - Activity - Based - Costing - ABC - .Doc - Filename UTF-8''Chapter 05 Activity Based Costing (ABC)Document8 pagesChapter - 05 - Activity - Based - Costing - ABC - .Doc - Filename UTF-8''Chapter 05 Activity Based Costing (ABC)NasrinTonni AhmedNo ratings yet

- Income Elasticity of DemandDocument14 pagesIncome Elasticity of DemandAamir Shahid ヅNo ratings yet

- MUSEDocument12 pagesMUSEmuse tamiruNo ratings yet

- The Portfoli Theory: Systematic Risk - These Are Market Risks That Cannot Be Diversified Away. InterestDocument12 pagesThe Portfoli Theory: Systematic Risk - These Are Market Risks That Cannot Be Diversified Away. Interestmuse tamiruNo ratings yet

- Investment Chapter 6 BodieDocument2 pagesInvestment Chapter 6 BodieBakpao CoklatNo ratings yet

- Finman3 Report DiscussionDocument5 pagesFinman3 Report DiscussionFlorence CuansoNo ratings yet

- Chapter 7Document6 pagesChapter 7Muhammed YismawNo ratings yet

- Powerpoint Concept Smjhne Security-Analysis-and-Portfolo-Management-Unit-4-Dr-Asma-KhanDocument66 pagesPowerpoint Concept Smjhne Security-Analysis-and-Portfolo-Management-Unit-4-Dr-Asma-KhanShailjaNo ratings yet

- Portfolio TheoryDocument3 pagesPortfolio TheoryZain MughalNo ratings yet

- Microfinance Pulse Report Oct 2019-Equifax PDFDocument28 pagesMicrofinance Pulse Report Oct 2019-Equifax PDFEshani ShahNo ratings yet

- Business Combination Part 2Document4 pagesBusiness Combination Part 2Charizza Amor TejadaNo ratings yet

- Lesson 1Document47 pagesLesson 1WilsonNo ratings yet

- Cost of Capital and Capital Structure PlanningDocument32 pagesCost of Capital and Capital Structure PlanningAshiq NobitaNo ratings yet

- Quiz 1 Matbis Revised Without Key AnswerDocument18 pagesQuiz 1 Matbis Revised Without Key AnswerNadya Estefania Brenaita SurbaktiNo ratings yet

- CPChap 1Document38 pagesCPChap 1Phương DaoNo ratings yet

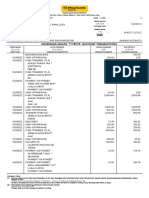

- MBBsavings - 164017 212412 - 2022 08 31 PDFDocument4 pagesMBBsavings - 164017 212412 - 2022 08 31 PDFAdeela fazlinNo ratings yet

- Introduction To Depository Institutions Info Sheet 2 2 1 f1Document5 pagesIntroduction To Depository Institutions Info Sheet 2 2 1 f1api-296017752No ratings yet

- MBAC 6450 Syllabus - Summer 2018 - Session 1Document25 pagesMBAC 6450 Syllabus - Summer 2018 - Session 1Hoang Kim NghiaNo ratings yet

- TVM Stocks and BondsDocument40 pagesTVM Stocks and Bondseshkhan100% (1)

- Fina 004Document4 pagesFina 004Mike RajasNo ratings yet

- ReviewerDocument3 pagesReviewergirlNo ratings yet

- Question of Cost of CapitalDocument3 pagesQuestion of Cost of CapitalAngel Atia IbnatNo ratings yet

- Ledger Posting/ Trial Balance / Financial StatementsDocument6 pagesLedger Posting/ Trial Balance / Financial StatementsSora 1211No ratings yet

- Bbse3009 1415 EnggEcon 01Document60 pagesBbse3009 1415 EnggEcon 01Jeff MedinaNo ratings yet

- Bloomberg Businessweek - 27 January-2 February 2014.bakDocument72 pagesBloomberg Businessweek - 27 January-2 February 2014.bakMichael MihaiNo ratings yet

- Reimbursement Expense ReceiptDocument2 pagesReimbursement Expense ReceiptCheryl AquinoNo ratings yet

- A Century of Capital Structure: The Leveraging of Corporate AmericaDocument68 pagesA Century of Capital Structure: The Leveraging of Corporate AmericaMuhammad UsmanNo ratings yet

- Syed Rameez Gohar 25391Document8 pagesSyed Rameez Gohar 25391Aurora MartinNo ratings yet

- History of BankDocument12 pagesHistory of BankvanpariyabhumikaNo ratings yet

- Solution:: Step 1Document3 pagesSolution:: Step 1venkatachalapathy.thNo ratings yet

- Discussion 4 FinanceDocument5 pagesDiscussion 4 Financepeter njovuNo ratings yet

- Capsa UnitedDocument12 pagesCapsa Unitedvenkat rajNo ratings yet

- Chapters 10 and 11Document51 pagesChapters 10 and 11Carlos VillanuevaNo ratings yet

- ALLPAGO Brazil Online PaymentsDocument5 pagesALLPAGO Brazil Online PaymentsBernard PortNo ratings yet

- Copy of DHM Client Listing Market Survey - in BucketsDocument46 pagesCopy of DHM Client Listing Market Survey - in BucketsFakemi MahluliNo ratings yet