Professional Documents

Culture Documents

K 000148

Uploaded by

aptureinc100%(7)100% found this document useful (7 votes)

315 views92 pagesOriginal Title

k000148

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF or read online from Scribd

100%(7)100% found this document useful (7 votes)

315 views92 pagesK 000148

Uploaded by

aptureincCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 92

-——

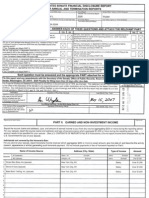

UNITED STATES SENATE FINANCIAL DISCLOSURE REPORT

FOR ANNUAL AND TERMINATION REPORTS

Taal Reso Genate en igeney a Wat Enpayed

Kerry John F.

‘Calendar Your Covered by Rapore

United States Senate

Sepa ce as Nema Sven CW Seana EP OSL

Sa Os Tapa TRS Has Oo

Fis sera n WR ERT

Senate Russell Bldg, Wash., DC 20510 202-224-0214

“erminaion Sate GOTT

Did any individual or organization make a donation to charty in lieu of

paying you fora speech, appearance, or article in the reporting period?

If Yes, Complete and Attach PART |

Did you or your spouse have earned income (@ 9, salarias or fees) or nor=

AFTER READING THE INSTRUCTIONS - ANSWER EACH OF THESE QUESTIONS AND ATTACH THE RELEVANT PART.

Did you, your spouse, or dependant child receive any feportable Wavel or

reimbursements for travel inthe reporting period (.e., worth more than

$305 from one source)?

IfYes, Complete and Attach PART VI

Yes, Complete and Attach PART V.

Senate, Washington, DC 20510. $200 Penalty for

one a J] ouyou yur spose, or aegencent id nave any eponable aby j—>

iene cinta 0 fa ay oat soe he [_]] seers cere roe alee

TEEN Be each PARTI |_] feet ana atch PAR IL

1a you, your spouse: Sepencer CRE FORD any eparabe Woh J] bayassou an aponane poston ono bownw awalangwhe = =S

more than $1000 at ean ene pro ecu were’ o Teli ete) | cee eee en

investment income of mere than $200 nthe reporting petod? LX] |_]] gument calendar year? aR Vi

ives, Conga 8 tath PART IIA andra

Bi you, yeu spose or dependent cid purchase, ah or axcengs any) |) | Oo yaa have ary repeal agreonent ar ovangonar wih an aukide

reportable asset worth mora than $1,000 in he reporting period? x} | entity? 4 ,

If Yes, Complete and Attach PART IV. LJ || Ives, complete and Attach PART IX. Loi Ld

Dia you, your apse, dapondent cH cave any peas GE

; || tis vour FIRST Resor. Dis you receive compeneaton ofmore than

roparing perdi aggegsng mare an 302 andre chonace Tye] SESS eR Baas 26 9 ene come

exon? LL} EI ies Stott in Atach PARTIC J

File this report and any amendments with the Secretary of the Senate, Office of Public Records, Room 232, Hart Senate Office Building, U.S.

1g more than 30 days after due date.

by the Office of the Secretary of the Senate to any req

on Ethics. Any individual who knowingly and willfully

criminal sanctions. (See 5 U.S.C. a

Cenifeation

TCERTIFY thatthe staterionta

hhave mace on this form anal

atached schecules ae tue,

Complete and covect othe best of

ny knowtedge and belt

C. 1001

Tis the Oplion of he reviewer tat

This Financial Disclosure Statement is required by the Ethics in Government Actof 1978, as amended, The statement willbe made avaliable

sting person upon written application and will be reviewed by the Select Committee

fies, or who knowingly and willfully fails to file this report may be subject to civil and

Signature of Reviewing Orso

STI

psu >

Date wont Ds

Tea

the statements made itis form

fare in compliance with Tse | ofthe

Ethie in Government Act.

ne

Taping eave ae a

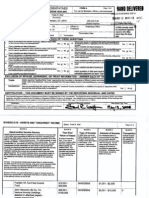

PARTI. PAYMENTS TO PAY CHARITABLE ORGANIZATIONS IN LIEU OF HONORARIA

Report the source (name and address), date, and amount of any payment from each source to a charitable organization made in lieu of honoraria to you

during the reporting period. Identify the activity (speech, article, or appearance), which generated the payment. For further information, see Instructions.

Note: Travel expenses in excess of $305 related to activities giving rise to these payments must be reported in Part VI, Reimbursements.

i ‘Speech, Article,

1 to/16/08 Home Box Office - Real Time wiBill Maher_}| New York, NY Appearance $800

Ho

14

2

13

4

report which names the charitable organization receiving such payments must be filed directly with the Select Committee on Ethics.

A separate, confider

John F. Kerry

EARNED AND NON-INVESTMENT INCOME

U.S. Government for you or yaur spouse.

Individuals not covered by the Honoraria Ban:

Name of Income Source

) Do not report income from employment by the

2

Report the source (name and address), type, and amount of earned income to you from any source aggregating $200 or more during the reporting period,

For your spouse, report the source (name and address) and type of earned income which aggregate $1,000 or more during the reporting period, No

‘amount needs to be specified for your spouse, (See p.3, CONTENTS OF REPORTS Part 8 of Instructions.

For you and /or your spouse, report honoraria income received which aggregates $200 or more by exact amount, give the date of, and describe the activity

(speech, appearance or article) generating such honoraria payment. Do not include payments in lieu of honoraria reported on Patt |

Address (City, State)

Tanne | eeanoa

Wash, DC

Example

Type of Income

$15,000,

MCI (Spouse)

‘Aringtan, VA

Exanple

Janklow & Nesbit

New York, NY

Royalties

(ver $7,000

$35,000

2| (Net proceeds to be donated to charity.)

4

You might also like

- Y 000031Document7 pagesY 000031aptureinc100% (4)

- Y 000033Document7 pagesY 000033aptureinc100% (6)

- Y 000062Document6 pagesY 000062aptureinc100% (3)

- Y 000033Document6 pagesY 000033aptureinc100% (6)

- Y 000031Document2 pagesY 000031aptureinc100% (5)

- Y 000031Document2 pagesY 000031aptureinc100% (5)

- Y 000033Document6 pagesY 000033aptureinc100% (5)

- Y 000062Document7 pagesY 000062aptureinc100% (3)

- W 000784Document10 pagesW 000784aptureinc100% (4)

- W 000779Document4 pagesW 000779aptureinc100% (1)

- W 000784Document4 pagesW 000784aptureinc100% (4)

- W 000779Document5 pagesW 000779aptureinc100% (3)

- W 000784Document4 pagesW 000784aptureinc100% (7)

- W 000793Document6 pagesW 000793aptureinc100% (2)

- W 000672Document17 pagesW 000672aptureinc100% (2)

- W 000793Document9 pagesW 000793aptureinc100% (3)

- W 000738Document5 pagesW 000738aptureinc100% (1)

- W 000738Document6 pagesW 000738aptureinc100% (3)

- W 000795Document7 pagesW 000795aptureinc100% (2)

- W 000793Document7 pagesW 000793aptureinc100% (3)

- W 000738Document8 pagesW 000738aptureinc100% (3)

- W 000672Document10 pagesW 000672aptureinc100% (3)

- W 000672Document15 pagesW 000672aptureinc100% (4)

- W 000804Document6 pagesW 000804aptureinc100% (5)

- W 000801Document6 pagesW 000801aptureincNo ratings yet

- W 000801Document12 pagesW 000801aptureincNo ratings yet

- W 000795Document9 pagesW 000795aptureincNo ratings yet

- W 000795Document8 pagesW 000795aptureincNo ratings yet

- W 000789Document34 pagesW 000789aptureincNo ratings yet